Professional Documents

Culture Documents

Order MiscComm 24 9 2018

Uploaded by

Gaurav JoshiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Order MiscComm 24 9 2018

Uploaded by

Gaurav JoshiCopyright:

Available Formats

F.No.225/358/2018/ITA.

1I

Government of India

Ministry of Finance

Department of Revenue

Central Board of Direct Taxes

North-Block, ITt· II Division

New Delhi, the 24'h of Sept mber, 2018

Order under Section 119 of the Income-tax Act. 1961

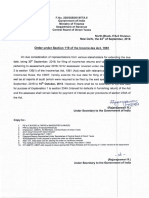

On due consideration of representations from various stakeholders for exten ing the due

date, being 30th September, 2018, for filing of income-tax returns and various repes of audit

pertaining to assessment-year 2018-19 for assessees' covered under clause (a) of f xPlanation

2 to section 139(1) of the Income-tax Act, 1961 (Act) read with relevant provisions of the Act &

Income-tax Rules , the CBDT, hereby extends the due date for filing of income-tat returns as

well as all reports of audit (which were required to be filed by the said specified dati)' from 30 th

September, 2018 to 15th October, 2018. However, there shall be no extension of t e due date

for purpose of Explanation 1 to section 234A (Interest for defaults in furn ishing retur ) of the Act

and the assessee shall remain liable for payment of interest as per provisions of sec ion 234A of

the Act.

~A

(Rajar~jeswari

R.)

Under Secretary to the Governm nt of India

Copy to:-

1. PS to F.M.lOSD to FMlPS to MoS(R)/OSD to MoS(R)

2. PPS to Secretary (Fin ance)/(Revenue)

3. Chairperson (CBDT), All Members, Central Board of Direct Taxes

4. All Pr.CCsIT/CCsITlPr.OsGIT/DsGIT

5. All Joint Secretaries/CsIT. CBDT

6. DirectorsJDeputy Secretaries/Under Secretaries of Central Board of Direct Taxes

7. ADG(Systems)-4 with request to place the order on official website

8. Addl. CIT, Data base Cell for placing the order on irsofficers website

9. The Institute of Chartered Accountants of India, IP Estate, New Delhi-11 0003

10. CIT (M&TP) , csor with request to issue appropriate Press-Release and for placing on Twitter handle of t e department

-sd --

(Rajar ~eswari R.)

Under Secretary to the Governm nt of India

You might also like

- Plot Summary of Atlas ShruggedDocument2 pagesPlot Summary of Atlas ShruggedDillip Kumar MahapatraNo ratings yet

- The King Alfred Plan (BKA) Rex 84Document5 pagesThe King Alfred Plan (BKA) Rex 84Mosi Ngozi (fka) james harris100% (5)

- CIR vs. AGFHA, Inc., G.R. No. 187425, March 28, 2011Document6 pagesCIR vs. AGFHA, Inc., G.R. No. 187425, March 28, 2011Lou Ann AncaoNo ratings yet

- Coup of 63 50th Anniversary E-Mail DraftDocument13 pagesCoup of 63 50th Anniversary E-Mail DraftGawker.com100% (1)

- Public Sector Accounting and Administrative Practices in Nigeria Volume 1From EverandPublic Sector Accounting and Administrative Practices in Nigeria Volume 1No ratings yet

- Pimentel Vs Cayetano NotesDocument5 pagesPimentel Vs Cayetano NotesvestiahNo ratings yet

- Pahud v. CADocument3 pagesPahud v. CAdelayinggratificationNo ratings yet

- Of Xplanation: FinanceDocument1 pageOf Xplanation: FinanceGaurav JoshiNo ratings yet

- Abc PDFDocument1 pageAbc PDFGaurav JoshiNo ratings yet

- Order MiscComm 24 918 PDFDocument1 pageOrder MiscComm 24 918 PDFGaurav JoshiNo ratings yet

- Jagd PDFDocument1 pageJagd PDFGaurav JoshiNo ratings yet

- Order MiscComm 24 9 2018 PDFDocument1 pageOrder MiscComm 24 9 2018 PDFGaurav JoshiNo ratings yet

- 2018-03-27 - ORDER - Extension Until 30 June of Deadline For PAN-AADHAAR LinkingDocument1 page2018-03-27 - ORDER - Extension Until 30 June of Deadline For PAN-AADHAAR LinkingRaj A KapadiaNo ratings yet

- CBDT Condones Delay in Filing Form 108Document2 pagesCBDT Condones Delay in Filing Form 108sandeep100% (1)

- 01-2023-ct-engDocument1 page01-2023-ct-engcadeepaksingh4No ratings yet

- Appropriation Act, 2018Document2 pagesAppropriation Act, 2018Latest Laws TeamNo ratings yet

- GST - PAO - Clarification Regarding Delegation of Powers To The Departmental OfficersDocument1 pageGST - PAO - Clarification Regarding Delegation of Powers To The Departmental OfficersSyed Ibrahim100% (4)

- Recog AICEIADocument1 pageRecog AICEIAVigneshwar Raju PrathikantamNo ratings yet

- 01 2024 ITR Eng CorriDocument2 pages01 2024 ITR Eng Corrikk5860232No ratings yet

- GST Returns - Types, Forms, Due Dates & PenaltiesDocument7 pagesGST Returns - Types, Forms, Due Dates & PenaltiesRaj ArlaNo ratings yet

- Notfctn 43 Central Tax EnglishDocument2 pagesNotfctn 43 Central Tax Englishapi-224058372No ratings yet

- 08 of 2020Document2 pages08 of 2020TELI TARIQ AZIZNo ratings yet

- 1574 Ir I 20208182020 - 63721 - PM PDFDocument2 pages1574 Ir I 20208182020 - 63721 - PM PDFSaleem SoomroNo ratings yet

- 2018rev MS398Document1 page2018rev MS398venkat manojNo ratings yet

- Andhra Pradesh NREGA Funds ReleaseDocument2 pagesAndhra Pradesh NREGA Funds ReleaseABCDNo ratings yet

- Tfi ZR: 1't of + WithDocument2 pagesTfi ZR: 1't of + WithABCDNo ratings yet

- Panaji, 11th January, 2018 (Pausa 21, 1939) : Government of GoaDocument28 pagesPanaji, 11th January, 2018 (Pausa 21, 1939) : Government of Goaks1962No ratings yet

- Notfctn 7 2019 CGST Rate EnglishDocument2 pagesNotfctn 7 2019 CGST Rate EnglishRamprakash vishwakarmaNo ratings yet

- 18 007004 PDFDocument206 pages18 007004 PDFBrenda HerringNo ratings yet

- Circular 18-2023Document1 pageCircular 18-2023Advocate ChandraNo ratings yet

- Notfctn 78 Central Tax English 2020Document2 pagesNotfctn 78 Central Tax English 2020Ashish Yadav & AssociatesNo ratings yet

- GSTNTF65Document1 pageGSTNTF65JGVNo ratings yet

- notfctn-74-central-tax-english-2020Document1 pagenotfctn-74-central-tax-english-2020cadeepaksingh4No ratings yet

- Government of Andhra PradeshDocument13 pagesGovernment of Andhra Pradeshafroz shaikNo ratings yet

- FNoL 15060$07$2021 RE VII$SlNo43 (ST 5)Document2 pagesFNoL 15060$07$2021 RE VII$SlNo43 (ST 5)ABCDNo ratings yet

- FNoL 15060$06$2021 RE VII$SlNo41 (SC 7) PDFDocument2 pagesFNoL 15060$06$2021 RE VII$SlNo41 (SC 7) PDFABCDNo ratings yet

- 07 EngDocument1 page07 EngYours YoursNo ratings yet

- Revenue MC 63-2018 - DTI DAO 16-01Document8 pagesRevenue MC 63-2018 - DTI DAO 16-01Angel BacaniNo ratings yet

- GST - Notification No. Order No. 02 - 2018 - Dated 31-12-2018 - Central GST (CGST)Document2 pagesGST - Notification No. Order No. 02 - 2018 - Dated 31-12-2018 - Central GST (CGST)ARJUN ATHREYANNo ratings yet

- Circular6 2018Document1 pageCircular6 2018madhu goudNo ratings yet

- Circular 17022023Document2 pagesCircular 17022023Asad AminNo ratings yet

- GST notification on composition schemeDocument2 pagesGST notification on composition schemergurvareddyNo ratings yet

- 0087 Ir Ii 20241102024 - 63231 - PMDocument2 pages0087 Ir Ii 20241102024 - 63231 - PMalifarmanbhayo1996No ratings yet

- PaymentArrears 70443258Document3 pagesPaymentArrears 70443258SJS GSSS Kot-PlahariNo ratings yet

- TLP Supplement GST Dec18 OldSyllabusDocument24 pagesTLP Supplement GST Dec18 OldSyllabusShreya s shettyNo ratings yet

- Government of Rajasthan Finance Department (Tax Division) : Joint Secretary:o The GovernmentDocument1 pageGovernment of Rajasthan Finance Department (Tax Division) : Joint Secretary:o The GovernmentAmitNo ratings yet

- Kerala Industries Budget Estimate Additional FundsDocument1 pageKerala Industries Budget Estimate Additional FundsRama KrishnaNo ratings yet

- 7yr PAR On ACPDocument2 pages7yr PAR On ACPदाढ़ीवाला दाढ़ीवालाNo ratings yet

- Charged As Under:: Upto Rupees Fifty LakhsDocument1 pageCharged As Under:: Upto Rupees Fifty LakhsNarendra AjmeraNo ratings yet

- CBDT Directive Dated 19.06.2015Document2 pagesCBDT Directive Dated 19.06.2015vaabscaNo ratings yet

- GSTNTF66Document1 pageGSTNTF66JGVNo ratings yet

- 3 GSTR 9A Without TrackDocument12 pages3 GSTR 9A Without Trackbipin ggnkNo ratings yet

- GO Ms No 509 Registration DeptDocument4 pagesGO Ms No 509 Registration DeptJagan MohanNo ratings yet

- Latest GST Updates: Key Takeaways from 32nd GST Council MeetingDocument4 pagesLatest GST Updates: Key Takeaways from 32nd GST Council MeetingSandeep K TiwariNo ratings yet

- 0006 Ir Ii 2024112024 - 42102 - PMDocument2 pages0006 Ir Ii 2024112024 - 42102 - PMrabiahashmatttNo ratings yet

- G.O.Ms - No. 258-Financial-CodeDocument1 pageG.O.Ms - No. 258-Financial-CodeMohd Rahim KhanNo ratings yet

- IDT Corrigendum For Nov 22 ExamsDocument8 pagesIDT Corrigendum For Nov 22 Examspreeti sinhaNo ratings yet

- FNoL 15060$06$2021 RE VII$SlNo41 (SC 3)Document2 pagesFNoL 15060$06$2021 RE VII$SlNo41 (SC 3)ABCDNo ratings yet

- Notification No 9 CustomDocument1 pageNotification No 9 CustomShubham MittalNo ratings yet

- GST State ActDocument27 pagesGST State ActsolomonNo ratings yet

- Ms Shree Laxmi Tobaco Compny-MinDocument8 pagesMs Shree Laxmi Tobaco Compny-Minsourav rorNo ratings yet

- 04.2017-Central Tax Dt. 28.06.2017Document1 page04.2017-Central Tax Dt. 28.06.2017rajanbardiaNo ratings yet

- Registration Fee Revision Simplified RationalizedDocument3 pagesRegistration Fee Revision Simplified Rationalizedsrivani217No ratings yet

- Goods and Services TaxDocument9 pagesGoods and Services Taxlavanya22banalaNo ratings yet

- Dsa PDFDocument22 pagesDsa PDFJai MauryaNo ratings yet

- AppointemtnNotification 13022018Document1 pageAppointemtnNotification 13022018Gateies PsuNo ratings yet

- Unfiled Notes from Nov 2010Document15 pagesUnfiled Notes from Nov 2010akjhashishNo ratings yet

- Sri Shivmahimyah StrotramDocument34 pagesSri Shivmahimyah StrotramGaurav JoshiNo ratings yet

- Optimize the Layout and Format of a PivotTable ReportDocument8 pagesOptimize the Layout and Format of a PivotTable ReportGaurav JoshiNo ratings yet

- Jonathan Swift's Satirical MasterpieceDocument149 pagesJonathan Swift's Satirical MasterpieceGaurav JoshiNo ratings yet

- Current Affairs April PDF Capsule 2015 by AffairsCloudDocument69 pagesCurrent Affairs April PDF Capsule 2015 by AffairsCloudTejTejuNo ratings yet

- Excel UsefulfnsDocument9 pagesExcel UsefulfnsJennifer GreeneNo ratings yet

- Jonathan Swift's Satirical MasterpieceDocument149 pagesJonathan Swift's Satirical MasterpieceGaurav JoshiNo ratings yet

- Jonathan Swift's Satirical MasterpieceDocument149 pagesJonathan Swift's Satirical MasterpieceGaurav JoshiNo ratings yet

- Jonathan Swift's Satirical MasterpieceDocument149 pagesJonathan Swift's Satirical MasterpieceGaurav JoshiNo ratings yet

- Chris Abbott - CV and List of PublicationsDocument5 pagesChris Abbott - CV and List of PublicationsChris AbbottNo ratings yet

- VU Special Consideration FormDocument5 pagesVU Special Consideration FormEdin BekticNo ratings yet

- President's Veto Power - Part IIDocument42 pagesPresident's Veto Power - Part IITeacherEliNo ratings yet

- NEET-PG 2021 Rank and Score CardDocument1 pageNEET-PG 2021 Rank and Score CardfidaNo ratings yet

- Ffice of The Lerk: Elephone AcsimileDocument2 pagesFfice of The Lerk: Elephone AcsimileWBAYNo ratings yet

- The ChiefDocument3 pagesThe Chiefglenn0805No ratings yet

- Ethics For UpscDocument2 pagesEthics For UpscAnonymous tLP4Ow6Gm100% (1)

- 2021-06-07 Yoe Suárez Case UpdateDocument1 page2021-06-07 Yoe Suárez Case UpdateGlobal Liberty AllianceNo ratings yet

- 2 Sec of Dotc V MabalotDocument2 pages2 Sec of Dotc V MabalotBluebells33No ratings yet

- Private and Public Sector Enterprises: ObjectivesDocument12 pagesPrivate and Public Sector Enterprises: ObjectivesSanta GlenmarkNo ratings yet

- Vaibhav Steel Corporation W.P.1735 of 2013 Dt.26.11.2013Document7 pagesVaibhav Steel Corporation W.P.1735 of 2013 Dt.26.11.2013sweetuhemuNo ratings yet

- Magdala Multipurpose - Livelihood Cooperative and Sanlor Motors Corp. v. Kilusang Manggagawa NG LGS, Magdala Multipurpose - Livelihood CooperativeDocument14 pagesMagdala Multipurpose - Livelihood Cooperative and Sanlor Motors Corp. v. Kilusang Manggagawa NG LGS, Magdala Multipurpose - Livelihood CooperativeAnnie Herrera-LimNo ratings yet

- Wpa Sign On Letter4Document13 pagesWpa Sign On Letter4lbrty4all9227No ratings yet

- Robbinsville 0410Document16 pagesRobbinsville 0410elauwitNo ratings yet

- Military Review August 1967Document116 pagesMilitary Review August 1967mikle97No ratings yet

- Docs6 ReligiousPersecutionDocument90 pagesDocs6 ReligiousPersecutionLTTuangNo ratings yet

- Raymond Corporate GovernanceDocument10 pagesRaymond Corporate GovernanceFoRam KapzNo ratings yet

- Harshita Vatsayan, INDIA'S QUEST FOR SECULAR IDENTITY AND FEASIBILITY OF A UNIFORM CIVIL CODEDocument33 pagesHarshita Vatsayan, INDIA'S QUEST FOR SECULAR IDENTITY AND FEASIBILITY OF A UNIFORM CIVIL CODENikhil RanjanNo ratings yet

- 2016-Annual Performance Report V-IIDocument197 pages2016-Annual Performance Report V-IIMacro Fiscal Performance100% (1)

- Saraswathy Rajamani || Woman Who Fooled British by Dressing as ManDocument11 pagesSaraswathy Rajamani || Woman Who Fooled British by Dressing as Manbasutk2055No ratings yet

- National Officers Academy: Mock Exams Special CSS & CSS-2024 August 2023 (Mock-5) International Relations, Paper-IiDocument1 pageNational Officers Academy: Mock Exams Special CSS & CSS-2024 August 2023 (Mock-5) International Relations, Paper-IiKiranNo ratings yet

- Lakemont Shores POA Bylaws As of 2005Document11 pagesLakemont Shores POA Bylaws As of 2005PAAWS2No ratings yet

- Resume For John StufflebeemDocument4 pagesResume For John StufflebeemNJSGroupNo ratings yet

- Tattoos and Piercings Are They Compatible in The WorkplaceDocument3 pagesTattoos and Piercings Are They Compatible in The WorkplaceOkoth WilliamNo ratings yet