Professional Documents

Culture Documents

Teamlease Services (Team In) : Q4Fy19 Result Update

Uploaded by

saran21Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Teamlease Services (Team In) : Q4Fy19 Result Update

Uploaded by

saran21Copyright:

Available Formats

TeamLease Services (TEAM IN)

Rating: HOLD | CMP: Rs2,980 | TP: Rs3,203

May 29, 2019 Margin expansion remains key

Q4FY19 Result Update Teamlease (TEAM) reported a tepid quarter with gross revenues declining by

~1% QoQ & specialized staffing and other HR service verticals pulled down

Change in Estimates | Target | Reco

overall performance. Specialized staffing growth in Q4FY19 was mild at 9.1%

Change in Estimates on a YoY basis. Q4FY19 performance was tepid mainly due to flat growth of

Current Previous specialized staffing vertical, flat EBITDA growth & associate employee’s

FY20E FY21E FY20E FY21E

additions. Specialized staffing revenues stagnated QoQ (+0.3%) with

Rating HOLD HOLD

Target Price 3,203 3,203 revenues being INR 794mn. IT staffing continues to grow well but weak

Sales (Rs. m) 53,531 61,969 53,531 61,969

growth in telecom vertical is a headwind. General staffing pipeline for FY20E

% Chng. - -

EBITDA (Rs. m) 1,314 1,518 1,314 1,518 appears to be strong & the structural story around increased formalization of

% Chng. - -

labor market & TEAM spot in flexible staffing industry keeps us positive.

EPS (Rs.) 72.7 89.2 72.7 89.2

% Chng. - - However, stretched valuations of 42.x/ 34.8x FY20/21E keeps us cautious

especially when operating leverages are showing signs of weakness.

Key Financials Maintain HOLD rating, with unchanged target price of Rs.3203.

FY18 FY19 FY20E FY21E

Sales (Rs. m) 36,241 44,476 53,531 61,969 Miss on Revenues and margin: Revenue came in at Rs11,634 mn down 1%

EBITDA (Rs. m) 688 945 1,314 1,518

QoQ and up 19% YoY (Ple: Rs12,115mn). Gross margin came at 5.8% up

Margin (%) 1.9 2.1 2.5 2.4

PAT (Rs. m) 738 984 1,243 1,524 30bps QoQ. EBIDTA margin came at 2.21% up 12bps QoQ and below our

EPS (Rs.) 43.1 57.6 72.7 89.2 estimates (PLe: 2.3%). Absolute EBIDTA came at Rs257mn which is 7.7%

Gr. (%) 28.1 33.4 26.3 22.6

DPS (Rs.) - - - -

below our estimates led by weak margins in specialized staffing. PAT at

Yield (%) - - - - Rs260mn was 0.8% partially ahead of estimates aided by higher other income

RoE (%) 18.3 20.1 20.7 20.6

and thus offset impact of miss on revenue and margins

RoCE (%) 7.6 8.5 10.3 10.9

EV/Sales (x) 1.4 1.1 0.9 0.8

EV/EBITDA (x) 71.6 52.6 37.2 31.6 General staffing- Margin expansion offset by Tepid Revenue growth:

PE (x) 69.1 51.8 41.0 33.4 General staffing associates stood at 154,095 grew by 16.5% YoY with weak

P/BV (x) 11.5 9.5 7.7 6.2

addition of ~1400 QoQ. Revenue remain weak at Rs10,565mn (-0.5% QoQ/

+20% YoY). However, margins expanded by 25bps QoQ/ 46bps YoY with

Key Data TLSV.BO | TEAM IN tailwind from improvement in employee productivity and operational

52-W High / Low Rs.3,339 / Rs.1,990

efficiencies. We note that ratio of associates to core staffing associates

Sensex / Nifty 39,502 / 11,861

Market Cap Rs.51bn/ $ 729m improved to 270 (vs 260 in Q3FY19). Pipeline remain strong with open position

Shares Outstanding 17m

3M Avg. Daily Value Rs.112.83m

at end of Q4FY19 with 10000 (vs ~5500 in Q4FY18).

Telecom staffing drags Specialized staffing: Revenue came at Rs794mn

Shareholding Pattern (%)

(flat QoQ/ +9% YoY) with EBITDA margin of 6% (+50bps QoQ/ -97bps YoY).

Promoter’s 40.78

Foreign 42.38 IT staffing business saw improved momentum in FY2019 with ~18% growth in

Domestic Institution 7.61 associates to 2,100. Though IT staffing continues to grow well, weak

Public & Others 9.23

Promoter Pledge (Rs bn) - performance in telecom staffing (Evolve) is dragging growth for the segment,

Telecom staffing (~50% of total IT staffing business) dragged the margins in

Stock Performance (%) FY19 (Q3FY19 EBITDA Margin for Telecom Staffing- 3%). Management

1M 6M 12M expects telecom margins to recover back to ~5% with investments made last

Absolute (0.6) 6.2 11.6

year and realignment of associates from non- profitable projects to profitable

Relative (1.7) (2.8) (1.3)

projects. However also cited that revenue growth is expected to be flat in this

segment.

Aniket Pande

aniketpande@plindia.com | 91-22-66322300

Rajat Gandhi

rajatgandhi@plindia.com | 91-22-66322246

May 29, 2019 1

TeamLease Services

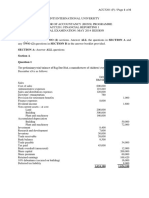

Body Text Q4FY19: Quick view on results

Y/e March (Rs mn) Q4FY19 Q3FY19 QoQ gr. Q4FY18 YoY gr. PL Estimates Variance

Revenues 11,634 11,722 -0.8% 8,756 32.9% 12,115 -4.0%

EBITDA 257.3 245.2 4.9% 151.4 69.9% 278.7 -7.7%

EBITDA Margins 2.2% 2.1% 12 bps 1.7% 48 bps 2.30% -9 bps

EBIT 232.5 220.5 5.5% 200.0 16.2% 248.4 -6.4%

EBIT Margin 2.0% 1.9% 12 bps 2.0% -5 bps 2.1% -5 bps

Net Profit 262 252 4.0% 174 50.5% 260 0.8%

Source: Company, PL

Revenue came in at Rs11634mn Weak performance with tepid revenue growth

down 1% QoQ and up 19% YoY (Ple:

Rs12115mn). Revenue miss on Revenues Growth YoY

account of lower than expected

14,000 35.0%

associate and trainee’s addition in 29.1% 27.7%

General staffing. 12,000 24.6% 30.0%

23.0%24.0%

10,000 21.4% 21.2%

19.7%19.7% 25.0%

19.0%

8,000 20.0%

12.3% 12.7%

6,000 15.0%

10,213

11,722

11,634

10,907

4,000 10.0%

6,877

8,147

8,169

8,530

9,181

9,774

7,226

8,756

2,000 5.0%

- 0.0%

3QFY17

4QFY17

3QFY18

4QFY18

2QFY19

3QFY19

4QFY19

1QFY17

2QFY17

1QFY18

2QFY18

1QFY19

Source: Company, PL

General staffing associates stood at Addition of General staffing associates slowed in Q4

154,095 grew by 16.5% YoY with

weak addition of ~1400 QoQ. General Staffing associates Growth YoY (%)

Pipeline remain strong with open 16.2% 16.6%16.5%

180,000 18.0%

position at end of Q4FY19 with 10000 14.1%

160,000 14.1% 13.5% 16.0%

(vs ~5500 in Q4FY18). 12.7%

140,000 14.0%

10.8%

120,000 9.8% 12.0%

100,000 10.0%

80,000 5.7% 6.1% 8.0%

60,000 4.6% 6.0%

40,000 4.0%

20,000 2.0%

0 0.0%

Q1FY17

Q2FY17

Q3FY17

1QFY18

2QFY18

3QFY18

1QFY19

2QFY19

3QFY19

Q4FY17

4QFY18

4QFY19

Source: Company, PL

May 29, 2019 2

TeamLease Services

Key Highlights from concall:

Company currently has open position of 10000 (vs ~5500 in FY18) and will

continue to focus on filling this position.

Management cited that demand was across BFSI sector, Digital, E-commerce

and Manufacturing.

Management guided to achieve 15-17% associate growth in medium term.

Revenue from Telecom staffing (Evolve) stood at Rs43 Cr with EBITDA of

Rs1.3Cr (EBITDA Margin- ~3%) with core employee count of 86 and associate

count of 3800.

In IT staffing business, Telecom staffing (~50% of total IT staffing business)

dragged the margins in FY19 (Q3FY19 EBITDA Margin for Telecom Staffing-

3%). Management expects telecom margins to recover back to ~5% with

investments made last year and realignment of associates from non- profitable

projects to profitable projects. However also cited that revenue growth is

expected to be flat in this segment.

HR services: Excess provisions taken in this segment in Q3FY19 partly

reversed in Q4FY19, as grants from state governments come in for the

government training business. Target is to provide all general staffing clients

with value added services also, thus providing a more comprehensive suite of

services and improving customer stickiness.

Marginal Recovery in mark-up

Mark-up (Realization per associate per month)

755

760 747

735 736 735

740 729

720 712 712 710 710 714

700 691

680

660

640

1QFY17

3QFY17

4QFY17

1QFY18

2QFY18

3QFY18

4QFY18

1QFY19

2QFY19

3QFY19

4QFY19

2QFY17

Source: Company, PL

May 29, 2019 3

TeamLease Services

Strong addition of NETAP trainees

NETAP Trainees Growth QoQ (%)

60,000 25.7% 30.0%

23.9%

50,000 22.3% 25.0%

20.7%19.7%

40,000 16.3% 20.0%

30,000 15.0%

9.2% 10.3%

7.8% 6.9%

20,000 6.5% 10.0%

10,000 2.6% 5.0%

0 0.0%

Q1FY17

1QFY18

2QFY18

3QFY18

4QFY18

1QFY19

4QFY19

Q2FY17

Q3FY17

Q4FY17

2QFY19

3QFY19

Source: Company, PL

Segment-wise performance Analysis

Particulars Q4FY19 Q4FY18 YoY gr. Q3FY19 QoQ gr. FY19 FY18 YoY gr.

Revenue:

General Staffing and Allied Services 10565 8830 20% 10617 0% 40115 33749 19%

Specialized Staffing Services 794 728 9% 792 0% 3092 1829 NC

Other HR Services 275 217 27% 314 12% 1269 663 91%

Total Income from Operations 11634 9775 19% 11723 -1% 44476 36241 23%

EBITDA:

General Staffing and Allied Services 247 162 53% 221 12% 808 615 31%

Specialized Staffing Services 49 52 -7% 45 9% 202 180 NC

Other HR Services 16 27 40% 3 423% 83 39 111%

Unallocated -57 -33 72% -23 152% -151 -149 1%

Total EBITDA 255 208 23% 246 4% 942 685 37%

EBITDA Margin

General Staffing and Allied Services 2.3% 1.8% 50 bps 2.1% 20 bps 2.0% 1.8% 20 bps

Specialized Staffing Services 6.1% 7.2% -97 bps 5.6% 50 bps 6.5% 9.9% -340 bps

Other HR Services 5.8% 12.3% -662 bps 1.0% 480 bps 6.5% 5.9% 60 bps

Total 2.2% 2.1% -10 bps 2.1% 9 bps 2.1% 1.9% 23 bps

Source: Company, PL

May 29, 2019 4

TeamLease Services

Financials

Income Statement (Rs m) Balance Sheet Abstract (Rs m)

Y/e Mar FY18 FY19 FY20E FY21E Y/e Mar FY18 FY19 FY20E FY21E

Net Revenues 36,241 44,476 53,531 61,969 Non-Current Assets

YoY gr. (%) 19.2 22.7 20.4 15.8

Employee Cost 34,712 41,971 50,718 58,778 Gross Block 1,768 1,818 1,868 1,918

Gross Profit 1,529 2,504 2,813 3,191 Tangibles 190 200 210 220

Margin (%) 4.2 5.6 5.3 5.1 Intangibles 1,578 1,618 1,658 1,698

SG&A Expenses - - - -

Other Expenses 841 1,560 1,499 1,673 Acc: Dep / Amortization 393 498 625 751

Tangibles 136 162 192 223

EBITDA 688 945 1,314 1,518 Intangibles 257 336 432 528

YoY gr. (%) 85.6 37.3 39.1 15.5

Margin (%) 1.9 2.1 2.5 2.4 Net fixed assets 1,375 1,320 1,243 1,167

Tangibles 54 38 18 (3)

Depreciation and Amortization 92 105 127 126 Intangibles 1,321 1,282 1,226 1,170

EBIT 597 840 1,187 1,392 Capital Work In Progress 2 60 60 60

Margin (%) 1.6 1.9 2.2 2.2 Goodwill - - - -

Non-Current Investments 1,202 1,441 1,441 1,441

Net Interest 25 52 21 12 Net Deferred tax assets 399 653 653 653

Other Income 156 181 80 160 Other Non-Current Assets 1,019 1,637 1,637 1,637

Profit Before Tax 728 968 1,246 1,540 Current Assets

Margin (%) 2.0 2.2 2.3 2.5 Investments 323 160 160 160

Inventories - - - -

Total Tax (9) (16) 3 15 Trade receivables 2,235 2,643 3,227 3,735

Effective tax rate (%) (1.3) (1.7) 0.2 1.0 Cash & Bank Balance 1,424 1,230 1,967 2,859

Other Current Assets 130 194 194 194

Profit after tax 738 984 1,243 1,524 Total Assets 8,860 10,698 11,941 13,265

Minority interest - - - -

Share Profit from Associate - - - - Equity

Equity Share Capital 171 171 171 171

Adjusted PAT 738 984 1,243 1,524 Other Equity 4,246 5,220 6,463 7,988

YoY gr. (%) 28.1 33.4 26.3 22.6 Total Networth 4,417 5,391 6,634 8,158

Margin (%) 2.0 2.2 2.3 2.5

Extra Ord. Income / (Exp) - - - - Non-Current Liabilities

Long Term borrowings - - - -

Reported PAT 738 984 1,243 1,524 Provisions 437 566 566 566

YoY gr. (%) 28.1 33.4 26.3 22.6 Other non current liabilities 49 94 94 94

Margin (%) 2.0 2.2 2.3 2.5

Current Liabilities

Other Comprehensive Income - - - - ST Debt / Current of LT Debt 73 106 106 106

Total Comprehensive Income 738 984 1,243 1,524 Trade payables 176 280 280 280

Equity Shares O/s (m) 17 17 17 17 Other current liabilities 3,709 4,458 4,458 4,258

EPS (Rs) 43.1 57.6 72.7 89.2 Total Equity & Liabilities 8,861 10,895 12,138 13,463

Source: Company Data, PL Research Source: Company Data, PL Research

May 29, 2019 5

TeamLease Services

Cash Flow (Rs m) Key Financial Metrics

Y/e Mar FY18 FY19 FY20E FY21E Year

Y/e Mar FY18 FY19 FY20E FY21E

PBT 728 968 1,246 1,540 Per Share(Rs)

Add. Depreciation 92 105 127 126 EPS 43.1 57.6 72.7 89.2

Add. Interest 25 52 21 12 CEPS 48.5 63.7 80.1 96.5

Less Financial Other Income 156 181 80 160 BVPS 258.3 315.3 388.0 477.2

Add. Other (156) (181) (80) - FCF (0.7) 103.7 39.6 69.4

Op. profit before WC changes 688 945 1,314 1,678 DPS - - - -

Net Changes-WC (310) 862 (583) (447) Return Ratio(%)

Direct tax 9 16 (3) (15) RoCE 7.6 8.5 10.3 10.9

Net cash from Op. activities 387 1,823 728 1,216 ROIC 8.5 9.0 11.8 13.2

Capital expenditures (400) (50) (50) (30) RoE 18.3 20.1 20.7 20.6

Interest / Dividend Income 156 181 80 - Balance Sheet

Others (491) (621) - - Net Debt : Equity (x) (0.4) (0.2) (0.3) (0.4)

Net Cash from Invt. activities (735) (490) 30 (30) Debtor (Days) 23 22 22 22

Issue of share cap. / premium - - - - Valuation(x)

Debt changes 1,032 33 - - PER 69.1 51.8 41.0 33.4

Dividend paid - - - - P/B 11.5 9.5 7.7 6.2

Interest paid (25) (52) (21) (12) P/CEPS 48.5 63.7 80.1 96.5

Others 62 174 - - EV/EBITDA 71.6 52.6 37.2 31.6

Net cash from Fin. activities 1,070 156 (21) (12) EV/Sales 1.4 1.1 0.9 0.8

Net change in cash 722 1,488 737 1,174 Dividend Yield (%) - - - -

Free Cash Flow (13) 1,773 678 1,186 Source: Company Data, PL Research

Source: Company Data, PL Research

Quarterly Financials (Rs m)

Y/e Mar Q1FY19 Q2FY19 Q3FY19 Q4FY19

Net Revenue 10,213 10,907 11,722 11,634

YoY gr. (%) 19.7 24.6 27.7 19.0

Raw Material Expenses 9,683 10,244 11,083 10,961

Gross Profit 530 663 639 673

Margin (%) 5.2 6.1 5.5 5.8

EBITDA 202 240 245 257

YoY gr. (%) (11.3) 19.1 2.0 4.9

Margin (%) 2.0 2.2 2.1 2.2

Depreciation / Depletion 27 29 25 25

EBIT 175 211 220 232

Margin (%) 1.7 1.9 1.9 2.0

Net Interest 11 14 13 14

Other Income 52 40 36 52

Profit before Tax 217 238 243 270

Margin (%) 2.1 2.2 2.1 2.3

Total Tax (3) (12) (9) 8

Effective tax rate (%) (1.2) (5.2) (3.7) 2.9

Profit after Tax 219 250 252 262

Minority interest - - - -

Share Profit from Associates (1) (1) - (2)

Adjusted PAT 218 249 252 260

YoY gr. (%) 32.8 43.1 37.0 22.6

Margin (%) 2.1 2.3 2.2 2.2

Extra Ord. Income / (Exp) - - - -

Reported PAT 218 249 252 260

YoY gr. (%) 32.8 43.1 37.0 22.6

Margin (%) 2.1 2.3 2.2 2.2

Other Comprehensive Income - - - -

Total Comprehensive Income 218 249 252 260

Avg. Shares O/s (m) 17 17 17 17

EPS (Rs) 12.8 14.6 14.8 15.2

Source: Company Data, PL Research

May 29, 2019 6

TeamLease Services

Price Chart Recommendation History

(Rs)

No. Date Rating TP (Rs.) Share Price (Rs.)

3250

1 10-Jul-18 Hold 2,940 2,940

2646 2 25-Jul-18 Hold 2,740 2,672

3 5-Oct-18 Hold 2,740 2,219

2042

4 7-Jan-19 Hold 2,740 2,884

1438 5 5-Apr-19 Hold 3,203 3,031

835

May - 16

May - 17

May - 18

May - 19

Nov - 18

Nov - 16

Nov - 17

Analyst Coverage Universe

Sr. No. CompanyName Rating TP (Rs) Share Price (Rs)

1 Cyient Accumulate 621 579

2 HCL Technologies BUY 1,186 1,087

3 Hexaware Technologies Reduce 325 333

4 Infosys Accumulate 782 748

5 L&T Technology Services Accumulate 1,835 1,691

6 Larsen & Toubro Infotech BUY 1,981 1,678

7 Mindtree Reduce 873 972

8 Mphasis Accumulate 1,090 975

9 NIIT Technologies BUY 1,539 1,268

10 Persistent Systems Hold 618 636

11 Redington (India) BUY 114 99

12 Sonata Software Accumulate 400 346

13 Tata Consultancy Services BUY 2,312 2,013

14 TeamLease Services Hold 3,203 3,031

15 Tech Mahindra BUY 847 770

16 Wipro Hold 247 281

17 Zensar Technologies Accumulate 260 246

PL’s Recommendation Nomenclature (Absolute Performance)

Buy : > 15%

Accumulate : 5% to 15%

Hold : +5% to -5%

Reduce : -5% to -15%

Sell : < -15%

Not Rated (NR) : No specific call on the stock

Under Review (UR) : Rating likely to change shortly

May 29, 2019 7

TeamLease Services

ANALYST CERTIFICATION

(Indian Clients)

We/I, Mr. Aniket Pande- MBA, Mr. Rajat Gandhi- MBA Research Analysts, authors and the names subscribed to this report, hereby certify that all of the views expressed in this

research report accurately reflect our views about the subject issuer(s) or securities. We also certify that no part of our compensation was, is, or will be directly or indirectly related to

the specific recommendation(s) or view(s) in this report.

(US Clients)

The research analysts, with respect to each issuer and its securities covered by them in this research report, certify that: All of the views expressed in this research report accurately

reflect his or her or their personal views about all of the issuers and their securities; and No part of his or her or their compensation was, is or will be directly related to the specific

recommendation or views expressed in this research report.

DISCLAIMER

Indian Clients

Prabhudas Lilladher Pvt. Ltd, Mumbai, India (hereinafter referred to as “PL”) is engaged in the business of Stock Broking, Portfolio Manager, Depository Participant and distribution for

third party financial products. PL is a subsidiary of Prabhudas Lilladher Advisory Services Pvt Ltd. which has its various subsidiaries engaged in business of commodity broking,

investment banking, financial services (margin funding) and distribution of third party financial/other products, details in respect of which are available at www.plindia.com.

This document has been prepared by the Research Division of PL and is meant for use by the recipient only as information and is not for circulation. This document is not to be reported

or copied or made available to others without prior permission of PL. It should not be considered or taken as an offer to sell or a solicitation to buy or sell any security.

The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or completeness

of the same. Neither PL nor any of its affiliates, its directors or its employees accepts any responsibility of whatsoever nature for the information, statements and opinion given, made

available or expressed herein or for any omission therein.

Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The suitability or

otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent expert/advisor.

Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or engage in transactions

of securities of companies referred to in this report and they may have used the research material prior to publication.

PL may from time to time solicit or perform investment banking or other services for any company mentioned in this document.

PL is in the process of applying for certificate of registration as Research Analyst under Securities and Exchange Board of India (Research Analysts) Regulations, 2014

PL submits that no material disciplinary action has been taken on us by any Regulatory Authority impacting Equity Research Analysis activities.

PL or its research analysts or its associates or his relatives do not have any financial interest in the subject company.

PL or its research analysts or its associates or his relatives do not have actual/beneficial ownership of one per cent or more securities of the subject company at the end of the month

immediately preceding the date of publication of the research report.

PL or its research analysts or its associates or his relatives do not have any material conflict of interest at the time of publication of the research report.

PL or its associates might have received compensation from the subject company in the past twelve months.

PL or its associates might have managed or co-managed public offering of securities for the subject company in the past twelve months or mandated by the subject company for any

other assignment in the past twelve months.

PL or its associates might have received any compensation for investment banking or merchant banking or brokerage services from the subject company in the past twelve months.

PL or its associates might have received any compensation for products or services other than investment banking or merchant banking or brokerage services from the subject

company in the past twelve months

PL or its associates might have received any compensation or other benefits from the subject company or third party in connection with the research report.

PL encourages independence in research report preparation and strives to minimize conflict in preparation of research report. PL or its analysts did not receive any compensation or

other benefits from the subject Company or third party in connection with the preparation of the research report. PL or its Research Analysts do not have any material conflict of interest

at the time of publication of this report.

It is confirmed that Mr. Aniket Pande- MBA, Mr. Rajat Gandhi- MBA Research Analysts of this report have not received any compensation from the companies mentioned in the report

in the preceding twelve months

Compensation of our Research Analysts is not based on any specific merchant banking, investment banking or brokerage service transactions.

The Research analysts for this report certifies that all of the views expressed in this report accurately reflect his or her personal views about the subject company or companies and its

or their securities, and no part of his or her compensation was, is or will be, directly or indirectly related to specific recommendations or views expressed in this report.

The research analysts for this report has not served as an officer, director or employee of the subject company PL or its research analysts have not engaged in market making activity

for the subject company

Our sales people, traders, and other professionals or affiliates may provide oral or written market commentary or trading strategies to our clients that reflect opinions that are contrary

to the opinions expressed herein, and our proprietary trading and investing businesses may make investment decisions that are inconsistent with the recommendations expressed

herein. In reviewing these materials, you should be aware that any or all o the foregoing, among other things, may give rise to real or potential conflicts of interest.

PL and its associates, their directors and employees may (a) from time to time, have a long or short position in, and buy or sell the securities of the subject company or (b) be engaged

in any other transaction involving such securities and earn brokerage or other compensation or act as a market maker in the financial instruments of the subject company or act as an

advisor or lender/borrower to the subject company or may have any other potential conflict of interests with respect to any recommendation and other related information and opinions.

US Clients

This research report is a product of Prabhudas Lilladher Pvt. Ltd., which is the employer of the research analyst(s) who has prepared the research report. The research analyst(s)

preparing the research report is/are resident outside the United States (U.S.) and are not associated persons of any U.S. regulated broker-dealer and therefore the analyst(s) is/are

not subject to supervision by a U.S. broker-dealer, and is/are not required to satisfy the regulatory licensing requirements of FINRA or required to otherwise comply with U.S. rules or

regulations regarding, among other things, communications with a subject company, public appearances and trading securities held by a research analyst account.

This report is intended for distribution by Prabhudas Lilladher Pvt. Ltd. only to "Major Institutional Investors" as defined by Rule 15a-6(b)(4) of the U.S. Securities and Exchange Act,

1934 (the Exchange Act) and interpretations thereof by U.S. Securities and Exchange Commission (SEC) in reliance on Rule 15a 6(a)(2). If the recipient of this report is not a Major

Institutional Investor as specified above, then it should not act upon this report and return the same to the sender. Further, this report may not be copied, duplicated and/or transmitted

onward to any U.S. person, which is not the Major Institutional Investor.

In reliance on the exemption from registration provided by Rule 15a-6 of the Exchange Act and interpretations thereof by the SEC in order to conduct certain business with Major

Institutional Investors, Prabhudas Lilladher Pvt. Ltd. has entered into an agreement with a U.S. registered broker-dealer, Marco Polo Securities Inc. ("Marco Polo").

Transactions in securities discussed in this research report should be effected through Marco Polo or another U.S. registered broker dealer.

Prabhudas Lilladher Pvt. Ltd.

3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai-400 018, India | Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209

www.plindia.com | Bloomberg Research Page: PRLD <GO>

May 29, 2019 AMNISH

Digitally signed by AMNISH AGGARWAL

DN: c=IN, o=Prabhudas Lilladher Private Limited,

ou=organisation, cn=AMNISH AGGARWAL,

serialNumber=7a6f13691881d5a8af6353865a61b48b7040e72

8

AGGARWAL

f4a1bf53182e368b3ca14a5e4, postalCode=400015,

2.5.4.20=c9b37ca6a8c78a11d6c42a4b6014e984fdf135dc1449

611df0dc682d08443fc6, st=Maharashtra

Date: 2019.05.29 17:26:31 +05'30'

You might also like

- Economic Indicators for South and Central Asia: Input–Output TablesFrom EverandEconomic Indicators for South and Central Asia: Input–Output TablesNo ratings yet

- Zensar Technologies (ZENT IN) : Q3FY19 Result UpdateDocument8 pagesZensar Technologies (ZENT IN) : Q3FY19 Result Updatesaran21No ratings yet

- Bharti Airtel Company Update - 270810Document6 pagesBharti Airtel Company Update - 270810Robin BhimaiahNo ratings yet

- Affle - Q2FY22 - Result Update - 15112021 Final - 15-11-2021 - 12Document8 pagesAffle - Q2FY22 - Result Update - 15112021 Final - 15-11-2021 - 12Bharti PuratanNo ratings yet

- Larsen & Toubro: Bottoming Out Order Pick-Up Awaited BUYDocument10 pagesLarsen & Toubro: Bottoming Out Order Pick-Up Awaited BUYVikas AggarwalNo ratings yet

- S Chand and Company (SCHAND IN) : Q3FY20 Result UpdateDocument6 pagesS Chand and Company (SCHAND IN) : Q3FY20 Result UpdateanjugaduNo ratings yet

- Teamlease: Near Term Impact To Be ManageableDocument8 pagesTeamlease: Near Term Impact To Be ManageableAnand KNo ratings yet

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathNo ratings yet

- Telkom Indonesia showing strength across segmentsDocument6 pagesTelkom Indonesia showing strength across segmentsMochamad IrvanNo ratings yet

- Sonata Software (SSOF IN) : Q2FY19 Result UpdateDocument9 pagesSonata Software (SSOF IN) : Q2FY19 Result UpdateADNo ratings yet

- Wipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityDocument14 pagesWipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityPramod KulkarniNo ratings yet

- INFY - NoDocument12 pagesINFY - NoSrNo ratings yet

- Angel One: Revenue Misses Estimates Expenses in LineDocument14 pagesAngel One: Revenue Misses Estimates Expenses in LineRam JaneNo ratings yet

- Q3FY19 Update Deepak Nitrite's Phenomenal PerformanceDocument6 pagesQ3FY19 Update Deepak Nitrite's Phenomenal Performance4nagNo ratings yet

- Polycab India's Strong Export Orders Drive FY20 Earnings GrowthDocument10 pagesPolycab India's Strong Export Orders Drive FY20 Earnings Growthkishore13No ratings yet

- Infosys Raises Revenue Guidance After Strong Q1 ResultsDocument13 pagesInfosys Raises Revenue Guidance After Strong Q1 ResultsPrahladNo ratings yet

- SChand Analyst CoverageDocument7 pagesSChand Analyst CoverageMohan KNo ratings yet

- Nirmal Bang PDFDocument11 pagesNirmal Bang PDFBook MonkNo ratings yet

- Wipro Q4FY09 Result UpdateDocument4 pagesWipro Q4FY09 Result UpdateHardikNo ratings yet

- L&T Technology Services (LTTS IN) : Q3FY19 Result UpdateDocument9 pagesL&T Technology Services (LTTS IN) : Q3FY19 Result UpdateanjugaduNo ratings yet

- Tech Mahindra (TECHM IN) : Q1FY21 Result UpdateDocument12 pagesTech Mahindra (TECHM IN) : Q1FY21 Result UpdatewhitenagarNo ratings yet

- Nirmal Bang Sees 2% UPSIDE in United Spirits Better Than ExpectedDocument11 pagesNirmal Bang Sees 2% UPSIDE in United Spirits Better Than ExpectedDhaval MailNo ratings yet

- IDirect MarutiSuzuki Q2FY19Document12 pagesIDirect MarutiSuzuki Q2FY19Rajani KantNo ratings yet

- LT Tech - 4qfy19 - HDFC SecDocument12 pagesLT Tech - 4qfy19 - HDFC SecdarshanmadeNo ratings yet

- Wipro upgraded to Buy on strong margin performanceDocument12 pagesWipro upgraded to Buy on strong margin performancewhitenagarNo ratings yet

- Tata Elxsi 4qfy19 Result Update19Document6 pagesTata Elxsi 4qfy19 Result Update19Ashutosh GuptaNo ratings yet

- PPB Group: 2019: Good Results Amid Challenging EnvironmentDocument4 pagesPPB Group: 2019: Good Results Amid Challenging EnvironmentZhi Ming CheahNo ratings yet

- Iiww 300710Document4 pagesIiww 300710joshichirag77No ratings yet

- CEAT Annual Report 2019Document5 pagesCEAT Annual Report 2019Roberto GrilliNo ratings yet

- London Sumatra Indonesia TBK: Still Positive But Below ExpectationDocument7 pagesLondon Sumatra Indonesia TBK: Still Positive But Below ExpectationHamba AllahNo ratings yet

- 141342112021251larsen Toubro Limited - 20210129Document5 pages141342112021251larsen Toubro Limited - 20210129Michelle CastelinoNo ratings yet

- RIL 4QFY20 Results Update | Sector: Oil & GasDocument34 pagesRIL 4QFY20 Results Update | Sector: Oil & GasQUALITY12No ratings yet

- Prabhudas DmartDocument8 pagesPrabhudas DmartGOUTAMNo ratings yet

- Ril 1qfy23Document12 pagesRil 1qfy23Deepak KhatwaniNo ratings yet

- MSIL Earnings UpdateDocument6 pagesMSIL Earnings UpdateHitesh JainNo ratings yet

- Cyient: Poor Quarter Recovery Likely in The Current QuarterDocument9 pagesCyient: Poor Quarter Recovery Likely in The Current QuarterADNo ratings yet

- Ganesha Ecosphere 3QFY20 Result Update - 200211 PDFDocument4 pagesGanesha Ecosphere 3QFY20 Result Update - 200211 PDFdarshanmadeNo ratings yet

- UltraTech Cement's strong growth visibilityDocument10 pagesUltraTech Cement's strong growth visibilityLive NIftyNo ratings yet

- Asian Paints Jan 2011Document3 pagesAsian Paints Jan 2011shahavNo ratings yet

- Ambuja Cement (ACEM IN) : Q3CY20 Result UpdateDocument6 pagesAmbuja Cement (ACEM IN) : Q3CY20 Result Updatenani reddyNo ratings yet

- ABFRL-20240215-MOSL-RU-PG012Document12 pagesABFRL-20240215-MOSL-RU-PG012krishna_buntyNo ratings yet

- Tech Mahindra announces one of its largest deals from AT&TDocument10 pagesTech Mahindra announces one of its largest deals from AT&TdarshanmaldeNo ratings yet

- ZEE Q4FY20 RESULT UPDATEDocument5 pagesZEE Q4FY20 RESULT UPDATEArpit JhanwarNo ratings yet

- Mitra Adiperkasa: Indonesia Company GuideDocument14 pagesMitra Adiperkasa: Indonesia Company GuideAshokNo ratings yet

- Results Below Expectation Due To Seasonally Weak Quarter Outlook Remains HealthyDocument1 pageResults Below Expectation Due To Seasonally Weak Quarter Outlook Remains HealthyMeharwal TradersNo ratings yet

- Voltamp Transformers 26112019Document5 pagesVoltamp Transformers 26112019anjugaduNo ratings yet

- Blue Star (BLSTR In) 2QFY20 Result Update - RsecDocument9 pagesBlue Star (BLSTR In) 2QFY20 Result Update - RsecHardik ShahNo ratings yet

- Result Update Presentation - Q1 FY18: AUGUST 10, 2017Document10 pagesResult Update Presentation - Q1 FY18: AUGUST 10, 2017Mohit PariharNo ratings yet

- Avenue Supermarts (DMART IN) : Q1FY20 Result UpdateDocument8 pagesAvenue Supermarts (DMART IN) : Q1FY20 Result UpdatejigarchhatrolaNo ratings yet

- CDSL TP: 750: in Its Own LeagueDocument10 pagesCDSL TP: 750: in Its Own LeagueSumangalNo ratings yet

- Indiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Document12 pagesIndiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Veronika AkheevaNo ratings yet

- JK Cement: Valuations Factor in Positive Downgrade To HOLDDocument9 pagesJK Cement: Valuations Factor in Positive Downgrade To HOLDShubham BawkarNo ratings yet

- Heidelberg Cement India (HEIM IN) : Q4FY19 Result UpdateDocument6 pagesHeidelberg Cement India (HEIM IN) : Q4FY19 Result UpdateTamilNo ratings yet

- United Spirits Report - MotilalDocument12 pagesUnited Spirits Report - Motilalzaheen_1No ratings yet

- S Chand and Company (SCHAND IN) : Q4FY20 Result UpdateDocument6 pagesS Chand and Company (SCHAND IN) : Q4FY20 Result UpdateRaj PrakashNo ratings yet

- ICICI Prudential Life Insurance 27-07-2018Document10 pagesICICI Prudential Life Insurance 27-07-2018zmetheuNo ratings yet

- HDFC Securities Results ReviewDocument5 pagesHDFC Securities Results ReviewmisfitmedicoNo ratings yet

- Telekomunikasi Indonesia: 1Q18 Review: Weak But Within ExpectationsDocument4 pagesTelekomunikasi Indonesia: 1Q18 Review: Weak But Within ExpectationsAhmad RafifNo ratings yet

- Reliance Industries - Q1FY23 - HSIE-202207250637049258859Document9 pagesReliance Industries - Q1FY23 - HSIE-202207250637049258859tmeygmvzjfnkqcwhgpNo ratings yet

- Asian Paints JefferiesDocument12 pagesAsian Paints JefferiesRajeev GargNo ratings yet

- Geojit's Report On Agri Picks-Geojit-26.03.2021Document9 pagesGeojit's Report On Agri Picks-Geojit-26.03.2021saran21No ratings yet

- APL Apollo Tubes 01 01 2023 KhanDocument7 pagesAPL Apollo Tubes 01 01 2023 Khansaran21No ratings yet

- HDFC 01 01 2023 KhanDocument7 pagesHDFC 01 01 2023 Khansaran21No ratings yet

- Britannia Industries 01 01 2023 KhanDocument7 pagesBritannia Industries 01 01 2023 Khansaran21No ratings yet

- Titan Company 01 01 2023 KhanDocument8 pagesTitan Company 01 01 2023 Khansaran21No ratings yet

- Sharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khanDocument9 pagesSharekhan's Research Report On Godrej Consumer Products-Godrej-Consumer-Products-26-03-2021-khansaran21No ratings yet

- Sharekhan's Research Report On Asian Paints-Asian-Paints-25-03-2021-khanDocument8 pagesSharekhan's Research Report On Asian Paints-Asian-Paints-25-03-2021-khansaran21No ratings yet

- KEC International 01 01 2023 PrabhuDocument7 pagesKEC International 01 01 2023 Prabhusaran21No ratings yet

- JSW Steel Maintain Buy on Strong Margin OutlookDocument10 pagesJSW Steel Maintain Buy on Strong Margin Outlooksaran21No ratings yet

- Daily Currency Outlook: September 11, 2019Document7 pagesDaily Currency Outlook: September 11, 2019saran21No ratings yet

- Dolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatDocument22 pagesDolat Capital Market's Research Report On Intellect Design-Intellect-Design-26-03-2021-dolatsaran21No ratings yet

- Hindustan-Unilever 28022020Document5 pagesHindustan-Unilever 28022020saran21No ratings yet

- 06 12 2019 41061219Document6 pages06 12 2019 41061219saran21No ratings yet

- Fundamental Outlook Market Highlights: Indian RupeeDocument2 pagesFundamental Outlook Market Highlights: Indian Rupeesaran21No ratings yet

- Greenply Industries: Plywood Business Growing in Single-DigitsDocument8 pagesGreenply Industries: Plywood Business Growing in Single-Digitssaran21No ratings yet

- Housing Development Finance Corporation 27082019Document6 pagesHousing Development Finance Corporation 27082019saran21No ratings yet

- Icici Bank: CMP: INR396 TP: INR520 (+31%)Document22 pagesIcici Bank: CMP: INR396 TP: INR520 (+31%)saran21No ratings yet

- Bhel (Bhel In) : Q4FY19 Result UpdateDocument6 pagesBhel (Bhel In) : Q4FY19 Result Updatesaran21No ratings yet

- Coal-India 11092019Document10 pagesCoal-India 11092019saran21No ratings yet

- Vedicmaths EbookDocument212 pagesVedicmaths Ebooksaurab83100% (9)

- Dabur India (DABUR IN) : Analyst Meet UpdateDocument12 pagesDabur India (DABUR IN) : Analyst Meet Updatesaran21No ratings yet

- Ahluwalia Contracts: Industry OverviewDocument20 pagesAhluwalia Contracts: Industry Overviewsaran21No ratings yet

- JK Lakshmi Cement 18062019Document6 pagesJK Lakshmi Cement 18062019saran21No ratings yet

- Coal India (COAL IN) : Q4FY19 Result UpdateDocument6 pagesCoal India (COAL IN) : Q4FY19 Result Updatesaran21No ratings yet

- ODLI20181225 001 UPD en AA Standard Waranty Professional LED Lamps EuropeDocument4 pagesODLI20181225 001 UPD en AA Standard Waranty Professional LED Lamps Europesaran21No ratings yet

- S Chand and Company 18062019Document6 pagesS Chand and Company 18062019saran21No ratings yet

- The Murder of The MahatmaDocument65 pagesThe Murder of The MahatmaKonkman0% (1)

- Federal Bank LTD: Q3FY19 Result UpdateDocument4 pagesFederal Bank LTD: Q3FY19 Result Updatesaran21No ratings yet

- Misq 42 1 101Document46 pagesMisq 42 1 101406536927No ratings yet

- 1 - ST Benedicts Teaching Hospital - Case QuestionsDocument1 page1 - ST Benedicts Teaching Hospital - Case QuestionsJM LopezNo ratings yet

- Efficient InefficiencyDocument2 pagesEfficient InefficiencymcampuzaNo ratings yet

- ALFM Money Market Fund Key Facts and PerformanceDocument3 pagesALFM Money Market Fund Key Facts and Performanceippon_osotoNo ratings yet

- Plumbing ArithmeticDocument23 pagesPlumbing ArithmeticAdrian sanNo ratings yet

- Azerbaijan Oil Company 2017 IFRS ReportsDocument96 pagesAzerbaijan Oil Company 2017 IFRS ReportsMehemmed MemmedliNo ratings yet

- CHP 13 Testbank 2Document15 pagesCHP 13 Testbank 2judyNo ratings yet

- Study on Performance of SBI Merchant BankingDocument73 pagesStudy on Performance of SBI Merchant BankingSonia Jacob50% (4)

- SWAPDocument18 pagesSWAPashish3009No ratings yet

- Class Problems Chapter 6 - Haryo IndraDocument3 pagesClass Problems Chapter 6 - Haryo IndraHaryo HartoyoNo ratings yet

- Acc 223 PointersDocument2 pagesAcc 223 PointersAngel FlordelizaNo ratings yet

- Top 100 Finance and Accounting QuestionsDocument7 pagesTop 100 Finance and Accounting QuestionsArun KC0% (1)

- 31-The Forex GambitDocument6 pages31-The Forex Gambitlowtarhk100% (1)

- Ferrera Gann Angles FormulaDocument29 pagesFerrera Gann Angles FormulaNeoHooda100% (2)

- ACC3201Document6 pagesACC3201natlyhNo ratings yet

- Merchandising ProblemDocument2 pagesMerchandising ProblemLizette MedranoNo ratings yet

- The Dao of CapitalDocument14 pagesThe Dao of Capitalfredtag4393No ratings yet

- Keating Capital Lists Shares On NasdaqDocument2 pagesKeating Capital Lists Shares On NasdaqkeatingcapitalNo ratings yet

- Proforma Cash Flow Analysis and Recommendations for Chemalite IncDocument8 pagesProforma Cash Flow Analysis and Recommendations for Chemalite IncHàMềmNo ratings yet

- Finance Chapter009 - Solutions AbcDocument3 pagesFinance Chapter009 - Solutions AbckysovutdaNo ratings yet

- Schneider 2016-Annual-Report-Tcm50-288816Document372 pagesSchneider 2016-Annual-Report-Tcm50-288816b1079144No ratings yet

- ME CH 1 Tutorial AnswersDocument4 pagesME CH 1 Tutorial AnswersTabassum AkhtarNo ratings yet

- Liquidity and Asset Management Ratio Analysis for Khind Holding Bhd and Milux Corporation BhdDocument14 pagesLiquidity and Asset Management Ratio Analysis for Khind Holding Bhd and Milux Corporation BhdfuzaaaaaNo ratings yet

- Mastering Options Trading: by Mentor - Ravi ChandiramaniDocument120 pagesMastering Options Trading: by Mentor - Ravi ChandiramanivivekNo ratings yet

- Chapter One Accounting For Income TaxesDocument55 pagesChapter One Accounting For Income TaxestalilaNo ratings yet

- Idea FinalDocument482 pagesIdea Finalsatwinder sidhuNo ratings yet

- Dresdner Struct Products Vicious CircleDocument8 pagesDresdner Struct Products Vicious CircleBoris MangalNo ratings yet

- FIN 500 Mod6 Assignment6 InstructionDocument6 pagesFIN 500 Mod6 Assignment6 InstructionalannorainNo ratings yet

- Pilipinas Shell Vertical and Horizontal AnalysisDocument7 pagesPilipinas Shell Vertical and Horizontal Analysismaica G.No ratings yet

- Chapter 4 - Audit of InvestmentsDocument45 pagesChapter 4 - Audit of InvestmentsClene DoconteNo ratings yet