Professional Documents

Culture Documents

Tata Sia Mumbai

Uploaded by

RohitCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tata Sia Mumbai

Uploaded by

RohitCopyright:

Available Formats

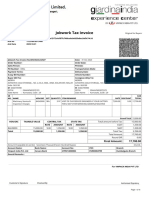

ORIGINAL FOR BUYER

RAJHANS NUTRIMENTS PVT LTD

INVOICE

Rajhans Nutriments Pvt. Ltd

M/S. HAMEED MANEKIA,SHOP NO 2, MEGHDOOT SOCIETY,Dr. R A RAIKAR MARG,

KAPAD BAZAR MUMBAI-400016

CIN NO: U1549OGJ2011PTCO66906

GSTIN NO:27AAFCR4322Q1ZY,

Reverse Charge : NO PO No :4700002371

Invoic e No : 90026701 Vehicle Number:

Invoice Date : 27.06.2019 Date of Supply:

State : Maharashtra State Code : 27 Place of Supply: Maharashtra:

Details of Receiver | Billed To Details of Consignee | Shipped To

TATA SIA AIRLINES LIMITED-MUMBAI TATA SIA AIRLINES LIMITED-MUMBAI

TajSATS AIR CATERING LIMITED TajSATS AIR CATERING LIMITED

CENTRAL WAREHOUSE CENTRAL WAREHOUSE

OFF INTERNATIONAL AIRPORT APPROACH ROAD, SAHAR OFF INTERNATIONAL AIRPORT APPROACH ROAD, SAHAR

MUMBAI 400099 MUMBAI 400099

Tel No : 9820513034 Tel No : 9820513034

Email neelesh.sardeshmukh@airvistara.com Email neelesh.sardeshmukh@airvistara.com

Contact Person : TATA SIA AIRLINES LIMITED-MUMBAI Contact Person : TATA SIA AIRLINES LIMITED-MUMBAI

GSTIN : 27AAECT8346F1Z4 GSTIN :

State : Maharashtra State Code: 27 State : Maharashtra State Code: 27

Sr.No Name of HSN Code Batch No./ UOM Qty MRP Rate Taxable CGST CGST SGST SGST

Product/Service Mfg Date Value Rate Amount Rate Amount

1 80100 18069010 SM0007069A/ Nos 8,640.000 10.50 10.50 90,720.00 9.0 8,164.80 9.0 8,164.80

SC Creamy Milk 20gm 07.06.2019

12BoxX48Unt

2 80101 18069010 SM0122069G Nos 8,640.000 10.50 10.50 90,720.00 9.0 8,164.80 9.0 8,164.80

SC Crunchy Rice /

Crispy 20gm 22.06.2019

12BoxX48Unt

Total 17,280.00

0

Total Invoice Amount In Words Total Amount Before Tax 181,440.00

RUPEES TWO LAKH FOURTEEN THOUSAND NINETY NINE AND TWENTY PAISE

ONLY

ADD:CGST 16,329.60

ADD:SGST 16,329.60

Total Amount:GST 32,659.20

Total Amount After Tax 214,099.20

Bank Details Special Note

BankA/C Holder:RAJHANS NUTRIMENTS PVT LTD No Return will be accepted in case of damage

Bank Name :ICICI BANK

Branch :LH ROAD

Account No :058405005606

Swift Code: :ICIC0000584

(Common Seal)

Terms and Condition Certified that the particulars given above are true and correct

This is to be certify that the price, declared herein is as per GST Act and that

the amount indicated in the document, represents the price, actually charged

by us & that there is no additional consideration flowing directly or indirectly

from the goods over and above what has directly or & if any differential duty,

shall be paid, if payable Authorised Signatory

E& O.E.

You might also like

- Screenshot 2021-07-05 at 6.40.56 PMDocument1 pageScreenshot 2021-07-05 at 6.40.56 PMChandu HiremathNo ratings yet

- Ramesh Verma PDFDocument2 pagesRamesh Verma PDFPankajNo ratings yet

- Print 2Document2 pagesPrint 2SwagBeast SKJJNo ratings yet

- 93 AvvashyaDocument1 page93 AvvashyaAnonymous rNqW9p3No ratings yet

- Hotel BillDocument3 pagesHotel BillAbbas FakhruddinNo ratings yet

- Faulty Adopters InvoiceDocument1 pageFaulty Adopters InvoicesumitsharmaNo ratings yet

- Tax Invoice: Charge DetailsDocument3 pagesTax Invoice: Charge DetailssrinivasNo ratings yet

- Tally Bill The Perfect 1Document1 pageTally Bill The Perfect 1Unnat aggarwalNo ratings yet

- C3TW4F: Date Flight From / Terminal To / Terminal Stops Departs Arrives Baggage Allowance ClassDocument1 pageC3TW4F: Date Flight From / Terminal To / Terminal Stops Departs Arrives Baggage Allowance ClassMadhuram SharmaNo ratings yet

- Od226072790000978000 3Document2 pagesOd226072790000978000 3Ajit BeheraNo ratings yet

- Morph Ser202324027 31102023 277Document6 pagesMorph Ser202324027 31102023 277gokulpics1No ratings yet

- Lenovo A6000 PlusDocument1 pageLenovo A6000 PlusKishore ReddyNo ratings yet

- Crystal Reports ActiveX DesignerDocument3 pagesCrystal Reports ActiveX DesignerMohit PanchalNo ratings yet

- Nitesh Pad PDFDocument1 pageNitesh Pad PDFdeep kumarNo ratings yet

- Cw-Invoices Invoice 6263277 CWI1739012 3rjax6 PDFDocument1 pageCw-Invoices Invoice 6263277 CWI1739012 3rjax6 PDFBBA SNUNo ratings yet

- SmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceDocument2 pagesSmlFT3VYRHpYZzRnV010am9veC9IZz09 InvoiceJitender NarulaNo ratings yet

- Invoice SocleanDocument1 pageInvoice SocleanDavid ThomasNo ratings yet

- Patanjali DN 33Document1 pagePatanjali DN 33Jai SoniNo ratings yet

- Renewal of Your Easy Health Individual Standard Insurance PolicyDocument5 pagesRenewal of Your Easy Health Individual Standard Insurance PolicyHeena BhatNo ratings yet

- Medical Bill Invoice KarnadakaDocument1 pageMedical Bill Invoice Karnadakaganesamoorthy1987No ratings yet

- Calibration Lab Assessment Fee InvoiceDocument1 pageCalibration Lab Assessment Fee InvoiceSharad JainNo ratings yet

- Tax - Invoice: Burckhardt Compression (India) Pvt. LTDDocument1 pageTax - Invoice: Burckhardt Compression (India) Pvt. LTDYOGESHNo ratings yet

- Metronaut Men Light Blue Trousers: Grand Total 5800.00Document7 pagesMetronaut Men Light Blue Trousers: Grand Total 5800.00prince GoriaNo ratings yet

- Tax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPDocument1 pageTax Invoice: CIN:U72900DL2020PTC361314 GSTIN: 07AAFCE8193A1ZPAbhijit SarkarNo ratings yet

- Inv 004093Document1 pageInv 004093Hyderabad CastingsNo ratings yet

- BSNL Telephone Bill DetailsDocument1 pageBSNL Telephone Bill DetailsPulkit GargNo ratings yet

- Ferns N Petals Invoice for Plant DeliveryDocument1 pageFerns N Petals Invoice for Plant DeliveryPritha MondalNo ratings yet

- Washing Machine InvoiceDocument1 pageWashing Machine InvoiceAmeet ParekhNo ratings yet

- FabHotels J8443 2324 00254 Invoice VMKCCIDocument1 pageFabHotels J8443 2324 00254 Invoice VMKCCIM.K JHANo ratings yet

- Bill Ms 95Document3 pagesBill Ms 95onlineanoop786No ratings yet

- Access - KA-51-AB-6862Document10 pagesAccess - KA-51-AB-6862Subhan ShaikhNo ratings yet

- Sez / Chennai Y RoadDocument1 pageSez / Chennai Y RoadKumaresan KumaresanNo ratings yet

- Sale Invoice for Books Worth Rs. 685Document1 pageSale Invoice for Books Worth Rs. 685AMIT SRIVASTAVANo ratings yet

- In Voice 14872711677448121073Document3 pagesIn Voice 14872711677448121073shashiNo ratings yet

- Laptop Repair InvoiceDocument2 pagesLaptop Repair InvoiceSaurabh Prakash DixitNo ratings yet

- Oneplus 108Cm (43 Inch) Full HD Led Smart Android TV: Grand Total 22499.00Document2 pagesOneplus 108Cm (43 Inch) Full HD Led Smart Android TV: Grand Total 22499.00Ravi PrajapatiNo ratings yet

- 9011496693Document3 pages9011496693RITVIK ARORANo ratings yet

- Invoice: Pest Kare (India) PVT - LTDDocument1 pageInvoice: Pest Kare (India) PVT - LTDAnonymous rNqW9p3No ratings yet

- TAX INVOICE Unique Glass 30janDocument1 pageTAX INVOICE Unique Glass 30janRupam SahaNo ratings yet

- HMB Ispat Pi 81022Document1 pageHMB Ispat Pi 81022Suman PramanikNo ratings yet

- Invoice - 873437740Document1 pageInvoice - 873437740Umar SayedNo ratings yet

- Invoice Cum Bill of Supply: FNP E Retail Private LimitedDocument1 pageInvoice Cum Bill of Supply: FNP E Retail Private LimitedVishNo ratings yet

- For Zomato Limited (Formerly Known As Zomato Private Limited and Zomato Media Private Limited)Document1 pageFor Zomato Limited (Formerly Known As Zomato Private Limited and Zomato Media Private Limited)Shubham ShrivasNo ratings yet

- InvoiceDocument1 pageInvoiceUNo ratings yet

- Sri Vasavi Medical Agencies Invoice Rpaug002Document1 pageSri Vasavi Medical Agencies Invoice Rpaug002amareshNo ratings yet

- D-524 BiomeriuxDocument4 pagesD-524 BiomeriuxVinay KatochNo ratings yet

- ACFrOgBNRppEQC DWGGV uJqpoY2hX9mEFUXxqkoJ3H1DDcOVUkiRfgQzPcmy8L3bTf YT4fEZDzowwmH-17Vheg6bSrFh7rQdjy72j7ezSYoejzm3H7fDYrYo-8E5YDocument1 pageACFrOgBNRppEQC DWGGV uJqpoY2hX9mEFUXxqkoJ3H1DDcOVUkiRfgQzPcmy8L3bTf YT4fEZDzowwmH-17Vheg6bSrFh7rQdjy72j7ezSYoejzm3H7fDYrYo-8E5YArif KhanNo ratings yet

- Aspl Invoice 2019-20 Jan'20 To Mar'20Document20 pagesAspl Invoice 2019-20 Jan'20 To Mar'20Gurupada SahooNo ratings yet

- V4C SMS InvoiceDocument1 pageV4C SMS Invoiceaasimshaikh111No ratings yet

- Cw-Invoices Invoice 6730051 CWI1903736 Gif4us PDFDocument1 pageCw-Invoices Invoice 6730051 CWI1903736 Gif4us PDFManav SpoliaNo ratings yet

- Accounting VoucherDocument1 pageAccounting VoucherVirendra SahuNo ratings yet

- Invoice 16Document1 pageInvoice 16kuldeep singhNo ratings yet

- Tax Invoice for Bluewud Concepts Pvt. LtdDocument1 pageTax Invoice for Bluewud Concepts Pvt. LtdNavdeep MinhasNo ratings yet

- Srinivas InvoiceDocument1 pageSrinivas InvoiceKanchanapalli SrinivasNo ratings yet

- Invoice TNTDocument1 pageInvoice TNTAbas AbasariNo ratings yet

- Tax Invoice Abc PVT LTD ABC/001/17-18 1-Jul-2017: Sec.23 of Rule 1Document2 pagesTax Invoice Abc PVT LTD ABC/001/17-18 1-Jul-2017: Sec.23 of Rule 1Rinku Singh RinkuNo ratings yet

- Internet Account Statement SummaryDocument1 pageInternet Account Statement SummarySandynestleNo ratings yet

- Medical Bill - 2Document1 pageMedical Bill - 2sagar rj (saagi)No ratings yet

- OPera GoaDocument1 pageOPera GoaJaTiN RaYNo ratings yet

- Sai Lubricants: BuyerDocument1 pageSai Lubricants: Buyerstamboli9No ratings yet

- Information Systems Engineering: Activity DiagramDocument17 pagesInformation Systems Engineering: Activity DiagramparkarmubinNo ratings yet

- Brand Management - PPT (Part2)Document3 pagesBrand Management - PPT (Part2)muna siddiqueNo ratings yet

- 2008 LCCI Level1 Book-Keeping (1517-4)Document13 pages2008 LCCI Level1 Book-Keeping (1517-4)JessieChuk100% (2)

- Risk Management Learning DiaryDocument27 pagesRisk Management Learning DiaryUbed AhmedNo ratings yet

- Scribd Robert KuokDocument3 pagesScribd Robert KuokRavi Kumar Nadarashan0% (2)

- Solution Homework#7 Queuing Models BBADocument5 pagesSolution Homework#7 Queuing Models BBAongnaze2No ratings yet

- Introduction To "Services Export From India Scheme" (SEIS)Document6 pagesIntroduction To "Services Export From India Scheme" (SEIS)Prathaamesh Chorge100% (1)

- Daily Lesson Log: I. ObjectivesDocument5 pagesDaily Lesson Log: I. ObjectivesRuth ChrysoliteNo ratings yet

- Emerging OD Approaches and Techniques for Organizational LearningDocument16 pagesEmerging OD Approaches and Techniques for Organizational LearningDinoop Rajan100% (1)

- Kaizen Management for Continuous ImprovementDocument39 pagesKaizen Management for Continuous ImprovementSakshi Khurana100% (4)

- Introduction to malls - What's a mall? Types of malls and their componentsDocument134 pagesIntroduction to malls - What's a mall? Types of malls and their componentsPrince Nornor-Quadzi100% (1)

- Process Costing Breakdown/TITLEDocument76 pagesProcess Costing Breakdown/TITLEAnas4253No ratings yet

- Integrated Resorts 3Document8 pagesIntegrated Resorts 3STP DesignNo ratings yet

- Supply Chain AnalyticsDocument2 pagesSupply Chain AnalyticsDHRUV SONAGARANo ratings yet

- The Marketer's Guide To Travel Content: by Aaron TaubeDocument18 pagesThe Marketer's Guide To Travel Content: by Aaron TaubeSike ThedeviantNo ratings yet

- 2018 Lantern Press CatalogDocument56 pages2018 Lantern Press Catalogapi-228782900No ratings yet

- Computation of Tax On LLPS and Critical Appraisal.Document14 pagesComputation of Tax On LLPS and Critical Appraisal.LAW MANTRANo ratings yet

- Suza Business Plan (Honey Popcorn)Document49 pagesSuza Business Plan (Honey Popcorn)Cartoon WalaNo ratings yet

- Press Release (Florida) .03.03Document2 pagesPress Release (Florida) .03.03Eric LechtzinNo ratings yet

- Training On APQPDocument38 pagesTraining On APQPSachin Chauhan100% (1)

- Citizens CharterDocument505 pagesCitizens CharterBilly DNo ratings yet

- SHALINI CV PDFDocument2 pagesSHALINI CV PDFSanjay JindalNo ratings yet

- "Brands Aren't Just Names On Packages!": Executive PerspectiveDocument5 pages"Brands Aren't Just Names On Packages!": Executive PerspectiveMeray George Wagih EbrahimNo ratings yet

- How To Use Transaction SOST & SCOT For Chec..Document2 pagesHow To Use Transaction SOST & SCOT For Chec..ghenno18No ratings yet

- CIPC Turn Around Times PDFDocument12 pagesCIPC Turn Around Times PDFkyaq001No ratings yet

- Serial Card: 377X1-A3-J1-D18-9A7-9B2Document1 pageSerial Card: 377X1-A3-J1-D18-9A7-9B2troy minangNo ratings yet

- Bill Ackman's Letter On General GrowthDocument8 pagesBill Ackman's Letter On General GrowthZoe GallandNo ratings yet

- CMM-006-15536-0006 - 6 - Radar AltimeterDocument367 pagesCMM-006-15536-0006 - 6 - Radar AltimeterDadang100% (4)

- Bicolandia Drug Vs CirDocument6 pagesBicolandia Drug Vs CiritatchiNo ratings yet

- Pro Services in Dubai - Pro Services in Abu DhabiDocument23 pagesPro Services in Dubai - Pro Services in Abu DhabiShiva kumarNo ratings yet