Professional Documents

Culture Documents

Stock Update: Icici Bank

Uploaded by

saran21Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Stock Update: Icici Bank

Uploaded by

saran21Copyright:

Available Formats

Stock Update

Structural and environmental changes improve outlook

Key points

ICICI Bank

Liability book, asset quality improving, affords

Reco: Buy | CMP: Rs364 safety to margins: We believe much has

changed in ICICI Bank for the better, which has

also improved the outlook for the bank. The

Company details

significant overhang on management transition

Price target: Rs410 (and uncertainty thereof) has finally been

resolved, for good. ICICI Bank’s liability franchise

Market cap: Rs234,214 cr

has improved significantly (almost at par with

52-week high/low: Rs375 / 257 the best in the industry); and has improved on an

NSE volume: (No of shares) 217.1 lakh

average basis too. We believe high proportion

of retail deposits, on overall term deposits,

BSE code: 532174 is a significant lever for the bank to maintain/

NSE code: ICICIBANK improve its margins, other things remaining

unchanged. With a strong liability profile and

Sharekhan code: ICICIBANK the effect of recent hike in MCLR rates (in the

Free float: (No of shares) 643.51 cr banking industry), there is a strong probability

that margins would sustain or improve.

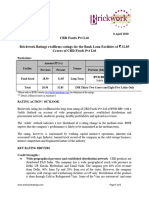

Shareholding pattern Asset quality wise too, ICICI Bank’s book has

improved in quality, tempered by the difficult

period in the past three years. Exposure to BB

Public & others

30%

and below-rated loans (fund + non-fund based)

stood at small Rs. 21,788 crore, which includes

Foreign

45% a drilldown list of Rs. 3,283 crore. We believe

its asset book quality has improved significantly

in the past few quarters, which should result

in lower provision pressure on profitability

and, therefore, gradually return to normalised

MF & FI earnings.

25%

Outlook: We believe significant developments

(such as end of leadership uncertainty and

Price chart asset-quality improvement) in ICICI Bank

are positive. With a comfortable capital

390

position (Tier 1 capital ratio of 15.3%), the bank

370

appears well positioned to make the most of

350 opportunities. While asset-quality performance

330 will be a key monitorable in the near term, we

310 expect a gradual improvement, and the long-

290

term outlook appears to be improving too. With

a strong liability (retail + CASA) profile, the

270

effect of hike in MCLR and a lower slippage

250

rate, there is a strong probability that margins

May-18

Jan-18

Sep-18

Jan-19

would sustain or improve in the medium term.

Improvement in liability and asset profile offer

ICICI Bank with greater elbow room to go for

Price performance

better quality underwriting with lower risks and,

(%) 1m 3m 6m 12m therefore, deliver better risk-adjusted returns.

We believe the market has yet to factor in the

Absolute 1.4 17.9 31.4 15.2

changed dynamics and the scope for earnings

Relative to Sensex 1.7 18.1 28.3 7.5 improvement, which can be a significant positive

for the bank.

January 01, 2019 2

Sharekhan Stock Update

Valuation: ICICI Bank is valued at ~2x its to fall by March 2019. Gross non-performing

FY2020E book value, which we believe is ratio (GNPAs) of the Indian banking system will

reasonable considering the business franchise drop to 10.3% by March 2019, as per RBI’s latest

and improving long-term outlook. Therefore, FSR (from 10.8% in September). Notably, in its

we maintain our Buy rating with a revised price last FSR report in July, the RBI had estimated

target of Rs. 410. GNPAs to rise to 12.9% by March. Hence, as per

the central bank, the asset-quality scenario on

Asset quality stress has peaked, earnings to a system-wide basis has improved significantly.

gradually normalise: The bad assets problem We believe corporate-facing banks such as ICICI

of the banking sector in the country is receding Bank are likely to benefit with improvement in

for the first time since 2015, according to the the overall asset quality. We believe while asset-

bi-annual financial stability report (FSR) for quality stress may still remain at elevated levels

December 2018, published by the Reserve Bank for ICICI Bank, going forward, normalisation of

of India (RBI). The report indicates that NPA earnings will be there with ICICI Bank in the

stress recognition is appearing to be over (to a medium term.

large part). The RBI expects NPAs in the system

Valuation Rs cr

Particulars FY16 FY17 FY18 FY19E FY20E

Net Interest Income (NII) 21224.0 21737.3 23498.5 26735.3 31278.6

Net profit (Rs cr) 9726.3 9801.1 6777.2 7152.4 10066.1

EPS (Rs) 16.7 16.8 10.6 12.3 17.3

EPS growth (%) -0.1 0.0 -0.4 0.2 0.4

P/E (x) 21.7 21.6 34.4 29.6 21.0

BVPS (Rs) 146.4 164.6 150.9 173.9 185.2

P/BV (x) 2.5 2.2 2.4 2.1 2.0

RoE (%) 11.4% 10.3% 6.7% 6.9% 9.3%

RoA (%) 1.4% 1.3% 0.8% 0.7% 0.9%

Sharekhan Limited, its analyst or dependant(s) of the analyst might be holding or having a position in the companies mentioned in the article.

January 01, 2019 3

Know more about our products and services

For Private Circulation only

Disclaimer: This document has been prepared by Sharekhan Ltd. (SHAREKHAN) and is intended for use only by the person or entity

to which it is addressed to. This Document may contain confidential and/or privileged material and is not for any type of circulation

and any review, retransmission, or any other use is strictly prohibited. This Document is subject to changes without prior notice.

This document does not constitute an offer to sell or solicitation for the purchase or sale of any financial instrument or as an official

confirmation of any transaction. Though disseminated to all customers who are due to receive the same, not all customers may

receive this report at the same time. SHAREKHAN will not treat recipients as customers by virtue of their receiving this report.

The information contained herein is obtained from publicly available data or other sources believed to be reliable and SHAREKHAN

has not independently verified the accuracy and completeness of the said data and hence it should not be relied upon as such. While

we would endeavour to update the information herein on reasonable basis, SHAREKHAN, its subsidiaries and associated companies,

their directors and employees (“SHAREKHAN and affiliates”) are under no obligation to update or keep the information current. Also,

there may be regulatory, compliance, or other reasons that may prevent SHAREKHAN and affiliates from doing so. This document is

prepared for assistance only and is not intended to be and must not alone be taken as the basis for an investment decision. Recipients

of this report should also be aware that past performance is not necessarily a guide to future performance and value of investments

can go down as well. The user assumes the entire risk of any use made of this information. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies

referred to in this document (including the merits and risks involved), and should consult its own advisors to determine the merits and

risks of such an investment. The investment discussed or views expressed may not be suitable for all investors. We do not undertake to

advise you as to any change of our views. Affiliates of Sharekhan may have issued other reports that are inconsistent with and reach

different conclusions from the information presented in this report.

This report is not directed or intended for distribution to, or use by, any person or entity who is a citizen or resident of or located in any

locality, state, country or other jurisdiction, where such distribution, publication, availability or use would be contrary to law, regulation

or which would subject SHAREKHAN and affiliates to any registration or licencing requirement within such jurisdiction. The securities

described herein may or may not be eligible for sale in all jurisdictions or to certain category of investors. Persons in whose possession

this document may come are required to inform themselves of and to observe such restriction.

The analyst certifies that the analyst has not dealt or traded directly or indirectly in securities of the company and that all of the views

expressed in this document accurately reflect his or her personal views about the subject company or companies and its or their

securities and do not necessarily reflect those of SHAREKHAN. The analyst further certifies that neither he nor his relatives has any

direct or indirect financial interest nor have actual or beneficial ownership of 1% or more in the securities of the company nor have

any material conflict of interest nor has served as officer, director or employee or engaged in market making activity of the company.

Further, the analyst has also not been a part of the team which has managed or co-managed the public offerings of the company and

no part of the analyst’s compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed

in this document.

Either SHAREKHAN or its affiliates or its directors or employees / representatives / clients or their relatives may have position(s), make

market, act as principal or engage in transactions of purchase or sell of securities, from time to time or may be materially interested

in any of the securities or related securities referred to in this report and they may have used the information set forth herein before

publication. SHAREKHAN may from time to time solicit from, or perform investment banking, or other services for, any company

mentioned herein. Without limiting any of the foregoing, in no event shall SHAREKHAN, any of its affiliates or any third party involved

in, or related to, computing or compiling the information have any liability for any damages of any kind.

Compliance Officer: Mr. Joby John Meledan; Tel: 022-61150000; email id: compliance@sharekhan.com;

For any queries or grievances kindly email igc@sharekhan.com or contact: myaccount@sharekhan.com

Registered Office: Sharekhan Limited, 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway

Station, Kanjurmarg (East), Mumbai – 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos.: BSE / NSE / MSEI

(CASH / F&O / CD) / MCX - Commodity: INZ000171337; DP: NSDL/CDSL-IN-DP-365-2018; PMS: INP000005786; Mutual Fund: ARN

20669; Research Analyst: INH000006183;

Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and the T&C on www.sharekhan.

com; Investment in securities market are subject to market risks, read all the related documents carefully before investing.

You might also like

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Icici Bank: On Track To Regain Its MojoDocument5 pagesIcici Bank: On Track To Regain Its MojodarshanmadeNo ratings yet

- Bajaj Finance - SKDocument3 pagesBajaj Finance - SKADNo ratings yet

- KrazyBee Services Private LimitedDocument9 pagesKrazyBee Services Private LimitedBalakrishnan IyerNo ratings yet

- Indian Banks 2023 Growth at Reasonable Price Stay PositiveDocument67 pagesIndian Banks 2023 Growth at Reasonable Price Stay PositiveBhavya OT070No ratings yet

- Maruti Suzuki Kizashi Marketing PlanDocument8 pagesMaruti Suzuki Kizashi Marketing Planniranjan bhagatNo ratings yet

- Incred Financial Services Limited Press+ReleaseDocument7 pagesIncred Financial Services Limited Press+ReleaseGautam MehtaNo ratings yet

- Axis Bank - 03 - 03 - 2023 - Khan030323Document7 pagesAxis Bank - 03 - 03 - 2023 - Khan030323Ranjan SharmaNo ratings yet

- Home First Finance Company India LimitedDocument8 pagesHome First Finance Company India LimitedRAROLINKSNo ratings yet

- Lic Housing FinanceDocument5 pagesLic Housing Financeabhilasha uikeNo ratings yet

- What We Published: January 2022Document29 pagesWhat We Published: January 2022prassna_kamat1573No ratings yet

- PC - Banking Sector - March 2020 20200326075411 PDFDocument22 pagesPC - Banking Sector - March 2020 20200326075411 PDFmanunair13No ratings yet

- Orner Ffice: Business Outlook Steady Internal Accruals To Support Growth MomentumDocument8 pagesOrner Ffice: Business Outlook Steady Internal Accruals To Support Growth Momentum0003tzNo ratings yet

- State Bank of India: CMP: INR487 TP: INR675 (+39%)Document26 pagesState Bank of India: CMP: INR487 TP: INR675 (+39%)bradburywillsNo ratings yet

- SMFG India Credit Company LimitedDocument11 pagesSMFG India Credit Company Limitedvatsal sinhaNo ratings yet

- Banking Sector Update: Strong Franchisee Would PrevailDocument3 pagesBanking Sector Update: Strong Franchisee Would PrevailPALLAVI KAMBLENo ratings yet

- Bajaj Finance JP MorganDocument38 pagesBajaj Finance JP MorganNikhilKapoor29No ratings yet

- Onshore Construction Company Private LimitedDocument7 pagesOnshore Construction Company Private Limitedhesham zakiNo ratings yet

- Axis Bank - HSL - 06122021Document14 pagesAxis Bank - HSL - 06122021GaganNo ratings yet

- Indusind Bank: MGMT Commentary Suggests A Complete Overhaul AheadDocument8 pagesIndusind Bank: MGMT Commentary Suggests A Complete Overhaul AheadAmit AGRAWALNo ratings yet

- SMC Power Generation LTD.: Summary of Rated InstrumentsDocument7 pagesSMC Power Generation LTD.: Summary of Rated Instrumentspiyush upadhyayNo ratings yet

- Luxor Writing Instruments Pvt. LTDDocument7 pagesLuxor Writing Instruments Pvt. LTDbookdekho.ytNo ratings yet

- Power Finance Corporation - Elara Securities - 27 June 2023Document48 pagesPower Finance Corporation - Elara Securities - 27 June 2023SudharsanNo ratings yet

- Bajaj Finance: Long-Term Positives in PlaceDocument3 pagesBajaj Finance: Long-Term Positives in PlacedarshanmadeNo ratings yet

- Zetwerk Manufacturing Businesses PVT LTDDocument8 pagesZetwerk Manufacturing Businesses PVT LTDrahulappikatlaNo ratings yet

- Microfinance Private LimitedDocument5 pagesMicrofinance Private LimitedsantoshbsantuNo ratings yet

- Nezone Pipes & Structures-R-05042018Document7 pagesNezone Pipes & Structures-R-05042018rahul badgujarNo ratings yet

- Save Microfinance Private Limited: RatingsDocument4 pagesSave Microfinance Private Limited: RatingsSubhamNo ratings yet

- State Bank of India: ESG Disclosure ScoreDocument7 pagesState Bank of India: ESG Disclosure ScoredeveshNo ratings yet

- SBI Cards and Payment Services LTD: SubscribeDocument16 pagesSBI Cards and Payment Services LTD: Subscribejpsmu09No ratings yet

- Profitable Acquisition: Reduces Time To MarketDocument4 pagesProfitable Acquisition: Reduces Time To MarketRohit ShahNo ratings yet

- Axis Bank LimitedDocument8 pagesAxis Bank LimitedshivamNo ratings yet

- Stock Update: LIC Housing FinanceDocument5 pagesStock Update: LIC Housing Financesaran21No ratings yet

- BLS Inter Initial (Investec)Document21 pagesBLS Inter Initial (Investec)beza manojNo ratings yet

- SMFG India Credit Company LimitedDocument9 pagesSMFG India Credit Company Limitedvatsal sinhaNo ratings yet

- PNB Housing Finance: IndiaDocument14 pagesPNB Housing Finance: IndiaMalolanRNo ratings yet

- Banking: Performance OverviewDocument7 pagesBanking: Performance OverviewAKASH BODHANINo ratings yet

- HSL PCG Investment Idea - CITY UNION BANK LTD.Document14 pagesHSL PCG Investment Idea - CITY UNION BANK LTD.kishore13No ratings yet

- RBL 20181127 Mosl CF PDFDocument8 pagesRBL 20181127 Mosl CF PDFmilandeepNo ratings yet

- Bajaj Finance: Strong Fundamentals But Environment Appears ChallengingDocument4 pagesBajaj Finance: Strong Fundamentals But Environment Appears ChallengingdarshanmadeNo ratings yet

- Samunnati Rating Rationale b764561b41Document8 pagesSamunnati Rating Rationale b764561b41PratyushNo ratings yet

- Ambit - Strategy - Err Group - Delivering Alpha in India PDFDocument24 pagesAmbit - Strategy - Err Group - Delivering Alpha in India PDFshahavNo ratings yet

- Nykaa - Company Update - Jan23Document8 pagesNykaa - Company Update - Jan23Abhishek MurarkaNo ratings yet

- Rico Auto Margin of SsafetyDocument3 pagesRico Auto Margin of Ssafetysumit malikNo ratings yet

- IDirect BoI ShubhNivesh 15jan24Document4 pagesIDirect BoI ShubhNivesh 15jan24Naveen KumarNo ratings yet

- Indian Banks (Cracking Code 7.18 in Depth Analysis of Annual Reports) 20181109Document188 pagesIndian Banks (Cracking Code 7.18 in Depth Analysis of Annual Reports) 20181109Debjit AdakNo ratings yet

- Housing Development Finance Corporation: Growth With QualityDocument5 pagesHousing Development Finance Corporation: Growth With QualitydarshanmadeNo ratings yet

- HDFC Bank: Fundamentals Stay Strong Amid UncertaintyDocument6 pagesHDFC Bank: Fundamentals Stay Strong Amid UncertaintydarshanmadeNo ratings yet

- Kotak Mahindra Bank: Better and in Line PerformanceDocument9 pagesKotak Mahindra Bank: Better and in Line PerformancesuprabhattNo ratings yet

- Suryoday Small Finance Bank LimitedDocument8 pagesSuryoday Small Finance Bank LimitedDivy JainNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Zen Technologies Ltd-Rising Star - 3QFY24 Results UpdateDocument5 pagesZen Technologies Ltd-Rising Star - 3QFY24 Results Updaterahul98897No ratings yet

- MNM Finance-Mar03 2023Document7 pagesMNM Finance-Mar03 2023Rajavel GanesanNo ratings yet

- Punjab National Bank: Merger To Present Further ChallengesDocument5 pagesPunjab National Bank: Merger To Present Further ChallengesdarshanmadeNo ratings yet

- Stock Update: Divis LaboratoriesDocument3 pagesStock Update: Divis LaboratoriesdarshanmadeNo ratings yet

- Canara Bank - CAREDocument7 pagesCanara Bank - CAREbhavan123No ratings yet

- CRD Foods 8apr2020Document6 pagesCRD Foods 8apr2020samudragupta05No ratings yet

- IREDADocument8 pagesIREDAGorilla GondaNo ratings yet

- Naresh Kumar and Company Private LimitedDocument5 pagesNaresh Kumar and Company Private LimitedKunalNo ratings yet

- ICICI Bank - HSIE - 061221Document13 pagesICICI Bank - HSIE - 061221GaganNo ratings yet

- APL Apollo Tubes 01 01 2023 KhanDocument7 pagesAPL Apollo Tubes 01 01 2023 Khansaran21No ratings yet

- Titan Company 01 01 2023 KhanDocument8 pagesTitan Company 01 01 2023 Khansaran21No ratings yet

- Britannia Industries 01 01 2023 KhanDocument7 pagesBritannia Industries 01 01 2023 Khansaran21No ratings yet

- Sharekhan's Research Report On JSW Steel-JSW-Steel-26-03-2021-khanDocument10 pagesSharekhan's Research Report On JSW Steel-JSW-Steel-26-03-2021-khansaran21No ratings yet

- HDFC 01 01 2023 KhanDocument7 pagesHDFC 01 01 2023 Khansaran21No ratings yet

- Fundamental Outlook Market Highlights: Indian RupeeDocument2 pagesFundamental Outlook Market Highlights: Indian Rupeesaran21No ratings yet

- Sharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khanDocument9 pagesSharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khansaran21No ratings yet

- Icici Bank: CMP: INR396 TP: INR520 (+31%)Document22 pagesIcici Bank: CMP: INR396 TP: INR520 (+31%)saran21No ratings yet

- Housing Development Finance Corporation 27082019Document6 pagesHousing Development Finance Corporation 27082019saran21No ratings yet

- KEC International 01 01 2023 PrabhuDocument7 pagesKEC International 01 01 2023 Prabhusaran21No ratings yet

- Dolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatDocument22 pagesDolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatsaran21No ratings yet

- Greenply Industries: Plywood Business Growing in Single-DigitsDocument8 pagesGreenply Industries: Plywood Business Growing in Single-Digitssaran21No ratings yet

- Coal India: CMP: INR234 Sputtering Production Growth Impacting VolumesDocument10 pagesCoal India: CMP: INR234 Sputtering Production Growth Impacting Volumessaran21No ratings yet

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21No ratings yet

- Ahluwalia Contracts: Industry OverviewDocument20 pagesAhluwalia Contracts: Industry Overviewsaran21No ratings yet

- Daily Currency Outlook: September 11, 2019Document7 pagesDaily Currency Outlook: September 11, 2019saran21No ratings yet

- Dabur India (DABUR IN) : Analyst Meet UpdateDocument12 pagesDabur India (DABUR IN) : Analyst Meet Updatesaran21No ratings yet

- Coal India (COAL IN) : Q4FY19 Result UpdateDocument6 pagesCoal India (COAL IN) : Q4FY19 Result Updatesaran21No ratings yet

- Teamlease Services (Team In) : Q4Fy19 Result UpdateDocument8 pagesTeamlease Services (Team In) : Q4Fy19 Result Updatesaran21No ratings yet

- JK Lakshmi Cement 18062019Document6 pagesJK Lakshmi Cement 18062019saran21No ratings yet

- ODLI20181225 001 UPD en AA Standard Waranty Professional LED Lamps EuropeDocument4 pagesODLI20181225 001 UPD en AA Standard Waranty Professional LED Lamps Europesaran21No ratings yet

- Federal Bank LTD: Q3FY19 Result UpdateDocument4 pagesFederal Bank LTD: Q3FY19 Result Updatesaran21No ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- JK Tyre - Research - Note - 2017-06-06 - 06-08-51-000000Document9 pagesJK Tyre - Research - Note - 2017-06-06 - 06-08-51-000000saran21No ratings yet

- South Indian Bank (SIB IN) : Q3FY19 Result UpdateDocument10 pagesSouth Indian Bank (SIB IN) : Q3FY19 Result Updatesaran21No ratings yet

- IME Echnoplast TD: P R - 100 T R .128 BUYDocument9 pagesIME Echnoplast TD: P R - 100 T R .128 BUYsaran21No ratings yet

- Somany Ceramics (SOMCER) : Multiple Triggers For Margin RevivalDocument4 pagesSomany Ceramics (SOMCER) : Multiple Triggers For Margin Revivalsaran21No ratings yet

- Cox & Kings (CNKLIM) : Weak Performance Debt Concerns AddressedDocument9 pagesCox & Kings (CNKLIM) : Weak Performance Debt Concerns Addressedsaran21No ratings yet

- Bank of Baroda (BOB) BUY: Retail Equity ResearchDocument5 pagesBank of Baroda (BOB) BUY: Retail Equity Researchsaran21No ratings yet

- Confidence Petroleum India 020119Document17 pagesConfidence Petroleum India 020119saran21No ratings yet

- Itinerary KigaliDocument2 pagesItinerary KigaliDaniel Kyeyune Muwanga100% (1)

- Verka Project ReportDocument69 pagesVerka Project Reportkaushal244250% (2)

- Maharashtra Government Dilutes Gunthewari ActDocument2 pagesMaharashtra Government Dilutes Gunthewari ActUtkarsh SuranaNo ratings yet

- Pronunciation SyllabusDocument5 pagesPronunciation Syllabusapi-255350959No ratings yet

- Navoa Vs DomdomaDocument2 pagesNavoa Vs DomdomaRL N DeiparineNo ratings yet

- Priyanshu Mts Answer KeyDocument34 pagesPriyanshu Mts Answer KeyAnima BalNo ratings yet

- Form I-129F - BRANDON - NATALIADocument13 pagesForm I-129F - BRANDON - NATALIAFelipe AmorosoNo ratings yet

- 3 Longman Academic Writing Series 4th Edition Answer KeyDocument21 pages3 Longman Academic Writing Series 4th Edition Answer KeyZheer KurdishNo ratings yet

- Pre Project PlanningDocument13 pagesPre Project PlanningTewodros TadesseNo ratings yet

- Campaign Period: Terms and Conditions "CIMB 4.7% FD/FRIA-i Bundle With CASA/-i"Document6 pagesCampaign Period: Terms and Conditions "CIMB 4.7% FD/FRIA-i Bundle With CASA/-i"Tan Ah LiannNo ratings yet

- Cultural Materialism and Behavior Analysis: An Introduction To HarrisDocument11 pagesCultural Materialism and Behavior Analysis: An Introduction To HarrisgabiripeNo ratings yet

- Oracle Fusion Global Human Resources Payroll Costing GuideDocument90 pagesOracle Fusion Global Human Resources Payroll Costing GuideoracleappshrmsNo ratings yet

- Show Catalogue: India's Leading Trade Fair For Organic ProductsDocument58 pagesShow Catalogue: India's Leading Trade Fair For Organic Productsudiptya_papai2007No ratings yet

- Essay R JDocument5 pagesEssay R Japi-574033038No ratings yet

- BPI Lesson 1 - Surveys & Investigation PDFDocument60 pagesBPI Lesson 1 - Surveys & Investigation PDFMayNo ratings yet

- Biopolitics and The Spectacle in Classic Hollywood CinemaDocument19 pagesBiopolitics and The Spectacle in Classic Hollywood CinemaAnastasiia SoloveiNo ratings yet

- Foundations of Special and Inclusive Education: A Learning ModuleDocument12 pagesFoundations of Special and Inclusive Education: A Learning ModuleDensiel Jude OrtegaNo ratings yet

- Environment Impact Assessment Notification, 1994Document26 pagesEnvironment Impact Assessment Notification, 1994Sarang BondeNo ratings yet

- ARTA Art of Emerging Europe2Document2 pagesARTA Art of Emerging Europe2DanSanity TVNo ratings yet

- Macroeconomics NotesDocument4 pagesMacroeconomics NotesishikaNo ratings yet

- Grile EnglezaDocument3 pagesGrile Englezakis10No ratings yet

- Simao Toko Reincarnated Black JesusDocument25 pagesSimao Toko Reincarnated Black JesusMartin konoNo ratings yet

- Garvida V SalesDocument1 pageGarvida V SalesgemmaNo ratings yet

- Day1 - Session4 - Water Supply and Sanitation Under AMRUTDocument30 pagesDay1 - Session4 - Water Supply and Sanitation Under AMRUTViral PatelNo ratings yet

- Visi Dan Misi Kementerian Keuangan:: ANTAM's Vision 2030Document5 pagesVisi Dan Misi Kementerian Keuangan:: ANTAM's Vision 2030Willy DavidNo ratings yet

- Unit 2.exercisesDocument8 pagesUnit 2.exercisesclaudiazdeandresNo ratings yet

- Sir Gawain and The Green Knight: A TranslationDocument39 pagesSir Gawain and The Green Knight: A TranslationJohn AshtonNo ratings yet

- "Underdevelopment in Cambodia," by Khieu SamphanDocument28 pages"Underdevelopment in Cambodia," by Khieu Samphanrpmackey3334100% (4)

- Rada Trading 1200#119-07-2019Document5 pagesRada Trading 1200#119-07-2019Ing. Ramon AguileraNo ratings yet

- Mangalore Electricity Supply Company Limited: LT-4 IP Set InstallationsDocument15 pagesMangalore Electricity Supply Company Limited: LT-4 IP Set InstallationsSachin KumarNo ratings yet