Professional Documents

Culture Documents

Bir Gina

Uploaded by

April ManjaresOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bir Gina

Uploaded by

April ManjaresCopyright:

Available Formats

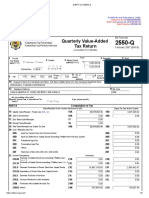

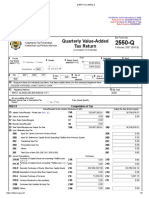

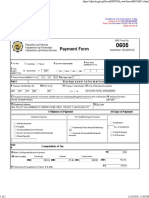

BIR Form No.

2551M Page 1 of 1

BIR Form No.

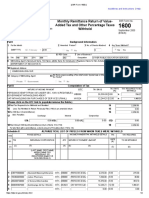

Republika ng Pilipinas Monthly Percentage

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

Tax Return 2551M

September 2005 (ENCS)

3 For the month (MM /YYYY) 4 Amended Return? No. of Sheets

1 For the Calendar Fiscal 5 Attached

2

Year Ended

12 - December 2019 03 - March 2019 0

(MM/YYYY) Yes

No

Part I Background Information

6 TIN 001 585 482 000 7 RDO 43B Line of Business / Occupation

Code 8

technical school

9 Taxpayer's Name (For Individual) Last Name, First Name, Middle Name/ (For Non-individual) Registered Name 10 Telephone Number

CAPELLAN INSTITUTE OF TECHNOLOGY, INC. 6415648

11 Registered Address 12 Zip Code

35 DR. PILAPIL ST. SAGAD PASIG CITY 1600

13 Are you availing of tax relief under Special Law / International Tax Treaty? Yes No If yes, specify

Part II Computation of Tax ATC

Taxable Transaction / Industry Classification ATC Taxable Amount Tax Rate Tax Due

PERSON EXEMPT FROM VAT UNDER SEC. 109(BB) (SEC. 116) PT010 3.0 0.00

19 Total Tax Due 19 0.00

20 Less: Tax Credits/Payments

20A Creditable Percentage Tax Withheld Per BIR Form No. 2307 (See Schedule 1) 20A 0.00

20B Tax Paid in Return Previously Filed, if this is an amended return 20B 0.00

21 Total Tax Credit/Payments (Sum of Items 20A & 20B) 21 0.00

22 Tax Payable (Overpayment) (Item 19 less Item 21) 22 0.00

23 Add Penalties Surcharge Interest Compromise

23A 0.00 23B 0.00 23C 0.00 23D 0.00

24 Total Amount Payable (Overpayment) (Sum of Items 22 and 23D) 24 0.00

If Overpayment, mark one box only To be Refunded To be issued a Tax Credit Certificate

Schedule 1 Tax Withheld Claimed as Tax Credit

Period Covered Name of Withholding Agent Income Payments Tax Withheld Applied

Total Amount(to item 20A)................. 0.00

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge, and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

25___________________________________________________________________________________ 26_____________________________

President/Vice President/Principal Officer/Accredited Tax Agent/ Treasurer/Assistant Treasurer

Authorized Representative/Taxpayer (Signature Over Printed Name)

(Signature Over Printed Name)

___________________________________________ ___________________________________________ ______________________________

Title/Position of Signatory TIN of Signatory Title/Position of Signatory

___________________________________________ _______________ _______________ ______________________________

Tax Agent Acc. No./Atty's Roll No.(if applicable) Date of Issuance Date of Expiry TIN of Signatory

Machine Validation/Revenue Official Receipt Details (If not filed with an Authorized Agent Bank)

file:///C:/Users/admin/AppData/Local/Temp/%7B0C58706A-8CD0-47D3-8FB4-1FA8796... 4/10/2019

You might also like

- Monthly Percentage Tax Return: 12 - December 04 - AprilDocument1 pageMonthly Percentage Tax Return: 12 - December 04 - AprilTamara HamiltonNo ratings yet

- Monthly Percentage Tax Return: 12 - December 06 - JuneDocument1 pageMonthly Percentage Tax Return: 12 - December 06 - JuneDana PardeNo ratings yet

- BIR Form 2550M Monthly VAT SummaryDocument2 pagesBIR Form 2550M Monthly VAT SummaryLulu Adaro VillanuevaNo ratings yet

- BIR Form 2551M Monthly Percentage Tax ReturnDocument1 pageBIR Form 2551M Monthly Percentage Tax ReturnLorraine Steffany BanguisNo ratings yet

- Quarterly Value-Added Tax ReturnDocument2 pagesQuarterly Value-Added Tax ReturnFrancis M. TabajondaNo ratings yet

- MarioeFPS Home - EFiling and Payment SystemDocument2 pagesMarioeFPS Home - EFiling and Payment SystemEdward Roy “Ying” AyingNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment Systemmelanie venturaNo ratings yet

- 2550-M February-2022Document2 pages2550-M February-2022Jing ReyesNo ratings yet

- 1701Q BIR Form PDFDocument3 pages1701Q BIR Form PDFJihani A. SalicNo ratings yet

- 2550-M October-2022Document2 pages2550-M October-2022Jing ReyesNo ratings yet

- TIPCO ESTATES QUARTERLY TAX RETURNDocument3 pagesTIPCO ESTATES QUARTERLY TAX RETURNJa'maine ManguerraNo ratings yet

- 1701qjuly2008 (ENCS) q22019Document5 pages1701qjuly2008 (ENCS) q22019Andrew AndalNo ratings yet

- 2550-M August-2022Document2 pages2550-M August-2022Jing ReyesNo ratings yet

- Group 8 Project 2 - Preparation of Quarterly Percentage Tax ReturnDocument4 pagesGroup 8 Project 2 - Preparation of Quarterly Percentage Tax ReturnVan Joshua NunezNo ratings yet

- Monthly Percentage Tax ReturnDocument4 pagesMonthly Percentage Tax ReturnromarcambriNo ratings yet

- Quarterly Income Tax Return: 12 - December 056Document2 pagesQuarterly Income Tax Return: 12 - December 056Cha GomezNo ratings yet

- 2551Q Jan 2018 ENCS Final Rev 3Document2 pages2551Q Jan 2018 ENCS Final Rev 3MIS MijerssNo ratings yet

- 0605 PDFDocument2 pages0605 PDFeugene badere50% (2)

- 0605 PDFDocument2 pages0605 PDFRob Villanueva100% (1)

- Form 0605 PDFDocument2 pagesForm 0605 PDFeugene badereNo ratings yet

- BIR Payment Form ExplainedDocument2 pagesBIR Payment Form ExplainedElbert Natal100% (1)

- 0605Document2 pages0605Kath Rivera60% (42)

- BIR Payment Form TitleDocument2 pagesBIR Payment Form Titleeugene badere50% (2)

- 2550-M November-2022Document2 pages2550-M November-2022Jing ReyesNo ratings yet

- BIR Form 2551 - PDFDocument1 pageBIR Form 2551 - PDFMichael LaquianNo ratings yet

- Quarterly Value-Added Tax ReturnDocument2 pagesQuarterly Value-Added Tax ReturnjoshuaNo ratings yet

- 0605 - Dasma Bir Registration - Year 2022 - Draft For Filing - 01.12.2022Document1 page0605 - Dasma Bir Registration - Year 2022 - Draft For Filing - 01.12.2022graceNo ratings yet

- Mail To LornaDocument27 pagesMail To Lornaapi-3740993No ratings yet

- BIR Form No. 0605 (2021)Document1 pageBIR Form No. 0605 (2021)Nathan Veracruz100% (1)

- Mci REGDocument3 pagesMci REGPAULA TVNo ratings yet

- BIR Form 0605 Payment FormDocument1 pageBIR Form 0605 Payment FormbertlaxinaNo ratings yet

- 2020 0605 Return MspaduaDocument1 page2020 0605 Return MspaduaEljoe VinluanNo ratings yet

- Nilda 1Document1 pageNilda 1Mary Lynn Sta PriscaNo ratings yet

- Quarterly Percentage Tax Return: 12 - December 059Document2 pagesQuarterly Percentage Tax Return: 12 - December 059Abby UmipigNo ratings yet

- Gts 1stDocument2 pagesGts 1stGOLDEN TOPSTEEL CONSTRUCTION SUPPLYNo ratings yet

- Monthly Remittance Return of Income Taxes Withheld On CompensationDocument4 pagesMonthly Remittance Return of Income Taxes Withheld On CompensationHanabishi RekkaNo ratings yet

- EFPS Home - EFiling and Payment SystemDocument2 pagesEFPS Home - EFiling and Payment SystemJinkieNo ratings yet

- Monthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12Document2 pagesMonthly Percentage Tax Return: Fill in All Applicable Spaces. Mark All Appropriate Boxes With An "X". X X 12PingLomaadEdulanNo ratings yet

- 6J Store - WPDocument99 pages6J Store - WPAngelo LabiosNo ratings yet

- 2000 XHTMLDocument2 pages2000 XHTMLJanniza RoceroNo ratings yet

- BIR Form 1702RT Annual Income Tax ReturnDocument2 pagesBIR Form 1702RT Annual Income Tax ReturnRic Dela CruzNo ratings yet

- 3rd Quarter TaxDocument1 page3rd Quarter Taxmiguel tinsayNo ratings yet

- 2020 With PenaltiesDocument1 page2020 With PenaltiesKashato BabyNo ratings yet

- BIR Form No. 0605 (2022)Document1 pageBIR Form No. 0605 (2022)Nathan VeracruzNo ratings yet

- Monthly Remittance ReturnDocument1 pageMonthly Remittance ReturnAnalyn DomingoNo ratings yet

- Annual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3Document9 pagesAnnual Income Tax Return: I I 0 1 1 I I 0 1 2 I I 0 1 1 I I 0 1 2 I I 0 1 3albertNo ratings yet

- VAT Form Explains August 2020 Tax PositionDocument2 pagesVAT Form Explains August 2020 Tax PositionJa'maine ManguerraNo ratings yet

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDocument2 pagesQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNo ratings yet

- 1701Document6 pages1701Dolly BringasNo ratings yet

- Sana MabagoDocument1 pageSana MabagojoystambaNo ratings yet

- Registration FeeDocument1 pageRegistration FeeanakinNo ratings yet

- 1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityDocument3 pages1 0 2 0 1 0 8 0 0 National Agency Deped - Division of Las Piñas City Gabaldon BLDG Diego Cera Avenue E. Aldana, Las Piñas CityReese QuinesNo ratings yet

- BIR Form 1600 Monthly Remittance ReturnDocument1 pageBIR Form 1600 Monthly Remittance ReturnAnalyn DomingoNo ratings yet

- 1701osd 2018 101224Document7 pages1701osd 2018 101224Janeth Tamayo NavalesNo ratings yet

- Miflores-1701A-2023Document3 pagesMiflores-1701A-2023catherine aleluyaNo ratings yet

- BIR Form 0605 Payment Form InstructionsDocument2 pagesBIR Form 0605 Payment Form InstructionsRonald varrie BautistaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- New Government Accounting System (NGAS) OverviewDocument20 pagesNew Government Accounting System (NGAS) OverviewIsiah Jarrett Trinidad Abille100% (1)

- New Asian Abstracts June 2009Document10 pagesNew Asian Abstracts June 2009Restu AnggrainiNo ratings yet

- 20 - Segismundo - Gilead - Exercise #1Document1 page20 - Segismundo - Gilead - Exercise #1Maria IsabellaNo ratings yet

- Cake | Extra | James | Sukree Die Hard Strategy Results and LearningDocument72 pagesCake | Extra | James | Sukree Die Hard Strategy Results and LearningAkshay SinghNo ratings yet

- Accounting-Income Statement MCQDocument19 pagesAccounting-Income Statement MCQHaniyaAngel0% (2)

- CAPEX Guide: Capital Expenditure and Investment Analysis MethodsDocument8 pagesCAPEX Guide: Capital Expenditure and Investment Analysis Methodsmagoimoi100% (1)

- 6.trial BalanceDocument20 pages6.trial BalanceChrisjin SujiNo ratings yet

- Ifrs 16 Leases MiningDocument48 pagesIfrs 16 Leases MiningBill LiNo ratings yet

- Practical problems with capital markets green shoe options and FCCBsDocument9 pagesPractical problems with capital markets green shoe options and FCCBsGautamSinghNo ratings yet

- TSDBF Answering Affidavit (Signed) 020919-OCRDocument147 pagesTSDBF Answering Affidavit (Signed) 020919-OCRjillianNo ratings yet

- Theories OF Change:: High-Growth Small AND Medium Enterprise DevelopmentDocument45 pagesTheories OF Change:: High-Growth Small AND Medium Enterprise DevelopmentLynssej BarbonNo ratings yet

- Income From House Property Practical 1Document1 pageIncome From House Property Practical 1Jitendra SharmaNo ratings yet

- Valuing and Acquiring A Business: Hawawini & Viallet 1Document53 pagesValuing and Acquiring A Business: Hawawini & Viallet 1Kishore ReddyNo ratings yet

- HDFC 4W MUMBAI Online AuctionDocument13 pagesHDFC 4W MUMBAI Online AuctionDeep ChoudharyNo ratings yet

- Financial Records of a Law PartnershipDocument78 pagesFinancial Records of a Law PartnershipAndrea Beverly TanNo ratings yet

- Acceptance&discharge-State Home Mortgage, Atlanta, GaDocument13 pagesAcceptance&discharge-State Home Mortgage, Atlanta, GaTiyemerenaset Ma'at El82% (17)

- Corporate Tax Planning PDFDocument2 pagesCorporate Tax Planning PDFarjrocks235No ratings yet

- Tire City-Spread SheetDocument6 pagesTire City-Spread SheetVibhusha SinghNo ratings yet

- Management of Habib Bank LTD PakistanDocument30 pagesManagement of Habib Bank LTD PakistanMohammad Ismail Fakhar HussainNo ratings yet

- PNB v. Sps Reblando, G.R. No. 194014, September 12, 2012Document4 pagesPNB v. Sps Reblando, G.R. No. 194014, September 12, 2012SophiaFrancescaEspinosaNo ratings yet

- Pregunta: Finalizado Puntúa 0,0 Sobre 1,0Document21 pagesPregunta: Finalizado Puntúa 0,0 Sobre 1,0Jhon CardozoNo ratings yet

- Chapter 2 Residential StatusDocument6 pagesChapter 2 Residential StatusGrave diggerNo ratings yet

- HR QueriesDocument6 pagesHR Queriesfrancy_rajNo ratings yet

- Final Report Aman DwivediDocument48 pagesFinal Report Aman Dwivediaman DwivediNo ratings yet

- India: Venture Capital ReportDocument15 pagesIndia: Venture Capital ReportHarsh KediaNo ratings yet

- 281 Kainantu Urban Local Level Government 281: Prepared By: Rosita Ben Tubavai A/financial ControllerDocument1 page281 Kainantu Urban Local Level Government 281: Prepared By: Rosita Ben Tubavai A/financial ControllerMichael MotanNo ratings yet

- Surcharge Report BTKSC-P05164Document1 pageSurcharge Report BTKSC-P05164Nasir Badshah AfridiNo ratings yet

- Basic Accounting: Accounts Titles Date Debit CreditDocument5 pagesBasic Accounting: Accounts Titles Date Debit CreditJamel torres82% (17)

- Based on the ABC analysis, the classification would be:A items: 1, 2 B items: 3, 4C items: 5, 6, 7 Mr. John Pradeep K, KJSOM 23Document47 pagesBased on the ABC analysis, the classification would be:A items: 1, 2 B items: 3, 4C items: 5, 6, 7 Mr. John Pradeep K, KJSOM 23Mebin MathewNo ratings yet

- Role of Banking Sector in The Development of The Indian Economy in The Context of (Agriculture and Textile) Industry by Yogesh YadavDocument40 pagesRole of Banking Sector in The Development of The Indian Economy in The Context of (Agriculture and Textile) Industry by Yogesh Yadavyogesh0794No ratings yet