Professional Documents

Culture Documents

English HKSI LE Paper 12 Pass Paper Question Bank (QB)

Uploaded by

Tsz Ngong KoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

English HKSI LE Paper 12 Pass Paper Question Bank (QB)

Uploaded by

Tsz Ngong KoCopyright:

Available Formats

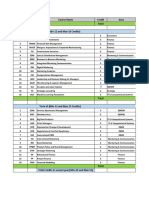

2CEXAM Mock Question

Licensing Examination Paper 12

16-Sep-19

19:49:42

1 Effectively investors of managed funds delegate the investment management of their money to Topic 1

professionals, who exercise their own discretion as to how it should be invested. So managed funds are:

A trust investment. Chapter 1

B non-trust investment. Section

C discretionary investment. QID 813

D half-discretionary investment. Ans C Hot

Exp Effectively, individuals delegate the investment management of their money to professionals, who

exercise their own discretion as to how it should be invested.

2 The plan which allows local institutional investors in Mainland China to invest in overseas financial Topic 1

markets is

A RQFII Chapter 1

B QDII Section

C QFII QID 2011

D CEPA Ans B Hot

Exp QDIIs are local institutional investors (such as fund houses, banks, insurance companies and securities

brokerages) in Mainland China who have been granted permission to invest in overseas financial markets.

3 In the future, the advantage of the market for funds in Hong Kong doesn't include: Topic 1

A Geographically close to the mainland China Chapter 1

B Strong and robust financial infrastructure Section

C Accurate and effective financial regulation, rules and financial professionals QID 822

D Lower tax rate than the average globe but higher than China Ans D Hot

Exp Local tax rate is not the main concern because fund is tended to invest in many other countries.

4 There is a huge increase in the market for managed fund in Hong Kong. Which of the following is not the Topic 1

main reason?

A Hong Kong continues to attract professionals in financial asset management. Chapter 1

B The introduction of QDII, CEPA, and RQFII Section

C Hong Kong is widely acknowledged as an international asset management centre in Asia. QID 821

D Hong Kong's advantage of innovation in bond market Ans D Hot

Exp Hong Kong attracts fund managers for several reasons, including: its central location in Asia; clear

regulations on how to establish and become authorized in the local market, a just and equitable legal

system, the English language (mandatory for conducting international business) and administration skills

(needed to develop and maintain a viable operation); a simple and low-tax regime; a window to mainland

China (and its mass market); a world class and technologically advanced communications system and

telecommunication network; high liquidity in the local stock market; a plentiful supply of professionals,

such as accountants, lawyers and stockbrokers, to support the fund management industry.

Website: www.2cexam.com Phone: 21109644 WhatsApp:93472064 WeChat:hk2cexam P.1

Please be reminded our company has no relationship with the Hong Kong Securities and Investment Institute (HKSI). The study materials we provide are

not related to the Hong Kong Securities and Investment Institute (HKSI) in any manner. The Hong Kong Securities and Investment Institute (HKSI) does

not offer any HKSI Past Paper or HKSI Mock Paper for sale.

5 Which of the following is not the reason why offshore fund is popular? Topic 1

A Tax haven Chapter 1

B Lower regulation Section

C Close to large market QID 820

D Higher regulation Ans D Hot

Exp There are three reasons for their success: low taxes, less burdensome regulation and supervision, and (in

most cases) strict secrecy laws protecting bank clients.

6 Which of the following is the major classification of managed fund? Topic 1

A Private fund Chapter 1

B Hedge fund Section

C Private trust QID 819

D Unit fund Ans B Hot

Exp Hedge fund is the major classification of managed fund.

7 Which of the following is not the major classification of managed fund? Topic 1

A Mutual trusted fund Chapter 1

B Mutual fund Section

C Umbrella funds QID 818

D Mandatory Provident Fund Ans A Hot

Exp In a competitive global market, many types of managed funds are offered, including unit trusts, mutual

funds, retirement or corporate funds and private equity funds. The management of all such funds is called

asset management.

8 "They are natural person who has an investment amount lower than institutional investor but higher than Topic 1

retail investor" Which kind of investor/customer is it more likely to be?

A Start-up investors Chapter 1

B Wealthy investor Section

C Private customer QID 817

D Corporate customer Ans C Hot

Exp Private customer has an investment amount lower than institutional investor but higher than retail

investor.

9 "Investment requirement is usually simpler than institutional investors, complexity of investment goal is Topic 1

lower, and there is no need of documentation of investment entrusted" Which kind of investor/customer is

it more likely to be?

A Institutional investor Chapter 1

B Retail investor Section

C Private customer QID 816

D Corporate customer Ans B Hot

Exp Retail/private investors: these are individuals invest on their own behalf. Their complexity of investment

goal is lower, and there is no need of documentation of investment entrusted since they trade for

themselves.

Website: www.2cexam.com Phone: 21109644 WhatsApp:93472064 WeChat:hk2cexam P.2

Please be reminded our company has no relationship with the Hong Kong Securities and Investment Institute (HKSI). The study materials we provide are

not related to the Hong Kong Securities and Investment Institute (HKSI) in any manner. The Hong Kong Securities and Investment Institute (HKSI) does

not offer any HKSI Past Paper or HKSI Mock Paper for sale.

10 In the classification of managed fund market, large institutional investors like insurance companies and Topic 1

pension fund are classified:

A as retail market. Chapter 1

B as institutional customer market(wholesale market). Section

C between retail market and institutional customer market. QID 815

D as a kind of private customer investor. Ans B Hot

Exp In Hong Kong, the main institutional investors include banks, insurance companies, fund managers and

other financial institutions.

11 __ is also called wholesale investor who has a larger investment amount and more complex investment Topic 1

goals.

A Institutional investor Chapter 1

B Retail investor Section

C Private customer QID 814

D Corporate customer Ans A Hot

Exp Institutional investors: in Hong Kong, the main such investors include banks, insurance companies, fund

managers and other financial institutions. They are called wholesale investor who has a larger investment

amount and more complex investment goals.

12 The plan which allows foreign institutional investors to invest in China securities by RMB is Topic 1

A RQFII Chapter 1

B QDII Section

C QFII QID 1987

D CEPA Ans A Hot

Exp RQFII is a policy initiative of mainland China, which allows qualified RQFII holders to channel renminbi

funds raised in Hong Kong to invest in the Mainland securities markets.

13 The plan which allows foreign institutional investors to invest in China securities is Topic 1

A RQFII Chapter 1

B QDII Section

C QFII QID 1988

D CEPA Ans C Hot

Exp QFIIs are foreign institutional investors who are allowed to invest in China A shares.

14 MPF schemes belong to which pillars ? Topic 1

A a privately managed, tax-financed social safety net for the old; Chapter 1

B a mandatory, privately managed, fully funded contribution scheme Section

C voluntary personal savings and insurance QID 1985

D a publicly managed, tax-financed social safety net for the old Ans B Hot

Exp MPFA requires all employees aged between 18 and 65, including the self-employed, to participate in

registered MPF schemes (except those remaining in the original ORSO schemes). These schemes rely on

the fund management industry for investment products, which are simply a collection of investment

schemes or managed funds.

Website: www.2cexam.com Phone: 21109644 WhatsApp:93472064 WeChat:hk2cexam P.3

Please be reminded our company has no relationship with the Hong Kong Securities and Investment Institute (HKSI). The study materials we provide are

not related to the Hong Kong Securities and Investment Institute (HKSI) in any manner. The Hong Kong Securities and Investment Institute (HKSI) does

not offer any HKSI Past Paper or HKSI Mock Paper for sale.

15 The plan which allows local institutional investors in Mainland China to invest in overseas financial Topic 1

markets is

A RQFII Chapter 1

B QDII Section

C QFII QID 1989

D CEPA Ans B Hot

Exp QDIIs are local institutional investors (such as fund houses, banks, insurance companies and securities

brokerages) in Mainland China who have been granted permission to invest in overseas financial markets.

16 Which factor most likely determines the supply of goods and services? Topic 1

A Price of goods and services Chapter 1

B Production cost Section 1

C Distribution cost QID 9

D Supply and price of substitutes Ans A Hot

Exp The objective of the producer is to make a profit from the item. Hence, the most important factor, from the

producer’s perspective, is the price that can be obtained from selling the item.

17 Generally demand curve is: Topic 1

A upward-sloping. Chapter 1

B downward-sloping. Section 1

C flat. QID 8

D wavy. Ans B Hot

Exp Generally, the higher the price for the item, the lower the quantity demanded for it will be, and vice versa.

Quantity demanded is therefore inversely related to price. Thus, demand curve is generally shown as

negatively sloped curve.

18 Investors can be classified into which 2 of the following types? Topic 1

I. Individuals

II. Corporate

III. Institutions

IV. Private Clients

A I, III Chapter 1

B II, III Section 1

C II, IV QID 1982

D III, IV Ans A Hot

Exp Today, the asset management market in Hong Kong is mainly divided into three categories: institutional,

retail and private client markets.

19 Managed funds are: Topic 1

A indirect investments. Chapter 1

B semi-direct investment. Section 2

C direct investments. QID 810

D semi-indirect investments. Ans A Hot

Exp Managed funds are indirect investments known as collective, pooled or investment funds.

Website: www.2cexam.com Phone: 21109644 WhatsApp:93472064 WeChat:hk2cexam P.4

Please be reminded our company has no relationship with the Hong Kong Securities and Investment Institute (HKSI). The study materials we provide are

not related to the Hong Kong Securities and Investment Institute (HKSI) in any manner. The Hong Kong Securities and Investment Institute (HKSI) does

not offer any HKSI Past Paper or HKSI Mock Paper for sale.

20 What are managed funds also known as? Topic 1

I. Collective Investments

II. Pooled Investments

III. Investment Funds

IV. Funds

A I, III Chapter 1

B II, IV Section 2

C II, III, IV QID 1983

D I, II, III, IV Ans D Hot

Exp There are five types of managed funds: unit trusts, mutual funds, umbrella trusts, MPF funds and hedge

funds.

21 Kaohsiung company starts a collective investment scheme called "Garbage Dealing Fund" which is Topic 1

managed by a fund manager called Mr. Ye and mainly invests in foreign stocks. Many retail investors buy

"Garbage Dealing Fund" through banks. What kind of product is the "Garbage Dealing Fund"?

A Sovereign fund Chapter 1

B Unit trust. Section 3

C Depository receipts QID 1165

D Fixed income securities Ans B Hot

Exp A unit trust refers to a collective investment scheme pooling money from individual investors, with a large

portfolio of securities managed according to pre-set investment objectives by professional fund managers.

22 The main difference between mutual fund and unit investment trust is Topic 1

A The level of fees Chapter 1

B Legal structure Section 3.2

C No differences QID 1799

D Investment restrictions Ans B Hot

Exp Mutual funds are similar to investment trusts from an investment perspective, and the difference lies only

in their legal structure. A unit trust is established in the form of a trust, while a mutual fund is established

in the form of a company.

23 What is the feature of offshore financial center: Topic 1

I. Low tax rate

II. Less regulation

III. Highly confidential

IV. Sound law system

A I, II, III Chapter 1

B I, III, IV Section 4

C II, III, IV QID 2196

D I, II, III, IV Ans A Hot

Exp There are three reasons for the success of offshore financial center: low taxes, less burdensome

regulation and supervision, and (in most cases) strict secrecy laws protecting bank clients.

Website: www.2cexam.com Phone: 21109644 WhatsApp:93472064 WeChat:hk2cexam P.5

Please be reminded our company has no relationship with the Hong Kong Securities and Investment Institute (HKSI). The study materials we provide are

not related to the Hong Kong Securities and Investment Institute (HKSI) in any manner. The Hong Kong Securities and Investment Institute (HKSI) does

not offer any HKSI Past Paper or HKSI Mock Paper for sale.

24 The mechanism for QFIIs allows foreign institutional investors to invest Topic 1

A A shares Chapter 1

B B shares Section 5.2

C H shares QID 2199

D Specific shares Ans A Hot

Exp QFIIs are foreign institutional investors who are allowed to invest in China A shares.

25 The mechanism for QDIIs allows Topic 1

A Investors in Mainland China to invest in overseas financial markets. Chapter 1

B Foreign investors to invest in China financial markets. Section 5.2

C Hong Kong investors to invest in China securities . QID 2197

D Investors in Mainland China to invest in Hong Kong financial markets. Ans A Hot

Exp QDIIs are local institutional investors (such as fund houses, banks, insurance companies and securities

brokerages) in Mainland China who have been granted permission to invest in overseas financial markets.

26 QFIIs are foreign institutional investors who are allowed to invest Topic 1

A A shares Chapter 1

B B shares Section 5.2

C H shares QID 1956

D Specific shares Ans A Hot

Exp Qualified Domestic Institutional Investors (“QDIIs”) and Qualified Foreign Institutional Investors (“QFIIs”)

are introduced in China in 2002. QDIIs are local institutional investors (such as fund houses, banks,

insurance companies and securities brokerages) in Mainland China who have been granted permission to

invest in overseas financial markets, while QFIIs are foreign institutional investors who are allowed to

invest in China A shares. These have an impact on the flow of funds in the market. Investment by QFIIs,

for instance, has a positive impact

on the flow of funds into the country.

27 The mechanism for QFIIs allows Topic 1

A Investors in Mainland China to invest in overseas financial markets. Chapter 1

B Foreign investors to invest in China financial markets. Section 5.2

C Hong Kong investors to invest in China securities . QID 2198

D Investors in Mainland China to invest in Hong Kong financial markets. Ans B Hot

Exp QFIIs are foreign institutional investors who are allowed to invest in China A shares.

Website: www.2cexam.com Phone: 21109644 WhatsApp:93472064 WeChat:hk2cexam P.6

Please be reminded our company has no relationship with the Hong Kong Securities and Investment Institute (HKSI). The study materials we provide are

not related to the Hong Kong Securities and Investment Institute (HKSI) in any manner. The Hong Kong Securities and Investment Institute (HKSI) does

not offer any HKSI Past Paper or HKSI Mock Paper for sale.

28 Which of the following factor is not the reason why there is sharp increase in services of financial advisor? Topic 1

A Aging population Chapter 1

B Large increase in saving Section 5.3

C Markets for finance and investments become more mature day by day. QID 698

D Global plunge in interest rate Ans D Hot

Exp In many countries, the aging of the post-World War II baby-boomers has driven the growth of the financial

advisory industry. This aging has been brought about by increased longevity in the majority of developed

world populations. This large segment of the population is more highly educated and wealthier than

preceding generations. The high average savings of such people represent a larger percentage of the

population than earlier or subsequent generations, and their accumulated savings have stimulated

demand for financial advisory services. The profession has gained importance in recent years as the

financial and investment markets have become increasingly sophisticated.

29 Why are the needs of individual financial advisors getting bigger and bigger? Topic 1

I. Aging population in developed countries

II. Higher level of saving

III. The increased mobility of the labour force

IV. As the financial markets of investments becomes mature.

A I, II, III, IV Chapter 1

B I, II, IV Section 5.3

C I, III, IV QID 696

D II, III, IV Ans A Hot

Exp In many countries, the aging of the post-World War II baby-boomers has driven the growth of the financial

advisory industry. This aging has been brought about by increased longevity in the majority of developed

world populations. This large segment of the population is more highly educated and wealthier than

preceding generations. The high average savings of such people represent a larger percentage of the

population than earlier or subsequent generations, and their accumulated savings have stimulated

demand for financial advisory services.

30 Why is Hong Kong a popular place for fund management? Topic 1

I. Low tax rate

II. Have many professionals to back up

III. Transparent and sound rules

IV. It is the only place where investors in mainland China can invest overseas.

A I, II, III Chapter 1

B I, II, IV Section 5.3

C I, III, IV QID 679

D II, III, IV Ans A Hot

Exp With the globalization of investment activity, many independent fund managers have come to Hong Kong.

Hong Kong attracts fund managers for several reasons, including: (1) its central location in Asia; (2) clear

regulations on how to establish and become authorized in the local market, a just and equitable legal

system, the English language (mandatory for conducting international business) and administration skills

(needed to develop and maintain a viable operation);

(3) a simple and low-tax regime; (4) a window to mainland China (and its mass market); (5) a world class

and technologically advanced communications system and telecommunication network; (6) high liquidity

in the local stock market; (7) a plentiful supply of professionals, such as accountants, lawyers and

stockbrokers, to support the fund management industry.

Website: www.2cexam.com Phone: 21109644 WhatsApp:93472064 WeChat:hk2cexam P.7

Please be reminded our company has no relationship with the Hong Kong Securities and Investment Institute (HKSI). The study materials we provide are

not related to the Hong Kong Securities and Investment Institute (HKSI) in any manner. The Hong Kong Securities and Investment Institute (HKSI) does

not offer any HKSI Past Paper or HKSI Mock Paper for sale.

31 Which of the following statement correctly describes the activities of asset management? Topic 1

I. A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets

value.

II. A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

III. A fund should manage its assets according to its target and strategy.

IV. A fund can be sold publicly in Hong Kong only if it is registered in Hong Kong.

A I, II, III Chapter 1

B I, II, IV Section 7.1

C I, III, IV QID 682

D II, III, IV Ans A Hot

Exp - A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets

value.

- A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

Investments in a particular fund will be made in line with the fund’s investment objective and strategy.

32 Which of the following fund does not violate the diversification rule in《Code on Unit Trusts and Mutual Topic 1

Funds》?

A Spring fund - invests in 15% of shares issued by company A equivalent to 50% of the fund's net assets Chapter 1

value

B Summer fund - invests in 15% of shares issued by company A equivalent to 5% of the fund's net assets Section 7.1

value

C Autumn fund - invests in 2% of shares issued by company A equivalent to 50% of the fund's net assets QID 825

value

D Winter fund - invests in 10% of shares issued by company A equivalent to 5% of the fund's net assets Ans D Hot

value

Exp The Securities and Futures Commission has set standards on diversification in Hong Kong. These

requirements are stated in the Code on Unit Trusts and Mutual Funds, and include: (1) A fund cannot hold

securities issued by a single issuer with value more than 10% of its total net assets value. (2) A fund

cannot hold more than 10% of the ordinary shares issued by a single issuer.

33 Investing in managed fund has which of the following advantages? Topic 1

I. Have more investment opportunities than direct investment

II. Have professional services of investment management

III. Cost advantages with lower commission

IV. Focused investment to increase return

A I, II Chapter 1

B I, II, IV Section 7.1

C I, II, III QID 826

D II, IV Ans C Hot

Exp The key benefits of managed funds are (i) access to professional investment management services; and

(ii) diversification. Diversification is the ability to spread your assets across different asset classes,

sectors, countries or issuers of securities. A diversified portfolio aims to minimize risk by offsetting

losses from some securities with gains in others.

Website: www.2cexam.com Phone: 21109644 WhatsApp:93472064 WeChat:hk2cexam P.8

Please be reminded our company has no relationship with the Hong Kong Securities and Investment Institute (HKSI). The study materials we provide are

not related to the Hong Kong Securities and Investment Institute (HKSI) in any manner. The Hong Kong Securities and Investment Institute (HKSI) does

not offer any HKSI Past Paper or HKSI Mock Paper for sale.

34 Why is investing in fund better than investing in stocks? Topic 1

I. Easy to diversify

II. Can invest in different markets

III. Cost reduction

IV. More easy to control investment directly

A I, II, III Chapter 1

B I, II, IV Section 7.1

C I, III, IV QID 703

D II, III, IV Ans A Hot

Exp The key benefits of managed funds are access to professional investment management services; and

diversification. Fund managers can also invest in a broader range of securities, and usually faster and

more cheaply, than individuals. Through managed funds, the investment range is broadened to include

overseas investments. In Hong Kong, this is particularly relevant as the majority of authorized managed

funds are based elsewhere, enabling the investor to choose the fund manager with the best skill set and

local knowledge in the market in which he wants to invest.

35 The advantages of investing in unit trusts or mutual funds include: Topic 1

I. Professional management

II. Various and diversified investment channels

III. Simple procedure

IV. Tax incentives

A I, II, III Chapter 1

B I, III, IV Section 7.1

C II, III, IV QID 1168

D I, II, III, IV Ans D Hot

Exp Individual investors benefit from professional management, diversification, a broader range of

opportunities, cost benefits, and convenience through managed funds.

36 The advantages of investing in unit trusts or mutual funds doesn't include: Topic 1

A Professional management Chapter 1

B Low custodian fees Section 7.1

C Various and diversified investment channels QID 1166

D Long investment periods Ans D Hot

Exp Having long investment periods is the disadvantage of investing in unit trusts or mutual funds. It is

because it is more risky.

37 Investing in managed fund doesn't have which of the following advantages? Topic 1

A Higher return Chapter 1

B Technology Section 7.1

C Liquidity QID 827

D Convenience Ans A Hot

Exp Individuals, employers, institutions and companies are generally attracted to managed funds because

their money is handled by professionals who have the expertise to produce a higher return for a given risk

level than they would achieve themselves.

Website: www.2cexam.com Phone: 21109644 WhatsApp:93472064 WeChat:hk2cexam P.9

Please be reminded our company has no relationship with the Hong Kong Securities and Investment Institute (HKSI). The study materials we provide are

not related to the Hong Kong Securities and Investment Institute (HKSI) in any manner. The Hong Kong Securities and Investment Institute (HKSI) does

not offer any HKSI Past Paper or HKSI Mock Paper for sale.

38 A fund cannot hold more than how many percent of the ordinary shares issued by a single issuer. Topic 1

A 5% Chapter 1

B 10% Section 7.1

C 15% QID 685

D 20% Ans B Hot

Exp A fund cannot hold more than 10% of the ordinary shares issued by a single issuer.

39 A fund cannot hold securities issued by a single issuer with value more than how many percent of its total Topic 1

net assets value?

A 5% Chapter 1

B 10% Section 7.1

C 20% QID 684

D 25% Ans B Hot

Exp A fund cannot hold securities issued by a single issuer with value more than 10% of its total net assets

value.

40 Mr. Gao is an elderly retiree who knows little about investments. What is the more likely reason for Mr. Gao Topic 1

to invest in fund?

I. Increase investment opportunity

II. Diversification

III. Increase the control for investment

IV. Reduce the cost of investment

A I, III, IV Chapter 1

B I, II, III Section 7.1

C I, II, IV QID 683

D II, III, IV Ans C Hot

Exp The key benefits of managed funds are access to professional investment management services; and

diversification. Fund managers can also invest in a broader range of securities, and usually faster and

more cheaply, than individuals. Certain investment opportunities may only be available to large investors,

such as bonds and direct property. Through managed funds, small retail investors can gain exposure to

such assets.

41 What is the advantage of investing in managed funds? Topic 1

I. Professional management

II. Risk diversification

III. Exempt from capital appreciation tax

IV. Higher returns than other investors for certain

A I, II Chapter 1

B I, III Section 7.1

C I, IV QID 492

D II, III Ans A Hot

Exp The key benefits of managed funds are (i) access to professional investment management services; and

(ii) diversification. Diversification is the ability to spread your assets across different asset classes,

sectors, countries or issuers of securities. A diversified portfolio aims to minimize risk by offsetting

losses from some securities with gains in others.

Website: www.2cexam.com Phone: 21109644 WhatsApp:93472064 WeChat:hk2cexam P.10

Please be reminded our company has no relationship with the Hong Kong Securities and Investment Institute (HKSI). The study materials we provide are

not related to the Hong Kong Securities and Investment Institute (HKSI) in any manner. The Hong Kong Securities and Investment Institute (HKSI) does

not offer any HKSI Past Paper or HKSI Mock Paper for sale.

You might also like

- English HKSI LE Paper 8 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 8 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- English HKSI LE Paper 9 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 9 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- 2CEXAM Mock Question Licensing Examination Paper 8Document9 pages2CEXAM Mock Question Licensing Examination Paper 8Tsz Ngong KoNo ratings yet

- 2CEXAM Mock Question Licensing Examination Paper 7Document10 pages2CEXAM Mock Question Licensing Examination Paper 7Tsz Ngong Ko100% (1)

- 2CEXAM Mock Question Licensing Examination Paper 12Document8 pages2CEXAM Mock Question Licensing Examination Paper 12Tsz Ngong KoNo ratings yet

- English HKSI LE Paper 3 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 3 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- English HKSI LE Paper 2 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 2 Pass Paper Question Bank (QB)Tsz Ngong Ko0% (1)

- 2CEXAM Mock Question Mandatory Provident Fund Schemes ExaminationDocument35 pages2CEXAM Mock Question Mandatory Provident Fund Schemes ExaminationTsz Ngong KoNo ratings yet

- English HKSI LE Paper 6 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 6 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- 2CEXAM Mock Question Licensing Examination Paper 6Document21 pages2CEXAM Mock Question Licensing Examination Paper 6Tsz Ngong KoNo ratings yet

- 2CEXAM Mock Question Licensing Examination Paper 2Document22 pages2CEXAM Mock Question Licensing Examination Paper 2Tsz Ngong Ko100% (1)

- English HKSI LE Paper 5 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 5 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- English HKSI LE Paper 7 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 7 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- Key SFO Definitions: Asset ManagementDocument24 pagesKey SFO Definitions: Asset ManagementAndrew LeeNo ratings yet

- Past Questions and Answers (December 2006)Document28 pagesPast Questions and Answers (December 2006)Ryan LamNo ratings yet

- 2CEXAM Mock Question Licensing Examination Paper 9Document17 pages2CEXAM Mock Question Licensing Examination Paper 9Tsz Ngong KoNo ratings yet

- Hksi Le Paper 3 Pastpaper 20200518Document11 pagesHksi Le Paper 3 Pastpaper 20200518Tsz Ngong Ko100% (1)

- 2CEXAM Mock Question Licensing Examination Paper 5Document2 pages2CEXAM Mock Question Licensing Examination Paper 5Tsz Ngong KoNo ratings yet

- Topic 3 - Overview: Licensing Exam Paper 1 Topic 3Document16 pagesTopic 3 - Overview: Licensing Exam Paper 1 Topic 3anonlukeNo ratings yet

- Topic 5 - Overview: Licensing Exam Paper 1 Topic 5Document28 pagesTopic 5 - Overview: Licensing Exam Paper 1 Topic 5anonlukeNo ratings yet

- Iiqe Paper 3 Pastpaper 20200518Document20 pagesIiqe Paper 3 Pastpaper 20200518Tsz Ngong Ko100% (1)

- Topic 2 - Overview: Licensing Exam Paper 1 Topic 2Document16 pagesTopic 2 - Overview: Licensing Exam Paper 1 Topic 2anonlukeNo ratings yet

- Topic 1 - Overview: Licensing Exam Paper 1 Topic 1Document18 pagesTopic 1 - Overview: Licensing Exam Paper 1 Topic 1anonlukeNo ratings yet

- English IIQE Paper 5 Pass Paper Question Bank (QB)Document10 pagesEnglish IIQE Paper 5 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- Paper1 200606Document28 pagesPaper1 200606clee9999No ratings yet

- Licensing Exam Syllabus for Securities and Futures RegulationDocument2 pagesLicensing Exam Syllabus for Securities and Futures RegulationnananaNo ratings yet

- Paper 8 Securities Past Questions and Answers (December 2006)Document17 pagesPaper 8 Securities Past Questions and Answers (December 2006)Ben YungNo ratings yet

- Paper 1 - Fundamentals of Securities and Futures RegulationDocument50 pagesPaper 1 - Fundamentals of Securities and Futures RegulationBogey Pretty100% (1)

- Iiqe Paper 2 Pastpaper 20200518Document25 pagesIiqe Paper 2 Pastpaper 20200518Tsz Ngong KoNo ratings yet

- Iiqe Paper 1 Pastpaper 20200518Document42 pagesIiqe Paper 1 Pastpaper 20200518Tsz Ngong Ko100% (3)

- Standards Organisation of Nigeria: SONCAP CertificateDocument2 pagesStandards Organisation of Nigeria: SONCAP CertificateBhavna UpadhyayNo ratings yet

- Iiqe Paper 5 Pastpaper 20200518Document33 pagesIiqe Paper 5 Pastpaper 20200518Tsz Ngong Ko0% (1)

- IIQE Paper 1 Principles (2004 Ver Eng)Document154 pagesIIQE Paper 1 Principles (2004 Ver Eng)Varun HknzNo ratings yet

- HKSI Study Manual L16 Eng PDFDocument208 pagesHKSI Study Manual L16 Eng PDFTTNo ratings yet

- Common Finance Interview QuestionsDocument3 pagesCommon Finance Interview QuestionsLeon Mushi100% (1)

- English IIQE Paper 2 Pass Paper Question Bank (QB)Document10 pagesEnglish IIQE Paper 2 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- Jun18l1eth-C02 QaDocument7 pagesJun18l1eth-C02 Qarafav10No ratings yet

- HKICPA QP Exam (Module A) May2005 AnswerDocument12 pagesHKICPA QP Exam (Module A) May2005 Answercynthia tsuiNo ratings yet

- HKICPA QP Exam (Module A) Sep2006 Question PaperDocument7 pagesHKICPA QP Exam (Module A) Sep2006 Question Papercynthia tsuiNo ratings yet

- Jun18l1eth-E01 QaDocument3 pagesJun18l1eth-E01 Qarafav10No ratings yet

- HKICPA QP Exam (Module A) Feb2008 Question PaperDocument8 pagesHKICPA QP Exam (Module A) Feb2008 Question Papercynthia tsuiNo ratings yet

- VWAPDocument1 pageVWAPKartick NarayanNo ratings yet

- 2018 Introduction To Alternative Investments: Test Code: R58 INAI Q-BankDocument13 pages2018 Introduction To Alternative Investments: Test Code: R58 INAI Q-BankKartik SinghNo ratings yet

- English HKSI LE Paper 1 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 1 Pass Paper Question Bank (QB)Tsz Ngong Ko0% (2)

- China Musings Goldman Sachs 060122Document20 pagesChina Musings Goldman Sachs 060122Sreehari SNo ratings yet

- DocxDocument2 pagesDocxMoazzam ShahNo ratings yet

- NipponIndia Gold Savings Fund PDFDocument62 pagesNipponIndia Gold Savings Fund PDFGita ThoughtsNo ratings yet

- c3 Manila BayDocument5 pagesc3 Manila BayJonuelin InfanteNo ratings yet

- PRTC Olympiad Region 12: Page 1 of 16Document16 pagesPRTC Olympiad Region 12: Page 1 of 16Anne EstrellaNo ratings yet

- Your Results For: "Multiple Choice Questions "Document7 pagesYour Results For: "Multiple Choice Questions "prakashzodpe2013No ratings yet

- Hock Section A QuestionsDocument103 pagesHock Section A QuestionsMustafa AroNo ratings yet

- CH 01Document9 pagesCH 01Bilal ImtiazNo ratings yet

- CISI - 1. Financial Service IndustryDocument4 pagesCISI - 1. Financial Service Industrykhushi chaudhariNo ratings yet

- IQ Capital Fund IV Investment ProposalDocument31 pagesIQ Capital Fund IV Investment Proposalyveslegoff143No ratings yet

- QPB Dec 20 Mock AnswersDocument14 pagesQPB Dec 20 Mock AnswersBernice Chan Wai WunNo ratings yet

- FCCB - Good ReportDocument138 pagesFCCB - Good ReportKartik RajuNo ratings yet

- FINS1612 Quiz 1 Practice Semester 2, 2014Document4 pagesFINS1612 Quiz 1 Practice Semester 2, 2014Tofuu Power100% (1)

- Study Session 8 - Long Lived Assets - SharedDocument55 pagesStudy Session 8 - Long Lived Assets - SharedIhuomacumehNo ratings yet

- Section B QuestionsDocument130 pagesSection B QuestionsJohn DoeNo ratings yet

- 17 Corporate Strategy and Foreign Direct Investment: Chapter ObjectivesDocument13 pages17 Corporate Strategy and Foreign Direct Investment: Chapter ObjectivesJayant312002 ChhabraNo ratings yet

- HKSI LE Paper 11 Pass Paper Question Bank (QB)Document10 pagesHKSI LE Paper 11 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- What Is The Validity Period of IIQE Test Results?Document4 pagesWhat Is The Validity Period of IIQE Test Results?Tsz Ngong KoNo ratings yet

- What Is The Validity Period of The HKSI LE Hong Kong Securities Examination Results?Document5 pagesWhat Is The Validity Period of The HKSI LE Hong Kong Securities Examination Results?Tsz Ngong KoNo ratings yet

- 2CEXAM Mock Question Licensing Examination Paper 6Document21 pages2CEXAM Mock Question Licensing Examination Paper 6Tsz Ngong KoNo ratings yet

- Iiqe Paper 3 Pastpaper 20200518Document20 pagesIiqe Paper 3 Pastpaper 20200518Tsz Ngong Ko100% (1)

- Iiqe Paper 5 Pastpaper 20200518Document33 pagesIiqe Paper 5 Pastpaper 20200518Tsz Ngong Ko0% (1)

- Iiqe Paper 1 Pastpaper 20200518Document42 pagesIiqe Paper 1 Pastpaper 20200518Tsz Ngong Ko100% (3)

- 2CEXAM Mock Question Mandatory Provident Fund Schemes ExaminationDocument35 pages2CEXAM Mock Question Mandatory Provident Fund Schemes ExaminationTsz Ngong KoNo ratings yet

- Iiqe Paper 2 Pastpaper 20200518Document25 pagesIiqe Paper 2 Pastpaper 20200518Tsz Ngong KoNo ratings yet

- 2CEXAM Mock Question Licensing Examination Paper 9Document17 pages2CEXAM Mock Question Licensing Examination Paper 9Tsz Ngong KoNo ratings yet

- Hksi Le Paper 3 Pastpaper 20200518Document11 pagesHksi Le Paper 3 Pastpaper 20200518Tsz Ngong Ko100% (1)

- English IIQE Paper 2 Pass Paper Question Bank (QB)Document10 pagesEnglish IIQE Paper 2 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- 2CEXAM Mock Question Licensing Examination Paper 2Document22 pages2CEXAM Mock Question Licensing Examination Paper 2Tsz Ngong Ko100% (1)

- 2CEXAM Mock Question Licensing Examination Paper 5Document2 pages2CEXAM Mock Question Licensing Examination Paper 5Tsz Ngong KoNo ratings yet

- English HKSI LE Paper 2 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 2 Pass Paper Question Bank (QB)Tsz Ngong Ko0% (1)

- English HKSI LE Paper 7 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 7 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- 2CEXAM Mock Question Licensing Examination Paper 1Document21 pages2CEXAM Mock Question Licensing Examination Paper 1Tsz Ngong KoNo ratings yet

- English HKSI LE Paper 6 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 6 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- English HKSI LE Paper 1 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 1 Pass Paper Question Bank (QB)Tsz Ngong Ko0% (2)

- English HKSI LE Paper 5 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 5 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- English MPFE Pass Paper Question Bank (QB)Document10 pagesEnglish MPFE Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- English HKSI LE Paper 3 Pass Paper Question Bank (QB)Document10 pagesEnglish HKSI LE Paper 3 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- English IIQE Paper 3 Pass Paper Question Bank (QB)Document11 pagesEnglish IIQE Paper 3 Pass Paper Question Bank (QB)Tsz Ngong Ko25% (4)

- English IIQE Paper 5 Pass Paper Question Bank (QB)Document10 pagesEnglish IIQE Paper 5 Pass Paper Question Bank (QB)Tsz Ngong KoNo ratings yet

- Adjudication Order in Respect of M/s. Tulive Developers LTD., Mr. Atul Gupta and Mr. K V Ramana in The Matter of M/s. Tulive Developers Ltd.Document25 pagesAdjudication Order in Respect of M/s. Tulive Developers LTD., Mr. Atul Gupta and Mr. K V Ramana in The Matter of M/s. Tulive Developers Ltd.Shyam SunderNo ratings yet

- Contract LetterDocument5 pagesContract LetterprashantNo ratings yet

- LeanIX WhitePaper Integrate ITFM and EA With LeanIX and Apptio ENDocument13 pagesLeanIX WhitePaper Integrate ITFM and EA With LeanIX and Apptio ENSocialMedia NewLifeNo ratings yet

- BlackRock 2023-2024 Portfolio Management Job DescriptionDocument8 pagesBlackRock 2023-2024 Portfolio Management Job Descriptionharikevadiya4No ratings yet

- Lean Fundamentals Training: Gain A World Recognised AccreditationDocument4 pagesLean Fundamentals Training: Gain A World Recognised AccreditationAhmed ElhajNo ratings yet

- Naturecare Products: Risk Identification ReportDocument2 pagesNaturecare Products: Risk Identification Reporte_dmsaveNo ratings yet

- Case InstructionsDocument4 pagesCase InstructionsHw SolutionNo ratings yet

- Application OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedDocument50 pagesApplication OF THE Balanced Scorecard IN Strategy Implementation by Unilever Tea Kenya LimitedShokry AminNo ratings yet

- Orientation and TrainingDocument28 pagesOrientation and TrainingSunny Ramesh SadnaniNo ratings yet

- Checklist For DSA - DOADocument2 pagesChecklist For DSA - DOAkhriskammNo ratings yet

- Business Data Modelling - Why and HowDocument18 pagesBusiness Data Modelling - Why and HowYoussef El MeknessiNo ratings yet

- Finance, Marketing & HR courses in MBA 2nd yearDocument28 pagesFinance, Marketing & HR courses in MBA 2nd yearGaneshRathodNo ratings yet

- Sponsorship Proposal TemplateDocument11 pagesSponsorship Proposal TemplateMichaell Moore100% (2)

- Institute of Rural Management AnandDocument6 pagesInstitute of Rural Management AnandAmit Kr GodaraNo ratings yet

- ABCs of Relationship Selling Through Service 12th Edition Futrell Solutions Manual 1Document251 pagesABCs of Relationship Selling Through Service 12th Edition Futrell Solutions Manual 1autumn100% (26)

- DL-6104 - Business LawDocument358 pagesDL-6104 - Business LawTiki TakaNo ratings yet

- POMOFFICIALLECTUREDocument919 pagesPOMOFFICIALLECTURER A GelilangNo ratings yet

- Continuing Certification Requirements: (CCR) HandbookDocument19 pagesContinuing Certification Requirements: (CCR) HandbookLip Min KhorNo ratings yet

- Procurement Workshop Invite 8th April 2013 PDFDocument2 pagesProcurement Workshop Invite 8th April 2013 PDFDurban Chamber of Commerce and IndustryNo ratings yet

- Target Market Strategies for The Royal PharmacyDocument12 pagesTarget Market Strategies for The Royal PharmacyIsmail MustafaNo ratings yet

- Siebel Systems Case Analysis SummaryDocument6 pagesSiebel Systems Case Analysis SummaryAyush MittalNo ratings yet

- BS 25999-2 Basics: A Leading Business Continuity StandardDocument3 pagesBS 25999-2 Basics: A Leading Business Continuity StandardMemet H BilgitekinNo ratings yet

- T7 TCS 【愛知】Bilingual Design Engineer PDFDocument3 pagesT7 TCS 【愛知】Bilingual Design Engineer PDFchutiyaNo ratings yet

- FPC ManualDocument8 pagesFPC ManualAdnan KaraahmetovicNo ratings yet

- Economic ServicesDocument34 pagesEconomic ServicesTUMAUINI TOURISMNo ratings yet

- Demantra and ASCP Presentation PDFDocument54 pagesDemantra and ASCP Presentation PDFvenvimal1No ratings yet

- Ocean Carriers Assignment 1: Should Ms Linn purchase the $39M capsizeDocument6 pagesOcean Carriers Assignment 1: Should Ms Linn purchase the $39M capsizeJayzie LiNo ratings yet

- FM59 New GuideDocument190 pagesFM59 New GuideDr. Naeem MustafaNo ratings yet

- CH 04Document9 pagesCH 04jaysonNo ratings yet

- Planner Approval For Move Order RequisitionsDocument7 pagesPlanner Approval For Move Order RequisitionsSrimannarayana KasthalaNo ratings yet