Professional Documents

Culture Documents

Employee full and final settlement details

Uploaded by

तेजस्विनी रंजनOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Employee full and final settlement details

Uploaded by

तेजस्विनी रंजनCopyright:

Available Formats

Employee Name : Tejaswini Ranjan Employee Code : AT01228

Financial Year:2018-2019 Assesment Year: 2019-2020

Aeries Technology Group Private Limited

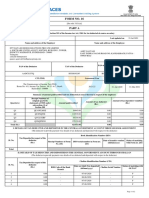

FULL AND FINAL SETTLEMENT - DECEMBER 2018

Employee Code AT01228 Employee Name Tejaswini Ranjan

Company Aeries Technology Group Pvt Location Hyderabad

Ltd

Business Unit EPIQ Group Aeries Technology Group

Private Limited

Level 2 Grade 2A

Designation Legal Associate Project DRS

Department DRS Date Of Joining 06 Aug 2018

Last working day 16 Dec 2018 Days Worked 16

Arrears Days 0 Notice Days 0

ESIC Account Number Leave Encashment Days 0

Bank Name Kotak Mahindra Bank Account Number 8712029814

Permanent Account Number BQUPR7249M

The following items have been return to the company by the above employee.

Handover Doc ID CARD KT Doc LAPTOP

Mobile Other SIM

Earnings Deductions

Particulars Rate/Month Amount Particulars Amount

Basic Salary 22920 11830 PF Deduction 1420

House Rent 9168 4732 PT Deduction 200

Allowance

Special Allowance 10844 5597

Total Earnings 42932 22159 Total Deductions 1620

Net full and final settlement amount payable : 20539 (In words : Twenty Thousand Five Hundred Thirty Nine Only)

Prepared By Authorized By Approved By

I, Tejaswini Ranjan Employee Code No: AT01228 hereby accept a sum of Rs.20539 as per above full and final settlement and also

declare that there are no pending dues from aeries

Signature Of Employee Signature Of Cashier / Accountant

This is a computer generated statement and hence no signature is required.

Page 1

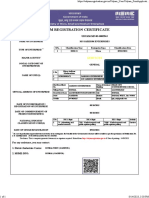

Employee Name : Tejaswini Ranjan Employee Code : AT01228

Financial Year:2018-2019 Assesment Year: 2019-2020

CUMULATIVE PAY SLIP

Financial Year:2018-2019

PARTICULARS AUG SEP OCT NOV DEC TOTAL

Days Worked 26.00 30.00 31.00 30.00 16.00 133.00

LWP 0.00 0.00 0.00 0.00 0.00 0.00

Arrears Days 0.00 0.00 0.00 0.00 0.00 0.00

Basic Salary 19223.00 22920.00 22920.00 22920.00 11830.00 99,813.00

House Rent 7689.00 9168.00 9168.00 9168.00 4732.00 39,925.00

Allowance

Special Allowance 9095.00 10844.00 10844.00 10844.00 5597.00 47,224.00

Gross Earnings 36007.00 42932.00 42932.00 42932.00 22159.00 186,962.00

Professional Tax 200.00 200.00 200.00 200.00 200.00 1,000.00

Provident Fund 1800.00 1800.00 1800.00 1800.00 1420.00 8,620.00

Total Deductions 2000.00 2000.00 2000.00 2000.00 1620.00 9,620.00

Net Salary 34007.00 40932.00 40932.00 40932.00 20539.00 177,342.00

Disclaimer : Figure reflecting against Unpaid Salary in above cumulative data should be

subtracted from the Gross salary earned while matching earnings in Tax Computation.

This is a computer generated statement and hence no signature is required.

Page 2

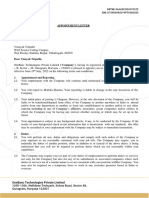

Employee Name : Tejaswini Ranjan Employee Code : AT01228

Financial Year:2018-2019 Assesment Year: 2019-2020

INCOME TAX COMPUTATION

Sl. Description Amount in(Rs) Investment details eligible under Amount in(Rs)

no. 80C

Salary Components(Breakup) PF & VPF & Prev Emplr PF 18,993.00

Basic Salary 99,813.00 Pension Schemes (80 CCC) 0.00

House Rent Allowance 39,925.00 LIC Premium 0.00

Special Allowance 47,224.00 PPF 0.00

Perquisite Breakup Post Office Savings Schemes 0.00

Previous employer income 92,680.00 NSC 0.00

A Gross salary 279,642.00 NSC Accrued Interest 0.00

B Exemptions u/s Section 10 ULIP 0.00

HRA Exemption 27,934.00 Retirement Benefit Plan 0.00

Total exemptions Section 10 (Total 27,934.00 Equity Linked Plan 0.00

B) Home Loan Acc. Scheme 0.00

C Other Income 0.00 Housing Loan Principal 0.00

D1 Profession tax 1,000.00 Stamp Duty 0.00

D2 Profession tax previous employer 0.00 Tuition fees 0.00

D Total Profession tax(Subject to 1,000.00 Infrastructure Bonds 0.00

max. 2500)

Fixed Deposits 0.00

E Standard Deduction 40,000.00

National Pension Scheme 0.00

F Interest on Housing Loan 0.00

National Pension Scheme - Employee 0.00

G Gross taxable income (A - B + 210,708.00 Through Salary

C - D - E - F) Sukanya Samriddhi Account Scheme 0.00

Deductions under Chapter VI A National Savings Scheme 0.00

Section 80 C 18,993.00 Pradhan Mantri Suraksha Bima Yojana 0.00

NPS 80CCD1(B) Employee 0.00

Total investments for section 80C 18993.00

H Total 18,993.00 (restricted without NPS to 1.5 lakh &

I Net taxable income (G-H) 191,720.00 with NPS 2.0 lakh)

J Tax on total income 0.00 HRA Details

K Rebate Sec 87A 0.00 Month HRARec RentPai RentPaidL Basic_4050 HraExempt

L Tax on Total Income after Rebate 0.00 d d essBasic

Sec 87A AUG 7689 8000 6078 7689 6078

M Surcharge 0.00 SEP 9168 8000 5708 9168 5708

N Education cess 0.00 OCT 9168 8000 5708 9168 5708

O Total tax payable (L+M+N) 0.00 NOV 9168 8000 5708 9168 5708

P Tax deducted till Current Month 0.00 DEC 4732 8000 6817 4732 4732

Q TDS previous employer 0.00

R Balance tax payable (O-P-Q) 0.00

S Monthly payable tax 0.00

This is a computer generated statement and hence no signature is required.

Page 3

You might also like

- Subject: Merit Increase: Emp Code: 901105 Name: Ashish Kumar Singh Designation: Officer Department: ProductionDocument4 pagesSubject: Merit Increase: Emp Code: 901105 Name: Ashish Kumar Singh Designation: Officer Department: ProductionAshish SinghNo ratings yet

- Deepak Giri Sai Kumar - Offer LetterDocument5 pagesDeepak Giri Sai Kumar - Offer Lettersaikumar009.mallaNo ratings yet

- AppointmentLetter 751197Document3 pagesAppointmentLetter 751197Ankit A DesaiNo ratings yet

- Mohan A PDFDocument3 pagesMohan A PDFARK ArbaazNo ratings yet

- Form 16 TDS CertificateDocument9 pagesForm 16 TDS CertificateAmit GautamNo ratings yet

- Offer Letter - Siddhartha Sharma (Signed)Document8 pagesOffer Letter - Siddhartha Sharma (Signed)SiddharthNo ratings yet

- VIRCHOW Petrochemical Pay SlipsDocument5 pagesVIRCHOW Petrochemical Pay SlipsraajiNo ratings yet

- Pay Slip For The Month of January 2018: Earnings Deductons ReimbursementsDocument1 pagePay Slip For The Month of January 2018: Earnings Deductons ReimbursementsBHAUSAHEB KOKANENo ratings yet

- Print Udyam Registration CertificateDocument1 pagePrint Udyam Registration CertificatedevjitNo ratings yet

- LOAOfficer Sales1670321389659Document4 pagesLOAOfficer Sales1670321389659Pradeep MishraNo ratings yet

- Unit Holder Previleges: Account Statement 3012950203 Folio NumberDocument2 pagesUnit Holder Previleges: Account Statement 3012950203 Folio Numberanand mishraNo ratings yet

- FUPVNO1894 Arman Khan's Digital Appointment Letter - PVR PDFDocument5 pagesFUPVNO1894 Arman Khan's Digital Appointment Letter - PVR PDFdilipkhanaman1980No ratings yet

- PDFDocument6 pagesPDFAjit RaoNo ratings yet

- Vinayak Tripathi APLDocument19 pagesVinayak Tripathi APLManan GuptaNo ratings yet

- InnovDocument11 pagesInnovJawed AmanNo ratings yet

- Form No. 16: Part ADocument6 pagesForm No. 16: Part AVinaya ChennadiNo ratings yet

- Dated: 05-January-2023Document5 pagesDated: 05-January-2023Vitthal TapashiNo ratings yet

- Private and Confidential: CIN: L3007KA1992PLC025294Document11 pagesPrivate and Confidential: CIN: L3007KA1992PLC025294devashish sinhaNo ratings yet

- 7Document1 page7solankivijayv8No ratings yet

- UpgardDocument4 pagesUpgardTraining & PlacementsNo ratings yet

- CertificateDocument1 pageCertificateAjay Dada GaykarNo ratings yet

- Manish Kumar - Appointment LetterDocument4 pagesManish Kumar - Appointment Letterak4784449No ratings yet

- Fixed Term Contract OfferDocument8 pagesFixed Term Contract OfferMohsin DesaiNo ratings yet

- DEVARAJ RAMESH India Offer Letter 11-03-2022 210108Document4 pagesDEVARAJ RAMESH India Offer Letter 11-03-2022 210108Darwin RdNo ratings yet

- DeepikaDocument3 pagesDeepikatashiNo ratings yet

- Bangalore, Karnataka, India - Tel: +91 - E-Mail: Info@ - Web: WWWDocument1 pageBangalore, Karnataka, India - Tel: +91 - E-Mail: Info@ - Web: WWWVenu PalabandlaNo ratings yet

- March 2019 Payslip for Vijay RahiDocument1 pageMarch 2019 Payslip for Vijay RahiVijay RahiNo ratings yet

- Sum A 1589Document1 pageSum A 1589Suma KishoreNo ratings yet

- Offer Letter - Noor Basha.sDocument7 pagesOffer Letter - Noor Basha.sVenkatesh RoyalNo ratings yet

- Appointment Letter - C1681 - Sahil Shah - 28 Dec - EncryptedDocument11 pagesAppointment Letter - C1681 - Sahil Shah - 28 Dec - EncrypteditsmesahilshahhNo ratings yet

- Pay Slip SeptemberDocument1 pagePay Slip SeptemberboomiNo ratings yet

- Sr Process Associate JaipurDocument3 pagesSr Process Associate JaipurPiyush chandnaNo ratings yet

- Amruthyunjaya Hruser 4 1670936962502Document7 pagesAmruthyunjaya Hruser 4 1670936962502Anusha RampalliNo ratings yet

- Id CardDocument1 pageId Cardsiddhesh nagarkarNo ratings yet

- AugustDocument1 pageAugustNikhil DubeyNo ratings yet

- Technical Support Executive Appointment LetterDocument4 pagesTechnical Support Executive Appointment LetterArvind SinghaniyaNo ratings yet

- CombinepdfDocument16 pagesCombinepdfAtharva RaoNo ratings yet

- 2982 Ritesh Kumar ShahDocument6 pages2982 Ritesh Kumar ShahBoishal Bikash BaruahNo ratings yet

- Appointment Letter Mohammed AmeenDocument7 pagesAppointment Letter Mohammed AmeenKhan ShamsNo ratings yet

- ConsolidatedMarksheet R210823018492Document1 pageConsolidatedMarksheet R210823018492Ritik VermaNo ratings yet

- Abrpb4480f Partb 2020-21Document3 pagesAbrpb4480f Partb 2020-21Subray N BanaulikarNo ratings yet

- To Whom It May Concern: ST THDocument1 pageTo Whom It May Concern: ST THHarold BramlettNo ratings yet

- AAJCP8274HDocument1 pageAAJCP8274HSamNo ratings yet

- Salary slips Murali Mohan 2021Document3 pagesSalary slips Murali Mohan 2021Digi CreditNo ratings yet

- AccentureDocument1 pageAccenturesdrfNo ratings yet

- FORM 16 CERTIFICATEDocument3 pagesFORM 16 CERTIFICATEDebesh KuanrNo ratings yet

- Statement of Axis Account No:912010049541859 For The Period (From: 01-05-2022 To: 23-05-2022)Document4 pagesStatement of Axis Account No:912010049541859 For The Period (From: 01-05-2022 To: 23-05-2022)Rahul BansalNo ratings yet

- PDF 691846850250723Document1 pagePDF 691846850250723Anish MishraNo ratings yet

- Suhail Saifi-Offer Letter PDFDocument2 pagesSuhail Saifi-Offer Letter PDFSuhail SaifiNo ratings yet

- Anna University, Chennai - 25: Semester Fee Receipt (Dec'19 - May'20)Document1 pageAnna University, Chennai - 25: Semester Fee Receipt (Dec'19 - May'20)mani maranNo ratings yet

- Offer Letter - Lakshit ChauhanDocument2 pagesOffer Letter - Lakshit ChauhanGLOCYBS SECURITYNo ratings yet

- 1570887760215QG4eUPRWdF9SzCAv PDFDocument2 pages1570887760215QG4eUPRWdF9SzCAv PDFKarishma YadavNo ratings yet

- Pay Slip - Jan 2017Document1 pagePay Slip - Jan 2017Nagarjuna MuthineniNo ratings yet

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro LimitedPrantik PramanikNo ratings yet

- Cognizant offer letter for Patan ArbazDocument9 pagesCognizant offer letter for Patan Arbazeidpics 2022No ratings yet

- MeharwanDocument1 pageMeharwanSteve BurnsNo ratings yet

- Payslip 4 2021Document1 pagePayslip 4 2021Mehraj PashaNo ratings yet

- Account StatementDocument12 pagesAccount StatementRamanjulNo ratings yet

- FORM 16 TAX DEDUCTION CERTIFICATEDocument2 pagesFORM 16 TAX DEDUCTION CERTIFICATEpiyushkumar patelNo ratings yet

- CRM Services India Private Limited: Full and Final Settlement - December 2022Document3 pagesCRM Services India Private Limited: Full and Final Settlement - December 2022Harshit jaimanNo ratings yet

- Southern District of West Virginia Local RulesDocument95 pagesSouthern District of West Virginia Local Rulesतेजस्विनी रंजनNo ratings yet

- Northern District of Illinois Local Rules PDFDocument198 pagesNorthern District of Illinois Local Rules PDFतेजस्विनी रंजनNo ratings yet

- LA-11 (Consumer Protection Act)Document16 pagesLA-11 (Consumer Protection Act)Maahi ChoudharyNo ratings yet

- Budget 3Document11 pagesBudget 3तेजस्विनी रंजनNo ratings yet

- 888Document2 pages888तेजस्विनी रंजनNo ratings yet

- 888Document2 pages888तेजस्विनी रंजनNo ratings yet

- Environmental Law & Governance in IndiaDocument12 pagesEnvironmental Law & Governance in Indiaतेजस्विनी रंजनNo ratings yet

- Centre-State fiscal relations in 12th-13th UFCDocument8 pagesCentre-State fiscal relations in 12th-13th UFCतेजस्विनी रंजनNo ratings yet

- ADR ProjectDocument42 pagesADR Projectतेजस्विनी रंजनNo ratings yet

- Zay Ka PremiumDocument7 pagesZay Ka Premiumतेजस्विनी रंजनNo ratings yet

- Autonomy in Social and Political ContextDocument9 pagesAutonomy in Social and Political Contextतेजस्विनी रंजनNo ratings yet

- Young Professionals Programme For Legal EmpowermentDocument4 pagesYoung Professionals Programme For Legal EmpowermentArjun KapoorNo ratings yet

- ReportDocument5 pagesReportतेजस्विनी रंजनNo ratings yet

- Financial Relations Between Centre and State in The Light of ConstitutionDocument11 pagesFinancial Relations Between Centre and State in The Light of Constitutionतेजस्विनी रंजनNo ratings yet

- Arena Da AmazôniaDocument1 pageArena Da Amazôniaतेजस्विनी रंजनNo ratings yet

- Violence Against Women: A Global Human Rights CrisisDocument2 pagesViolence Against Women: A Global Human Rights Crisisतेजस्विनी रंजनNo ratings yet

- Abstract LGBTDocument1 pageAbstract LGBTतेजस्विनी रंजनNo ratings yet

- Atm Frauds in IndiaDocument5 pagesAtm Frauds in Indiaतेजस्विनी रंजनNo ratings yet

- Subtheme: Social Development and Social Change Title of The Paper: Mnrega and The Changing Plight of Rural WomenDocument5 pagesSubtheme: Social Development and Social Change Title of The Paper: Mnrega and The Changing Plight of Rural Womenतेजस्विनी रंजनNo ratings yet

- Abstract BurdwanDocument1 pageAbstract Burdwanतेजस्विनी रंजनNo ratings yet

- Australia KitDocument1 pageAustralia Kitतेजस्विनी रंजनNo ratings yet

- Call UtkalDocument1 pageCall Utkalतेजस्विनी रंजनNo ratings yet

- 1 BALLB Student, CNLU, PatnaDocument1 page1 BALLB Student, CNLU, Patnaतेजस्विनी रंजनNo ratings yet

- To Whomsoever It May ConcernDocument1 pageTo Whomsoever It May Concernतेजस्विनी रंजनNo ratings yet

- Copyright 1Document10 pagesCopyright 1तेजस्विनी रंजनNo ratings yet

- Title of The Paper: Comparing Women in West Africa and India: The Political Mirror - Tejaswini RanjanDocument1 pageTitle of The Paper: Comparing Women in West Africa and India: The Political Mirror - Tejaswini Ranjanतेजस्विनी रंजनNo ratings yet

- Call For LIPS: Probation Period: 2 Months Tasks Assigned: 1. Providing EventsDocument1 pageCall For LIPS: Probation Period: 2 Months Tasks Assigned: 1. Providing Eventsतेजस्विनी रंजनNo ratings yet

- Case Law On Sting Operations: 1. Court On Its Own Motion V StateDocument5 pagesCase Law On Sting Operations: 1. Court On Its Own Motion V StatestudydatadownloadNo ratings yet

- BelgiumDocument1 pageBelgiumतेजस्विनी रंजनNo ratings yet

- Government Schemes Marathon - FinalDocument82 pagesGovernment Schemes Marathon - FinalabhishekNo ratings yet

- Monthly Current Wallah - NovemberDocument137 pagesMonthly Current Wallah - Novembergowrishankar nayanaNo ratings yet

- Daily Current Affairs Quiz 31st August PDF DownloadDocument14 pagesDaily Current Affairs Quiz 31st August PDF Downloadshukla dhavalNo ratings yet

- IBM Offer Letter - P. JayachandraDocument17 pagesIBM Offer Letter - P. JayachandraGuru PrasadNo ratings yet

- National Pension System One Pager V2Document2 pagesNational Pension System One Pager V2ramboNo ratings yet

- Income Tax Proof Guidelines FY. 2023-24.cleanedDocument11 pagesIncome Tax Proof Guidelines FY. 2023-24.cleanedGaurav SharmaNo ratings yet

- National Pension System (NPS) : Form 101-GSDocument10 pagesNational Pension System (NPS) : Form 101-GSSREERAMULU MADINE0% (1)

- Current Affairs of November 2017: National Events and AwardsDocument7 pagesCurrent Affairs of November 2017: National Events and AwardsDr-Jhonson SurgeonNo ratings yet

- Ibps Clerk 2022 MainsDocument55 pagesIbps Clerk 2022 MainsVIJAY JaiswalNo ratings yet

- Om 28323Document4 pagesOm 28323शुभांगी क्षिरसागर पवारNo ratings yet

- IPSF Submission Process Online 2018-19 PDFDocument69 pagesIPSF Submission Process Online 2018-19 PDFChanakya GorlaNo ratings yet

- Information SheetDocument5 pagesInformation SheetShrishNo ratings yet

- Admin 16-06-2021 301 PDFDocument6 pagesAdmin 16-06-2021 301 PDFRajendra Nath MitraNo ratings yet

- Unit 2 & 3 1) What Is Risk and Return?Document23 pagesUnit 2 & 3 1) What Is Risk and Return?RajeswariNo ratings yet

- Bose Tax 2024Document2 pagesBose Tax 2024placementcell Govt ITI AttingalNo ratings yet

- Pension Circular Compendium PDFDocument187 pagesPension Circular Compendium PDFsantoshkumarNo ratings yet

- Smart Annuity Plus - SBI Life's Annuity Plan for NPS SubscribersDocument3 pagesSmart Annuity Plus - SBI Life's Annuity Plan for NPS SubscribersMangal SinghNo ratings yet

- AMJITHDocument2 pagesAMJITHplacementcell Govt ITI AttingalNo ratings yet

- New NPS Application Form Annexure I (English)Document2 pagesNew NPS Application Form Annexure I (English)Vaibhav KapseNo ratings yet

- Notice of Arbitration and Statement of Claim ENGDocument54 pagesNotice of Arbitration and Statement of Claim ENGAbhishek SharmaNo ratings yet

- Rbi Grade B 2020: Discussion On Government Schemes Through Mcqs - IDocument25 pagesRbi Grade B 2020: Discussion On Government Schemes Through Mcqs - ITarun GargNo ratings yet

- Summer Internship Report On Sbi Life InsuranceDocument26 pagesSummer Internship Report On Sbi Life Insurancesalmy bhattNo ratings yet

- State of State Finances 2022-23Document35 pagesState of State Finances 2022-23sushilNo ratings yet

- TAX COMPUTATION FOR 2017-18Document1 pageTAX COMPUTATION FOR 2017-18Ravi KumarNo ratings yet

- SSS - Employee - Investment - Declaration - Form12BB - FY 2022-23Document10 pagesSSS - Employee - Investment - Declaration - Form12BB - FY 2022-23gowtham DevNo ratings yet

- Mcqs On Basic Concept of Income Tax, Residential Status & Exempt IncomeDocument6 pagesMcqs On Basic Concept of Income Tax, Residential Status & Exempt IncomePradeep SethyNo ratings yet

- Employee full and final settlement detailsDocument3 pagesEmployee full and final settlement detailsतेजस्विनी रंजनNo ratings yet

- National Pension System (Blackbook)Document86 pagesNational Pension System (Blackbook)chirag karara100% (2)

- NPS Form 102 GPDocument6 pagesNPS Form 102 GPVivek KumarNo ratings yet

- Task - 2: Empty Your Tea Cup: Swot AnalysisDocument7 pagesTask - 2: Empty Your Tea Cup: Swot AnalysisMeghna B RajNo ratings yet