Professional Documents

Culture Documents

Ratio Analysis of Chipla and Cedila LTD

Uploaded by

darshanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratio Analysis of Chipla and Cedila LTD

Uploaded by

darshanCopyright:

Available Formats

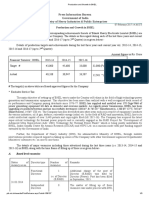

Cipla ltd.

Mar '18 Mar '17 Mar '16

Profitability Ratios:

𝒈𝒓𝒐𝒔𝒔 𝒑𝒓𝒐𝒇𝒊𝒕 9.87 7.87 12.51

Gross Profit Margin(%) = 𝒏𝒆𝒕 𝒔𝒂𝒍𝒆𝒔

*100

𝒏𝒆𝒕 𝒑𝒓𝒐𝒇𝒊𝒕 9.3 6.99 9.86

Net Profit Margin(%) = *100

𝒏𝒆𝒕 𝒔𝒔𝒂𝒍𝒆

𝒐𝒑𝒆𝒓𝒂𝒕𝒊𝒏𝒈 𝒆𝒙𝒑.+𝑪𝑶𝑮𝑺 18.57 16.92 17.98

Operating Profit Margin(%) =

𝒏𝒆𝒕 𝒔𝒂𝒍𝒆𝒔

Liquidity Ratios:

𝒄𝒖𝒓𝒓𝒆𝒏𝒕 𝒂𝒔𝒔𝒆𝒕𝒔 2.31 2.02 0.99

Current Ratio =

𝒄𝒖𝒓𝒓𝒆𝒏𝒕 𝒍𝒊𝒂𝒃𝒊𝒍𝒊𝒕𝒊𝒆𝒔

𝒄𝒂𝒔𝒉+𝒄𝒂𝒔𝒉 𝒆𝒒𝒖𝒊𝒗𝒂𝒍𝒆𝒏𝒕𝒔 1.54 1.33 1.24

Cash position Ratio =

𝒍𝒊𝒒𝒖𝒊𝒅 𝒍𝒊𝒂𝒃𝒊𝒍𝒊𝒕𝒊𝒆𝒔

Turnover Ratios:

𝒄𝒓𝒆𝒅𝒊𝒕 𝒔𝒂𝒍𝒆𝒔 5.37 5.95 6.33

Debtors Turnover Ratio (Times) =

𝑨𝒗𝒈.𝒅𝒆𝒃𝒕𝒐𝒓𝒔

𝟑𝟔𝟓 68days 61days 58days

Average collection period(days) =

𝒅𝒆𝒃𝒕𝒐𝒓𝒔 𝒕𝒖𝒓𝒏𝒐𝒗𝒆𝒓 𝒓𝒂𝒕𝒊𝒐

𝑪𝑶𝑮𝑺 3.76 4.2 3.62

Inventory Turnover Ratio (Times) =

𝑨𝒗𝒈.𝒔𝒕𝒐𝒄𝒌

𝒏𝒆𝒕 𝒔𝒂𝒍𝒆𝒔 2.19 2.42 2.71

Fixed Assets Turnover Ratio =

𝒇𝒊𝒙𝒆𝒅 𝒂𝒔𝒔𝒆𝒕𝒔−𝒂𝒄𝒄𝒖𝒎𝒖𝒂𝒍𝒕𝒆𝒅 𝒅𝒆𝒑.

Composite Ratios:

𝒍𝒐𝒏𝒈 𝒕𝒆𝒓𝒎 𝒅𝒆𝒃𝒕𝒔 0.29 0.33 0.45

Debt Equity Ratio =

𝒔𝒉𝒂𝒓𝒆 𝒉𝒐𝒍𝒅𝒆𝒓′ 𝒔𝒇𝒖𝒏𝒅

𝒔𝒆𝒄𝒖𝒓𝒆𝒅 𝒍𝒐𝒂𝒏+𝒖𝒏𝒔𝒆𝒄𝒖𝒓𝒆𝒅 𝒍𝒐𝒂𝒏+𝒑𝒓𝒆𝒇𝒆𝒓𝒏𝒄𝒆 𝒔𝒉𝒂𝒓𝒆𝒔 27.87 16.97 13.01

capital gearing Ratio =

𝒆𝒒𝒖𝒊𝒕𝒚 𝒔𝒉𝒂𝒓𝒆𝒔

𝒆𝒂𝒓𝒏𝒊𝒏𝒈 𝒂𝒇𝒕𝒆𝒓 𝒕𝒂𝒙−𝒑𝒓𝒆𝒇.𝒔𝒉𝒂𝒓𝒆 𝒅𝒊𝒗𝒊𝒅𝒆𝒏𝒕 9.91 8.02 11.8

Return On Equity capital(%) = *100

𝒆𝒒𝒖𝒊𝒕𝒚 𝒔𝒉𝒂𝒓𝒆 𝒄𝒂𝒑𝒊𝒕𝒂𝒍

𝒆𝒂𝒓𝒏𝒊𝒏𝒈 𝒃𝒆𝒇𝒐𝒓𝒆 𝒊𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝒂𝒏𝒅 𝒕𝒆𝒙 10.15 8.29 11.57

Return On Capital Employed(%) = *100

𝒄𝒂𝒑𝒊𝒕𝒂𝒍 𝒆𝒎𝒑𝒍𝒐𝒚𝒆𝒅

𝒓𝒆𝒕𝒂𝒊𝒏𝒆𝒅 𝒆𝒂𝒓𝒏𝒊𝒏𝒈 87.36 81.43 87.04

Earning Retention Ratio =

𝒏𝒆𝒕 𝒊𝒏𝒄𝒐𝒎𝒆

Interpretation

Profitability Ratios:

1. Gross Profit Margin ratio:

There are high overheads it should be reduce

Higher values indicate that more cents are earned per dollar of revenue which is

favourable because more profit will be available to cover non-production cost.

2. Net profit margin ratio:

Percentage of revenue remaining after all operating expense interest taxes

and preferred stock dividends (but not common stock dividends) have been

deducted from a company’s total revenue has increased high in the year 2018.

3. Operating profit margin ratio:

There is a increase in operating profit ratio in 2018(18.57)

Liquidity Ratios:

4. Current ratio:

The current ratio of Cipla Ltd is above standard norm of 2:1for the year 2017

and 2018.

The current ratio of Cipla Ltd is showing a increasing trend

5. Cash position ratio:

The cash position ratio is continuously increasing.

The Cipla ltd cash position are good in 2018.

Turnover Ratios:

6. Debtors turnover ratio:

It is showing constant decrease from year to year.

Credit period is very liberal

7. Inventory turnover ratio:

It is an activity ratio measuring the number of times per period.

The company doesn’t have retained earnings to reinvest it showing constant

fluctuation from year to year.

It has to really work hard to survive in the market.

8. Fixed asset turnover ratio:

The asset turnover ratio is maintain the trend

This shows that the company has used its assets more effectively in order to

generate its revenue.

Composite ratios:

9. Debt equity ratio:

The debt equity ratio of Cipla ltd is 0.49 , 0.33 ,and 0.29 for the years

2016,2017 and 2018.

10. Capital Gearing ratio:

It is showing constant increase from year to year.

In year 2018 rapid increase in capital gearing ratio.

11. Return on equity capital:

Profitability of company has degraded compare to previous year.

The company is having less income over the value of equity.

12. Return on capital employed:

Capital employed is defined as total assets less current liabilities.

The ratio shows the efficiency and profitability of a company’s capital

investment.

13. Earning retain ratio:

The earning retain ratio of Cipla lid is 87.04, 81.43 and 87.36 for the years

2016, 2017 and 2018.

The ratio that measures the amount of earnings retained after dividends have

been paid out to the shareholders.

Cedila healthcare ltd.

Mar '18 Mar '17 Mar '16

Profitability Ratios:

𝒈𝒓𝒐𝒔𝒔 𝒑𝒓𝒐𝒇𝒊𝒕 19.60 18.04 23.17

Gross Profit Margin(%) = *100

𝒏𝒆𝒕 𝒔𝒂𝒍𝒆𝒔

𝒏𝒆𝒕 𝒑𝒓𝒐𝒇𝒊𝒕 14.87 15.54 20.1

Net Profit Margin(%) = *100

𝒏𝒆𝒕 𝒔𝒔𝒂𝒍𝒆

𝒐𝒑𝒆𝒓𝒂𝒕𝒊𝒏𝒈 𝒆𝒙𝒑.+𝑪𝑶𝑮𝑺 24.11 21.94 26.21

Operating Profit Margin(%) =

𝒏𝒆𝒕 𝒔𝒂𝒍𝒆𝒔

Liquidity Ratios:

𝒄𝒖𝒓𝒓𝒆𝒏𝒕 𝒂𝒔𝒔𝒆𝒕𝒔 1.38 1.17 1.08

Current Ratio =

𝒄𝒖𝒓𝒓𝒆𝒏𝒕 𝒍𝒊𝒂𝒃𝒊𝒍𝒊𝒕𝒊𝒆𝒔

𝒄𝒂𝒔𝒉+𝒄𝒂𝒔𝒉 𝒆𝒒𝒖𝒊𝒗𝒂𝒍𝒆𝒏𝒕𝒔 1.49 1.52 1.37

Cash position Ratio =

𝒍𝒊𝒒𝒖𝒊𝒅 𝒍𝒊𝒂𝒃𝒊𝒍𝒊𝒕𝒊𝒆𝒔

Turnover Ratios:

𝒄𝒓𝒆𝒅𝒊𝒕 𝒔𝒂𝒍𝒆𝒔 4.35 4.76 5.77

Debtors Turnover Ratio (Times) =

𝑨𝒗𝒈.𝒅𝒆𝒃𝒕𝒐𝒓𝒔

𝟑𝟔𝟓 84days 77days 63days

Average collection period(days) =

𝒅𝒆𝒃𝒕𝒐𝒓𝒔 𝒕𝒖𝒓𝒏𝒐𝒗𝒆𝒓 𝒓𝒂𝒕𝒊𝒐

𝑪𝑶𝑮𝑺 5 5.31 7.19

Inventory Turnover Ratio (Times) =

𝑨𝒗𝒈.𝒔𝒕𝒐𝒄𝒌

𝒏𝒆𝒕 𝒔𝒂𝒍𝒆𝒔 2.02 1.9 2.35

Fixed Assets Turnover Ratio =

𝒇𝒊𝒙𝒆𝒅 𝒂𝒔𝒔𝒆𝒕𝒔−𝒂𝒄𝒄𝒖𝒎𝒖𝒂𝒍𝒕𝒆𝒅 𝒅𝒆𝒑.

Composite Ratios:

𝒍𝒐𝒏𝒈 𝒕𝒆𝒓𝒎 𝒅𝒆𝒃𝒕𝒔 0.58 0.71 0.37

Debt Equity Ratio =

𝒔𝒉𝒂𝒓𝒆 𝒉𝒐𝒍𝒅𝒆𝒓′ 𝒔𝒇𝒖𝒏𝒅

𝒔𝒆𝒄𝒖𝒓𝒆𝒅 𝒍𝒐𝒂𝒏+𝒖𝒏𝒔𝒆𝒄𝒖𝒓𝒆𝒅 𝒍𝒐𝒂𝒏+𝒑𝒓𝒆𝒇𝒆𝒓𝒏𝒄𝒆 𝒔𝒉𝒂𝒓𝒆𝒔 32.85 49.97 49.93

capital gearing Ratio =

𝒆𝒒𝒖𝒊𝒕𝒚 𝒔𝒉𝒂𝒓𝒆𝒔

𝒆𝒂𝒓𝒏𝒊𝒏𝒈 𝒂𝒇𝒕𝒆𝒓 𝒕𝒂𝒙−𝒑𝒓𝒆𝒇.𝒔𝒉𝒂𝒓𝒆 𝒅𝒊𝒗𝒊𝒅𝒆𝒏𝒕 20.3 21.37 34.46

Return On Equity capital(%) = *100

𝒆𝒒𝒖𝒊𝒕𝒚 𝒔𝒉𝒂𝒓𝒆 𝒄𝒂𝒑𝒊𝒕𝒂𝒍

𝒆𝒂𝒓𝒏𝒊𝒏𝒈 𝒃𝒆𝒇𝒐𝒓𝒆 𝒊𝒏𝒕𝒆𝒓𝒆𝒔𝒕 𝒂𝒏𝒅 𝒕𝒆𝒙 17.7 15.58 30.02

Return On Capital Employed(%) = *100

𝒄𝒂𝒑𝒊𝒕𝒂𝒍 𝒆𝒎𝒑𝒍𝒐𝒚𝒆𝒅

𝒓𝒆𝒕𝒂𝒊𝒏𝒆𝒅 𝒆𝒂𝒓𝒏𝒊𝒏𝒈 99.95 76.56 67.37

Earning Retention Ratio =

𝒏𝒆𝒕 𝒊𝒏𝒄𝒐𝒎𝒆

Profitability Ratios:

1) Gross Profit Margin ratio:

There are high overheads it should be reduce

Higher values indicate that more cents are earned per dollar of revenue which is

favourable because more profit will be available to cover non-production cost.

2) Net profit margin ratio:

Percentage of revenue remaining after all operating expense interest taxes

and preferred stock dividends (but not common stock dividends) have been

deducted from a company’s total revenue has decreased in the year 2018.

3) Operating profit margin ratio:

There is a increase in operating profit ratio in 2018(24.11)

Liquidity Ratios:

4) Current ratio:

The current ratio of Cedila Ltd is not as per standard norm of 1:1for all the

year

The current ratio of Cedila Ltd is showing a increasing trend

5) Cash position ratio:

The cash position ratio is not stable.

The Cedila ltd cash position are good in 2018.

Turnover Ratios:

6) Debtors turnover ratio:

It is showing constant decrease from year to year.

Credit period is very liberal

7) Inventory turnover ratio:

It is an activity ratio measuring the number of times per period.

The company doesn’t have retained earnings to reinvest it showing constant

reduce from year to year.

It has to really work hard to survive in the market.

8) Fixed asset turnover ratio:

The asset turnover ratio is maintain the trend

This shows that the company has used its assets more effectively in order to

generate its revenue.

Composite ratios:

9) Debt equity ratio:

The debt equity ratio of Cedila ltd is 0.37 , 0.71 ,and 0.58 for the years

2016,2017 and 2018.

10) Capital Gearing ratio:

It is showing constant reduction from year to year.

In year 2018 rapid decrease in capital gearing ratio.

11) Return on equity capital:

Profitability of company has degraded compare to previous year.

The company is having less income over the value of equity.

12) Return on capital employed:

Capital employed is defined as total assets less current liabilities.

The ratio shows the efficiency and profitability of a company’s capital

investment.

13) Earning retain ratio:

The earning retain ratio of Cedila lid is 67.37, 76.58 and 99.95 for the years

2016, 2017 and 2018.

There is the rapid increase in year 2018.

The ratio that measures the amount of earnings retained after dividends have

been paid out to the shareholders.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Spiritual Warfare - Mystery Babylon The GreatDocument275 pagesSpiritual Warfare - Mystery Babylon The GreatBornAgainChristian100% (7)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 1803 Hector Berlioz - Compositions - AllMusicDocument6 pages1803 Hector Berlioz - Compositions - AllMusicYannisVarthisNo ratings yet

- Deadly UnnaDocument2 pagesDeadly Unnaroflmaster22100% (2)

- Classwork Notes and Pointers Statutory Construction - TABORDA, CHRISTINE ANNDocument47 pagesClasswork Notes and Pointers Statutory Construction - TABORDA, CHRISTINE ANNChristine Ann TabordaNo ratings yet

- Felomino Urbano vs. IAC, G.R. No. 72964, January 7, 1988 ( (157 SCRA 7)Document1 pageFelomino Urbano vs. IAC, G.R. No. 72964, January 7, 1988 ( (157 SCRA 7)Dwight LoNo ratings yet

- World War 2 Soldier Stories - Ryan JenkinsDocument72 pagesWorld War 2 Soldier Stories - Ryan JenkinsTaharNo ratings yet

- Research PaperDocument8 pagesResearch PaperdarshanNo ratings yet

- Impact of Money Supply and Inflation On Economic GDocument13 pagesImpact of Money Supply and Inflation On Economic GdarshanNo ratings yet

- Is retirement planning a priority for individuals? A study of demographic and psychological factors in BengaluruDocument13 pagesIs retirement planning a priority for individuals? A study of demographic and psychological factors in BengalurudarshanNo ratings yet

- Food Truck Food Van Food Sale Vehicle Food Vehicle Shawarma VehicleDocument5 pagesFood Truck Food Van Food Sale Vehicle Food Vehicle Shawarma VehicledarshanNo ratings yet

- Design Science Research Process PDFDocument25 pagesDesign Science Research Process PDFTou hidNo ratings yet

- Consumer Attitude 4 Green PracticesDocument14 pagesConsumer Attitude 4 Green PracticesKamboj ShampyNo ratings yet

- Teaching Research Methodology in Medical Schools: Students' Attitudes Towards and Knowledge About ScienceDocument3 pagesTeaching Research Methodology in Medical Schools: Students' Attitudes Towards and Knowledge About SciencedarshanNo ratings yet

- TVS.001060 - Alison - Mackey, - Susan - M. - Gass-Second - Language - Research - Methodology - 1Document12 pagesTVS.001060 - Alison - Mackey, - Susan - M. - Gass-Second - Language - Research - Methodology - 1darshanNo ratings yet

- Garment Manufacturing Project ReportDocument64 pagesGarment Manufacturing Project ReportAVANTIKA VERMANo ratings yet

- dc3420859eb36c4c7b4d1b1030dac6bbDocument1 pagedc3420859eb36c4c7b4d1b1030dac6bbdarshanNo ratings yet

- Mortality Rate Table - Kotak Invest Maxima: Age Mortality Rates Age Mortality RatesDocument6 pagesMortality Rate Table - Kotak Invest Maxima: Age Mortality Rates Age Mortality RatesdarshanNo ratings yet

- Research Methodology in Management: Current Practices, Trends, and Implications For Future ResearchDocument19 pagesResearch Methodology in Management: Current Practices, Trends, and Implications For Future ResearchdarshanNo ratings yet

- The Production Process of Whole Garments and The Development Case of Knitwear - Focused On The SWG-X MachineDocument17 pagesThe Production Process of Whole Garments and The Development Case of Knitwear - Focused On The SWG-X MachinedarshanNo ratings yet

- Consumer Attitude Toward Gray Market GoodsDocument17 pagesConsumer Attitude Toward Gray Market GoodsdarshanNo ratings yet

- Axis Bank SR 2018 Final Report - v1 0 PDFDocument114 pagesAxis Bank SR 2018 Final Report - v1 0 PDFAnurag KhareNo ratings yet

- Consumer Attitude Toward Gray Market GoodsDocument17 pagesConsumer Attitude Toward Gray Market GoodsdarshanNo ratings yet

- Theoretical Background on PerceptionDocument1 pageTheoretical Background on PerceptiondarshanNo ratings yet

- Ca Bharat CoDocument4 pagesCa Bharat CodarshanNo ratings yet

- Introduction of Research Topics and Current Researches in Insurance PDFDocument44 pagesIntroduction of Research Topics and Current Researches in Insurance PDFdarshanNo ratings yet

- Cambridge English Logo Regulations for Preparation CentresDocument2 pagesCambridge English Logo Regulations for Preparation CentresdarshanNo ratings yet

- Types of Groups DefinedDocument2 pagesTypes of Groups DefineddarshanNo ratings yet

- Berger Compny ProfileDocument7 pagesBerger Compny ProfiledarshanNo ratings yet

- Exploring Motivation and Identity in Teachers Wilkerson and AguaDocument6 pagesExploring Motivation and Identity in Teachers Wilkerson and AguadarshanNo ratings yet

- Introduction of Research Topics and Current Researches in Insurance PDFDocument44 pagesIntroduction of Research Topics and Current Researches in Insurance PDFdarshanNo ratings yet

- International Sales and Distribution ManagementDocument11 pagesInternational Sales and Distribution ManagementdarshanNo ratings yet

- Introduction To Google GroupsDocument6 pagesIntroduction To Google GroupsdarshanNo ratings yet

- ProductionDocument21 pagesProductiondarshanNo ratings yet

- Balancesheet of CiplaDocument4 pagesBalancesheet of CipladarshanNo ratings yet

- Google Sheets TutorialDocument9 pagesGoogle Sheets TutorialdarshanNo ratings yet

- Production and Growth in BHELDocument3 pagesProduction and Growth in BHELdarshanNo ratings yet

- Monetbil Payment Widget v2.1 enDocument7 pagesMonetbil Payment Widget v2.1 enDekassNo ratings yet

- The Forum Gazette Vol. 2 No. 23 December 5-19, 1987Document16 pagesThe Forum Gazette Vol. 2 No. 23 December 5-19, 1987SikhDigitalLibraryNo ratings yet

- Complete BPCL AR 2022 23 - English Final 9fc811Document473 pagesComplete BPCL AR 2022 23 - English Final 9fc811Akanksha GoelNo ratings yet

- Criteria For RESEARCHDocument8 pagesCriteria For RESEARCHRalph Anthony ApostolNo ratings yet

- Lucy Wang Signature Cocktail List: 1. Passion Martini (Old Card)Document5 pagesLucy Wang Signature Cocktail List: 1. Passion Martini (Old Card)Daca KloseNo ratings yet

- Corti Et Al., 2021Document38 pagesCorti Et Al., 2021LunaNo ratings yet

- MAY-2006 International Business Paper - Mumbai UniversityDocument2 pagesMAY-2006 International Business Paper - Mumbai UniversityMAHENDRA SHIVAJI DHENAKNo ratings yet

- Motivation and Emotion FinalDocument4 pagesMotivation and Emotion Finalapi-644942653No ratings yet

- FOL Predicate LogicDocument23 pagesFOL Predicate LogicDaniel Bido RasaNo ratings yet

- GPAODocument2 pagesGPAOZakariaChardoudiNo ratings yet

- Polisomnografí A Dinamica No Dise.: Club de Revistas Julián David Cáceres O. OtorrinolaringologíaDocument25 pagesPolisomnografí A Dinamica No Dise.: Club de Revistas Julián David Cáceres O. OtorrinolaringologíaDavid CáceresNo ratings yet

- Principles of DisplaysDocument2 pagesPrinciples of DisplaysShamanthakNo ratings yet

- Second Year Memo DownloadDocument2 pagesSecond Year Memo DownloadMudiraj gari AbbaiNo ratings yet

- TOPIC - 1 - Intro To Tourism PDFDocument16 pagesTOPIC - 1 - Intro To Tourism PDFdevvy anneNo ratings yet

- MagnitismDocument3 pagesMagnitismapi-289032603No ratings yet

- Puberty and The Tanner StagesDocument2 pagesPuberty and The Tanner StagesPramedicaPerdanaPutraNo ratings yet

- History Project Reforms of Lord William Bentinck: Submitted By: Under The Guidelines ofDocument22 pagesHistory Project Reforms of Lord William Bentinck: Submitted By: Under The Guidelines ofshavyNo ratings yet

- M Information Systems 6Th Edition Full ChapterDocument41 pagesM Information Systems 6Th Edition Full Chapterkathy.morrow289100% (24)

- Information BulletinDocument1 pageInformation BulletinMahmudur RahmanNo ratings yet

- Haryana Renewable Energy Building Beats Heat with Courtyard DesignDocument18 pagesHaryana Renewable Energy Building Beats Heat with Courtyard DesignAnime SketcherNo ratings yet

- Full Download Ebook Ebook PDF Nanomaterials Based Coatings Fundamentals and Applications PDFDocument51 pagesFull Download Ebook Ebook PDF Nanomaterials Based Coatings Fundamentals and Applications PDFcarolyn.hutchins983100% (43)

- App Inventor + Iot: Setting Up Your Arduino: Can Close It Once You Open The Aim-For-Things-Arduino101 File.)Document7 pagesApp Inventor + Iot: Setting Up Your Arduino: Can Close It Once You Open The Aim-For-Things-Arduino101 File.)Alex GuzNo ratings yet

- Study Habits Guide for Busy StudentsDocument18 pagesStudy Habits Guide for Busy StudentsJoel Alejandro Castro CasaresNo ratings yet

- Kenneth L. Campbell - The History of Britain and IrelandDocument505 pagesKenneth L. Campbell - The History of Britain and IrelandKseniaNo ratings yet