Professional Documents

Culture Documents

$ Corporate Governance

Uploaded by

ritika agrawalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

$ Corporate Governance

Uploaded by

ritika agrawalCopyright:

Available Formats

Committee recommendations:

The Kotak Committee on Corporate Governance (hereinafter referred to as 'The

Committee') was constituted on June 2, 2017, under the chairmanship of Uday Kotak.

Its primary objective was improving standards concerning corporate governance of

listed companies in India.

The Committee was represented by different stakeholders, including the government,

the industry, stock exchanges, academicians, proxy advisors, professional bodies,

lawyers, etc. It was requested to provide recommendations on diverse issues such as

ensuring independence in spirit of independent directors and their active participation

in the functioning of the company, and improving safeguards and disclosures

pertaining to related party transactions.

At the said meeting, the capital and commodities market regulator's board considered

the Committee's recommendations and the public comments. The board decided to

accept several recommendations of the Committee without any modifications,

including the following:

Reduction in the maximum number of listed entity directorships from 10 to 8 by April

01, 2019 and to 7 by April 1, 2020

Expanding the eligibility criteria for independent directors

Enhanced role of the Audit Committee, Nomination and Remuneration Committee

and Risk Management Committee

Disclosure of utilization of funds from QIP/preferential issue

Disclosures of auditor credentials, audit fee, reasons for resignation of auditors, etc.

Disclosure of expertise/skills of directors

Enhanced disclosure of related party transactions (RPTs) and related parties to be

permitted to vote against RPTs

Mandatory disclosure of consolidated quarterly results with effect from FY 2019-20

Enhanced obligations on the listed entities with respect to subsidiaries

Secretarial Audit to be mandatory for listed entities and their material unlisted

subsidiaries under SEBI Listing Obligations and Disclosure Requirements (LODR)

Regulations.

The regulator's board decided to accept several recommendations with modifications,

which included the following:

Minimum 6 directors in the top 1000 listed entities by market capitalization by April

1, 2019 and in the top 2000 listed entities by April 1, 2020

At least one woman independent director in the top 500 listed entities by market

capitalization by April 1, 2019 and in the top 1000 listed entities by April 1, 2020

Separation of CEO/MD and Chairperson (to be initially made applicable to the top

500 listed entities by market capitalization w.e.f. April 1, 2020)

Quorum for Board meetings (1/3rd of the size of the Board or 3 members,whichever is

higher) in the top 1000 listed entities by market capitalization by April 1, 2019 and in

the top 2000 listed entities by April 1, 2020

Top 100 entities to hold AGMs within 5 months after the end of FY 2018-19 i.e. by

August 31, 2019

Webcast of AGMs will be compulsory for top 100 entities by market capitalization

w.e.f. FY 2018-19

Shareholder approval (majority of minority) for royalty/brand payments to related

party exceeding 2 percent of consolidated turnover (instead of the proposed 5

percent).

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Chapter 01 Introductory To Mergers and AcquisitionsDocument38 pagesChapter 01 Introductory To Mergers and Acquisitionsritika agrawalNo ratings yet

- M&A Chapter SummaryDocument10 pagesM&A Chapter SummarySom DasNo ratings yet

- Indicate The Correct Answer: 1.: Ans: (A) ShareholdersDocument39 pagesIndicate The Correct Answer: 1.: Ans: (A) Shareholdersritika agrawalNo ratings yet

- The Impact of Taxation On Economic GrowthDocument4 pagesThe Impact of Taxation On Economic Growthritika agrawalNo ratings yet

- Antila Sara PDFDocument47 pagesAntila Sara PDFVaishnavi GnanasekaranNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Training AgreementDocument2 pagesTraining AgreementpaydyNo ratings yet

- People of The PH vs. Zeta PDFDocument1 pagePeople of The PH vs. Zeta PDFJulianne Ruth TanNo ratings yet

- Written Report Socio-Cultural AnthropologyDocument8 pagesWritten Report Socio-Cultural AnthropologyJo-Nathaniel G. ValbuenaNo ratings yet

- Pantaleon v. American Express International, Inc., G.R. No. 174269, August 25, 2010, 629 SCRA 276Document9 pagesPantaleon v. American Express International, Inc., G.R. No. 174269, August 25, 2010, 629 SCRA 276marieshantelleNo ratings yet

- Oppenheimer CaseDocument3 pagesOppenheimer CaselxyxnxNo ratings yet

- HC + 9 Districts Physical Roster Oct 2021Document27 pagesHC + 9 Districts Physical Roster Oct 2021JahnaviSinghNo ratings yet

- Barrido v. NonatoDocument6 pagesBarrido v. NonatoCherish Kim FerrerNo ratings yet

- Content LB 301 - Constitutional Law - I PDFDocument11 pagesContent LB 301 - Constitutional Law - I PDFHackieChanNo ratings yet

- AMA Land Inc. v. Wack Wack Residents' AssociationDocument2 pagesAMA Land Inc. v. Wack Wack Residents' AssociationAleli Bucu100% (2)

- DD Form 93 Spouse BriefDocument3 pagesDD Form 93 Spouse Briefeaglefrg100% (1)

- Campanilla Crim PreWeek 2018Document42 pagesCampanilla Crim PreWeek 2018Beau Masiglat100% (2)

- Decree 10/04 Angolan Petroleum Activities LawDocument38 pagesDecree 10/04 Angolan Petroleum Activities LawDebbie CollettNo ratings yet

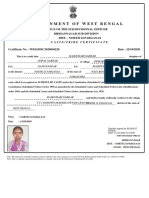

- SC CertificateDocument1 pageSC CertificateRubi RoyNo ratings yet

- Gensoc ReviewerDocument50 pagesGensoc ReviewerAdora AdoraNo ratings yet

- Deed of Cession and Direct Payment AgreementDocument6 pagesDeed of Cession and Direct Payment Agreementtholoana sentiNo ratings yet

- Police in America 1st Edition Brandl Test BankDocument16 pagesPolice in America 1st Edition Brandl Test Bankcivilianpopulacy37ybzi100% (26)

- PSCI 1201 Book PDFDocument623 pagesPSCI 1201 Book PDFBack FitoNo ratings yet

- CustodyDocument9 pagesCustodyNawalRamayNo ratings yet

- Williams v. Taylor Hardin Secure Medical Facility Et Al (Inmate 2) - Document No. 3Document3 pagesWilliams v. Taylor Hardin Secure Medical Facility Et Al (Inmate 2) - Document No. 3Justia.comNo ratings yet

- Libarios vs. DabalosDocument11 pagesLibarios vs. DabalosAnthony De La CruzNo ratings yet

- Golesorkhi v. Lufthansa German Air, 4th Cir. (1997)Document6 pagesGolesorkhi v. Lufthansa German Air, 4th Cir. (1997)Scribd Government DocsNo ratings yet

- Audit of Insurance CompaniesDocument6 pagesAudit of Insurance CompaniesKrishna Jha100% (1)

- Legal Aspects of Contract LawDocument62 pagesLegal Aspects of Contract LawAARCHI JAINNo ratings yet

- Lorcom Vs ZurichDocument12 pagesLorcom Vs ZurichAnjNo ratings yet

- I-A-R-R-, AXXX XXX 887 (BIA Sept. 20, 2017)Document2 pagesI-A-R-R-, AXXX XXX 887 (BIA Sept. 20, 2017)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Bernas Constitutional Structure PDFDocument808 pagesBernas Constitutional Structure PDFAngelic Recio100% (13)

- Application Form For AMODocument4 pagesApplication Form For AMOPamela SalazarNo ratings yet

- Abettor in IPCDocument13 pagesAbettor in IPCRvi MahayNo ratings yet

- Barut Vs CabacunganDocument7 pagesBarut Vs CabacunganCharm Divina LascotaNo ratings yet

- Rep v. JosonDocument9 pagesRep v. JosonGianne Claudette LegaspiNo ratings yet