Professional Documents

Culture Documents

InternationalFinancial MGM Forex

Uploaded by

pratikkange@gmail.comCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

InternationalFinancial MGM Forex

Uploaded by

pratikkange@gmail.comCopyright:

Available Formats

16.

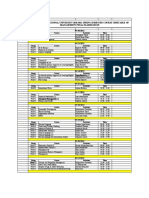

FOREIGN EXCHANGE DEALINGS

1. SPREAD:

This is the difference between the “ask” (buy) price and the

“bid” (sell) price from the foreign exchange dealer’s point of

view.

The buying rate precedes the selling rate, that is the first rate

is the buying rate and selling rate is the second rate.

For example, when a dealer in Mumbai quotes:

1 Pound Sterling = Rs. 78.00 – 78.15 or 78.00 / 78.15

meaning he will buy (bid) 1 Pound @ Rs. 78.00 and

sell (ask) 1 Pound @ Rs. 78.15

(Quotations are normally given upto 4 decimal points.)

Spread is influenced by the currency involved, the volume of

business and the market sentiments/rumours about that currency.

It is like the gross profit of a business firm out of which the

dealer has to meet his establishment expenses.

Spread percent = [(Ask price – Bid Price) / Ask price x

100]

= [(78.15 – 78.00) / 78.15 x 100] =

0.19193%

And

[(Ask price – Bid price) / Bid

Price x 100]

= [(78.15 -78.00) / 78.00 x 100] =

0.19231%

The spread appears very low, but on a daily turnover of

Rs. 1 million, the gross spread is Rs. 1,91,130.

2. SPOT & FORWARD RATES

Example 1: On 1st February, 2010, an Indian firm exports goods of

the value of US$ 100 million on 6 months’ credit.

On that day, the six-month Forward Rate is Rs. 49 per 1US$.

The firm agrees to sell US$ 100 million, 6 months forward at Rs.

49. (i.e.1st August, 2010).

By this, the firm has assured itself of the receipt of US$ 100

million x Rs. 49 = Rs. 4900 million.

a. Suppose the Spot Rate per US$ on 1st August is Rs. 48.50.

The Indian firm has gained Rs. 50 million (Rs. 4900 million

actual receipts (-) Rs. 4,850 million that it would have

otherwise obtained in the absence of a forward contract.

b. If no forward cover had been made and the Spot Rate on 1st

August is Rs. 49.30, he would have gained Rs. 30 million.

c. If 6 months’ forward cover had been made on 1st Feb.,

and the Spot Rate on 1st August is Rs. 49.30, he will suffer

a

loss of Rs. 30 million.

The forward rates are normally for 1, 2, 3, 6, 9 and 12 months.

The forward rates can be a. at a premium or b. at a discount.

In case, the forward rates are higher than the spot rate, it

implies that forward rates are at a premium as more amounts of

domestic currency is required to be paid in future, to buy y

amount of foreign currency.

If the forward rates are lesser than the spot rates, it signals

that the forward rates are at a discount since less amount of

domestic currency is required to buy y amount of foreign

currency.

Forward rate premium / discount is calculated as:

Premium = (Forward rate – Spot rate) / Spot rate

X (12 months / N)

Discount = (Spot rate – Forward rate) / Spot rate

X (12 months / N)

(N refers to the number of months for which forward contract

is to be made)

Example 2: From the data given below, calculate the forward

premium and discount of the Pound in relation to the INR:

Spot Rs. 77.9542 / 78.1255

1 month forward Rs. 78.2111 / .4000

3 months forward Rs. 77.6055 / .7555

6 months forward Rs. 78.8550 / .9650

Premium at Bid Price:

1 month: (Rs.78.2111 – 77.9542) /

77.9542

X (12 / 1) X 100 =

3.95% p.a.

6 months: (Rs.78.8550 – 77.9542) /

77.9542

X (12 / 6) X 100 =

2.31% p.a.

Premium at Ask price:

1 month: (Rs. 78.4000 – 78.1255) /

78.1255

X (12 / 1) X 100 =

4.21% p.a.

6 months: (Rs. 78.9650 – 78.1255) /

78.1255

X (12 / 6) X 100 =

2.15% p.a.

Note: Pound is at a premium and Rs. in discount .

Discount at Bid price:

3 months: (Rs. 77.9542 – 77.6055) /

77.9542

X (12 / 3) X 100 =

1.79% p.a.

Discount at Ask price:

3 months: (Rs. 78.1255 – 77.7555) /

78.1255

X (12 / 3) X 100

= 1.89% p.a.

Note: Pound is at a discount and Rs. in premium.

Forward premiums for longer time spans tend to be higher in view

of the enhanced risk.

3. CROSS RATES:

When a direct quote of the home currency or any other currency

desired by the dealer/corporate firm bank, is not available in

the forex market, it is computed with reference to other pairs of

currencies.

Cross rates facilitate in determining exchange rates (both sport

and forward) with respect to currencies not having direct quotes.

The US$ is the most actively traded currency in the world forex

markets.

On account of this, exchange rates of most of the currencies are

quoted in relation to the US$. It becomes the benchmark /

intermediate / third currency to calculate the exchange rates of

other currencies.

In fact, the cross rate between any two currencies can be

determined using Pound Sterling, Ff, DM, Japanese yen etc.

Example 3: An Indian importer has to pay to a New Zealand export

firm in NZ$.

Direct quote of INR to NZ$ is not available.

Therefore, he has to use the other two relevant quotes viz:

NZ$ / US$: 1.7908 – 1.8510

INR / US$: 48.0465 – 48.2111

The exchange rate between INR and NZ$ is determined as:

The Indian importer has to buy US$ at the ask rate of

Rs. 48.2111

b. He then sells the US$ to buy NZ $, when the dealer/bank

buys the US$ in exchange for NZ $ at the bid rate of 1.7908.

He gets NZ$ 1.7908 for INR 48.2111.

The INR /NZ$ rate is Rs. 48.2111 /1.7908 which is equal to

Rs. 26.9215 / 1 NZ$ selling / ask rate from the point of view of

the dealer bank.

To complete the quote, the buying/bid rate is also required,

which is computed as below:.

The dealer purchases US$ for Rs. 48.0465

The dealer sells 1US$ in exchange for 1.8510 NZ$.

1,8510 NZ$ are equivalent to Rs. 48.0465 which means

that 1 NZ$ buying rate is Rs. 25.9571.

The complete quote is: INR / NZ$ = Rs. 25.9571 – 26.9215

The term “cross” rate is used literally to determine the bid rate

and the ask rate as:

NZ$ / US$ 1.7908 - 1.8510

INR / US$ 48.0465 - 48.2111

INR / NZ$ 48.2111 / 1.7908 = 25.9571

48.0465 / 1.8510 =

26.9215

Since exchange rates for a third pair of currency can be

derived , given two pairs of exchange rates, cross rates between

B and C can be derived if the rates between currencies A and B as

well as A and C are given, the following formulae can be used:

(B/C)bid = (B/A)bid X (A/C)bid where,

(A/C)bid = 1/

(C/A)ask

(B/C)ask = (B/A)ask X (A/C)ask where,

(A/C)ask = 1/

(C/A)bid

Example 4: From the following rates, determine INR / Can$

exchange rate: INR / US$ = 47.7568 / 47.9675

Can$ / US$ = 1.5412 / 1.5450

(INR/Can$)bid = (INR/US$)bid X (US$/Can$)bid

= 47.7568 X 1/1.5450 = INR

30.9106

(INR/Can$)ask = (INR/US$)ask X (US$/Can$)ask

= 47.9675 X 1/1.5142 = INR

31.6784

Therefore, INR/Can$ rate is = Rs. 30.9106 – 31.6784

In case the actual exchange rates are not in tune with cross

rates, firms as well as dealers/bankers would like to switch over

to markets offering them more favourable rates.

Non-equivalence of the two rates would provide a riskless

arbitrage opportunity to dealers/bankers/arbitrageurs.

4. ARBITRAGE:

In the context of Forex markets, arbitrage means an act of buying

currency in one market (at lower price) and selling it in another

(at higher price). The difference in exchange rates (in a

specified pair of currencies ) in two markets provides an

opportunity to earn profit without risk.

As a result, equilibrium will be restored in the exchange rates

in different markets.

A. Geographical Arbitrage:

This consists of buying currency from a forex market, say London,

where it is cheaper and sell in another forex market, say Tokyo,

where it is costly.

Since forex transactions take place on telephone/fax messages,

geographical distances have no relevance.

Example 5: At two forex centres, the following Rs.-US$ rates are

quoted:

London Rs. 47.5730 - 47.6100

Tokyo (i) Rs. 47.6350 - 47.6675

Tokyo (ii) Rs. 47.6000 - 47.6450

Find out the arbitrage possibilities for an arbitrageur who has

Rs. 100 million.

In the case of Tokyo (i),

He will buy US$ from London market at the rate of 47.6100

as it is cheaper compared to Tokyo rate of 47.6350.

He will obtain Rs. 100 million / 47.6100

= US$

2,100,399.075

He will sell US$ 2,100,399.075 in Tokyo market at the rate of Rs.

47.6350 as it is higher and will obtain Rs. 100,052,509.90

He will earn a profit of Rs. 100,052,509.90 (-) 100 million

= Rs. 52,509.90 without any risk.

In the case of Tokyo (ii),

If he buys US$ from London @ 47.6100, he can sell it in

Tokyo market at the lower rate of 47.6000, he will make

only

a loss. There is no arbitrage opportunity.

B. Triangular Arbitrage:

This takes place when there are three currencies involving three

markets. This arbitrage is also known as three-point arbitrage.

Example 6: The following are three quotes in three forex markets:

US$ 1 = Rs. 48.3011 in Mumbai

Pound 1 = Rs. 77.1125 in London

US$ 1 = Pound 1.6231 in New York

If an arbitrageur has US$ 1 million, is any arbitrage

gains

possible? (assuming no transaction costs)

Arbitrage gains are possible since the cross rates

between

US$ and Pound by using the rates at London and Mumbai

are different.

(Rs. 77.1125/Rs. 48.3011 = US$ 1.5965 per Pound)

He buys Indian Rupees with US$ 1 million in Mumbai

market.

The proceeds will be Rs. 48.3011 X US$ 1 million

= Rs. 48,301,100.

He converts Indian Rupees to Pounds at London market

Rs. 48,301,100 / 77.1125 = Pounds 626,371.8592.

He then converts Pounds at New York Market and gets

626,371.8592 X US$ 1.6231 = US$ 1,016,664.164

d. The arbitrage profit is US$ 1,016,664.164 – 1

Million

= US$ 16,664.164.

The arbitrage process will set in whenever there are significant

differences between quoted rates and cross rates.

This process continues till there is a realignment of the rates.

C. Covered Interest Arbitrage (in Forward Market):

In the case of Spot Markets, a mismatch between cross rates and

quoted rates provides an opportunity for arbitrage.

Similar opportunities exist in Forward Markets also in case the

difference between the forward rate and the spot rates (in terms

of premium or discount) is not matched by the interest rate

differentials of the two currencies.

Since the comparison is to be made with interest rate

differentials, this is also called covered interest arbitrage.

Example 7: Spot rate Rs. 78.10 /

Pound

3 month Forward rate Rs. 78.60 /

Pound

3 month Interest rates: INR:

9%

Pound: 5%

(Assume borrowings of Pounds 200,000)

3 month forward rate of Pound is higher at Rs. 78.60

compared to the Spot rate of Rs. 78.10, which implies

that the

Pound is at a premium.

Premium % = [(Rs.78.60 – 78.10) / Rs.78.60] X (12/3) X

100

= 2.56%.

Interest rate differential = 9.00% - 4.00% = 4.00%

Since Interest rate differential (4%) and

Premium percentage (2.56%) do not match,

there is an arbitrage opportunity.

The arbitrageur borrows Pounds 200,000 at 5% for 3

months (since Pounds carry a lower rate of interest of 5%).

He converts Pounds 200,000 at the rate of Rs. 78.10 in the

Spot market and gets 200,000 X 78.10 = Rs. 15,620,000.

He invests Rs. 15,620,000 in the money market at 9%

p.a. for 3 months and gets an interest of:

Rs. 15,620,000 X (9/100) X (3/12) = Rs. 351,450.

Total sum available three months from now will be

Rs. 15,620,000 + Rs. 351,450 = Rs. 15,971,450.

Since he will get this Rs. 15,971,450 after 3 months, he

will sell forward at the rate of Pound 1 = Rs. 78.60 and

he will get Rs. 15,971,450 / 78.60 = Pounds 203,199.1094.

The interest due on Pounds borrowed will be:

Pounds 200,000 X (3/12) X (5/100) = 2,500.

He refunds the sum borrowed alongwith interest which

amounts to Pounds 200,000 + 2,500 = 202,500

h. His net gain is:

Pounds 203,199.1094 – 202,500 = 699.1094.

These arbitrage gain possibilities will cease to exist:

if the difference in forward rate and spot rates

(in percentage terms)

coincides with the interest rate differential (in percentage)

of the two currencies.

5. THEORIES OF EXCHANGE RATES

Purchasing Power Parity (PPP) Theory

This is the theory according to which goods of equal value in

different countries are equated through an exchange rate.

Example:

Assume the spot rate between the INR and US$ is Rs. 47 in year 1

(base year - 100).

In the first quarter of year 2, the price index in India is 105

and that of US is 102.

Based on this data, the new exchange rate will be:

INR/US$ 1 = Rs. 47 X (105/102) = Rs. 48.3823

Interest rate Parity Theory

This is the theory according to which, the discount/premium of

one currency in relation to another reflects the interest rate

differentials between them.

For instance, if interest rates are relatively higher in US than

in Japan, Japanese funds will be attractive to the

bankers/investors in US.

There will be a flight of capital from Japan to US causing

appreciation of the exchange rate of the US$.

More units of Japanese yen will be required to buy the ssame US$;

there would be arelative decline in the exchange value of

Japanese yen vis-à-vis US$.

According to this theory,

Forward rate = Spot Rate X [(1 + Ib) /(1 + If)

Where,

Ib represents interest rate on home currency and

If represents interest rate on foreign currency.

Therefore, foreign currency is to be at a premium if it has a

lower interest rate and vice versa.

Balance of Payment Position

In the event of a country running a big deficit or persistent

deficit in its BOP, its currency is likely to be under pressure

and the monetary authority has to resort to devaluation of the

currency.

Devaluation is expected to help in reducing imports (as foreign

goods become more costly) and in increasing exports (as the home

currency becomes cheaper and the country’s goods are cheaper

overseas).

In contrast, if the BOP of a country is in a favourable position

with surpluses, the value of the currency is likely to

appreciate.

Volume of International Reserves / Foreign Exchange:

In case the monetary authority feels that its currency is

depreciating in the forex market, it may step in by

releasing/selling foreign exchange out of its reserves.

The monetary authority can ‘prop up’ its currency only if it has

adequate F/E reserves available.

Level of Activity and Employment:

There is likely to be a positive impact on the exchange rates, by

way of a higher level of economic activity and full employment.

Growing economies having a higher level of economic activity and

employment have good potential and prospects of appreciation in

the value of their currencies.

Low level of economic activity and increasing unemployment

enhances the probability of depreciation of its currency.

All the above factors, taken together, have their impact on

exchange rates.

You might also like

- Cloud NotesDocument1 pageCloud Notespratikkange@gmail.comNo ratings yet

- Azure DWDocument2 pagesAzure DWpratikkange@gmail.comNo ratings yet

- International Financial MGMDocument8 pagesInternational Financial MGMpratikkange@gmail.comNo ratings yet

- International Financial MGMDocument1 pageInternational Financial MGMpratikkange@gmail.comNo ratings yet

- Data WarehousingDocument29 pagesData Warehousingpratikkange@gmail.comNo ratings yet

- DW Quiz 1Document2 pagesDW Quiz 1pratikkange@gmail.comNo ratings yet

- Embedded Platforms: Enterprise Mobility Securi TY U XDocument1 pageEmbedded Platforms: Enterprise Mobility Securi TY U Xpratikkange@gmail.comNo ratings yet

- IELTS2015 EssayDocument3 pagesIELTS2015 Essaypratikkange@gmail.comNo ratings yet

- PMP Lesson LearnedDocument16 pagesPMP Lesson Learnedpratikkange@gmail.comNo ratings yet

- Places To Visit in JaipurDocument1 pagePlaces To Visit in Jaipurpratikkange@gmail.comNo ratings yet

- Risk ManagementDocument2 pagesRisk Managementpratikkange@gmail.comNo ratings yet

- Oracle JDDocument1 pageOracle JDpratikkange@gmail.comNo ratings yet

- IELTS2015 EssayDocument3 pagesIELTS2015 Essaypratikkange@gmail.comNo ratings yet

- Database Design QuestionsDocument2 pagesDatabase Design Questionspratikkange@gmail.comNo ratings yet

- PMP Comprehensive Study NotesDocument76 pagesPMP Comprehensive Study Notespratikkange@gmail.comNo ratings yet

- Short Story of Lord AyyappaDocument10 pagesShort Story of Lord Ayyappapratikkange@gmail.comNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Letter Request For Rent Waiver of MBTC Dagupan-Perez Branch During ECQDocument2 pagesLetter Request For Rent Waiver of MBTC Dagupan-Perez Branch During ECQGerman ReyesNo ratings yet

- Inflation AccountingDocument2 pagesInflation AccountingDeepanshu SharmaNo ratings yet

- Idx IcDocument36 pagesIdx Icsas2000idNo ratings yet

- Bank Sort CodesDocument1 pageBank Sort CodesAnonymous tg2LDSi74% (19)

- Relations Between Bangladesh and Canada: Politics and EconomyDocument12 pagesRelations Between Bangladesh and Canada: Politics and EconomyFaria RahmanNo ratings yet

- Admission ChallanDocument2 pagesAdmission ChallanBorn TalentedNo ratings yet

- Macroeconomics 11th Edition Parkin Solutions ManualDocument26 pagesMacroeconomics 11th Edition Parkin Solutions ManualCathyHowardokqm100% (49)

- Quantitative Easing Timeline What Is Quantitative EasingDocument3 pagesQuantitative Easing Timeline What Is Quantitative EasingMohamad soltaniNo ratings yet

- Property Rights Institutions in Development: Chapter FIVEDocument48 pagesProperty Rights Institutions in Development: Chapter FIVEWelday GebremichaelNo ratings yet

- Ingles Clase 22 de MayoDocument5 pagesIngles Clase 22 de MayoDarwing Alfonso TorresNo ratings yet

- Eng 465 Final 2Document3 pagesEng 465 Final 2api-705999488No ratings yet

- Writing IIDocument6 pagesWriting IIAntonio UrrutiaNo ratings yet

- Interview Materials ICICI BankDocument3 pagesInterview Materials ICICI BankBiswajit BeheraNo ratings yet

- Cbsnews 20230205 TUEDocument65 pagesCbsnews 20230205 TUECBS News PoliticsNo ratings yet

- DOMS Industries LTD - RHPDocument506 pagesDOMS Industries LTD - RHPGovernment ExamsNo ratings yet

- Dr. Somdeep Chatterjee Extn: 2028 M-105, NAB: Somdeep@iimcal - Ac.inDocument30 pagesDr. Somdeep Chatterjee Extn: 2028 M-105, NAB: Somdeep@iimcal - Ac.inV SURENDAR NAIKNo ratings yet

- HTTPSCDN Nodia Presspdfjessspsujessspsu05 PDFDocument3 pagesHTTPSCDN Nodia Presspdfjessspsujessspsu05 PDFSubha ShiniNo ratings yet

- WP 990 - Sharing Economy Platforms - Immovable Property PDFDocument11 pagesWP 990 - Sharing Economy Platforms - Immovable Property PDFJORGESHSSNo ratings yet

- Session 4.1: Leveraging On The New Economy For Inclusive Growth: Factory Asia, Shopper Asia by Lam San LingDocument43 pagesSession 4.1: Leveraging On The New Economy For Inclusive Growth: Factory Asia, Shopper Asia by Lam San LingADBI EventsNo ratings yet

- Chapter 14Document34 pagesChapter 14Pháp NguyễnNo ratings yet

- Superscalper PDFDocument27 pagesSuperscalper PDFNguyễn VươngNo ratings yet

- PS - STUDY - Ethiopia - Small Scale Edible Oil Operations - Business ModelsDocument50 pagesPS - STUDY - Ethiopia - Small Scale Edible Oil Operations - Business ModelsBereket TekaNo ratings yet

- Economic Growth and Human DevelopmentDocument48 pagesEconomic Growth and Human DevelopmentTHORIQ ADHARIARDINo ratings yet

- Investment Analysis and Portfolio Management: Question: Explain TheDocument4 pagesInvestment Analysis and Portfolio Management: Question: Explain TheMo ToNo ratings yet

- Key Concepts: Ceteris Paribus, P. 70Document3 pagesKey Concepts: Ceteris Paribus, P. 70Wan Muhamad ShariffNo ratings yet

- Price Tag FormatDocument3 pagesPrice Tag FormatDarshan PradhanNo ratings yet

- Development of Entrepeneurship and Role of Edii in GujaratDocument7 pagesDevelopment of Entrepeneurship and Role of Edii in GujaratViŠhål PätělNo ratings yet

- Interest Rates and Bond ValuationDocument79 pagesInterest Rates and Bond ValuationNina ElbenniNo ratings yet

- Seatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWDocument5 pagesSeatwork 02 Statement of Income (TEST I) Multiple Choice: Shade Your Answer With YELLOWChristine Joy LanabanNo ratings yet

- Ala-Too International University 2020-2021 Spring Semester Course Timetable of Management Final ExaminationDocument8 pagesAla-Too International University 2020-2021 Spring Semester Course Timetable of Management Final ExaminationKunduz IbraevaNo ratings yet