Professional Documents

Culture Documents

AP 10 Cash

Uploaded by

spspsjpia0 ratings0% found this document useful (0 votes)

33 views5 pagesaudit program for cash

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentaudit program for cash

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views5 pagesAP 10 Cash

Uploaded by

spspsjpiaaudit program for cash

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

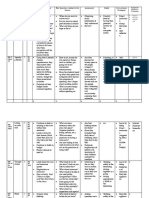

Form AP 10

Index Reference__________

Audit Program for Cash

Legal Company Name Client:

Balance Sheet Date:

Instructions: The auditor should refer to the audit planning documentation to gain

an understanding of the financial reporting system and the planned extent of testing

for cash balances. Modification to the auditing procedures listed below may be

necessary in order to achieve the audit objectives.

All audit work should be documented in attached working papers, with appropriate

references noted in the right column below.

Audit Objectives Financial Statement

Assertions

Existence or occurrence

Cash physically exists and is owned by the company

as of the balance sheet date. Rights and obligations

Existence or occurrence

Cash receipts and cash disbursements are recorded

Completeness

correctly as to account, amount, and period.

Valuation or allocation

Existence or occurrence

Cash balances include funds at all locations, funds

Completeness

with custodians and deposits in transit.

Presentation and disclosure

Rights and obligations

Cash is properly classified and presented in the

Presentation and disclosure

financial statements, and adequate disclosures are

made with respect to restricted cash.

Performed Workpaper

By Reference

1. Explain significant fluctuations in the amounts in

cash balances from the prior year.

2. Prepare or obtain from the client a listing of all cash

accounts open as of the balance-sheet date or opened

and closed during the period under audit, showing

(a) account number and type, (b) custodian, and (c)

balance per the general ledger.

3. Request that the client prepare bank confirmation

forms for bank/custodian accounts used during the

period under audit (including accounts closed as of

the balance sheet date). Maintain control of the bank

confirmation forms and mail directly to the

bank/custodian.

4. Ask the client to request copies of the daily bank

statements (including all supporting documents) for

a period of 5 days subsequent to the balance-sheet

date to be mailed by the bank directly to the auditor.

5. Prepare or obtain an analysis of savings accounts,

certificates of deposit, and other interest-bearing

accounts showing (a) name of institution, (b) interest

rate, (c) maturity date, (d) balances at the beginning

of the period, (e) activity during the period, (f)

balances at the end of the period, and (g) interest

income and related accruals, and perform the

following:

a. Trace book balances, interest income, and

interest accrued to the general ledger.

b. Compare balances and interest rate per

passbooks and certificates of deposit to returned

confirmation forms.

c. Test the arithmetical accuracy of the analysis.

d. Recalculate interest earned and evaluate results

for reasonableness.

Performed Workpaper

By Reference

6. Prepare or obtain a schedule of bank payment orders

for a period of 5 days before and after the balance

sheet date, showing the (a) name of disbursing bank,

(b) payment order or transfer number, (c) amount of

transfer, (d) date transferred out per books, (e) date

transferred out per bank, (f) name of receiving bank,

(g) date transferred in per books, and (h) date

transferred in per bank, and perform the following:

a. Review the cash receipts and cash disbursements

journal, bank statements, and journal entries for

5 days before and after the balance sheet date and

determine whether they are all included in the

schedule of bank payment orders.

b. Determine if all receipts and disbursements per

books are recorded in the correct period.

c. Investigate any disbursements with bank

statement dates that precede the dates per books.

d. Determine whether the number of days’ lag

between bank statement dates and dates per

books appears reasonable and investigate any

unusual delays.

7. If bank statements are not requested and/or not

received directly by the auditor, obtain the bank

statement for the month subsequent to the balance-

sheet date and perform the following:

a. Test the arithmetical accuracy of the bank

statement.

b. Compare bank payment orders listed in the bank

statement to the totals per the client’s records.

c. Foot client’s copies of deposits slips and

compare them to totals show per the bank

statement.

d. Inspect the bank statement for alterations.

Performed Workpaper

By Reference

8. Determine which petty cash funds should be counted

and perform the following:

a. Count petty cash funds in the presence of a client

representative.

b. Summarize cash counted by denomination.

Include other items such as coins and other

stamps.

c. Reconcile the balance per the custodian to the

general ledger.

d. At the conclusion of the count, return all items to

the custodian and ask for a signed receipt.

9. Ascertain that the requests for bank confirmations

and confirmations with other custodians have been

received, signed, and all questions have been

answered. Follow up on all comments and missing

information.

10. Review the confirmations received from the banks or

other financial institutions and determine whether

any of the following exists:

a. Accounts are subject to withdrawal restrictions,

minimum balance requirements, or compensating

balances.

b. Guarantees, letters of credit, or contingent

liabilities.

c. Arrangements for related parties, such as

guarantees.

d. Commitments and contingencies.

Based on the procedures performed and the results obtained, it is my opinion that the

objectives listed in this audit program have been achieved.

Performed by Date

Reviewed and approved by Date

Conclusions:

Comments:

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- N26 StatementDocument4 pagesN26 StatementCris TsauNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Trading Securities Problem Adjusted Balance Gain LossDocument2 pagesTrading Securities Problem Adjusted Balance Gain LossspspsjpiaNo ratings yet

- Student Lecture Notes: Capital Budgeting Is A Process of Management Accounting Which Assists ManagementDocument13 pagesStudent Lecture Notes: Capital Budgeting Is A Process of Management Accounting Which Assists ManagementspspsjpiaNo ratings yet

- Trading Securities Problem Adjusted Balance Gain LossDocument2 pagesTrading Securities Problem Adjusted Balance Gain LossspspsjpiaNo ratings yet

- Summary Pas, PFRS, PsaDocument5 pagesSummary Pas, PFRS, PsaspspsjpiaNo ratings yet

- MBA711 - Answers To All Chapter 7 ProblemsDocument21 pagesMBA711 - Answers To All Chapter 7 Problemsshweta shuklaNo ratings yet

- MBA711 - Answers To All Chapter 7 ProblemsDocument21 pagesMBA711 - Answers To All Chapter 7 Problemsshweta shuklaNo ratings yet

- Transfer Tax Quiz QuestionsDocument5 pagesTransfer Tax Quiz QuestionsKyasiah Mae AragonesNo ratings yet

- Grade 7 Practice: Calculating Percent Changes and DiscountsDocument3 pagesGrade 7 Practice: Calculating Percent Changes and DiscountsRizky HermawanNo ratings yet

- Audit EvidenceDocument23 pagesAudit EvidenceAmna MirzaNo ratings yet

- Engineering Economics HandoutDocument6 pagesEngineering Economics HandoutRomeoNo ratings yet

- FX Fluctuations, Intervention, and InterdependenceDocument9 pagesFX Fluctuations, Intervention, and InterdependenceRamagurubaran VenkatNo ratings yet

- GST Session 38Document20 pagesGST Session 38manjulaNo ratings yet

- This Study Resource Was: Case Analysis Note GoncharDocument4 pagesThis Study Resource Was: Case Analysis Note GoncharMickey JindalNo ratings yet

- SECP Form 6Document4 pagesSECP Form 6mirza faisalNo ratings yet

- Word - ISS Application For Authorized Persons - BSE - 01-JULY-2015Document35 pagesWord - ISS Application For Authorized Persons - BSE - 01-JULY-2015meera nNo ratings yet

- Denim Jeans Stitching UnitDocument25 pagesDenim Jeans Stitching UnitSaad NaseemNo ratings yet

- Adjusted Trial BalanceDocument4 pagesAdjusted Trial BalanceMonir HossainNo ratings yet

- Negen Capital: (Portfolio Management Service)Document5 pagesNegen Capital: (Portfolio Management Service)Sumit SagarNo ratings yet

- Excel Clarkson LumberDocument9 pagesExcel Clarkson LumberCesareo2008No ratings yet

- Bata & AB BankDocument8 pagesBata & AB BankSaqeef RayhanNo ratings yet

- Asset-Backed Commodity TradingDocument4 pagesAsset-Backed Commodity Tradingluca sacakiNo ratings yet

- Square Pharma Annual Report 2019-2020Document148 pagesSquare Pharma Annual Report 2019-2020Muktar HossainNo ratings yet

- Acc101 RevCh1 3 PDFDocument29 pagesAcc101 RevCh1 3 PDFWaqar AliNo ratings yet

- Intra Firm Ratio Analysis of Financial Statements of Bharti Realty Holdings Ltd.Document37 pagesIntra Firm Ratio Analysis of Financial Statements of Bharti Realty Holdings Ltd.DevNo ratings yet

- ACCT203 LeaseDocument4 pagesACCT203 LeaseSweet Emme100% (1)

- Introduction To Insurance IndustriesDocument37 pagesIntroduction To Insurance IndustriesNishaTambeNo ratings yet

- Rogoff (1985) ConservativeDocument5 pagesRogoff (1985) Conservative92_883755689No ratings yet

- Calm Finance Unit PlanDocument7 pagesCalm Finance Unit Planapi-331006019No ratings yet

- CTRN Citi Trends Slides March 2017Document18 pagesCTRN Citi Trends Slides March 2017Ala BasterNo ratings yet

- Adnan MajeedDocument3 pagesAdnan MajeedJenniferNo ratings yet

- Resume Account Assistant Seeks New OpportunityDocument3 pagesResume Account Assistant Seeks New OpportunitySteve MichelNo ratings yet

- Power of Attorney (General)Document3 pagesPower of Attorney (General)champakNo ratings yet

- Flame I - Jaideep FinalDocument23 pagesFlame I - Jaideep FinalShreya TalujaNo ratings yet

- Bajaj Auto Annual Report - Secc - grp6Document11 pagesBajaj Auto Annual Report - Secc - grp6Varun KumarNo ratings yet

- Stock Corp By-LawsDocument35 pagesStock Corp By-LawsAngelica Sanchez100% (3)