Professional Documents

Culture Documents

Chapter 2 Classification Accounts

Uploaded by

Priyanka Kamble0 ratings0% found this document useful (0 votes)

41 views3 pageschapter

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentchapter

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

41 views3 pagesChapter 2 Classification Accounts

Uploaded by

Priyanka Kamblechapter

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

Chapter 2 classification accounts

Types of accounts

• Two categories – personal account , impersonal account

• Personal account – A/c related to all names (it can be name of person, institutes )noun comes it

is a personal account –natural personal account ,( sony corporation ltd, l& t ltd , JB steel ltd –

Artificial account)

• Representative personal account –outstanding salary (expenses pending to pay or expenses paid

in advance )

• Expenses comes under the nominal category

• Impersonal account is divided into two categories real A/c and nominal A/c

• Real a/c- all property and assets

• Assets- tangible and intangible assets

• Tangible assets – land and building (which we can touch), furniture , lease premises (properties)

• Intangible Assets- the assets cannot be seen (E,g Goodwill-reputation )(intangible assets cannot

be property)

• Patents – this formula invented by me , copy right

• Nominal account- accounts related to all income and gains , expenses and losses

• Normal people – purchase of car is expense , petrol is expenses for them it’s a nominal account

• Amount incurred by the person for getting some property is a real account and amount incurred

by the person for services like electricity bill that is called nominal account

• Payment of electricity –nominal A/c, payment for electrical pump-real A/c

• Interest –received or paid it’s a nominal A/c

• Rent – payment of rent and rent received both are nominal

• Discount allowed and discount received Nominal A/c

• Wages , salary A/c- Nominal, if salary not paid – it’s a personal , rent due –personal, rent paid –

nominal, rent paid in advance –personal

• Loss by fire, loss by sale of assets-Nominal

• Bad Debts –the debts which is irrecoverable it is called bad debts

• Reduction in the value of assets –depreciation , it’s a loss –Nominal A/C

Rules to be applied after classification of A/c

• Three golden rules

• Personal A/c- debit the receiver and credit the giver

• For eg.paid cash to ramesh , Ramesh’s A/c……………………….Dr

To Cash A/c

• Two sides , left side debit side, right side credit side

• Paid cash to Ajay, Ajay’s A/c………….Dr

To cash A/c

• Received cash from Ajay , Cash A/C……….Dr

To Ajay’s A/c

• Real Account – accounts related to all properties or assets , either comes in or goes it , it’s says

that debit what comes in and credit what goes out

• For e.g. , machinery A/c and cash A/c , purchased machinery for cash

Machinery A/c……….Dr

To Cash A/c

• One more E.g. sold machinery for cash , Rs.10,00,000

Cash A/c………………..10,00,000…..Dr

To Machinery A/c ……10,00,000

• Nominal A/c –accounts related to all expenses and losses, income and gains, rule – whenever

there is loss debit all losses and expenses , credit all income and gains (Eg , dukh debit and such

credit )

• Paid rent , Rent A/c……………..Dr

To Cash A/c

• Received Interest, Cash A/c ……..Dr

To Interest A/c

• Paid cash to ramesh , Remesh A/c ………Dr

To cash A/c

• Received cash from ramesh , cash A/c……Dr

To Ramesh A/c

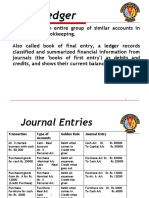

• Business transaction first recorded in books called journal and ledger

• Journal is books of prime entry ,

• From journal it transfer to ledger

• Ledger A/c balance carry forward to next month , End of the year balances of the ledger taken as

a trial balance

• Trial balance is a list of ledger accounts (all categories of transactions assets and liabilities )

• After the trial balance two financial statements –revenue statements and balance sheet

• Return of goods (credit note ), return good from customer (debit note )

How to record the transaction

• Cash invested into business – entity concept

• Rajesh has invested into business two accounts effected , cash A/c and rajesh A/c, we will

record cash a/c and rajesh Capital a/c ,

• Think in companies point of view cash is coming in and rajesh is giving the money so entry will

be Cash A/c ……100000…Dr

To Rajesh’s A/c ……100000

• When you have to credit in just right to , To rajesh A/c

• Dual Aspect concept – for every action there is opposite reaction similar in accounts every

transaction we have two effects one is debited one is credited in same value , in every

transaction minimum two accounts are effected , total of credit should be equal to total of debit

• Journals 1).Cash paid to Rahul , 2) cash received from salman

Date Particulars L/F Debit Credit

11-08-18 Rahul’s A/c …..Dr 40,000

To Cash A/c 40,000

(narration :- being cash paid to

rahul)

11-08-18 Cash A/c ….Dr 40,000

To Salman’s A/c 40,000

(Being Cash received from

Salman-receipt no-XXX)

You might also like

- Group 4 HR201 Last Case StudyDocument3 pagesGroup 4 HR201 Last Case StudyMatt Tejada100% (2)

- BRD TemplateDocument4 pagesBRD TemplateTrang Nguyen0% (1)

- Overhead Door Closers and Hardware GuideDocument2 pagesOverhead Door Closers and Hardware GuideAndrea Joyce AngelesNo ratings yet

- 22 How To Solve Difficult Adjustments and Journal Entries in Financial AccountsDocument43 pages22 How To Solve Difficult Adjustments and Journal Entries in Financial AccountsKushal D Kale79% (33)

- BAR Digest MenuDocument4 pagesBAR Digest MenuFloila Jane YmasNo ratings yet

- Chaman Lal Setia Exports Ltd fundamentals remain intactDocument18 pagesChaman Lal Setia Exports Ltd fundamentals remain intactbharat005No ratings yet

- Financial Accounting - Journal EntriesDocument28 pagesFinancial Accounting - Journal EntriesPraneeth KumarNo ratings yet

- Double Entry SystemDocument6 pagesDouble Entry SystemBensy MariamNo ratings yet

- Second Day Tally Contents (Type of Account)Document9 pagesSecond Day Tally Contents (Type of Account)Kamlesh KumarNo ratings yet

- Accounting & Finance Module: B: Ca R. C. JoshiDocument131 pagesAccounting & Finance Module: B: Ca R. C. JoshiRahul GuptaNo ratings yet

- Manual Accounting NotesDocument14 pagesManual Accounting NotesAbaan SalimNo ratings yet

- Double Entry System ExplainedDocument19 pagesDouble Entry System ExplainedanitikaNo ratings yet

- What Are The Golden Rules For AccountingDocument28 pagesWhat Are The Golden Rules For AccountingWong KianTatNo ratings yet

- 110-Chapter 3 - Books of Original Entry-Journal - WMDocument21 pages110-Chapter 3 - Books of Original Entry-Journal - WMaaditya kumar jhaNo ratings yet

- Fundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookDocument7 pagesFundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookShekhar TNo ratings yet

- Session 5 Double Entry SystemDocument19 pagesSession 5 Double Entry SystemSagar ParateNo ratings yet

- Accounting Solution Through Tally SoftDocument24 pagesAccounting Solution Through Tally Softmnnappaji100% (1)

- Double Entry SystemDocument12 pagesDouble Entry SystemEshetieNo ratings yet

- Finance Management: Hospital: - WHO DefinitionDocument77 pagesFinance Management: Hospital: - WHO DefinitionMitisha Hirlekar100% (1)

- Accounting For Managers - Unit 2Document161 pagesAccounting For Managers - Unit 2Chirag JainNo ratings yet

- BASIC ACCOUNTING PROCEDURESDocument35 pagesBASIC ACCOUNTING PROCEDURESjune100% (1)

- Types of Accounting AccountsDocument44 pagesTypes of Accounting AccountsAzhar Hussain100% (2)

- 3 - Trial Balance To PL Account - ExamplesDocument49 pages3 - Trial Balance To PL Account - ExamplesDivyansh Pandey100% (2)

- Accounting Fundamentals ExplainedDocument20 pagesAccounting Fundamentals Explained1986anuNo ratings yet

- Accounts BasicsDocument2 pagesAccounts BasicsRithvik SangilirajNo ratings yet

- Financial Accounting With Journal EntriesDocument48 pagesFinancial Accounting With Journal EntriesAnkita Soni100% (2)

- Journal EntriesDocument55 pagesJournal Entriesmunna00016100% (1)

- 2 JournalDocument18 pages2 JournalPraveen Yadav100% (1)

- Journal & LedgerDocument36 pagesJournal & Ledgerapi-373125733% (3)

- ACCOUNTING FUNDAMENTALS: THE JOURNALDocument22 pagesACCOUNTING FUNDAMENTALS: THE JOURNALMohit DhawanNo ratings yet

- Introduction To AccountingDocument55 pagesIntroduction To Accountingarjun2185No ratings yet

- Rules of Journalising: Personal Accounts Impersonal AcoountsDocument4 pagesRules of Journalising: Personal Accounts Impersonal AcoountsRachit DixitNo ratings yet

- Golden Rules For Types of AccountsDocument4 pagesGolden Rules For Types of AccountsABDUL FAHEEMNo ratings yet

- Profit and Loss P&L Statement StatementDocument3 pagesProfit and Loss P&L Statement StatementShreepathi AdigaNo ratings yet

- Accounting Question: (Tally)Document9 pagesAccounting Question: (Tally)prempankaj7788% (17)

- Personal, Real and Nominal AccountsDocument5 pagesPersonal, Real and Nominal AccountsRaghav GroverNo ratings yet

- FAM - Session IIDocument7 pagesFAM - Session IIMukund kelaNo ratings yet

- Accounting: Vista AcademyDocument124 pagesAccounting: Vista AcademyVistaAcademy Dehradun100% (1)

- Processing Transactions: Classifying Accounts and Understanding Double Entry SystemDocument34 pagesProcessing Transactions: Classifying Accounts and Understanding Double Entry SystemAkanksha Gupta100% (1)

- Financial Accounting 1 (By Prof - Rupesh Dahake)Document13 pagesFinancial Accounting 1 (By Prof - Rupesh Dahake)rupeshdahake100% (1)

- Golden Rules For Types of AccountsDocument4 pagesGolden Rules For Types of AccountsABDUL FAHEEMNo ratings yet

- Understanding Real, Personal and Nominal AccountsDocument3 pagesUnderstanding Real, Personal and Nominal Accountsarsalan ShahzadNo ratings yet

- Understand accounting classifications with 3 key account typesDocument15 pagesUnderstand accounting classifications with 3 key account typesAKINYEMI ADISA KAMORUNo ratings yet

- Classification of AccountsDocument15 pagesClassification of AccountsBrian Reyes GangcaNo ratings yet

- Rules of Determining Debit & Credit PDFDocument26 pagesRules of Determining Debit & Credit PDFasadurrahman40100% (1)

- Basic Accounting Terminology: Prof. S. Y. Shewale LecturerDocument16 pagesBasic Accounting Terminology: Prof. S. Y. Shewale Lecturersneharsh2370No ratings yet

- Accounting TransactionsDocument15 pagesAccounting TransactionsVaibhav SinghNo ratings yet

- Double Entry SystemDocument17 pagesDouble Entry SystemDastaan Ali100% (1)

- What Are The 3 Types of Accounts in Accounting?: What Is An Account?Document8 pagesWhat Are The 3 Types of Accounts in Accounting?: What Is An Account?ShubhamNo ratings yet

- The Basis of All Accounting Is Concerned With The Ascertaining and Analyzing of Business ResultsDocument42 pagesThe Basis of All Accounting Is Concerned With The Ascertaining and Analyzing of Business ResultsAswin S PanickerNo ratings yet

- Journal PostingDocument22 pagesJournal PostingPoonam JadhavNo ratings yet

- Journal, Ledger, Trial BalanceDocument34 pagesJournal, Ledger, Trial Balancepankaj tiwariNo ratings yet

- RulesDocument10 pagesRuleskainat zahid100% (1)

- Fundamentals of accounting fundamentalsDocument40 pagesFundamentals of accounting fundamentalsakon sanNo ratings yet

- Lecture#3 ContinueDocument45 pagesLecture#3 ContinueBeluga GamerTMNo ratings yet

- Account Types or Kinds of Accounts - Personal, Real, NominalDocument5 pagesAccount Types or Kinds of Accounts - Personal, Real, NominalKabir Mahlotra100% (1)

- 05.02.2020, 1. S.srinivas Sir, Chartered Accountant, Accounting FundamentalsDocument40 pages05.02.2020, 1. S.srinivas Sir, Chartered Accountant, Accounting FundamentalsAradhana AndrewsNo ratings yet

- Debit Credit RulesDocument8 pagesDebit Credit RulesIrfan Ul HaqNo ratings yet

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersFrom EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersRating: 2 out of 5 stars2/5 (4)

- The Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveFrom EverandThe Barrington Guide to Property Management Accounting: The Definitive Guide for Property Owners, Managers, Accountants, and Bookkeepers to ThriveNo ratings yet

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- CruiseDocument29 pagesCruiseAlivarvar YetiNo ratings yet

- Cruise Line IndustryDocument19 pagesCruise Line IndustryPaul Jasper BaronaNo ratings yet

- Accrual Accounting and the Balance SheetDocument2 pagesAccrual Accounting and the Balance SheetPriyanka KambleNo ratings yet

- 3441050Document7 pages3441050Priyanka KambleNo ratings yet

- CruiseDocument8 pagesCruiseapoloniadumingyayNo ratings yet

- 3441050Document45 pages3441050Priyanka KambleNo ratings yet

- MICE English 2016Document60 pagesMICE English 2016Everboleh ChowNo ratings yet

- 3441050Document45 pages3441050Priyanka KambleNo ratings yet

- Accrual Accounting and the Balance SheetDocument2 pagesAccrual Accounting and the Balance SheetPriyanka KambleNo ratings yet

- FA Chapter 2Document7 pagesFA Chapter 2Priyanka KambleNo ratings yet

- Strategic Management 408 v2 PDFDocument433 pagesStrategic Management 408 v2 PDFPriyanka KambleNo ratings yet

- Operation Roman Empire Indictment Part 1Document50 pagesOperation Roman Empire Indictment Part 1Southern California Public RadioNo ratings yet

- The SAGE Handbook of Digital JournalismDocument497 pagesThe SAGE Handbook of Digital JournalismK JNo ratings yet

- Supplier Quality Requirement Form (SSQRF) : Inspection NotificationDocument1 pageSupplier Quality Requirement Form (SSQRF) : Inspection Notificationsonnu151No ratings yet

- Pig PDFDocument74 pagesPig PDFNasron NasirNo ratings yet

- How To Make Money in The Stock MarketDocument40 pagesHow To Make Money in The Stock Markettcb66050% (2)

- POS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFDocument23 pagesPOS CAL SF No4 B2 BCF H300x300 7mmweld R0 PDFNguyễn Duy QuangNo ratings yet

- Advanced Real-Time Systems ARTIST Project IST-2001-34820 BMW 2004Document372 pagesAdvanced Real-Time Systems ARTIST Project IST-2001-34820 BMW 2004كورسات هندسيةNo ratings yet

- Compressive Strength Beam DesignDocument70 pagesCompressive Strength Beam DesignDjuned0% (1)

- Product Manual 36693 (Revision D, 5/2015) : PG Base AssembliesDocument10 pagesProduct Manual 36693 (Revision D, 5/2015) : PG Base AssemblieslmarcheboutNo ratings yet

- Understanding CTS Log MessagesDocument63 pagesUnderstanding CTS Log MessagesStudentNo ratings yet

- Credentials List with Multiple Usernames, Passwords and Expiration DatesDocument1 pageCredentials List with Multiple Usernames, Passwords and Expiration DatesJOHN VEGANo ratings yet

- Queries With AND and OR OperatorsDocument29 pagesQueries With AND and OR OperatorstrivaNo ratings yet

- Conplast SP430 0407Document4 pagesConplast SP430 0407Harz IndNo ratings yet

- Case Study - Soren ChemicalDocument3 pagesCase Study - Soren ChemicalSallySakhvadzeNo ratings yet

- Leases 2Document3 pagesLeases 2John Patrick Lazaro Andres100% (1)

- Salary Slip Oct PacificDocument1 pageSalary Slip Oct PacificBHARAT SHARMANo ratings yet

- CST Jabber 11.0 Lab GuideDocument257 pagesCST Jabber 11.0 Lab GuideHải Nguyễn ThanhNo ratings yet

- Excavator Loading To Truck TrailerDocument12 pagesExcavator Loading To Truck TrailerThy RonNo ratings yet

- Proposal Semister ProjectDocument7 pagesProposal Semister ProjectMuket AgmasNo ratings yet

- Part I-Final Report On Soil InvestigationDocument16 pagesPart I-Final Report On Soil InvestigationmangjuhaiNo ratings yet

- Hardened Concrete - Methods of Test: Indian StandardDocument16 pagesHardened Concrete - Methods of Test: Indian StandardjitendraNo ratings yet

- RAP Submission Form, OBIDocument3 pagesRAP Submission Form, OBIAhmed MustafaNo ratings yet

- Yi-Lai Berhad - COMPANY PROFILE - ProjectDocument4 pagesYi-Lai Berhad - COMPANY PROFILE - ProjectTerry ChongNo ratings yet

- APM Terminals Safety Policy SummaryDocument1 pageAPM Terminals Safety Policy SummaryVaviNo ratings yet

- Planning For Network Deployment in Oracle Solaris 11.4: Part No: E60987Document30 pagesPlanning For Network Deployment in Oracle Solaris 11.4: Part No: E60987errr33No ratings yet