Professional Documents

Culture Documents

Consignment

Uploaded by

Emma Mariz GarciaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Consignment

Uploaded by

Emma Mariz GarciaCopyright:

Available Formats

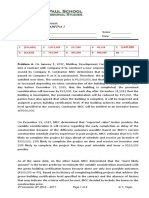

Jessie Corporation consigned 400 dresses to Anne Fashions a. P 0 c.

P70,300

at a suggested retail price of P500 each. Jessie paid freight b. P81,700 d. P69,375

charges of P2,000 on the shipment on consignment. Anne

paid delivery charges of P2,100 for units sold, subject to Passionate Enterprises consigned 15 dozens of fine men’s

subsequent settlement. Jessie and Anne agreed that any suits with a cost of P800 a suit to Fashion Treats Company.

sales in excess of the suggested retail price will accrue to Passionate incurred freight cost of P35 per dozen. As

the latter. Anne submitted an account sales on the sale of required by the agreement, Fashion Treats reported sales

215 dresses, 40% of which was sold at P580 each and the of 8 dozens at P1,200 a suit and reimbursable expenses of

rest at P640 each, All these sales were paid in cash. P2,500. Fashion Treats remitted the proceeds to

Jessie’s cost is P375 each dress, before any deferred costs Passionate, net of the agreed 15% commissions on sale.

on consignment are taken into account.

7. How much cash was remitted by Fashion Treats to

1. How much should Anne remit to Bryan for the Passionate Enterprises?

aforementioned sales to customers? a. P139, 800 c. P 95,420

a. P105,400 c. P107,500 b. P142,500 d. P142,800

b. P130,340 d. P132,440

8. How much was the consignment profit to Passionate

2. The journal entry to be recorded by Anne for the Enterprises?

remittance to Jessie, assuming profits are separately a. P 55, 590 c. P 18,430

determined and Anne uses the Consignment-in b. P 58,590 d. P 18,340

account, will include

a. a debit to Consignment-in of P107,500 9. How much is the Inventory of consigned goods after

b. a credit to commissions revenue of P24,940 the above mentioned sales?

c. a credit to cash of P105,400 a. P 67, 445 c. P 67,545

d. a credit to Consignment-in of P2,100 b. P 67,544 d. P 65,744

3. How much is the commission earned by Anne from Aircon, Inc. consigned 10 one-horse power air conditioner

sales of the consigned goods? units to Argy Trading and paid P2,000 freight out. Gross

a. P 13, 236 c. P 24,940 margin is 12.5% of sales. The consignee is allowed a

b. P 49,800 d. P 82,560 commission of 5% on sales. Argy Trading submitted an

account sales on December 31, 2017 as follows:

4. The cost of consigned goods to Jessie for the units

sold by Anne to customers was Sales P 72,000

a. P 81, 700 c. P 87,100 Less: Advances to consignor P 10,000

b. P100,654 d. P106,50 Selling expenses 800

Delivery and 1,200

5. The cost of the unsold 185 dresses still held by Anne is installation cost

shown at what amount in Anne’s Consignment-in Commission 3,600 15,600

account? Net remittance P 56,400

a. P69,375 c. P70,300

b. P81,700 d. P 0 10. How much is the net profit or loss of Aircon, Inc. in the

consignment?

6. The balance of the consignment-out account in the a. P 1,400 profit c. P 2,200 profit

books of Jessie after adjustment for recognized profit b. P 8,800 loss d. P 720 loss

will be

- end of AFAR.2407 -

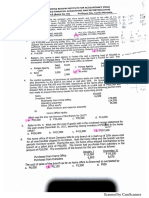

DO IT YOURSELF DRILL

A Consignment Out account on the books of Consignor Inc. a. P 14, 300 c. P 15,380

appears below b. P 19,700 d. P 21,600

Consignment Out – Consignee Sales

Jan. 3 Shipped 12 P16,800 Jan 31 P21,600 4. The inventory of consigned goods is

sets Sales, 9 a. P 2, 800 c. P 4,200

sets b. P 4,560 d. P 4,810

3 Freight charges 1,440

31 Charges by Philacor consigned 12 refrigerator units to Ocampo

consignee Emporium. The cost is P6,000 each and the consignor paid

Delivery exp. 900 P720 for the freight to Ocampo. The consignee rendered

Commission(20%) 4,320 an account sales for the 5 refrigerator units it sold at

Advertising 1,000 P7,700 per unit. It deducted the following items:

Commissions at 10% of sales net of commission

1. The consignment profit realized by Consignor, Inc. on

Marketing expense of 10% of commission

the consignment during the month was

Delivery and installation cost of P30 per unit.

a. P 1,700 c. P 3,360 5. How much is the net profit of the consignor?

b. P 4,340 d. P 4,800 a. P 3, 815 c. P 37,780

b. P 4,200 d. P 3,395

2. The adjusted balance of the Consignment-Out account

after recognition of the net profit will be 6. How much is the net remittance of the consignee?

a. P 6,450 c. P 4,560 a. P 34, 500 c. P 4,200

b. P 4,605 d. P 6,540 b. P 4,500 d. P 33,780

3. The amount of cash remitted by Consignee was

7. How much is the balance of the Consignment-Out

account after recognizing the net profit computed in

Item 15?

a. P 34,500 c. P 33,780

b. P 37,780 d. P 42,420

8. How much is the balance of the Consignment-In

account in the books of the consignee after its cash

remittance in full to the consignor?

a. P 0 c. P37,780

b. P42,420 d. P34,500

9. The entry to be recorded by the consignor to recognize

its net profit from this consignee will include

a. A debit to Consignment-Out of P4,200

b. A credit to Consignment Profit of P4,800

c. A debit to Consignment-Out of P4,800

d. A credit to Consignment-Out of P4,200

10. The deferred cost that will be recognized by the

consignor on its statement of financial position, from

the given information will be

a. P 42,420 c. P 37,780

b. P 37,840 d. P 33,780

11. The gross profit recognized by the consignor from the

consignee sales will be

a. P 4,200 c. P 8,200

b. P 4,800 d. P 8,420

You might also like

- BAFINAR - SW 1 ConsignmentDocument3 pagesBAFINAR - SW 1 ConsignmentRoy Mitz Aggabao Bautista V100% (1)

- FADocument3 pagesFAJomar VillenaNo ratings yet

- Consignment Accounting Questions and AnswersDocument18 pagesConsignment Accounting Questions and AnswersDele Aremo0% (1)

- Franchise FeeDocument2 pagesFranchise FeeCodeSeekerNo ratings yet

- AFAR QuizDocument18 pagesAFAR QuizHans Even Dela Cruz100% (1)

- Afar 2Document7 pagesAfar 2Diana Faye CaduadaNo ratings yet

- HO, B & A AcctgDocument15 pagesHO, B & A AcctgCarolina Fortez Dacanay71% (7)

- Long-Term Construction Contracts and FranchisingDocument7 pagesLong-Term Construction Contracts and FranchisingEpal AkoNo ratings yet

- OfficeDocument12 pagesOffice123r12f1100% (1)

- Multiple Choices QuestionsDocument10 pagesMultiple Choices QuestionsChristopher Price0% (1)

- Vdocuments - MX - Advanced Financial Accounting 1Document11 pagesVdocuments - MX - Advanced Financial Accounting 1Sweet EmmeNo ratings yet

- YowDocument35 pagesYowJane Michelle Eman100% (1)

- Set ADocument5 pagesSet ASomersNo ratings yet

- Partnership Distribution of $60,000 in DissolutionDocument9 pagesPartnership Distribution of $60,000 in DissolutionAllynna JoyNo ratings yet

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- Accounting for Home Office, Branch and Agency TransactionsDocument30 pagesAccounting for Home Office, Branch and Agency TransactionsHarvey Dienne Quiambao100% (3)

- Prac 1 - First Preboard - P2 65th NewDocument12 pagesPrac 1 - First Preboard - P2 65th NewArianne Llorente100% (1)

- Home Office IntegDocument9 pagesHome Office IntegReshielyn Vee Entrampas LopezNo ratings yet

- Comprehensive Examinations 2 (Part II)Document4 pagesComprehensive Examinations 2 (Part II)Yander Marl BautistaNo ratings yet

- Consignment Accounting Journal EntriesDocument22 pagesConsignment Accounting Journal EntriesRashid HussainNo ratings yet

- P2 1PB 2nd Sem 1314 With SolDocument15 pagesP2 1PB 2nd Sem 1314 With SolRhad EstoqueNo ratings yet

- Naqdown Final QuestionsDocument43 pagesNaqdown Final Questionssarahbee0% (1)

- Araullo University Advanced Financial Accounting & ReportingDocument7 pagesAraullo University Advanced Financial Accounting & ReportingDarelle Hannah MarquezNo ratings yet

- Strictly no erasures allowedDocument12 pagesStrictly no erasures allowedErwin Labayog MedinaNo ratings yet

- AFAR 01 Partnership AccountingDocument6 pagesAFAR 01 Partnership AccountingAriel DimalantaNo ratings yet

- InvestmentDocument9 pagesInvestmentJade Malaque0% (1)

- Midterm Exam Review: Accounting Problems and SolutionsDocument16 pagesMidterm Exam Review: Accounting Problems and SolutionsPrincess Claris Araucto33% (3)

- Multiple Choice - ConceptualDocument22 pagesMultiple Choice - Conceptualjustinng191No ratings yet

- 8506 - Installment SalesDocument4 pages8506 - Installment SalesAnonymous iNRMC4mgORNo ratings yet

- Assessment Materials #1Document5 pagesAssessment Materials #1Don John Rojas100% (1)

- Installment SalesDocument5 pagesInstallment SalesMarianne LanuzaNo ratings yet

- AFAR Answer KeyDocument9 pagesAFAR Answer KeyKim Fernandez50% (2)

- AA2Q1Document1 pageAA2Q1Sweet EmmeNo ratings yet

- Multiple Choice ACCSTDocument5 pagesMultiple Choice ACCSTJaene L.No ratings yet

- Quiz FARDocument5 pagesQuiz FARGlen JavellanaNo ratings yet

- FL AfarDocument20 pagesFL AfarKenneth Robledo50% (2)

- Page Comprehensive Theories and ProblemsDocument7 pagesPage Comprehensive Theories and Problemsharley_quinn11No ratings yet

- Corporate LiquidationDocument3 pagesCorporate LiquidationJasmine Marie Ng CheongNo ratings yet

- Stock Valuation Activity - Compare Share Types & Calculate PricesDocument3 pagesStock Valuation Activity - Compare Share Types & Calculate PricesKyla de SilvaNo ratings yet

- Aud Theo Part 2Document10 pagesAud Theo Part 2Naia Gonzales0% (2)

- Calculating Consolidated Net IncomeDocument18 pagesCalculating Consolidated Net IncomeFleo GardivoNo ratings yet

- LiquiDocument3 pagesLiquiPremium Netflix0% (1)

- Partnership Formation and Operations GuideDocument4 pagesPartnership Formation and Operations GuideMark Edgar De Guzman0% (1)

- Chapter 10Document9 pagesChapter 10chan.charanchan100% (1)

- Prerev FOREX 2019Document8 pagesPrerev FOREX 2019RojParcon50% (4)

- Activity For Finals TermDocument6 pagesActivity For Finals TermRhegee Irene RosarioNo ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationMae100% (1)

- Final Exam in Advanced Financial Accounting IDocument6 pagesFinal Exam in Advanced Financial Accounting IYander Marl BautistaNo ratings yet

- P2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Document12 pagesP2 103 Special Revenue Recognition Installment Sales Construction Contracts Franchise 1Kate Alvarez100% (2)

- Unit 9 - Consignment SalesDocument2 pagesUnit 9 - Consignment SalesKen-Ei BautistaNo ratings yet

- CHAPTER 1 Caselette - Accounting CycleDocument51 pagesCHAPTER 1 Caselette - Accounting CycleKaren MagsayoNo ratings yet

- All CaseletteDocument358 pagesAll CaseletteNish100% (1)

- AstDocument19 pagesAstshaylieeeNo ratings yet

- AccountingDocument25 pagesAccountingMaida Joy LusongNo ratings yet

- This Study Resource Was: Consignment SalesDocument3 pagesThis Study Resource Was: Consignment SalesKez MaxNo ratings yet

- Questions SsDocument7 pagesQuestions SsAngelli Lamique100% (2)

- Pamantasan ng Cabuyao Auditing ExamDocument13 pagesPamantasan ng Cabuyao Auditing Examfer maNo ratings yet

- Galatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Document5 pagesGalatians 6: 9 "Let Us Not Become Weary in Doing Good, For at The Proper Time We Will Reap A Harvest If We Do Not Give Up."Kei TsukishimaNo ratings yet

- Buscom Problem Solving DiazDocument5 pagesBuscom Problem Solving DiazErico PaderesNo ratings yet

- Quiz 1 Inventory and InvestmentsDocument7 pagesQuiz 1 Inventory and InvestmentsMark Lawrence YusiNo ratings yet

- Prelim Post Test 1Document4 pagesPrelim Post Test 1Emma Mariz GarciaNo ratings yet

- Module 3 - Activity Based CostingDocument5 pagesModule 3 - Activity Based CostingEmma Mariz GarciaNo ratings yet

- The Purpose Driven LifeDocument17 pagesThe Purpose Driven LifeEmma Mariz GarciaNo ratings yet

- Necessary Condition For Control.: PAS 38 Intangible AssetsDocument2 pagesNecessary Condition For Control.: PAS 38 Intangible AssetsEmma Mariz GarciaNo ratings yet

- AFAR FORMULAS EXPLAINEDDocument53 pagesAFAR FORMULAS EXPLAINEDEmma Mariz GarciaNo ratings yet

- Advance Financial Accounting and ReportingDocument25 pagesAdvance Financial Accounting and ReportingEmma Mariz GarciaNo ratings yet

- Business CombinationDocument7 pagesBusiness CombinationEmma Mariz GarciaNo ratings yet

- CVP Analysis Guide for Cost Planning and Decision MakingDocument4 pagesCVP Analysis Guide for Cost Planning and Decision MakingEmma Mariz GarciaNo ratings yet

- Module 2 - Methods of Segregating Mixed CostDocument4 pagesModule 2 - Methods of Segregating Mixed CostEmma Mariz GarciaNo ratings yet

- Business Combination - Stock AcquisitionDocument6 pagesBusiness Combination - Stock AcquisitionEmma Mariz GarciaNo ratings yet

- Proof of CashDocument1 pageProof of CashEmma Mariz GarciaNo ratings yet

- Depreciated Separately.: Property, Plant and EquipmentDocument5 pagesDepreciated Separately.: Property, Plant and EquipmentEmma Mariz GarciaNo ratings yet

- Branch Accounting TestbankDocument5 pagesBranch Accounting TestbankCyanLouiseM.Ellixir100% (6)

- Audit of CashDocument9 pagesAudit of CashEmma Mariz Garcia25% (8)

- Vat Exempt SalesDocument4 pagesVat Exempt SalesEmma Mariz GarciaNo ratings yet

- Value-Added Tax FinalDocument5 pagesValue-Added Tax FinalEmma Mariz GarciaNo ratings yet

- Payment Form: Under Tax Compliance Verification Drive/Tax MappingDocument2 pagesPayment Form: Under Tax Compliance Verification Drive/Tax MappingtristanjohnmagrareNo ratings yet

- If Deductions Are Claimed:, The Burden of Proving The Legality of The Deductions Rests Upon The TaxpayerDocument7 pagesIf Deductions Are Claimed:, The Burden of Proving The Legality of The Deductions Rests Upon The TaxpayerEmma Mariz GarciaNo ratings yet

- DonationDocument3 pagesDonationEmma Mariz GarciaNo ratings yet

- Share-based Payment Problems SolutionsDocument4 pagesShare-based Payment Problems SolutionsEmma Mariz Garcia100% (1)

- HOBA ProblemsDocument3 pagesHOBA ProblemsEmma Mariz Garcia67% (3)

- Deduction From The Gross EstateDocument6 pagesDeduction From The Gross EstateEmma Mariz GarciaNo ratings yet

- PFRS for Small Entities Simplifies Financial ReportingDocument3 pagesPFRS for Small Entities Simplifies Financial ReportingEmma Mariz Garcia100% (2)

- Deduction From The Gross EstateDocument6 pagesDeduction From The Gross EstateEmma Mariz GarciaNo ratings yet

- Branch Accounting TestbankDocument5 pagesBranch Accounting TestbankCyanLouiseM.Ellixir100% (6)

- AFAR Mastery Part5Document7 pagesAFAR Mastery Part5Emma Mariz GarciaNo ratings yet

- Pas 12: Income Taxes Accounting Income Taxable IncomeDocument5 pagesPas 12: Income Taxes Accounting Income Taxable IncomeEmma Mariz GarciaNo ratings yet

- Correction of ErrorsDocument15 pagesCorrection of ErrorsEmma Mariz GarciaNo ratings yet

- Estate TaxDocument7 pagesEstate TaxEmma Mariz GarciaNo ratings yet

- Bir UpdatesDocument2 pagesBir UpdatesEmma Mariz GarciaNo ratings yet

- Dwnload Full International Monetary Financial Economics 1st Edition Daniels Solutions Manual PDFDocument36 pagesDwnload Full International Monetary Financial Economics 1st Edition Daniels Solutions Manual PDFelegiastepauleturc7u100% (16)

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- 2JA5K2 FullDocument22 pages2JA5K2 FullLina LacorazzaNo ratings yet

- The SAGE Handbook of Digital JournalismDocument497 pagesThe SAGE Handbook of Digital JournalismK JNo ratings yet

- API MidtermDocument4 pagesAPI MidtermsimranNo ratings yet

- Corruption in PakistanDocument15 pagesCorruption in PakistanklutzymeNo ratings yet

- Green Management: Nestlé's Approach To Green Management 1. Research and DevelopmentDocument6 pagesGreen Management: Nestlé's Approach To Green Management 1. Research and DevelopmentAbaidullah TanveerNo ratings yet

- Biggest Lessons of 20 Years InvestingDocument227 pagesBiggest Lessons of 20 Years InvestingRohi Shetty100% (5)

- Magnetism 02Document10 pagesMagnetism 02Niharika DeNo ratings yet

- CCT AsqDocument12 pagesCCT Asqlcando100% (1)

- Diagnostic Information For Database Replay IssuesDocument10 pagesDiagnostic Information For Database Replay IssuesjjuniorlopesNo ratings yet

- Case Study - Soren ChemicalDocument3 pagesCase Study - Soren ChemicalSallySakhvadzeNo ratings yet

- Ebook The Managers Guide To Effective Feedback by ImpraiseDocument30 pagesEbook The Managers Guide To Effective Feedback by ImpraiseDebarkaChakrabortyNo ratings yet

- 1.1 Introduction To Networks - Networks Affect Our LivesDocument2 pages1.1 Introduction To Networks - Networks Affect Our LivesCristian MoralesNo ratings yet

- Backup and Recovery ScenariosDocument8 pagesBackup and Recovery ScenariosAmit JhaNo ratings yet

- 01-Azeotropic Distillation (IL Chien)Document35 pages01-Azeotropic Distillation (IL Chien)Shivam Vinoth100% (1)

- The Human Resource Department of GIK InstituteDocument1 pageThe Human Resource Department of GIK InstitutexandercageNo ratings yet

- Gps Anti Jammer Gpsdome - Effective Protection Against JammingDocument2 pagesGps Anti Jammer Gpsdome - Effective Protection Against JammingCarlos VillegasNo ratings yet

- Philippine Architecture, Film Industry EvolutionDocument4 pagesPhilippine Architecture, Film Industry EvolutionCharly Mint Atamosa IsraelNo ratings yet

- AHP for Car SelectionDocument41 pagesAHP for Car SelectionNguyên BùiNo ratings yet

- NEW CREW Fast Start PlannerDocument9 pagesNEW CREW Fast Start PlannerAnonymous oTtlhP100% (3)

- Instrumentos de Medición y Herramientas de Precisión Starrett DIAl TEST INDICATOR 196 A1ZDocument24 pagesInstrumentos de Medición y Herramientas de Precisión Starrett DIAl TEST INDICATOR 196 A1Zmicmarley2012No ratings yet

- Complaint Handling Policy and ProceduresDocument2 pagesComplaint Handling Policy and Proceduresjyoti singhNo ratings yet

- ITSCM Mindmap v4Document1 pageITSCM Mindmap v4Paul James BirchallNo ratings yet

- Mapping Groundwater Recharge Potential Using GIS-Based Evidential Belief Function ModelDocument31 pagesMapping Groundwater Recharge Potential Using GIS-Based Evidential Belief Function Modeljorge “the jordovo” davidNo ratings yet

- Computers As Components 2nd Edi - Wayne WolfDocument815 pagesComputers As Components 2nd Edi - Wayne WolfShubham RajNo ratings yet

- Lista Precio Septiembre 0609Document75 pagesLista Precio Septiembre 0609gNo ratings yet

- Gary Mole and Glacial Energy FraudDocument18 pagesGary Mole and Glacial Energy Fraudskyy22990% (1)

- Super Flexible, Super Fast, Super Value: Gigabit PTMP Client and PTP With Modular AntennasDocument5 pagesSuper Flexible, Super Fast, Super Value: Gigabit PTMP Client and PTP With Modular AntennasAbdallaNo ratings yet

- AE383LectureNotes PDFDocument105 pagesAE383LectureNotes PDFPoyraz BulutNo ratings yet