Professional Documents

Culture Documents

Quick Lunch Financial Statements

Uploaded by

DV VillanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quick Lunch Financial Statements

Uploaded by

DV VillanCopyright:

Available Formats

1.

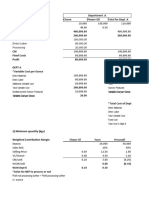

QUICK LUNCH

Income Statement

For the Four Months Ended December 31, 2002

Sales to customers $ 29,315.00

Sales to customers - Coupon Books $ 2,700.00

less: Discounts $ -225.00 $ 2,475.00

Net Sales $ 31,790.00

Less: Cost of sales $ -14,415.00

Gross Income $ 17,375.00

less: Expenses

City restaurant licenses

expenses $ 75.00

Rent expenses $ 4,975.00

Other operating expenses $ 90.00

Repairs Expenses - Coffee

urn $ 156.00

Lease Expenses $ 1,900.00

Loss on sale of equipment $ 4,200.00 $ 11,396.00

Net income $ 5,979.00

QUICK LUNCH

Balance Sheet

As of December 31, 2002

ASSET

Current Assets

Cash $ 12,265.00

Food and Supplies Inventory $ 750.00

Prepaid Lease $ 3,800.00

Prepaid City Restaurant Licenses $ 150.00

Total current assets $ 16,965.00

Non-Current Assets

Cooking Range $ 4,600.00

TOTAL ASSETS $ 21,565.00

LIABILITIES AND OWNER'S CAPITAL

Liabilities

Accrued Meat Payable $ 890.00

Accrued Rent Payable $ 1,515.00

Accrued Repairs Payable $ 156.00

Coupon Books Payable $ 1,375.00

Total liabilities $ 3,936.00

Owner's Capital

Bingham Capital 09/01/2002 $ 15,450.00

Add: Net income $ 5,979.00

$ 21,429.00

Less: Withdrawals $ 3,800.00

Bingham Capital,

12/31/2002 $ 17,629.00

TOTAL LIABILITIES AND OWNER'S CAPITAL $ 21,565.00

QUICK LUNCH

Statement of Cash Flows

For the Four Months Ended December 31, 2002

Cash flows from operating activities:

Receipts from Customers $ 33,165.00

Disbursements:

Purchase of Food and Supplies $ -14,275.00

Payment of city restaurant license $ -225.00

payment of rent $ -3,460.00

Payment of other operating expenses $ -90.00

Payment of lease agreement $ -5,700.00 $ -23,750.00

Net cash flows provided by operating activities $ 9,415.00

Cash flows from investing activities:

Proceeds from sale of old equipment $ 400.00

Purchase of old

equipment $ -4,600.00

Purchase of new equipment $ -4,000.00

Installation cost for new equipment $ -600.00

Net cash flows provided by investing activities $ -8,800.00

Cash flows from financing activities:

Initial investment by the owner $ 15,450.00

Withdrawals by the owner $ -3,800.00

Net cash flows from financing activities $ 11,650.00

Cash at the end of the period 12/31/2002 $ 12,265.00

You might also like

- Sugar IndustryDocument19 pagesSugar IndustryDV VillanNo ratings yet

- Chapter 5 ProblemsDocument7 pagesChapter 5 Problemsanu balakrishnanNo ratings yet

- Whitney CompanyDocument4 pagesWhitney CompanyRIZA JOY CAÑETE DELARAGANo ratings yet

- Quick Lunch CASE 14-1Document2 pagesQuick Lunch CASE 14-1sheeraveal0% (1)

- 6 - Browning MFTG Company Case SolutionDocument12 pages6 - Browning MFTG Company Case Solutionjenice joy100% (2)

- Hardin Tool CompanyDocument42 pagesHardin Tool CompanyMayank KumarNo ratings yet

- Joan Holtz (A) Case Revenue Recognition QuestionsDocument5 pagesJoan Holtz (A) Case Revenue Recognition QuestionsAashima GroverNo ratings yet

- About RioTinto BrochureDocument16 pagesAbout RioTinto BrochureAleksandarNo ratings yet

- Revenues and costs allocation by divisionDocument7 pagesRevenues and costs allocation by divisionlaale dijaan100% (1)

- (Case 6-7) 5-1 Stern CorporationDocument1 page(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- Revenue Recognition Case Study DiscussionDocument5 pagesRevenue Recognition Case Study DiscussionRahul KaulNo ratings yet

- Quick Lunch CaseDocument4 pagesQuick Lunch CaseChleo EsperaNo ratings yet

- Bill French Google Docs Group 5Document7 pagesBill French Google Docs Group 5Jay Florence DalucanogNo ratings yet

- Case Report - Grenell FarmDocument5 pagesCase Report - Grenell Farmajsibal100% (1)

- Crystal Meadows of TahoeDocument5 pagesCrystal Meadows of TahoeNikitha Andrea Saldanha80% (5)

- Browning Manufacturing CompanyDocument7 pagesBrowning Manufacturing CompanyajsibalNo ratings yet

- CPA Reviewer Multiple Choice Questions TaxationDocument38 pagesCPA Reviewer Multiple Choice Questions TaxationCookie Pookie BallerShopNo ratings yet

- Segmented Income Statement - L01-7Document5 pagesSegmented Income Statement - L01-7Yza Belle Soldevilla Vego100% (1)

- Problem Sets Finacc Chapter 9Document19 pagesProblem Sets Finacc Chapter 9Reg LagartejaNo ratings yet

- Lone Pine Cafe Balance SheetsDocument15 pagesLone Pine Cafe Balance SheetsCynthia Anggi Maulina100% (1)

- OjoylanJenny - Charmingly (Case#5)Document5 pagesOjoylanJenny - Charmingly (Case#5)Jenny Ojoylan100% (1)

- Delaney Motors CaseDocument15 pagesDelaney Motors CaseVan DyNo ratings yet

- Case-Bill FrenchDocument3 pagesCase-Bill FrenchthearpanNo ratings yet

- Group 1-Java SourceDocument5 pagesGroup 1-Java SourceLorena Mae LasquiteNo ratings yet

- Quick Lunch Balance Sheet and Income Statement AnalysisDocument4 pagesQuick Lunch Balance Sheet and Income Statement AnalysisBitan BanerjeeNo ratings yet

- GROUP 4 Music Teachers IncDocument4 pagesGROUP 4 Music Teachers IncLorena Mae LasquiteNo ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Cooperative Training ModuleDocument38 pagesCooperative Training ModuleAndreline AnsulaNo ratings yet

- Delaney Motors Case SolutionDocument13 pagesDelaney Motors Case SolutionParambrahma Panda100% (2)

- Export Procedure GuideDocument128 pagesExport Procedure GuidePrateek SinghNo ratings yet

- Reflective Essay - Pestle Mortar Clothing BusinessDocument7 pagesReflective Essay - Pestle Mortar Clothing Businessapi-239739146No ratings yet

- Department A Cost Analysis and Profitability CalculationsDocument8 pagesDepartment A Cost Analysis and Profitability CalculationsRica PresbiteroNo ratings yet

- Philippine Vending CorporationDocument32 pagesPhilippine Vending CorporationCharlz Capa CaroNo ratings yet

- Case 6 1Document10 pagesCase 6 1cashmerehitNo ratings yet

- 2010 06 13 - 091545 - Case13 30Document6 pages2010 06 13 - 091545 - Case13 30Sheila Mae Llamada Saycon IINo ratings yet

- TLG SolutionsDocument22 pagesTLG SolutionsDV Villan71% (7)

- Quick Lunch & Browning ManufacturingDocument9 pagesQuick Lunch & Browning ManufacturingMariaAngelicaMargenApeNo ratings yet

- Case 5 Ans - Charmingly YoursDocument4 pagesCase 5 Ans - Charmingly YoursVaness Grace Aniban100% (4)

- Lipman Bottle Company Case Analysis Group1Document13 pagesLipman Bottle Company Case Analysis Group1Shubham Nigam100% (1)

- Management Accounting - I (Section A, B &H) Term I (2021-22)Document3 pagesManagement Accounting - I (Section A, B &H) Term I (2021-22)saurabhNo ratings yet

- AkuntansiDocument3 pagesAkuntansier4sallNo ratings yet

- Master Chef Employment Agmt (14 Pages)Document14 pagesMaster Chef Employment Agmt (14 Pages)Jonny DuppsesNo ratings yet

- Product IdeationDocument13 pagesProduct IdeationHenry Rock100% (1)

- anthonyIM 06Document18 pagesanthonyIM 06Jigar ShahNo ratings yet

- Bill FrenchDocument5 pagesBill Frenchabigail franciscoNo ratings yet

- Enterprise Architecture DesignerDocument22 pagesEnterprise Architecture DesignerVENKATNo ratings yet

- Quick Lunch 2Document5 pagesQuick Lunch 2Ceclie DelfinoNo ratings yet

- Problem 13-1 - Chapter 13 - SolutionDocument6 pagesProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- Amerbran Company A Final1Document6 pagesAmerbran Company A Final1Rio TanNo ratings yet

- Medieval Case SolutionDocument7 pagesMedieval Case SolutionTarry BerryNo ratings yet

- Service Organization Segment ReportingDocument6 pagesService Organization Segment ReportingAudrey LouelleNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Case 5-3Document2 pagesCase 5-3ragil1988No ratings yet

- GROUP 6-Case-Wesco-Inc.Document4 pagesGROUP 6-Case-Wesco-Inc.Lorena Mae LasquiteNo ratings yet

- Case StudyDocument11 pagesCase Studyapi-269859076No ratings yet

- Yuvraj Patil Section B 2010PGP435 Case: Bill French Mac IiDocument4 pagesYuvraj Patil Section B 2010PGP435 Case: Bill French Mac Iiyuveesp5207No ratings yet

- Lipman Bottle CompanyDocument20 pagesLipman Bottle CompanySaswata BanerjeeNo ratings yet

- Case 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTDocument4 pagesCase 3 - 1: Maynard Company (B) : DR Ashish Varma / IMTkunalNo ratings yet

- Bonus Ch15Document45 pagesBonus Ch15agctdna5017No ratings yet

- Case Analysis 3 1 Maynard BusinessDocument6 pagesCase Analysis 3 1 Maynard BusinessDAVE RYAN DELA CRUZNo ratings yet

- Elwy Melina-Sarah MHCDocument7 pagesElwy Melina-Sarah MHCpalak32No ratings yet

- Corporate Finance Practice ProblemsDocument9 pagesCorporate Finance Practice ProblemsEunice NanaNo ratings yet

- Joan HoltzDocument10 pagesJoan HoltzKarlo PradoNo ratings yet

- Case Study 4 - 3 Copies ExpressDocument8 pagesCase Study 4 - 3 Copies ExpressJZ0% (1)

- Maynard Company Balance Sheet AnalysisDocument2 pagesMaynard Company Balance Sheet AnalysisArchin Padia100% (1)

- Chapter 3 SolutionsDocument8 pagesChapter 3 SolutionsSol S.No ratings yet

- Lawsuit and bond discount accounting questionsDocument2 pagesLawsuit and bond discount accounting questionsPatrick HariramaniNo ratings yet

- Grennell Farm Balance Sheet AnalysisDocument6 pagesGrennell Farm Balance Sheet AnalysisMichael TorresNo ratings yet

- Class Case 1 Quick LunchDocument4 pagesClass Case 1 Quick Lunch9ry5gsghybNo ratings yet

- COPIES EXPRESS BALANCE SHEET AND INCOME STATEMENTDocument7 pagesCOPIES EXPRESS BALANCE SHEET AND INCOME STATEMENTCHERRYL VALMORESNo ratings yet

- Assignment 17Document8 pagesAssignment 17Nicolas ErnestoNo ratings yet

- Ethical Guidance For ODDocument11 pagesEthical Guidance For ODDV VillanNo ratings yet

- Assignment No. 3 Feedback and ResistanceDocument5 pagesAssignment No. 3 Feedback and ResistanceDV VillanNo ratings yet

- Browning Mfmg. CompanyDocument4 pagesBrowning Mfmg. CompanyDV VillanNo ratings yet

- Org. DevDocument5 pagesOrg. DevDV VillanNo ratings yet

- 01 Background PDFDocument7 pages01 Background PDFDV VillanNo ratings yet

- GC 1 AlaireDocument3 pagesGC 1 AlaireDV VillanNo ratings yet

- Is It Much Ado About NothingDocument1 pageIs It Much Ado About NothingDV VillanNo ratings yet

- Gi FSWKG Iu 6 Er OhkDocument3 pagesGi FSWKG Iu 6 Er OhkPrasanna Das RaviNo ratings yet

- J.K Wellhead Service Engineer ResumeDocument6 pagesJ.K Wellhead Service Engineer ResumeLuis A G. C.0% (1)

- Economics NumericalsDocument9 pagesEconomics NumericalsIshaan KumarNo ratings yet

- Customer Satisfaction Survey ISO9001 TemplateDocument1 pageCustomer Satisfaction Survey ISO9001 TemplateCabrelNo ratings yet

- Template Slip Gaji - V2.1 - enDocument35 pagesTemplate Slip Gaji - V2.1 - enHk ThNo ratings yet

- Audi AnswerrDocument10 pagesAudi AnswerrHend MoneimNo ratings yet

- A Study On Risk and Return Analysis of Listed Stocks in Sensex With Special Reference To Bombay Stock ExchangeDocument83 pagesA Study On Risk and Return Analysis of Listed Stocks in Sensex With Special Reference To Bombay Stock ExchangeVRameshram50% (8)

- STP DoneDocument3 pagesSTP DoneD Attitude KidNo ratings yet

- University of Caloocan City: College of Business and AccountancyDocument20 pagesUniversity of Caloocan City: College of Business and AccountancyDezavelle LozanoNo ratings yet

- EPU GuidelineDocument11 pagesEPU GuidelineHani Adyanti AhmadNo ratings yet

- 1 Taxpayer Identification Number (TIN) 2 RDO Code 3 Contact Number - 4 Registered NameDocument3 pages1 Taxpayer Identification Number (TIN) 2 RDO Code 3 Contact Number - 4 Registered NameRose O. DiscalzoNo ratings yet

- Types of TaxesDocument6 pagesTypes of TaxesRohan DangeNo ratings yet

- Us Lisega Catalog 2020 PDFDocument289 pagesUs Lisega Catalog 2020 PDFozkanhasan100% (1)

- Accounting An Introduction NZ 2nd Edition Atrill Test BankDocument26 pagesAccounting An Introduction NZ 2nd Edition Atrill Test Banksophronianhat6dk2k100% (25)

- S 296001-1 A3 APQP Status Report enDocument2 pagesS 296001-1 A3 APQP Status Report enfdsa01No ratings yet

- NebicoDocument6 pagesNebicomaharjanaarya21No ratings yet

- 2012 CCG Indonesia Latest Eg Id 050874Document111 pages2012 CCG Indonesia Latest Eg Id 050874kenwongwmNo ratings yet

- Javeria Essay 3Document7 pagesJaveria Essay 3api-241524631No ratings yet

- The Challenges of Nigerian Agricultural Firms in Implementing The Marketing ConceptDocument10 pagesThe Challenges of Nigerian Agricultural Firms in Implementing The Marketing Conceptrohan singhNo ratings yet

- Catalog Labu ScaffoldDocument4 pagesCatalog Labu ScaffoldLabu ScaffoldNo ratings yet

- Mercedes-Benz SA Limited: 1. DefinitionsDocument3 pagesMercedes-Benz SA Limited: 1. DefinitionsvikasNo ratings yet