Professional Documents

Culture Documents

Cost Volume Analysis 2 PDF

Uploaded by

alkanm750Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost Volume Analysis 2 PDF

Uploaded by

alkanm750Copyright:

Available Formats

IOSR Journal of Business and Management (IOSR-JBM)

e-ISSN: 2278-487X, p-ISSN: 2319-7668. Volume 19, Issue 2. Ver. I (Feb. 2017), PP 40-45

www.iosrjournals.org

Cost-Volume-Profit Analysis as a Management Tool for Decision

Making In Small Business Enterprise within Bayero

University, Kano

1

Sadiq Rabiu Abdullahi, 2Bello Abiodun Sulaimon,

2

Ibrahim Salihu Mukhtar, 2 Muhammed Hardy Musa

1

Department of Accounting, Bayero University, Kano- Nigeria (srabdullahi.acc@buk.edu.ng)

2

M. Sc. Accounting, Bayero University, Kano- Nigeria

Abstract: This study aimed to figure out if small business enterprises utilize cost volume profit (CVP) analysis

as a management tool for decision-making process in Bayero University Kano, with a view to shed light on the

reality of the use of CVP analysis as a decision-making tool in small business enterprises. The study population

is made up of the entire small business enterprises within Bayero University, Kano. Primary source of data

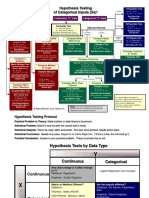

were utilized using structured questionnaires. The hypotheses were tested using Mann-Whitney U test and

Pearson correlation coefficient. A very weak relationship (0.02) was recorded, it was discovered that there is no

statistical significant difference between having the knowledge of a management accounting tools and its

application. The study concludes that small business enterprises utilize CVP ignorantly and it is recommended

that CVP analysis and other management accounting tools be introduced to small business enterprises so that

productivity can be improved.

I. Introduction

A business is an enterprise, or organization set up by an individual or group of individuals for the

purpose of making profits from. Olagunju (2008) defines business as an enterprise that engages in the

production of goods/services that provide satisfaction for consumers. Businesses in Nigeria range from micro,

small and medium to large ones. The definition of small business differs from country to country and from

industry to industry. Each country tends to derive its own definition based on the role small businesses are

expected to perform in the development of the country. Definitions change over a period of time with respect to

price levels, levels of technology, and other considerations. Small businesses are synonymous with small and

medium scale enterprises (SMEs). SMEs are usually referred to as small businesses in developed countries

The existence of strong and effective small-scale industries has been considered as the best way to

improve the socio-economic status of any society in large number of developed and less developed countries.

There are excellent examples of government initiatives aimed at promoting and sustaining entrepreneurship

development in small- scale industries (Adejumo, 2001). The main purpose is usually to reduce

underdevelopment. Other underlying reasons include a desire to establish an enterprise culture; assist the

disadvantaged section of the population; develop alternative to stagnation sector economy; reduce national

dependence on imported goods; increase rural transformation; diversification of the economy and reduction of

unemployment.

Earning of maximum profit is the ultimate goal of almost all business undertakings. The most

important factor influencing the earning of profit is the level of production (i.e., volume of output). Cost-

volume-profit (CVP) analysis examines the relationship of costs and profit to the volume of business to

maximize profits. There may be a change in the level of production due to many reasons, such as competition,

introduction of a new product, trade depression or boom, increased demand for the product, scarce resources,

change in selling prices of products, etc. In such cases management must study the effect on profit on account of

the changing levels of production. A number of techniques can be used as an aid to management in this respect.

One such technique is the cost-volume-profit analysis.

The term cost volume profit analysis is interpreted in the narrower as well as broader sense. Used in its

narrower sense, it is concerned with finding out the “crisis point”, (i.e., break-even point) i.e., level of activity

when the total cost equals total sales value. In other words, it helps in locating the level of output which evenly

breaks the costs and revenues. Used in its broader sense, it means that system of analysis which determines

profit, cost and sales value at different levels of output. The cost-volume-profit analysis establishes the

relationship of cost, volume and profits.

Furthermore, one of the most important decisions that need to be made before any business even starts

is „how much do we need to sell in order to break-even?‟ By „break-even‟ we mean simply covering all our costs

without making a profit. This type of analysis is known as „cost-volume-profit analysis‟. Cost-volume-profit

DOI: 10.9790/487X-1902014045 www.iosrjournals.org 40 | Page

Cost-volume-profit analysis as a management tool for decision making in small business enterprise ..

analysis is a key factor in many decisions, including choice of product lines, pricing of products, marketing

strategy, and utilization of productive facilities. It is a tool used to show the relationship between various

ingredients of profit planning and if properly applied it enable the company to satisfy the industry and

stakeholders of such business. This research work intends to look at cost volume profit analysis as a

management tool for decision-making.

This study therefore seeks to know if cost volume profit analysis has any relevance when making

decision in small business enterprise within Bayero University Kano. In developing countries like Nigeria, the

role of SMEs is equally of strategic importance as they facilitate Indigenous entrepreneurship, reduce poverty

and provide employment for a large number of people amongst other important roles that they play.

Although there are no clear statistics on the number, geographical distribution, and activities of the

SME sector and the available statistics could be very partial and highly unreliable. The best estimates available

suggest that SMEs comprise 87% of all firms operating in Nigeria, although the total number of registered firms

in Nigeria is also unknown (World Bank 2002a, p.127). In another study conducted in Nigeria by the Federal

Office of Statistics, it is estimated that over 97% of all businesses in Nigeria employ less than 100 employees.

This therefore means that about 97% of all businesses in Nigeria are SMEs Ariyo (2000) as sighted in (Abereijo

and Fayomi, 2005)

This study will assist small business enterprise managers and other professional who may find it useful

to understand how to make better managerial decisions using cost Volume Profit analysis. It will also help

academicians or student of knowledge who want to conduct further research on CVP analysis.

So many people run different business without any technical know-how or how to make decision that

will affect their business positively. They nurture a dream to make profit from business and immediately venture

into it within the university. It is on the bedrock of this that the study seek to find out the relevance of cost

volume profit (CVP) analysis as a management tools for decision making in small business enterprise within

Bayero University Kano.

This study focused on analyzing the relevance of cost volume profit analysis as a management tool for

decision making in small business enterprise in general but with particular reference to small business enterprise

within Bayero University Kano, Nigeria.

II. Literature Review

According to Ekpeyong & Nyong, (1992), there is no universally accepted definition of SMEs because

the classification of business into small and large scale is a subjective judgment. The main criterion employ in

the definition of SMEs according to Carpenter (2003) could include various combinations of the following:

Number of employees, financial strength, sales value, relative size, initial capital outlay and types of industry. In

countries like the USA, Britain and other European countries, Small and medium scale enterprises are defined in

terms of turnover and number of employees.

The definition and classification of SMEs in Nigeria is in terms of capital employed, turnover and

number of employees. The CBN communiqué No 69 of the special monetary policy committee meeting of April

15, 2010 acknowledged the existence of several definitions of SMEs. One of such definition/classification states

that an enterprise that has an asset base (excluding land) of between N5 million to N500 million and labour

force of between 11 and 300 belongs to the SME sub-sector. This definition is what the Small and Medium

Enterprises Credit Guarantee Scheme (SMECGS) adopted. SMEs have also been broadly defined as businesses

with turnover of less than N100million, for the Small and Medium Enterprises Equity Investment Scheme

(SMEEIS), a small and medium enterprise is defined as any enterprise with a maximum asset base of N1.5

billion (excluding land and working capital) with no lower or upper limit of staff. For the purpose of this study,

small business enterprises are business with not less than two employees.

There exists close relationship between the cost, volume and profit. If volume is increased, the cost per

unit will decrease and profit per unit will increase. Thus, there is direct relation between volume and profit but

inverse relation between volume and cost. Analysis of this relationship has become interesting and useful for the

cost and management accountant. This analysis may be applied for profit-planning, cost control, evaluation of

performance and decision making.

Abdullahi (2015) describes cost volume profit analysis as an estimate of how changes in costs (Both

variable and Fixed) sales volume, and price effect the company‟s profit. Adenji (2008) states that cost-volume-

profit analysis are predetermined costs, target costs or carefully pre planned costs which management endeavors

to achieve with a view to establishing or attaining maximum efficiency in the production process. According to

him, cost-volume-profit analysis is cost plans relating to a single cost unit. Because cost-volume profit analysis

purports to be what cost should be, any deviation represents a measure of performance. The predetermined costs

are known as cost-volume-profit analysis and the difference between the cost-volume-profit analysis and actual

costs are known as a variance. Drury (2000) defines cost-volume-profit analysis as predetermined cost; they are

cost that should be marred under efficient operating conditions. The cost-volume profit analysis may be

DOI: 10.9790/487X-1902014045 www.iosrjournals.org 41 | Page

Cost-volume-profit analysis as a management tool for decision making in small business enterprise ..

determined on a number of bases. The main uses of cost-volume-profit analysis are in performance

measurement, control, stock valuation and in the establishment of selling prices. Cost-volume-profit analysis is a

target cost which should be attained. Cost- volume- profit analysis is the systematic examination of the inter-

relationship between selling prices, sales and production volume, cost, expenses and profits (Glautier &

Underdown, 2001). This definition explains cost-volume profit analysis to be a commonly used tool providing

management with useful information for decision making. Cost volume-profit analysis will also be employed on

making vital and reasonable decision when a firm is faced with managerial problems which have cost volume

and profit implications. Cost- volume- profit analysis according to Hilton R.W (2002) is a mathematical

representation of the economics of producing a product. The relationship between a products revenue and cost

function expressed within the cost-volume-profit analysis are used to evaluate the financial implication of a

wide range of strategic and operational decisions.

Lucey (1996) defined breakeven analysis as “the term given to the study of the inter-relationships

between costs, volume and profit at various levels of activity” .The term breakeven analysis is the one

commonly used, but it is somewhat misleading as it implies that only concern is with that level of activity which

produces neither profit nor loss the breakeven point although the behaviour of costs and profits at other level is

usually of much greater significance. Because of this an alternative term, cost-volume-profit analysis or CVP

analysis is frequently used and is more descriptive.

Underlying the operation of cost-volume-profit analysis is a principle which states that “at the lowest

level of activity cost exceed income but as activity increases income rises faster than cost and eventually the two

amount are equal, after which income exceed cost until diminishing returns bring cost above income once again.

This principle describe cost-volume-profit analysis with curvilinear. Cost and revenue curves which thought

theoretically sound lack practicability. Accountant found the need to bring in addition information relating to

cost behavior and sales policy this was to ensure that practical model be develop out of this principles.

The followings are the underlying assumptions of cost-volume profit analysis according to Horngen et al (2006)

• The behavior and revenues is linear.

• Selling price is constant.

• All cost can be divided in to their fixed and variable element.

• Total fixed cost remains constant.

• Total variable cost is proportional to volume.

• Volume is the only drive of cost.

• Prices of production inputs (eg materials) are constant.

Other areas of application of the breakeven model (C-V-P).exist and these include equipment selection,

make – or- buy decision, advertising programmes, choice of channels of distribution, and plant additions. These

decisions are the essence of planning and control. No doubt product planning and control in manufacturing firms

is a necessity and can be facilitated and improved upon by breakeven analysis.

Other management accounting decision tools that can be used in making business decisions among small

business enterprises includes; Activity based costing, Make or Buy Analysis, Budgets, Product costing, Variance

analysis, Economic Ordering quantity (EOQ), Decision theory (decision tree), among others.

III. Empirical Review

Practical applications of Cost-Volume profit analysis often give rise to series of questions both at the

tactical and strategic management level. Ihemejea, Okereafor, & Ogungbangbe (2015) found out that cost-

volume-profit analysis is considered to a large extent in the decision making process of manufacturing industries

and hence affect the various decisions made by manufacturing industries. It was also found these manufacturing

industries adopt both graphical and algebraic approaches to cost-volume- profit analysis. The study further

revealed that the application of cost-volume profit analysis techniques in decision making process to a very large

extent enhance managerial efficiency of manufacturing industries. In addition it was revealed that the benefits

derived from the application of cost-volume-profit analysis include: efficient cost control, high productive

capacity and increase in profitability.

Georgiev (2014) studied the Application of „Cost-Volume-Profit‟ Analysis in the Hotel Industry based

on survey data of high-ranking hotels in the north-east region of Bulgaria, research results indicate that analysts

apply the CVP analysis to all aspects of management accounting, which clearly speaks of its significance for

generation of data on hotel management. Taking into account the specifics of the hotel product we cannot but

accept as logical the results on the extent and frequency of application of CVP analysis.

Consequently, Nabil, Osama, & Zaid (2014) while looking at the effect of using break-even-point in

planning, controlling, and decision making in the industrial Jordanian companies concluded that, the most of the

Jordanian industrial companies are using break-even point in the planning, controlling and decision-making, and

DOI: 10.9790/487X-1902014045 www.iosrjournals.org 42 | Page

Cost-volume-profit analysis as a management tool for decision making in small business enterprise ..

there is a statistical significant relationship between the use of the break-even point and successful planning,

control and decision-making in the Jordanian industrial companies.

Corroborating the study by Ndaliman and Bala (2007), Onwuka (2009) suggests a thorough application

of breakeven analysis to improve profit levels of small manufacturing firms. She (Onwuka) further states that

the mathematical involvement was little, while the advantage was enormous. Most managers are too afraid of

figures; they would find this method a safe- landing. Ndaliman and Bala (2007), in a related study discovered

that “sales revenue and total cost were not linear, two or more breakeven points were found to exist, some costs

fall under both fixed and variable portions and that beyond certain optimal production levels sales revenue

decreases and total cost also increases. They suggest that block industry operators because of the short pay back

period of the investment and rising profit levels when efficiently managed using breakeven tool of analysis

should adopt breakeven theory frequently. Although they found slight variation in the principles of breakeven

theory between the two industries studied, they emphasise adequate production planning and control using

breakeven theory

IV. Methodology

The study was conducted using the survey approach. The area of study was Bayero University Kano,

which was choosing because it has a growing cluster of small business enterprises. Primary source of data was

utilized using structured questionnaires. The hypotheses were tested using Mann-Whitney U test and the

Pearson correlation coefficient

A total of 144 small business enterprises was physically counted [18(13%) at old site and 126(87%) at

new site], given the small number, the total population was selected. Out of the 144 questionnaires distributed,

123(85%) was returned and accurately filled, 13 (9%) was invalidated while 8 (6%) shop owners decline to

participate in the study.

V. Data Analysis

Demographic distribution of respondents

Majority of the respondents (79%) are located at the new campus this is due to the fact that the new

campus have most of the faculties and as such more business activities takes place in the new campus compared

to the old campus of the university. Result shows that 85% of the respondents are male while only 15% are

female (fig 1.2); 61% of the business enterprise had been in existence for over five years, while 25% are

between two to five years and only 14% are below two years (fig 1.3). Most of the business owners, 49% are

student currently undergoing a degree in the university while 15% are seeking admission into the university

while running their business (fig 1.4).

DOI: 10.9790/487X-1902014045 www.iosrjournals.org 43 | Page

Cost-volume-profit analysis as a management tool for decision making in small business enterprise ..

VI. Discussion of Findings

Ho1: There is no significant relationship between having knowledge of CVP analysis and its application as a

management accounting tools among small business enterprise in Bayero University, Kano.

Giving a P value of 0.798, at 0.05 level of significant, we fail to reject the null hypothesis and conclude that

there is no statistical significant relationship between having knowledge of CVP analysis and its application as a

management accounting tools among small business enterprise in Bayero University, Kano.

Though a relationship was established, it was a very weak one (i.e. 0.1) and not statistically significant.

This implies that most of the small business enterprise in Bayero University, Kano have been unknowingly

applying CVP analysis in making management decisions. This is however in contrast with the findings of Nabil,

Osama, & Zaid, (2014) who concluded that there is a significant statistical relationship between Break-Even-

Point and decision making in the Jordanian Industrial companies.

Table 1: Pearson Correlations coefficient

Ho2: P value

Pearson Correlation

(95% confidence)

There is no significant relationship between having knowledge of CVP analysis and

its application among small business enterprise in Bayero University, Kano. 0.024 0.798

Ho2: The awareness of CVP have no significant difference with its application among small business enterprise

in Bayero University Kano

The Mann-Whitney U test yielded a p-value of 0.792, at 0.05 level of significance, this suggests that no

significant difference exists between awareness of CVP analysis and its application. We therefore fail to reject

the null hypothesis and concludes that awareness of CVP have no significant difference with its application

among small business enterprise in Bayero University, Kano.

This shows that CVP analysis can be applied in small business enterprises, this is in line with the

submission of Ndalima and Bala (2007) and the assertion of Levin et al (1999) and Nweze (1992). These studies

indicate that B./E or C.V.P is applicable in many situations. It was found that the application of B./E analysis in

making business decision enhances profitability of the firm.

Table 2: Mann-Whitney U test

VII. Conclusions and Recommendations

Findings suggest that there is no significant difference between the application and awareness of CVP

analysis, most of the small business enterprises ignorantly applied cost volume profit analysis in the course of

doing their business, without knowing that the managerial decisions they took most times is related to cost

volume profit analysis. It was also shown that small business enterprise can apply cost volume profit analysis to

great advantage as it aids the management decision making process.

Based on the above conclusions, it was recommended that cost volume profit analysis and other

management accounting tools be introduces to small business enterprise in other to improve their productivity.

Managers of small businesses should utilize the advantage of being situated in an academic environment to

attend a crash course on cost volume profit analysis and other management decision making tools to broaden

their scope in other to make better management decisions.

DOI: 10.9790/487X-1902014045 www.iosrjournals.org 44 | Page

Cost-volume-profit analysis as a management tool for decision making in small business enterprise ..

References

[1]. Abereijo and Fayomi (2005): Innovative Approach to SME Financing in Nigeria: A Review of Small and Medium Industries Equity

Investment Scheme (SMIEIS ) J. Soc. Sci., 11(3): 219-227 (2005)

[2]. Abdullahi, R. S. (2015). Mastering Cost and Management Accounting.(3rd ed) Kano: Sharif Mahir Investment Ltd

[3]. Adejumo, G. (2001). Indigenous entrepreneurship development in characteristics, problems and prospects. Journal of Department of

Business Administration, University of Ilorin, Ilorin Nigeria., 112-122.

[4]. Adeniran, Y. A. (2001). Introduction to Engineering Economics. Minna: Fuin Association.

[5]. Adeniyi, A. A. (2008). An Insight into Management Accounting (4th ed.). Lagos, Nigeria: El - Toda Ventures Limited.

[6]. Amrine, H. T., Ritchrey, J. A., & Hully, O. S. (1983). Manufacturing Organisation and Management (4th ed.). New Delhi: Prentice

Hall of Indian Private Ltd.

[7]. Ann, I. O., Christopher, C. O., & Adibe, T. N. (2012). Improving Production Planning and Control through the Application of

Breakeven Analysis in Manufacturing Firms in Nigeria. Industrial Engineering Letters , 2(No. 6). doi:ISSN 2224-6096

[8]. Berryman, C. W., & Nobe, M. D. (1999). Practical Business Application of Breakeven Analysis in Graduate Construction

Education. Edinburgh: J. Crust.

[9]. Carpenter, C. (2003) “SME Finance in Nigeria”. Paper presented to the Roundtable on “Making Small Business Finance Profitable

in Nigeria”. Access at http://www.ypforum.org/newsCarpenter.

[10]. Colin, D. (2008). Management and Cost Accounting. . London: .Booking Power Publishers.

[11]. Ekpeyong, D.B. and Nyong, M.O. (1992) “Small and Medium Scale Enterprises Development in Nigeria”. Seminar Paper on

Economic Policy Research for Policy Design and Management in Nigeria, NCEMA.

[12]. Georgiev D. (2014), Application of „Cost-Volume-Profit‟ Analysis in the Hotel Industry (Based On Survey Data Of High-Ranking

Hotels In The North-East Region Of Bulgaria). Journal of University of Economics Varna 48 Econ Lit

[13]. Glautier, M., & Underdown, B. (2001). Accounting Theory and Practice. Harlow England: Pearson Education Limited.

[14]. Hilton, R. W. (2002). Management Accounting Creating Value in a Dynamic: Business Environment. . Irwin: McGraw Hill .

[15]. J.Ihemejea, J. C., Okereafor, G. B., & Ogungbangbe, B. M. (2015, November). Cost-volume-profit Analysis and Decision Making

in the Manufacturing Industries of Nigeria. Journal of International Business Research and Marketing, 1(1).

doi:10.18775/jibrm.1849-8558.2015.11.3001

[16]. Lewin., R. (1999). Production /Operations Management: Contemporary Policy for Managing Operating Systems. Cambridge:

Harvard University Press.

[17]. Lynn, H. B. (1999). Production Planning and Control and Cost Accounting Systems: Effect on Management Decision Making and

Firm Performance. New York: Free Press.

[18]. Nabil, A., Osama, S. S., & Zaid, A.Z. (2014). The Effect of Using Break-Even-Point in Planning, Controlling, and Decision Making

in the Industrial Jordanian Companies. International Journal of Academic Research in Business and Social Sciences, 4(5).

doi:10.6007/IJARBSS/v4-i5/888

[19]. Ndaliman, M. B., & .Bala, K. C. (2007). Practical Limitations of Breakeven theory.

[20]. Nvachukwu, C. C. (2004). Management Theory and Practice. Onitsha: Africana Fist Pub. Ltd.

[21]. Olagunju, Y.A. (2008). Entrepreneurship and Small Scale Business Enterprises Development in Nigeria. Ibadan: University Press

PLC

[22]. Pollack, B. (1995). Breakeven Analysis; The Third Leg of the Underwriting Stool. Real Estate Review, 25.

[23]. Powers, L. (1987). Breakeven Analysis with Semi Fixed cost. Journal of Industrial Market Management, 67(8).

[24]. Sinclar, K., & Talbot, J. (1986). Using Breakeven Analysis When Behaviour is Unknown. Journal of Management Accounting,

68(1).

DOI: 10.9790/487X-1902014045 www.iosrjournals.org 45 | Page

You might also like

- Effectiveness of Agricultural Loans in Solapur DistrictDocument214 pagesEffectiveness of Agricultural Loans in Solapur Districtalkanm750No ratings yet

- Study of Retailers SatisfactionDocument83 pagesStudy of Retailers Satisfactionalkanm750100% (1)

- Firm performance determinants and financial ratios analysisDocument7 pagesFirm performance determinants and financial ratios analysisalkanm750No ratings yet

- 2008002733Document41 pages2008002733Aditya 苏巴马廉 IyerNo ratings yet

- Strategic Marketing Planning For A B2B High-Tech ManufacturerDocument126 pagesStrategic Marketing Planning For A B2B High-Tech ManufacturerSarabdeep SinghNo ratings yet

- Financial Planning and ForecastingDocument15 pagesFinancial Planning and Forecastingalkanm750100% (1)

- International BusinessDocument50 pagesInternational Businessalkanm750No ratings yet

- Textile IndustryDocument70 pagesTextile Industryalkanm750No ratings yet

- Project Report On Technical AnalysisDocument97 pagesProject Report On Technical Analysisvishalnabde80% (59)

- Firm performance determinants and financial ratios analysisDocument7 pagesFirm performance determinants and financial ratios analysisalkanm750No ratings yet

- 352 1490343704 PDFDocument5 pages352 1490343704 PDFMega SipayungNo ratings yet

- Cost of Capital ProjectDocument49 pagesCost of Capital ProjectMohit JoshiNo ratings yet

- Project Report On Technical AnalysisDocument97 pagesProject Report On Technical Analysisvishalnabde80% (59)

- International BusinessDocument50 pagesInternational Businessalkanm750No ratings yet

- International BusinessDocument50 pagesInternational Businessalkanm750No ratings yet

- Project Report On Technical AnalysisDocument97 pagesProject Report On Technical Analysisvishalnabde80% (59)

- International BusinessDocument50 pagesInternational Businessalkanm750No ratings yet

- Strategic Marketing Planning For A B2B High-Tech ManufacturerDocument126 pagesStrategic Marketing Planning For A B2B High-Tech ManufacturerSarabdeep SinghNo ratings yet

- International BusinessDocument50 pagesInternational Businessalkanm750No ratings yet

- Sales Performance Literature ReviewDocument26 pagesSales Performance Literature ReviewSangram Panda80% (10)

- Stress Testing and Credit Risk ManagementDocument33 pagesStress Testing and Credit Risk Managementalkanm750No ratings yet

- Stock Industry AwarenessDocument47 pagesStock Industry Awarenessalkanm750No ratings yet

- Stock Industry AwarenessDocument47 pagesStock Industry Awarenessalkanm750No ratings yet

- Workers Participation in ManagementDocument2 pagesWorkers Participation in Managementalkanm750No ratings yet

- Stock Industry AwarenessDocument47 pagesStock Industry Awarenessalkanm750No ratings yet

- Advertising & Sales PromotionDocument75 pagesAdvertising & Sales Promotionalkanm750100% (1)

- Talent Management Literature ReviewDocument19 pagesTalent Management Literature Reviewalkanm750100% (3)

- Review of Literature on Impact of AdvertisementsDocument22 pagesReview of Literature on Impact of Advertisementsalkanm750100% (2)

- Distribution Channels Study Questionnaire enDocument6 pagesDistribution Channels Study Questionnaire enMuhammad RafiuddinNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Research MCQS, Data AnalysisDocument4 pagesResearch MCQS, Data AnalysisZainab MehfoozNo ratings yet

- Robust Detection of Multiple Outliers in A Multivariate Data SetDocument30 pagesRobust Detection of Multiple Outliers in A Multivariate Data Setchukwu solomonNo ratings yet

- Lezama Et Al. 2014. Variation of Grazing Induced Vegetation Changes Across A Large Scale Productivity GradientDocument14 pagesLezama Et Al. 2014. Variation of Grazing Induced Vegetation Changes Across A Large Scale Productivity GradientMagdalena QuirogaNo ratings yet

- Course Syllabus Introduction To SPSSDocument2 pagesCourse Syllabus Introduction To SPSSAnissa Negra AkroutNo ratings yet

- Hypothesis Testing RoadmapDocument2 pagesHypothesis Testing RoadmapVanessa MoralesNo ratings yet

- Hallmarks of Scientific ResearchDocument32 pagesHallmarks of Scientific ResearchAb EdNo ratings yet

- Factors Influencing Job Satisfaction Among Gen X and Gen YDocument10 pagesFactors Influencing Job Satisfaction Among Gen X and Gen YfirinaluvinaNo ratings yet

- Ell409 AqDocument8 pagesEll409 Aqlovlesh royNo ratings yet

- Study The Different Flora in Your LocalityDocument16 pagesStudy The Different Flora in Your Localityversenopee0100% (8)

- ESSAYDocument4 pagesESSAYEY SINo ratings yet

- FILPSYDocument27 pagesFILPSYMichael CamusNo ratings yet

- Synopsis-Role of Effective Operation Services in Tourism IndustryDocument10 pagesSynopsis-Role of Effective Operation Services in Tourism IndustryDeepak SinghNo ratings yet

- Cfa AmosDocument7 pagesCfa AmosfengkyadieperdanaNo ratings yet

- A Study About The Impact of The City's Economic Condition To The Businesses in Navotas CityDocument8 pagesA Study About The Impact of The City's Economic Condition To The Businesses in Navotas CityEdrilyn Nichole AlvarezNo ratings yet

- Exploratory Data AnalysisDocument22 pagesExploratory Data AnalysisjdmarinNo ratings yet

- Evaluation of Relative Importance of Environmental Issues Associated With A Residential Estate in Hong KongDocument13 pagesEvaluation of Relative Importance of Environmental Issues Associated With A Residential Estate in Hong KongMohammed Younus AL-BjariNo ratings yet

- 12 - Summary and ConclusionsDocument28 pages12 - Summary and ConclusionsAndreiNo ratings yet

- Bio Statistics PG CD MDocument23 pagesBio Statistics PG CD McrneeteshNo ratings yet

- An Empirical Study of Factors Affecting Sales of Mutual Funds Companies in IndiaDocument289 pagesAn Empirical Study of Factors Affecting Sales of Mutual Funds Companies in Indiashradha srivastavaNo ratings yet

- Data Exploration & VisualizationDocument23 pagesData Exploration & Visualizationdivya kolluriNo ratings yet

- MBAS901 2 LectureDocument87 pagesMBAS901 2 LectureSabinaNo ratings yet

- Applied Business Forecasting and Planning: Moving Averages and Exponential SmoothingDocument48 pagesApplied Business Forecasting and Planning: Moving Averages and Exponential SmoothingChampika SomathilakeNo ratings yet

- SVKM'S Nmims: Mukesh Patel School of Technology Management and EngineeringDocument22 pagesSVKM'S Nmims: Mukesh Patel School of Technology Management and EngineeringRaj Kothari MNo ratings yet

- Krause-Pargament2018 Article ReadingTheBibleStressfulLifeEvDocument12 pagesKrause-Pargament2018 Article ReadingTheBibleStressfulLifeEvLorilee Joy LaguardiaNo ratings yet

- Graphical Analysis 4 - User Manual: September 2018Document56 pagesGraphical Analysis 4 - User Manual: September 2018Faris Al FarisNo ratings yet

- Short Time Well Test Data Interpretation PDFDocument8 pagesShort Time Well Test Data Interpretation PDFJodicaNo ratings yet

- 2023 Oct CSC649 Group Project - Evaluation FormDocument1 page2023 Oct CSC649 Group Project - Evaluation FormMUHAMMAD AMER FAIZ BIN ABDUL RAHMANNo ratings yet

- Data Science Interview Prep For SQL, Panda, Python, R LanguDocument136 pagesData Science Interview Prep For SQL, Panda, Python, R LangufabiancdNo ratings yet

- Summer Internship Report GuidelineDocument11 pagesSummer Internship Report GuidelineAmit PandeyNo ratings yet

- CV Vetting Guidelines 2023-24Document16 pagesCV Vetting Guidelines 2023-24rishikajha1243No ratings yet