Professional Documents

Culture Documents

Ephrem

Uploaded by

samuel debebeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ephrem

Uploaded by

samuel debebeCopyright:

Available Formats

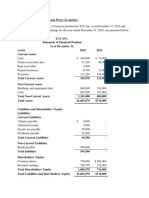

Assets 2016 2015

Current assets:

Cash 9,000 7,000

Marketable securities 3,000 2,000

Accounts receivable (net) 20,700 18,300

Inventories 24,900 23,700

Total current assets 57,600 51,000

Fixed assets:

Land and buildings 33,000 27,000

Plant and equipment 130,500 120,000

Total fixed assets 163,500 147,000

Less: accumulated depreciation 67,200 61,200

Net fixed assets 96,300 85,800

Total assets 153,900 136,800

Liabilities and stockholders’ equity

Current liabilities:

Accounts payable 20,100 17,100

Notes payable 14,700 13,200

Taxes payable 3,300 3,000

Total current liabilities 38,100 33,300

Long-term debt:

Mortgage bonds –5% 60,000 60,000

Total liabilities 98,100 93,300

Stockholders’ equity:

Preferred stock –5% (Br. 100 par) 6,000 -

Common stock (Br. 10 par) 33,000 30,000

Capital in excess of par value 7,500 4,500

Retained earnings 9,300 9,000

Total stockholders’ equity 55,800 43,500

Total liabilities and stockholders’ equity 153,900 136,800

Table 2.2: Comparative Balance sheet of Zebra company from 2015-2016

Zebra Share Company

Income Statement

For the Year Ended December 31, 2016

________________________________________________________________________

Net sales Br. 196,200,000

Cost of goods sold 159,600,000

Gross profit Br. 36,600,000

Operating expenses* 26,100,000

Earnings before interest and taxes (EBIT) Br. 10,500,000

Interest expense 3,000,000

Earnings before taxes (EBT) Br. 7,500,000

Income taxes 3, 600,00

Net income Br. 3,900,000

* Included in operating expenses are Br. 6,000,000 depreciation and Br. 2,700,000 lease payment

Zebra Share Company

Statement of Retained Earnings

For the Year Ended December 31, 2016

Retained earnings at beginning of year Br. 9,000,000

Add: Net income 3,900,000

Sub-total Br. 12,900,000

Less: Cash dividends

Preferred Br. 300,000

Common 3,300,000

Sub-total Br. 3,600,000

Retained earnings at end of year Br. 9,300,000

Required:from the above calculate the financial ratios of year 2016 and compare it with given

industry average?

You might also like

- FMA AssignmentDocument2 pagesFMA AssignmentGetahun MulatNo ratings yet

- Sample Financial StatmentDocument2 pagesSample Financial Statmentkiya TadeleNo ratings yet

- Chapter 2 FM For BMDocument22 pagesChapter 2 FM For BMMeron TemisNo ratings yet

- ARM Corp Statement of Cash FlowsDocument2 pagesARM Corp Statement of Cash FlowsJeasmine Andrea Diane PayumoNo ratings yet

- Unit 2 Financial AnalysisDocument12 pagesUnit 2 Financial AnalysisGizaw BelayNo ratings yet

- CHAPTER TWO FM Mgt-1Document18 pagesCHAPTER TWO FM Mgt-1Belex Man100% (1)

- FINANCIAL RATIO ANALYSISDocument8 pagesFINANCIAL RATIO ANALYSISFATIMAH ZAHRA BINTI ABDUL HADI KAMELNo ratings yet

- Session 8 - Mohali MicrobrewersDocument1 pageSession 8 - Mohali MicrobrewersPORURI MADHAVINo ratings yet

- 2ND Year QualiDocument4 pages2ND Year QualiMark Domingo MendozaNo ratings yet

- Exercise 3 Basic Acctg. TemplateDocument6 pagesExercise 3 Basic Acctg. TemplateKiana FernandezNo ratings yet

- Sunshine Income Statement 2014Document4 pagesSunshine Income Statement 2014sanjay blakeNo ratings yet

- Geme CostDocument6 pagesGeme CostBiruk Chuchu NigusuNo ratings yet

- Final Account (Solution) RainbowDocument4 pagesFinal Account (Solution) RainbowIsteehad RobinNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- Intermediate Accounting 3 - SolutionsDocument3 pagesIntermediate Accounting 3 - Solutionssammie helsonNo ratings yet

- Ecsy Cola Question2Document8 pagesEcsy Cola Question2Dhagash SanghaviNo ratings yet

- Analisis Laporan KeuanganDocument15 pagesAnalisis Laporan KeuanganMhmmd HirziiNo ratings yet

- Sesi 13 & 14Document15 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Akuntansi Chapter 4Document23 pagesAkuntansi Chapter 4Alfian Rizal MahendraNo ratings yet

- Tax ProblemsDocument14 pagesTax Problemsrav dano100% (1)

- BTDocument2 pagesBTTrâm PhươngNo ratings yet

- BF4013 Revision Questions Set 2Document2 pagesBF4013 Revision Questions Set 2shazlina_liNo ratings yet

- Financial Analysis of Zebra Share CompanyDocument18 pagesFinancial Analysis of Zebra Share CompanybikilahussenNo ratings yet

- Sesi 13 & 14Document10 pagesSesi 13 & 14Dian Permata SariNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow StatementROHIT SHANo ratings yet

- 462 Chapter 5 Assignment Solutions 2019Document20 pages462 Chapter 5 Assignment Solutions 2019Shajid Ul HaqueNo ratings yet

- Westmont PLCDocument5 pagesWestmont PLCmutuamutisya306No ratings yet

- Role Play 20204 - Fin242Document2 pagesRole Play 20204 - Fin242Muhd Arreif Mohd AzzarainNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- MSC F & A Test One SolutionDocument7 pagesMSC F & A Test One Solutionsebastian mlingwaNo ratings yet

- Problem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowDocument2 pagesProblem 1: Chapter 1 - Introduction To Corporate Finance - Chapter 2 - Financial Statement, Taxes, and Cash FlowChristy YouNo ratings yet

- Ch5 Additional Q OnlyDocument13 pagesCh5 Additional Q OnlynigaroNo ratings yet

- Engineering Company Financial Analysis for 2015/2016Document4 pagesEngineering Company Financial Analysis for 2015/2016Umar AshrafNo ratings yet

- Wainwright Corp accounting homeworkDocument2 pagesWainwright Corp accounting homeworkumarNo ratings yet

- Addisu Tadesse Adj FSDocument6 pagesAddisu Tadesse Adj FSGali AbamededNo ratings yet

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- Assignment No. 2 - Cash Flow Statement AnalysisDocument3 pagesAssignment No. 2 - Cash Flow Statement AnalysisNCF- Student Assistants' OrganizationNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- Ventura, Mary Mickaella R. - p.49 - Statement of Financial PositionDocument5 pagesVentura, Mary Mickaella R. - p.49 - Statement of Financial PositionMary VenturaNo ratings yet

- Practice Problems, CH 5Document7 pagesPractice Problems, CH 5scridNo ratings yet

- Fin 621Document3 pagesFin 621animations482047No ratings yet

- Indian Institute of Management Rohtak: End Term ExaminationDocument14 pagesIndian Institute of Management Rohtak: End Term ExaminationaaNo ratings yet

- STATEMENT OF COMPREHENSIVE INCOME (For The Year Ended 31 December, 2017)Document5 pagesSTATEMENT OF COMPREHENSIVE INCOME (For The Year Ended 31 December, 2017)Fatima Ansari d/o Muhammad AshrafNo ratings yet

- Is Fishing Non Motorized BangkaDocument4 pagesIs Fishing Non Motorized BangkaAnonymous EvbW4o1U7No ratings yet

- Chapter 4 Best Master Budget IllustrationDocument23 pagesChapter 4 Best Master Budget IllustrationLeykun GizealemNo ratings yet

- Cash Flow Statement for K BarrettDocument4 pagesCash Flow Statement for K BarrettRajay BramwellNo ratings yet

- Financial Analysis 2Document12 pagesFinancial Analysis 2NicoleNo ratings yet

- Soal Uts Lab Ak. KeuanganDocument3 pagesSoal Uts Lab Ak. KeuanganAltaf HauzanNo ratings yet

- Solution Key To Problem Set 1Document6 pagesSolution Key To Problem Set 1Ayush RaiNo ratings yet

- Financial Statement AnalysisDocument5 pagesFinancial Statement AnalysisPines MacapagalNo ratings yet

- Revision - Additional ExercisesDocument2 pagesRevision - Additional ExercisesĐào Huyền Trang 4KT-20ACNNo ratings yet

- Cash Flow Statement for 2017 ProjectDocument2 pagesCash Flow Statement for 2017 ProjectShakil ShekhNo ratings yet

- Financial StatmentDocument2 pagesFinancial StatmentMohammed ademNo ratings yet

- Accounting Sharim Final ExamDocument5 pagesAccounting Sharim Final ExamsubhanNo ratings yet

- 3.1-ug-3.2-version-2.0Document3 pages3.1-ug-3.2-version-2.0kentjudenercuit1234No ratings yet

- Contoh DTA DTLDocument23 pagesContoh DTA DTLZahra MawarNo ratings yet

- Accounting Assignments Financial StatementsDocument5 pagesAccounting Assignments Financial StatementsTendai MakosaNo ratings yet

- Management Accounting Final ExamDocument4 pagesManagement Accounting Final Examacctg2012No ratings yet

- Managing Financial PrinciplesDocument37 pagesManaging Financial PrinciplesNinu MolNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- AccountingDocument1 pageAccountingsamuel debebeNo ratings yet

- AFAR - Business CombinationDocument11 pagesAFAR - Business CombinationJohn Mahatma Agripa100% (8)

- Total Assets of Jessica P4550,000 Total Liabilities Only of Jenny CoDocument17 pagesTotal Assets of Jessica P4550,000 Total Liabilities Only of Jenny CoNelia Mae S. VillenaNo ratings yet

- Multiple Choice Questions From Cpa ExaminationsDocument4 pagesMultiple Choice Questions From Cpa Examinationssamuel debebe100% (2)

- Development Banking and Its Function in EthiopiaDocument3 pagesDevelopment Banking and Its Function in Ethiopiasamuel debebe80% (5)

- Formulas For Business Combination PDFDocument28 pagesFormulas For Business Combination PDFJulious CaalimNo ratings yet

- Branch Accounting TestbankDocument5 pagesBranch Accounting TestbankCyanLouiseM.Ellixir100% (6)

- Cost-Volume-Profit Analysis Assumptions and ApplicationsDocument1 pageCost-Volume-Profit Analysis Assumptions and Applicationssamuel debebeNo ratings yet

- Formation of a Partnership AccountsDocument27 pagesFormation of a Partnership Accountssamuel debebeNo ratings yet

- AyniDocument4 pagesAynisamuel debebeNo ratings yet

- Chapter 1: The Demand For Audit and Other Assurance ServicesDocument32 pagesChapter 1: The Demand For Audit and Other Assurance Servicessamuel debebeNo ratings yet

- Contractual Capacity and the Effect of Minority and InsanityDocument9 pagesContractual Capacity and the Effect of Minority and Insanitysamuel debebeNo ratings yet

- Advanced Accounting Test Bank Chapter 07 Susan Hamlen PDFDocument60 pagesAdvanced Accounting Test Bank Chapter 07 Susan Hamlen PDFsamuel debebeNo ratings yet

- EbayDocument4 pagesEbaysamuel debebeNo ratings yet

- Branch BestDocument46 pagesBranch Bestsamuel debebeNo ratings yet

- The CPA Profession: Concept Checks P. 28Document10 pagesThe CPA Profession: Concept Checks P. 28dian kusumaNo ratings yet

- 711Document12 pages711samuel debebeNo ratings yet

- Instructor's ManualDocument275 pagesInstructor's Manualrlonardo0583% (6)

- Joint Ventures: That The Joint VenturerDocument8 pagesJoint Ventures: That The Joint Venturersamuel debebeNo ratings yet

- Mental Age (12) Chronological Age (10) X 100 120 IQ: Verbal ReasoningDocument4 pagesMental Age (12) Chronological Age (10) X 100 120 IQ: Verbal Reasoningsamuel debebeNo ratings yet

- UNICEF Ethiopia - 2017 - Education Budget BriefDocument11 pagesUNICEF Ethiopia - 2017 - Education Budget Briefsamuel debebeNo ratings yet

- Development Banking and Its Function in EthiopiaDocument3 pagesDevelopment Banking and Its Function in Ethiopiasamuel debebeNo ratings yet

- Audience Options Audience Selection Production PositioningDocument54 pagesAudience Options Audience Selection Production Positioningsamuel debebeNo ratings yet

- TAXATION001Document31 pagesTAXATION001Boqorka AmericaNo ratings yet

- Account Sales ReportDocument12 pagesAccount Sales Reportsamuel debebeNo ratings yet

- Business Plan for Internet Cafe in Kasama, ZambiaDocument20 pagesBusiness Plan for Internet Cafe in Kasama, ZambiaSaad KaramiNo ratings yet

- Bank Principle and Practices Group Assigment 2018Document1 pageBank Principle and Practices Group Assigment 2018samuel debebeNo ratings yet

- SDocument370 pagesSyeshi janexo86% (7)

- Instructors ManualDocument18 pagesInstructors Manualsamuel debebeNo ratings yet

- Emerging OD Approaches and Techniques for Organizational LearningDocument16 pagesEmerging OD Approaches and Techniques for Organizational LearningDinoop Rajan100% (1)

- Tri-R and Gardenia Reaction PaperDocument7 pagesTri-R and Gardenia Reaction PaperKatrina LeonardoNo ratings yet

- 04 Time Value of MoneyDocument45 pages04 Time Value of MoneyGladys Dumag80% (5)

- Dir 3BDocument2 pagesDir 3Banon_260967986No ratings yet

- Distribution and Logistic (Materi # 4)Document65 pagesDistribution and Logistic (Materi # 4)ayuelvinaNo ratings yet

- Kaizen Management for Continuous ImprovementDocument39 pagesKaizen Management for Continuous ImprovementSakshi Khurana100% (4)

- Lady M Confections case discussion questions and valuation analysisDocument11 pagesLady M Confections case discussion questions and valuation analysisRahul Sinha40% (10)

- Master Data Online Trustworthy, Reliable Data: DatasheetDocument2 pagesMaster Data Online Trustworthy, Reliable Data: DatasheetSahilNo ratings yet

- Cost Accounting Importance and Advantages of Cost Accounting PapaDocument14 pagesCost Accounting Importance and Advantages of Cost Accounting PapaCruz MataNo ratings yet

- Telebrands Corp V Martfive - DJ ComplaintDocument37 pagesTelebrands Corp V Martfive - DJ ComplaintSarah BursteinNo ratings yet

- Accounting For Developers 101Document7 pagesAccounting For Developers 101farkasdanNo ratings yet

- 9708 Economics: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of TeachersDocument4 pages9708 Economics: MARK SCHEME For The October/November 2009 Question Paper For The Guidance of Teachersroukaiya_peerkhanNo ratings yet

- (NAK) Northern Dynasty Presentation 2017-06-05Document39 pages(NAK) Northern Dynasty Presentation 2017-06-05Ken Storey100% (1)

- 2-2mys 2002 Dec ADocument17 pages2-2mys 2002 Dec Aqeylazatiey93_598514No ratings yet

- Asian EfficiencyDocument202 pagesAsian Efficiencysilvia100% (5)

- Transaction Banking Trends in Transaction Banking Report Survey Report v21Document16 pagesTransaction Banking Trends in Transaction Banking Report Survey Report v21Shifat HasanNo ratings yet

- Abbott Vascular Coronary Catheter FSN 3-16-17Document7 pagesAbbott Vascular Coronary Catheter FSN 3-16-17medtechyNo ratings yet

- Lecture 12 Structural Identification and EstimationDocument211 pagesLecture 12 Structural Identification and Estimationfarhad shahryarpoorNo ratings yet

- Booklet - EpfpclDocument9 pagesBooklet - EpfpclAnonymous G5Od0CTrmeNo ratings yet

- QA System KMC AS7Document76 pagesQA System KMC AS7Rayudu VVSNo ratings yet

- Capital Alert 6/13/2008Document1 pageCapital Alert 6/13/2008Russell KlusasNo ratings yet

- Form 6 (Declaration of Compliance)Document1 pageForm 6 (Declaration of Compliance)Zaim AdliNo ratings yet

- Maximize Google Ads Results With a Low BudgetDocument3 pagesMaximize Google Ads Results With a Low BudgetErick Javier FlorezNo ratings yet

- Fisheries Business Plan - Finley Fisheries PVT LTDDocument44 pagesFisheries Business Plan - Finley Fisheries PVT LTDcrazyaps93% (57)

- International Finance and Banking Conference FI BA 2015 XIIIth Ed PDFDocument391 pagesInternational Finance and Banking Conference FI BA 2015 XIIIth Ed PDFrodica_limbutuNo ratings yet

- Hul Subsidirary Annual Report 2018 19Document284 pagesHul Subsidirary Annual Report 2018 19dhananjay1504No ratings yet

- Garment On Hanger SystemsDocument8 pagesGarment On Hanger SystemspithalokaNo ratings yet

- Using DITA With Share Point - Frequently Asked QuestionsDocument6 pagesUsing DITA With Share Point - Frequently Asked QuestionsJohn MelendezNo ratings yet

- Plant Growth Regulators - PGR - MarketDocument15 pagesPlant Growth Regulators - PGR - MarketAgricultureNo ratings yet

- Oe/Ee/Hps:: Instructions To Bidder FORDocument46 pagesOe/Ee/Hps:: Instructions To Bidder FORRabana KaryaNo ratings yet