Professional Documents

Culture Documents

Taxation 101 PDF

Uploaded by

Ben Dhekenz0 ratings0% found this document useful (0 votes)

23 views48 pagesOriginal Title

taxation 101.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

23 views48 pagesTaxation 101 PDF

Uploaded by

Ben DhekenzCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 48

© STsRe

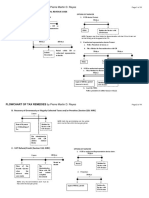

TABLE OF CONTENTS

Preface

Message from Sen. Franklin M. Drilon

Senate President

Message from Sen. Sonny Angara

Chairperson, Committee on Ways and Means

Message from Atty. Oscar G. Yabes

Secretary of the Senate

Message from Atty. Rodelio T. Dascil, MNSA

Director General, STSRO-

Introduction - Basic Concepts on Taxation

Principles of a Sound Tax System

Impositions Under the Basic Philippine Tax

Law. - National Internal Revenue Code (NIRC),

as amended

Income Tax

Estate and Donor’s Tax

Value-Added Tax (VAT)

Other Percentage Taxes

Excise Taxes

Documentary Stamp Taxes (DST)

Others

Impositions Under Basic Philippine Tax Laws.

— Local Government Code (LGC) of 1994

15

15

20

22

28

32

33

33

Republic ofthe Philippines

Senate

Pasay City

PREFACE

This is prepared specifically for the Senators, their Staff,

Officers and Secretariat personnel of the 17th Congress.

This latest publication of the Senate Tax Study and

Research Office (STSRO) aims to inform the reader of the

fundamentals and basics of taxation in a clear and concise

format.

The subject of taxation is presented in its simplest form

and discussed in an easily understandable manner.

It is hoped that this publication - TAXATION 101 - would

serve as a guide to the lawmakers, their staff complement and to

the Senate Secretariat.

July 18, 2016.

STSRO’s Officers and Staff

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- LRA Registration Application Form - Front - Final 201502061 PDFDocument1 pageLRA Registration Application Form - Front - Final 201502061 PDFrui riveraNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 9-Motion For ExecutionDocument1 page9-Motion For ExecutionAnob EhijNo ratings yet

- Insurance 4 MlsDocument105 pagesInsurance 4 MlsBen DhekenzNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- RR No. 7-2018Document2 pagesRR No. 7-2018Rheneir MoraNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Briefer On Revised Corporation CodeDocument15 pagesBriefer On Revised Corporation CodeBella Marie UmipigNo ratings yet

- AT - Certificate of Approval of Increase of Capital Stock - 17nov2017 PDFDocument24 pagesAT - Certificate of Approval of Increase of Capital Stock - 17nov2017 PDFBen DhekenzNo ratings yet

- Flowchart of Tax Remedies 2017 Update PRDocument11 pagesFlowchart of Tax Remedies 2017 Update PRMarjorie Kate CresciniNo ratings yet

- OCA Circular No. 45 2019 PDFDocument2 pagesOCA Circular No. 45 2019 PDFBen DhekenzNo ratings yet

- MC2004 084Document6 pagesMC2004 084Ben DhekenzNo ratings yet

- Celestial v. People (2015) G.R. No. 214865Document11 pagesCelestial v. People (2015) G.R. No. 214865Anonymous 01pQbZUMMNo ratings yet

- People v. Salvador Tulagan GR227363 PDFDocument69 pagesPeople v. Salvador Tulagan GR227363 PDFMary LouiseNo ratings yet

- Debt Collector-Wc PDFDocument9 pagesDebt Collector-Wc PDFBen DhekenzNo ratings yet

- HB04423Document16 pagesHB04423Ben DhekenzNo ratings yet

- Anti Age Discrimination in Employment Act PDFDocument4 pagesAnti Age Discrimination in Employment Act PDFBen DhekenzNo ratings yet

- Taxbits Vol2 Jan FebDocument20 pagesTaxbits Vol2 Jan FebQueen Ann NavalloNo ratings yet

- SAEZ Vs Arroyo PDFDocument19 pagesSAEZ Vs Arroyo PDFCMBDBNo ratings yet

- Estate and Donors Taxes PDFDocument14 pagesEstate and Donors Taxes PDFdhez10No ratings yet

- Celestial v. People (2015) G.R. No. 214865Document11 pagesCelestial v. People (2015) G.R. No. 214865Anonymous 01pQbZUMMNo ratings yet

- PDFDocument51 pagesPDFJan DumanatNo ratings yet

- PDFDocument51 pagesPDFJan DumanatNo ratings yet

- PDFDocument16 pagesPDFBen DhekenzNo ratings yet

- Amendment Ot RR2-98 Providing Additional Transactions Subject To Creditable Withholding Tax Re-Establishing Policy On Capital Gain Tax (RR 17-2003) PDFDocument12 pagesAmendment Ot RR2-98 Providing Additional Transactions Subject To Creditable Withholding Tax Re-Establishing Policy On Capital Gain Tax (RR 17-2003) PDFRomer LesondatoNo ratings yet

- Bir RR 6-2008Document20 pagesBir RR 6-2008Jay CastilloNo ratings yet

- L/Epublic of Tbe Ijuprtmt (Ourt: TbilippineDocument7 pagesL/Epublic of Tbe Ijuprtmt (Ourt: TbilippineDeric MacalinaoNo ratings yet

- BIR RR-4-2008 (Expanded Withholding Tax)Document6 pagesBIR RR-4-2008 (Expanded Withholding Tax)Danilo Bayana AnolNo ratings yet

- Preface 1. Corporate Income Tax: April 2014Document2 pagesPreface 1. Corporate Income Tax: April 2014Ben DhekenzNo ratings yet

- Philippines Tax Rates Guide for Individuals and BusinessesDocument3 pagesPhilippines Tax Rates Guide for Individuals and BusinesseserickjaoNo ratings yet

- Philippines Revenue Regulations amend de minimis benefits limitDocument3 pagesPhilippines Revenue Regulations amend de minimis benefits limitChalo GarciaNo ratings yet

- Acting C.J., ChairpersonDocument5 pagesActing C.J., ChairpersonBen DhekenzNo ratings yet