Professional Documents

Culture Documents

Balance Sheet Income Statement

Uploaded by

Kamaljit SinghOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Balance Sheet Income Statement

Uploaded by

Kamaljit SinghCopyright:

Available Formats

The Balance Sheet – Illustrative Accounts

ASSETS LIABILITIES & SHAREHOLDERS’ EQUITY

Cash legally set aside (e.g., Current Assets Cash equivalents are highly Current Liabilities

escrow for self-insurance or liquid, short-term securities Money owed to vendors and

loan repayment) Cash and Cash Equivalents (e.g., 30-day Treasury Bills)

Accounts Payable suppliers

Liquid short-term securities Restricted Cash Accrued Expenses / Accrued Liabilities

Expenses that have occurred

that have a maturity of less but not yet paid for, such as

Short-term Marketable Securities Deferred Revenue Taxes that must be paid to

than a year wages or utilities the government within a year

Accounts Receivable, net Income Tax Payables

Money you expect to receive Revenue that we have The portion of debt that is

from customers (owed less an Financing Receivables received cash for, but cannot Current Portion of Long-term Debt due within 12 months

allowance for nonpayment) be recognized by the

Inventory company because it has not Capital Lease Obligations, current portion

Receivables with payment been earned yet

plans (e.g., store credit cards, Prepaid Expense

Obligations for capital lease

auto manufacturer loans) Taxes owed by various payments due within the

Deferred Tax Assets Non Current Liabilities

government agencies to the next 12 months

Prepayment for items such as Income Tax Receivables company Deferred Revenue, non-current

insurance and rent

Other Current Assets Can include items such as Long-term Debt and Capital Leases

Arises when net income advances to suppliers, A type of hybrid security

recognized for GAAP receivables from employees, Convertible Debt that allows the debtholder to

accounting purposes differs undeposited checks, etc. convert to equity

from net income used for tax Non-Current Assets Other Non-current Liabilities

purposes; can also show up Securities that have a

as a liability Long-term Marketable Securities maturity of more than a year,

Total Liabilities Could include items such as

including equities, that the pensions, or financial

Property, Plant and Equipment, net liabilities such as derivatives

PP&E (Gross) less company intends to hold

accumulated depreciation Goodwill Shareholders’ Equity

The value of all common

Other Intangible Assets stock issued at par value Common Stock Excess amount received

Type of an intangible asset

that arises when an acquirer from shareholders over the

pays more than the appraised

Other Assets Takes into account Additional Paid-in Capital par value of the common

unrealized gains or losses on stock

value of identifiable net

items such as securities, Retained Earnings

assets (e.g., inventory, PP&E, Can include

items such as exchange rate derivatives

non-goodwill intangible Other Comprehensive Income / (Loss) Ending Balance Retained

deferred charges, and pension assets

assets, net of liabilities) Earnings = Beginning

Total Assets non-current Noncontrolling Interest Balance Retained Earnings +

receivables, etc. The portion of equity Net Income - Dividends

Could include items such as

ownership in a subsidiary Total Shareholders’ Equity

patents, trademarks,

that is not attributable to the

copyrights, trade secrets,

parent company; also

brand name, customer lists,

referred to as “minority

etc.

interest” Total Liabilities & Shareholders’ Equity

Based on materials provided by O. Even-Tov (UC Berkeley)

The Income Statement – Illustrative Accounts

Also referred to as “Sales”; Could potentially show

up as multiple lines on the income statement (E.g.,

product revenue and service revenue)

Revenue $100,000

Includes the direct cost associated with generating Cost of Sales / Cost of Service / Cost of Goods Sold (50,000)

the revenue (E.g., materials, wages and depreciation

of equipment directly associated with producing the Gross Profit $50,000

good or service)

Research and Development Expense ($5,000)

Any cost that is not directly attributable to

producing the good or service; Sometimes referred General and Administrative Expense ($5,000)

to as “indirect costs” or “overheard”.

Sales and Marketing Expense ($5,000)

Financial income or interest that is non-operating in Total Operating Expenses $15,000

nature (Note: in some industries, such as financial

services, this may be a part of the company’s core

operations so it would show up as revenue)

Operating Income / (loss) $35,000

Other non-operating income or expense (e.g., non- Interest Income / (expense) ($1,000)

operating rent income or gain on PP&E sale)

Other Income / (expense) ($500)

Also known as “provisions for income taxes”; This

number differs from the actual tax paid as it is an Income (loss) Before Income Tax $33,500

estimate and may be different from the final tax bill

(similar to tax withholding)

Income Tax Expense ($13,500)

Net Income / (loss) from Continuing Operations $20,000

Income or loss from a segment of the company’s

business that has been sold, disposed or abandoned Net Income / (loss) from Discontinued Operations $250

Income or loss for a company which is infrequent Extraordinary Income (loss) ($1,000)

and unusual in nature, and is unlikely to recur in the

foreseeable future (e.g., tidal wave in Chicago; Consolidated Net Income $19,250

includes ‘badwill’ – the opposite of goodwill from

acquisition) Less: Consolidated Net Income from non-controlling Interest ($1,250)

Income or loss generated from subsidiaries that is Consolidated Net Income Attributable to Parent Company $18,000

not attributable to the parent company

Also referred to as “Earnings Per Share”. The first Profit Per Common Share $1.80

uses “basic shares outstanding” as the denominator

whereas the latter uses “fully diluted shares Profit Per Common Share – Diluted $1.75

outstanding”, which includes the effects of RSUs,

options, etc.

You might also like

- Toast Profit Loss Statement Template 2022Document24 pagesToast Profit Loss Statement Template 2022Krishna SharmaNo ratings yet

- Calculations in The Catering Industry: 8065-02 Unit 219: Catering Operations, Costs and Menu PlanningDocument12 pagesCalculations in The Catering Industry: 8065-02 Unit 219: Catering Operations, Costs and Menu PlanningSZA100% (1)

- Presupuesto FamiliarbDocument10 pagesPresupuesto FamiliarbmmauryfgNo ratings yet

- Establishing Sales TargetDocument10 pagesEstablishing Sales TargetErich VirayNo ratings yet

- ADG Staffing Matrix As at 13-6-11 FINALDocument44 pagesADG Staffing Matrix As at 13-6-11 FINALAnanda ZoelfaNo ratings yet

- Cookery & Bakery: Ruwan Ranasinghe, BSC, MbaDocument61 pagesCookery & Bakery: Ruwan Ranasinghe, BSC, MbaCHATURIKA priyadarshaniNo ratings yet

- Excel 3 TestDocument3 pagesExcel 3 Testapi-233183465No ratings yet

- Employee Schedule1Document4 pagesEmployee Schedule1Faishal KalbuadiNo ratings yet

- Justification of Canteen SubsidyDocument2 pagesJustification of Canteen SubsidyGaurav Vij Asstt. Manager - H.RNo ratings yet

- Food Courts Food Malls Banquet Halls Set Up ConsultancyDocument28 pagesFood Courts Food Malls Banquet Halls Set Up ConsultancymohamadNo ratings yet

- Basic and Common Competencies ExamDocument2 pagesBasic and Common Competencies ExamNoreen Cañaveral NochefrancaNo ratings yet

- Restaurant Rating QuestionsDocument4 pagesRestaurant Rating QuestionsshehzadaminNo ratings yet

- Rev MNGTDocument63 pagesRev MNGTKiran MayiNo ratings yet

- Prof. V. B. Shah Institute of ManagementDocument69 pagesProf. V. B. Shah Institute of ManagementFaidz FuadNo ratings yet

- Food Storing and Issuing Control: Principles of Food, Beverage, and Labour Cost Controls, Canadian EditionDocument26 pagesFood Storing and Issuing Control: Principles of Food, Beverage, and Labour Cost Controls, Canadian Editionnur sharmira mohamdNo ratings yet

- Understanding Financial Statements and Financial RatiosDocument5 pagesUnderstanding Financial Statements and Financial RatiosJana Rose PaladaNo ratings yet

- Cookery 161121024647 PDFDocument150 pagesCookery 161121024647 PDFArlette Cargullo MolinaNo ratings yet

- Waste Managment NKA UPES Mar 2-2k11Document64 pagesWaste Managment NKA UPES Mar 2-2k11Nk AgarwalNo ratings yet

- Mapping of Cookery SkillsDocument2 pagesMapping of Cookery Skillszoltan2014No ratings yet

- PortfolioDocument49 pagesPortfolioapi-373140726No ratings yet

- FC & VCDocument25 pagesFC & VCAdanbungaran PangribNo ratings yet

- Soezzy'S Catering Planner V 3.06Document8 pagesSoezzy'S Catering Planner V 3.06José Manuel VazNo ratings yet

- Kitchen Equipment SelectionDocument21 pagesKitchen Equipment Selectioncucucucucu72No ratings yet

- Daily LogDocument1 pageDaily LogTarun MaudgalyaNo ratings yet

- F and B NC II Core - Unit 1Document28 pagesF and B NC II Core - Unit 1Jaybert GamayonNo ratings yet

- 6 7 Basic Kitchen Opening and Closing Checks TemplateDocument2 pages6 7 Basic Kitchen Opening and Closing Checks TemplatedonexcelNo ratings yet

- Meat and PoultryDocument34 pagesMeat and PoultryEben BudiantoNo ratings yet

- Sake Inventory and Cost - 16 Feb '15Document2 pagesSake Inventory and Cost - 16 Feb '15Tom TommyNo ratings yet

- Model Balance Sheet Word TemplateDocument2 pagesModel Balance Sheet Word TemplateHina JeeNo ratings yet

- Comply With Workplace Hygiene Procedures: Unit Code: D1.HRS - CL1.05 D1.HOT - CL1.04 D2.TTO - CL4.10Document187 pagesComply With Workplace Hygiene Procedures: Unit Code: D1.HRS - CL1.05 D1.HOT - CL1.04 D2.TTO - CL4.10irneil H. PepitoNo ratings yet

- SP Session1Document72 pagesSP Session1Abood Abood100% (1)

- Sequences of SpielsDocument5 pagesSequences of SpielsRoy AmoresNo ratings yet

- Service Standard Training PlanDocument9 pagesService Standard Training PlanQuy TranxuanNo ratings yet

- Hotel MuseFood Safety Monitoring Record Version 1Document13 pagesHotel MuseFood Safety Monitoring Record Version 1Aditya SharmaNo ratings yet

- Clean and Tidy Beverage and Food Service Areas HPR 3-12 SPDocument7 pagesClean and Tidy Beverage and Food Service Areas HPR 3-12 SPTiara Niken A100% (1)

- 337 Hotel Management & CateringDocument175 pages337 Hotel Management & CateringThusith WijayawardenaNo ratings yet

- Ch.5 - Inventory and COGS - MHDocument61 pagesCh.5 - Inventory and COGS - MHSamZhaoNo ratings yet

- Restaurant Cleaning Checklist: Week in Use: InitialsDocument3 pagesRestaurant Cleaning Checklist: Week in Use: InitialsSampalau AnglerNo ratings yet

- CostControls BarArtsDocument12 pagesCostControls BarArtsHuu Thanh TranNo ratings yet

- 15 Utensils and 5 Equipments: Anggota Kelompok: Yohana Riri Dian Hery BOYDocument21 pages15 Utensils and 5 Equipments: Anggota Kelompok: Yohana Riri Dian Hery BOYNadzwaaNo ratings yet

- Financial Analysis Cheat Sheet: by ViaDocument2 pagesFinancial Analysis Cheat Sheet: by Viaheehan6No ratings yet

- Hotel Management & Catering Technology SyllabusDocument81 pagesHotel Management & Catering Technology SyllabusYelesh LanjewarNo ratings yet

- Barmanagementpartone 220328155613Document257 pagesBarmanagementpartone 220328155613yudhiNo ratings yet

- Menu Pricing Menu PricingDocument44 pagesMenu Pricing Menu PricingEduardo GrandeNo ratings yet

- Restaurant ManualDocument38 pagesRestaurant Manualmaria ysareli jaimes rodriguezNo ratings yet

- Hospitality Hub Recipe Costing SheetDocument12 pagesHospitality Hub Recipe Costing SheetAntonio Salazar GutierrezNo ratings yet

- BHM 402T PDFDocument120 pagesBHM 402T PDFKamlesh HarbolaNo ratings yet

- Recipe Costing Form - Vegan Banana Bread - in Class Starting Point - Partially CompletedDocument1 pageRecipe Costing Form - Vegan Banana Bread - in Class Starting Point - Partially Completedapi-529979796No ratings yet

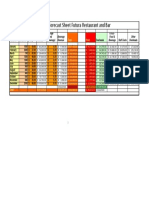

- Budget Forecast Sheet Futura Restaurant and BarDocument1 pageBudget Forecast Sheet Futura Restaurant and BarRaviNo ratings yet

- Ratio Analysis of The Balance Sheet: Accounting For Hospitality Managers Fifth Edition (362TXT or 362CIN)Document13 pagesRatio Analysis of The Balance Sheet: Accounting For Hospitality Managers Fifth Edition (362TXT or 362CIN)grishma jadavNo ratings yet

- M&M ThaneDocument808 pagesM&M ThanegadmaleNo ratings yet

- Food and Beverage ManagementDocument138 pagesFood and Beverage ManagementCaleb MukaviNo ratings yet

- Chapter 05 The Flow of Food An IntroductionDocument12 pagesChapter 05 The Flow of Food An Introductiondajonaef89No ratings yet

- BHM 232 Food and Beverage Operations 4Document6 pagesBHM 232 Food and Beverage Operations 4Pankaj PathaniaNo ratings yet

- Chapter 10 - Managing Food HygieneDocument38 pagesChapter 10 - Managing Food Hygienenaa znlNo ratings yet

- Forty Thieves of Food Cost An Updated Version v2Document4 pagesForty Thieves of Food Cost An Updated Version v2pogasNo ratings yet

- Free Training For Full Tools of F&B ManagementDocument48 pagesFree Training For Full Tools of F&B ManagementSPHM HospitalityNo ratings yet

- F&B Project - Tina TahilyaniDocument26 pagesF&B Project - Tina TahilyaniTina Tahilyani�No ratings yet

- HT2 CoCU 2 Cooking TechniqueDocument10 pagesHT2 CoCU 2 Cooking TechniqueNama Saya Suhail HadriNo ratings yet

- Balance Sheet Component Matching Solution: Account DescriptionDocument3 pagesBalance Sheet Component Matching Solution: Account Descriptionnishant jindalNo ratings yet

- Ent600 - Blueprint - Guidelines & TemplateDocument16 pagesEnt600 - Blueprint - Guidelines & TemplateSOFIA EIZZATUL EILLYANA ZAMBAHARINo ratings yet

- SM Garrison MGR Acc 13e Ch16Document49 pagesSM Garrison MGR Acc 13e Ch16YuliArdiansyahNo ratings yet

- Business Plan: Mobile RestaurantDocument29 pagesBusiness Plan: Mobile RestaurantVytautas VasiliauskasNo ratings yet

- 1049 IndAS Notes by CA Chiranjeev Jain PDFDocument28 pages1049 IndAS Notes by CA Chiranjeev Jain PDFMaya ChaudharyNo ratings yet

- Financial Accounting: Accounting For Merchandise OperationsDocument84 pagesFinancial Accounting: Accounting For Merchandise OperationsAnnie DuolingoNo ratings yet

- Monopoly Profit MaximizationDocument29 pagesMonopoly Profit MaximizationArmanNo ratings yet

- Pre-Test Entreprenuership Grade-12 Choose The Best AnswerDocument5 pagesPre-Test Entreprenuership Grade-12 Choose The Best AnswerMark Gil GuillermoNo ratings yet

- Eportfolio AssignmentDocument12 pagesEportfolio Assignmentapi-300872702No ratings yet

- WatatapsDocument29 pagesWatatapsjessa mae zerdaNo ratings yet

- Implementing Strategies: Marketing, Finance/Accounting, R&D, & MIS IssuesDocument18 pagesImplementing Strategies: Marketing, Finance/Accounting, R&D, & MIS IssuesIcuwootNo ratings yet

- Mid Term Exam FIN 3-Aug 2013Document20 pagesMid Term Exam FIN 3-Aug 2013monzkymine57% (7)

- Chapter 14Document38 pagesChapter 14Carmelie CumigadNo ratings yet

- Specific Financial Reporting Questions & Answers: Suggested Solution 1Document37 pagesSpecific Financial Reporting Questions & Answers: Suggested Solution 1Tawanda Tatenda Herbert100% (2)

- 21 Financial Assets at Fair Value: Solution 21-1 Answer CDocument30 pages21 Financial Assets at Fair Value: Solution 21-1 Answer CLayNo ratings yet

- 6.income Statement and Related InformationDocument45 pages6.income Statement and Related InformationShajidur RashidNo ratings yet

- Item 1days Expenses (RM) Other Expenses (RM) : Administrative BudgetDocument4 pagesItem 1days Expenses (RM) Other Expenses (RM) : Administrative Budgetmohd_mddNo ratings yet

- Latihan Jurnal PenyesuaianDocument5 pagesLatihan Jurnal Penyesuaiangabriel berwulo100% (1)

- Entrepreneurship ManagementDocument18 pagesEntrepreneurship Managementcandy lollipoNo ratings yet

- Most Common Finance Interview QuestionsDocument20 pagesMost Common Finance Interview QuestionsAyushiNo ratings yet

- CHAPTER 2 Review of Financial Statement Preparation, Analysis, and InterpretationDocument6 pagesCHAPTER 2 Review of Financial Statement Preparation, Analysis, and InterpretationCatherine Rivera100% (3)

- Fabm 121.week 6-10 ModuleDocument22 pagesFabm 121.week 6-10 Modulekhaizer matias100% (1)

- Chapter 08, Modern Advanced Accounting-Review Q & ExrDocument36 pagesChapter 08, Modern Advanced Accounting-Review Q & Exrrlg4814100% (5)

- Project On HondaDocument68 pagesProject On HondaPraveen Kumar Hc50% (2)

- Feasibility StudyDocument46 pagesFeasibility StudyAcsecnarf AbarueNo ratings yet

- Cash Flow Excercise Questions-Set-2Document2 pagesCash Flow Excercise Questions-Set-2AgANo ratings yet

- Financial Planning and ControlDocument10 pagesFinancial Planning and ControlMoona AwanNo ratings yet

- Employees Benefit PalnDocument60 pagesEmployees Benefit PalnHimanshu GaurNo ratings yet

- Khurasan University Faculty of Economics (BBA) : Cost AccountingDocument47 pagesKhurasan University Faculty of Economics (BBA) : Cost AccountingTalaqa Sam Sha100% (2)

- Boston Beer Company Case ExhibitsDocument2 pagesBoston Beer Company Case ExhibitsDavidNo ratings yet

- Worksheet Data For Savaglia Company Are Presented Below. The Owner Did Not Make Any Additional Investments in The Business in April.Document6 pagesWorksheet Data For Savaglia Company Are Presented Below. The Owner Did Not Make Any Additional Investments in The Business in April.Risky FernandoNo ratings yet