Professional Documents

Culture Documents

MG - SWKS 16 09

Uploaded by

derek_2010Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MG - SWKS 16 09

Uploaded by

derek_2010Copyright:

Available Formats

September 19, 2016

Skyworks Solutions, Inc.

NASD: SWKS - Semiconductors

Grade Earnings Quick Facts

69.4 Last Earnings Release

Last Qtr. Actual vs. Est.

07/22/2016 Dividend Yield

$1.24 / $1.21 52 Wk High

1.39%

$91.52

Next Release 11/03/2016 N/A 52 Wk Low $55.85

$76.07

09/16/2016

Year Ending 09/30/2016 $5.53 Short Interest 7% of float

Rated 'BUY' since Feb 1st, 2013, when it

Year Ending 09/30/2017 $6.15 Market Cap $14.3B

was upgraded from 'HOLD'

Overview

Company Performs Well In Fundamental Analysis

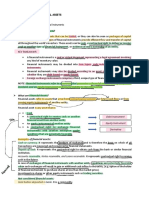

MarketGrader currently has a BUY rating on Skyworks

Solutions, Inc. (SWKS), based on a final overall grade of

69.4 scored by the company's fundamental analysis.

Skyworks Solutions, Inc. scores at the 96th percentile

among all 5888 North American equities currently

followed by MarketGrader. Our present rating dates to

February 1, 2013, when it was upgraded from a HOLD.

Relative to the Semiconductors sub-industry, which is

comprised of 71 companies, Skyworks Solutions, Inc.'s

grade of 69.4 ranks seventh. The industry grade leader

is Tower Semiconductor Ltd (TSEM) with an overall

grade of 85.0. The stock has performed poorly in the

last six months in relative terms, down 0.17% compared

with the Semiconductors sub-industry, up 18.67% and

the S&P 500 Index, up 5.07%. Please go to pages two

and three of this report for a complete breakdown of

SWKS's fundamental analysis.

Price, Rating and Sentiment History - 2 Years

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved. 1

September 19, 2016

Skyworks Solutions, Inc.

NASD: SWKS - Semiconductors 69.4

While Not Entirely Negative, Growth Indicators Show Several Signs of

Growth B- Weakness

Skyworks Solutions, traditionally healthy sales growth appears to have

Market Growth LT B+

virtually ground to a halt during its most recent quarter, in which it booked

$751.70 million in total revenue. This represents a decline of 7.20%

Market Growth ST Frelative to the year earlier revenue of $810.00 million for the comparable

EPS Growth quarter. This drop contrasts to the 92.06% increase in the company's 12-

A+

month trailing revenue over a three year period. Skyworks Solutions, had

Growth Potential Fa total of $3.33 billion in 12-month trailing revenue up to--and including--

its latest quarter compared to the $1.74 billion it reported for the Revenue Qtrly. 06/30/2016 $752M

Earnings Momentum Dequivalent period ended three years ago. This reversal suggests a very Revenue Qtrly. Year Ago $810M

rapid deterioration in the company's business which, based on the Revenue 1 Yr. Chg. (7.2%)

Earnings Surprise B-

company's past performance and stable business, might also be affecting Revenue 12 Mo. Tr. Latest $3.3B

its competitors. It also reported a yearly drop in profit during the last quarter from the year earlier period, a sudden Revenue 12 Mo. Tr. 3Y Ago $1.7B

reversal from the strong profit growth the company has been posting on a long term basis. MarketGrader Revenue 12 Mo. Tr. 3Y Chg. 92.06%

measures long term profit growth by comparing the latest full year profit (12-month trailing) to the equivalent

period's results three years earlier. Skyworks Solutions,'s Second quarter net fell 10.80% to $185.00 million from

the year earlier profit of $207.40 million (excluding extraordinary items) , which contrasts with its growth in 12-

month trailing profit over a three year period. Also including last quarter's results, the company's profit grew to

$977.60 million for the 12 months ended June 30, 2016, a 282.63% jump from full year profit of $255.50 million

reported for the period ended three years earlier. The company's margins, including cash flow, operating and net

margins, grew by an average 16.44% in the latest quarter relative to the year earlier period, a significant increase;

however this is a slower growth rate compared to the two previous quarters.

The company's positive earnings surprise on July 22, 2016, 2.48% above the consensus view, failed to excite

investors as the stock fell 8.43% following the announcement, suggesting the report offered poor guidance for

future quarters. In light of this reaction to a positive earnings surprise it's important to consider how this latest

release affected the company's overall grade beyond earnings per share considering its earnings surprise record Net Income Qtrly. 06/30/2016 $185M

is still positive; over the last six quarters it has reported earnings that have been, on average, 1.84% higher than Net Income Qtrly. Year Ago $207M

the consensus estimate. Net Income 1 Yr. Chg. (10.8%)

Net Income 12 Mo. Tr. Latest $978M

Net Income 12 Mo. Tr. 3Y Ago $255M

Net Income 12 Mo. Tr. 3Y Chg. 282.63%

Company's Shares Are Attractively Priced Considering the Strength

Value A- of its Overall Fundamentals

Shares of Skyworks Solutions, are trading currently at 12.93 times 12-

Capital Structure A+

month earnings. This P/E ratio represents a 65.18% discount to the

MarketGrader-calculated "optimum" P/E ratio of 37.14, which is based on

P/E Analysis A+

the company's two-year EPS growth rate. According to this calculation,

Price/Book Ratio which looks at the company's growth across rolling 12-month periods,

A-

Skyworks Solutions,'s earnings per share have grown at an impressive

Price/Cash Flow Ratio B+

annualized rate of 35.64% in the last five years. The combination of such

a high growth rate with an apparent margin expansion probably means P/E Ratio 12 Mo. Tr. 06/30/2016 15.06

Price/Sales Ratio B-

the company has been gaining market share in recent quarters without

Optimum P/E Ratio 37.14

sacrificing financial performance, evidenced by its superior overall

Market Value A-

Profitability grade. This combination offers a strong case for future gains Forward P/E Ratio 12.93

S&P 500 Forward P/E Ratio 15.20

in the stock price. The stock also trades at 12.93 times forward earnings estimates for the next four quarters,

lower than its trailing P/E and the S&P 500 index's forward P/E of 15.20. By placing a lower multiple on the Price to (Tangible) Book Ratio 8.73

company's future earnings than it does on the market as a whole, investors may see the company as financially Price-to-Cash Flow Ratio 16.70

strong but with relatively poor growth prospects. This may offer a valuable opportunity for patient investors willing Price/Sales Ratio 4.28

to wait for future earnings reports.

Skyworks Solutions,'s current share price seems inexpensive compared to its book value, trading at a 4.15 price

to book ratio. However, when intangible assets such as goodwill, which account for a full 52.48% of the

company's total shareholders' equity, are subtracted from its total assets, the stock's price to book ratio increases

quite significantly to 8.73, a richer multiple. Its shares seem reasonably priced at 16.70 times the $4.56 in cash

flow per share generated by the company over the last twelve months, if only because its overall fundamentals

are pretty healthy. Its price to sales ratio of 4.28 is slightly higher than the Semiconductors's average of 3.39,

both based on trailing 12-month sales. Our final value indicator looks at the relationship between the company's

current market capitalization and its operating profits after deducting taxes. According to this indicator Skyworks

Solutions,'s $14.26 billion valuation is reasonable at 11.71 times its most recent quarterly net income plus

depreciation.

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved. 2

September 19, 2016

Skyworks Solutions, Inc.

NASD: SWKS - Semiconductors 69.4

Profitability Record Is Excellent Across the Board Suggesting a Very

Profitability A Well Managed Operation

Skyworks Solutions, is a very profitable company with strong overall

Asset Utilization A+

indicators in this section of our analysis. The company's different

measures of return to shareholders and margins are typically above those

Capital Utilization B+

of its peers. In the last four quarters Skyworks Solutions, earned a profit

Operating Margins of $977.60 million, equivalent to 29.32% of its sales in the period. The

A

Semiconductors industry had an average operating margin of 12.96% in

Relative Margins A+

the period. The company's operating margin of 33.89% exceeded that

average by 148.67%. Skyworks Solutions,'s return on equity--an

Return on Equity A-

important measure used by MarketGrader to gauge management

efficiency--is very strong, at 27.82% based on how much the company

Quality of Revenues A+

has earned in the last year. This represents an improvement from the

year-earlier 24.46% return on equity, a very healthy sign of profitable growth.

Given such strong returns the company's capital structure seems to conservative, especially assuming it could

raise debt capital to invest into what is a steady and profitable business. Skyworks Solutions, has no debt at all.

Skyworks Solutions,'s core earnings in the last twelve months grew moderately from the twelve months ended a

year earlier. The company's EBITDA for the most recent period was $1.36 billion, or 22.90% above the $1.11

billion earned from its core operations in the prior period. EBITDA is used by MarketGrader to measure the

company's true earnings power since it includes interest expenses, income taxes, depreciation and amortization,

all non-operating expenses, which are nevertheless accounted for in other parts of our analysis that look at EPS

gains and net income.

Company's Cash Flow Indicators Are Solid Across the Board but

Cash Flow A- Offer Some Room for Improvement

Skyworks Solutions,' cash flow fell considerably during the latest quarter

Cash Flow Growth Fto $140.90 million, a 36.50% decline from the $221.90 million reported

after the same quarter last year. This marks an accelerating decline from

EBIDTA Margin A-

twelve month trailing cash flow, which fell to $873.40 million in the period

Debt/Cash Flow Ratio ended last quarter, 9.07% lower than the $960.50 million in the year

A+

earlier period, underscoring the ongoing deterioration of the company's

Interest Cov. Capacity A+

business. Even though the company's balance sheet remains debt-free,

as was the case a year ago, over that same period its cash on hand fell Cash Flow Qtrly. 06/30/2016 $141M

Economic Value A-

by 11.96%, from $1.11 billion to $973.70 million, something worth

Cash Flow Qtrly Year Ago $222M

watching when it next reports financial results.

Retention Rate A+According to our Economic Value indicator, which measures the Cash Flow 1 Yr. Chg. (36.5%)

Cash Flow 12 Mo. Tr. Latest $873M

company's return to shareholders after accounting for its costs of capital as well as its operating costs, Skyworks

Solutions,'s results were very solid last year. The company had $3.51 billion in total invested capital as of its most Cash Flow 12 Mo. Tr. 3Y Ago $393M

recently reported quarter; this includes only all forms of equity since it carries no debt. And based on its 12-month Cash Flow 12 Mo. Tr. 3Y Chg. 122.49%

trailing operating income the company generated a 32.16% return on that capital over the same period. Its after Free Cash Flow Last Qtr. $84M

tax cost of equity in the last year was 15.18%, which should be seen as the opportunity cost of investing in

Skyworks Solutions,'s shares. After deducting this cost from its return on investment the result is 16.98% in

economic value added, or EVA, the true economic profit generated by the company last year for its shareholders. Economic Value

The company hiked its quarterly common dividend in its latest quarter, reported on March 31, 2016, to 28.00 Total Invested Capital $3.5B

cents a share from 26.00 cents, a 7.69% increase. It has now been paying dividends for at least 38 years and the Return on Inv. Capital 32.16%

stock's current yield is 1.39%. Skyworks Solutions, paid out $198.10 million in common dividends during the 12 Weighted Cost of Equity 15.18%

months ended last quarter, accounting for 22.68% of cash flow and 20.26% of total earnings after taxes. This

Weighted Cost of Debt 0.00%

relatively modest payout is slightly higher than the 17.32% of total earnings is paid out in the 12 months ended a

Total Cost of Capital 15.18%

quarter earlier. Assuming it maintains its generally positive fundamentals, the company has ample flexibility to

Economic Value Added 16.98%

increase its payout by a bigger margin in the future should it wish to do so.

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved. 3

September 19, 2016

Skyworks Solutions, Inc.

NASD: SWKS - Semiconductors 69.4

Profile

Skyworks Solutions, Inc. designs, develops, manufactures and markets proprietary semiconductor Key Facts:

products. It offers diverse standard and custom linear products supporting automotive, broadband, 20 Sylvan Road

cellular infrastructure, energy management, GPS, industrial, medical, military, wireless networking, Woburn ,MA 01801

smartphone and tablet applications. The company's portfolio consists of amplifiers, attenuators, Phone:

www.skyworksinc.com

circulators, demodulators, detectors, diodes, directional couplers, front-end modules, hybrids,

infrastructure RF subsystems, isolators, lighting and display solutions, mixers, modulators,

optocouplers, optoisolators, phase shifters, PLLs/synthesizers/VCOs, power dividers/combiners, Biggest Company in Sub-Industry

power management devices, receivers, switches and technical ceramics. Skyworks Solutions was Intel Corporation (INTC)

founded on June 25, 2002 and the company roots back to 1962 is headquartered in Woburn, MA. Grade 67.4

Market Cap:$178.22 billion

Smallest Company in Sub-Industry

Dynex Power Inc. (DNX.CA)

Grade 24.8

Market Cap:$5.07 million

MarketGrader Dilution Analysis Income Last Qtr 12 Mo.

Statement (06/2016) Trailing

Impact of Change in Shares on EPS - Q3 2016

Dilution Summary Revenue $752M $3.3B

*EPS Latest $0.97 Op. Income $244M $1.1B

*EPS Year Ago $1.06

Net Income $185M $978M

EPS Change 1 Yr. (9%)

*EPS $0.97 0

C. Shares - Latest(M) 192

C. Shares - Yr Ago(M) 195 *Earnings per share are based on fully diluted net income per share

excluding extrodinary items. This number may not match the

C. Shares - 1Yr Chg. (2%) headline number reported by the company.

EPS if Yr. Ago Shares $0.95

EPS Chg. if Yr. Ago (11%)

EPS Loss from Dilution $0.02

Balance Sheet Latest

Total Assets $4.0B

*Earnings per share are based on fully diluted net income per share excluding extrodinary items. This number may not match the headline number reported by the company.

Total Debt 0

Stockholders Eq. $3.5B

All numbers in millions except EPS

Ratios

Price/Earnings (12 mo. trailing) 15.06

Price/Tangible Book 8.73

Price/Cash Flow 16.70

Price/Sales 4.28

Debt/Cash Flow 0.00

Return on Equity 27.82%

Gross Margin (12 mo. trailing) 49.00%

Operating Margin (12 mo. trailing) 33.89%

Total Assets $4.0B '11 '12 '13 '14 '15 '16

Net Profit Margin (12 mo. trailing) 29.32%

Intangible Assets $1.8B Qtr 1 0.00 0.00 0.00 0.11 0.13 0.26

Long Term Debt 0 Qtr 2 0.00 0.00 0.00 0.11 0.26 0.28

Total Debt 0 Qtr 3 0.00 0.00 0.00 0.13 0.26

Book Value $3.5B Qtr 4 0.00 0.00 0.00 0.13 0.26

Enterprise Value ($974M)

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved. 4

September 19, 2016

Skyworks Solutions, Inc.

NASD: SWKS - Semiconductors 69.4

Top Down Analysis

# Ticker Grade Sentiment Name Price Next EPS

1 NTIP 88.13 N Network-1 Technologies, Inc. $2.70 11/14/2016

Technology 2 UBNT 87.65 Ubiquiti Networks, Inc. $52.50 11/03/2016

P

Stocks in Sector: 806 3 SVC.CA 87.61 N Sandvine Corporation $2.93 10/06/2016

Buys: 120 (14.89%) 4 TSEM 85.05 P Tower Semiconductor Ltd $15.10 11/10/2016

Holds: 110 (13.65%)

Sells: 576 (71.46%) 5 ATHM 85.03 N Autohome, Inc. Sponsored ADR Class A $23.49 11/03/2016

6 NTES 82.44 P NetEase, Inc. Sponsored ADR $238.03 11/09/2016

No. of stocks at:

7 SILC 82.14 P Silicom Ltd. $40.27 10/24/2016

52-Wk. High: 36

52-Wk. Low: 25 8 GOOGL 81.59 P Alphabet Inc. Class A $797.97 10/20/2016

Above 50 & 200-day MA: 397 9 NII.CA 80.16 P Norsat International Inc. $8.39 11/02/2016

Below 50 & 200-day MA: 217

10 VCM.CA 79.58 N Vecima Networks Inc. $9.60 09/22/2016

37 SWKS 69.43 N Skyworks Solutions, Inc. $76.07 11/03/2016

# Ticker Grade Sentiment Name Price Next EPS

1 TSEM 85.05 P Tower Semiconductor Ltd $15.10 11/10/2016

Semiconductors

2 SIMO 78.56 P Silicon Motion Technology Corporation $50.56 07/26/2016

Stocks in Sub-Industry: 71 3 MXL 76.70 N MaxLinear, Inc. Class A $19.21 11/01/2016

Buys: 12 (16.90%)

4 SEDG 70.71 N SolarEdge Technologies, Inc. $14.59 11/03/2016

Holds: 6 (8.45%)

Sells: 53 (74.65%) 5 NVDA 70.14 P NVIDIA Corporation $62.84 11/03/2016

6 TSM 70.02 P Taiwan Semiconductor Manufacturing $28.91 10/13/2016

No. of stocks at:

52-Wk. High: 3 7 SWKS 69.43 N Skyworks Solutions, Inc. $76.07 11/03/2016

52-Wk. Low: 2 8 TXN 69.18 P Texas Instruments Incorporated $69.36 10/26/2016

Above 50 & 200-day MA: 45

9 IDTI 67.86 N Integrated Device Technology, Inc. $21.00 10/24/2016

Below 50 & 200-day MA: 10

10 INTC 67.40 P Intel Corporation $37.67 10/12/2016

1. Price Trend. A- 2. Price Momentum. B-

6.9

3. Earnings Guidance. B- 4. Short Interest. B

Copyright 2010 MarketGrader.com Corp. All rights reserved. Any unauthorized use or disclosure is prohibited. Neither the information nor any opinion expressed constitutes an offer to buy or sell any securities or any options, futures or other derivatives related to

such securities ("related investments"). The information herein was obtained from various sources; we do not guarantee its accuracy or completeness. This research report is prepared for general circulation and is circulated for general information only. It does not

have regards to the specific investment objectives, financial situation and the particular needs of any specific person who may receive this report. Investors should seek financial advice regarding the appropriateness of investing in any securities or investment

strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realized. Investors should note that income from such securities, if any, may fluctuate and that each security's price or value may

rise or fall. Accordingly, investors may receive back less than originally invested. Past performance is not necessarily a guide to future performance. Future returns are not guaranteed, and a loss of original capital may occur. MarketGrader does not make markets

in any of the securities mentioned in this report. MarketGrader does not have any investment banking relationships. MarketGrader and its employees may have long/short positions or holdings in the securities or other related investments of companies mentioned

herein. Officers or Directors of MarketGrader.com Corp. are not employees of covered companies. MarketGrader or any of its employees do not own shares equal to one percent or more of the company in this report.

MarketGrader.com ©2010. MarketGrader.com Corp. All Rights Reserved. 5

You might also like

- Important Notice:: DisclaimerDocument13 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Bmi C Amer 17 07Document13 pagesBmi C Amer 17 07derek_2010No ratings yet

- Bmi C Amer 17 09 PDFDocument13 pagesBmi C Amer 17 09 PDFderek_2010No ratings yet

- Bmi Brazil 17 10Document9 pagesBmi Brazil 17 10derek_2010No ratings yet

- Important Notice:: DisclaimerDocument13 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument13 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Bmi Andean 19 05Document13 pagesBmi Andean 19 05derek_2010No ratings yet

- BUY BUY BUY BUY: Pepsico IncDocument5 pagesBUY BUY BUY BUY: Pepsico Incderek_2010No ratings yet

- Bmi Brazil 16 04Document9 pagesBmi Brazil 16 04derek_2010No ratings yet

- Bmi Brazil 16 03Document9 pagesBmi Brazil 16 03derek_2010No ratings yet

- BUY BUY BUY BUY: TJX Companies IncDocument5 pagesBUY BUY BUY BUY: TJX Companies Incderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument9 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Bmi Venez 18 07Document13 pagesBmi Venez 18 07derek_2010No ratings yet

- BUY BUY BUY BUY: Novo Nordisk A/SDocument5 pagesBUY BUY BUY BUY: Novo Nordisk A/Sderek_2010No ratings yet

- BUY BUY BUY BUY: Medtronic PLCDocument5 pagesBUY BUY BUY BUY: Medtronic PLCderek_2010No ratings yet

- Important Notice:: DisclaimerDocument13 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- Important Notice:: DisclaimerDocument17 pagesImportant Notice:: Disclaimerderek_2010No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Grennell Farm Balance Sheet AnalysisDocument6 pagesGrennell Farm Balance Sheet AnalysisMichael TorresNo ratings yet

- Vishal Retail Limited.: A Wright Investors' Service Research ReportDocument40 pagesVishal Retail Limited.: A Wright Investors' Service Research ReportAnkit JainNo ratings yet

- A Look at Current Financial Reporting Issues: in DepthDocument26 pagesA Look at Current Financial Reporting Issues: in Depthhur hussainNo ratings yet

- Managerial Accounting Quiz 2Document1 pageManagerial Accounting Quiz 2Raju SainiNo ratings yet

- Intoduction To Financial Assets and Financial Assets at Fair ValueDocument11 pagesIntoduction To Financial Assets and Financial Assets at Fair ValueKin Lee100% (2)

- Brac Internship Report On Al Arafah Islami BankDocument44 pagesBrac Internship Report On Al Arafah Islami BankMd Tajwar Rashid TokyNo ratings yet

- Afar Midterm Major Exam Key Answer PDFDocument4 pagesAfar Midterm Major Exam Key Answer PDFMadelyn Jane IgnacioNo ratings yet

- Chapter 2 MBA 560Document25 pagesChapter 2 MBA 560CendorlyNo ratings yet

- Tax Chronicles Issue 57 FinaDocument26 pagesTax Chronicles Issue 57 FinaMeagen Steven Brown SeidelNo ratings yet

- Working Capital Management ReportDocument43 pagesWorking Capital Management Reportsunny2311986100% (1)

- Mba Case 2 - Value Based ManagementDocument13 pagesMba Case 2 - Value Based Managementdjmphd100% (1)

- Solutions Manual: Introducing Corporate Finance 2eDocument12 pagesSolutions Manual: Introducing Corporate Finance 2eMane Scal JayNo ratings yet

- 1 Partnership FormationDocument7 pages1 Partnership FormationJ MahinayNo ratings yet

- Ema Ge Berk CF 2GE SG 22Document15 pagesEma Ge Berk CF 2GE SG 22080395No ratings yet

- Aldo LKDocument88 pagesAldo LKdwi amaliaNo ratings yet

- Financial Management: Intermediate Course Study MaterialDocument7 pagesFinancial Management: Intermediate Course Study MaterialA.KNo ratings yet

- Intermediate Accounting Textbook and StandardsDocument50 pagesIntermediate Accounting Textbook and StandardsEstiNo ratings yet

- How To Make Money Through Stock MarketDocument31 pagesHow To Make Money Through Stock Marketwasiq shirinNo ratings yet

- Stevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsDocument2 pagesStevens Textiles S 2013 Financial Statements Are Shown Here Balance Sheet AsAmit PandeyNo ratings yet

- Guidelines for Securities Margin Financing ActivitiesDocument41 pagesGuidelines for Securities Margin Financing ActivitiesTC ChengNo ratings yet

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangNo ratings yet

- Assignment Ratio AnalysisDocument7 pagesAssignment Ratio AnalysisMrinal Kanti DasNo ratings yet

- KLBFDocument3 pagesKLBFM Khoirun NasihNo ratings yet

- Finance MeterialDocument244 pagesFinance MeterialMohammad FazalahamadNo ratings yet

- Project Management - Project SelectionDocument16 pagesProject Management - Project Selectionarmando.chappell1005100% (1)

- KM23315567 StatementDocument9 pagesKM23315567 StatementPrashant RajNo ratings yet

- Ishares World Equity Index Fund (Lu) Class n2 Eur Factsheet Lu0852473015 GB en IndividualDocument4 pagesIshares World Equity Index Fund (Lu) Class n2 Eur Factsheet Lu0852473015 GB en IndividualAbduRahman ZakariaNo ratings yet

- 67 C 3 AccountancyDocument31 pages67 C 3 AccountancyNaghma ShaheenNo ratings yet

- Off Balance SheetDocument15 pagesOff Balance SheetHussain khawajaNo ratings yet

- Manheim Buyer FeeDocument7 pagesManheim Buyer FeecontactklinecarsNo ratings yet