Professional Documents

Culture Documents

Final Accounts Theory and Structures

Uploaded by

Diptesh KunduCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final Accounts Theory and Structures

Uploaded by

Diptesh KunduCopyright:

Available Formats

i:t:-+E>:.

Tiil

FINAL ACCOUNTS

(b) For the items that appear in th.e credit side:

Sales (Net) A/c Dr.

Closing Stock A/c Dr.

To Trading A/c

(c) For the Cross Profit (i.e. when credit side is greater than the debit side)

Trading A/c Dr.

To Profit and Loss Aic

(d) For Cross Loss (i.e. when debit side is greater than the credit side):

Profit and Loss A/c Dr.

s.

To Trading A/c

mer

rtua i

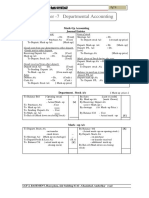

Ruling of o Troding Account

red

Trading Accounl

pos€

for the year ended .,....

)r. (,r

Rs. Rs Rs. Rs

di ng

To Opening Stock By Sales

Cs rs Purchases le.ss: Returns lnward ..---

-essr Returns Outward

r the By Closing Stock

:ern -o Direct Expenses:

ut it- Wages

rcds Carriage lnwards

rsing

Freight

ryer

lmport Duty

a5e-(

Cas and Fuel

sioe

Factory Expenses

Royalty on Production

Profit and Loss A/c

(Cross Profit tra nsferred)

\ote.' Other adjustments, if any (e,9. Outstanding Wages or Prepaid Expenses), are also to be considered.

' ln case of Cross [.oss, it will be reversed:

It has already been explained in an earlier paragraph that the purposc of preparrng a

-'ading Account is to ascertain the gross profit or gross loss at the end of the financial year.

'.eedless to mention here that the gross profit or gross loss so ascertained is the difference

::\\/een'Sales'and'Cost of Coods Sold'. So, it becomes necessary to know the above two

-'rts: viz., Sales and Cost of Coods Sold.

iales: lt is not a problem for us to compLlte the total amount of sales. We can g,et it from the

Tria I Ba la nce.

=r Acc.- l2l

You might also like

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Final Accounts Theory and Structures PDFDocument1 pageFinal Accounts Theory and Structures PDFDip KunduNo ratings yet

- Poa FormatDocument4 pagesPoa FormatSumithaNo ratings yet

- UNIT - 2 - Final AccountsDocument57 pagesUNIT - 2 - Final AccountsRaju NagarNo ratings yet

- Chapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesDocument17 pagesChapter - 7 Departmental Accounting: Mark-Up Accounting Journal EntriesAyush AcharyaNo ratings yet

- Depriciation & Final Accounts: AmortisationDocument4 pagesDepriciation & Final Accounts: AmortisationVedant YadavNo ratings yet

- Trading, P & L and BSDocument25 pagesTrading, P & L and BSshreyu14796No ratings yet

- Accounts Sem1Document24 pagesAccounts Sem1api-3849048No ratings yet

- Format of Trading Account & P&LDocument10 pagesFormat of Trading Account & P&L072 Yasmin AkhtarNo ratings yet

- Vadodara ZoneDocument30 pagesVadodara ZoneSurajPandeyNo ratings yet

- Partnership NotesDocument68 pagesPartnership NotesSandeepNo ratings yet

- 02 Partnership Final AccountsDocument43 pages02 Partnership Final AccountsroyNo ratings yet

- Income Statement & Balance SheetDocument23 pagesIncome Statement & Balance SheetSAURABH PATELNo ratings yet

- 4 General Accounts of Partnership FirmDocument16 pages4 General Accounts of Partnership FirmNisarga T DaryaNo ratings yet

- Partnership Final Accounts: Tar EtDocument40 pagesPartnership Final Accounts: Tar EtVenkatesh Ramchandra100% (3)

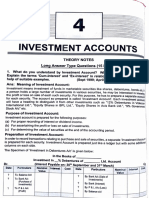

- Investment Accounts: Theory Notes Long Answer Type Questions (15 Marks)Document8 pagesInvestment Accounts: Theory Notes Long Answer Type Questions (15 Marks)Mayank GargNo ratings yet

- Notes For 403Document17 pagesNotes For 403Inder KumarNo ratings yet

- Final-Accounts-Q - A P&L ACCDocument31 pagesFinal-Accounts-Q - A P&L ACCNikhil PrasannaNo ratings yet

- Cost of Capital 2018Document17 pagesCost of Capital 2018Akhil GargNo ratings yet

- G e A e C A E: Merchandi at TH ND The PeriodDocument8 pagesG e A e C A E: Merchandi at TH ND The Periodkakao67% (3)

- Adobe Scan 5 May 2023Document5 pagesAdobe Scan 5 May 2023NarayanNo ratings yet

- S.Y.J.C. (Commerce) Book-Kkeping & Accoutancy Partnership Final Accounts Compiled By: Prof. Bosco FernandesDocument11 pagesS.Y.J.C. (Commerce) Book-Kkeping & Accoutancy Partnership Final Accounts Compiled By: Prof. Bosco FernandesDheer BhanushaliNo ratings yet

- NoidaDocument6 pagesNoidaAvnish KumarNo ratings yet

- Purchase and Sales Entry in Journal ModeDocument9 pagesPurchase and Sales Entry in Journal ModeBiplab SwainNo ratings yet

- Sharing Session - Accounting 13.11.23Document5 pagesSharing Session - Accounting 13.11.23marlina elisabethNo ratings yet

- A:I Apiwllle$$Qmmy: ,: Proposed Transact'Ion (Purpose of RequestDocument14 pagesA:I Apiwllle$$Qmmy: ,: Proposed Transact'Ion (Purpose of RequestKhandaker Amir EntezamNo ratings yet

- Contract Costing 07Document16 pagesContract Costing 07Kamal BhanushaliNo ratings yet

- Microsoft PowerPoint - PL & BS (Compatibility Mode)Document30 pagesMicrosoft PowerPoint - PL & BS (Compatibility Mode)Riyasat khanNo ratings yet

- Chapter - 5 Final Accounts: Learning Objectives After Learning This Chapter, You Will Be Able ToDocument41 pagesChapter - 5 Final Accounts: Learning Objectives After Learning This Chapter, You Will Be Able ToPranav SreeNo ratings yet

- Final Accounts: Presented by Manmeet Kaur (110069) Payal Motwani (110072)Document28 pagesFinal Accounts: Presented by Manmeet Kaur (110069) Payal Motwani (110072)Payal Motwani100% (1)

- Entries and Adjustments in Different Books of AccountsDocument34 pagesEntries and Adjustments in Different Books of AccountsSHEKHAR SUMITNo ratings yet

- CHDocument124 pagesCHDeeran DhayanithiRPNo ratings yet

- Adobe Scan 8 Jan 2023Document2 pagesAdobe Scan 8 Jan 2023charvi.22052No ratings yet

- Readme How To Import, Crack UDI Magic & DDevil PDFDocument6 pagesReadme How To Import, Crack UDI Magic & DDevil PDFkdman100% (1)

- Cash Flow PDFDocument9 pagesCash Flow PDFYatra ShuklaNo ratings yet

- Mbaf0701 - Far - Unit - 2Document13 pagesMbaf0701 - Far - Unit - 2RahulNo ratings yet

- Solution 635854Document12 pagesSolution 635854Abhishek ChauhanNo ratings yet

- Distributions of P and L Account-1Document4 pagesDistributions of P and L Account-1NarayanNo ratings yet

- Final AccountsDocument7 pagesFinal Accountssubhasishmajumdar0% (2)

- PL and BSDocument30 pagesPL and BSAdefolajuwon ShoberuNo ratings yet

- Incomplete Record 2019Document3 pagesIncomplete Record 2019Parvatee Ramessur100% (1)

- Contract Costing - ClassworkDocument47 pagesContract Costing - ClassworkAneri ShahNo ratings yet

- TRANSMITTAL 08.20.2022 Ms - SchatzDocument1 pageTRANSMITTAL 08.20.2022 Ms - SchatzIremie CuevasNo ratings yet

- Ia - Sketchnote Chap 8 Receivables N Chap 9 PpeDocument19 pagesIa - Sketchnote Chap 8 Receivables N Chap 9 PpeUyên Nguyễn Hoàng ThanhNo ratings yet

- Mba 2 Sem Cost Accounting Cbcs Summer 2017Document4 pagesMba 2 Sem Cost Accounting Cbcs Summer 2017Nikhil JaiswalNo ratings yet

- AnswerKey - Accounts-7-17Document11 pagesAnswerKey - Accounts-7-17Prabhakar DashNo ratings yet

- Sharing Session - Accounting 14.11.23Document6 pagesSharing Session - Accounting 14.11.23marlina elisabethNo ratings yet

- ManualDocument70 pagesManualNithin MohanNo ratings yet

- Exercisr For ProvisionDocument6 pagesExercisr For ProvisionRojesh BasnetNo ratings yet

- Dissolution Notes 2Document16 pagesDissolution Notes 2bhosaleparth97No ratings yet

- Departmental Accounts PDFDocument10 pagesDepartmental Accounts PDFMINTU SARAFNo ratings yet

- CH 01 Accounting For Partnership - Basic ConceptsDocument11 pagesCH 01 Accounting For Partnership - Basic ConceptsMahathi AmudhanNo ratings yet

- 06 Correction of Errors (I)Document9 pages06 Correction of Errors (I)Babamu Kalmoni JaatoNo ratings yet

- Notes-Unit-3-Final Accounts - (Partial)Document12 pagesNotes-Unit-3-Final Accounts - (Partial)happy lifeNo ratings yet

- Partnership: AdmissionDocument7 pagesPartnership: AdmissionSweta SinghNo ratings yet

- Bangaluru ZoneDocument16 pagesBangaluru ZoneASHIN SHAJI GEORGE 1960119No ratings yet

- Ch-01: Accounting For Partnership Firms - Fundamental: Maintenance of Partners Capital AlcDocument70 pagesCh-01: Accounting For Partnership Firms - Fundamental: Maintenance of Partners Capital AlcPawan TalrejaNo ratings yet

- Financial Statement Part 1Document51 pagesFinancial Statement Part 1aashishkumar4123No ratings yet

- Adjustments:: Outstanding/Prepaid ExpenditureDocument25 pagesAdjustments:: Outstanding/Prepaid ExpenditureParag DhandeNo ratings yet

- 5 - Profit TheoryDocument14 pages5 - Profit TheoryTemitayo OguntiNo ratings yet

- Patels Airtemp (India) LimitedDocument5 pagesPatels Airtemp (India) LimitedAnkit LohiyaNo ratings yet

- Encasa BrochureDocument12 pagesEncasa Brochuremanoj_dalalNo ratings yet

- March 2020 Diploma in Accountancy Programme Question and AnswerDocument102 pagesMarch 2020 Diploma in Accountancy Programme Question and Answerethel100% (1)

- 2 Ac4Document2 pages2 Ac4Rafols AnnabelleNo ratings yet

- Form Credit Application NewDocument2 pagesForm Credit Application NewRSUD AnugerahNo ratings yet

- Globalizing The Cost of Capital and Capital Budgeting at AESDocument33 pagesGlobalizing The Cost of Capital and Capital Budgeting at AESK Ramesh100% (1)

- Trắc nghiệm tieng anhDocument2 pagesTrắc nghiệm tieng anhMinh HoàngNo ratings yet

- Third Party FDDocument4 pagesThird Party FDWali AshrafNo ratings yet

- (B) They Share A Majority of Their Common Assets and (C) They Have CommonDocument5 pages(B) They Share A Majority of Their Common Assets and (C) They Have CommonSab0% (1)

- EFim 05 Ed 3Document23 pagesEFim 05 Ed 3bia070386100% (1)

- MRA Letter Template For WaiverDocument2 pagesMRA Letter Template For WaiverSadiya BodhyNo ratings yet

- Residency ReportDocument83 pagesResidency ReportaromamanNo ratings yet

- UAS Bahasa Inggris Menengah 2022 02SMJM001Document4 pagesUAS Bahasa Inggris Menengah 2022 02SMJM001Nikita Pina RahmadaniNo ratings yet

- Summary SheetDocument7 pagesSummary SheetAbdullah AbualkhairNo ratings yet

- Arab-Malaysian Finance Berhad V Taman Ihsan Jaya SDN BHD - 2008Document3 pagesArab-Malaysian Finance Berhad V Taman Ihsan Jaya SDN BHD - 2008Norkamilah Mohd RoselyNo ratings yet

- Standard Chartered Bank PakistanDocument19 pagesStandard Chartered Bank PakistanMuhammad Mubasher Rafique100% (1)

- Templates For Cost Pricing Labor Burden Overhead CalculationDocument13 pagesTemplates For Cost Pricing Labor Burden Overhead CalculationameerNo ratings yet

- Assignment Banking ShivaniDocument25 pagesAssignment Banking ShivaniAnil RajNo ratings yet

- Tutorial Topic 4Document4 pagesTutorial Topic 4Aiyoo JessyNo ratings yet

- MainMenuEnglishLevel-3 RLD2014016Document291 pagesMainMenuEnglishLevel-3 RLD2014016Asif RafiNo ratings yet

- PenswastaanDocument11 pagesPenswastaanRidawati LimpuNo ratings yet

- Axis Bank PrintDocument41 pagesAxis Bank PrintRudrasish BeheraNo ratings yet

- Risk As Financial IntermediationDocument20 pagesRisk As Financial Intermediationkaytokyid1412No ratings yet

- Chapter 4Document7 pagesChapter 4Eumar FabruadaNo ratings yet

- 10000000296Document132 pages10000000296Chapter 11 DocketsNo ratings yet

- Cheques: Features of A ChequeDocument12 pagesCheques: Features of A ChequebushrajaleelNo ratings yet

- Vodafone Idea LTD.: Detailed QuotesDocument21 pagesVodafone Idea LTD.: Detailed QuotesVachi VidyarthiNo ratings yet

- 4 - 5882075308076565519Fx Traders HandbookDocument71 pages4 - 5882075308076565519Fx Traders HandbookDaniel ObaraNo ratings yet

- Phrasal Verbs Related To MoneyDocument3 pagesPhrasal Verbs Related To MoneyFrancisco Antonio Farias TorresNo ratings yet

- Monetary Policy and Fiscal PolicyDocument5 pagesMonetary Policy and Fiscal PolicySurvey CorpsNo ratings yet

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- Project Control Methods and Best Practices: Achieving Project SuccessFrom EverandProject Control Methods and Best Practices: Achieving Project SuccessNo ratings yet

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 4.5 out of 5 stars4.5/5 (14)

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet

- How to Measure Anything: Finding the Value of "Intangibles" in BusinessFrom EverandHow to Measure Anything: Finding the Value of "Intangibles" in BusinessRating: 4.5 out of 5 stars4.5/5 (28)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)