Professional Documents

Culture Documents

Tax Lecture VAT

Uploaded by

Rozzane Ann Roma0 ratings0% found this document useful (0 votes)

114 views4 pagesTaxation

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTaxation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

114 views4 pagesTax Lecture VAT

Uploaded by

Rozzane Ann RomaTaxation

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 4

VAT

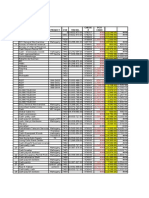

1. LBJ made the following sales during the 12-month period:

Sales, VAT taxable transactions P1,500,000

Sales, VAT zero-rated transactions 400,000

Sales, VAT exempt transactions 100,000

Total P2,000,000

Which of the following statements is correct?

a. LBJ may not register under the VAT system because his sales from VAT taxable transactions

did not exceed P1,919,500.

b. LBJ may not register under the VAT system because his sales from VAT taxable and zero-

rated transactions did not exceed P1,919,500.

c. LBJ is required to register because his total 12-month sales exceeded P1,919,500.

d. None of the foregoing.

2. Which of the following is exempt from VAT?

a. Common carriers transporting passengers by air within the Philippines

b. Common carriers transporting passengers by sea within the Philippines

c. Common carriers transporting passengers by land within the Philippines

d. Common carriers transporting cargoes by air within the Philippines

3. Which statement is correct about value-added tax on goods or properties sold?

a. It is based on gross sales and not on net sales;

b. May be due even if the goods or properties were not actually sold;

c. Does not cover goods exported;

d. It forms part of the selling expense of the trader.

4. For value-added tax purposes, which of the following transactions of a VAT-registered taxpayer may

not be zero-rated?

a. Export sales

b. Foreign currency denominated sales

c. Sale of goods to the Asian Development Bank

d. Sale of goods to an export oriented enterprise

5. A subdivision developer sold five (5) residential house and lots, each to different vendees, for

P3,000,000 per lot, or a total sales of P15,000,000 for the taxable period.

These sales shall be classified as:

a. 12% VAT transactions

b. 0% VAT transactions

c. VAT exempt transactions

d. None of the foregoing

6. CP operated a retail business that had been generating sales not exceeding the threshold for VAT

exempt persons. However, he desires to be registered under the VAT system for the first time in order to

benefit from input tax credits.

What benefit may CP be entitled to once he registers under the VAT system?

a. Tax refund

b. Presumptive input tax credit

c. Transitional input tax credit

d. None of the foregoing

7. What institution is required to deduct and withhold a final VAT of 5% on the purchase of goods or

services subject to VAT?

a. National government or any political subdivision thereof

b. Government-owned or controlled corporations

c. Both (a) and (b)

d. Neither (a) nor (b)

8. In the value-added tax on sale of services, the output tax is computed:

a. On the billings of the month

b. On collections of the month on all billings made

c. On the contract price of contracts completed during the taxable period

d. Only and strictly on labor performed under the contract for services

9. Which statement is wrong?

a. There is a transitional input tax from purchases of goods or properties;

b. There is a transitional input tax from purchases of services;

c. There is a transitional input tax from purchases of materials;

d. There is a transitional input tax from purchases of supplies.

10. Which of the following statements is correct on the inventory balance in the financial statements at

any given date of a VAT registered person?

a. Balance, net of input taxes

b. Balance, inclusive of input taxes

c. Balance on which the transitional input tax is computed annually

d. Balance where the VAT thereon may be calculated by multiplying it by 12%

11. Genson Distribution Inc., a VAT taxpayer, had the following data in a month:

Cash sales P200,000

Open account sales 500,000

Consignment:

0 to 30 days old (on which there were remittances from consignees of P200,000) 600,000

31 to 60 days old 700,000

61 days old and above 900,000

How much is the output tax?

a. P348,000 c. P264,000

b. P216,000 d. P108,000

12. The financial records of Benz Corp., a VAT-registered taxpayer, for the taxable year 2016 disclosed

the following:

Local sales to private entities 1,500,000

Export Sales 500,000

Local sales to government 800,000

How much is the total sales subject to value-added tax?

a. P2,800,000 c. P2,000,000

b. P2,300,000 d. P1,500,000

13. Mantika Corp., a VAT-registered Corp., is a producer of cooking oil from coconut and corn. It had the

following data for the month of January 2017:

Sales, gross of VAT P 784,000

Corn & Coconut, 12-31-16 50,000

Purchases of Corn & Coconut 330,000

Corn & Coconut, 1-31-17 20,000

Purchases from VAT suppliers, VAT included:

Packaging Materials 56,000

Supplies 16,800

The value-added tax payable for the month:

a. P56,060 c. P60,650

b. P54,900 d. P63,000

14. Bunga Inc., a VAT taxpayer, is engage in the business of processing of fruits. Its data on sales and

purchases for the month of August are provided below:

Sales P200,000

Purchases:

Fresh Fruits 30,000

Raw sugarcane 12,000

Tin Can, gross of VAT 12,320

Paper Labels, net of VAT 5,000

Cardboard for boxes, net of VAT 8,000

Freight, gross of VAT (50% still unpaid) 10,080

How much is the value-added tax payable?

a. P20,580 c. P19,380

b. P18,900 d. P20,100

15. Bahay Kubo Inc. is a real estate dealer. Details of its sales during the year showed the following:

Date of sale June 2, 2017

Consideration in the deed of sale P 5,000,000

Fair market value in the assessment rolls 4,800,000

Zonal Value 5,200,000

Schedule of payments:

June 2, 2017 1,000,000

June 2, 2018 2,000,000

June 2, 2019 2,000,000

How much is the output tax to be recognized for the June 2, 2018

payment?

a. P0 c. P249,600

b. P124,800 d. P624,000

16. Assuming that the scheduled payment on June 2, 2017 is P2,000,000, how much is the output tax to

be recognized for the June 2, 2019 payment?

a. P0 c. P249,600

b. P124,800 d. P624,000

17. Mr. Karpentero, a vat-registered building contractor, has the

following data on gross receipts in a month, any tax not included:

From Mr. A, a private property owner, final payment on the contract price, net of 5% agreed

retention fee of P2,850,000

From Mr. B, a payment of 5% retention on the contract price previously made by him P100,000

From Mr. C, for materials used in the construction 500,000

How much is the output tax?

a. P414,000 c. P72,000

b. P342,000 d. P62,000

18. COC Inc., in its first month of operation, and as a VAT taxpayer, purchased various fixed assets.

Purchases of fixed assets in the first month were as follows:

Light equipment, with a useful life of 3 years P 300,000

Heavy equipment, with a useful life of 10 years 4,000,000

How much is the input tax available for the month?

a. P516,000 c. P480,000

b. P9,000 d. P8,600

19. Kusina Co., had its kitchen assembled by a VAT taxpayer. It took six months for the contractor to

finish the work. Kusina Co. purchased materials in July from VAT suppliers at a cost of P500,000, VAT

not included. Payment to the contractor in July 2017 on the Construction in Progress, VAT not included

was:

On contractor’s billing in June P100,000

On contractor’s billing in July 70,000

The input tax available in July is:

a. P0 c. P60,000

b. P80,400 d. P20,400

20. Data from the books of accounts of a VAT taxpayer for February:

Domestic Exports

Sales P 2,000,000 8,000,000

Purchases:

From VAT Suppliers:

Goods for sale 600,000 2,400,000

Supplies & service 90,000 360,000

From Suppliers Paying percentage tax:

Goods for sale 100,000 1,500,000

Supplies & services 20,000 80,000

If the input taxes attributable to zero-rated sales are claimed as tax credit, the net value-added tax

refundable is:

a. P136,000 c. P145,000

b. P203,924.70 d. P174,000

You might also like

- Midterm Examination BSAISDocument11 pagesMidterm Examination BSAISAlexis Kaye DayagNo ratings yet

- MINDANAO STATE UNIVERSITY ACCOUNTANCY QUIZ SERIES 3Document4 pagesMINDANAO STATE UNIVERSITY ACCOUNTANCY QUIZ SERIES 3Cardo DalisayNo ratings yet

- VAT and OPTDocument10 pagesVAT and OPTSharon CarilloNo ratings yet

- Value Added TaxDocument6 pagesValue Added TaxjamNo ratings yet

- TAX-402 (Other Percentage Taxes - Part 2)Document6 pagesTAX-402 (Other Percentage Taxes - Part 2)VKVCPlaysNo ratings yet

- Practice Quiz NonFinlLiabDocument15 pagesPractice Quiz NonFinlLiabIsabelle GuillenaNo ratings yet

- Chapter 11 Excise TaxDocument10 pagesChapter 11 Excise TaxAmzelle Diego LaspiñasNo ratings yet

- FAR-4214 (Bonds - Other Long-Term Liabilities)Document4 pagesFAR-4214 (Bonds - Other Long-Term Liabilities)saligumba mikeNo ratings yet

- Other Percentage TaxDocument2 pagesOther Percentage TaxGerald SantosNo ratings yet

- Taxation 1 Final Exam Multiple ChoiceDocument5 pagesTaxation 1 Final Exam Multiple ChoiceYamateNo ratings yet

- Tax ReviewerDocument22 pagesTax ReviewercrestagNo ratings yet

- Philippine Excise Tax ExplainedDocument10 pagesPhilippine Excise Tax ExplainedLemhar DayaoenNo ratings yet

- Bustamante TAX CDocument19 pagesBustamante TAX CJean Rose Tabagay BustamanteNo ratings yet

- Understanding VAT: A Business Tax, Its Computation, Registration RequirementsDocument24 pagesUnderstanding VAT: A Business Tax, Its Computation, Registration RequirementsPeter AhNo ratings yet

- Transfer Taxes Theory QuizzerDocument15 pagesTransfer Taxes Theory QuizzerKenNo ratings yet

- Short Quiz 4 Set A With AnswerDocument3 pagesShort Quiz 4 Set A With AnswerJean Pierre IsipNo ratings yet

- Exercise 2 Estate Tax Pt1.5Document4 pagesExercise 2 Estate Tax Pt1.5Angelica Nicole TamayoNo ratings yet

- Modes of Acquiring Ownership & Estate TaxesDocument11 pagesModes of Acquiring Ownership & Estate TaxesMarko JerichoNo ratings yet

- Donor's Tax Review QuestionsDocument7 pagesDonor's Tax Review QuestionsRodelLaborNo ratings yet

- Tax 1 PDFDocument17 pagesTax 1 PDFLeah MoscareNo ratings yet

- Modified Finals VatDocument3 pagesModified Finals VatClyden Jaile RamirezNo ratings yet

- Individual and corporate community tax obligationsDocument1 pageIndividual and corporate community tax obligationsCams DlunaNo ratings yet

- WITHHOLDING TAX GUIDEDocument5 pagesWITHHOLDING TAX GUIDEKobe BullmastiffNo ratings yet

- XBUSTAX Percentage and Other TaxesDocument5 pagesXBUSTAX Percentage and Other TaxesFlorine Fate SalungaNo ratings yet

- HRM MidtermDocument16 pagesHRM MidtermJsn Pl Cabg-sNo ratings yet

- Value Added TaxDocument4 pagesValue Added TaxAllen KateNo ratings yet

- TAX 2021 - Theories and Independent ProblemsDocument28 pagesTAX 2021 - Theories and Independent ProblemsMingcheng JeeNo ratings yet

- LTCC Exam PDF FreeDocument5 pagesLTCC Exam PDF FreeMichael Brian TorresNo ratings yet

- TAX-304 (VAT Compliance Requirements)Document5 pagesTAX-304 (VAT Compliance Requirements)Edith DalidaNo ratings yet

- Donor's TaxDocument25 pagesDonor's TaxMark Erick Acojido RetonelNo ratings yet

- VAT (Theory & Problem)Document10 pagesVAT (Theory & Problem)dimpy dNo ratings yet

- Professiona Review & Training Center, IncDocument14 pagesProfessiona Review & Training Center, IncBryan Christian MaragragNo ratings yet

- Sample Problem For Gross EstateDocument5 pagesSample Problem For Gross EstateChristineNo ratings yet

- Income Taxation Ind PracticeDocument3 pagesIncome Taxation Ind PracticeJanine Tividad100% (1)

- Salient Points of TRAIN LawDocument21 pagesSalient Points of TRAIN LawNani kore100% (1)

- TAX-303 (Input VAT)Document8 pagesTAX-303 (Input VAT)Fella GultianoNo ratings yet

- Excise Tax BIR FinalDocument11 pagesExcise Tax BIR FinalmixxNo ratings yet

- Philippine Christian University: Midterm Examination inDocument5 pagesPhilippine Christian University: Midterm Examination inleo pigafetaNo ratings yet

- Solutions Manual for Transfer & Business Taxation, 3rd EditionDocument44 pagesSolutions Manual for Transfer & Business Taxation, 3rd EditionEzekiel Malazzab67% (6)

- Other Percentage TaxesDocument3 pagesOther Percentage TaxesClaudine Allyson DungoNo ratings yet

- Exercises 04 - Intangibles INTACC2 PDFDocument3 pagesExercises 04 - Intangibles INTACC2 PDFKhan TanNo ratings yet

- CPA REVIEW SCHOOL OF THE TAXATIDocument39 pagesCPA REVIEW SCHOOL OF THE TAXATIAiziel OrenseNo ratings yet

- Allowed Deductions From Gross IncomeDocument8 pagesAllowed Deductions From Gross Incomealliahbilities currentNo ratings yet

- Indirect Method Cash Flow Statement for Hill CompanyDocument6 pagesIndirect Method Cash Flow Statement for Hill CompanyJessbel MahilumNo ratings yet

- Aescartin/Tlopez/Jpapa: Mobile Telephone GmailDocument7 pagesAescartin/Tlopez/Jpapa: Mobile Telephone GmailReynalyn BarbosaNo ratings yet

- DocumentDocument2 pagesDocumentAisaka Taiga0% (1)

- TAX Final-PB FEUDocument9 pagesTAX Final-PB FEUkarim abitagoNo ratings yet

- CHAPTER 4 Regular Income Taxation Individuals ModuleDocument10 pagesCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- CTT Multiple Questions 2023Document31 pagesCTT Multiple Questions 2023Nicole BaguioNo ratings yet

- 2015 VAT in Cambodia Sesion II 22aug 2015Document27 pages2015 VAT in Cambodia Sesion II 22aug 2015Sovanna HangNo ratings yet

- Estate TaxDocument2 pagesEstate Taxucc second yearNo ratings yet

- Midterm Quiz 1 Gross IncomeDocument3 pagesMidterm Quiz 1 Gross IncomeMjhayeNo ratings yet

- H13.3 - Excise Tax - DSTDocument9 pagesH13.3 - Excise Tax - DSTnona galidoNo ratings yet

- Business and Transfer Taxation Chapter 13 Discussion Questions and AnswerDocument2 pagesBusiness and Transfer Taxation Chapter 13 Discussion Questions and AnswerKarla Faye LagangNo ratings yet

- Value Added TaxDocument8 pagesValue Added TaxErica VillaruelNo ratings yet

- Business & Transfer Taxation: Rex B. Banggawan, Cpa, MbaDocument38 pagesBusiness & Transfer Taxation: Rex B. Banggawan, Cpa, Mbajustine reine cornicoNo ratings yet

- Agricultural tax exemptions quizDocument19 pagesAgricultural tax exemptions quizJona Celle Castillo100% (1)

- Tax QuizzerDocument33 pagesTax QuizzerClarisse Peter86% (14)

- DocxDocument28 pagesDocxGrace Managuelod GabuyoNo ratings yet

- Tax 2 PDFDocument16 pagesTax 2 PDFLeah MoscareNo ratings yet

- Classic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Document4 pagesClassic 15 December 2020 To 14 January 2021: Your Account Arranged Overdraft Limit 250Deva LinaNo ratings yet

- Transactions List - Sahakar Global Limited (Inr) - 001905005599 No. Value Date TXN Posted Date Chequeno. Transaction IdDocument14 pagesTransactions List - Sahakar Global Limited (Inr) - 001905005599 No. Value Date TXN Posted Date Chequeno. Transaction IdDILIP VELHALNo ratings yet

- Zero Only: Application For Funds Transfer Under Rtgs/NeftDocument1 pageZero Only: Application For Funds Transfer Under Rtgs/NeftHemanth KumarNo ratings yet

- Kotler Chapter 12 MCQDocument41 pagesKotler Chapter 12 MCQAnthony Scott88% (65)

- Invoice: Depo Pasir SedoganDocument1 pageInvoice: Depo Pasir SedoganChandra PriatamaNo ratings yet

- PDS Rafahia Sept18Document5 pagesPDS Rafahia Sept18M ErnadyNo ratings yet

- 2023 09 01 19 40 52apr 23 - 495668Document3 pages2023 09 01 19 40 52apr 23 - 495668harsha.tahalaniNo ratings yet

- Complaint Against Kansas Attorney Sean Allen McElwain - December 25th, 2018Document8 pagesComplaint Against Kansas Attorney Sean Allen McElwain - December 25th, 2018Conflict GateNo ratings yet

- WTS Dhruva VAT Handbook PDFDocument40 pagesWTS Dhruva VAT Handbook PDFFaraz AkhtarNo ratings yet

- Final Payslip of Circle For 7-17Document11 pagesFinal Payslip of Circle For 7-17Manas Kumar SahooNo ratings yet

- Financial Accounting Midterm ExamDocument4 pagesFinancial Accounting Midterm ExamMary Joy SumapidNo ratings yet

- Statement MAR2021 125323533 (1)Document9 pagesStatement MAR2021 125323533 (1)Bakibillah MollaNo ratings yet

- Vajiram & Ravi: Chennai Centre Subject TimingsDocument1 pageVajiram & Ravi: Chennai Centre Subject TimingsUdayabhanu MuthaluruNo ratings yet

- Su20200319111601x206 1052124735 2446096170Document5 pagesSu20200319111601x206 1052124735 2446096170Mohd FaizNo ratings yet

- Visa MEDocument20 pagesVisa MESuhail HurzukNo ratings yet

- E StampDocument1 pageE StampUmer ShaukatNo ratings yet

- Cash Disbursement 2007Document48 pagesCash Disbursement 2007api-3740993No ratings yet

- Sweet Employee and Company ProfileDocument67 pagesSweet Employee and Company ProfileAchibabaNo ratings yet

- Shri Krishnam HDFCDocument10 pagesShri Krishnam HDFCSimi AroraNo ratings yet

- Gen Bir Annex B2Document2 pagesGen Bir Annex B2ArgielJedTabalBorras100% (2)

- HomeCredit Loan Payment ScheduleDocument2 pagesHomeCredit Loan Payment ScheduleKylyn JynNo ratings yet

- Fares and Pricing ManualDocument46 pagesFares and Pricing ManualGagan Deep Kohli88% (17)

- Receipt From STC Pay: Transaction ID: 97770838 Amount 16093.23 PKR MTCN 0974782306Document1 pageReceipt From STC Pay: Transaction ID: 97770838 Amount 16093.23 PKR MTCN 0974782306DAWAYA BAKHSHNo ratings yet

- Sovachem & Co.: Tax InvoiceDocument1 pageSovachem & Co.: Tax InvoiceSohamNo ratings yet

- Quotation: Kentex CargoDocument2 pagesQuotation: Kentex CargoMalueth AnguiNo ratings yet

- CDBDocument35 pagesCDBAnonymous eLy0WHoJN5No ratings yet

- Account Statement2Document31 pagesAccount Statement2Parminder SinghNo ratings yet

- Dub 5198522Document1 pageDub 5198522Anand BabuNo ratings yet

- Attachment 4 To Item 8.1-Safe Speed Plan Proposed Speed Limits Bylaw 201...Document108 pagesAttachment 4 To Item 8.1-Safe Speed Plan Proposed Speed Limits Bylaw 201...Stuff NewsroomNo ratings yet

- Current Invoice 11179003613Document2 pagesCurrent Invoice 11179003613Chaitanya ChaituNo ratings yet