Professional Documents

Culture Documents

Andhra Pradesh Government launches Comprehensive Financial Management System

Uploaded by

Balu Mahendra Susarla0 ratings0% found this document useful (0 votes)

25 views5 pages1) The document provides clarifications and resolutions on issues reported in the Comprehensive Financial Management System (CFMS) in Andhra Pradesh.

2) It outlines modified processes for handling failed transactions, creation of bills for encashment of earned leave for retired/deceased employees, payment of GPF final payments and gratuity payments.

3) Guidelines are provided for remitting GPF/APGLI challans, changing employee positions due to transfers/promotions, and limitations of accommodating certain working arrangements in CFMS that violate established rules.

Original Description:

go

Original Title

cfms 12

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1) The document provides clarifications and resolutions on issues reported in the Comprehensive Financial Management System (CFMS) in Andhra Pradesh.

2) It outlines modified processes for handling failed transactions, creation of bills for encashment of earned leave for retired/deceased employees, payment of GPF final payments and gratuity payments.

3) Guidelines are provided for remitting GPF/APGLI challans, changing employee positions due to transfers/promotions, and limitations of accommodating certain working arrangements in CFMS that violate established rules.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views5 pagesAndhra Pradesh Government launches Comprehensive Financial Management System

Uploaded by

Balu Mahendra Susarla1) The document provides clarifications and resolutions on issues reported in the Comprehensive Financial Management System (CFMS) in Andhra Pradesh.

2) It outlines modified processes for handling failed transactions, creation of bills for encashment of earned leave for retired/deceased employees, payment of GPF final payments and gratuity payments.

3) Guidelines are provided for remitting GPF/APGLI challans, changing employee positions due to transfers/promotions, and limitations of accommodating certain working arrangements in CFMS that violate established rules.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

GOVERNMENT OF ANDHRA PRADESH

FINANCE (IT) DEPARTMENT

COMPREHENSIVE FINANCIAL MANAGEMENT SYSTEM (CFMS)

CFMS Circular – 12 Dt.: 03.07.2018

Comprehensive Financial Management System (CFMS) is launched on 02.04.2018 and currently

being stabilized. One of the main objectives of CFMS, in addition to establishing a Single Source of

Truth, is to promote efficiency and effectiveness in public financial management activities. APCFSS is

the nodal agency for the implementation, sustenance and support of the CFMS program. Towards this,

APCFSS aims at providing seamless services to all the users of CFMS in a structured and focused

manner. Every effort has been made to address the requirements of all the diversified departments

and individuals. However, during the course of operationalization, users have been reporting issues.

While some issues require a change to the design, majority of the issues are related to understanding,

adoption, data related and above all patience. Attention, of all the HODs and users is invited to GO MS

40, wherein the Help Desk and issue resolution process is explained in detail. Based on the issues

reported so far, the following resolutions and clarifications are being provided and all departmental

users are required to make sure that they understand and disseminate the information to all users.

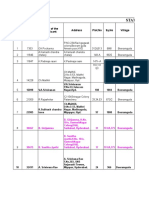

S. No. Issue Reported Requirement/Clarification/Solution/New Process

To ease the process of handling of failure transactions and

to reduce the time lag, some modifications are introduced

and the treasury role is eliminated in this process as there is

no audit involved in processing of failed payments and it is

the responsibility of the DDO to identify the right beneficiary

and correct the bank account details of such beneficiary.

The process of failure transactions handling is detailed

below:

HOO shall configure the workflow to authorise one person

for failed payment request access in OTHERS tab under BLM

Submitter Workflow. This configuration is pre-requisite to

get the display of failure transactions.

Failure Transactions In case of regular vendors i.e. employees / DDO vendors /

1 handling in CFMS going some third party vendors who were registered, the

forward corrections to the Bank Account number and IFSC code are

to be carried out first in Beneficiary Master through

Beneficiary creation request and Master Records have to be

updated first. In case of Other one time vendors who were

not registered, e.g. Scholarship Beneficiaries, corrections

can be made in the screen available to authorised person

who has access to failed payment request function.

Once Bank account number and IFSC code details are

updated, authorised person will save and submit these

details. All such submitted transactions are processed for

payment by CFMS automatically. Once payment is done, the

status will be updated both in beneficiary account

statement and in bill status.

For any reason, if the transaction is failed again, the same

will be communicated to the authorized person who deals

with failure transactions handling process and the same

procedure as above shall be adopted for reprocess.

Provision for EEL Bill in case of Retired employees as well as

Deceased employees is available in CFMS. The detailed

procedure for creation and submission of EEL bill is detailed

below:

In Case of Retired Employee:

The provision for creation of EEL bill is available in HR Bills

Encashment of Earned

category under “Encashment of EL”. The Maker who is

Leave (EEL) in case of

2 assigned with relevant HOAs under MH 2071 can create the

Retired / Deceased

bill duly selecting the Retired employee as Beneficiary.

employees

In Case of Deceased Employee:

The provision for creation of EEL bill is available in HR Bills

category under “DA Arrears and Encashment of EL for

deceased employees”. In this the maker can select any

beneficiary i.e. employee / pensioner / third party

beneficiary.

GPF/Class-IV GPF Final payment in respect of employees

died while in service has to be paid to the nominees or legal

heirs of the deceased employee. To facilitate this, a

provision is available to pay the amount to third party

3 GPF final payment

beneficiaries as well as employee/pension vendors.

Therefore, the DDOs can make these payments under GPF

final payments in HR bill type by selecting loans and

advances category.

In Case of Retired Employees :

Gratuity payment payable to retired Government

employees shall be prepared in IMPAcT-Pension system and

migrated to CFMS for processing and payment.

In case of Deceased Employees :

4 Gratuity Payments

Gratuity in case of deceased Govt. employees has to be paid

to legal heirs/nominees. These payments are facilitated

directly in CFMS. The Treasury Officers can prepare Gratuity

bills by selecting Pensionary charges category under HR Bill

type. The DDOs can pay the Gratuity amount to any type of

beneficiary i.e., employee/pensioner/third parties.

The employees working in foreign Service have to pay their

GPF/APGLI/CPS/AIS GPF/ZPPF deductions through challans.

The remitters have to pay these challans under “employee

challan” option in CFMS. The remitter should fill in the

employee wise and month wise subscription details in the

Remittance of GPF/APGLI

5 challan in order to generate challan number. Further the

Challans

form validates the availability of subscriber category and

account numbers i.e. GPF, APGLI account numbers etc. in

CFMS. If the Employee’s Master record doesn’t have these

Account numbers and Remitter tried to generate the

challan, System will give message that particular employee

is not assigned to that specific service. Such of the

employees have to update their GPF/APGLI/Class IV GPF/

CPS account numbers in CFMS before remitting these

challans.

Whenever, there is change in position for any employee due

Changing of employee

to transfer/ transfer by promotion, such requests have to be

6 positions due to

made to CFMS via helpdesk. The CFMS team would

transfers/promotions

incorporate such changes in the system.

CFMS central team has been receiving several requests to

accommodate working arrangements made by respective

departments in CFMS. It is noticed that the departments

are issuing orders of FAC on a position where another

employee, who is deputed to some other office, is drawing

Working arrangements/ salary. Further the employees who are kept FAC to a

7

FAC/Deputations position are relieved from his original position (post),

whereas FAC is meant for discharging duties on a vacant

position along with the duties of original position to avoid

dislocation of work due to vacant position. Such working

arrangements cannot be accommodated in CFMS as these

are against to the rules in vogue.

R&R is a major component of the Capital Expenditure of the

state as it relates to the rehabilitation and resettlement in

relation to the major infrastructure projects undertaken by

the state. Works related to R&R are part of the irrigation

projects like Dams, Canals and Barrages; power projects;

major industry etc. R & R bills fall into the following

categories:

R&R Cash Awards/Benefits;

R&R Works;

R&R related Land Acquisition Charges; and

R & R Establishment Charges.

Prior to the introduction of CFMS, all R&R bills were being

presented to PAO/APAO (Works) in the BMS portal by the

Procedure for Preparation Joint Collectors (JCs), who are the designated Project

and Presentation of R & R Administrators of all the R & R activities, through the Joint

8

(Rehabilitation and Re- Collector's office login IDs provided in BMS portal.

settlement ) Bills

With the implementation of CFMS, a Workflow process has

been introduced through which every DDO office is given an

opportunity to define their Maker, Checker and Submitter

for preferring bills to the PAO/Treasury. While bringing a

level of accountability as well as transparency in to the

process, this configurable workflow also provides flexibility

and transaction security. Considering the huge volume of

the expenditure it is very essential to ensure the integrity

and the security of the transactions. This process has posed

certain limitations from the perspective of the R&R as the

JCs cannot prefer the bills in this process due to the way they

are positioned in the organizational structure as they are

part of the District Collectorate and not independent offices.

During the meeting held on 26.06.2018 with the Special

Commissioner, R&R; Jt. Collector, West Godavari; CEO,

APCFSS and Director, Works Accounts; the need for a

smooth process was discussed. It was noted that the pace of

the R&R works is picking up and a major project in this is

Polavaram project. Considering the reimbursable nature of

the Polavaram project, the need for a smooth and a

seamless process in preferring the bills was discussed.

Towards this, a modified procedure for presentation of the

R&R bills to PAO/APAO was proposed to and agreed to by

the Finance Department is as under:

R&R activities have been approved to be a separate

office structure in every district and a separate cadre

strength is provided for such offices. These will be

referred to as R&R units in each district.

R&R Units will be headed by the R&R Project

Administrators, who are Jt. Collectors of the districts.

Therefore, in CFMS new Org Units (OU) under the R&R

Spl. Commissioner will be created in each district.

These OUs will be headed by the Project

Administrators. Jt. Collectors will be assigned this

position in an I/c capacity,

R&R Spl. Commissioner will request the government to

allot separate DDO codes for all these 13 R&R units in

the districts.

R&R cash benefit bills will be presented by the DDO of

the R&R Unit (New offices to be created). In this

context, the current procedure of certain RDOs acting

as R&R officers and preferring R&R cash benefits bills

has to be studied and ascertained whether that should

continue as well or that should also be routed through

the R&R units being created in each district.

Creation of R&R (Works) bill in the CFMS system has

certain prerequisites such as creation of Work Masters

- Administrative Sanction details, Technical Sanction

details and Agreement details. The scanned copies of

these original documents have to be uploaded against

the respective Work Masters.

R&R (Works) bills will be preferred by the Executing

Agencies as Maker, Checker and Submitter. R&R

Project Administrators will be set up as mandatory Pre-

Auditors for all R&R (Works) bills, therefore ensuring

that the R&R Administrators (Jt. Collectors) have

complete visibility into the activities. Since the

preferring of Works bills as Submitter is a tedious

activity owing to the various documents that are

needed like mBook etc., it is discussed ad agreed that

JCs need not be asked to submit bills, but will be asked

to do pre-audit thereby ensuring the integration of

their role as well as ensuring the smooth/seamless

operation.

At the time of submitting the bill, any additional

documents like Quality Control Certificate, Seignior age

Charges calculation sheet etc. have to scanned and

uploaded against the bill.

Implementation of mandatory pre-audit step require

certain changes and development in CFMS. In the

interim, it is determined that a mandatory checklist

item will be made available in the R&R bill, which will

also require an attachment of the scanned

authorization copy for the bill as required to be

attached against the checklist item.

All the R&R HoAs (DH-500 SDH-501) will be mapped to

the DDO codes of the executing agencies for smooth

preparation of the bills. In case of non-government

executing agencies like APEWIDC, APSIDC, APSHCL, etc,

the process of Deposit Contributory Works (DCW) will

be followed.

In order to monitor the financial progress of R&R

works, reports will be made available to all the R&R

officers and the Spl. Commissioner, R&R. Additionally,

certain reports will be made available to the executing

agencies as well to monitor their own progress

Land Acquisition bills related to R&R, which

expenditure also need to be booked against 500-501

under the respective major heads of account will be

continued to be preferred by the respective Land

Acquisition Officers (either RDO or SDC, whoever is

entrusted with job). They shall be considered as the

DDO for this purpose. The head of account 500-501

under the respect major heads, will be enabled in their

logins.

Salaries to be moved to 310-311 and Works to 310-319.

Salaries expenditure under DH 310- SDH 312 should not be

310-312 and 500-503

admitted by Treasury. Works sanctioned under 500-503 to

9 Works and Salaries.

be moved to 530-531 (like ROB works) and works

expenditure under DH 500 – SDH 503 should not be

admitted by PAO.

PRINCIPAL FINANCE SECRETARY TO GOVT. (FAC)

You might also like

- Comprehensive Financial Management System (CFMS) CFMS Circular - 8 Dt. 26.04.2018Document3 pagesComprehensive Financial Management System (CFMS) CFMS Circular - 8 Dt. 26.04.2018Samdhani StrikesNo ratings yet

- Textbook of Urgent Care Management: Chapter 13, Financial ManagementFrom EverandTextbook of Urgent Care Management: Chapter 13, Financial ManagementNo ratings yet

- E-Circular: All The Offices/ Branches of State Bank of India Project: Hrms Roll-Out of New ServicesDocument6 pagesE-Circular: All The Offices/ Branches of State Bank of India Project: Hrms Roll-Out of New ServicesMithun SinghNo ratings yet

- Comprehensive Financial Management System (CFMS) Cfms Circular - 6 Dt. 18.04.2018Document3 pagesComprehensive Financial Management System (CFMS) Cfms Circular - 6 Dt. 18.04.2018chinni351No ratings yet

- CFMS Circular - 1: Comprehensive Financial Management System (CFMS)Document2 pagesCFMS Circular - 1: Comprehensive Financial Management System (CFMS)madhavimadhavbNo ratings yet

- EPF Online Withdrawal ProcessDocument5 pagesEPF Online Withdrawal ProcessKalyanaramanNo ratings yet

- PFMS WithmarkingDocument6 pagesPFMS WithmarkingutkarshNo ratings yet

- PFDocument18 pagesPFPredhivrajNo ratings yet

- Commonly Asked QuestionsDocument13 pagesCommonly Asked Questionsdivya vijayanandNo ratings yet

- Time For Change MyDocument3 pagesTime For Change MymaryannbediakoNo ratings yet

- MPF Transfer Form GuideDocument4 pagesMPF Transfer Form GuideLam Sin WingNo ratings yet

- HANDBOOKDocument10 pagesHANDBOOKSavita matNo ratings yet

- Guidelines FICODocument2 pagesGuidelines FICORajeev BangaNo ratings yet

- b15t2 Oap LoansDocument12 pagesb15t2 Oap LoansabhishekNo ratings yet

- UBI Reading Material VITAL-CBSDocument43 pagesUBI Reading Material VITAL-CBSPankaj AhujaNo ratings yet

- User Manual CDDOsDocument89 pagesUser Manual CDDOsAnkitjee86No ratings yet

- Human Resources Management Division, Head Office, New Delhi: TH THDocument5 pagesHuman Resources Management Division, Head Office, New Delhi: TH THVipul GautamNo ratings yet

- Claims SPark Temp EmpDocument5 pagesClaims SPark Temp EmpShreeshakumar M P BallalNo ratings yet

- One Month Notice Period Letter FormatDocument12 pagesOne Month Notice Period Letter FormatShakeel Ahmed AjizNo ratings yet

- No Question Proposed AnswerDocument3 pagesNo Question Proposed AnswerKianKianKianKianNo ratings yet

- No Question Proposed AnswerDocument3 pagesNo Question Proposed AnswerShahrizal IsmailNo ratings yet

- policy-finance-payroll-ke-012Document9 pagespolicy-finance-payroll-ke-012mzafarullah.rphNo ratings yet

- Description: Tags: RemittingFundsThroughACHDocument3 pagesDescription: Tags: RemittingFundsThroughACHanon-866559No ratings yet

- Circular No.88 - 2018 - Fin Dated 25-09-2018 PDFDocument2 pagesCircular No.88 - 2018 - Fin Dated 25-09-2018 PDFDeepak KumarNo ratings yet

- Banoko Pilipinas: Serurnai. NoDocument12 pagesBanoko Pilipinas: Serurnai. NoNan YuNo ratings yet

- FICAAADocument4 pagesFICAAAYash GuptaNo ratings yet

- EPF For Construction WorkersDocument10 pagesEPF For Construction WorkersBIJAY KRISHNA DASNo ratings yet

- Access E-Disbursement Details and RTC Reference NumbersDocument2 pagesAccess E-Disbursement Details and RTC Reference NumbersAbarquez JenNo ratings yet

- Bank Payroll Service AgreementDocument4 pagesBank Payroll Service AgreementMikaelaNo ratings yet

- User Manual For Conformation of Employees HR Data: Step1: LoginDocument10 pagesUser Manual For Conformation of Employees HR Data: Step1: Loginkirank_11No ratings yet

- PF & Pension Fund Deptt. Circular No. PF & Pension Fund Deptt. Circular No.05/2021Document4 pagesPF & Pension Fund Deptt. Circular No. PF & Pension Fund Deptt. Circular No.05/2021Amit SinghNo ratings yet

- Article PF Contributions On AllowancesDocument4 pagesArticle PF Contributions On Allowancestarlochan singhNo ratings yet

- COVID19 - JobKeeper - Guide 1.0.2Document19 pagesCOVID19 - JobKeeper - Guide 1.0.2Theresa NguyenNo ratings yet

- ContentDocument15 pagesContentS.K. PREMEENo ratings yet

- Employer-English Final 221219 175931Document21 pagesEmployer-English Final 221219 175931saravanass BakersNo ratings yet

- Test 3Document12 pagesTest 3Maithili KulkarniNo ratings yet

- PO and Payment ProcessDocument3 pagesPO and Payment Processkalpanashah.1961No ratings yet

- Naya' Form 3Cd: 1. Non-Compliance With Provisions of Tax Deduction at Source (Clause 27) : Delays andDocument6 pagesNaya' Form 3Cd: 1. Non-Compliance With Provisions of Tax Deduction at Source (Clause 27) : Delays andrakeshca1No ratings yet

- Stepbystepguide Paysys PDFDocument21 pagesStepbystepguide Paysys PDFKhalid PandithNo ratings yet

- Case Assignment 1 - Invent A Fraud Khadine PriceDocument8 pagesCase Assignment 1 - Invent A Fraud Khadine Pricekhadine PriceNo ratings yet

- FBT Perks Vs FBTDocument5 pagesFBT Perks Vs FBTnirav_poptaniNo ratings yet

- Les and RegulationsDocument12 pagesLes and RegulationsRajeev VarmaNo ratings yet

- Exit - Policy - ECMS V 1 0Document7 pagesExit - Policy - ECMS V 1 0rohitmahali0% (1)

- Chapter - 5: Recruitment, Selection and Placement: Back To Manual IndexDocument4 pagesChapter - 5: Recruitment, Selection and Placement: Back To Manual IndexNajaf RizviNo ratings yet

- FPC010 Application For Providnet Benefits ClaimDocument2 pagesFPC010 Application For Providnet Benefits ClaimFe Pastor100% (1)

- PayAll-3Document1 pagePayAll-3Gogreen FieldsNo ratings yet

- Accounts Receivable PolicyDocument6 pagesAccounts Receivable PolicyJS100% (1)

- User Manual For Single Master Form-FirmsDocument103 pagesUser Manual For Single Master Form-FirmsUmaMaheshwariMohanNo ratings yet

- Online Bills - SPARK HELPDocument68 pagesOnline Bills - SPARK HELPTEAM AGRINo ratings yet

- Updating of Registered Employees (SSS, PHIC, HDMF)Document9 pagesUpdating of Registered Employees (SSS, PHIC, HDMF)Carmina EdradanNo ratings yet

- Pag-IBIG penalty programDocument2 pagesPag-IBIG penalty programCrizetteTarcena100% (1)

- SAOF-Individual - FSL PDFDocument15 pagesSAOF-Individual - FSL PDFtalhaNo ratings yet

- JM Transaction SlipDocument2 pagesJM Transaction SlipAuthentic StagNo ratings yet

- EPF Scheme Overview: Benefits, Withdrawals, and ServicesDocument36 pagesEPF Scheme Overview: Benefits, Withdrawals, and ServicesE01212501-PRAKASH KUMAR T DEPT OF PURE COMMERCENo ratings yet

- APDocument6 pagesAPprasana devi babu raoNo ratings yet

- Loan Penalty Con DonationDocument2 pagesLoan Penalty Con DonationEdithaSubaste100% (1)

- Payroll Dictionary of Payroll and HR TermsDocument28 pagesPayroll Dictionary of Payroll and HR TermsMarkandeya ChitturiNo ratings yet

- Client Billing and Collection PolicyDocument7 pagesClient Billing and Collection PolicyGerard Nelson ManaloNo ratings yet

- Procedure For Handling Npa Two Accounts at Cbs BranchesDocument3 pagesProcedure For Handling Npa Two Accounts at Cbs BranchessunilNo ratings yet

- CEA-Reimbursement-FormatDocument4 pagesCEA-Reimbursement-FormatBalu Mahendra SusarlaNo ratings yet

- 2016hou RT131Document3 pages2016hou RT131Balu Mahendra SusarlaNo ratings yet

- iit 5th roundDocument26 pagesiit 5th roundBalu Mahendra SusarlaNo ratings yet

- 685Document4 pages685Balu Mahendra SusarlaNo ratings yet

- S O U T H C E N T R A L: List of LIC Offices For Servicing of PMJDY ClaimDocument23 pagesS O U T H C E N T R A L: List of LIC Offices For Servicing of PMJDY ClaimBalu Mahendra SusarlaNo ratings yet

- OutcomeBudgetE2020 2021Document285 pagesOutcomeBudgetE2020 2021Rohit MishraNo ratings yet

- Limited On Their Being Allotted To Telangana Cadre.: K. Praveen Kumar Secretary To GovernmentDocument2 pagesLimited On Their Being Allotted To Telangana Cadre.: K. Praveen Kumar Secretary To GovernmentBalu Mahendra SusarlaNo ratings yet

- DA GoDocument6 pagesDA GoBalu Mahendra SusarlaNo ratings yet

- 2017rev MS111Document2 pages2017rev MS111Balu Mahendra SusarlaNo ratings yet

- DOCSs 25112020Document2 pagesDOCSs 25112020Balu Mahendra SusarlaNo ratings yet

- Explanatory NoteDocument5 pagesExplanatory NoteBalu Mahendra SusarlaNo ratings yet

- State District Zone: Divisional Grievance Redressal OfficersDocument9 pagesState District Zone: Divisional Grievance Redressal Officersdheerajnarula1991No ratings yet

- Évé) (Éjééå Béeé ºéæéêfé (Ié (Ééê®Sé É: Key To The Budget Documents 2021-2022Document18 pagesÉvé) (Éjééå Béeé ºéæéêfé (Ié (Ééê®Sé É: Key To The Budget Documents 2021-2022SidharthaNo ratings yet

- Budget at A GlanceDocument19 pagesBudget at A GlanceRohan PalNo ratings yet

- CMRFDocument2 pagesCMRFBalu Mahendra SusarlaNo ratings yet

- 2017hou RT4Document1 page2017hou RT4Balu Mahendra SusarlaNo ratings yet

- Beeramguda (V) PatancheruDocument10 pagesBeeramguda (V) PatancheruvikramsimhareddyNo ratings yet

- 2019hou RT33Document2 pages2019hou RT33Balu Mahendra SusarlaNo ratings yet

- 9.form For TTA Claim PDFDocument3 pages9.form For TTA Claim PDFBalu Mahendra SusarlaNo ratings yet

- Circular - VAT Refund 60 DaysDocument1 pageCircular - VAT Refund 60 DaysBalu Mahendra SusarlaNo ratings yet

- 2012rev RT1012Document1 page2012rev RT1012Balu Mahendra SusarlaNo ratings yet

- BudgetDocument33 pagesBudgetRaghu RamNo ratings yet

- 2017se RT84Document1 page2017se RT84Balu Mahendra SusarlaNo ratings yet

- TreasurycodeDocument59 pagesTreasurycodeBalu Mahendra SusarlaNo ratings yet

- 07 - Chapter 2 PDFDocument58 pages07 - Chapter 2 PDFBalu Mahendra SusarlaNo ratings yet

- rps1999 PDFDocument429 pagesrps1999 PDFsyedNo ratings yet

- SignedDocument1 pageSignedBalu Mahendra SusarlaNo ratings yet

- Volume VII 1 PDFDocument322 pagesVolume VII 1 PDFBalu Mahendra SusarlaNo ratings yet

- 2018PR RT58Document2 pages2018PR RT58Balu Mahendra SusarlaNo ratings yet

- TDS Under Section 194C: Press Releases Blog PostsDocument4 pagesTDS Under Section 194C: Press Releases Blog PostsBalu Mahendra SusarlaNo ratings yet

- CRM Project PlanDocument12 pagesCRM Project Planwww.GrowthPanel.com100% (5)

- To Be Discussed Final ExaminationDocument11 pagesTo Be Discussed Final ExaminationRenz CastroNo ratings yet

- Attachment 2 - Sample Master Service AgreementDocument11 pagesAttachment 2 - Sample Master Service AgreementAnubha MathurNo ratings yet

- BuyersGuide For Fraud Detection in Banking - Guide - For - FR - 756888 - NDXDocument17 pagesBuyersGuide For Fraud Detection in Banking - Guide - For - FR - 756888 - NDXKEEPGEEKNo ratings yet

- Break Even Point, Benefit Cost Ratio, Payback PeriodDocument20 pagesBreak Even Point, Benefit Cost Ratio, Payback PeriodnofiarozaNo ratings yet

- Report On Financial Ratio Analysis Of: Section: 01Document25 pagesReport On Financial Ratio Analysis Of: Section: 01Meher AfrozNo ratings yet

- International Trade: application exercisesDocument10 pagesInternational Trade: application exercisesHa Nguyen Pham HaiNo ratings yet

- Private Organization Pension Amendment ProclamationDocument8 pagesPrivate Organization Pension Amendment ProclamationMulu DestaNo ratings yet

- L6 Interpreting FlowchartDocument28 pagesL6 Interpreting FlowchartRykkiHigajVEVONo ratings yet

- ADEVA Task#1Document3 pagesADEVA Task#1Maria Kathreena Andrea AdevaNo ratings yet

- Top reasons to invest in Oracle EPM Cloud for operational efficiencyDocument3 pagesTop reasons to invest in Oracle EPM Cloud for operational efficiencyemedinillaNo ratings yet

- Granules India SWOT and Porter AnalysisDocument12 pagesGranules India SWOT and Porter AnalysisSarthak GoelNo ratings yet

- Taxation Part 2Document101 pagesTaxation Part 2Akeefah BrockNo ratings yet

- KPMG Bangladesh Investment Guide General 1601523967-Unlocked PDFDocument42 pagesKPMG Bangladesh Investment Guide General 1601523967-Unlocked PDFMuhammad Tahan AbdullahNo ratings yet

- QUESTION 1 Moo & Co. in Ipoh, Engaged The Services of A Carrier, BZDocument5 pagesQUESTION 1 Moo & Co. in Ipoh, Engaged The Services of A Carrier, BZEllyriana QistinaNo ratings yet

- Ede ReportDocument33 pagesEde ReportMayur Wadal75% (4)

- IRCTC 09022023142232 OutcomeofboardmeetingDocument7 pagesIRCTC 09022023142232 OutcomeofboardmeetingsaiNo ratings yet

- Accounting For AR AP TransactionsDocument9 pagesAccounting For AR AP TransactionsFeroz MohammedNo ratings yet

- Bandhan Bank Case Study: Transformation from MFI to Leading BankDocument14 pagesBandhan Bank Case Study: Transformation from MFI to Leading BankSOURAV GOYALNo ratings yet

- NPTEL Assign 5 Jan23 Behavioral and Personal FinanceDocument9 pagesNPTEL Assign 5 Jan23 Behavioral and Personal FinanceNitin Mehta - 18-BEC-030No ratings yet

- HR QsDocument44 pagesHR QsRahul SinghaniaNo ratings yet

- Ude My For Business Course ListDocument107 pagesUde My For Business Course ListHONEYRIKNo ratings yet

- Partnership Law Atty. Macmod: Multiple ChoiceDocument10 pagesPartnership Law Atty. Macmod: Multiple ChoiceJomarNo ratings yet

- An Innovative Step in Loyalty programs-LOYESYSDocument18 pagesAn Innovative Step in Loyalty programs-LOYESYSJason MullerNo ratings yet

- Sample Quiz QuestionsDocument2 pagesSample Quiz QuestionsSuperGuyNo ratings yet

- Introduction To Industrial RelationsDocument14 pagesIntroduction To Industrial RelationsYvonne NjorogeNo ratings yet

- AFM 2021 BatchDocument4 pagesAFM 2021 BatchDhruv Shah0% (1)

- Module 6 - Lect 3 - Role of CBDocument22 pagesModule 6 - Lect 3 - Role of CBBHAVYA GOPAL 18103096No ratings yet

- Fraud Tree Focus InventorycompressedDocument64 pagesFraud Tree Focus InventorycompressedJonathan Navallo100% (1)

- 1.mba6 Syllabus Financial ManagementDocument5 pages1.mba6 Syllabus Financial ManagementIoana DragneNo ratings yet