Professional Documents

Culture Documents

Sundaram Large and Mid Cap Fund 01

Uploaded by

Ranjan SharmaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sundaram Large and Mid Cap Fund 01

Uploaded by

Ranjan SharmaCopyright:

Available Formats

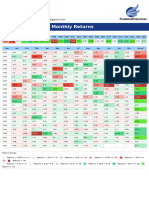

Performance (%) @See Regulatory Disclosure

Period Fund Benchmark* Additional

Nifty 200 Index (TRI) Benchmark

Nifty 50 (TRI)

Last 1 year 1.8 5.2 10.8

April 2019 Last 3 years 16.6 15.4 15.9

• Large and Midcap fund with minimum 35% in each category. Last 5 years 17.3 14.1 13.3

The strategy is to have an asset allocation of 50-60% in large

caps and 40-50% in midcaps ~Since Inception 10.7 10.8 10.8

• Investment Strategy: Top down approach with focus on theme ` 10,000 Invested @See Regulatory Disclosure

/ sector allocation with a view to buy the secular growth

opportunities in India, combined with bottom up stock Period Fund Benchmark* Additional

selection. Nifty 200 Index (TRI) Benchmark

Nifty 50 (TRI)

• Strategy is to focus on opportunities in large caps & mid caps

between ` 20,000 Cr & ` 1,00,000 Cr market cap segment. Last 1 year 10,175 10,521 11,084

• Fund will invest in approximately 40 stocks on which the Fund Last 3 years 15,862 15,348 15,580

Manager has high conviction.

Last 5 years 22,252 19,325 18,693

• Buy and hold approach for 3-5 years

Since Inception 34,508 34,801 34,843

• Sectors that the Fund will focus on: Consumer Discretionary,

Lifestyle, Auto, Retail Credit, Wealth.

*The benchmark has changed to Nifty 200 w.e.f. May 04, 2018.

Consolidated Dividend Market Cap (%)

Cash & Others

4.5 7.7

` 4 per unit

4.0

3.5

3.0

2.5

Mid cap

2.0 Large Cap 41.9

1.5 50.4

` 1 per unit ` 1.5 per unit

1.0

0.5

0

FY 2017 FY 2018 FY 2019 YTD

*Including special dividend Dividend history is available in website Value of ` 10,000-a-month SIP @See Regulatory Disclosure

Portfolio Industry Classification

Period Investment Fund Benchmark Additional

Banks 15.9% Nifty 200 Index (TRI) Benchmark

Nifty 50 (TRI)

Consumer Non Durables 13.2%

Finance 10.9% Last 1 year 1,20,000 1,24,480 1,26,333 1,29,345

Cement 9.2%

Last 3 years 3,60,000 4,26,492 4,28,982 4,42,877

Consumer Durables 7.6%

Petroleum Products 4.7% Last 5 years 6,00,000 8,17,664 8,01,045 8,13,742

Construction Project 3.8%

Hotels, Resorts And Other Recr. 3.4% Growth of ` 10,000 since inception @See Regulatory Disclosure

Software 3.3% 34,801 34,843

34,508

Industrial Capital Goods 3.0%

Retailing 2.9%

Healthcare Services 2.8%

Auto 2.8%

10,000

Industrial Products 2.0%

Services 1.9%

Other Sectors 5.0%

Investment Fund Benchmark TRI Nifty 50 TRI

Cash & Others 7.7%

Source: Bloomberg, In house computation, Data as of April 30, 2019

Top 10 Holdings @Regulatory Disclosure

Benchmark (Nifty 200 Index) & Nifty 50 returns are based on TRI

Security Weight (%)

Returns are compounded annual basis for period more than one year and computed

Axis Bank 4.9 using NAV of Regular Plan – Growth Option. Value of `10,000 invested at inception

Reliance Industries 4.7 is as on April 30, 2019. • Different plans shall have a different expense structure.

ICICI Bank 4.5 Launch February 2007.

UltraTech Cement 4.1 @As TRI data is not available since inception of the scheme, benchmark

(Nifty 200 Index) performance is calculated using composite CAGR of PRI

HDFC Bank 3.8

values from fund’s inception till TRI inception date and TRI values since

Larsen & Toubro 3.8 the inception of Total Return index as per SEBI regulations.

EIH 3.4 The dividends are subject to availability of distributable surplus in the

Varun Beverages 3.3 respective plan-option of the scheme(s) on the record date. Past

performance may or may not be sustained in future. Pursuant to the

Ramco Cements 3.1

payment of dividend, the NAV of the scheme will fall to the extent of pay

Siemens 3.0 out and statutory levies.

Scheme Facts Scheme Features

Month End AUM ` 616 Cr. Scheme Type An open ended equity scheme investing in both large

Min. Initial Investment (Lumpsum) ` 5000 & multiples of ` 1 thereafter cap and mid cap stocks

SIP/STP Weekly ` 1,000, Monthly ` 250 Entry Load Nil

Exit Load 1% If redeemed within 12 months from the date of

Quarterly ` 750

allotment

Daily STP ` 1000 (minimum no. of instalments 20)

Plan Regular and Direct

Benchmark* Nifty 200 Index Option Growth

Fund Manager Mr. S. Krishna Kumar Dividend (Pay Out, Re-Investment & Sweep)

*The benchmark has changed to Nifty 200 w.e.f. May 04, 2018.

Performance details for other schemes managed by S Krishnakumar

Funds 1 Year (%) 3 Years (%) 5 Years (%)

Fund Benchmark (TRI) Fund Benchmark (TRI) Fund Benchmark (TRI)

Sundaram Mid Cap Fund -13.9 -11.6 10.4 11.6 17.9 16.6

Sundaram Small Cap Fund -23.5 -19.9 6.8 10.7 17.0 15.3

Sundaram Select Small Cap Series III -8.2 -19.9 12.5 10.7 — —

Sundaram Select Small Cap Series IV -8.0 -19.9 12.7 10.7 — —

Sundaram Select Small Cap Series V -9.1 -19.9 — — — —

Sundaram Select Small Cap Series VI -9.0 -19.9 — — — —

Source : In-house Computation, Data as on April 30, 2019

• The fund manager S. Krishna Kumar individually manages 7 funds of the mutual fund. • Performance data of Top 3 and bottom 3 funds managed by the fund manager is provided

herein. • Different plans shall have a different expense structure. • The performance details are provided for Regular Plan Growth Option. • Performance data is as of April 30, 2019.

• The fund manager managing Sundaram Small Cap Fund* (*The fund was earlier known as Sundaram SMILE Fund) since December 2006, Sundaram Mid Cap Fund* (*The fund was

earlier known as Sundaram Select Mid Cap) since December 2012, Sundaram Select Small Cap Series III since March 2015 • Sundaram Select Small Cap Series Series IV since April

2015 • Sundaram Select Small Cap Series V since June 2017 • Sundaram Select Small Cap Series VI since July 2017.

Common to all schemes: Past performance may or may not be sustained in the future and may not necessarily serve as a basis for comparison with other

investments. The returns are calculated on CAGR basis since inception of the scheme and for periods above one year as on April 30, 2019 and on an absolute

basis for one year period for Regular Plan - Growth Option. NAV per unit provided for the scheme(s) pertain to Regular Plan - Growth Option and is considered

` 10 on the inception date. Load and taxes are not considered for computation of returns. Additional Benchmark: Nifty 50. All data provided herein above are

as on April 30, 2019 unless otherwise mentioned.

Riskometer

at

el

y Moderate M

od

e

This Product is suitable for investor who are seeking*

er w Hi rat

od Lo gh ely

M

• Long term capital growth

• Investment in equity & equity related securities in large and mid cap companies

High

Low

LOW HIGH

*Investor should consult their financial advisers if in doubt about whether the product is suitable

Investors understand that their principal will be at for them.

Moderately High Risk

Consult your investment advisor or call Distributed by:

1860 425 7237 (India) +91 44 28310301 (NRI)

SMS SFUND to 56767

Mutual Fund Investments are subject to market risks, read all Scheme related documents carefully.

You might also like

- Why You Should Have Multiallocation FundsDocument5 pagesWhy You Should Have Multiallocation FundsRanjan SharmaNo ratings yet

- Canara Revecco ManufacturingDocument7 pagesCanara Revecco ManufacturingRanjan Sharma100% (1)

- Kotak TechnologynfundDocument7 pagesKotak TechnologynfundRanjan SharmaNo ratings yet

- Direct Plans Vs RegularDocument4 pagesDirect Plans Vs RegularRanjan SharmaNo ratings yet

- Point To Point Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolDocument6 pagesPoint To Point Returns - Mutual Fund Screener Mutual Fund Screening and Analysis ToolRanjan SharmaNo ratings yet

- AIQ FactsheetDocument2 pagesAIQ FactsheetRanjan SharmaNo ratings yet

- Middle Name Last Name First Name Prefix: Know Your Client (KYC) Application Form (For Individuals Only)Document6 pagesMiddle Name Last Name First Name Prefix: Know Your Client (KYC) Application Form (For Individuals Only)Vijay SwamiNo ratings yet

- NAACL10 TalkDocument26 pagesNAACL10 TalkRanjan SharmaNo ratings yet

- Benchmark ReturnsDocument2 pagesBenchmark ReturnsRanjan SharmaNo ratings yet

- Aapke Life Goals Ka Back-Up Plan: A Non Linked, Non Participating, Pure Life Term Insurance PlanDocument24 pagesAapke Life Goals Ka Back-Up Plan: A Non Linked, Non Participating, Pure Life Term Insurance PlanSudhirGajareNo ratings yet

- (Learn Persian With Chai & Conversation) Learn Persian With Chai & Conversation - Learn Persian With Chai & Conversation-Speak (L01-L90) (2021)Document383 pages(Learn Persian With Chai & Conversation) Learn Persian With Chai & Conversation - Learn Persian With Chai & Conversation-Speak (L01-L90) (2021)Ranjan SharmaNo ratings yet

- HDFC Capital GuaranteeDocument34 pagesHDFC Capital GuaranteeRanjan SharmaNo ratings yet

- Non-Transferable StatementDocument4 pagesNon-Transferable StatementRanjan SharmaNo ratings yet

- Planning For Your Child'S Future With Mutual Fund SipsDocument4 pagesPlanning For Your Child'S Future With Mutual Fund SipsRanjan SharmaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Faisal Spinning Mills Annual Report Highlights Record ProfitsDocument57 pagesFaisal Spinning Mills Annual Report Highlights Record Profitssome_one372No ratings yet

- Module-2 Equity Valuation Numerical For StudentsDocument11 pagesModule-2 Equity Valuation Numerical For Studentsgaurav supadeNo ratings yet

- Far.118 Sharholders-EquityDocument8 pagesFar.118 Sharholders-EquityMaeNo ratings yet

- Chapter 29 PDFDocument11 pagesChapter 29 PDFSangeetha Menon100% (1)

- Clariant Chemicals PDFDocument13 pagesClariant Chemicals PDFjoycoolNo ratings yet

- Ratio - Dutch LadyDocument7 pagesRatio - Dutch Ladyushanthini santhirasegarNo ratings yet

- Rights of Accession: Maria Yoradyl D. AdralesDocument23 pagesRights of Accession: Maria Yoradyl D. AdralesMadeleine DinoNo ratings yet

- FMDocument233 pagesFMparika khannaNo ratings yet

- Common Stock Financing ProblemsDocument7 pagesCommon Stock Financing ProblemsSoo CealNo ratings yet

- 2013 Ar Ammb 1 PDFDocument72 pages2013 Ar Ammb 1 PDFMasturah SamsuddinNo ratings yet

- Why a Statement of Cash Flows is Critical for Business SuccessDocument5 pagesWhy a Statement of Cash Flows is Critical for Business SuccesskajsdkjqwelNo ratings yet

- Operating and Financial Leverage Operating and Financial LeverageDocument58 pagesOperating and Financial Leverage Operating and Financial LeverageFarzad TouhidNo ratings yet

- Dividend Policy - Project On Ashok LeylandDocument15 pagesDividend Policy - Project On Ashok LeylandRuchi MadiyaNo ratings yet

- Strategic ManagementDocument196 pagesStrategic ManagementSateesh Prem GuptaNo ratings yet

- 100 Q & A in Corporation LawDocument16 pages100 Q & A in Corporation LawJovelle Zabala Cayaban90% (10)

- Q Feb21 PDFDocument9 pagesQ Feb21 PDFuser mrmysteryNo ratings yet

- NSC Accounting Grade 12 May June 2023 P1 and MemoDocument32 pagesNSC Accounting Grade 12 May June 2023 P1 and Memozondoowethu5No ratings yet

- Chapter Nineteen: The Analysis of Credit RiskDocument4 pagesChapter Nineteen: The Analysis of Credit RiskHarsh SaxenaNo ratings yet

- Ratio AnalysisDocument56 pagesRatio Analysisvishi takhar80% (10)

- Inventory Management Project PDFDocument87 pagesInventory Management Project PDFSK KHURANSAINo ratings yet

- Chapter 2 Problems - Financial Position AnalysisDocument8 pagesChapter 2 Problems - Financial Position AnalysisKimochi SenpaiiNo ratings yet

- Ratio Analysis ItcDocument41 pagesRatio Analysis ItcPrit Ranjan Jha86% (7)

- Fundamental Analysis of Media and Entertainment StocksDocument17 pagesFundamental Analysis of Media and Entertainment StocksShashank PalNo ratings yet

- Preparation of Published Financial StatementsDocument46 pagesPreparation of Published Financial StatementsBenard Bett100% (2)

- F7 Financial Reporting (Malaysia) AnswersDocument10 pagesF7 Financial Reporting (Malaysia) AnswersMohamed NazimNo ratings yet

- Paper 1 Financial Reporting For May 2012Document68 pagesPaper 1 Financial Reporting For May 2012Kunal KhandualNo ratings yet

- Test BDocument5 pagesTest Bhjgdjf cvsfdNo ratings yet

- Declarations of Trust As Effective Substitutes For Incorporation-1911Document40 pagesDeclarations of Trust As Effective Substitutes For Incorporation-1911James Evans75% (4)

- A Conceptual View On Companies Act 2013: With Special Reference To Share CapitalDocument12 pagesA Conceptual View On Companies Act 2013: With Special Reference To Share CapitalSameer DhumaleNo ratings yet

- Solutions To Chapter 6 Valuing StocksDocument14 pagesSolutions To Chapter 6 Valuing StocksdevashneeNo ratings yet