Professional Documents

Culture Documents

Mas

Uploaded by

Emma Mariz GarciaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mas

Uploaded by

Emma Mariz GarciaCopyright:

Available Formats

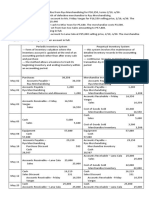

1. Stockholm Company is considering the sale of a machine with the following characteristics.

Book value $120,000

Remaining useful life 5 years

Annual straight-line depreciation $ 24,000

Current market value $ 70,000

If the company sells the machine its cash operating expenses will increase by $30,000 per year due to

an operating lease. The tax rate is 40%.

a. Find the cash flow from selling the machine.

b. Calculate the increase in annual net cash outflows as a result of selling the machine.

2. Pepin Company is considering replacing a machine that has the following characteristics.

Book value $100,000

Remaining useful life 5 years

Annual straight-line depreciation $ ???

Current market value $ 60,000

The replacement machine would cost $150,000, have a five-year life, and save $50,000 per year in

cash operating costs. It would be depreciated using the straight-line method. The tax rate is 40%.

a. Find the net investment required to replace the existing machine.

b. Compute the increase in annual income taxes if the company replaces the machine.

c. Compute the increase in annual net cash flows if the company replaces

3. Cable Company is considering the purchase of a machine with the following characteristics.

Cost $100,000

Useful life 10 years

Expected annual cash cost savings $30,000

Cable's income tax rate is 40% and its cost of capital is 12%. Cable expects to use straight-line

depreciation for tax purposes.

a. Compute the expected increase in annual net cash flow for this project.

b. Compute the profitability index for the project.

c. How would the profitability index for this project be affected if Cable were to use MACRS depreciation

for tax purposes and the machine fell into the 7-year MACRS class? (increase decrease not

affected) Circle the appropriate answer.

Frank Co. has the opportunity to introduce a new product. Frank expects the product to sell for $60 and

to have per-unit variable costs of $35 and annual cash fixed costs of $4,000,000. Expected annual

sales volume is 275,000 units. The equipment needed to bring out the new product costs

$6,000,000, has a four-year life and no salvage value, and would be depreciated on a straight-line

basis. Frank's cost of capital is 14% and its income tax rate is 40%.

a. Compute the annual net cash flows for the investment.

b. Compute the NPV of the project.

c. Suppose that some of the 275,000 units expected to be sold would be to customers who currently

buy another of Frank's products, the X-10, which has a $12 per-unit contribution margin. Find the

sales of X-10 that can Frank lose per year and still have the investment in the new product return

at least the 14% cost of capital.

d. Suppose that selling the new product has no complementary effects but that Frank's production

engineers anticipate some production problems in making the new product and are not confident

of the $35 estimate of per-unit variable costs for the new product. Find the amount by which

Frank's estimate of per-unit variable cost could be in error and the investment still have a return

at least equal to the 14% cost of capital.

5. Zenex is considering the purchase of a machine. Data are as follows:

Cost $240,000

Useful life 10 years

Annual straight-line depreciation $ ???

Expected annual savings in cash

operation costs $ 80,000

Additional working capital needed $100,000

Zenex's cutoff rate is 12% and its tax rate is 40%.

a. Compute the annual net cash flows for the investment.

b. Compute the NPV of the project.

c. Compute the profitability index of the project.

You might also like

- Capital Budgeting Cash Flow Principles ProblemsDocument3 pagesCapital Budgeting Cash Flow Principles ProblemsripplerageNo ratings yet

- PGPM FM I Glim Assignment 3 2014Document5 pagesPGPM FM I Glim Assignment 3 2014sexy_sam280% (1)

- Cap Budg IIDocument9 pagesCap Budg IIqueenbeeastNo ratings yet

- Incremental cash flows and NPV of Miller Corporation's new productDocument5 pagesIncremental cash flows and NPV of Miller Corporation's new producttrelvisd0% (1)

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- SFM Practice QuestionsDocument13 pagesSFM Practice QuestionsAmmar Ahsan0% (1)

- Capital Budgeting NPV Analysis for Earth Mover ProjectDocument6 pagesCapital Budgeting NPV Analysis for Earth Mover ProjectMarcoBonaparte0% (1)

- ANGELICADocument7 pagesANGELICAAngel Reconalla Lapadan100% (2)

- Add - L Problems CBDocument4 pagesAdd - L Problems CBJamesCarlSantiagoNo ratings yet

- S 12Document15 pagesS 12AbhishekKumar0% (3)

- Chapter 10 - Capital Budgeting - ProblemsDocument4 pagesChapter 10 - Capital Budgeting - Problemsbraydenfr05No ratings yet

- NPV SumsDocument2 pagesNPV SumsSunitha RamNo ratings yet

- MAS Compre Quiz To PrintDocument3 pagesMAS Compre Quiz To PrintJuly LumantasNo ratings yet

- Pamantasan ng Cabuyao Quiz No. 1 Capital Budgeting ProblemsDocument3 pagesPamantasan ng Cabuyao Quiz No. 1 Capital Budgeting ProblemsDan Ryan MagalangNo ratings yet

- Capital Budgeting: Workshop Questions: Finance & Financial ManagementDocument12 pagesCapital Budgeting: Workshop Questions: Finance & Financial ManagementJuan SanguinetiNo ratings yet

- Exercises Capital BudgetingDocument3 pagesExercises Capital BudgetingSwap WerdNo ratings yet

- Cash Flow Estimation Problem SetDocument6 pagesCash Flow Estimation Problem SetmehdiNo ratings yet

- Problems 7.1Document1 pageProblems 7.1Tuan Anh LeeNo ratings yet

- Strategic Business AnalysisDocument8 pagesStrategic Business AnalysisAdora Chielka SalesNo ratings yet

- Fin3n Cap Budgeting Quiz 1Document1 pageFin3n Cap Budgeting Quiz 1Kirsten Marie EximNo ratings yet

- Calculate Capital Budgeting Payback Period & NPVDocument11 pagesCalculate Capital Budgeting Payback Period & NPVSarah BalisacanNo ratings yet

- Capital Budgeting ProblemsDocument9 pagesCapital Budgeting ProblemsMark De Jesus0% (1)

- Ie342 SS4Document8 pagesIe342 SS4slnyzclrNo ratings yet

- Tutorial CashflowDocument2 pagesTutorial CashflowArman ShahNo ratings yet

- 1 Problem Assignment TwoDocument23 pages1 Problem Assignment TwoFerdinand Dave0% (1)

- MANAGEMENT ADVISORY SERVICES CAPITAL BUDGETINGDocument37 pagesMANAGEMENT ADVISORY SERVICES CAPITAL BUDGETINGjoooNo ratings yet

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDocument3 pages3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanNo ratings yet

- Cash Flows-Capbud PDFDocument2 pagesCash Flows-Capbud PDFErjohn PapaNo ratings yet

- CB ExerciseDocument2 pagesCB ExerciseJohn Carlos WeeNo ratings yet

- Financial Calculation QuestionsDocument2 pagesFinancial Calculation QuestionspriyavlNo ratings yet

- Problem 12-1aDocument8 pagesProblem 12-1aJose Ramon AlemanNo ratings yet

- Financial Management-Capital Budgeting:: Answer The Following QuestionsDocument2 pagesFinancial Management-Capital Budgeting:: Answer The Following QuestionsMitali JulkaNo ratings yet

- Management Accounting 2 Handout #2 TheoriesDocument4 pagesManagement Accounting 2 Handout #2 TheoriesCyrille MananghayaNo ratings yet

- Required:: Project A Would CostDocument10 pagesRequired:: Project A Would CostSad CharlieNo ratings yet

- Financial Functions Excel TutorialDocument5 pagesFinancial Functions Excel Tutorialpleasetryagain12345No ratings yet

- Capital Budgeting: Key Topics To KnowDocument11 pagesCapital Budgeting: Key Topics To KnowBernardo KristineNo ratings yet

- Maxwell CompanyDocument1 pageMaxwell CompanyAngeline RamirezNo ratings yet

- Assignment TwoDocument9 pagesAssignment TwoKiro EmadNo ratings yet

- Investment Appraisal-Fm AccaDocument11 pagesInvestment Appraisal-Fm AccaCorrinaNo ratings yet

- Bài Tập Buổi 4 (Updated)Document4 pagesBài Tập Buổi 4 (Updated)Minh NguyenNo ratings yet

- Chapter 13 Appendix CDocument30 pagesChapter 13 Appendix Cfoxstupidfox100% (1)

- Revision Question 2023.11.21Document5 pagesRevision Question 2023.11.21rbaambaNo ratings yet

- AcmeDocument2 pagesAcmeAngeline RamirezNo ratings yet

- Chapter 3. Advanced Discounted Cash Flow TechniquesDocument16 pagesChapter 3. Advanced Discounted Cash Flow TechniquesHastings KapalaNo ratings yet

- Measuring Investment Returns: Questions and ExercisesDocument9 pagesMeasuring Investment Returns: Questions and ExercisesKinNo ratings yet

- FIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingDocument3 pagesFIN3101 Corporate Finance Practice Questions Topic: Capital BudgetingKelly KohNo ratings yet

- Tennessee-Atlantic Paper Company capital investment analysisDocument3 pagesTennessee-Atlantic Paper Company capital investment analysisYasir AamirNo ratings yet

- Ma 2Document3 pagesMa 2123 123No ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- ISSM 541 Winter 2015 Assignment 5Document5 pagesISSM 541 Winter 2015 Assignment 5Parul KhannaNo ratings yet

- FINANCIAL MANAGEMENT Capital BudgetingDocument3 pagesFINANCIAL MANAGEMENT Capital BudgetingDiomela BionganNo ratings yet

- Worksheet#3-MCQ-2018 .PDF Engineering EconomyDocument6 pagesWorksheet#3-MCQ-2018 .PDF Engineering EconomyOmar F'Kassar0% (1)

- AsemDocument10 pagesAsemasem shabanNo ratings yet

- Capital Budgeting Techniques for Evaluating Investment ProjectsDocument15 pagesCapital Budgeting Techniques for Evaluating Investment ProjectsSpencer Tañada100% (1)

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTENo ratings yet

- CCDocument28 pagesCCeiNo ratings yet

- HW1 NPVDocument4 pagesHW1 NPVLalit GuptaNo ratings yet

- Econ F315 1923 CM 2017 1Document3 pagesEcon F315 1923 CM 2017 1Abhishek GhoshNo ratings yet

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- Global Management Accounting TrendsDocument2 pagesGlobal Management Accounting TrendsEmma Mariz GarciaNo ratings yet

- Assurance & Nonassurance ServicesDocument16 pagesAssurance & Nonassurance ServicesEmma Mariz GarciaNo ratings yet

- Financial Analysis TheoryDocument1 pageFinancial Analysis TheoryEmma Mariz GarciaNo ratings yet

- MSQ-02 - Variable & Absorption Costing (Final)Document11 pagesMSQ-02 - Variable & Absorption Costing (Final)Kevin James Sedurifa OledanNo ratings yet

- Toa 123Document13 pagesToa 123fredeksdiiNo ratings yet

- TB - Chapter21 Mergers and AcquisitionsDocument12 pagesTB - Chapter21 Mergers and AcquisitionsPrincess EspirituNo ratings yet

- Capital Structure and Leverage MCQsDocument53 pagesCapital Structure and Leverage MCQsArya StarkNo ratings yet

- Financial Accounting and ReportingDocument3 pagesFinancial Accounting and ReportingEmma Mariz GarciaNo ratings yet

- Capital BudgetingDocument5 pagesCapital BudgetingEmma Mariz GarciaNo ratings yet

- Management Consultancy and AccountingDocument10 pagesManagement Consultancy and AccountingEmma Mariz GarciaNo ratings yet

- RMC No 50-2018Document18 pagesRMC No 50-2018JajajaNo ratings yet

- Train Law PDFDocument27 pagesTrain Law PDFLanieLampasaNo ratings yet

- Fin3b Working Capital ManagementDocument11 pagesFin3b Working Capital ManagementEmma Mariz GarciaNo ratings yet

- Ifrs 8Document11 pagesIfrs 8TasminNo ratings yet

- Time Value of Money Gitman PDFDocument34 pagesTime Value of Money Gitman PDFEmma Mariz GarciaNo ratings yet

- MCQ - Intro To AuditDocument13 pagesMCQ - Intro To Auditemc2_mcv74% (27)

- CHAPTER 8 - CapacityDocument5 pagesCHAPTER 8 - CapacityEmma Mariz GarciaNo ratings yet

- Cpar Afar 1 Final Preboard May 2018Document10 pagesCpar Afar 1 Final Preboard May 2018Emma Mariz Garcia50% (2)

- Chapter 9 - LocationDocument5 pagesChapter 9 - LocationEmma Mariz GarciaNo ratings yet

- Solution Manual Partnership Corporation 2014 2015 PDFDocument5 pagesSolution Manual Partnership Corporation 2014 2015 PDFEmma Mariz GarciaNo ratings yet

- Cis - Chapter 1Document1 pageCis - Chapter 1Emma Mariz GarciaNo ratings yet

- Acc101-FinalRevnew 001yDocument26 pagesAcc101-FinalRevnew 001yJollybelleann MarcosNo ratings yet

- Solution Manual - Partnership & Corporation, 2014-2015 PDFDocument77 pagesSolution Manual - Partnership & Corporation, 2014-2015 PDFRomerJoieUgmadCultura78% (88)

- Sde 55Document19 pagesSde 55YaniNo ratings yet

- Parnership Corpo NotesDocument15 pagesParnership Corpo NotesMJ YaconNo ratings yet

- Test Bank Auditng ProbDocument11 pagesTest Bank Auditng ProbTinne PaculabaNo ratings yet

- Audit of Inventories Quiz PrintingDocument2 pagesAudit of Inventories Quiz PrintingEmma Mariz GarciaNo ratings yet

- Bank Reconciliation Without SolutionDocument7 pagesBank Reconciliation Without SolutionEmma Mariz GarciaNo ratings yet

- Law On Negotiable InstrumentsDocument16 pagesLaw On Negotiable InstrumentsEmma Mariz GarciaNo ratings yet

- Liquidity Ratios: Basic Formulas of Ratio AnalysisDocument2 pagesLiquidity Ratios: Basic Formulas of Ratio AnalysisVishal IngoleNo ratings yet

- A Study On Analysis of Financial Statements of Bharti AirtelDocument48 pagesA Study On Analysis of Financial Statements of Bharti AirtelVijay Gohil74% (23)

- Buku Ajar Ak. Keu. Lanj. Ii WorkpaperDocument85 pagesBuku Ajar Ak. Keu. Lanj. Ii Workpapermirna nurwenda100% (2)

- Factor-Factor Relationships: X X / X X (X XDocument50 pagesFactor-Factor Relationships: X X / X X (X XAnandKuttiyanNo ratings yet

- Group Reporting II: Application of The Acquisition Method Under IFRS 3Document77 pagesGroup Reporting II: Application of The Acquisition Method Under IFRS 3فهد التويجريNo ratings yet

- Accounting 2 Admission & WithdrawalDocument6 pagesAccounting 2 Admission & WithdrawalZyka SinoyNo ratings yet

- 12th Accountancy EM - Public Exam 2022 Model Question Paper - English Medium PDF DownloadDocument10 pages12th Accountancy EM - Public Exam 2022 Model Question Paper - English Medium PDF DownloadMohamed Jamil IrfanNo ratings yet

- Evaluating Financial Performance: Chapter TwoDocument41 pagesEvaluating Financial Performance: Chapter TwoSanad Rousan100% (1)

- Window DressingDocument3 pagesWindow Dressingkriti_a100% (2)

- ACCA - Applied Skills Financial ReportingDocument274 pagesACCA - Applied Skills Financial Reportingerickson tyroneNo ratings yet

- Era PROJECT WORKING CAPITALDocument64 pagesEra PROJECT WORKING CAPITALDiwakar BandarlaNo ratings yet

- Cfas Inventories QuizletDocument2 pagesCfas Inventories Quizletagm25No ratings yet

- Finance Module 6 Long-Term FinancingDocument5 pagesFinance Module 6 Long-Term FinancingKJ JonesNo ratings yet

- FABM 1 Rules of Debit and CreditDocument13 pagesFABM 1 Rules of Debit and CreditAllyssa LaquindanumNo ratings yet

- Measuring Financial PerformanceDocument41 pagesMeasuring Financial PerformanceRafael KusumaNo ratings yet

- Working Capital Ratio - : Particulars 2014-15 2015-2016 2016-2017 2017-2018 2018-2019Document2 pagesWorking Capital Ratio - : Particulars 2014-15 2015-2016 2016-2017 2017-2018 2018-2019parthNo ratings yet

- Topic 1 IPMDocument22 pagesTopic 1 IPMmeshack mbalaNo ratings yet

- Accounting For Merchandising Operations LongDocument2 pagesAccounting For Merchandising Operations Longgk concepcionNo ratings yet

- Financial Markets ExamDocument5 pagesFinancial Markets ExamHisham AshrafNo ratings yet

- Financial reporting questions on consolidated financial statements, discontinued operations, and changes in equityDocument16 pagesFinancial reporting questions on consolidated financial statements, discontinued operations, and changes in equityUlanda2100% (2)

- How Marwaris Are So RichDocument12 pagesHow Marwaris Are So RichMawsinNo ratings yet

- Joint ArrrangementsDocument5 pagesJoint ArrrangementsGIGI BODONo ratings yet

- Canadian Entrepreneurship and Small Business Management Canadian 10th Edition Balderson Test BankDocument5 pagesCanadian Entrepreneurship and Small Business Management Canadian 10th Edition Balderson Test Bankelijahlonga9w9i100% (29)

- JPM BanksDocument220 pagesJPM BanksÀlex_bové_1No ratings yet

- Presentation Topics First CaseDocument2 pagesPresentation Topics First CaseRohit KumarNo ratings yet

- Victoria Corporation Financial Statements AnalysisDocument18 pagesVictoria Corporation Financial Statements AnalysisPattraniteNo ratings yet

- Sources and Uses of Short-Term and Long-Term FundsDocument3 pagesSources and Uses of Short-Term and Long-Term FundsAiron Bendaña100% (2)

- Liquidation Statement of AffairsDocument6 pagesLiquidation Statement of AffairsArmhel FangonNo ratings yet

- Financial AssetsDocument3 pagesFinancial AssetsAshik Uz ZamanNo ratings yet

- Burberry Financial AnalysisDocument17 pagesBurberry Financial AnalysisGiulio Francesca50% (2)