Professional Documents

Culture Documents

LIQUIDATION SOLUTIONS

Uploaded by

gracel angela tolejanoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LIQUIDATION SOLUTIONS

Uploaded by

gracel angela tolejanoCopyright:

Available Formats

No.

1 for CA/CWA & MEC/CEC MASTER MINDS

5. LIQUIDATION OF COMPANIES

SOLUTIONS TO ASSIGNMENT PROBLEMS

Problem No. 1

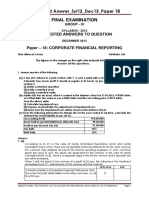

th

Statement of Affairs of ‘A’ Ltd. (in Liquidation) as at 30 September, 2011

Estimated

Realisable

Value (Rs.)

Assets not specifically pledged (as per List A):

Other Fixed Assets 36,00,000

Current Assets 70,00,000

Total 1,06,00,000

Assets specifically pledged (as per List B):

Estimated Due to Deficiency Surplus

Realizable Secured Ranking as Carried to the

Value Creditors Unsecured last column

Rs. Rs. Rs. Rs.

Land & 22,00,000 20,00,000 - 2,00,000 2,00,000

Building

Estimated total assets available for preferential creditors debenture

holder secured by a floating charge and unsecured creditors 1,08,00,000

Summary of Gross Assets:

Gross realizable value of assets specifically pledged 22,00,000

Other Assets 1,06,00,000

Total Assets 1,28,00,000

Liabilities

Gross

Liabilities

Liabilities

20,00,000 Secured creditors (as per List B) to the extent to which claims are

estimated to be covered by assets specifically pledged -

3,00,000 Preferential creditors (as per List C) – for demand of excise duty 3,00,000

Balance of assets available for debenture holders secured by floating 1,05,00,000

charge and unsecured creditors -

- Debenture holders secured by floating charge (as per List D)

Unsecured creditors (as per List E):

40,00,000 Unsecured Loans 40,00,000

70,00,000 Trade creditors 70,00,000

2,00,000 Liability for bills discounted (Contingent) 2,00,000

1,35,00,000 Estimated deficiency as regards creditors (difference between gross 7,00,000

assets and gross liabilities)

Issued and called up capital:

5,00,000 Equity shares of Rs.10 each (as per List G) 50,00,000

Estimated deficiency as regards members/ contributories 57,00,000

Copy Rights Reserved

To MASTER MINDS, Guntur

IPCC_33e_Accounts_Group-II_Liquidation of Companies_Assignment Solutions _____1

Ph: 9885125025/26 www.mastermindsindia.com

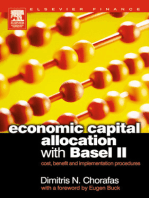

Problem No. 2

Prakash Processors Limited Liquidator’s Statement of Account

Receipts Amount Amount Payments Amount Amount

To Assets realised By Liquidation expenses 27,250

– Bank 75,000

Other assets: By Liquidator’s Remuneration 36750

Land etc. 3,00,000 By Debenture holders:

Machinery etc. 5,00,000 Debentures 2,50,000

Patents 75,000 Interest accrued 37,500

Stock 1,50,000 Interest 1-1-11/ 30-6-11 18,750 3,06,250

Trade receivables 2,00,000 12,25,000 By Preferential creditors 38,000

By Unsecured creditors 2,80,750

By Preferential

shareholders:

Preference capital 5,00,000

Arrear of Dividend 1,00,000 6,00,000

To Call on equity By Equity share holders

share holders Rs.12.35 on 2,500 shares 30,875

(7,500 x Rs.2.65) 19,875

(1)

13,19,875 13,19,875

Working Notes:

3

1. Liquidator’s remuneration = 12,25,000 x = Rs.36,750

100

2. As the company is solvent, interest on the debentures will have to be paid for the period 1-1-2011 to

15 1

30-6-2011 = 2,50,000 x x x = Rs.18,750

100 2

3.

Particulars Amount

Total equity capital – paid up 6,37,500

Less: Balance available after payment to unsecured and preference shares 11,000

(13,00,000 – 12,89,000)

Loss to be borne by 10,000 equity shares 6,26,500

Loss per share 62.65

Hence, amount of call on Rs.60 paid share 2.65

Refund to share on Rs.75 paid 12.35

Copy Rights Reserved

To MASTER MINDS, Guntur

IPCC_33e_Accounts_Group-II_Liquidation of Companies_Assignment Solutions _____2

No.1 for CA/CWA & MEC/CEC MASTER MINDS

Problem No. 3

Dr. Liquidator’s final statement of Account Cr.

Receipts Amount Amount Payments Amount Amount

To amount realised By legal charges 780

from assets not

specifically pledged:

Furniture 7,800 By Liquidation expenses 650

Debtors (W.N – 1) 1,03,025 By Liquidator’s remuneration 6,500

SV of LIP received from 15,015 By Preferential creditors:

a debtors (15,600-585)

Cash at bank 11,700 1,37,540 Income tax (2000-01) 14,300

To amount realised Salaries of employees 10,640 24,940

from assets - (15,590 – 4,950)

specifically pledged

To amount received 19,500 By creditors with floating

from contributories charges:

(6,500 - 2,600)5

14% Debentures 26,000

By unsecured creditors @ 98,170

0.6321 (W.N-3)

1,57,040 1,57,040

W.N.1:

Sundry Debtors - Rs.1,04,000

Basis Ltd other debtors

6500 97,500

(975)

5525

5,525 + 97,500 = 1,03,025

W.N.2:

Sundry trade creditors - Rs.1,07,000

One of the creditors other creditors

13,000 94,000

(1625)

11,375

11,375 + 94,000 = 1,05,375

W.N.3: Unsecured creditors

Particulars Amount

Income tax for 1999-2000 3,250

MD’s Salary 4,950

Loan from bank 39,000

Trade creditors (W.N-2) 1,05,375

Salaries in lieu of notice 2,730

1,55,305

98,170 / 1,55,305 = 0.6321

IPCC_33e_Accounts_Group-II_Liquidation of Companies_Assignment Solutions _____3

Ph: 9885125025/26 www.mastermindsindia.com

Problem No. 4

M. Ltd. (in liquidation)

st th

Liquidator’s Statement of Account from 1 January, 2011 to 30 June, 2011

Particulars Amount Amount Particulars Amount Amount

Balance at bank 74,000 Liquidator’s remuneration 7302*

(3% on Rs.2,43,398)

Realisation from: Liquidation Expenses 3,000

Sundry Debtors 52,000 Loan on mortgage with 2,04,000

Accrued interest**

M Ltd.- Creditors including 75,500

Outstanding Expenses

Rs.1,40,000 6% 1,42,800 Return contributors: 1,00,000

Debentures 6% Preference

shareholders Rs.10 per

share

Cash 2,62,200 4,05,000 6% Debentures Cash (03 1,42,800

P. approx..)

6 months’ interest on 4,200 per share 598 1,43,398

debentures

5,35,200

Less: Cost of Collection 2,000

of Debts

5,33,200 5,33,200

* 3/103 x 2,50,700 (i.e. Rs.5,32,000 less payments made to all creditors)

** It is assumed that loan is secured by a floating charge

Problem No.5

(i) Liquidator’s Statement of Account

Particulars Amount Particulars Amount

To Assets realized 23,20,000 By Liquidator’s remuneration

(20,00,000+3,20,000) 2.5% on 23,20,000*

To Receipt of call money on 58,000 58,000

29,000 equity shares @ 2 2% on 50,000 1,000 85,255

per share 2% on 13,12,745 (W.N.3)

26,255

By Liquidation Expenses 10,000

By secured creditors 320000

By Debenture holder having a 6,00,000

floating charge on all assets

By Preferential creditors 50,000

By Unsecured creditors 13,12,745

23,78,000 23,78,000

* Total assets realised = Rs.20,00,000 + Rs.3,20,000 = Rs.23,20,000

(ii) Percentage of amount paid to unsecured creditors to total unsecured creditors

13,12,745

= x 100 = 71.73%

18,30,000

IPCC_33e_Accounts_Group-II_Liquidation of Companies_Assignment Solutions _____4

No.1 for CA/CWA & MEC/CEC MASTER MINDS

Working Notes:

1. Unsecured portion in partly secured creditors = Rs.3,50,000 – Rs.3,20,000 = Rs.30,000

2. Total unsecured creditors = 18,00,000 + 30,000 (W.N.1) = Rs.18,30,000

3. Liquidator’s remuneration on payment to unsecured creditors

Cash available for unsecured creditors after all payments including payment to preferential creditors

& liquidator’s remuneration on it = Rs.13,39,000 [20,58,000-58,000-1,000-10,000- 6,00,000-50,000]

2

Liquidator’s remuneration on unsecured creditors = x 13,39,000 = Rs.26,255 or on

102

2

= x 13,12,754 = Rs.26,255

100

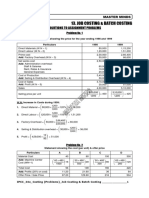

PROBLEM NO. 6

Statement of liabilities of B List Contributories

Creditors outstanding on the date of Amount to be paid

Q R S T

transfer (ceasing to be member) to creditor

No. of shares 1,200 1,500 800 500

Date Rs. Rs. Rs. Rs. Rs. Rs.

15.5.2010 5,000 1,500 1,875 1,000 625 5,000

18.9.2010 9,200

-5,000 4,200 - 2,250 1,200 750 4,200

10,500

24.12.2010 -9,200 1,300 - - 800 500 1,300

11,000

12.3.2011 10,500 500 - - - 500 125*

Total (a) 11,000 1,500 4,125 3,000 2,375 10,625

Maximum liability on 4,800 6,000 3,200 2,000

shares held (b)

Amount paid (a) and 1,500 4,125 3,000 2,000

(b) whichever is lower

Working Note:

P will not be liable since he transferred his shares prior to one year preceding the date of winding up.

th

The amount of Rs.5,000 outstanding on 15 May, 2010 will have to contributed by Q, R, S and T in the

ratio of number of shares held by them, i.e. in the ratio of 12:15:8:5; thus Q will have to contribute

Rs.1,500; R Rs.1,875; S Rs.1,000; T Rs.625.

th th

Similarly, the further debts incurred between 15 May, 2010 to 18 September, 2010, viz. Rs.4,200 for

which Q is not liable will be contributed by R, S and T in the ratio of 15:8:5. R will have to contribute

Rs.2,250, S and T will contribute Rs.1,200 and Rs.750 respectively.

th

The further increase from Rs.9,200 to Rs.10,500 viz. Rs.1,300 occurring between 18 September and

th

24 December will be shared by S and T who will be liable for Rs.800 and Rs.500 respectively.

th th

The increase between 24 December and 12 March, is solely the responsibility of T.

Note: Against T’s liability of Rs.2,375, he can be called upon to pay Rs.2,000, the loss of Rs.375 will

have to be suffered by creditors.

IPCC_33e_Accounts_Group-II_Liquidation of Companies_Assignment Solutions _____5

Ph: 9885125025/26 www.mastermindsindia.com

Problem No. 7

Receiver’s Receipts and Payments Accounts

Receipts Amount Amount Payments Amount Amount

Sundry Assets realised 2,00,000 Costs of the Receiver 2,000

Surplus received from Preferential payments -

mortgage: Creditors paid Taxes

raised within 12 months 26,000

Debentures holders

Sale Proceeds of land and 1,50,000 Principal 1,50,000

building

Less: Applied to 80,000 70,000 Interest for half year 9,750 1,59,750

discharge of mortgage loan

Surplus transferred to the 82,250

Liquidator

2,70,000 2,70,000

Liquidator’s Final Statement of Account

Particulars Amount Particulars Amount Amount

Surplus received from 82,250 Cost of Liquidation 2,800

Receiver

Assets Realised 1,00,000 Remuneration to Liquidator 3,000

Call on Contributories: Unsecured Creditors:

Trade 32,000

Directors for payment of

Bank O/D 30,000 62,000

On holder of 5,000 at the Preferential Shareholders:

rate of Rs.2.17 per share 10,850

Principal 1,00,000

Arrears of Dividends 22,000 1,22,000

Equity shareholders:

Return of money to contributors 3,300

to holder of 10,000 shares at 33

paise each

1,93,100 1,93,100

Working Note: Call from party paid shares

Particulars Amount

Deficit before call from Equity Shares (1,82,250 – 1,89,800) 7,550

Notional call on 5,000 shares @ Rs.2.50 each 12,500

Net balance after notional call 4,950

No. of shares deemed fully paid 15,000

4,950 33p

Refund on fully paid shares

15,000

Calls on party paid share (2.50 – 0.33) 2.17

IPCC_33e_Accounts_Group-II_Liquidation of Companies_Assignment Solutions _____6

No.1 for CA/CWA & MEC/CEC MASTER MINDS

Problem No. 8

Receiver’s Receipts and Payments Account

Receipts Amount Amount Payments Amount Amount

Sundry Assets realized 2,00,000 Costs of the Receiver 1,950

Surplus received from Preferential payments:

Mortgage loan : - Income Taxes (raised

Sale Proceeds of land within 12 months) 25,000

and building 1,60,000 Debentures holders :

Less: Applied to Principal amount

discharge mortgage Interest for half year 1,50,000

loan (70,000) 90,000 Surplus transferred to 9,750 1,59,750

the Liquidator 1,03,300

2,90,000 2,90,000

Liquidator’s Final Statement of Account

Receipts Amount Payments Amount

Surplus received from 1,03,300 Cost of Liquidation 3,000

Receiver Remuneration to Liquidator

Assets Realised 1,50,000 (1,50,000 x 2%) 3,000

Calls on Contributories : Unsecured Creditors :

On holder of 5,000 6,900 Trade 38,000

Equity Shares at the Directors for Bank

rate of ` 1.38 per share O/D cleared 30,000 68,000

Preferential Shareholders:

Capital 1,50,000

Arrears of Dividends 30,000 1,80,000

Equity shareholders:

Return of money to holders

of 10,000 equity shares at

62 paise each

6,200

2,60,200 2,60,200

Working Note:

Call from partly paid shares

Deficit before call from Equity Shares Rs.

= Rs.(1,03,300+1,50,000) – Rs.(3,000+3,000+68,000+1,80,000) = 700

Notional call on 5,000 shares @ Rs.2 each 10,000

Net balance after notional call (a) 9,300

No. of shares deemed fully paid (b) 15,000

9,300

Refund on fully paid shares = Rs.0.62

15,000

Calls on partly paid share (Rs.2 — Rs.0.62) = Rs.1.38

THE END

IPCC_33e_Accounts_Group-II_Liquidation of Companies_Assignment Solutions _____7

You might also like

- Particulars: © The Institute of Chartered Accountants of IndiaDocument17 pagesParticulars: © The Institute of Chartered Accountants of IndiaPraveen Reddy DevanapalleNo ratings yet

- Accounting For Corporate LiquidationDocument8 pagesAccounting For Corporate LiquidationShaz NagaNo ratings yet

- Liquidation of CompaniesDocument12 pagesLiquidation of CompaniesFaisal ManjiNo ratings yet

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Document56 pagesPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaNo ratings yet

- Accounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Document6 pagesAccounting For Holding Co. (Lecture 3) : Total 12,00,000 6,00,000Michael JimNo ratings yet

- MTP Corporate Financial ReportingDocument24 pagesMTP Corporate Financial ReportingI'm Just FunnyNo ratings yet

- Adv Acc - 3 CHDocument21 pagesAdv Acc - 3 CHhassan nassereddineNo ratings yet

- 9 Consolidated Financial StatementsDocument20 pages9 Consolidated Financial StatementsArpan SinghNo ratings yet

- AdvDocument19 pagesAdvashwin krishnaNo ratings yet

- AFM Assignment 2021Document7 pagesAFM Assignment 2021NARENDRA PATTELANo ratings yet

- Lesson 5 Partnrship LiquidationDocument14 pagesLesson 5 Partnrship LiquidationheyheyNo ratings yet

- Cap III Group I RTP Dec 2023Document111 pagesCap III Group I RTP Dec 2023meme.arena786No ratings yet

- Partnership Firm Conversion to Limited Company Balance SheetDocument8 pagesPartnership Firm Conversion to Limited Company Balance SheetAnshul BiyaniNo ratings yet

- Final Exam Corporate Financial Reporting Paper SolutionsDocument39 pagesFinal Exam Corporate Financial Reporting Paper SolutionskkpaiNo ratings yet

- Corporate Liquidation FinancialsDocument11 pagesCorporate Liquidation FinancialsJenny LelisNo ratings yet

- 3054 Faca-V L 8Document8 pages3054 Faca-V L 8ab6154951No ratings yet

- 1stLecture-Partnership LiquidationDocument25 pages1stLecture-Partnership LiquidationRechelle Dalusung100% (1)

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltNo ratings yet

- Additional Questions 5Document13 pagesAdditional Questions 5Sanjay SiddharthNo ratings yet

- DocumentDocument4 pagesDocumentTûshar ThakúrNo ratings yet

- Sample Probles For Corpo Liquidation Part 2Document1 pageSample Probles For Corpo Liquidation Part 2Kezia GuevarraNo ratings yet

- Cash Flow Statement TestDocument2 pagesCash Flow Statement TestHitesh SemwalNo ratings yet

- 2 Corporate LiquidationDocument5 pages2 Corporate LiquidationSamantha0% (1)

- Learning Unit 7 - Elimination of Intragroup TransactionsDocument61 pagesLearning Unit 7 - Elimination of Intragroup TransactionsThulani NdlovuNo ratings yet

- 57096bos46250finalnew p1 A PDFDocument18 pages57096bos46250finalnew p1 A PDFAayush LaddhaNo ratings yet

- AFAR HO2 Corporate LiquidationDocument4 pagesAFAR HO2 Corporate LiquidationLoyd Vince NaganagNo ratings yet

- 13Document6 pages13adityatiwari122006No ratings yet

- Statement of Affairs for Sudden Death LtdDocument9 pagesStatement of Affairs for Sudden Death LtdLokesh .cNo ratings yet

- 05 Corporate LiquidationDocument4 pages05 Corporate LiquidationEric CauilanNo ratings yet

- Updates - Midterm Lspu ExamDocument6 pagesUpdates - Midterm Lspu ExamAngelo HilomaNo ratings yet

- Chapter # 03 ProblemsDocument99 pagesChapter # 03 Problemsruman mahmoodNo ratings yet

- Assignment 02Document2 pagesAssignment 02yashwinsri027No ratings yet

- Tutorial On Ratio AnalysisDocument4 pagesTutorial On Ratio AnalysisRajyaLakshmiNo ratings yet

- b-6 - Liquidation-Pg.11.69Document2 pagesb-6 - Liquidation-Pg.11.69Deepika. BabuNo ratings yet

- Accounting Redemption of Debentures 1642416359Document19 pagesAccounting Redemption of Debentures 1642416359Shashank SikarwarNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- Unit I VDocument15 pagesUnit I VLeslie Mae Vargas ZafeNo ratings yet

- Advanced AccountingDocument12 pagesAdvanced AccountingmayuriNo ratings yet

- Adv Acc - Buy Back and LiquidationDocument15 pagesAdv Acc - Buy Back and Liquidationrshyams165No ratings yet

- RATIO ANALYSIS Q 1 To 4Document5 pagesRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Cash Flow Statement Problems PDFDocument32 pagesCash Flow Statement Problems PDFnsrivastav179% (29)

- BBS 1st Year QuestionDocument2 pagesBBS 1st Year Questionsatya100% (1)

- Module-2 Equity Valuation Numerical For StudentsDocument11 pagesModule-2 Equity Valuation Numerical For Studentsgaurav supadeNo ratings yet

- CASH FLOW Revision-1 PDFDocument12 pagesCASH FLOW Revision-1 PDFBHUMIKA JAINNo ratings yet

- Chapter 4 Liquidation of Companies TYBAFDocument4 pagesChapter 4 Liquidation of Companies TYBAFvikax90927No ratings yet

- Dilemma Company Financial Statement 2020Document1 pageDilemma Company Financial Statement 2020Tish ViennaNo ratings yet

- FR (New) A MTP Final Mar 2021Document17 pagesFR (New) A MTP Final Mar 2021ritz meshNo ratings yet

- COM203 AmalgamationDocument10 pagesCOM203 AmalgamationLogeshNo ratings yet

- Fund Flow Statement WorksheetDocument3 pagesFund Flow Statement WorksheetAnish AroraNo ratings yet

- PROBLEMS ON LIABILITIES AND CURRENTLY MATURING OBLIGATIONSDocument29 pagesPROBLEMS ON LIABILITIES AND CURRENTLY MATURING OBLIGATIONSDivine CuasayNo ratings yet

- Balance Sheet and Cash Flow Statement AnalysisDocument3 pagesBalance Sheet and Cash Flow Statement AnalysisAmit GodaraNo ratings yet

- 027 Practice Test 09 Accounting Test Solution Subjective Udesh RegularDocument6 pages027 Practice Test 09 Accounting Test Solution Subjective Udesh Regulardeathp006No ratings yet

- Statement of Financial PositionDocument2 pagesStatement of Financial PositionmoNo ratings yet

- CORPORATE LIQUIDATION STATEMENTDocument73 pagesCORPORATE LIQUIDATION STATEMENTCasper John Nanas MuñozNo ratings yet

- Paper - 1: Advanced Accounting: Answer All QuestionsDocument22 pagesPaper - 1: Advanced Accounting: Answer All Questionsmakarand8july78100% (1)

- Paper - 1: Financial Reporting Questions Ind AS 103Document30 pagesPaper - 1: Financial Reporting Questions Ind AS 103sam kapoorNo ratings yet

- Balance SheetDocument2 pagesBalance SheetKeight NuevaNo ratings yet

- Chapter 6 Solutions To Problems and CasesDocument24 pagesChapter 6 Solutions To Problems and Caseschandel08No ratings yet

- Credit Derivatives and Structured Credit: A Guide for InvestorsFrom EverandCredit Derivatives and Structured Credit: A Guide for InvestorsNo ratings yet

- Economic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresFrom EverandEconomic Capital Allocation with Basel II: Cost, Benefit and Implementation ProceduresNo ratings yet

- LIQUIDATION SOLUTIONSDocument7 pagesLIQUIDATION SOLUTIONSgracel angela tolejanoNo ratings yet

- 01 Economic Roots of Globalization PDFDocument20 pages01 Economic Roots of Globalization PDFgracel angela tolejanoNo ratings yet

- ReviewerartsDocument5 pagesReviewerartsgracel angela tolejanoNo ratings yet

- 15 Bas Investments in AssociatesDocument3 pages15 Bas Investments in Associatesgracel angela tolejanoNo ratings yet

- LIQUIDATION SOLUTIONSDocument7 pagesLIQUIDATION SOLUTIONSgracel angela tolejanoNo ratings yet

- 11 CH 20Document57 pages11 CH 20Nitin WakodeNo ratings yet

- Accounting for Borrowing CostsDocument9 pagesAccounting for Borrowing Costsgracel angela tolejanoNo ratings yet

- 08 Philippines RecabarDocument19 pages08 Philippines Recabargracel angela tolejanoNo ratings yet

- Conceptual Framework For Financial Reporting: March 2018Document20 pagesConceptual Framework For Financial Reporting: March 2018Priss PrissNo ratings yet

- 9 Job Costing & Batch Costing PDFDocument7 pages9 Job Costing & Batch Costing PDFgracel angela tolejano100% (1)

- Conceptual Framework For Financial Reporting: March 2018Document20 pagesConceptual Framework For Financial Reporting: March 2018Priss PrissNo ratings yet

- Business MathematicsDocument2 pagesBusiness MathematicsAntaraBanerjeeNo ratings yet

- 15 Bas Investments in AssociatesDocument3 pages15 Bas Investments in Associatesgracel angela tolejanoNo ratings yet

- Lecture 1Document4 pagesLecture 1gracel angela tolejanoNo ratings yet

- Accounting Notes: Product CostingDocument4 pagesAccounting Notes: Product Costinggracel angela tolejanoNo ratings yet

- Accounting Notes: Product CostingDocument4 pagesAccounting Notes: Product Costinggracel angela tolejanoNo ratings yet

- Generally Accepted Accounting Principles ModuleDocument30 pagesGenerally Accepted Accounting Principles Modulegracel angela tolejanoNo ratings yet

- Chapter04 000 PDFDocument27 pagesChapter04 000 PDFgracel angela tolejanoNo ratings yet

- Buying A HouseDocument4 pagesBuying A Houseapi-325824593No ratings yet

- Capital Budgeting and Working Capital AnalysisDocument36 pagesCapital Budgeting and Working Capital Analysis19-R-0503 ManogjnaNo ratings yet

- California Budget Summary 2018-19Document272 pagesCalifornia Budget Summary 2018-19Capital Public Radio100% (1)

- Final Accounts - AdjustmentsDocument12 pagesFinal Accounts - AdjustmentsSarthak Gupta100% (1)

- Econ6049 Economic Analysis, S1 2021: Week 7: Unit 10 - Banks, Money and The Credit MarketDocument27 pagesEcon6049 Economic Analysis, S1 2021: Week 7: Unit 10 - Banks, Money and The Credit MarketTom WongNo ratings yet

- Financial and Corporate Law Issues in Emerging EconomiesDocument68 pagesFinancial and Corporate Law Issues in Emerging Economiesa_rwabizambuga100% (1)

- Preventing College Debt Deliberation GuideDocument18 pagesPreventing College Debt Deliberation Guideapi-549298301No ratings yet

- HARTALEGADocument7 pagesHARTALEGATeo Zhen TingNo ratings yet

- Cambridge Assessment International Education: Commerce 7100/23 May/June 2018Document12 pagesCambridge Assessment International Education: Commerce 7100/23 May/June 2018Kim Seng OnnNo ratings yet

- RFBT - Q&A Pt.2Document5 pagesRFBT - Q&A Pt.2John Mahatma Agripa100% (1)

- CIMA F3 Notes - Financial Strategy - Chapter 3Document11 pagesCIMA F3 Notes - Financial Strategy - Chapter 3athancox5837100% (2)

- Pledge, Antichresis and Mortgage (Case Digests by @mcvinicious) PDFDocument33 pagesPledge, Antichresis and Mortgage (Case Digests by @mcvinicious) PDFVeen Galicinao FernandezNo ratings yet

- UAE Restructuring OverviewDocument6 pagesUAE Restructuring OverviewSadnanNo ratings yet

- Facts:: Leung Yee V Strong Machinery (G.R. NO. L-11658, February 15, 1918)Document33 pagesFacts:: Leung Yee V Strong Machinery (G.R. NO. L-11658, February 15, 1918)Ayana LockeNo ratings yet

- Education Loan ProjectDocument45 pagesEducation Loan ProjectyogeshgharpureNo ratings yet

- Measurement of Earnings ManagementDocument17 pagesMeasurement of Earnings ManagementmercyNo ratings yet

- During The Last Week of March Siro Stereo S Owner ApproachesDocument1 pageDuring The Last Week of March Siro Stereo S Owner ApproachesAmit PandeyNo ratings yet

- Court Update For Reading 2017Document132 pagesCourt Update For Reading 2017chris cardinoNo ratings yet

- Capital Structure and Cost of CapitalDocument24 pagesCapital Structure and Cost of CapitalRakesh Krishnan100% (2)

- AvantGard Brochure CFMDocument12 pagesAvantGard Brochure CFMcrossxwindNo ratings yet

- Guna Fibres Case Study: Financial Forecasting and Debt ManagementDocument2 pagesGuna Fibres Case Study: Financial Forecasting and Debt ManagementvinitaNo ratings yet

- Audit ProceduresDocument14 pagesAudit ProceduresAnand Rocker100% (1)

- Understanding Human Capital in 40 CharactersDocument18 pagesUnderstanding Human Capital in 40 CharactersRegine ArienteNo ratings yet

- Personal Financial PlanningDocument8 pagesPersonal Financial PlanningAbhinav Rana50% (2)

- Attra Infotech PVT LTD: Ratings Reaffirmed Summary of Rating ActionDocument7 pagesAttra Infotech PVT LTD: Ratings Reaffirmed Summary of Rating ActionCharan gowdaNo ratings yet

- USAID Digital InvestDocument14 pagesUSAID Digital InvestAkshayanNo ratings yet

- Breaking The Power of DebtDocument3 pagesBreaking The Power of DebtClifford NyathiNo ratings yet

- Bafinmax Topic 2Document109 pagesBafinmax Topic 2airwaller rNo ratings yet

- 7e - Chapter 16Document65 pages7e - Chapter 16Lindsay SummersNo ratings yet

- 55e96-2066 Mains Approach-Answer e 2023Document20 pages55e96-2066 Mains Approach-Answer e 2023Atul Kumar ChaubeyNo ratings yet