Professional Documents

Culture Documents

Browning Mfmg. Company

Uploaded by

DV VillanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Browning Mfmg. Company

Uploaded by

DV VillanCopyright:

Available Formats

1.

Prepare a projected statement of cost of goods sold for 2006, a projected income statement for

2006, and a projected balance sheet as of December 31, 2006,

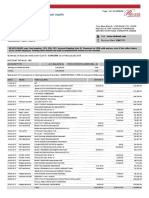

Browning Manufacturing Company

Projected Statement of Cost of Goods Sold

For the period ending December 31, 2006

Finished goods inventory, 1/1/2006 $ 257,040.00

Wook in process inventory, 1/1/2006 $ 172,200.00

Materials Used

Beginning $ 110,520.00

Add: Purchases $ 825,000.00

Less: Ending $ -124,520.00 $ 811,000.00

Plus: Factory Expenses

Direct manufacturing labor $ 492,000.00

Factory Overhead:

Indirect manufacturing labor $ 198,000.00

Power, heat, and light $ 135,600.00

Depreciation of plant $ 140,400.00

Social Security taxes $ 49,200.00

Taxes and insurance, factory $ 52,800.00

Supplies $ 61,200.00 $ 637,200.00

$ 2,112,400.00

Less: Work in process inventory, 12/31/2006 $ -210,448.00

Cost of goods manufactured $ 1,901,952.00

$ 2,158,992.00

Less: Finished goods inventory, 12/31/2006 $ -352,368.00

Cost of goods sold $ 1,806,624.00

Browning Manufacturing Company

Projected Income Statement

For the period ending December 31, 2006

Sales $ 2,562,000.00

Less: Sales returns and allowances $ 19,200.00

Sales discounts allowed $ 49,200.00 $ 68,400.00

Net Sales $ 2,493,600.00

Less: Cost of goods sold (per schedule) $ 1,806,624.00

Gross margin $ 686,976.00

less: Selling and administrative expenses $ 522,000.00

Operating income $ 164,976.00

Less: Interest expense $ 38,400.00

Income before federal and state income tax $ 126,576.00

Less:Estimated income tax expense $ 58,000.00

Net income $ 68,576.00

Browning Manufacturing Company

Projected Balance Sheet

As of December 31, 2006

Assets

Current Assets:

Cash and marketable securities $ 443,640.00

Accounts receivable, net $ 201,360.00

Inventories:

Materials $ 124,520.00

Work in process $ 210,448.00

Finished goods $ 352,368.00

Supplies $ 22,080.00 $ 709,416.00

Prepaid taxes and insurance $ 91,920.00

Total current assets $ 1,446,336.00

Other Assets

Manufacturing plant at cost $ 2,822,400.00

less: Accumulated Depreciation $ 1,047,600.00 $ 1,774,800.00

Total Assets $ 3,221,136.00

Liabilities and Shareholders' Equity

Current liabilities

Accounts Payable $ 288,360.00

Notes Payable $ 552,840.00

Income taxes payable $ 5,800.00

Total current liabilities $ 847,000.00

Shareholders' equity:

Capital stock $ 1,512,000.00

Retained Earnings $ 862,136.00 $ 2,374,136.00

Total Liabilities and Shareholders' Equity $ 3,221,136.00

2. Describe the principal differences between the 2006 estimates and the 2005 figures. In what

respects is 2006 performance expected to be better than 2005 performance, and in what

respects is it expected to be worse?

Better

a. Net Sales was increase to 11.62 %.

b. Gross margin was increase to 3.19%

c. Reduction in the accounts receivable from 311,760.00 to 201,360.00. Management make an

aggressive effort to collect its receivable on time.

Worse

a. Significant increase in selling and administrative expenses up to 19.41%

b. Increase in interest expense to 12.68%

c. Reduction in the income before federal and state income tax to 34.93%.

d. Significant increase in inventory from 557,040.00 to 709,416.00.

3. Does the budget indicate that management will achieve its note payable repayment goal? If not,

what do you suggest they do to achieve their minimum objective?

No. The projected cash balance is not enough if the management wants a year cash balance of 150,000.

The management should properly plan the procurement with regards to its inventory because there is a

huge increase and there investment were mostly tied up there.

4. Does the budget indicate management’s inventory turnover goal will be achieved? If not, what

do you suggest they do to improve the company’s inventory turnover?

No. Increasing the cost of inventory for the period means that it takes a longer days to convert it to cash.

Management should reduce the cost of inventory on hand as much as possible.

5. What does the budget indicate might happen to the company’s trade credit standing?

On the analysis, the company credit standing becomes weak. Due to the huge increase in the

procurement of inventory, the company make increase payables to its suppliers.

You might also like

- Class Case 2 - Browning Manufacturing CompanyDocument5 pagesClass Case 2 - Browning Manufacturing Company9ry5gsghybNo ratings yet

- Browning Manufacturing CaseDocument6 pagesBrowning Manufacturing CaseChleo EsperaNo ratings yet

- Browning Manufacturing Company Budget AnalysisDocument10 pagesBrowning Manufacturing Company Budget Analysisabigail franciscoNo ratings yet

- Week 13 - SoalDocument3 pagesWeek 13 - SoalHeidi ParamitaNo ratings yet

- Chapter 23 Statement of Cash Flows Multiple Choice With SolutionsDocument10 pagesChapter 23 Statement of Cash Flows Multiple Choice With SolutionsHossein Parvardeh50% (2)

- Browning-Manufacturing BudgetingDocument19 pagesBrowning-Manufacturing BudgetingMavis ThoughtsNo ratings yet

- Lecture Practice QuestionsDocument5 pagesLecture Practice QuestionsMariøn Lemonnier BruelNo ratings yet

- Thumbs Up & ChemaliteDocument8 pagesThumbs Up & ChemaliteVaibhav MahajanNo ratings yet

- Devie Helen S1 Akuntansi T12 C PADocument5 pagesDevie Helen S1 Akuntansi T12 C PAShigit PebriantoNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Practice Exercise Ch18Document3 pagesPractice Exercise Ch18ngocanhhlee.11No ratings yet

- Jullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Document5 pagesJullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Jullie-Ann YbañezNo ratings yet

- Below Are Sample Questions Question 1 (1 Point) : Round The Answers To Two Decimal Places in Percentage Form.Document3 pagesBelow Are Sample Questions Question 1 (1 Point) : Round The Answers To Two Decimal Places in Percentage Form.Ayushi SinghalNo ratings yet

- Villena Stephanie A12-02 QA2 Attempt2Document8 pagesVillena Stephanie A12-02 QA2 Attempt2Stephanie VillenaNo ratings yet

- CMA Part2 EssaysDocument128 pagesCMA Part2 EssaysSandeep Sawan100% (1)

- PepsiCo Financial StatementsDocument9 pagesPepsiCo Financial StatementsBorn TaylorNo ratings yet

- Achmad Ardanu 20080694029 Chapter5Document13 pagesAchmad Ardanu 20080694029 Chapter5Achmad ArdanuNo ratings yet

- Setup and Financial Information for Current, Hi-Tech and Broker ScenariosDocument6 pagesSetup and Financial Information for Current, Hi-Tech and Broker ScenariosGabiNo ratings yet

- Answer W8 - As5 CashflowDocument2 pagesAnswer W8 - As5 CashflowJere Mae MarananNo ratings yet

- Financial PlanDocument12 pagesFinancial PlanNico BoialterNo ratings yet

- Financial Statements, Closing Entries, and Reversing EntriesDocument4 pagesFinancial Statements, Closing Entries, and Reversing EntriesKathleen VerboNo ratings yet

- Lecture Practice Questions - Sep.Document3 pagesLecture Practice Questions - Sep.Mariøn Lemonnier BruelNo ratings yet

- The Seabright Manufacturing Company, Inc.Document11 pagesThe Seabright Manufacturing Company, Inc.Iqbal RosyidinNo ratings yet

- Class Case 1 Quick LunchDocument4 pagesClass Case 1 Quick Lunch9ry5gsghybNo ratings yet

- Movie RagsDocument2 pagesMovie RagsrmpremsNo ratings yet

- Abellano - Activity 1 & 2Document4 pagesAbellano - Activity 1 & 2Nelia AbellanoNo ratings yet

- Tarea Contabilidad Ingles - Es.enDocument2 pagesTarea Contabilidad Ingles - Es.enLUIS ENRIQUE VELASCO MENDOZANo ratings yet

- Assignment 3Document2 pagesAssignment 3kjoel.ngugiNo ratings yet

- Answer Problem 1Document9 pagesAnswer Problem 1MARY JUSTINE PAQUIBOTNo ratings yet

- Business Financial AnalysisDocument14 pagesBusiness Financial Analysismc limNo ratings yet

- VUICO Projected Financial StatementsDocument18 pagesVUICO Projected Financial StatementsRoseinthedark TiuNo ratings yet

- PEANUT FINANCIALSDocument4 pagesPEANUT FINANCIALSTertius Du ToitNo ratings yet

- Financial StatementDocument5 pagesFinancial StatementChristian MartizanoNo ratings yet

- Financial Statements FinalssssssDocument5 pagesFinancial Statements FinalssssssHelping Five (H5)No ratings yet

- Problem 2.19Document3 pagesProblem 2.19CNo ratings yet

- CommercialMetals SolutionDocument5 pagesCommercialMetals SolutionFalguni ShomeNo ratings yet

- Bab 6 Akuntansi Untuk Perusahaan DagangDocument76 pagesBab 6 Akuntansi Untuk Perusahaan DagangBaskaraaryaNo ratings yet

- 6 - Browning MFTG Company Case SolutionDocument12 pages6 - Browning MFTG Company Case Solutionjenice joy100% (2)

- Chapter 8 CostDocument5 pagesChapter 8 CostDogmanNo ratings yet

- JKON Financial Report Study NotesDocument34 pagesJKON Financial Report Study NotesJessica BernaciliaNo ratings yet

- Brewer Chapter 13Document7 pagesBrewer Chapter 13Atif RehmanNo ratings yet

- Chapter 5 SpreadsheetDocument7 pagesChapter 5 SpreadsheetChâu Trần Dương MinhNo ratings yet

- Practice Exam Chapters 1-5 (2) Solutions: Problem IDocument4 pagesPractice Exam Chapters 1-5 (2) Solutions: Problem IAtif RehmanNo ratings yet

- FS Financial StudyDocument6 pagesFS Financial StudyMarina AbanNo ratings yet

- Nama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityDocument10 pagesNama: Aliea Yenemia Putri NPM: 120110210003 P4-19 A. Randy & Wiskers Enterprises Pro Forma Balance Sheet December 31, 2019 Assets Liabilities and Stockholders' EquityAliea YenemiaNo ratings yet

- Fundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions ManualDocument16 pagesFundamental Managerial Accounting Concepts 9th Edition Edmonds Solutions Manualeffigiesbuffoonmwve9100% (18)

- CH 12 Wiley Plus Kimmel Quiz & HWDocument9 pagesCH 12 Wiley Plus Kimmel Quiz & HWmkiNo ratings yet

- ACCT 2500 Test 2 Format, Instructions and ReviewDocument17 pagesACCT 2500 Test 2 Format, Instructions and Reviewyahye ahmedNo ratings yet

- Projected Income Statement for Maple Leaf Hardware Ltd 2013-2014Document1 pageProjected Income Statement for Maple Leaf Hardware Ltd 2013-2014Henry KimNo ratings yet

- Smyth Inc. Pro Forma Income StatementsDocument7 pagesSmyth Inc. Pro Forma Income StatementsJARED DARREN ONGNo ratings yet

- Excercises of Chapter Two-SolutionDocument7 pagesExcercises of Chapter Two-SolutionMohammad Al AkoumNo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- Dispensers of California, Inc.Document7 pagesDispensers of California, Inc.Prashuk SethiNo ratings yet

- Inato Sauce Financial ForecastDocument5 pagesInato Sauce Financial ForecastRamir SamonNo ratings yet

- Movida CashtoaccrualDocument5 pagesMovida CashtoaccrualVivienne Rozenn LaytoNo ratings yet

- International Finance Final ProjectDocument2 pagesInternational Finance Final ProjectAshna KoshalNo ratings yet

- AppleDocument15 pagesApplevaleriamontejocNo ratings yet

- FDNACCT Business Case - 1T1819 PDFDocument3 pagesFDNACCT Business Case - 1T1819 PDFJazehl Joy ValdezNo ratings yet

- FS Preparation 1Document4 pagesFS Preparation 1Bae Tashnimah Farina BaltNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Ethical Guidance For ODDocument11 pagesEthical Guidance For ODDV VillanNo ratings yet

- Assignment No. 3 Feedback and ResistanceDocument5 pagesAssignment No. 3 Feedback and ResistanceDV VillanNo ratings yet

- Org. DevDocument5 pagesOrg. DevDV VillanNo ratings yet

- Quick Lunch Financial StatementsDocument3 pagesQuick Lunch Financial StatementsDV Villan100% (1)

- TLG SolutionsDocument22 pagesTLG SolutionsDV Villan71% (7)

- GC 1 AlaireDocument3 pagesGC 1 AlaireDV VillanNo ratings yet

- 01 Background PDFDocument7 pages01 Background PDFDV VillanNo ratings yet

- Sugar IndustryDocument19 pagesSugar IndustryDV VillanNo ratings yet

- Is It Much Ado About NothingDocument1 pageIs It Much Ado About NothingDV VillanNo ratings yet

- Dividend Policy Insights for Maximizing Firm ValueDocument16 pagesDividend Policy Insights for Maximizing Firm Valuestillwinms100% (3)

- Garnet CompanyDocument2 pagesGarnet CompanycheckaiNo ratings yet

- Suggested Answer - Syl12 - Dec13 - Paper 12 Intermediate ExaminationDocument23 pagesSuggested Answer - Syl12 - Dec13 - Paper 12 Intermediate ExaminationsmrndrdasNo ratings yet

- Corbett Business ModelsDocument47 pagesCorbett Business ModelsAbi RMNo ratings yet

- Emirates ReportDocument23 pagesEmirates Reportrussell92No ratings yet

- J. H. Decker Auth. Mining Latin America - Minería Latinoamericana Challenges in The Mining Industry - Desafíos para La Industria MineraDocument437 pagesJ. H. Decker Auth. Mining Latin America - Minería Latinoamericana Challenges in The Mining Industry - Desafíos para La Industria MineraAlfaro Robles100% (1)

- Oyo HotelsDocument4 pagesOyo HotelsSumit ChouhanNo ratings yet

- Barnes and Noble (BKS)Document8 pagesBarnes and Noble (BKS)Geoffrey HortonNo ratings yet

- METROBANK STRATEGIC PLANNING AND MANAGEMENTDocument28 pagesMETROBANK STRATEGIC PLANNING AND MANAGEMENTAnderei Acantilado67% (9)

- Living TrustDocument3 pagesLiving TrustShevis Singleton Sr.100% (5)

- DISSERTATION RE NikhilDocument37 pagesDISSERTATION RE NikhilNikhil Ranjan50% (2)

- MR - Vijaya Gopal Medisetti: Page 1 of 2 M-6008439Document2 pagesMR - Vijaya Gopal Medisetti: Page 1 of 2 M-6008439anilvishaka7621No ratings yet

- Planning To Meet A Surge in DemandDocument19 pagesPlanning To Meet A Surge in DemandAbhi0% (1)

- AFCL Other FormDocument3 pagesAFCL Other FormihshourovNo ratings yet

- Capital FormationDocument16 pagesCapital Formationemmanuel Johny100% (3)

- Chapter 5 - Financial Management and Policies - SyllabusDocument7 pagesChapter 5 - Financial Management and Policies - SyllabusharithraaNo ratings yet

- IPM 3.11.2016 Financial Portfolio ManagementDocument9 pagesIPM 3.11.2016 Financial Portfolio Managementavinash rNo ratings yet

- Hospital Services Market IndiaDocument3 pagesHospital Services Market IndiaVidhi BuchNo ratings yet

- Project Management: Generation & Screening of Project IdeasDocument16 pagesProject Management: Generation & Screening of Project Ideasshital_vyas1987No ratings yet

- Adv Acc MTPO1 PDFDocument18 pagesAdv Acc MTPO1 PDFuma shankarNo ratings yet

- 329Document56 pages329Lionel MaddoxNo ratings yet

- Multiple Bank Accounts Registration FormDocument2 pagesMultiple Bank Accounts Registration FormMamina DubeNo ratings yet

- Icici Bank LTDDocument8 pagesIcici Bank LTDAmit TripathiNo ratings yet

- Act 1508Document7 pagesAct 1508Alyssa Fabella ReyesNo ratings yet

- Edelweiss Sales and Distribution Strategies ReportDocument86 pagesEdelweiss Sales and Distribution Strategies Reportpsusnat0% (1)

- Linklaters (Corporate Restructuring - Shrink To GrowDocument40 pagesLinklaters (Corporate Restructuring - Shrink To GrowneagucosminNo ratings yet

- Nielson & Co. Inc. vs. Lepanto Consolidated Mining Co.Document3 pagesNielson & Co. Inc. vs. Lepanto Consolidated Mining Co.Karen Patricio Lustica100% (1)

- MGM 3101 Case StudyDocument8 pagesMGM 3101 Case StudyNurul Ashikin ZulkefliNo ratings yet

- Theory and Practice 08 04 PDFDocument100 pagesTheory and Practice 08 04 PDFHạng VũNo ratings yet