Professional Documents

Culture Documents

Damon Corporation machine replacement analysis

Uploaded by

haiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Damon Corporation machine replacement analysis

Uploaded by

haiCopyright:

Available Formats

Damon Corporation, a sports equipment manufacturer, has a machine currently in use that was originally purchased 3 years ag

The firm depreciates the machine under MACRS using a 5-year recovery period.

Once removal and clenaup costs are taken into consideration, the expected net selling price for the present machine will be $70

Damon can buy a new machine for a net price of $160,000 (including installation costs of $15,000).

The proposed machine will be depreciated under MACRS using a 5-year recovery period.

It the firm acquires the new machine, its workign capital needs will change: Accounts receivable will increase $15,000, inventor

Earnings before depreciation, interest, and taxes (EBDIT) for the present machine are expected to be $95,000 for each of the s

For the proposed machine, the expected EBDIT for each OF THE NEXT 5 YEARS ARE $105,000, $110,000, $120,000, $120,0

The corporate tax rate (T) for the firm is 40%.

See Table 4.2 on page 120 for the applicable MACRS depreciation percentages.

Damon expects to be able to liquidate the proposed machine at the end of its 5-year usable life for $24,000 (after paying remov

The present machine is expected to net $8,000 upon liquidation at the end of the same period.

Damon expects to recover its net working capital investment upon termination of the project.

The firm is subject to a tax rate of 40%.

TO DO

Use the Answer Sheet to answer the following:

a. initial investment

b. operating cash flows for both the prposed and the present machine

c. terminal cash flow associated with the project.

s originally purchased 3 years ago for $120,000.

r the present machine will be $70,000

e will increase $15,000, inventory will increase $19,000, and accounts payable will increase $16,000.

d to be $95,000 for each of the successive 5 years.

000, $110,000, $120,000, $120,000, $120,000, $120,000, respectively.

for $24,000 (after paying removable and cleanup costs).

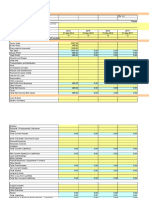

The Damon Corporation

Calculation of the Initial Investment

Installed cost of proposed machine

Cost of proposed machine

plus: Installation costs

Total installed cost - proposed $ -

(depreciable value)

After-tax proceeds from sale of present machine

Proceeds from sale of present machine

less: Tax on sale of present machine 0

Total after-tax proceeds - present $ -

Change in net working Capital 0

Initial investment $ -

Tax on sale of old machine Change in Working Capital

cost of old machine Increase in receivables

MACRS increase in inventory

year 1 0 increase in payables

year 2 0 Net working capital $ -

year 3 0

Book Value $ -

Sale price of old machine $ -

Gain on sale $ -

Tax rate

Tax Expense $ -

Depreciation Expense for Proposed and Present

Machines for the Damon Corporation

Year Cost Applicable MACRS depreciation Depreciation

With proposed machine

1 $ - $0

2 0 0

3 0 0

4 0 0

5 0 0

6 0 0

Total 0% $ -

With present machine

1 $ - $ -

2 0 0

3 0 0

4 0

5 0

6 0

Total $ -

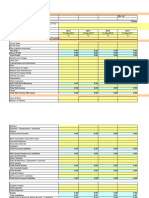

Calculation of Operating Cash Inflows for Damon Corporation

Proposed and Present Machines

Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

With proposed

Earnings before machine

depr. and int.

and taxes $ -

Depreciation 0 0 0 0 0 0

Earnings before interest and ta $ - $ - $ - $ - $ - $ -

Taxes 0% 0 0 0 0 0 0

Net operating profit after taxes $ - $ - $ - $ - $ - $ -

Depreciation 0 0 0 0 0 0

Operating cash inflows $ - $ - $ - $ - $ - $ -

With present machine

Earnings before depr. and int.

and taxes $ -

Depreciation 0 0 0 0 0 0

Earnings before interest and

taxes $ - $ - $ - $ - $ - $ -

Taxes 0% 0 0 0 0 0 0

Net operating profit after taxes $ - $ - $ - $ - $ - $ -

Depreciation 0 0 0 0 0 0

Operating cash inflows $ - $ - $ - $ - $ - $ -

Calculation of the Terminal Cash Flow

After-tax proceeds from sale of proposed machine

Proceeds from sale of proposed machine

Book value as of end of year 5 0

Net gain $ -

Tax on gain 0% 0

Total after-tax proceeds - proposed $ -

After-tax proceeds from sale of present machine

Proceeds from sale of present machine

Book value as of end of year 5 0

Net gain $ -

Tax on gain 0% 0

Total after-tax proceeds - present $ -

Change in net working capital $ -

Terminal Cash Flow $ -

You might also like

- Cash Flow HeeraDocument31 pagesCash Flow HeeraChristian AgultoNo ratings yet

- CashflowDocument2 pagesCashflowElgaNurhikmahNo ratings yet

- Financial Plan TemplateDocument4 pagesFinancial Plan TemplateHalyna NguyenNo ratings yet

- Building A Dream Spreadsheet Model Business Plan Schedule DescriptionDocument11 pagesBuilding A Dream Spreadsheet Model Business Plan Schedule DescriptionDodyNo ratings yet

- Financial Projections Super1Document31 pagesFinancial Projections Super1Caren Perez PeraltaNo ratings yet

- Basic Balance SheetDocument3 pagesBasic Balance SheetJean Marc LouisNo ratings yet

- Bank of India Fund BasedDocument33 pagesBank of India Fund Basedhariram v choudharyNo ratings yet

- Financial Projection Model for Your Business Name HereDocument70 pagesFinancial Projection Model for Your Business Name HerenabayeelNo ratings yet

- QuotesDocument1 pageQuotesJohn Carlos Montes RodriguezNo ratings yet

- Assignment 1 - 2021 - 2022Document4 pagesAssignment 1 - 2021 - 2022Assya El MoukademNo ratings yet

- Accounting Books & WorksheetDocument11 pagesAccounting Books & WorksheetWiSeVirGoNo ratings yet

- Premium Calculator: Select PeriodDocument5 pagesPremium Calculator: Select PeriodDeep DkNo ratings yet

- Business Plan 52536Document9 pagesBusiness Plan 52536feri marrNo ratings yet

- Business Administration 636: Managerial Economics Homework Set #2 Dr. Adel ZaghaDocument4 pagesBusiness Administration 636: Managerial Economics Homework Set #2 Dr. Adel ZaghaDana TahboubNo ratings yet

- Initial Investment: Initial Investment Means Cash Outflow For A Proposed Project (Machine) atDocument4 pagesInitial Investment: Initial Investment Means Cash Outflow For A Proposed Project (Machine) atRahat KhanNo ratings yet

- Ic Cash Flow Cfroi 9436Document3 pagesIc Cash Flow Cfroi 9436Tom LeeNo ratings yet

- Investment Valuation Model TemplateDocument37 pagesInvestment Valuation Model TemplateousmaneNo ratings yet

- R & D Converter: InputsDocument6 pagesR & D Converter: InputsKarthi KeyanNo ratings yet

- Premium calculator SADocument3 pagesPremium calculator SAEsteban HernándezNo ratings yet

- Template For Financial ProjectionDocument32 pagesTemplate For Financial ProjectionRussel Jess HeyranaNo ratings yet

- Business Plan Workbook: About This TemplateDocument15 pagesBusiness Plan Workbook: About This Templateavinashr139No ratings yet

- GensetDocument5 pagesGensetdhkn9t8btgNo ratings yet

- McKinsey Valuation DCF ModelDocument18 pagesMcKinsey Valuation DCF Modelnsksharma46% (13)

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationRajkumar NateshanNo ratings yet

- Instructions: Business Startup Cash Flow TemplateDocument14 pagesInstructions: Business Startup Cash Flow TemplatedlcpakNo ratings yet

- Investment ValuationDocument16 pagesInvestment ValuationJaco CrouseNo ratings yet

- FIN 500 Extra Problems Fall 20-21Document4 pagesFIN 500 Extra Problems Fall 20-21saraNo ratings yet

- IPO Valuation 3E TemplateDocument3 pagesIPO Valuation 3E TemplateLohith Kumar ReddyNo ratings yet

- Business Valuations: Net Asset Value (Nav)Document9 pagesBusiness Valuations: Net Asset Value (Nav)Artwell ZuluNo ratings yet

- Income Statement - QuarterlyDocument3 pagesIncome Statement - QuarterlyNu SNo ratings yet

- LCCA Spread SheetDocument19 pagesLCCA Spread SheetMuhammad ImranNo ratings yet

- Income Statement V 1 1Document7 pagesIncome Statement V 1 1Akbar AliNo ratings yet

- FRA TemplateDocument14 pagesFRA TemplatevidyaNo ratings yet

- Template 2Document17 pagesTemplate 2vidyaNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With Calculationkhanjishan113No ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationMithilesh pandeyNo ratings yet

- CMA Data in Excel FormatDocument18 pagesCMA Data in Excel FormatKaushik Chattoraj0% (1)

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With Calculationchirag desaiNo ratings yet

- Financial Projections and Key RatiosDocument18 pagesFinancial Projections and Key RatiosRajesh BogulNo ratings yet

- Copy of Cma For Less Than 1 Crore With CalculationDocument18 pagesCopy of Cma For Less Than 1 Crore With Calculationshukla.aj.0007No ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationArun KumarNo ratings yet

- Financial Projections and Key RatiosDocument18 pagesFinancial Projections and Key RatiosSushil GabaNo ratings yet

- Cma For Less Than 1 Crore With CalculationDocument18 pagesCma For Less Than 1 Crore With CalculationUser 1109No ratings yet

- Financial Projections and Key RatiosDocument18 pagesFinancial Projections and Key RatiosRahulKumarNo ratings yet

- Five Year Plan (Service Industry) Model Inputs and Investor ScenarioDocument4 pagesFive Year Plan (Service Industry) Model Inputs and Investor Scenariomary34d100% (1)

- Case Study - Discounted Cash FlowDocument14 pagesCase Study - Discounted Cash FlowSalman AhmadNo ratings yet

- Comparative Income Statement AnalysisDocument2 pagesComparative Income Statement AnalysishilarytevesNo ratings yet

- Score Financial Projection Template - 1Document32 pagesScore Financial Projection Template - 1Nandan MaluNo ratings yet

- AW Monthly Sales Report v0Document1 pageAW Monthly Sales Report v0eurostarNo ratings yet

- UGBA 120AB Chapter 16 With Solutions Spring 2020 For ClassDocument144 pagesUGBA 120AB Chapter 16 With Solutions Spring 2020 For Classyadi lauNo ratings yet

- Financial Statement AnalysisDocument26 pagesFinancial Statement AnalysisRam PhalNo ratings yet

- How To Use This Excel FileDocument27 pagesHow To Use This Excel FileKatoNo ratings yet

- Balance Sheet and Income StatementDocument7 pagesBalance Sheet and Income StatementAlexNo ratings yet

- accountDocument2 pagesaccountvetijeb369No ratings yet

- BusinessPlan 2022 01 31Document13 pagesBusinessPlan 2022 01 31Komal GuptaNo ratings yet

- s0 8000000 s1 9200000 A0 7000000 l0 900000 M 6% Por 40%: FIN 3085 Problem: 13-9Document9 pagess0 8000000 s1 9200000 A0 7000000 l0 900000 M 6% Por 40%: FIN 3085 Problem: 13-9safqwfNo ratings yet

- Please Fill in The Following Information: Legal Name Trading Name AddressDocument32 pagesPlease Fill in The Following Information: Legal Name Trading Name AddressvmmultimediaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Cleaner/ Conditioner PurgelDocument2 pagesCleaner/ Conditioner PurgelbehzadNo ratings yet

- Ramadan Lantern Geo V2Document4 pagesRamadan Lantern Geo V2Little MuslimsNo ratings yet

- As 2252.4-2010 Controlled Environments Biological Safety Cabinets Classes I and II - Installation and Use (BSDocument7 pagesAs 2252.4-2010 Controlled Environments Biological Safety Cabinets Classes I and II - Installation and Use (BSSAI Global - APACNo ratings yet

- TDW Pipeline Pigging CatalogDocument135 pagesTDW Pipeline Pigging CatalogShaho Abdulqader Mohamedali100% (1)

- Latur District JUdge-1 - 37-2015Document32 pagesLatur District JUdge-1 - 37-2015mahendra KambleNo ratings yet

- Class 9 Extra Questions on What is Democracy? Why DemocracyDocument13 pagesClass 9 Extra Questions on What is Democracy? Why DemocracyBlaster-brawl starsNo ratings yet

- Labour Laws& Practice PDFDocument568 pagesLabour Laws& Practice PDFmahesh100% (1)

- Guingona v. Gonzales G.R. No. 106971 March 1, 1993Document1 pageGuingona v. Gonzales G.R. No. 106971 March 1, 1993Bernadette SandovalNo ratings yet

- Ds Tata Power Solar Systems Limited 1: Outline AgreementDocument8 pagesDs Tata Power Solar Systems Limited 1: Outline AgreementM Q ASLAMNo ratings yet

- Criminal Attempt: Meaning, Periphery, Position Explained Under The Indian Penal CodeDocument27 pagesCriminal Attempt: Meaning, Periphery, Position Explained Under The Indian Penal CodePrabhash ChandNo ratings yet

- Pop Art: Summer Flip FlopsDocument12 pagesPop Art: Summer Flip FlopssgsoniasgNo ratings yet

- 2.8 Commissioner of Lnternal Revenue vs. Algue, Inc., 158 SCRA 9 (1988)Document10 pages2.8 Commissioner of Lnternal Revenue vs. Algue, Inc., 158 SCRA 9 (1988)Joseph WallaceNo ratings yet

- RKMFiles Study Notes on Criminal Identification and InvestigationDocument168 pagesRKMFiles Study Notes on Criminal Identification and InvestigationTfig Fo EcaepNo ratings yet

- Global Strategy (Indian Equities - On Borrowed Time) 20211112 - 211113 - 201930Document14 pagesGlobal Strategy (Indian Equities - On Borrowed Time) 20211112 - 211113 - 201930Hardik ShahNo ratings yet

- Manifesto: Manifesto of The Awami National PartyDocument13 pagesManifesto: Manifesto of The Awami National PartyonepakistancomNo ratings yet

- Napoleon Edwards Amended Complaint - RedactedDocument13 pagesNapoleon Edwards Amended Complaint - Redactedthe kingfishNo ratings yet

- Dr. Annasaheb G.D. Bendale Memorial 9th National Moot Court CompetitionDocument4 pagesDr. Annasaheb G.D. Bendale Memorial 9th National Moot Court CompetitionvyasdesaiNo ratings yet

- Block Class Action LawsuitDocument53 pagesBlock Class Action LawsuitGMG EditorialNo ratings yet

- War in The Tibet of Old On A Number of Occasions Meant The Military Intervention of Various Mongolian Tribes Into The Internal Affairs of The CountryDocument44 pagesWar in The Tibet of Old On A Number of Occasions Meant The Military Intervention of Various Mongolian Tribes Into The Internal Affairs of The CountryTikkun OlamNo ratings yet

- The Pentagon Wars EssayDocument5 pagesThe Pentagon Wars Essayapi-237096531No ratings yet

- Ontario Municipal Board DecisionDocument38 pagesOntario Municipal Board DecisionToronto StarNo ratings yet

- SC rules on illegitimate children's share in ancestral propertyDocument27 pagesSC rules on illegitimate children's share in ancestral propertyChandraSekaranBmNo ratings yet

- Memorandum of AgreementDocument4 pagesMemorandum of AgreementCavite PrintingNo ratings yet

- RP-new Light DistrictsDocument16 pagesRP-new Light DistrictsShruti VermaNo ratings yet

- WEC13 01 Que 20220111Document32 pagesWEC13 01 Que 20220111Mike JACKSONNo ratings yet

- 44.0 - Traffic Management and Logistics v3.0 EnglishDocument14 pages44.0 - Traffic Management and Logistics v3.0 EnglishEyob Yimer100% (1)

- 2-Doctrine of Arbitrariness and Legislative Action-A Misconceived ApplicationDocument14 pages2-Doctrine of Arbitrariness and Legislative Action-A Misconceived ApplicationShivendu PandeyNo ratings yet

- MC No. 005.22Document5 pagesMC No. 005.22raymund pabilarioNo ratings yet

- Disinvestment Policy of IndiaDocument7 pagesDisinvestment Policy of Indiahusain abbasNo ratings yet

- LWPYA2 Slide Deck Week 1Document38 pagesLWPYA2 Slide Deck Week 1Thowbaan LucasNo ratings yet