Professional Documents

Culture Documents

Hospital Cost Audit Observation PDF

Uploaded by

MOORTHY.KEOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Hospital Cost Audit Observation PDF

Uploaded by

MOORTHY.KECopyright:

Available Formats

Cost Audit of

Hospital

6th November, 2016

Strictly Confidential. For Private Circulation Only 1

Background - Cost Records

• As per Companies (Cost Records and Audit) Rules, 2014 & Amendment

thereto:

• Any company engaged in “Health services, namely functioning as or

running hospitals, diagnostic centres, clinical centres or test

laboratories” are required to maintain cost records: &

• having an overall turnover from all its products and services of rupees

thirty five crore or more during the immediately preceding financial

year

Needs to maintain prescribe cost records in accordance with Form

CRA 1 of the Rules to the extent applicable

Strictly Confidential. For Private Circulation Only 2

Exemption

As per FAQ2 of 8th July, 2015:

• …….. companies running hospitals exclusively for its own employees are

excluded from the ambit of these Rules, provided however, if such

hospitals are providing health services to outsiders also in addition to its

own employees on chargeable basis, then such hospitals are covered

within the ambit of these Rules.

• It is clarified that companies engaged in running of Beauty parlours /

beauty treatment are not covered under these Rules.

• There is no exemption for Companies registered under Section 8 of the

Companies Act, 2013 (corresponding to Section 25 of the Companies Act, 1956)

and One Person Company. Hence “not for profit” companies in healthcare also

covered.

Strictly Confidential. For Private Circulation Only 3

Background - Cost Audit

• They need to get cost records audited in accordance with these

rules if:

• The overall annual turnover of the company from all its products

and services during the immediately preceding FY is Rs. 100 cr or

more; and

• The aggregate turnover of the individual product or products or

service or services for which cost records are required to be

maintained is Rs. 35 crore or more.

• Appoint Cost Auditor and file Form CRA2

• Cost auditor needs to submit Report to Company within 180 days

of year-end

• The Report needs to be approved by Board of Directors

• Company needs to file CAR within 30 days of receipt of Report

from Cost Auditor

Strictly Confidential. For Private Circulation Only 4

Major Issues

• Business Models

• Identify Revenue Streams

• Peculiar Expenses

• Other Issues

Strictly Confidential. For Private Circulation Only 5

Business Models

Management / Ownership Models

Own & Operate

Lease & Operate

Operate on Revenue Share basis

Operate on Public Private Partnership basis

Operate on Management Fee basis

Business Models

Standalone Single Specialty or Multi Discipline Hospital

Multilocation Hospitals

Independent Pharmacy / OPD chain &/or In-House

For Profit / Not for Profit

Strictly Confidential. For Private Circulation Only 6

Revenue Streams

Revenue from Operations

Income from medical and healthcare services

Sale of medical consumables and drugs

In Patient Services

Out Patient Services

Laboratory/Clinical Services

Income from Medical Services

Management Fees from Hospitals

Income from Clinical Research

Out Patient Pharmacy

Contact Lens & Optical

Strictly Confidential. For Private Circulation Only 7

Revenue Streams

Other Operating Revenue

Learning and development income

Teleradiology income

Revenue share income

License fee & commission from licensees

Service charges received from doctors

Equipment Lease rentals

Sponsorship Income

Sale of Plasma

Strictly Confidential. For Private Circulation Only 8

Peculiar Expenses

Main P & L

Purchase of medical consumables, drugs and surgical equipment

Changes in inventories of medical consumables, drugs and surgical

equipment

Stores & Spares Consumed

Current Assets

Patient treatment in progress

Unbilled revenue

Strictly Confidential. For Private Circulation Only 9

Peculiar Expenses

Notes to P & L Pathology Laboratory Expenses

Hospital Operating/ General/ Radiology Expenses

Upkeep Expenses

Consultation Fees to Doctors

Professional fees to doctors

Medical Services Expenses

Patient Welfare Expenses

Pharmacy Loyalty Discount

Hospital Management Fees

Continuing Medical Education &

Medical Gas Charges

Hospitality Expenses

Biomedical Wastage Expenses Pharmacy Purchase

R & M to Hospital Equipment

Purchase of Contact Lens & Optical

Consultation fees paid to doctors

Canteen & Utility Purchase

Outside lab investigations

Patient Food & Beverages Camp Expenses

Strictly Confidential. For Private Circulation Only 10

Other Issues

• Need to identify & exclude Underutilisation Expenses

(EG: Wards, OT, Radiology, Lithotripsy, Dialysis)

• Reconcile issues and consumption between Pharmacy, Main Store & Sub

Stores for Medicines & Consumables

• How to bifurcate Package Rates into components – Rs. 3 Lakh Bypass

package will include OT charges, Surgeon’s fee, Room charges, medicines,

consumables, etc. Sum of parts based on rack rate is usually more than

package cost.

• Special discounted rates for corporate/government employees,

cheap/free land against commitment to treat certain patients at

subsidised rates

• Changes in billing, based on Bed Type

• Patient billed at higher rate although allotted cheaper ward, as per

industry practice

Strictly Confidential. For Private Circulation Only 11

Other Issues

• How to present data in C1 – Capacity & Utilisation

• How many services to include in C2 – Cost Sheet

o A typical bill includes several line items - Admission Charges, OT Fees,

Anaesthetic, X Ray, Dressings, Visitors' Cot, CAT Scan, Ward Room,

Surgical Supplies, Consumables, Pharmacy, Surgeon's Fee, Doctor's

Fee, etc

o Each of these do not constitute a separate service. Hence need to

work out proper classification for grouping of services

o Need to consolidate across locations

• How to present Expenses in C2 – “Industry Specific Expenses” is

very useful

• Sample cost sheet with two optional methodologies given at the

end of presentation

Strictly Confidential. For Private Circulation Only 12

Other Issues

• How to value captive consumption?

Provision of service by one division to another – Diagnostic service

to surgical patient.

• Pharmacy is Trading activity & hence not covered u/s148.

• Production, import and supply or trading of certain medical devices

including Stents, Valves, Implants, are covered u/s 148. However,

the hospitals take a stand that these are part of procedure and are

consumed & hence these are not covered.

• Service Tax: Very few services covered – Aesthetic Surgery.

Strictly Confidential. For Private Circulation Only 13

Thank You

kbhatia@kishorebhatia.com

Strictly Confidential. For Private Circulation Only 14

Name of manufactured product or service Wards & ICU

Sr Description Total Cost

1 Cost of materials consumed

Consumables 33,333

Pharmaceuticals 43,434

2 Cost of process materials or chemicals consumed

3 Cost of utilities consumed

Power 555

4 Cost of direct employees 12,345

5 Cost of direct expenses

6 Cost of stores and spares consumed (bedsheets, towels, etc) 40

7 Cost of repairs and maintenance 345

8 Cost of quality control

9 Cost of research and development

10 Cost of technical knowhow fee or royalty

11 Cost of depreciation or amortization 4,444

12 Cost of other production overheads (hospital admin) 333

13 Cost of industry specific operating expenses

Wards Common Expenses 6,666

Biomedical Waste 222

14 Total of inputs and conversion cost of product 1,01,717

15 Cost of increase/decrease in work-in-progress -

16 Credits for recoveries -

17 Cost of primary packing -

18 Cost of production or operations/Total cost of service provided 1,01,717

19 Cost of finished goods purchased or Cost of outsourced or contractual services

20 Total cost of production and purchases / Total cost of service available 1,01,717

21 Cost of increase/decrease in finished goods

22 Cost of self or captive consumption

23 Cost of other adjustments

24 Cost of production or operations of goods or services sold / Cost of services sold 1,01,717

25 Cost of administrative overheads-Corporate 400

26 Cost of secondary packing -

27 Cost of selling and distribution overheads 70

28 Cost of sales before Interest 1,02,187

29 Cost of interest and financing charges 20

30 Cost of sales of product or service 1,02,207

31 Net sales realization of product or service 2,00,000

32 Amount of margin as per cost accounts 97,793

Name of manufactured product or service Wards & ICU

Sr Description Total Cost

1 Cost of materials consumed

Consumables 33,333

Pharmaceuticals 43,434

2 Cost of process materials or chemicals consumed

3 Cost of utilities consumed

Power

4 Cost of direct employees

5 Cost of direct expenses

6 Cost of stores and spares consumed (bedsheets, towels, etc)

7 Cost of repairs and maintenance

8 Cost of quality control

9 Cost of research and development

10 Cost of technical knowhow fee or royalty

11 Cost of depreciation or amortization

12 Cost of other production overheads (hospital admin)

13 Cost of industry specific operating expenses (each of these will comprise of salaries,

repairs, depreciation, etc)

Multibed Wards 6,666

Twin Sharing 7,777

Single Bed 8,888

Delux Rooms 9,999

ICU 3,333

ICCU 2,222

14 Total of inputs and conversion cost of product 1,15,652

15 Cost of increase/decrease in work-in-progress -

16 Credits for recoveries -

17 Cost of primary packing -

18 Cost of production or operations/Total cost of service provided 1,15,652

19 Cost of finished goods purchased or Cost of outsourced or contractual services

20 Total cost of production and purchases / Total cost of service available 1,15,652

21 Cost of increase/decrease in finished goods

22 Cost of self or captive consumption

23 Cost of other adjustments

24 Cost of production or operations of goods or services sold / Cost of services sold 1,15,652

25 Cost of administrative overheads-Corporate 400

26 Cost of secondary packing -

27 Cost of selling and distribution overheads 70

28 Cost of sales before Interest 1,16,122

29 Cost of interest and financing charges 20

30 Cost of sales of product or service 1,16,142

31 Net sales realization of product or service 1,20,000

32 Amount of margin as per cost accounts 3,858

You might also like

- Ar Cloud FinanaceDocument1 pageAr Cloud FinanaceMOORTHY.KENo ratings yet

- Excellent NotesDocument84 pagesExcellent NotesAshishNo ratings yet

- SAP Convergent Mediation: Beyond UsageDocument16 pagesSAP Convergent Mediation: Beyond UsageMOORTHY.KE100% (1)

- SOVY Technology SolutionsDocument16 pagesSOVY Technology SolutionsMOORTHY.KENo ratings yet

- Understanding VAT Basics and TerminologiesDocument30 pagesUnderstanding VAT Basics and TerminologiesMOORTHY.KENo ratings yet

- ASUG - Southwest Utilities Days TXU EnergyDocument16 pagesASUG - Southwest Utilities Days TXU EnergyRomulo QuispeNo ratings yet

- KPMG PDFDocument18 pagesKPMG PDFEnrique Espindola Barajas100% (2)

- ProposalSupport RFX WorkbookDocument4 pagesProposalSupport RFX WorkbookMOORTHY.KENo ratings yet

- Interview Pre-Preparation Blue Print: Total Duration ExpectedDocument8 pagesInterview Pre-Preparation Blue Print: Total Duration ExpectedMOORTHY.KE100% (2)

- Business Process - Requirement: Soap Ui ActivationDocument1 pageBusiness Process - Requirement: Soap Ui ActivationMOORTHY.KENo ratings yet

- What Is SAP S/4HANA?Document7 pagesWhat Is SAP S/4HANA?Haitham Wahdan100% (1)

- Plan Your S/4 HANA Finance MigrationDocument4 pagesPlan Your S/4 HANA Finance MigrationMOORTHY.KENo ratings yet

- Convergent Invoicing ES Bundle Streamlines BillingDocument8 pagesConvergent Invoicing ES Bundle Streamlines BillingMOORTHY.KENo ratings yet

- What Is SAP S/4HANA?Document7 pagesWhat Is SAP S/4HANA?MOORTHY.KENo ratings yet

- Convergent Invoicing ES Bundle Streamlines BillingDocument8 pagesConvergent Invoicing ES Bundle Streamlines BillingMOORTHY.KENo ratings yet

- Get Started With Rapid Implementation: Week 1Document1 pageGet Started With Rapid Implementation: Week 1MOORTHY.KENo ratings yet

- DiiredDocument24 pagesDiiredMOORTHY.KENo ratings yet

- Aiba IntegrationDocument1 pageAiba IntegrationMOORTHY.KENo ratings yet

- BPR For Oil and Gas ConstructionDocument6 pagesBPR For Oil and Gas ConstructionMOORTHY.KENo ratings yet

- Pdf-To-Word - ScienceDocument12 pagesPdf-To-Word - ScienceMOORTHY.KENo ratings yet

- Singapore MarketDocument1 pageSingapore MarketMOORTHY.KENo ratings yet

- Dubai's Key Public AuthoritiesDocument1 pageDubai's Key Public AuthoritiesMOORTHY.KENo ratings yet

- PDF C LevelDocument6 pagesPDF C LevelMOORTHY.KENo ratings yet

- File and registry cleanup reportDocument16 pagesFile and registry cleanup reportMOORTHY.KENo ratings yet

- Us How Cfos Can Own Analytics 091814Document5 pagesUs How Cfos Can Own Analytics 091814MOORTHY.KENo ratings yet

- Development ObjectsDocument103 pagesDevelopment ObjectsMOORTHY.KENo ratings yet

- Eoi For Cbs 33-6-tDocument11 pagesEoi For Cbs 33-6-tMOORTHY.KENo ratings yet

- 2nd Anniversary-Expression of InterestDocument1 page2nd Anniversary-Expression of InterestMOORTHY.KENo ratings yet

- CreditDocument1 pageCreditMOORTHY.KENo ratings yet

- Sub Module Inex OpDocument1 pageSub Module Inex OpMOORTHY.KENo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Dhaka Stock Exchange General Index 2001-2013Document36 pagesDhaka Stock Exchange General Index 2001-2013Maruf HassanNo ratings yet

- ENG 111 Final SolutionsDocument12 pagesENG 111 Final SolutionsDerek EstrellaNo ratings yet

- Business, Finance & Economy: Winners - John Semakula & John Masaba, New VisionDocument7 pagesBusiness, Finance & Economy: Winners - John Semakula & John Masaba, New VisionAfrican Centre for Media ExcellenceNo ratings yet

- UntitledDocument2 pagesUntitleddayang FitrizaNo ratings yet

- 03 x03 Activity Costs WPDocument25 pages03 x03 Activity Costs WPRobert CastilloNo ratings yet

- Investor Digest 2021.10.19Document17 pagesInvestor Digest 2021.10.19omzeckNo ratings yet

- CoA Accounts SummaryDocument15 pagesCoA Accounts SummarygreyfanNo ratings yet

- Hindu Law Project on AlienationDocument21 pagesHindu Law Project on AlienationShruti JainNo ratings yet

- Null 001.2001.issue 139 enDocument36 pagesNull 001.2001.issue 139 enMark RiveraNo ratings yet

- Chapter 18Document12 pagesChapter 18ks1043210No ratings yet

- Zara Fast Fashion CaseDocument2 pagesZara Fast Fashion CaseAakanksha Mishra100% (1)

- TDF project monitoring templatesDocument3 pagesTDF project monitoring templatesNagendra GnawaliNo ratings yet

- Commission On Audit Circular No. 97-002Document7 pagesCommission On Audit Circular No. 97-002jongsn700No ratings yet

- C Martin-JournalDocument2 pagesC Martin-JournalGenuine SmileNo ratings yet

- Business Mobile Plus Transfer of Ownership FormDocument7 pagesBusiness Mobile Plus Transfer of Ownership FormVincent TonNo ratings yet

- Samsung Electronics Sales Promotion ImpactDocument51 pagesSamsung Electronics Sales Promotion ImpactPrince GuglaniNo ratings yet

- 2-F8 MCQ's Questions and AnswersDocument19 pages2-F8 MCQ's Questions and AnswersMansoor SharifNo ratings yet

- Credit Risk Management of United Commercial BDocument45 pagesCredit Risk Management of United Commercial Bএকজন নিশাচরNo ratings yet

- Changepond Aptitude 2Document4 pagesChangepond Aptitude 2Mani KandanNo ratings yet

- The Plastic Prison: Common Ground Creativity 0 CommentsDocument5 pagesThe Plastic Prison: Common Ground Creativity 0 CommentsSimply Debt SolutionsNo ratings yet

- 10.21.2017 Audit of ReceivablesDocument10 pages10.21.2017 Audit of ReceivablesPatOcampoNo ratings yet

- Brokerage Fees (Local & Foreign)Document3 pagesBrokerage Fees (Local & Foreign)Soraya AimanNo ratings yet

- Filed Proposed Findings of Fact and Conclusions of LawDocument44 pagesFiled Proposed Findings of Fact and Conclusions of Lawmichael-d-donovan-1299No ratings yet

- CHAPTER 15: SINGLE ENTRY ACCOUNTINGDocument12 pagesCHAPTER 15: SINGLE ENTRY ACCOUNTINGPaula Bautista100% (2)

- KN-Law-LLP On Movable Property Security RightsDocument2 pagesKN-Law-LLP On Movable Property Security RightsEmeka NkemNo ratings yet

- MBF-Banker Customer RelationshipDocument20 pagesMBF-Banker Customer Relationshipsagarg94gmailcomNo ratings yet

- Current Issue Assgn 1 and 4Document11 pagesCurrent Issue Assgn 1 and 4Sathys Waran JaganathanNo ratings yet

- Chapter 16 - Capital StructureDocument50 pagesChapter 16 - Capital StructureInga ȚîgaiNo ratings yet

- Problem 3Document2 pagesProblem 3Dan Shadrach DapegNo ratings yet

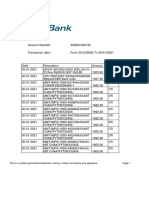

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument16 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any SignatureRaju SambheNo ratings yet