Professional Documents

Culture Documents

"Financial Accounting": An Assignment of The Subject

Uploaded by

Bushra SaleemOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

"Financial Accounting": An Assignment of The Subject

Uploaded by

Bushra SaleemCopyright:

Available Formats

An Assignment of the Subject

"Financial Accounting"

Submitted By:

Bushra Saleem

Roll Number:

mc180401455

Submitted To:

Sir Mujahid Eshai

Submission Date:

20Nov, 2018

VIRTUAL UNIVERSITY (BIIT CHICHAWATNI)

Requirements:

1 - Prepare the trial balance as on 31st January,2018

Answer:

Prince Brother

Trail Balance

As on January 31,2018

S. No. Account Names Account Debit Credit

Code No. Rs. Rs.

1 Cash in hand 1 8,78,000

2 Capital account 2 1,000,000

3 Furniture account 3 90,000

4 Purchase account 4 30,000

5 Sales account 5 40,000

6 Selling expense account 6 10,000

7 Admin expense account 7 17,000

8 Drawing account 8 15,000

Total 1,040,000 1,040,000

2- Calculate the Gross Profit.

we know that:

Sales - cost of goods sold = Gross Profit

so,

Sales 40,000

(less) COGS:

Purchases 30,000

(30,000)

Gross Profit 10,000

Req 3- calculate total Asset as on 31st January,2018

As we know that:

Assets = Capital+ Liabilities

So, first we are going to make income statement to see the profit or loss then we will add or

subtract profit or loss in the balance sheet

Prince Brothers

INCOME STATEMENT

As on January 31,2018

Sales 40,000

Cost Of Goods Sold:

Purchases 30,000

(30,000)

Gross profit 10,000

Expenses:

Selling Expense 10,000

Administration Expense 17,000 (27,000)

Net Loss (17000)

Prince Brothers

Balance Sheet

As on January 31st, 2018

Assets Capital + liabilities

Current Assets: Liabilities: 0

Cash 878000

Capital: 1,000,000

Fixed Assets: Less: Drawing (15000)

Furniture 90000 Less: Loss (17000) _______

_______ 9,68,000

9,68,000

Total assets: 9,68,000 Total capital. 9,68,000

Accounting Equation:

Assets = Capital + Liabilities

Assets = 9,68,000 + 0

Assets = 9,68,000

Assets = 9,68,000

You might also like

- SOLETRADER ACCOUNTING Handout 2Document4 pagesSOLETRADER ACCOUNTING Handout 2DenishNo ratings yet

- Solution To Worksheet - Modified-2Document25 pagesSolution To Worksheet - Modified-2Mohammed Saber Ibrahim Ramadan ITL World KSANo ratings yet

- Review Quiz Inter1Document9 pagesReview Quiz Inter1Vanessa vnssNo ratings yet

- Classwork HorizontalVertical BusFinDocument3 pagesClasswork HorizontalVertical BusFinSOFIA YASMIN VENTURANo ratings yet

- Classwork HorizontalVertical BusFinDocument3 pagesClasswork HorizontalVertical BusFinSOFIA YASMIN VENTURANo ratings yet

- Accounts Receivable CalculationDocument5 pagesAccounts Receivable CalculationCarmina SanchezNo ratings yet

- 11 To 20Document96 pages11 To 20JorniNo ratings yet

- Fsa Prac Ex PDFDocument3 pagesFsa Prac Ex PDFAngel Alejo AcobaNo ratings yet

- Financial Accounting and Reporting Test Bank 8152017 - 1: Problem 1 - Statement of Financial PositionDocument29 pagesFinancial Accounting and Reporting Test Bank 8152017 - 1: Problem 1 - Statement of Financial PositionBernadette PalermoNo ratings yet

- Manny Company: Required: Compute For The Balances of The Following On December 31, 2X14Document4 pagesManny Company: Required: Compute For The Balances of The Following On December 31, 2X14MauiNo ratings yet

- Latihan Siklus Dagang 1Document26 pagesLatihan Siklus Dagang 1AFIFA SAQIFANo ratings yet

- PPEDocument30 pagesPPEJohn Kenneth AlicawayNo ratings yet

- ACCOUNTING CYCLE FOR MERCHANDISING CONCERNDocument30 pagesACCOUNTING CYCLE FOR MERCHANDISING CONCERNMary100% (2)

- CPALE FAR STATEMENT OF FINANCIAL POSITIONDocument12 pagesCPALE FAR STATEMENT OF FINANCIAL POSITIONEnrique Hills RiveraNo ratings yet

- Installment Sales Preparartion of Financial StatementDocument2 pagesInstallment Sales Preparartion of Financial StatementRiza Mae AlceNo ratings yet

- Preparation of Financial Statements: Total 1,880,000 1,880,000Document2 pagesPreparation of Financial Statements: Total 1,880,000 1,880,000Riza Mae AlceNo ratings yet

- 1 Far Answer KeyDocument25 pages1 Far Answer KeyAngelie0% (1)

- Financial Accounting and Reporting Test BankDocument30 pagesFinancial Accounting and Reporting Test BankMiku Lendio78% (9)

- Mid-term 2017/2018 SolutionsDocument6 pagesMid-term 2017/2018 Solutionsddd huangNo ratings yet

- Acctg4a 02042017 Exam Quiz1aDocument5 pagesAcctg4a 02042017 Exam Quiz1aPatOcampoNo ratings yet

- FAR Test BankDocument24 pagesFAR Test BankMaryjel17No ratings yet

- Cash and AccrualDocument3 pagesCash and Accrual夜晨曦No ratings yet

- ABC Company Current Assets and LiabilitiesDocument9 pagesABC Company Current Assets and LiabilitiesChristine Joy LanabanNo ratings yet

- AsdfaDocument2 pagesAsdfaKevin T. OnaroNo ratings yet

- Case Study 1Document2 pagesCase Study 1ruruNo ratings yet

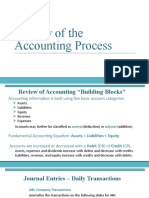

- Review of The Accounting ProcessDocument17 pagesReview of The Accounting ProcessLucy UnNo ratings yet

- 5 6294322980864393322Document10 pages5 6294322980864393322CharlesNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow StatementROHIT SHANo ratings yet

- A. Perpetual Inventory System: Depreciation Expense (Asset Cost - Residual Value) / Useful Life of The AssetDocument6 pagesA. Perpetual Inventory System: Depreciation Expense (Asset Cost - Residual Value) / Useful Life of The Assetismail malikNo ratings yet

- Partnership Formation, Operation, and Changes in OwnershipDocument4 pagesPartnership Formation, Operation, and Changes in OwnershipLoriNo ratings yet

- Answers To Handout 1 Financial AccountingDocument40 pagesAnswers To Handout 1 Financial AccountingMohand ElbakryNo ratings yet

- AC 41 Accounting Essentials PRACTICE DRILL Unit IIIDocument1 pageAC 41 Accounting Essentials PRACTICE DRILL Unit IIIAiahNo ratings yet

- Assignment 2 Acct 201 1 1Document5 pagesAssignment 2 Acct 201 1 1Minyoung ChaNo ratings yet

- FAR Test BankDocument17 pagesFAR Test BankMa. Efrelyn A. BagayNo ratings yet

- Home Depot Balance SheetDocument4 pagesHome Depot Balance SheetNicolas ErnestoNo ratings yet

- Accounting equation transactionsDocument3 pagesAccounting equation transactionsRudsan TurquezaNo ratings yet

- Accountancy Project 2Document9 pagesAccountancy Project 2Jyothika AkulaNo ratings yet

- Practice Questions and Answers: Financial AccountingDocument18 pagesPractice Questions and Answers: Financial AccountingFarah NazNo ratings yet

- SIKLUS PERUSAHAANDocument15 pagesSIKLUS PERUSAHAANRiska GintingNo ratings yet

- Activity 5-Adjusting Entries and Financial StatementsDocument9 pagesActivity 5-Adjusting Entries and Financial StatementsJanica VilladelgadoNo ratings yet

- Tutorial 11 QsDocument3 pagesTutorial 11 QsDylan Rabin PereiraNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Module 3 - SW On MFTG Acctg & CfsDocument2 pagesModule 3 - SW On MFTG Acctg & CfsestebandgonoNo ratings yet

- ABC Co Adjusted Working CapitalDocument2 pagesABC Co Adjusted Working CapitalRio De LeonNo ratings yet

- Lec Merchandising Perpetual PeriodicDocument8 pagesLec Merchandising Perpetual PeriodicAiddan Clark De JesusNo ratings yet

- SolotionsDocument34 pagesSolotionsabdulrahman Abdullah100% (1)

- Chapter 2 - Review On Financial StatementsDocument6 pagesChapter 2 - Review On Financial StatementsLorraine Millama PurayNo ratings yet

- Adjusting EntriesDocument14 pagesAdjusting Entriesmhrzyn27No ratings yet

- FAR Preboard SolutionsDocument4 pagesFAR Preboard SolutionsHikariNo ratings yet

- JulsDocument2 pagesJulsjhon KrizpNo ratings yet

- Problem Ratio 2022Document1 pageProblem Ratio 2022Mohd shariqNo ratings yet

- Gửi SV. POA - CÂU HỎI NGẮN 1Document2 pagesGửi SV. POA - CÂU HỎI NGẮN 1Minh Hạnh NguyễnNo ratings yet

- Exercise Sheet For Financial Accounting - Answer IMBADocument53 pagesExercise Sheet For Financial Accounting - Answer IMBAHager Salah100% (1)

- DocDocument19 pagesDocCj BarrettoNo ratings yet

- Yearly Ledger Changes: AssetsDocument8 pagesYearly Ledger Changes: AssetsMiguel OrjuelaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- (BAFI 1045) T01 & T02 (Investments Setting, Asset Allocation, Professional Portfolio Management, Alternative Assets, & Industry Ethics)Document43 pages(BAFI 1045) T01 & T02 (Investments Setting, Asset Allocation, Professional Portfolio Management, Alternative Assets, & Industry Ethics)Red RingoNo ratings yet

- CH 08Document4 pagesCH 08flrnciairnNo ratings yet

- Payment Terms: Dr. A.K. Sengupta Principal Advisor CED Former Dean, Indian Institute of Foreign TradeDocument14 pagesPayment Terms: Dr. A.K. Sengupta Principal Advisor CED Former Dean, Indian Institute of Foreign TradeimadNo ratings yet

- Capital Budgeting With Illustration and TheoryDocument145 pagesCapital Budgeting With Illustration and Theorymmuneebsda50% (2)

- BSBCOM603 - Task 3Document5 pagesBSBCOM603 - Task 3Ali Butt0% (1)

- European Bancassurance Benchmark 08-01-08Document24 pagesEuropean Bancassurance Benchmark 08-01-08Anita LeeNo ratings yet

- How To Swing TradeDocument270 pagesHow To Swing Tradejegonax73396% (28)

- FEDEX - Stock & Performance Analysis: Group MembersDocument15 pagesFEDEX - Stock & Performance Analysis: Group MembersWebCutPasteNo ratings yet

- Performance Evaluation - Accounting ManagementDocument17 pagesPerformance Evaluation - Accounting ManagementEka DarmadiNo ratings yet

- 02 Task Performance 1Document3 pages02 Task Performance 1Ralph Louise PoncianoNo ratings yet

- CRMO Basic RiskDocument29 pagesCRMO Basic RiskPASCA/51421120226/ARLINGGA K100% (1)

- 052181782XDocument343 pages052181782Xbishalsigdel100% (2)

- SSRN Id923557 PDFDocument11 pagesSSRN Id923557 PDFMuhammad Ali HaiderNo ratings yet

- Prize Bond ScheduleDocument5 pagesPrize Bond Schedulehati1No ratings yet

- NatureviewFarm Group6 SectionADocument10 pagesNatureviewFarm Group6 SectionAChetali HedauNo ratings yet

- MBA IV Class TimetableDocument4 pagesMBA IV Class TimetableSidharth KatyayanNo ratings yet

- Mansa-X KES Fact Sheet Q1 2023Document1 pageMansa-X KES Fact Sheet Q1 2023KevinNo ratings yet

- Fundamental Analyisis of It SectorDocument11 pagesFundamental Analyisis of It SectorKhushboo JariwalaNo ratings yet

- CIB OnlineDocument22 pagesCIB OnlineRejaul KarimNo ratings yet

- Tax Planning With Reference To New Business - NatureDocument26 pagesTax Planning With Reference To New Business - NatureasifanisNo ratings yet

- Nature and Scope of Financial MarketsDocument5 pagesNature and Scope of Financial MarketsSadiq MchNo ratings yet

- 2020 Appraiser's Exam Mock Exam Set GDocument5 pages2020 Appraiser's Exam Mock Exam Set GMarkein Dael VirtudazoNo ratings yet

- Instant Download Ebook PDF Fundamentals of Corporate Finance 5th Canadian Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF Fundamentals of Corporate Finance 5th Canadian Edition PDF Scribdlauryn.corbett387100% (41)

- Should The Builder Finance Construction - The Mortgage ProfessorDocument1 pageShould The Builder Finance Construction - The Mortgage ProfessorJericFuentesNo ratings yet

- Literature Review Wealth ManagementDocument7 pagesLiterature Review Wealth Managementea2pbjqk100% (1)

- Overhead Rate Calculation Instructions. SpreadsheetDocument15 pagesOverhead Rate Calculation Instructions. Spreadsheetanon_366970884No ratings yet

- Strategic Management Concepts & Cases 11th Edition Fred DavidDocument30 pagesStrategic Management Concepts & Cases 11th Edition Fred DavidPavan Rajesh100% (1)

- Applying the Importance Performance Matrix to analyze Singapore's financial clusterDocument29 pagesApplying the Importance Performance Matrix to analyze Singapore's financial clusterAlexNo ratings yet

- Silo PDFDocument3 pagesSilo PDFEko SetiawanNo ratings yet

- Uts Epii 2022Document17 pagesUts Epii 2022Ranessa NurfadillahNo ratings yet