Professional Documents

Culture Documents

Prob9 4 PDF

Uploaded by

irma cahyani kawiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prob9 4 PDF

Uploaded by

irma cahyani kawiCopyright:

Available Formats

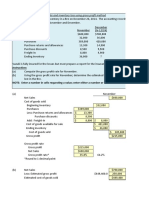

Problem 9‐4

Retail inventory method is used to estimate ending inventory and cost of

goods sold

Cost Retail

Beginning inventory $ 90,000 $180,000

Purchases 355,000 580,000

Freight‐in 9,000

Purchase returns 7,000 11,000

Net markups 16,000

Net markdowns 12,000

Normal spoilage 3,000

Abnormal spoilage 4,800 8,000

Sales 540,000

Sales returns 10,000

Sales are recorded net of employee discounts of $4,000

©Dr. Chula King

All Rights Reserved

Problem 9‐4 (continued)

Part 1: Estimate the ending inventory and cost of goods sold using the retail inventory

method and average cost

Cost Retail

Beginning inventory $ 90,000 $180,000

Add: Purchases 355,000 580,000

Freight‐in 9,000

Deduct: Purchase returns (7,000) (11,000)

Add: Net markups 16,000

Deduct: Net markdowns (12,000)

Abnormal spoilage

p g ((4,800)

, ) ((8,000)

, )

Goods available for sale $422,200 $745,000

Cost/Retail % = $422,200 ÷ $745,000 = 59.36%

Deduct: Normal spoilage (3,000)

Net sales (540,000 – 10,000) (530,000)

Employee discounts (4,000)

Ending Inventory at retail $208,000

Ending inventory at cost (59.36% x $208,000) (123,469)

Cost of goods sold $318,731

©Dr. Chula King

All Rights Reserved

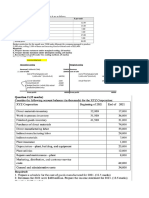

Problem 9‐4 (continued)

Part 2: Estimate the ending inventory and cost of goods sold using the retail inventory

method and conventional (average, LCM)

Cost Retail

Beginning inventory $ 90,000 $180,000

Add: Purchases 355,000 580,000

Freight‐in 9,000

Deduct: Purchase returns (7,000) (11,000)

Add: Net markups 16,000

Deduct: Abnormal spoilage (4,800) (8,000)

$442,200

$ , $757,000

$ ,

Cost/Retail % = $422,200 ÷ $757,000 = 58.41%

Deduct: Net markdowns (12,000)

Goods Available for sale $442,200 $745,000

Deduct: Normal spoilage (3,000)

Net sales (540,000 – 10,000) (530,000)

Employee discounts (4,000)

Ending Inventory at retail $208,000

Ending inventory at cost (58.41% x $208,000) (121,493)

Cost of goods sold $320,707

©Dr. Chula King

All Rights Reserved

You might also like

- Chapter 9Document6 pagesChapter 9Khoa VoNo ratings yet

- Problem set with cost of goods sold calculations for multiple companiesDocument6 pagesProblem set with cost of goods sold calculations for multiple companiesChristine HingcoNo ratings yet

- Calculating GPR under different assumptionsDocument4 pagesCalculating GPR under different assumptionsLily of the ValleyNo ratings yet

- Chapter 9 Exercises: Exercise 9 1Document8 pagesChapter 9 Exercises: Exercise 9 1karenmae intangNo ratings yet

- Barayuga - Ecological - Fabm2 - Module 2Document5 pagesBarayuga - Ecological - Fabm2 - Module 2Lee Arne BarayugaNo ratings yet

- Question 1-1-1Document14 pagesQuestion 1-1-1Aqsa AnumNo ratings yet

- BE Chap 5Document3 pagesBE Chap 5TIÊN NGUYỄN LÊ MỸNo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1a - 2020 EditionDocument14 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1a - 2020 EditionJapon, Jenn RossNo ratings yet

- Chapter 14 AnswersevenDocument4 pagesChapter 14 AnswersevenJulianne Mejia100% (1)

- Compute gross profit rate and inventory loss using gross profit methodDocument4 pagesCompute gross profit rate and inventory loss using gross profit methodMellaniNo ratings yet

- FDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFDocument5 pagesFDNACCT - Mock Exam - Answer Key - 3 - Fill in The Blank Problems PDFJames de LeonNo ratings yet

- Master Budget SolutionDocument2 pagesMaster Budget SolutionAra FloresNo ratings yet

- Problem P6-9A Accounting IIDocument3 pagesProblem P6-9A Accounting IIkalmanzaNo ratings yet

- Cost of Goods Available For SaleDocument4 pagesCost of Goods Available For SaleColeen RamosNo ratings yet

- Installment Sales Consignment Sales Construction ContractsDocument4 pagesInstallment Sales Consignment Sales Construction ContractsShaene GalloraNo ratings yet

- Chapter 8 AccountingDocument12 pagesChapter 8 AccountingDanica Mae GenaviaNo ratings yet

- Chap14 ProblemsDocument8 pagesChap14 ProblemsYen YenNo ratings yet

- The Income Statement and Inventories: Total of Goods That COULD Be SoldDocument4 pagesThe Income Statement and Inventories: Total of Goods That COULD Be SoldKenshin HayashiNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- Inventory Estimation Problems and SolutionsDocument6 pagesInventory Estimation Problems and SolutionsRezzan Joy Camara MejiaNo ratings yet

- CA TM 2nd Edition Chapter 22 EngDocument38 pagesCA TM 2nd Edition Chapter 22 EngIp NicoleNo ratings yet

- Income Statement Calculations and Inventory ValuationsDocument5 pagesIncome Statement Calculations and Inventory ValuationsIlovejjcNo ratings yet

- MAS Final Preboard Solutions B93Document5 pagesMAS Final Preboard Solutions B93813 cafeNo ratings yet

- Tutorial 2Document5 pagesTutorial 2Shah ReenNo ratings yet

- BAFACR16 04 Answer Key To Post TestsDocument5 pagesBAFACR16 04 Answer Key To Post TestsThats BellaNo ratings yet

- Absorption and Marginal Costing TemplateDocument13 pagesAbsorption and Marginal Costing TemplateGeorge PNo ratings yet

- MA1 sample of midterm testDocument4 pagesMA1 sample of midterm testLoan VũNo ratings yet

- Answers 2014 Vol 3 CH 4 PDFDocument8 pagesAnswers 2014 Vol 3 CH 4 PDFLian Blakely CousinNo ratings yet

- Retail Method: Problem 20-1 (AICPA Adapted)Document9 pagesRetail Method: Problem 20-1 (AICPA Adapted)Anne EstrellaNo ratings yet

- Cost of Goods Sold CalculationDocument5 pagesCost of Goods Sold CalculationKiminosunoo LelNo ratings yet

- QN 2 (STD Cost & Variance)Document2 pagesQN 2 (STD Cost & Variance)Kambi OfficialNo ratings yet

- Examples FMA - 5Document10 pagesExamples FMA - 5DaddyNo ratings yet

- Statement of IncomeDocument10 pagesStatement of IncomeScribdTranslationsNo ratings yet

- Contribution Price. This Contribution Approach To Pricing Is Most Appropriate When: (1) There Is ADocument7 pagesContribution Price. This Contribution Approach To Pricing Is Most Appropriate When: (1) There Is AEVELYN ROSE MOGAONo ratings yet

- ALFADocument3 pagesALFADiane MoutranNo ratings yet

- 6 DesemberDocument8 pages6 DesemberKezia N. ApriliaNo ratings yet

- Marginal Costing Values Inventory at The Total Variable Production Cost of A UnitDocument3 pagesMarginal Costing Values Inventory at The Total Variable Production Cost of A UnitNiomi GolraiNo ratings yet

- AnswersDocument4 pagesAnswersAbdulmajed Unda MimbantasNo ratings yet

- Intermediate Accounting 1 - Meeting 2 (Answers Sheets)Document4 pagesIntermediate Accounting 1 - Meeting 2 (Answers Sheets)WILLIAM CHANDRANo ratings yet

- Costing FormatsDocument43 pagesCosting FormatsUsman KhiljiNo ratings yet

- Adjusting entries and financial statements for Flawless IncDocument4 pagesAdjusting entries and financial statements for Flawless IncRocel Avery SacroNo ratings yet

- Inventory EstimationDocument2 pagesInventory EstimationFiona MoralesNo ratings yet

- Pasar Ko Co. accounts and cost of goods calculationsDocument4 pagesPasar Ko Co. accounts and cost of goods calculationsJuliana ZamorasNo ratings yet

- Pasar Ko Co. accounts and cost of goods calculationsDocument4 pagesPasar Ko Co. accounts and cost of goods calculationsJuliana ZamorasNo ratings yet

- Ss 3Document32 pagesSs 3Trần Nguyễn Quỳnh GiaoNo ratings yet

- Sba SemDocument9 pagesSba SemChelsa Mae AntonioNo ratings yet

- Supplemental Homework ProblemsDocument64 pagesSupplemental Homework ProblemsRolando E. CaserNo ratings yet

- UntitledDocument2 pagesUntitledpranjal92pandeyNo ratings yet

- Pham Le Thuy Duong - HW9Document4 pagesPham Le Thuy Duong - HW9Dương PhạmNo ratings yet

- IA ActivityDocument2 pagesIA ActivityCASTRO, JHONLY ROEL C.No ratings yet

- Solutions To ProblemsDocument4 pagesSolutions To ProblemslorraineNo ratings yet

- Problems - Inventory Estimation: Retail Inventory MethodDocument13 pagesProblems - Inventory Estimation: Retail Inventory MethodKez MaxNo ratings yet

- 8-Inventory EstimationDocument5 pages8-Inventory EstimationYulrir Alesteyr HiroshiNo ratings yet

- Chapter 7 Homework ADocument2 pagesChapter 7 Homework ALong BuiNo ratings yet

- Quiz Btaxxx 1Document3 pagesQuiz Btaxxx 1John LucaNo ratings yet

- Chapter 33 - Retail Method: Problem 33-1 (AICPA Adopted)Document15 pagesChapter 33 - Retail Method: Problem 33-1 (AICPA Adopted)Kimberly Claire Atienza83% (6)

- 21.08.2020 L11-12Document10 pages21.08.2020 L11-12sajedulNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Power Markets and Economics: Energy Costs, Trading, EmissionsFrom EverandPower Markets and Economics: Energy Costs, Trading, EmissionsNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- CASE I - RevDocument1 pageCASE I - Revirma cahyani kawiNo ratings yet

- Problem 9 3: Fruit Toppings Marshmallow Toppings Chocolate ToppingsDocument1 pageProblem 9 3: Fruit Toppings Marshmallow Toppings Chocolate Toppingsirma cahyani kawiNo ratings yet

- Cash Flow Case 3Document1 pageCash Flow Case 3irma cahyani kawiNo ratings yet

- Case P9-2Document1 pageCase P9-2irma cahyani kawiNo ratings yet

- Contoh Soal Pelaporan KorporatDocument4 pagesContoh Soal Pelaporan Korporatirma cahyani kawi0% (1)

- Management Letter - EnglishDocument3 pagesManagement Letter - Englishirma cahyani kawiNo ratings yet

- ch07 - Intermediate Acc IFRS (Cash and Receivable)Document104 pagesch07 - Intermediate Acc IFRS (Cash and Receivable)irma cahyani kawiNo ratings yet

- ERP Project on Smart Apparels Jockey retailerDocument5 pagesERP Project on Smart Apparels Jockey retailerBhawna YadavNo ratings yet

- Sturdivant Notes PomDocument3 pagesSturdivant Notes PomLoralyne Ursolino FistañoNo ratings yet

- 2754Document166 pages2754Kristina RekovicNo ratings yet

- SOP LambtonDocument3 pagesSOP Lambtonrbtvinod47% (15)

- TF. Ranked As No. 1 ERP Training For Quality Teaching Sap Placement in India & UsaDocument1 pageTF. Ranked As No. 1 ERP Training For Quality Teaching Sap Placement in India & UsaAnirban DebNo ratings yet

- Silo - Tips A Level Business Paper 3 Specimen Assessment Material Mark SchemeDocument22 pagesSilo - Tips A Level Business Paper 3 Specimen Assessment Material Mark SchemeJohnny PlaysNo ratings yet

- Work Cap. Start 1.4 Management of Accounts Receivable OnwardsDocument14 pagesWork Cap. Start 1.4 Management of Accounts Receivable OnwardsErza Scarlet ÜNo ratings yet

- CH 3Document15 pagesCH 3alfiNo ratings yet

- Packing List: Karam Safety Private Limited (Formerly Known As KARAM INDUSTRIES)Document3 pagesPacking List: Karam Safety Private Limited (Formerly Known As KARAM INDUSTRIES)rajmayatraNo ratings yet

- Link Belt Cadenas de RodillosDocument120 pagesLink Belt Cadenas de RodillosEduardo FaydellaNo ratings yet

- AP04-07 - Audit of InventoriesDocument4 pagesAP04-07 - Audit of InventorieseildeeNo ratings yet

- Differentiation Strategy of NestleDocument4 pagesDifferentiation Strategy of NestleDark Prince80% (10)

- Case Study Concept: Zara's Unique Business Model Is Driven by Its Supply Chain CapabilitiesDocument2 pagesCase Study Concept: Zara's Unique Business Model Is Driven by Its Supply Chain CapabilitiesAgnestasya NikenNo ratings yet

- Logistics MCQ ConceptsDocument8 pagesLogistics MCQ ConceptsRKT SOLUTION TP Help DeskNo ratings yet

- SAP Transaction CodesDocument1 pageSAP Transaction CodesHemant RasamNo ratings yet

- Varanasi India Pvt. LTDDocument24 pagesVaranasi India Pvt. LTDPaulo Eymard Nascimento50% (4)

- Problem SetDocument5 pagesProblem SetKUMRNo ratings yet

- Answers of Om Mid Term Exam - BSC - Batch 9-11-2009Document22 pagesAnswers of Om Mid Term Exam - BSC - Batch 9-11-2009Steffanie VasquezNo ratings yet

- Quality Manual: ConfidentialDocument18 pagesQuality Manual: ConfidentialafrizalNo ratings yet

- Concepts On Oracle SCM PDFDocument31 pagesConcepts On Oracle SCM PDFAravindAllamNo ratings yet

- Dimerco Logistics Overview Presentation LMTDocument27 pagesDimerco Logistics Overview Presentation LMTDuska VuletaNo ratings yet

- Manufacturing SystemDocument8 pagesManufacturing SystemShanky JainNo ratings yet

- Operation CostingDocument5 pagesOperation CostingAshmanur RhamanNo ratings yet

- Business Strategy Project: Submitted By: Abhishek Kulshrestha Suhas P CDocument37 pagesBusiness Strategy Project: Submitted By: Abhishek Kulshrestha Suhas P CsagarNo ratings yet

- Ambry Square Mall Floor Plan OverviewDocument62 pagesAmbry Square Mall Floor Plan OverviewJackNo ratings yet

- Strategic Cost Management Is The Process of Reducing Total Costs While Improving The Strategic PositionDocument9 pagesStrategic Cost Management Is The Process of Reducing Total Costs While Improving The Strategic PositionWinoah HubaldeNo ratings yet

- Case Study: Manajemen Logistik & Rantai PasokDocument30 pagesCase Study: Manajemen Logistik & Rantai PasokDede AtmokoNo ratings yet

- TM MG10Document23 pagesTM MG10sridhar sridhar100% (1)

- Assignment Supply Chain Management: Merloni Elettrodomestici Spa: The Transit Point ExperimentDocument5 pagesAssignment Supply Chain Management: Merloni Elettrodomestici Spa: The Transit Point ExperimentManish Kumar Maurya100% (1)

- Week 4 E-Business Assignment 2023Document4 pagesWeek 4 E-Business Assignment 2023Jonathan PereiraNo ratings yet