Professional Documents

Culture Documents

Kabel Decision 3.29

Uploaded by

LancasterOnline0 ratings0% found this document useful (0 votes)

2K views18 pagesJudge David Ashworth will allow Patricia Kabel's lawsuit against Manheim Township School District to proceed.

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJudge David Ashworth will allow Patricia Kabel's lawsuit against Manheim Township School District to proceed.

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

2K views18 pagesKabel Decision 3.29

Uploaded by

LancasterOnlineJudge David Ashworth will allow Patricia Kabel's lawsuit against Manheim Township School District to proceed.

Copyright:

© All Rights Reserved

You are on page 1of 18

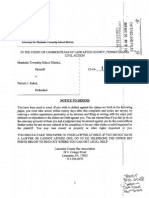

IN THE COURT OF COMMON PLEAS OF LANCASTER COUNTY, PENNSYLVANIA

CIVIL ACTION

PATRICIA J. KABEL

v. No. Cl-17-09663

MANHEIM TOWNSHIP

SCHOOL DISTRICT

OPINION

BY: ASHWORTH, J., MARCH 29, 2019

Before the Court for disposition is a motion for summary judgment brought by

Defendant Manheim Township School District (the District). Plaintiff Patricia J. Kabel has

filed a lawsuit seeking declaratory judgment and injunetive relief relative to her duties as

the elected tax collector for Manheim Township.’ For the reasons set forth below, this

‘motion for summary judgment will be denied.

1. Background

The District is a political subdivision and taxing district of the Commonwealth of

Pennsylvania. First Complaint at | 1. The District is comprised solely of Manheim

Township. Id. at 4. The District imposes a real estate tax pursuant to the Pennsylvania

Public School Code of 1949, 24 P.S. §§ 1-101, ef seq., and is a taxing district for purposes

of the Local Tax Collection Law, 72 P.S. §§ 511.1, of seq, (the Tax Law). Id. at 13.

‘Manheim Township is a political subdivision organized under the First Class Township

Code, 53 P.S. §§ 55101, et seq. Kabel was initially elected as the Manheim Township tax

collector in 2013 for a term beginning January 1, 2074, and ending on December 31, 2017. She

ran for re-election in 2017 for the four-year term beginning on January 1, 2018. Kabel was re-

elected as tax collector for Manheim Township on November 7, 2017.

Kabel, as the elected tax collector for the only municipality within the District, is

solely responsible for the collection of District real estate taxes, unless Kabel chooses to i

appoint a deputy in accordance with 72 P.S. § 8511.22(a)(1), pursuant to the procedures |

and requirements of the Tax Law. First Complaint at] 4-6. Historically, the District has

collected its own taxes, through a variety of collection techniques, including the use of

District employees. Defendant's Answer with New Matter to First Complaint at {ff 47-48.?

Kabel has never deputized the District to collect taxes on her behalf nor has she otherwise

delegated her statutory authority to collect District real estate taxes to any other party.

First Complaint at J 16.

On November 6, 2017, Kabel, who was the incumbent tax collector and who was a

candidate for election to that office in the 2017 election, filed a complaint against the

District (the First Complaint), seeking declaratory judgment, and preliminary and

permanent injunctive relief, Kabel claims “[{Jhe District's attempt to deprive [her] of her

right, and prevent [her] from executing her duty, of collection of District taxes in Manheim

Township is invalid, void, and ultra vires,” and she seeks a declaration that she has the

sole duty and right to collect District real estate taxes in Manheim Township and that the

District must pay a reasonable rate of compensation to the tax collector commensurate

with the statutory obligations associated with the office. First Complaint at {if 17-18.

Kabel further seeks to enjoin the District from collecting taxes and from interfering with

Kabel's duty and right to collect taxes. Id. at ff 20-30.

[Manheim Township] School district records Indicate that the school district has been

collecting taxes internally with the cooperation of previously elected tax collectors . . . since at

least 1985." Manheim Township School District Website, District News, Law Suit Re: Tax

Collection in Manheim Township, by Marcie Brody, Feb. 15, 2019.

2

On December 11, 2017, the District filed an answer and new matter to the First

Complaint. On January 4, 2018, Kabel filed a reply to the District's new matter, thereby

closing the first round of pleadings in this litigation.

On May 8, 2018, the District fled a motion for expedited case management order

and emergency hearing, to which Kabel stipulated. By Order dated May 9, 2018, | granted

the expedited discovery and briefing, and set a hearing date for May 30, 2018, to resolve

the claims raised by Kabel in the First Complaint.

On May 17, 2018, the District adopted a resolution titled, Resolution Establishing

Policies and Procedures for Elected Tax Collectors” (the Resolution). In chambers on

May 30, 2018, prior to the start of the scheduled hearing, Kabel informed the parties that

she intended to raise challenges to certain procedures in the Resolution. As a

consequence, an agreement was reached to postpone disposition of the claims raised by

Kabel in the First Complaint so that all of Kabe'’s challenges could be resolved at one

time. To effectuate that agreement, the parties stipulated to an order that was entered on

June 8, 2018. In relevant part, that order: (1) authorized Kabel to collect real estate taxes

on behalf ofthe District; (2) prohibited the Distrit from challenging, in ths itigation,

Kabe''s legal right to collect the District’s taxes; (3) obligated Kabel to comply with all the

terms of the Resolution pending further order of the Court; and (4) directed Kabel to obtain

a bond by June 11, 2018, to protect the Districts tax funds against loss and

misappropriation.? See June 8, 2018 Order at fl 1, 2(a), 2(f), 5.

°On February 14, 2018, Kabel received a bond from Travelers Casualty and Surety

Company of America in the amount of the municipal and county taxes she collects, or

$15,419,850.00, See Plaintiff's Brief in Opposition, Appendix “A,” Exhibit "6” (bond).

3

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Perceptions About Childhood Vaccinations: Pam CooperDocument19 pagesPerceptions About Childhood Vaccinations: Pam CooperLancasterOnlineNo ratings yet

- Open Letter To County CommissionersDocument3 pagesOpen Letter To County CommissionersLancasterOnline100% (1)

- Mixed Drinks-To-Go, Q&A: Pennsylvania Act 21 of 2020 PLCB FAQDocument8 pagesMixed Drinks-To-Go, Q&A: Pennsylvania Act 21 of 2020 PLCB FAQLancasterOnlineNo ratings yet

- Bridgeport Crossroads Transportation & Land Use StudyDocument95 pagesBridgeport Crossroads Transportation & Land Use StudyLancasterOnlineNo ratings yet

- Open Letter To County CommissionersDocument3 pagesOpen Letter To County CommissionersLancasterOnline100% (1)

- 2020 Pennsylvania Farm Show Junior Baking RecipesDocument8 pages2020 Pennsylvania Farm Show Junior Baking RecipesLancasterOnlineNo ratings yet

- 2020 Farm Show Angel Food CakeDocument6 pages2020 Farm Show Angel Food CakeLancasterOnlineNo ratings yet

- Senate Bill 89: The General Assembly of PennsylvaniaDocument149 pagesSenate Bill 89: The General Assembly of PennsylvaniaLancasterOnlineNo ratings yet

- Jelly and Jam Bar Contest 20Document5 pagesJelly and Jam Bar Contest 20LancasterOnline100% (1)

- Whoopie Pie 20Document5 pagesWhoopie Pie 20LancasterOnlineNo ratings yet

- Sears, Kmart Store Closing ListDocument4 pagesSears, Kmart Store Closing ListNational Content DeskNo ratings yet

- Garden Spot Locker Room DesignDocument1 pageGarden Spot Locker Room DesignLancasterOnline50% (2)

- Student Physical Privacy PolicyDocument5 pagesStudent Physical Privacy PolicyLancasterOnlineNo ratings yet

- Elanco Student Physical Privacy Policy (Draft)Document5 pagesElanco Student Physical Privacy Policy (Draft)LancasterOnlineNo ratings yet

- Senate Bill 440: The General Assembly of PennsylvaniaDocument4 pagesSenate Bill 440: The General Assembly of PennsylvaniaLancasterOnlineNo ratings yet

- DA Craig Stedman LetterDocument5 pagesDA Craig Stedman LetterPennLiveNo ratings yet

- Get The Lead OutDocument50 pagesGet The Lead OutLancasterOnlineNo ratings yet

- House Bill 250: The General Assembly of PennsylvaniaDocument2 pagesHouse Bill 250: The General Assembly of PennsylvaniaLancasterOnlineNo ratings yet

- 2018 Christmas Tree Municipal ProgramsDocument2 pages2018 Christmas Tree Municipal ProgramsLancasterOnlineNo ratings yet

- Manheim Township Expulsion DecisionDocument40 pagesManheim Township Expulsion DecisionLancasterOnlineNo ratings yet

- 2018 Voters' GuideDocument3 pages2018 Voters' GuideLancasterOnlineNo ratings yet

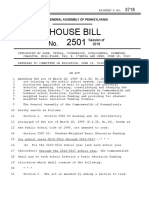

- House Bill 2501Document8 pagesHouse Bill 2501LancasterOnlineNo ratings yet

- Zimmerman Ethics Commission ReportDocument47 pagesZimmerman Ethics Commission ReportLancasterOnlineNo ratings yet

- Letter To Attorney GeneralDocument1 pageLetter To Attorney GeneralLancasterOnlineNo ratings yet

- Incredible Angel Food CakeDocument5 pagesIncredible Angel Food CakeLancasterOnlineNo ratings yet

- MT Lawsuit Against KabelDocument39 pagesMT Lawsuit Against KabelLancasterOnlineNo ratings yet

- Senate Bill 1104: The General Assembly of PennsylvaniaDocument3 pagesSenate Bill 1104: The General Assembly of PennsylvaniaLancasterOnlineNo ratings yet

- Columbia Teacher ContractDocument56 pagesColumbia Teacher ContractLancasterOnline100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)