Professional Documents

Culture Documents

MAS III Review Question Prelim

Uploaded by

Jana LingcayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MAS III Review Question Prelim

Uploaded by

Jana LingcayCopyright:

Available Formats

1 MAS III – Review Questionnaire - PRELIM

Name:__________________________________________________________________________________________

Section 1: Regression Analysis

1. A single-product company uses regression to predict one of its factory overhead costs with materials used as

the independent variable. The regression equation is as follows: Y = 542,000 + 0.0000253X. Based on R²,

management has determined that this model captures a significant portion of the relationship. The behavior

of this company’s factory overhead cost with respect to units of finished goods produced is

a. Fixed.

b. Semivariable.

c. Variable.

d. Not determinable from the provided information.

2. SleepTight, a nationwide retail mattress firm, will begin selling high-end crib mattresses next year.

Management believes sales for this product will be driven primarily by birth rates but will be influenced to a

lesser extent by income levels. The best method for SleepTight to use to predict next year’s sales is

a. Simple regression.

b. Time-series regression.

c. Multiple regression.

d. Maximum likelihood regression

3. Gathering cost information through observations and interviews from departments within an organization is

known as the:

a. account analysis method

b. conference method

c. industrial engineering method

d. quantitative analysis method

4. Which of the following statements related to assumptions about estimating linear cost functions is FALSE?

a. Variations in a single cost driver explain variations in total costs.

b. A cost object is anything for which a separate measurement of costs is desired.

c. A linear function approximates cost behavior within the relevant range of the cost driver.

d. A high correlation between two variables ensures that a cause-and-effect relationship exists.

5. A high correlation between two variables s and t indicates that:

a. s may cause t, or t may cause s

b. both may be affected by a third variable

c. the correlation may be due to random chance

d. All of these answers are correct.

6. Which of the following does NOT represent a cause-and-effect relationship?

a. Material costs increase as the number of units produced increases.

b. A company is charged 40 cents for each brochure printed and mailed.

c. Utility costs increase at the same time that insurance costs increase.

d. It makes sense that if a complex product has a large number of parts it will take longer to assemble

than a simple product with fewer parts.

MAS III – REVIEW QUESTIONS 1

7. For January, the cost components of a picture frame include P0.35 for the glass, P.65 for the wooden frame,

and P0.80 for assembly. The assembly desk and tools cost P400. 1,000 frames are expected to be produced

in the coming year. What cost function best represents these costs?

a. y = 1.80 + 400X

b. y = 400 +1.80X

c. y = 2.20 + 1,000X

d. y = 1.00 + 400X

8. The strength (degree) of the correlation between a set of independent variables X and a dependent variable

Y can be measured by

a. Coefficient of Correlation

b. Coefficient of Determination

c. Standard error of estimate

d. All of the above

9. The percent of total variation of the dependent variable Y explained by the set of independent variables X is

measured by

a. Coefficient of Correlation

b. Coefficient of Skewness

c. Coefficient of Determination

d. Standard Error or Estimate

e. Multicollinearity

10. A coefficient of correlation is computed to be -0.95 means that

a. The relationship between two variables is weak.

b. The relationship between two variables is strong and positive

c. The relationship between two variables is strong and but negative

d. Correlation coefficient cannot have this value

11. Let the coefficient of determination computed to be 0.39 in a problem involving one independent variable

and one dependent variable. This result means that

a. The relationship between two variables is negative

b. The correlation coefficient is 0.39 also

c. 39% of the total variation is explained by the independent variable

d. 39% of the total variation is explained by the dependent variable

12. Relationship between correlation coefficient and coefficient of determination is that

a. both are unrelated

b. The coefficient of determination is the coefficient of correlation squared

c. The coefficient of determination is the square root of the coefficient of correlation

d. both are equal

13. Multicollinearity exists when

a. independent variables are correlated less than -0.70 or more than 0.70

b. An independent variables is strongly correlated with a dependent variable.

c. There is only one independent variable

d. The relationship between dependent and independent variable is non-linear

14. If "time" is used as the independent variable in a simple linear regression analysis, then which of the

following assumption could be violated

MAS III – REVIEW QUESTIONS 2

a. There is a linear relationship between the independent and dependent variables

b. The residual variation is the same for all fitted values of Y

c. The residuals are normally distributed

d. Successive observations of the dependent variable are uncorrelated

15. In multiple regression, when the global test of significance is rejected, we can conclude that

a. All of the net sample regression coefficients are equal to zero

b. All of the sample regression coefficients are not equal to zero

c. At least one sample regression coefficient is not equal to zero

d. The regression equation intersects the Y-axis at zero.

16. A residual is defined as

a. y−ŷ

b. Error sum of square

c. Regression sum of squares

d. Type I Error

17. What test statistic is used for a global test of significance?

a. Z test

b. t test

c. Chi-square test

d. F test

18. The correlation coefficient r is independent of

a. Origin only

b. Scale of Measurement only

c. Both change of origin and scale of measurement

d. None of these

19. If X and Y are independent to each other, the coefficient of correlation is

a. 1

b. 0

c. +1

d. +2

20. When regression line passes through the origin then

a. Regression coefficient is zero

b. Correlation is zero

c. Intercept is zero

d. Association is zero

21. If ŷ=a then rxy

a. bxy=1

b. byx=−1

c. byx=0

d. None of these

22. The best fitting trend is one for which the sum of squares of error is

a. Zero

b. Minimum (Least)

MAS III – REVIEW QUESTIONS 3

c. Maximum

d. None

23. If all the values fall on the same straight line and the line has a positive slope then what will be the value of

the correlation coefficient ‘r’:

a. 0 ≤ r ≤ 1

b. r ≥ 0

c. r = +1

d. r = -1

e. 0

24. If the regression equation is equal to Y=23.6−54.2X, then 23.6 is the _____ while -54.2 is the ____ of the

regression line

a. Radius, intercept

b. Intercept, slope

c. Slope, intercept

d. Slope, regression coefficient

25. If the scatter diagram is drawn the scatter points lie on a straight line then it indicate

a. None of the above

b. Skewness

c. Perfect correlation

d. No correlation

26. In regression equation y=a+βx+e, both x and y variables are

a. Fixed

b. Random

c. y is fixed and x is random

d. None of above

e. x is fixed and y is random

27. The method of least squares finds the best fit line that _____ the error between observed and estimated

points on the line

a. Maximize

b. Approaches to infinity

c. Reduces to zero

d. Minimize

28. A plot of data that results in bunched points with little slope generally indicates:

a. a strong relationship

b. a weak relationship

c. a positive relationship

d. a negative relationship

29. Cross-sectional data analysis includes:

a. using a variety of time periods to measure the dependent variable

b. using the highest and lowest observation

c. observing different entities during the same time period

d. comparing information in different cost pools

MAS III – REVIEW QUESTIONS 4

30. Time-series data analysis includes:

a. using a variety of time periods to measure the dependent variable

b. using the highest and lowest observation

c. observing different entities during the same time period

d. comparing information in different cost pools

31. The smaller the residual term the:

a. stronger the relationship between the cost driver and costs

b. weaker the relationship between the cost driver and costs

c. steeper the slope of the cost function

d. gentler the slope of the cost function

32. The coefficient of determination is important in explaining variances in estimating equations. For a certain

estimating equation, the unexplained variation was given as 26,505. The total variation was given as 46,500.

What is the coefficient of determination for the equation?

a. 0.34

b. 0.43

c. 0.57

d. 0.66

r2 = 1 - (26,505/46,500) = 0.43

33. Craig’s Cola plans to sell 1,000 cases of cola next week. The accountant provided the following analysis of

total manufacturing costs.

Variable Coefficient Standard Error t-Value

Constant 100 71.94 1.39

Independent variable 200 91.74 2.18

r2 = 0.82

What is the estimated value of selling the 1,000 cases of cola?

a. P200,100

b. P142,071

c. P100,200

d. P9,000

y = P100 + (P200 x 1,000) = P200,100

34. Pam’s Stables used two different independent variables (trainer hours and number of horses) in two

different equations to evaluate the cost of training horses. The most recent results of the two regressions

are as follows:

Trainer's hours:

Variable Coefficient Standard Error t-Value

Constant P913.32 P198.12 4.61

Independent Variable P20.90 P2.94 7.11

r2 = 0.56

Number of horses:

Variable Coefficient Standard Error t-Value

Constant P4,764.50 P1,073.09 4.44

Independent Variable P864.98 P247.14 3.50

r2 = 0.63

MAS III – REVIEW QUESTIONS 5

What is the estimated total cost for the coming year if 16,000 trainer hours are incurred and the stable has

400 horses to be trained, based on the best cost driver?

a. P99,929.09

b. P350,756.50

c. P335,313.32

d. P13,844,444.50

y = P4,764.50 + P864.98 x 400 = P350,756.50 based on highest r2, which uses # of horses as the cost driver

35. A major concern that arises with multiple regression is multicollinearity, which exists when:

a. in simple regression, when the dependent variable is not normally distributed

b. in simple regression, when the R2 statistic is low

c. in multiple regression, when the R2 statistic is low

d. in multiple regression, when two or more independent variables are correlated with one another

36. Cascade Company has sales of P300,000 in 20x0 and the price index for its industry is expected to rise from

300 to 320 in 20x1. The level of sales that Cascade must reach in 20x1 in order to achieve a real growth rate

of 20% is

a. P384,000

b. P320,000

c. P360,000

d. P337,500

Projected Sales = [Base Sales * (Current Index/Base Index) ] 1+ Growth rate

= [P300,000 * (320/300)] 1+ 20%

=P384,000

Part 2: Long- term Financial Planning and EFN

1. A firm's external financing need is financed by which of the following?

a. retained earnings

b. net working capital and retained earnings

c. net income and retained earnings

d. debt or equity

e. owners' equity, including retained earnings

2. Sales can often increase without increasing which one of the following?

a. accounts receivable

b. cost of goods sold

c. accounts payable

d. fixed assets

e. inventory

3. Blasco Industries is currently at full-capacity sales. Which one of the following is limiting sales to this level?

a. net working capital

b. long-term debt

c. inventory

d. fixed assets

e. debt-equity ratio

MAS III – REVIEW QUESTIONS 6

4. All else constant, which one of the following will increase the internal rate of growth?

a. decrease in the retention ratio

b. decrease in net income

c. increase in the dividend payout ratio

d. decrease in total assets

e. increase in costs of goods sold

5. The external financing need:

a. will limit growth if unfunded.

b. is unaffected by the dividend payout ratio.

c. must be funded by long-term debt.

d. ignores any changes in retained earnings.

e. considers only the required increase in fixed assets.

6. Which one of the following will cause the sustainable growth rate to equal to internal growth rate?

a. dividend payout ratio greater than 1.0

b. debt-equity ratio of 1.0

c. retention ratio between 0.0 and 1.0

d. equity multiplier of 1.0

e. zero dividend payments

7. The sustainable growth rate:

a. assumes there is no external financing of any kind.

b. assumes no additional long-term debt is available.

c. assumes the debt-equity ratio is constant.

d. assumes the debt-equity ratio is 1.0.

e. assumes all income is retained by the firm.

8. If a firm equates its pro forma sales growth to the rate of sustainable growth, and has positive net income and

excess capacity, then the:

a. maximum capacity level will have to increase at the same rate as sales growth.

b. total assets will have to increase at the same rate as sales growth.

c. debt-equity ratio will increase.

d. retained earnings will increase.

e. number of common shares outstanding will increase.

9. Sal's Pizza has a dividend payout ratio of 10 percent. The firm does not want to issue additional equity shares but

does want to maintain its current debt-equity ratio and its current dividend policy. The firm is profitable. Which

one of the following defines the maximum rate at which this firm can grow?

a. internal growth rate x (1 - 0.10)

b. sustainable growth rate x (1 - 0.10)

c. internal growth rate

d. sustainable growth rate

e. zero percent

10. Which of the following can affect a firm's sustainable rate of growth?

I. capital intensity ratio

II. profit margin

MAS III – REVIEW QUESTIONS 7

III. dividend policy

IV. debt-equity ratio

a. III only

b. I and III only

c. II, III, and IV only

d. I, II, and IV only

e. I, II, III, and IV

11. Financial plans generally tend to ignore which one of the following?

a. dividend policy

b. manager's goals and objectives

c. risks associated with cash flows

d. operating capacity levels

e. capital structure policy

12. The financial planning process tends to place the least emphasis on which one of the following?

a. growth limitations

b. capacity utilization

c. market value of a firm

d. capital structure of a firm

e. dividend policy

13. The financial planning process:

I. involves internal negotiations among divisions.

II. quantifies senior manager's goals.

III. considers only internal factors.

IV. reconciles company activities across divisions.

a. III and IV only

b. II and III only

c. I, II, and IV only

d. II, III, and IV only

e. I, II, III, and IV

14. A Procrustes approach to financial planning is based on:

a. a policy of producing a financial plan once every five years.

b. developing a plan around the goals of senior managers.

c. a proactive approach to the economic outlook.

d. a flexible capital budget.

e. a flexible capital structure.

15. Fresno Salads has current sales of P4,900 and a profit margin of 6.5 percent. The firm estimates that sales will

increase by 5 percent next year and that all costs will vary in direct relationship to sales. What is the pro forma

net income?

a. P303.33

b. P327.18

c. P334.43

d. P338.70

e. P341.10

MAS III – REVIEW QUESTIONS 8

Net income = P4,900 x .065 x (1 + .05) = P334.43

16. Wagner Industrial Motors, which is currently operating at full capacity, has sales of P29,000, current assets of

P1,600, current liabilities of P1,200, net fixed assets of P27,500, and a 5 percent profit margin. The firm has no

long-term debt and does not plan on acquiring any. The firm does not pay any dividends. Sales are expected to

increase by 4.5 percent next year. If all assets, short-term liabilities, and costs vary directly with sales, how much

additional equity financing is required for next year?

a. -P259.75

b. -P201.19

c. P967.30

d. P1,099.08

e. P1,515.25

Projected assets = (P1,600 + P27,500) x 1.045 = P30,409.50

Projected liabilities = P1,200 x 1.045 = P1,254

Current equity = P1,600 + P27,500 - P1,200 = P27,900

Projected increase in retained earnings = P29,000 x .05 x 1.045 = P1,515.25

Equity funding need = P30,409.50 - P1,254 - P27,900 - P1,515.25 = -P259.75

17. The Cookie Shoppe expects sales of P437,500 next year. The profit margin is 4.8 percent and the firm has a 30

percent dividend payout ratio. What is the projected increase in retained earnings?

a. P14,700

b. P17,500

c. P18,300

d. P20,600

e. P21,000

Change in retained earnings = P437,500 x .048 x (1 - 0.30) = P14,700

18. Gladsden Refinishers currently has P21,900 in sales and is operating at 45 percent of the firm's capacity. What is

the full capacity level of sales?

a. P31,755

b. P36,250

c. P48,667

d. P51,333

e. P54,500

19. The Corner Store has P219,000 of sales and P187,000 of total assets. The firm is operating at 87 percent of

capacity. What is the capital intensity ratio at full capacity?

a. 0.62

b. 0.68

c. 0.74

d. 1.35

e. 1.47

20. Miller Bros. Hardware is operating at full capacity with a sales level of P689,700 and fixed assets of P468,000.

The profit margin is 7 percent. What is the required addition to fixed assets if sales are to increase by 10

percent?

a. P3,276

b. P4,680

c. P28,400

MAS III – REVIEW QUESTIONS 9

d. P32,760

e. P46,800

21. Designer's Outlet has a capital intensity ratio of 0.87 at full capacity. Currently, total assets are P48,900 and

current sales are P52,300. At what level of capacity is the firm currently operating?

a. 89 percent

b. 91 percent

c. 93 percent

d. 96 percent

e. 98 percent

22. Monika's Dinor is operating at 94 percent of its fixed asset capacity and has current sales of P611,000. How much

can the firm grow before any new fixed assets are needed?

a. 4.99 percent

b. 5.78 percent

c. 6.02 percent

d. 6.38 percent

e. 6.79 percent

23. Stop and Go has a 4.5 percent profit margin and a 15 percent dividend payout ratio. The total asset turnover is

1.6 and the debt-equity ratio is 0.60. What is the sustainable rate of growth?

a. 9.13 percent

b. 9.54 percent

c. 9.89 percent

d. 10.26 percent

e. 10.85 percent

Return on equity = 0.045 1.60 (1 + 0.60) = 0.1152

Sustainable growth = [0.1152 (1 - 0.15)]/{1 - [.1152 (1 - 0.15)]} = 10.85 percent

24. R. N. C., Inc. desires a sustainable growth rate of 4.5 percent while maintaining a 40 percent dividend payout

ratio and a 6 percent profit margin. The company has a capital intensity ratio of 1.23. What equity multiplier is

required to achieve the company's desired rate of growth?

a. 1.33

b. 1.38

c. 1.42

d. 1.47

e. 1.53

0.045 = [ROE (1 - 0.40)]/{1 - [ROE (1 - 0.40)]}; ROE = .07177

0.07177 = 0.06 (1/1.23) EM; EM = 1.47

25. A firm has a retention ratio of 45 percent and a sustainable growth rate of 6.2 percent. The capital intensity ratio

is 1.2 and the debt-equity ratio is 0.64. What is the profit margin?

a. 6.28 percent

b. 7.67 percent

c. 9.47 percent

d. 12.38 percent

MAS III – REVIEW QUESTIONS 10

e. 14.63 percent

26. Frasier Cabinets wants to maintain a growth rate of 5 percent without incurring any additional equity financing.

The firm maintains a constant debt-equity ratio of .0.55, a total asset turnover ratio of 1.30, and a profit margin

of 9.0 percent. What must the dividend payout ratio be?

a. 26.26 percent

b. 38.87 percent

c. 49.29 percent

d. 61.13 percent

e. 73.74 percent

27. Cross Town Express has sales of P132,000, net income of P12,600, total assets of P98,000, and total equity of

P45,000. The firm paid P7,560 in dividends and maintains a constant dividend payout ratio. Currently, the firm is

operating at full capacity. All costs and assets vary directly with sales. The firm does not want to obtain any

additional external equity. At the sustainable rate of growth, how much new total debt must the firm acquire?

a. P0

b. P4,311

c. P5,989

d. P6,207

e. P6,685

28. The Two Sisters has a 9 percent return on assets and a 75 percent retention ratio. What is the internal growth

rate?

a. 6.50 percent

b. 6.75 percent

c. 6.97 percent

d. 7.24 percent

e. 7.38 percent

29. The Dog House has net income of P3,450 and total equity of P8,600. The debt-equity ratio is 0.60 and the payout

ratio is 20 percent. What is the internal growth rate?

a. 14.47 percent

b. 17.78 percent

c. 25.09 percent

d. 29.40 percent

e. 33.33 percent

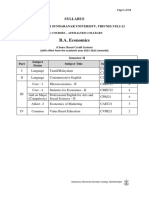

Fact Pattern: Major Manuscript Questions 30 – 36.

MAS III – REVIEW QUESTIONS 11

30. What is Major Manuscripts, Inc.'s retention ratio?

a. 33 percent

b. 40 percent

c. 50 percent

d. 60 percent

e. 67 percent

31. Major Manuscripts, Inc. does not want to incur any additional external financing. The dividend payout ratio is

constant. What is the firm's maximum rate of growth?

a. 7.44 percent

b. 7.78 percent

c. 9.26 percent

d. 9.75 percent

e. 10.90 percent

Retention ratio = (P2,376 - P950)/P2,376 = 0.60

Internal growth rate = [(P2,376/P20,590) 0.60]/{1 - [(P2,376/P20,590) 0.60]} = 7.44 percent

32. If Major Manuscripts, Inc. decides to maintain a constant debt-equity ratio, what rate of growth can it maintain

assuming that no additional external equity financing is available.

a. 10.23 percent

b. 10.49 percent

c. 10.90 percent

d. 11.27 percent

e. 11.65 percent

Retention ratio = (P2,376 - P950)/P2,376 = 0.60

Sustainable growth rate = {[P2,376/(P10,000 + P4,510)] 0.60}/(expression error) = 10.90 percent

33. Major Manuscripts, Inc. is currently operating at maximum capacity. All costs, assets, and current liabilities vary

directly with sales. The tax rate and the dividend payout ratio will remain constant. How much additional debt is

required if no new equity is raised and sales are projected to increase by 8 percent?

a. -P157

b. -P68

c. P241

MAS III – REVIEW QUESTIONS 12

d. P348

e. P367

Projected total assets = P20,590 1.08 = P22,237

Projected accounts payable = P3,300 1.08 = P3,564

Current long-term debt = P2,780

Current common stock = P10,000

Projected retained earnings = P4,510 + [(P2,376 - P950) 1.08] = P6,050

Additional debt required = P22,237 - P3,564 - P2,780 - P10,000 - P6,050 = -P157

34. Major Manuscripts, Inc. is currently operating at 85 percent of capacity. All costs and net working capital vary

directly with sales. The tax rate, the profit margin, and the dividend payout ratio will remain constant. How much

additional debt is required if no new equity is raised and sales are projected to increase by 15 percent?

a. -P810

b. -P756

c. -P642

d. P244

e. P358

35. Assume the profit margin and the payout ratio of Major Manuscripts, Inc. are constant. If sales increase by 6

percent, what is the pro forma retained earnings?

a. P5,220.18

b. P5,721.42

c. P6,021.56

d. P6,648.42

e. P7,028.56

36. Assume that Major Manuscripts, Inc. is currently operating at 95 percent of capacity and that sales are projected

to increase to P20,000. What is the projected addition to fixed assets?

a. P0

b. P1,493

c. P1,529

d. P1,546

e. P1,588

Current maximum capacity = P16,800/.95 = P17,684.21

Required addition to fixed assets = [(P11,400/P17,684.21) P20,000] - P11,400 = P1,493

Fact Pattern: Hungry Howie Foods Inc. – Questions 37 -

MAS III – REVIEW QUESTIONS 13

37. Hungry Howie's is currently operating at 78 percent of capacity. What is the full-capacity level of sales?

a. P21,106.00

b. P21,580.62

c. P22,179.49

d. P24,506.17

e. P25,301.91

38. Hungry Howie's is currently operating at 82 percent of capacity. What is the total asset turnover ratio at full

capacity?

a. .68

b. .78

c. .95

d. 1.29

e. 1.46

39. Hungry Howie's is currently operating at 96 percent of capacity. The profit margin and the dividend payout ratio

are projected to remain constant. Sales are projected to increase by 3 percent next year. What is the projected

addition to retained earnings for next year?

a. P1,309.19

b. P1,421.40

c. P1,884.90

d. P2,667.78

e. P3,001.40

40. Hungry Howie's is currently operating at full capacity. The profit margin and the dividend payout ratio are held

constant. Net working capital and fixed assets vary directly with sales. Sales are projected to increase by 11

percent. What is the external financing needed?

a. -P196.50

b. -P148.00

c. -P97.20

d. -P14.50

e. P26.80

41. Hungry Howie's maintains a constant payout ratio. The firm is currently operating at full capacity. What is the

maximum rate at which the firm can grow without acquiring any additional external financing?

a. 9.74 percent

MAS III – REVIEW QUESTIONS 14

b. 10.52 percent

c. 11.06 percent

d. 11.58 percent

e. 12.23 percent

42. Hungry Howie's is currently operating at 94 percent of capacity. What is the required increase in fixed assets if

sales are projected to increase by 14 percent?

a. P0

b. P511

c. P633

d. P708

e. P777

Some related budgeting problems:

43. Ward Corporation’s current year-end sales totaled P240 million, and its ending cash balance was P20 million.

Ward anticipates its sales for the upcoming year will be P260 million. On average, 10% of a year’s sales will be

collected during the following year. Assume Ward has no uncollectible accounts. Ward also anticipates cash

expenses of P240 million and depreciation of P5 million. During the next year, Ward intends to spend P30 million

cash for capital improvements. If Ward’s policy is to have a minimum of P10 million cash available at the

beginning of each year, its budgeted cash flow projections indicate that it will need outside financing of

a. P0

b. P2 million

c. P7 million

d. P26 million

44. Worley, Inc., a publicly traded company, operates a seasonal business with high production in the month of

November for which suppliers are paid in December in order to take advantage of a purchase discount. High

sales typically occur in December, with payment received by Worley in January. Worley’s abbreviated December

cash budget is shown below.

Cash balance, beginning P875,000

Cash receipts 200,000

Cash disbursements

Payments to suppliers 520,000

Other operating costs 500,000

Dividends 80,000

Cash balance, ending P (25,000)

The company is considering alternatives to provide the company with the desired ending cash balance of

P75,000 in December. The best action(s) for Worley would be to

a. Eliminate P80,000 of dividends and postpone P20,000 of payments to suppliers.

b. Eliminate P80,000 of dividends and arrange for P20,000 of short-term borrowing.

c. Postpone P100,000 of payments to suppliers.

d. Arrange for P100,000 of short-term borrowing.

45. Sanford has a beginning cash balance of P10,000 and expects P40,000 in cash receipts for each of the next 2

months. Typically, disbursements total about P20,000 per month. Sanford’s payables policy has been to pay the

bills upon receipt to maintain good vendor relationships and take advantage of any discounts. In month 1, the

company also expects a one-time P40,000 bill for a patent application. Based on this information, select the

MAS III – REVIEW QUESTIONS 15

statement below that reflects the most appropriate action that Sanford should take relative to the company’s

cash position during the 2-month period.

a. Sanford should arrange a short-term line of credit large enough to cover the projected P10,000 shortfall

during the first month.

b. Sanford should defer disbursements to maintain a desired level of cash.

c. Sanford should finance the P40,000 payment over a longer term, but with a higher interest rate.

d. No action is necessary as Sanford will have sufficient cash during the 2-month period.

Fact Pattern: Kelly Company : Questions 46-48

Kelly Company is a retail sporting goods store that uses accrual accounting for its records. Facts regarding Kelly’s

operations are as follows:

Sales are budgeted at P220,000 for December Year 1 and P200,000 for January Year 2.

Collections are expected to be 60% in the month of sale and 38% in the month following the sale.

Gross margin is 25% of sales.

A total of 80% of the merchandise held for resale is purchased in the month prior to the month of sale and 20%

is purchased in the month of sale. Payment for merchandise is made in the month following the purchase.

Other expected monthly expenses to be paid in cash are P22,600.

Annual depreciation is P216,000.

Below is Kelly Company’s statement of financial position at November 30, Year 1.

Assets

Cash P 22,000

Accounts receivable (net of P4,000

allowance for uncollectible accounts) 76,000

Inventory 132,000

Property, plant, and equipment (net of

P680,000 accumulated depreciation) 870,000

Total assets P1,100,000

Liabilities and Stockholders’ Equity

Accounts payable P 162,000

Common stock 800,000

Retained earnings 138,000

Total liabilities and stockholders’ equity P1,100,000

46. Kelly’s pro forma income (loss) before income taxes for December Year 1 is

a. P32,400

b. P28,000

c. P10,000

d. P15,000

47. Kelly’s projected balance in accounts payable on December 31, Year 1, is

a. P162,000

b. P204,000

c. P153,000

d. Some amount other than those given.

48. Kelly’s projected balance in inventory on December 31, Year 1, is

a. P160,000

MAS III – REVIEW QUESTIONS 16

b. P120,000

c. P153,000

d. P150,000

49. Shoo, Inc., owns several retail stores. After all initial budget requests were received for the upcoming year,

Shoo’s abbreviated pro forma income statement is as follows: Sales P46,000,000 Cost of goods sold 20,700,000

Selling and administrative costs 19,800,000 Operating income 5,500,000 The cost of goods sold and a 5% sales

commission are the only variable costs. Shoo’s upper management believes that the sales manager

underestimated projected sales units and wants the sales budget increased such that the company can achieve

its goal of a 15% return on sales. The amount by which sales must increase to achieve this goal is

a. P4,000,000

b. P3,500,000

c. P1,750,000

d. P1,400,000

-END-

Goodluck in your departmental exams. Remember: It’s only an exam.

“People who can’t throw something important away, can never hope to change

anything.” – Armin Arlelt – Shingeki no Kyojin

MAS III – REVIEW QUESTIONS 17

You might also like

- ASTHA SCHOOL MANAGEMENT Multiple Choice Questions (18MBA204Document8 pagesASTHA SCHOOL MANAGEMENT Multiple Choice Questions (18MBA204MD RehanNo ratings yet

- IV Semester MA Economics Advanced Econometrics Multiple Choice QuestionsDocument17 pagesIV Semester MA Economics Advanced Econometrics Multiple Choice QuestionsMadonaNo ratings yet

- Mutliple Regression-McqsDocument10 pagesMutliple Regression-McqsSaadatNo ratings yet

- Assignment6.1 DataMining Part1 Simple Linear RegressionDocument8 pagesAssignment6.1 DataMining Part1 Simple Linear Regressiondalo835No ratings yet

- 11 Economics sp01Document14 pages11 Economics sp01DËV DÃSNo ratings yet

- Review-Multiple Regression-Multiple ChoiceDocument6 pagesReview-Multiple Regression-Multiple ChoiceNguyễn Tuấn Anh100% (1)

- Class 11 - Economics Sample Paper 01Document15 pagesClass 11 - Economics Sample Paper 01Ansh YadavNo ratings yet

- Research Methods Statistics and Applications 1st Edition Adams Test BankDocument9 pagesResearch Methods Statistics and Applications 1st Edition Adams Test Bankfarleykhucucc59v100% (26)

- Mock Paper SIDocument5 pagesMock Paper SIIharry 1No ratings yet

- Stat982 (Chap14) Q SetDocument30 pagesStat982 (Chap14) Q SetGerald Flores100% (1)

- Linear Regression Analysis McqsDocument2 pagesLinear Regression Analysis McqsEngr Mujahid Iqbal100% (3)

- Economics Term IDocument9 pagesEconomics Term IPiyush JhamNo ratings yet

- CORRELATION & REGRESSION MULTIPLE CHOICEDocument22 pagesCORRELATION & REGRESSION MULTIPLE CHOICEGing freexNo ratings yet

- Regression MCQuestionsDocument8 pagesRegression MCQuestionsMuhammad ArslanNo ratings yet

- Regression MCQuestionsDocument8 pagesRegression MCQuestionstamizhNo ratings yet

- StatisticsDocument53 pagesStatisticsfelamendoNo ratings yet

- Economterics Final 2024.Document32 pagesEconomterics Final 2024.OSHI JOHRINo ratings yet

- 2ND Quarterly Examination in Practical Research 2Document5 pages2ND Quarterly Examination in Practical Research 2John Ferry P. SualNo ratings yet

- Chapter 14Document30 pagesChapter 14vishveshwarNo ratings yet

- Topic 5: Correlation: A. B. C. D. A. B. C. D. A. B. C. D. E. A. B. C. D. A. C. B. D. A. B. C. D. A. C. B. DDocument4 pagesTopic 5: Correlation: A. B. C. D. A. B. C. D. A. B. C. D. E. A. B. C. D. A. C. B. D. A. B. C. D. A. C. B. Dyou are loved100% (2)

- University of Mauritius Quantitative Finance II ExamDocument8 pagesUniversity of Mauritius Quantitative Finance II ExamRevatee HurilNo ratings yet

- 11 Economics Sp03Document14 pages11 Economics Sp03Prajin VermaNo ratings yet

- Assignment 5Document6 pagesAssignment 5Joseph SidhomNo ratings yet

- DS100-2-Grp#4 Chapter 6 Advanced Analytical Theory and Methods Regression (CADAY, CASTOR, CRUZ, SANORIA, TAN)Document4 pagesDS100-2-Grp#4 Chapter 6 Advanced Analytical Theory and Methods Regression (CADAY, CASTOR, CRUZ, SANORIA, TAN)Gelo CruzNo ratings yet

- Exam FinalDocument21 pagesExam FinalAnugrah Stanley100% (1)

- Chapter 15 Multiple Choice Questions Statistics ExamDocument6 pagesChapter 15 Multiple Choice Questions Statistics ExamSialhai100% (2)

- Practice Questions - Multiple Linear RegressionDocument44 pagesPractice Questions - Multiple Linear Regressionmanish100% (7)

- TB Chapter 18 AnswersDocument44 pagesTB Chapter 18 AnswersMahmoudElbehairyNo ratings yet

- 5 Regression 150330040604 Conversion Gate01Document5 pages5 Regression 150330040604 Conversion Gate01Venkat Macharla100% (1)

- Econ 3180 Final Exam, April 15th 2013 Ryan GodwinDocument14 pagesEcon 3180 Final Exam, April 15th 2013 Ryan GodwinsehunNo ratings yet

- Chapter 3Document5 pagesChapter 3Haris MalikNo ratings yet

- MCA4020-Model Question PaperDocument18 pagesMCA4020-Model Question PaperAppTest PINo ratings yet

- q4 Statistics and Probability Summative FinalDocument4 pagesq4 Statistics and Probability Summative FinalMaire Narag100% (2)

- MC Multiple RegressionDocument7 pagesMC Multiple Regressionnhat hoang ducNo ratings yet

- TrachnhiemDocument4 pagesTrachnhiemQuyên ThanhNo ratings yet

- 5) Mba Assignment 4Document2 pages5) Mba Assignment 42023502395No ratings yet

- STA 3024 Practice Problems Exam 2 Multiple RegressionDocument13 pagesSTA 3024 Practice Problems Exam 2 Multiple Regressiondungnt0406100% (2)

- BIOSTATDocument24 pagesBIOSTATMyzhel InumerableNo ratings yet

- Quiz RegressionDocument27 pagesQuiz Regressionnancy 1996100% (2)

- Model IIDocument29 pagesModel IIAhmed AbdiNo ratings yet

- MLPUE2 SolutionDocument9 pagesMLPUE2 SolutionNAVEEN SAININo ratings yet

- III Sem. BA Economics - Core Course - Quantitative Methods For Economic Analysis - 1Document29 pagesIII Sem. BA Economics - Core Course - Quantitative Methods For Economic Analysis - 1Agam Reddy M50% (2)

- BADM 299 Exam 4 Chap 12-Review QuestionsDocument7 pagesBADM 299 Exam 4 Chap 12-Review QuestionsStatistics LearningNo ratings yet

- Appilication of Statistics in PsychologyDocument16 pagesAppilication of Statistics in PsychologyMehak BatoolNo ratings yet

- Aff700 1000 230109Document9 pagesAff700 1000 230109nnajichinedu20No ratings yet

- Assignment6.1 DataMining Part2 Multiple Linear RegressionDocument8 pagesAssignment6.1 DataMining Part2 Multiple Linear Regressiondalo835100% (1)

- Test Bank For Business Forecasting 6th Edition Wilson Full DownloadDocument24 pagesTest Bank For Business Forecasting 6th Edition Wilson Full Downloaddanielnelsonstziebqjyp100% (47)

- Linear Regression and Correlation ExplainedDocument7 pagesLinear Regression and Correlation Explainedsayed7777No ratings yet

- Multiple Choice Questions On Quantitative TechniquesDocument20 pagesMultiple Choice Questions On Quantitative TechniquesDeependra SamantNo ratings yet

- Introductory Econometrics Test BankDocument106 pagesIntroductory Econometrics Test BankMinh Hạnhx CandyNo ratings yet

- Correlation & Regression Multiple Choice QuestionsDocument8 pagesCorrelation & Regression Multiple Choice QuestionsLatikataraniNo ratings yet

- Econ MIdterm 2 PractiseDocument11 pagesEcon MIdterm 2 PractiseConnorNo ratings yet

- Aff700 1000 221209Document11 pagesAff700 1000 221209nnajichinedu20No ratings yet

- MCQs (Machine Learning)Document7 pagesMCQs (Machine Learning)Zeeshan Ali Khan50% (22)

- Regression QuizDocument2 pagesRegression QuizKaiden AmaruNo ratings yet

- Chapter 03 Correlation and RegressionDocument21 pagesChapter 03 Correlation and RegressionJoseph Baring IIINo ratings yet

- Quiz2 ISDS 361BDocument5 pagesQuiz2 ISDS 361BAnh PhamNo ratings yet

- Solutions Manual to accompany Introduction to Linear Regression AnalysisFrom EverandSolutions Manual to accompany Introduction to Linear Regression AnalysisRating: 1 out of 5 stars1/5 (1)

- OpenDocument1 pageOpenJana LingcayNo ratings yet

- 04 Infant Care TechniquesDocument63 pages04 Infant Care TechniquesJana Lingcay100% (1)

- AisDocument1 pageAisJana LingcayNo ratings yet

- This Is A File I Made To Download From Scribd This Is Not UsefulDocument1 pageThis Is A File I Made To Download From Scribd This Is Not UsefulJana LingcayNo ratings yet

- Error CorrectionDocument1 pageError CorrectionJana LingcayNo ratings yet

- Sales Prediction Using Regression Analysis: Problem StatementDocument3 pagesSales Prediction Using Regression Analysis: Problem StatementdurgeshNo ratings yet

- NMCCDocument19 pagesNMCCRobin MNo ratings yet

- BM PDFDocument307 pagesBM PDFPulkit SharmaNo ratings yet

- Regression AnalysisDocument21 pagesRegression AnalysisAshish BaniwalNo ratings yet

- Multiple and Logistic Regression ModelsDocument3 pagesMultiple and Logistic Regression Modelsrodicasept1967No ratings yet

- Change of Incisor Inclination Effects On Points A and B PDFDocument6 pagesChange of Incisor Inclination Effects On Points A and B PDFAlvaro ChacónNo ratings yet

- MS 95Document3 pagesMS 95ONNEILE KGOSIITSILENo ratings yet

- ActuarDocument142 pagesActuarjose zepedaNo ratings yet

- Week3a ChangedetectionDocument99 pagesWeek3a ChangedetectionRusydan IbrahimNo ratings yet

- PHD Course Work Kadi Sarva Vishwa VidyalayaDocument136 pagesPHD Course Work Kadi Sarva Vishwa VidyalayaDharmender RatheeNo ratings yet

- Measurement of Cost BehaviourDocument43 pagesMeasurement of Cost BehaviourArie Widyastuti100% (4)

- On Estimation of Population Parameters in Sampling Theory Using A Sensitive VariableDocument113 pagesOn Estimation of Population Parameters in Sampling Theory Using A Sensitive VariablePranav SharmaNo ratings yet

- Bordens and Abbott 2008Document18 pagesBordens and Abbott 2008Damien PigottNo ratings yet

- Analysis of VarianceDocument5 pagesAnalysis of VarianceAshis LambaNo ratings yet

- Numerical Methods For Non-Linear Least Squares Curve FittingDocument55 pagesNumerical Methods For Non-Linear Least Squares Curve Fittingnagatopein6No ratings yet

- IIM Kozhikode Business Research Case Analysis Pilgrim Bank (BDocument3 pagesIIM Kozhikode Business Research Case Analysis Pilgrim Bank (BNeelesh Kamath100% (2)

- Chapter 4Document84 pagesChapter 4Mike Michael0% (1)

- R&D Dan Intangible Asset Pada Nilai Perusahaan: Kinerja Keuangan Sebagai Variabel Intervening PengaruhDocument22 pagesR&D Dan Intangible Asset Pada Nilai Perusahaan: Kinerja Keuangan Sebagai Variabel Intervening PengaruhTsania FerrariniNo ratings yet

- CS601 - Machine Learning - Unit 2 - Notes - 1672759753Document14 pagesCS601 - Machine Learning - Unit 2 - Notes - 1672759753mohit jaiswalNo ratings yet

- IMDB Data AnalysesDocument38 pagesIMDB Data Analysesphanindra varma0% (1)

- The Moderating Effect of Intellectual Capital On The Relationship Between Corporate Governance and Companies Performance in PakistanDocument11 pagesThe Moderating Effect of Intellectual Capital On The Relationship Between Corporate Governance and Companies Performance in PakistanDharmiani DharmiNo ratings yet

- Machine Learning Assignment AccuracyDocument2 pagesMachine Learning Assignment AccuracyVijayramasamyNo ratings yet

- Transportation Engineering 05 Ce 63xxDocument55 pagesTransportation Engineering 05 Ce 63xxwhiteelephant93No ratings yet

- Data Analytics Approach To Predict The Hardness of The Copper Matrix CompositesDocument9 pagesData Analytics Approach To Predict The Hardness of The Copper Matrix CompositesParth KhandelwalNo ratings yet

- Determinants of Banks' Profitability in EthiopiaDocument18 pagesDeterminants of Banks' Profitability in EthiopiaKanbiro OrkaidoNo ratings yet

- What (1) Every Engineer Should Know About Decision Making Under UncertaintyDocument311 pagesWhat (1) Every Engineer Should Know About Decision Making Under Uncertaintyankanchakraborty87100% (1)

- Managerial Economics (Chapter 4)Document45 pagesManagerial Economics (Chapter 4)api-370372475% (4)

- GondarDocument8 pagesGondarYared wolduNo ratings yet

- GlmselectDocument104 pagesGlmselectjapelsf5830No ratings yet

- Offrey Vining PDFDocument510 pagesOffrey Vining PDFCem Savaş AydınNo ratings yet