Professional Documents

Culture Documents

Avenue Report F2019

Uploaded by

William HarrisCopyright

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAvenue Report F2019

Uploaded by

William Harrisavenue report March 2019

Top Avenues 2018 WEST SIDE RETAINS LEAD ON CITY’S LARGEST

# Ave/Street Deals SF

OFFICE LEASES, EAST SIDE REBOUNDS

1 Park Ave 10 3.27m

2 Lexington Ave 7 2.10m OFFICE DEMAND IN 2018 REMAINED highest enth. In 2018, four leases were completed

on the City’s West Side, which accounted on Church Street totaling 1.03 million square

3 Eighth Ave 3 1.79m for 46% of the largest office leases in Man- feet. Ninth Avenue ranked sixth, with three

hattan, according to an analysis of the top transactions totaling 1.09 million square feet.

4 Broadway 6 1.24m 50 Manhattan office leases in 2018 compiled Madison Avenue moved up two spots from

by CoStar Inc. last year to eighth, with four leases totaling

5 Sixth Ave

5 1.20m

1.01 million square feet. Tenth Avenue,

Deal volume on the West Side, north of Ca-

6 Ninth Ave

3 1.09m where Pfizer leased 798,278 square feet at a

nal Street, remained strong for the second

new office development, ranked ninth. Sev-

straight year, but experienced a decline

7 Church St 4 1.03m enth Avenue ranked 10th, with four leases

from 58% in the prior year.

totaling 680,000 square feet.

8 Madison Ave 4 1.01m On the flip side, office leasing rebounded on

CoStar released its data February 18, cov-

the East Side last year, accounting for 36%

9 Tenth Ave 1 798k of the city’s largest office leases in 2018, up

ering the 50 largest leases in Manhattan

throughout 2018. Of the 50 largest leases, 49

10 Seventh Ave 4 680k from 20% the prior year.

were completed south of Central Park, with

While the West Side of Manhattan was the one lease for 136,818 square feet to Charter

most active, with six of the top 10 streets Communications completed in Harlem.

in 2018, it was two East Side avenues that

The cutoff transaction size to make the

claimed the most deals overall.

largest leases list, on a square footage basis,

Park Avenue, including Park Avenue South, was 109,656 square feet in 2018, compared

led all avenues or streets in Mahattan with to 107,440 square feet in 2017. The largest

10 of the largest leases in 2018, for a total of lease in 2018 was to Deutsche Bank, for 1.12

nearly 3.3 million square feet. Lexington Av- million square feet at 1 Columbus Circle.

enue, which shares several buildings with Park

In 2018, new leases continued to outpace

Avenue that border both avenues, ranked

renewals or expansions, comprising 34 of the

second. Seven leases were completed on

50 largest leases, up from 30 and 29 in the

Lexington Avenue totaling 2.1 million square

prior two years. In addition, in 2018, 13 leases

feet.

involved lease renewals or renewals and

Eighth Avenue, Broadway and Sixth Avenue expansions, compared to 20 leases in 2017.

rounded out the top five locations in 2018, An additional three leases were expansions

with 1.79 million, 1.24 million and 1.2 million in 2018.

square feet leased, respectively.

Among Manhattan’s 50 largest deals, The

Overall, Midtown Manhattan repeated as Related Cos. completed the most by square

the most active submarket, claiming 32 of the footage, with two leases totaling 1.25 million

50 largest leases, or nearly two-thirds of the square feet.

largest tenants. In 2017, Midtown accounted

for 34 of the largest leases. The most active building for leasing in 2018,

by square footage leased, was 1 Colum-

Demand for Midtown South locations rose

bus Circle, where Related, GIC Real Estate

substantially year-over-year, with the sub-

Avenue Report is published

and ADIA leased 1.12 million square feet to

market capturing nine leases, or 18% of the

by The Avenue of the Americas Deutsche Bank.

largest leases, up from five leases in the prior

Association, based on an analysis year. Downtown Manhattan attracted eight The most active building by volume of leases

of the 50 largest office leases in of the largest leases, or 16%, down from 11 completed, was 1271 Avenue of the Amer-

Manhattan in consecutive years, leases in the prior year. icas, where Rockefeller Group completed

as compiled by CoStar Inc. three new leases with Latham & Watkins,

One Downtown Manhattan location,

Bessemer Trust Company and Blank Rome,

For more information, Church Street, which borders the new World

for approximately 784,000 square feet.

contact Sarah Berman, Trade Center, made the top 10 for the third

sberman@bermangrp.com. consecutive year, rising one spot to sev-

AVENUE REPORT 2018

Top 10 Avenues 2018 Top 10 Avenues 2017

Rank Avenue/Street # of Deals SF Rank Avenue/Street # of Deals SF

1 Park Ave 10 3.27 million 1 Sixth Avenue 10 3.27 million

2 Lexington Ave 7 2.10 million 2 Tenth Avenue 4 1.66 million

3 Eighth Ave 3 1.79 million 3 Seventh Ave. 6 1.65 million

4 Broadway 6 1.24 million 4 Liberty Street 5 1.43 million

5 Sixth Ave 5 1.2 million 5 Broadway 5 1.14 million

6 Ninth Ave 3 1.09 million 6 Ninth Avenue 3 1.07 million

7 Church St 4 1.03 million 7 Fifth Avenue 3 981,036

8 Madison Ave 4 1.01 million 8 Church Street 3 903,141

9 Tenth Ave 1 798,278 9 Lexington Ave. 4 860,924

10 Seventh Ave 4 680,323 10 Madison Ave. 3 639,206

Overall Leasing Activity by Deal Volume*

Total Number of Leases Total Volume of Leases (square feet)

Submarket 2018 2017 2018 2017

Midtown 32 34 9.4 million 10.2 million

Midtown South 9 5 2.1 million 937,651

Downtown 8 11 1.9 million 3.0 million

*Including all lease types, new leases, renewals, expansions. Sample size is the 50 largest Manhattan office leases in consecutive years. One transaction was

outside these neighborhood boundaries in 2018, bringing the total deal sample in 2018 to 49.

Overall New Leasing Activity by Deal Volume**

Total Number of New Leases Total Volume of New Leases (square feet in millions)

Submarket 2018 2017 2018 2017

Midtown 19 18 5.6 million 5.6 million

Midtown South 8 4 1.9 million 587,874

Downtown 6 8 1.3 million 2.1 million

**Including new leases only, excluding renewals, expansions. Sample size is the 33 largest new office leases in Midtown, Midtown South and Downtown in 2018

and 30 in 2017. Note: there were 34 new leases among the 50 largest office leases in 2018, with one outside these boundaries (Harlem).

Most Active Buildings***

Rank Property Owner Deal Volume Total Square Footage

1 1271 Sixth Ave Rockefeller Group 3 784,176

2 277 Park Ave Stahl Real Estate 2 1.12 million

3 3 World Trade Center Silverstein Properties 2 320,310

4 1 Vanderbilt SL Green Realty 2 251,519

***Includes only buildings that completed more than one of the 50 largest transactions in 2018.

2018 Top Manhattan Owners by Overall Leasing Activity† 2018 Top Manhattan Owners by New Leasing Activity††

Rank

Owner SF Volume Rank Owner SF Volume

1 The Related Cos. 2 1.25 million 1 The Related Cos. 2 1.25 million

2 Tishman Speyer 3 1.23 million 2 GIC Real Estate/ADIA

1 1.12 million

3 GIC Real Estate/ADIA 1 1.12 million 3 Tishman Speyer 1 798,278

4 Stahl Real Estate Co.

2 1.12 million 4 Rockefeller Group 3 784,176

5 Boston Properties 4 993,198 5 RXR Realty 2 561,571

6 RXR Realty 3 832,104 6 Boston Properties 2 447,910

7 Rockefeller Group 3 784,176 7 Clarion Partners 1 417,158

8 Global Holdings 3 732,880 8 TF Cornerstone 1 362,658

9 Deco Towers Associates

1 521,374 9 Brookfield 1 324,658

10 Jack Resnick & Sons 2 494,492 10 Vornado Realty Trust

1 321,181

††Including new leases only, excluding renewals, expansions. Sample is the 34

†Including all lease types, new leases, renewals, expansions. Sample is the 50 largest new office leases from among the 50 largest office leases in Manhat-

largest Manhattan office leases in 2018. tan in 2018.

Methodology: Transactions are mapped according to their location along major avenues or streets in Manhattan. If a property occupies street frontage along

more than one major avenue or street, more than one avenue or street will receive credit for individual leases. If a property is mid-block between two avenues,

the avenue closest to the property is credited. If closest proximity cannot clearly be determined, more than one avenue or street may be credited.

Sources: CoStar Inc. (as published in Crain’s New York Business Feb. 18, 2019 and Feb. 26, 2018); Avenue of the Americas Association.

You might also like

- Huntington Club Redevelopment RFPDocument76 pagesHuntington Club Redevelopment RFPmjneibauerNo ratings yet

- Nyc ZonesDocument2 pagesNyc ZonesSean Ennis60% (5)

- 2023 Fast 500 Winners List v1.1Document16 pages2023 Fast 500 Winners List v1.1William HarrisNo ratings yet

- La Vista Association, Inc., vs. Court of AppealsDocument2 pagesLa Vista Association, Inc., vs. Court of AppealsSALMAN JOHAYR100% (1)

- Q1 2023 AcquisitionsDocument28 pagesQ1 2023 AcquisitionsWilliam HarrisNo ratings yet

- La Vista Association v. CA Et Al. - DigestDocument2 pagesLa Vista Association v. CA Et Al. - DigestKarlo DialogoNo ratings yet

- City Limits Magazine, June/July 1982 IssueDocument36 pagesCity Limits Magazine, June/July 1982 IssueCity Limits (New York)100% (1)

- Mega Projects in New York London and AmsterdamDocument18 pagesMega Projects in New York London and Amsterdam1mirafloresNo ratings yet

- For Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 EmailDocument4 pagesFor Immediate Release (4 Pages) Contact: Monday July 8, 2013 James Delmonte (212) 729-6973 EmailAnonymous Feglbx5No ratings yet

- Manhattan Monthly Snapshot - Oct 2021Document2 pagesManhattan Monthly Snapshot - Oct 2021Kevin ParkerNo ratings yet

- COpostings 013012Document1 pageCOpostings 013012NewYorkObserverNo ratings yet

- Drop in Leasing Volume While Asking Rents Reach New Record: News ReleaseDocument5 pagesDrop in Leasing Volume While Asking Rents Reach New Record: News ReleaseAnonymous 28PDvu8No ratings yet

- NY Highlights Q2 2011 JLLDocument1 pageNY Highlights Q2 2011 JLLAnonymous Feglbx5No ratings yet

- Q3-2017 Greenville Office Market ReportDocument4 pagesQ3-2017 Greenville Office Market ReportMike DoddsNo ratings yet

- Manhattan Companies Copy 2Document8 pagesManhattan Companies Copy 2Kirat SinghNo ratings yet

- 1095 Avenue of The Americas - NYT - 10.10.08Document3 pages1095 Avenue of The Americas - NYT - 10.10.08stc2104No ratings yet

- Year-End Review: Ukraine March, 2018Document19 pagesYear-End Review: Ukraine March, 2018mdshoppNo ratings yet

- Commercial Power 2013Document103 pagesCommercial Power 2013NewYorkObserverNo ratings yet

- No Frills Plaza DecisionDocument24 pagesNo Frills Plaza DecisionBrad PritchardNo ratings yet

- Anatomy of A City DealDocument6 pagesAnatomy of A City DealFrançois MorinNo ratings yet

- With $240 Million Deal, Floodgates Open For Air Rights in Midtown East - The New York TimesDocument4 pagesWith $240 Million Deal, Floodgates Open For Air Rights in Midtown East - The New York Timesal_crespoNo ratings yet

- Zoning and The Economic Geography of CitiesDocument20 pagesZoning and The Economic Geography of CitiesRodolfoMorganiNo ratings yet

- 2023 Midyear BigBox ReportDocument68 pages2023 Midyear BigBox ReportzhaoyynNo ratings yet

- City Office Market Watch: City Showed Significant Rental Growth During 2019 As A Result of Strong Take-Up and Low SupplyDocument3 pagesCity Office Market Watch: City Showed Significant Rental Growth During 2019 As A Result of Strong Take-Up and Low SupplytruefireNo ratings yet

- Council Committee 8 31 16Document8 pagesCouncil Committee 8 31 16Robin OdaNo ratings yet

- Final Manhattan B.P. Recommendation Re Nos C 170358 ZMM Et Al - East Harlem RezoningDocument27 pagesFinal Manhattan B.P. Recommendation Re Nos C 170358 ZMM Et Al - East Harlem RezoningGale A BrewerNo ratings yet

- City Limits Magazine, October 1981 IssueDocument28 pagesCity Limits Magazine, October 1981 IssueCity Limits (New York)No ratings yet

- City Limits Magazine, August/September 1982 IssueDocument36 pagesCity Limits Magazine, August/September 1982 IssueCity Limits (New York)No ratings yet

- HERMAN MILLER, INC., Plaintiff-Appellee-Cross-Appellant, v. Thom Rock Realty Company, L.P., Defendant-Appellant-Cross-AppelleeDocument10 pagesHERMAN MILLER, INC., Plaintiff-Appellee-Cross-Appellant, v. Thom Rock Realty Company, L.P., Defendant-Appellant-Cross-AppelleeScribd Government DocsNo ratings yet

- Planning Division Update For Sep-Oct 2018Document34 pagesPlanning Division Update For Sep-Oct 2018Connor RichardsNo ratings yet

- MPC Timeline For Coordination With Texas Historical Commission (THC)Document2 pagesMPC Timeline For Coordination With Texas Historical Commission (THC)Jessica GonzalezNo ratings yet

- From: Businessworld Online SM Still Interested' in P123-B Dike ProjectDocument2 pagesFrom: Businessworld Online SM Still Interested' in P123-B Dike ProjectEmaleth LasherNo ratings yet

- Land Use Proposal - AllDocument3 pagesLand Use Proposal - Allsunnavdeep1992No ratings yet

- Retained As Exclusive Broker To Sell Two Building Portfolio in The Bronx, NY For $14,020,000.Document3 pagesRetained As Exclusive Broker To Sell Two Building Portfolio in The Bronx, NY For $14,020,000.PR.comNo ratings yet

- Swing Crane Agreement & Tieback Agreement With Empire Communities Ltd. at Humber Bay Park East (August 2015)Document12 pagesSwing Crane Agreement & Tieback Agreement With Empire Communities Ltd. at Humber Bay Park East (August 2015)T.O. Nature & DevelopmentNo ratings yet

- Monthly Reports For June 2018 08-06-18Document50 pagesMonthly Reports For June 2018 08-06-18L. A. PatersonNo ratings yet

- Cin 2018q2 RetailDocument3 pagesCin 2018q2 RetailDewi AmeliaNo ratings yet

- Fortnightly News Summary: Real Estate News DigestDocument3 pagesFortnightly News Summary: Real Estate News Digestgladtan0511No ratings yet

- Huntington v. Huntington Branch, NAACP, 488 U.S. 15 (1989)Document3 pagesHuntington v. Huntington Branch, NAACP, 488 U.S. 15 (1989)Scribd Government DocsNo ratings yet

- PhiladelphiaDocument4 pagesPhiladelphiaAnonymous Feglbx5No ratings yet

- The Arts AnalysisDocument11 pagesThe Arts AnalysisNone None NoneNo ratings yet

- 3Q18 Atlanta LARDocument4 pages3Q18 Atlanta LARAnonymous Feglbx5No ratings yet

- Gilchrist v. Interborough Rapid Transit Co., 279 U.S. 159 (1929)Document17 pagesGilchrist v. Interborough Rapid Transit Co., 279 U.S. 159 (1929)Scribd Government DocsNo ratings yet

- The Dynamics of Land Use Change and Tenure Systems in Sub-Saharan CitiesDocument11 pagesThe Dynamics of Land Use Change and Tenure Systems in Sub-Saharan CitiesChloe AdlerNo ratings yet

- Privatizing Roads: 1 An "Old" New Approach To Infrastructure ProvisionDocument10 pagesPrivatizing Roads: 1 An "Old" New Approach To Infrastructure Provisionfyg500No ratings yet

- Apartment Developers - Special - Report - 0Document10 pagesApartment Developers - Special - Report - 0YC TeoNo ratings yet

- Uk Ind 4q18Document1 pageUk Ind 4q18Nguyen SKThaiNo ratings yet

- Lawsuit Against The City Over Magic CityDocument51 pagesLawsuit Against The City Over Magic Cityal_crespoNo ratings yet

- Manhattan Americas MarketBeat Office Q42019Document4 pagesManhattan Americas MarketBeat Office Q42019Zara SabriNo ratings yet

- 044 BF v. City Mayor 515 SCRA 1 PDFDocument9 pages044 BF v. City Mayor 515 SCRA 1 PDFJNo ratings yet

- One-Year Extension Town & Country Gardening 09-10-18Document4 pagesOne-Year Extension Town & Country Gardening 09-10-18L. A. PatersonNo ratings yet

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonNo ratings yet

- BAMODocument4 pagesBAMOKevin ParkerNo ratings yet

- HoustonDocument1 pageHoustonKevin ParkerNo ratings yet

- City Council Special Meeting Minutes August 6, 2018 09-10-18Document12 pagesCity Council Special Meeting Minutes August 6, 2018 09-10-18L. A. PatersonNo ratings yet

- Miami PDFDocument5 pagesMiami PDFAnonymous Feglbx5No ratings yet

- Urban EconDocument4 pagesUrban EconArmstrong BinyanyaNo ratings yet

- 1CO2000A1106Document1 page1CO2000A1106Jotham SederstromNo ratings yet

- City of Dallas v. Trinity East Energy, LLC, No. 05-20-00550-CV (Tex. App. Aug. 1, 2022)Document28 pagesCity of Dallas v. Trinity East Energy, LLC, No. 05-20-00550-CV (Tex. App. Aug. 1, 2022)RHTNo ratings yet

- US Office MarketBeat Q417Document11 pagesUS Office MarketBeat Q417ranjithNo ratings yet

- Via Hand Delivery & Electronic Submittal: 200 S. Biscayne Boulevard Suite 300, Miami, FL 33131Document11 pagesVia Hand Delivery & Electronic Submittal: 200 S. Biscayne Boulevard Suite 300, Miami, FL 33131the next miamiNo ratings yet

- 2023 ASI Impact ReportDocument43 pages2023 ASI Impact ReportWilliam HarrisNo ratings yet

- April 2024 CPRA Board Simoneaux 20240415 CompressedDocument37 pagesApril 2024 CPRA Board Simoneaux 20240415 CompressedWilliam HarrisNo ratings yet

- Development: Washington, DCDocument96 pagesDevelopment: Washington, DCWilliam HarrisNo ratings yet

- Market Report 2023 Q1 Full ReportDocument17 pagesMarket Report 2023 Q1 Full ReportKevin ParkerNo ratings yet

- QR 3 - FinalDocument20 pagesQR 3 - FinalWilliam HarrisNo ratings yet

- 2022 Abell Foundation Short Form Report 8yrDocument36 pages2022 Abell Foundation Short Form Report 8yrWilliam HarrisNo ratings yet

- Atlanta 2022 Multifamily Investment Forecast ReportDocument1 pageAtlanta 2022 Multifamily Investment Forecast ReportWilliam HarrisNo ratings yet

- Industry Update H2 2021 in Review: Fairmount PartnersDocument13 pagesIndustry Update H2 2021 in Review: Fairmount PartnersWilliam HarrisNo ratings yet

- Pebblebrook Update On Recent Operating TrendsDocument10 pagesPebblebrook Update On Recent Operating TrendsWilliam HarrisNo ratings yet

- Copt 2021Document44 pagesCopt 2021William HarrisNo ratings yet

- Regional Surveys of Business ActivityDocument2 pagesRegional Surveys of Business ActivityWilliam HarrisNo ratings yet

- For Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentDocument5 pagesFor Important Information, Please See The Important Disclosures Beginning On Page 2 of This DocumentWilliam HarrisNo ratings yet

- DSB Q3Document8 pagesDSB Q3William HarrisNo ratings yet

- 3Q21 I81 78 Industrial MarketDocument5 pages3Q21 I81 78 Industrial MarketWilliam HarrisNo ratings yet

- FP Pharmaceutical Outsourcing Monitor 08.30.21Document30 pagesFP Pharmaceutical Outsourcing Monitor 08.30.21William HarrisNo ratings yet

- Manhattan RetailDocument9 pagesManhattan RetailWilliam HarrisNo ratings yet

- FP - CTS Report H1.21Document13 pagesFP - CTS Report H1.21William HarrisNo ratings yet

- FP - CTS Report Q3.20Document13 pagesFP - CTS Report Q3.20William HarrisNo ratings yet

- 2020 Q3 Industrial Houston Report ColliersDocument7 pages2020 Q3 Industrial Houston Report ColliersWilliam HarrisNo ratings yet

- TROW Q3 2020 Earnings ReleaseDocument15 pagesTROW Q3 2020 Earnings ReleaseWilliam HarrisNo ratings yet

- Healthcare Technology Mailer v14Document4 pagesHealthcare Technology Mailer v14William HarrisNo ratings yet

- Gun Stocks: Fear Fires Up Investors To Purchase Gun StocksDocument14 pagesGun Stocks: Fear Fires Up Investors To Purchase Gun StocksWilliam HarrisNo ratings yet

- Richmond Office Performance in DownturnsDocument1 pageRichmond Office Performance in DownturnsWilliam HarrisNo ratings yet

- Comms Toolkit For MD Clean Energy Town HallDocument4 pagesComms Toolkit For MD Clean Energy Town HallWilliam HarrisNo ratings yet

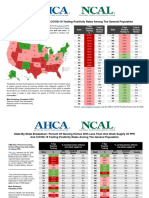

- State-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationDocument2 pagesState-By-State Breakdown: COVID-19 Testing Positivity Rates Among The General PopulationWilliam HarrisNo ratings yet

- Đề 4 PDFDocument6 pagesĐề 4 PDFHưng NguyễnNo ratings yet

- Thcs Khánh Hòa-Hsg 9Document12 pagesThcs Khánh Hòa-Hsg 9Thu Hiền Bùi ThịNo ratings yet

- Top 10 Guide To New York CityDocument106 pagesTop 10 Guide To New York CityAl PenaNo ratings yet

- Guide - Valentine's City of New York (1920) PDFDocument404 pagesGuide - Valentine's City of New York (1920) PDFGuillaume ARKINo ratings yet

- 26948.Đề thi chọn HSGDocument13 pages26948.Đề thi chọn HSGNgân NguyễnNo ratings yet

- Courtyard New York Manhattan/Herald Square: 71 West 35th Street, New York, NY 10001, United StatesDocument3 pagesCourtyard New York Manhattan/Herald Square: 71 West 35th Street, New York, NY 10001, United StatesmonicaNo ratings yet

- Final Revision 26Document21 pagesFinal Revision 26Trang TrangNo ratings yet

- Manhattan Americas MarketBeat Office Q32017Document4 pagesManhattan Americas MarketBeat Office Q32017Josef SzendeNo ratings yet

- Sentences. Write It in Your Answers' PartDocument9 pagesSentences. Write It in Your Answers' Partnguyễn Đình TuấnNo ratings yet

- đề thi hsg tỉnh anh 9 nghệ an 20-21Document18 pagesđề thi hsg tỉnh anh 9 nghệ an 20-21Hoàng Thị Minh AnhNo ratings yet

- ĐỀ 3Document9 pagesĐỀ 3takamikeigo1607No ratings yet

- Route 49 & 49J - Southbound Weekdays Port Authority Bus Terminal & MidtownDocument2 pagesRoute 49 & 49J - Southbound Weekdays Port Authority Bus Terminal & Midtownkushie0No ratings yet

- Papal Visit Street ClosuresDocument4 pagesPapal Visit Street Closures2joncampbellNo ratings yet

- Tiếng Anh - Chính Thức - ThiệpDocument7 pagesTiếng Anh - Chính Thức - ThiệpPhung Thanh ThomNo ratings yet

- English TestDocument15 pagesEnglish TestAlice NguyenNo ratings yet

- Thời gian làm bài 150 phút (bao gồm cả phần nghe) : each answerDocument15 pagesThời gian làm bài 150 phút (bao gồm cả phần nghe) : each answerThúy Lê Thị LệNo ratings yet

- United States Skyline Review 2013Document60 pagesUnited States Skyline Review 2013Anonymous Feglbx5No ratings yet

- đề thi thử TN ninh bình 2023Document21 pagesđề thi thử TN ninh bình 2023Long NguyênNo ratings yet

- 04 Sidewalk Cafe RegulationDocument19 pages04 Sidewalk Cafe RegulationHerwan HardianNo ratings yet

- TDG Spring13AccessoriesHandbagsDocument84 pagesTDG Spring13AccessoriesHandbagsdonegergroupNo ratings yet

- De Thi Thu TN Tieng Anh 2023 So GD Ninh BinhDocument30 pagesDe Thi Thu TN Tieng Anh 2023 So GD Ninh BinhPhan Lê Phương QuyênNo ratings yet

- Tong Tap de ThiDocument16 pagesTong Tap de ThiVăn Ngọc LêNo ratings yet

- Q2 2021 Manhattan Sublease Market OverviewDocument29 pagesQ2 2021 Manhattan Sublease Market OverviewKevin ParkerNo ratings yet

- De Thi Thu TN Tieng Anh 2023 So GD Ninh BinhDocument33 pagesDe Thi Thu TN Tieng Anh 2023 So GD Ninh Binhhoangduy181126No ratings yet

- All. Reading Passages For Pre-EAP InstructionDocument10 pagesAll. Reading Passages For Pre-EAP InstructionstevieNo ratings yet

- 55. ĐỀ THI THỬ TN THPT 2023 - MÔN TIẾNG ANH - Sở giáo dục và đào tạo Ninh Bình (Mã đề Chẵn) (Bản word có lời giải chi tiết) -hghoWlZgm-1686675129Document33 pages55. ĐỀ THI THỬ TN THPT 2023 - MÔN TIẾNG ANH - Sở giáo dục và đào tạo Ninh Bình (Mã đề Chẵn) (Bản word có lời giải chi tiết) -hghoWlZgm-1686675129dtth045No ratings yet

- (Lib24.vn) De-Thi-Chon-Hoc-Sinh-Gioi-Cap-Tinh-Mon-Tieng-Anh-Lop-10-So-Gd-Dt-Hai-Duong-Nam-Hoc-2015-2016-Co-Dap-AnDocument12 pages(Lib24.vn) De-Thi-Chon-Hoc-Sinh-Gioi-Cap-Tinh-Mon-Tieng-Anh-Lop-10-So-Gd-Dt-Hai-Duong-Nam-Hoc-2015-2016-Co-Dap-AnHoàng Đức Phú (Bếu)No ratings yet

- (123doc) - De-Thi-Chon-Hoc-Sinh-Gioi-Cap-Tinh-Mon-Tieng-Anh-Lop-10-So-Gd-Dt-Hai-Duong-Nam-Hoc-2015-2016Document12 pages(123doc) - De-Thi-Chon-Hoc-Sinh-Gioi-Cap-Tinh-Mon-Tieng-Anh-Lop-10-So-Gd-Dt-Hai-Duong-Nam-Hoc-2015-2016Thao AnhNo ratings yet