Professional Documents

Culture Documents

Bureau of Customs CAO 01-2019 Post Clearance Audit and Prior Disclosure Program

Uploaded by

PortCalls100%(14)100% found this document useful (14 votes)

4K views26 pagesPhilippine companies will now have to be ready for a potential customs audit with the signing of a Bureau of Customs (BOC) order finally operationalizing the agency's post-clearance audit function.

Customs Administrative Order (CAO) 01-2019, signed by Customs Commissioner Rey Leonardo Guerrero on November 29, 2018 and Finance Secretary Carlos Dominguez III on January 9, 2019, implements the post-clearance audit function as well as the Prior Disclosure Program (PDP) as prescribed under the Customs Modernization and Tariff Act (CMTA).

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentPhilippine companies will now have to be ready for a potential customs audit with the signing of a Bureau of Customs (BOC) order finally operationalizing the agency's post-clearance audit function.

Customs Administrative Order (CAO) 01-2019, signed by Customs Commissioner Rey Leonardo Guerrero on November 29, 2018 and Finance Secretary Carlos Dominguez III on January 9, 2019, implements the post-clearance audit function as well as the Prior Disclosure Program (PDP) as prescribed under the Customs Modernization and Tariff Act (CMTA).

Copyright:

© All Rights Reserved

100%(14)100% found this document useful (14 votes)

4K views26 pagesBureau of Customs CAO 01-2019 Post Clearance Audit and Prior Disclosure Program

Uploaded by

PortCallsPhilippine companies will now have to be ready for a potential customs audit with the signing of a Bureau of Customs (BOC) order finally operationalizing the agency's post-clearance audit function.

Customs Administrative Order (CAO) 01-2019, signed by Customs Commissioner Rey Leonardo Guerrero on November 29, 2018 and Finance Secretary Carlos Dominguez III on January 9, 2019, implements the post-clearance audit function as well as the Prior Disclosure Program (PDP) as prescribed under the Customs Modernization and Tariff Act (CMTA).

Copyright:

© All Rights Reserved

You are on page 1of 26

likin COPY

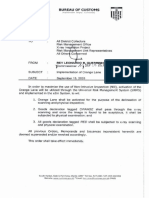

REPUBLIC OF THE PHILIPPINES.

DEPARTMENT OF FINANCE

BUREAU OF CUSTOMS

MANILA 1099

No. O]- 2019

CUSTOMS ADMINISTRATIVE ORDER (CAO)

Ol 2019

SUBJECT: POST CLEARANCE AUDIT AND PRIOR DISCLOSURE PROGRAM

Introduction. This Order implements (a) the post clearance audit functions of the

Bureau, found in Sections 1000 to 1006, Title X; and (b) other related provisions of

Republic Act No. 10863, otherwise known as the Customs Modernization and Tariff

Act (CMTA).

Section 1.

1a.

1.2.

Section 2.

2.1,

2.2,

2.3.

2.4,

Scope. This Order covers:

‘The post clearance audit of all records required to be kept by all

Importers, beneficial or true owners of imported goods, Customs

Brokers, agents and Locators as provided for in Section 1003 (a), (b),

and (c), Title X of the CMTA; and

The Prior Disclosure Program (PDP) as a compliance and revenue

measure,

Objectives.

To prescribe the principles, purposes and methodology of the post

Clearance audit system, recordkeeping requirement and the period

covered by the conduct of audit;

To provide guidance for record-keeping, document retention and

other legal obligations of Importers and other customs stakeholders

and the adverse consequences of non-compliance with customs rules

and regulations;

To facilitate trade by strengthening customs controls from the border

to the back-end of the cargo clearance process under a regime of

informed compliance;

To promote compliance with customs laws and regulations by

providing a non-punitive facility for Importers to voluntarily disclose or

report to customs authorities the errors in goods declarations and in

the payment of duties, taxes and other charges;

g

Page 1 of 26- CAO No. DI-20)4

&

M TER COPY

2.5. To provide a clear set of policies and guidelines in the application and

availment of the PDP; and

2.6. To generate additional customs revenues with least administrative cost

to both the government and the Importer.

Section 3. Definition of Terms. For purposes of this CAO, the following terms

are defined as follows:

3.1. Customs Broker — shall refer to any person who is a bona fide holder

of a valid Certificate of Registration or Professional Identification Card

issued by the Professional Regulatory Board and Professional

Regulation Commission pursuant to Republic Act No. 9280, as

amended, otherwise known as the "Customs Brokers Act of 2004".

3.2. Customs Clearance - shall refer to the completion of customs and

other government formalities necessary to allow goods to enter for

consumption, warehousing, transit or transshipment, or to be exported

or placed under another customs procedure under the following

Customs regimes:?

3.2.1. Customs Clearance for Consumption Entries - shall refer

to the procedure of making the final payment of duties and

taxes and other charges at the port of entry and the legal

permit for withdrawal has been granted.?

3.2.2. Customs Clearance for Warehousing Entries - shall refer

to the procedure of filing of goods declaration and the duties

and taxes has been secured to be paid at the point of entry

and the legal permit for withdrawal has been granted.*

3.2.3. Customs Clearance for Transit Entries - shall refer to the

customs procedure under which goods, in its original form,

are given permit to be transported under customs control from

One customs office to another, or to a free zone.5

3.2.4,

Customs Clearance for Transshipment Entries — shall

refer to the customs procedure under which goods are given

permit to be transferred under customs control from the

importing means of transport to the exporting means of

transport within the area of one customs office, which is the

office of both importation and exportation.°

+ cf. CMTA, Title I, Chapter 2, Section 102 (n)..

2 cf. CMTA, Title I, Chapter 2, Section 102 (k).

3 cf. CMTA, Title I, Chapter 2, Section 103 (a).

4 cf. CMTA, Title I, Chapter 2, Section 103 (a),

5 cf. CMTA, Title I, Chapter 2, Section 102 (rr).

© cf. CMTA, Title I, Chapter 2, Section 102 (ss).

Page 2 of 26 - CAO No. DI- 2014 og

ER COPY

3.3. Fraud — shall refer to the commission or omission of any act resulting

in material false statements such as, but not limited to, the submission

of false or altered documents in connection with any importation

knowingly, voluntarily and intentionally done to reduce the taxes and

duties paid or to avoid compliance with government regulations related

to the entry of Regulated’, Prohibited’ or Restricted? goods into

Philippine customs territory through Misdeclaration, Misclassification or

Undervaluation.!°

3.4, Free Zones - shall refer to special economic zones registered with the

Philippine Economic Zone Authority (PEZA) under Republic Act No.

7916, as amended, duly chartered or legislated special economic zones

and freeports such as Clark Freeport Zone; Poro Point Freeport Zone;

John Hay Special Economic Zone and Subic Bay Freeport Zone under

Republic Act No, 7227, as amended by Republic Act No. 9400; the

Aurora Special Economic Zone under Republic Act No. 9490, as

amended; the Cagayan Special Economic Zone and Freeport under

Republic Act No. 7922; the Zamboanga City Special Economic Zone

under Republic Act No. 7903; the Freeport Area of Bataan under

Republic Act No. 9728; and such other freeports as established or may

be created by law.!!

3.5. Importer — shall refer to the following:

3.5.1. Importer-of-record or consignee, owner or declarant, or a party

who:

a. imports goods into the Philippines or withdraws admitted

goods from the Free Zones into the customs territory for

consumption or warehousing; files a claim for refund or

drawback; or transports or stores such goods carried or

held under security; or

b. knowingly causes the importation or transportation or

storage of imported goods referred to above, or the filing

of refund or drawback claim.

? cf. CMTA, Title I, Chapter 3, Section 117.

® cf. CMTA, Title I, Chapter 3, Section 118,

° ef, CMTA, Title I, Chapter 3, Section 119.

*9 cf. CMTA, Title X, Section 1005 (b).

4 CMTA, Title TI, Chapter 2, Section 102 (w).

Gg

Page 3 of 26 - CAO No. O/-2014

You might also like

- Draft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021Document10 pagesDraft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021PortCallsNo ratings yet

- Bureau of Customs Customs Memorandum Order 28-2021Document2 pagesBureau of Customs Customs Memorandum Order 28-2021PortCalls100% (1)

- Bureau of Internal Revenue Revenue Regulations 15-2021Document1 pageBureau of Internal Revenue Revenue Regulations 15-2021PortCallsNo ratings yet

- Bureau of Customs - Customs Administrative Order 12-2020Document5 pagesBureau of Customs - Customs Administrative Order 12-2020PortCallsNo ratings yet

- BOC AOCG Memo Dated September 11Document1 pageBOC AOCG Memo Dated September 11PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 02-2021Document8 pagesPhilippine Ports Authority Administrative Order No. 02-2021PortCallsNo ratings yet

- Bureau of Customs Customs Memorandum Order No. 09-2021Document32 pagesBureau of Customs Customs Memorandum Order No. 09-2021PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 11 - 2020Document4 pagesPhilippine Ports Authority Administrative Order No. 11 - 2020PortCallsNo ratings yet

- Civil Aviation Authority of The Philippines Memorandum Circular No. 03 2021Document3 pagesCivil Aviation Authority of The Philippines Memorandum Circular No. 03 2021PortCallsNo ratings yet

- Joint Memorandum Circular No. 2021-01Document3 pagesJoint Memorandum Circular No. 2021-01PortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 13-2020Document3 pagesPhilippine Ports Authority Administrative Order No. 13-2020PortCallsNo ratings yet

- Bureau of Customs Memo Activating The Orange LaneDocument1 pageBureau of Customs Memo Activating The Orange LanePortCallsNo ratings yet

- Ds Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedDocument33 pagesDs Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedPortCallsNo ratings yet

- PortCalls (September 7, 2020)Document14 pagesPortCalls (September 7, 2020)PortCalls100% (1)

- BOC AOCG Memo Dated September 11Document2 pagesBOC AOCG Memo Dated September 11PortCalls100% (1)

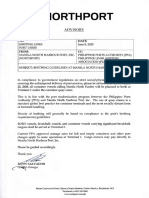

- NorthPort Advisory - June 8, 2020Document1 pageNorthPort Advisory - June 8, 2020PortCallsNo ratings yet

- Shippers' Protection Office Rules of ProceduresDocument10 pagesShippers' Protection Office Rules of ProceduresPortCallsNo ratings yet

- Philippine Ports Authority Administrative Order No. 05-2020Document5 pagesPhilippine Ports Authority Administrative Order No. 05-2020PortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-009Document4 pagesDepartment of Transportation Department Order No. 2020-009PortCallsNo ratings yet

- MC DS-2020-01Document3 pagesMC DS-2020-01PortCallsNo ratings yet

- SBMA Seaport Memorandum On Anti Pilferage SealDocument1 pageSBMA Seaport Memorandum On Anti Pilferage SealPortCallsNo ratings yet

- Department of Trade and Industry Advisory No. 20-02Document1 pageDepartment of Trade and Industry Advisory No. 20-02PortCallsNo ratings yet

- Ppa MC 23-2020Document1 pagePpa MC 23-2020PortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-008Document6 pagesDepartment of Transportation Department Order No. 2020-008PortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-007Document4 pagesDepartment of Transportation Department Order No. 2020-007PortCallsNo ratings yet

- Now Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuideDocument12 pagesNow Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuidePortCallsNo ratings yet

- Department of Transportation Department Order No. 2020-007Document4 pagesDepartment of Transportation Department Order No. 2020-007PortCallsNo ratings yet

- PortCalls April 27 IssueDocument13 pagesPortCalls April 27 IssuePortCallsNo ratings yet

- The Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020Document14 pagesThe Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020PortCallsNo ratings yet

- Department of Trade and Industry Memorandum Circular No. 20-22 Series of 2020Document8 pagesDepartment of Trade and Industry Memorandum Circular No. 20-22 Series of 2020PortCalls0% (2)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- IMO CREW LIST BoyaxDocument25 pagesIMO CREW LIST BoyaxJimboy AriasNo ratings yet

- Multilateral Investment Guarantee Agency: Governors and AlternatesDocument35 pagesMultilateral Investment Guarantee Agency: Governors and AlternatesHannaJoyCarlaMendozaNo ratings yet

- SAP Torque Vertex Project Tax Code Configurations V1.1-1Document16 pagesSAP Torque Vertex Project Tax Code Configurations V1.1-1Prudhvee TejaNo ratings yet

- 6th Pay Commission Salary and Arrears Calculator IndiaDocument41 pages6th Pay Commission Salary and Arrears Calculator Indiaanon-793202100% (13)

- Official Website of Department of Treasury - Contact DetailsDocument5 pagesOfficial Website of Department of Treasury - Contact DetailsNitesh SrivastavaNo ratings yet

- Division of Cavite-Elem-12-20-17 PDFDocument575 pagesDivision of Cavite-Elem-12-20-17 PDFAnne 닌 야 PiedadNo ratings yet

- Tax Codes Gf7eDocument9 pagesTax Codes Gf7eDragota MihaiNo ratings yet

- Latest PlantillaDocument14 pagesLatest PlantillaJULCON ARAIZNo ratings yet

- T2125 and GST-HST WorksheetDocument8 pagesT2125 and GST-HST WorksheetTax Templates Inc.No ratings yet

- Bir Tax ClearanceDocument95 pagesBir Tax ClearanceJeline ReyesNo ratings yet

- Finance Department Order 011-2018Document1 pageFinance Department Order 011-2018PortCalls100% (1)

- Bir Info - 2Document3 pagesBir Info - 2Leslie Joy YataNo ratings yet

- Cash Handling AllowanceDocument4 pagesCash Handling AllowanceK V Sridharan General Secretary P3 NFPENo ratings yet

- Notice: Sanctions, blocked persons, specially-designated nationals, terrorists, narcotics traffickers, and foreign terrorist organizations: Foreign Narcotics Kingpin Designation Act; additional designations; listDocument2 pagesNotice: Sanctions, blocked persons, specially-designated nationals, terrorists, narcotics traffickers, and foreign terrorist organizations: Foreign Narcotics Kingpin Designation Act; additional designations; listJustia.comNo ratings yet

- Certificate NACIN Jan-2024 72ndbatch (Revised)Document2 pagesCertificate NACIN Jan-2024 72ndbatch (Revised)IAS MeenaNo ratings yet

- Certificate of Business Name Registration: MGTV Sari Sari StoreDocument2 pagesCertificate of Business Name Registration: MGTV Sari Sari StoreMaria MalangNo ratings yet

- BIR RMO No. 13-2021Document2 pagesBIR RMO No. 13-2021Earl PatrickNo ratings yet

- BIR Tax ClearanceDocument63 pagesBIR Tax ClearanceKatherine Paceno0% (2)

- BIR October 2017 Signed AppointmentsDocument24 pagesBIR October 2017 Signed AppointmentsAntoinette SmithNo ratings yet

- Consulter Etat CompteDocument1 pageConsulter Etat Comptejanna cavalesNo ratings yet

- August 2017 BIR AppointeesDocument18 pagesAugust 2017 BIR AppointeesAntoinette SmithNo ratings yet

- Bureau of The Fiscal ServiceDocument3 pagesBureau of The Fiscal Servicebeyy100% (1)

- Treasury Bond ResultsDocument4 pagesTreasury Bond ResultsDennis OndiekiNo ratings yet

- Goods & Services Tax (GST) - Services3Document5 pagesGoods & Services Tax (GST) - Services3mohamed arabathNo ratings yet

- Federal Register / Vol. 71, No. 228 / Tuesday, November 28, 2006 / NoticesDocument6 pagesFederal Register / Vol. 71, No. 228 / Tuesday, November 28, 2006 / NoticesJustia.com0% (1)

- Court of Tax Appeals: VENUE: Second Division Courtroom, 3Document3 pagesCourt of Tax Appeals: VENUE: Second Division Courtroom, 3Aemie JordanNo ratings yet

- P Bhattacharya Pay FixationDocument1 pageP Bhattacharya Pay FixationMohamed AnsarNo ratings yet

- AuctionsDocument2 pagesAuctionsapi-25896854No ratings yet

- Invoice / Facture: Martin Bourque 110 Rue Robert Varennes, Quebec, J3X 1M8 CADocument1 pageInvoice / Facture: Martin Bourque 110 Rue Robert Varennes, Quebec, J3X 1M8 CAmartinNo ratings yet

- DRAFT CIVIL LIST 2021 INVITING CORRECTIONSDocument413 pagesDRAFT CIVIL LIST 2021 INVITING CORRECTIONSpkrawatNo ratings yet