Professional Documents

Culture Documents

SaaS Sector Update - Nov09

Uploaded by

Nicolas GandriacOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SaaS Sector Update - Nov09

Uploaded by

Nicolas GandriacCopyright:

Available Formats

IND EPENDENT TECHNOLOGY RESEARCH

Sector Update

EUROPEAN SAAS – AN ENVIRONMENT RIPE FOR

November 2009

INVESTMENT

Software-as-a-Service

SaaS is a Force to be Reckoned With

Software-as-a-Service (SaaS) is one of the most important trends in software at

present, and has become pervasive over the last few years. We believe that SaaS is

now entering its second phase – SaaS 2.0 – in which SaaS vendors will start

providing integrated solutions to Enterprise customers and improve platform

functionality and capabilities to take on more business critical and strategic

operations.

We expect SaaS 2.0 to expand the total addressable market for enterprise

application software, with growth in SaaS outpacing growth of the overall software

market as it continues to gain market share.

SaaS 2.0

4. Business-

domain SaaS

Provide tenant-

specific

3. Single-app SaaS configuration of

Provide one multiple packaged

SaaS 1.0

packaged business apps and custom

app out of one multi- extensions on a

2. Industrial ASP tenant app to many multi-purpose, multi-

Provide configured clients tenant platform

apps to many clients

1. Manual ASP

Provide similar apps

to multiple clients

0. Outsourcing

Delegate operations

of existing apps

Index Performance

120%

110% Time

100%

The SaaS 2.0 Opportunity

90%

Recently we have seen on-premise only application vendors such as Microsoft,

80%

70%

Oracle, and Adobe embrace the SaaS trend – either via their own offering or through

60%

acquisitions.

50% Despite this, pure-play SaaS vendors have been able to continue to dominate in the

40% near term, with the ongoing rapid entry of new companies into the market. We

Aug-08

Aug-09

Dec-08

Apr-08

Apr-09

believe that SaaS businesses remain attractive investment opportunities and expect

interest in SaaS opportunities to increase as the IPO and M&A activity starts to pick

up.

SaaS

Nasdaq Index Most recently, the acquisition of Gomez, Inc. by Compuware for $299m (sales

multiple of 5.5x) in October and the successful IPO of LogMeIn in June, highlight the

Claudio Alvarez level of activity and interest in the SaaS sector.

claudio@gpbullhound.com

London: +44 (0) 207 101 7571

In this report we discuss why SaaS fundamentals continue to be strong and

why now is the time for investors to seriously consider European SaaS

Per Roman

companies as attractive investments.

per@gpbullhound.com

London: +44 (0) 207 101 7567

Important disclosures appear at the back of this report.

GP Bullhound Ltd. is authorised and regulated by the Financial Services Authority in the United Kingdom

SaaS Sector Update

WHY SOFTWARE-AS-A-SERVICE

On-premise Software is Costly (Time + Money)

For decades on-premise software entailed a number of hurdles for customers and

vendors (and ultimately investors) that were taken as the normal price of

conducting business. However, it was not until the advent of Software-as-a-

Service (SaaS), that these issues surfaced. The main issues for on-premise

software are:

Time consuming implementation: implementation of new software is

typically costly and time consuming, with internal IT departments having to

integrate multiple systems;

Upfront costs: the upfront license fee paid by the customer was typically

millions of dollars. Thus, once the decision to go with a vendor was made, it

was very hard (and costly) to undo;

Difficult upgrades: on-premise software upgrades are equally difficult to

implement, causing many customers to stay on legacy versions. This makes

R&D more expensive for the vendor and, thus, maintenance more expensive

for the customer.

Since the on-demand evolution has been a gradual shift from the original

business process outsourcing (BPO) of non-mission-critical areas such as payroll

through the application service provider (ASP) wave to what we now define as

SaaS, we define upfront some of the major flavours of what vendors offer today.

In particular, vendors such as salesforce.com will espouse multi-tenant

architectures as the only on-demand method; however, we believe a broader

definition is required. It is also worth keeping in mind that customers buy to solve

a business need with underlying requirements such as security and company-

specific functionality that fall across a broad spectrum. Few care about definitions

such as multi-tenant or single-tenant, which tend to have more ramifications for

the vendors’ cost structure than a true impact on the solution for the customer.

On-premise software describes applications that are deployed in a company’s

own data centre. The on-premise deployment requires the customer to purchase

additional hardware to deploy the application within its own data centre. The

company’s own IT staff maintains the application, deploying patches and

upgrades that are sent from the software vendor on a regular basis.

Exhibit 1 – On-premise versus SaaS

Company Software Vendor’s Software

Data Vendor Data Vendor

Centre Centre

Source: GP Bullhound Research

GP Bullhound Ltd. November 2009

SaaS Sector Update

For SaaS there is only one application that multiple users use, as opposed to

different, individual, hosted, versions of an application for each user. All customer

data is co-mingled in databases on the back end.

SaaS Provides Quicker & Easier Implementation at Lower

TCO

The SaaS delivery method solves many of the above issues, increasing the value

of the application to the customer.

Implementation of a SaaS solution is quick and less costly: on-premise

applications that would have taken months to implement take just weeks or in

some cases days to implement as SaaS solutions.

Most SaaS companies charge monthly, quarterly, or yearly subscription

fees that include both maintenance and license fees: this means that the

company does not pay the initial upfront license fee and, thus, companies are

less constrained to switch vendors when the contract runs out. There is likely

some upfront consulting fee associated with the implementation, but given

the lack of customisation of SaaS solutions, this is again much smaller than

in the on-premise case.

Software upgrades are painless: under the SaaS delivery model upgrades

occur much more frequently, giving customers continuous access to

innovation. SaaS vendors typically release upgraded applications multiple

times a year. In the multi-tenant case, since all customers are on the same

version of the software, the upgrade for everyone can be easily performed.

This also results in just one version for the vendor to maintain, which cuts

down their R&D costs as well.

On-demand software can be accessed anywhere through an Internet

browser: this makes it easier for “on-the-road” access to applications

anywhere/anytime.

In the SaaS model, the vendor takes care of hosting the product and,

thus, incurs the additional costs of hardware, IT professionals, etc.:

these costs are passed on to the customer, but as the vendor is focused on

one application, there are typically synergies to be had from the vendor

managing the back end.

Network effects: community aspect benefits everyone. With more eyes

focused on the same application, new ideas are gleaned from a large pool,

while problems tend to be found and fixed more quickly. Similar to the

benefits found in the open-source community.

As SaaS has successfully tackled the issues of cost, security and time, it has

been able to grow robustly while taking share from on-premise software

providers.

GP Bullhound Ltd. November 2009

SaaS Sector Update

WHY NOW?

Technology Improving – SaaS 2.0

Exhibit 2 – SaaS 2.0

Large

High

SaaS 1.0 – Cost-Effective Software Delivery Enterprise

Routine

Software cost reduction and total cost of ownership

Users

paramount

Service level improvements

Rapid implementation

Match IT expense to business activity

Horizontal solution focus

Stand-alone/configurable SaaS applications

Rudimentary applications/data integration, with some

use of web services

Subscription and PAYG pricing

Adoption

SaaS 2.0 – Transforming How Companies

do Business

Secure, flexible and efficient business processes and

workflow

Service level agreements

Rapid achievement of business objectives

Early

Adopters Value-added business services such as analytics and

best practices

Low-cost “white-label” vertical solution stacks

SaaS platforms, providing application sharing,

delivery and management services

Extensive use of SOA enables scaling, rich

Lead configurability and integration

Users Robust subscription monitoring and usage-based

billing capabilities

Low

2003 2004 2005 2006 2007 2008 2009 2010 2011

Source: GP Bullhound Research, Saugatuck Technology

We believe that the SaaS industry is at the mid section of the second part of its

“S-Curve” adoption. However, several factors are contributing to broader adoption

of SaaS software, in our view.

The ubiquity of the Internet and Internet access points coupled with

bandwidth cost reductions has made the use of software on-demand feasible

from both a cost and convenience standpoint.

Reliability more proven: in 2005, Salesforce.com received a great deal of

negative press for an outage that brought the system’s availability to 99.5%.

When 0.5% downtime is enough to make headlines, reliability is in the realm

of “good enough,” especially considering the fact that traditional solutions

may have downtime issues as well. That said, some customers would rather

rely on their in-house IT teams for mission-critical software than rely on

professionals who are employed by an application provider. We believe over

time companies will begin to understand the synergy of having a few IT

professionals dedicated to one application, employed by that application

provider, instead of a few IT professionals who are forced to be a jack-of-all-

trades, knowing several different applications. These synergies will likely

result in greater up-time, with fewer upgrade and patch issues.

Security less of a show stopper: with applications being accessed over the

Internet, there comes an increased chance that sensitive data can be

intercepted or tampered with. Current security and identity and access

management solutions have helped alleviate customer fears around SaaS

application security. There are absolutely customers who prefer on-premise

GP Bullhound Ltd. November 2009

SaaS Sector Update

software or are unable to get comfortable with having their data stored

outside their data centre. That said, we believe this will become a shrinking

group of companies as SaaS providers develop a longer track record of

secure service to technology and security savvy customers.

Functionality moving ahead: one customer we spoke with who decided to

go with a Salesforce.com CRM implementation reviewed products from SAP,

Oracle, and Salesforce.com. They were focused on functionality and cost. As

SaaS businesses mature and continue to penetrate the Enterprise space, we

see them developing wide range functionalities to increase the number of

touch points which makes the platform more strategic and therefore stickier.

Momentum in Large Enterprises Shows Offering Maturity

Continuing momentum within the large enterprise space is crucial for the next

generation of SaaS, and a recent survey by Gartner uncovers that despite the

current economic environment, most large enterprises plan to either increase or

maintain current levels of SaaS spend.

The survey, which was conducted in December 2008 among users and prospects

of SaaS solutions in 333 enterprises in the U.S. and the U.K., found that nearly 6

in 10 companies will maintain their current levels of SaaS in the next two years.

Some 32% will extend SaaS usage and only 5% will decrease levels.

Furthermore, Goldman Sachs carried out a survey of 100 CIOs in November

2007, where it found steady progress in the adoption of SaaS applications over

the coming year. Taking a weighted average of their responses suggested 20%-

25% growth in SaaS licenses among Goldman Sachs’ large enterprise panel, a

positive sign given that the bulk of growth in SaaS adoption is currently driven by

the SME market.

Exhibit 3 – Current and Next Year’s % of Software Licenses Delivered via SaaS

50%

45%

45% 41%

40%

35%

% of Respondents

29%

30%

25%

25%

20%

15%

15%

9% 10%

10% 8% 8%

6%

5% 1% 0% 0% 1%

0%

None 0-5% 6-10% 11-15% 16-20% 21-25% More than

Currently In One Year 25%

Source: Goldman Sachs IT Spending Survey

Reasons for the relative success of SaaS providers with larger enterprises have

been: (i) SaaS vendors have started providing more customisable business-

critical applications which drive front-office decisions such as, financial

settlement, order fulfilment procurement, supply chain management and logistics;

(ii) the customer can test software with smaller deployment which does not

interrupt incumbent system. This removes a great deal of risk for the customer,

while also allowing for quicker implementation decisions; (iii) the vendor, not the

GP Bullhound Ltd. November 2009

SaaS Sector Update

customer, is responsible for maintenance. This means that the customer’s IT

department does not have to worry about getting up to speed on the new

software. Maintenance and upgrades are handled by the provider and are

continuously monitored.

In this economic environment, lower costs have also been one of the main factors

to contribute to the success of SaaS penetrating the large enterprise market. The

fact that SaaS doesn’t require a large upfront license fee makes a lot easier for

SaaS vendors to displace legacy software platforms. Furthermore, SaaS’ ability to

scale (i.e. add more seats) without the need to increase the customer’s overall IT

footprint as all seats are hosted by the vendor.

Buyer Focus Starting to Shift from Cost to Functionality

Traditionally buyers have focused on lower costs, rapid implementation cycles

and simplified software management when considering SaaS solutions. In a

survey conducted by Saugatuck Technology, it found that SaaS buyers are

increasingly focusing on how SaaS platforms can improve functionality and

become a more strategic asset to the company by which they can improve

internal and external collaboration and leverage SaaS’ leading technology.

According to Saugatuck Technology, by 2010 “Access to next-generation

functionality” will be among the top three buyer motivations for acquiring SaaS.

Exhibit 4 – Buyer Focus

Simplify software management

Reduce capital and/or operating costs SaaS 1.0

Speed implementation

Enable focus on core competencies

Access to next-generation functionality

Improve service levels SaaS 2.0

Improve internal & external collaboration

Leverage SaaS provider's leading-edge technology

Faster time to market

Convert fixed IT costs to variable costs

Reduce risk

Increase revenue

Access to SaaS provider's business expertise

0% 10% 20% 30% 40%

Source: Saugatuck Technology

As the industry moves into SaaS 2.0 we believe that platform functionality and

leveraging of SaaS technology with internal platform will become key topics for

companies looking to use SaaS services. Given this SaaS providers will have to

maintain a good degree of innovation coupled with a high degree of services in

order to maximise functionality and increase the level of integration within large

enterprises.

Functionality & Lower TCO Leading to High Renewal Rates

Despite an accelerating competitive landscape (fuelled by VC investment and

ISVs attempting to transition their business models), customer churn remains low,

and companies we have spoken to continue to experience renewal rates between

6

GP Bullhound Ltd. November 2009

SaaS Sector Update

70-95%. The top performing SaaS companies typically achieve annual customer

renewal rates above 90% - with most of the churn due to bankruptcies or

acquisitions - and over 100% renewals on a dollar value basis due to up-sells into

this installed base.

Exhibit 5 – Customer Satisfaction

Solution functionality

System response time

Availability or uptime

Pricing terms and conditions SaaS 1.0

Backup & recovery capability

Accountability for quality of service

Responsiveness to support requests

Security & privacy

Data access & analysis capabilities

Personalisation capabilities

Workflow capabilities SaaS 2.0

Customization capabilities

Integration capabilities

0% 15% 30% 45% 60% 75% 90%

Source: Saugatuck Technology

From exhibit 5 we can see that for SaaS 1.0 functionality, response time,

availability and pricing have been the top four categories customers have focused

on. The subscription-based model and high level of satisfaction for the

aforementioned categories have led to high renewal rates, which is integral for

the success of a SaaS business.

As we move into SaaS 2.0 categories such as (i) data access & analysis

capabilities, (ii) personalisation capabilities, (iii) workflow capabilities, (iv)

customisation capabilities and (v) integration capabilities. SaaS companies will

have to continue innovation in these categories in order to further penetrate the

Enterprise market and maintain their high renewal rates.

Higher Large Enterprises Adoption Not Key for Success

Although the results of the surveys discussed above do not suggest that the

higher intake of SaaS services by large enterprises is the watershed that the

market expected it to be, it does provide proof that SaaS vendors are successfully

penetrating a market that was previously thought to be out of reach.

Exhibit 6 – Global market heavily skewed towards SMEs

Large

> 1,000

~84k

Mid-Market

100-1k Employees

~1.2m Firms

Small

< 100 Employees

~55.4m Firms

Source: 2005 US Census Bureau, IDC, SAP

GP Bullhound Ltd. November 2009

SaaS Sector Update

However, given the much larger size of the SME market – it is estimated that

globally there are ~84k large enterprises versus ~56.6m SMEs – we believe that

higher adoption rates within large enterprises will not necessarily translate into

more financial success for some SaaS vendors as large enterprises will demand

more customised applications which naturally take up more time and resources,

and whose customised platforms are not always transferable to other clients.

Furthermore, according to the Morgan Stanley CIO Survey (October 2009), in

2010 SMEs expect the largest rebound in IT spending. Companies with less than

$500m in revenues see IT spend growing 9% in 2010, compared to -2.8% in

2009. Large enterprises (> $10bn in revenues) expect a more modest rebound to

1.7% growth in 2010. However, mid-sized companies are the least optimistic,

expecting little to no growth in IT spending next year.

Exhibit 7 – SME IT Spending Expected to Rebound Quicker than Large Enterprises

12.0%

2009 2010

9.0%

9.0%

Growth in External IT Spend

6.0%

3.0% 1.7% 1.7%

0.8%

0.0%

-0.1%

-3.0%

-2.8% -2.9% -2.9% -3.2%

-3.8%

-6.0%

Less than $500m-$1bn $1-10bn $10bn+ Overall

$500m

Source: Morgan Stanley CIO Survey, October 2009

Given the high level of optimism of IT spending within the SME community and

SaaS vendors ability to generate profitable scale through successfully servicing

the Enterprise segment, we believe that SaaS vendors will try to strike a healthy

balance between Enterprise and SME customers in order to fully optimise their

business plans and scale in a profitable manner.

GP Bullhound Ltd. November 2009

SaaS Sector Update

MARKET UPDATE

According to Gartner, the SaaS market is forecast to reach $8bn in 2009, a

21.9% increase from 2008 revenue of $6.6bn. The market will show consistent

growth through 2013 when worldwide SaaS revenue will total $16 billion for the

enterprise application markets.

The main factor for this solid level of growth has been the continued rate of

adoption of SaaS as vendors continue to evolve within the enterprise application

markets. The increased rate of adoption has been due to tighter capital budgets

in the current economic environment demand leaner alternatives, increased

popularity and heightened interest for platform as a service and cloud computing.

SaaS adoption varies between and within markets. Although usage is expanding,

growth remains most significant in areas characterized by horizontal applications

with common processes, among distributed virtual workforce teams, and within

Web 2.0 initiatives.

Exhibit 8 – Global SaaS Market

18,000

OnDemand / Cloud Revenues ($m)

16,000

14,000

12,000

10,000

8,000

6,000

4,000

2,000

0

2007 2008 2009 2010 2011 2012 2013

CCC Offices Suites DCC CRM ERP SCM Other Application Software

Source: Gartner

Office suites and digital content creation (DCC) remain the fastest-growing

markets for SaaS. Office suites are projected to total $512m in 2009, up from

$136m in 2008, while DCC is forecast to total $126m in 2009, up from $70m in

2008.

The traditional DCC market (estimated to be north of $4bn) has started to see the

shift from on-premise to SaaS as the overall market is being defined by a move

away from proprietary systems toward mainstream, desktop-based systems. Most

companies selling professional DCC tools are trying to adjust to this trend

because there is an obvious positive side: as tools become more accessible in

price and ease of use, there are more people who can take advantage of them.

The content, communications and collaboration (CCC) market continues to show

the widest disparity of SaaS revenue across market segments, generating $2.5bn

in 2009, up from $2.16bn in 2008.

The adoption of SaaS within enterprise resource planning (ERP) and supply

chain management (SCM) varies based on process complexity. SaaS is expected

to represent only about 1% of ERP manufacturing and operations revenue, but

GP Bullhound Ltd. November 2009

SaaS Sector Update

more than 18% of human capital management (HCM) and 30% of the

procurement segment by 2013.

SaaS is quickly becoming the industry standard for HCM as it fundamentally

changes the industry’s approach from a license arrangement to pricing schemes

where customers pay for what they are using on a subscription basis. SaaS is

particularly suited for HCM as it allows customers to select one or more HCM

modules, and can then integrate with 3rd party ERP and HRMS systems of their

choice.

Exhibit 9 – HR Market with SaaS Subscription Revenues Achieving Fastest Growth

9,000

8,000

7,000

6,000 14.0% CAGR

Revenues ($m)

5,000

4,000

4.6% CAGR

3,000

2,000

1,000 7.0% CAGR

0

2008 2009 2010 2011

Maintenance Licenses Subscription

Source: Forrester

The CRM market exhibits more general market adoption, ranging between 9%

and more than 33% of total software revenue, depending on the CRM sub

segment. Overall, SaaS accounted for more than 18% of the CRM market total

revenue in 2008.

SaaS currently accounts for a relatively small component of the overall software

market and most IT budgets. Specifically, SaaS applications accounted for only

3.3% of worldwide software spending in 2008. We expect this market to continue

to gain “wallet share” from traditional software solutions, as organisations adopt

the lower total cost of ownership, increasingly flexible and more agile SaaS

offerings. As such, we expect on-demand software to grow to 5.9% of the

worldwide software market by 2013.

Exhibit 10 – SaaS Market Share 2008 & 2013

2008 2013

SaaS SaaS

3% 6%

Traditional Traditional

Software Software

97% 94%

Source: Gartner, Credit Suisse

10

GP Bullhound Ltd. November 2009

SaaS Sector Update

SAAS BUSINESS MODEL

SaaS companies sell their software as a subscription as opposed to the

traditional perpetual license model; hence, valuation must take this into account.

In the growth phase SaaS companies typically spend a lot on customer

acquisition, with the focus on the total long-term value of the customer and less

on current profitability. Below we highlight the key differences in the SaaS model

that investors should focus on:

Recurring revenue model: one of the most compelling aspects of any SaaS

company is its revenue stream. Although it takes some time to develop, once

a SaaS company has a customer base and has reached a steady churn rate,

it has a predictable, repeatable revenue stream. Then it all comes down to

continuing to acquire customers while reducing churn.

Low cost of sales: another convincing aspect of the SaaS model is the low

total cost of sales associated with these companies. The product is available

for demonstration, evaluation, and long-term use right over the web. While

some customer accounts may still require in-person sales, the vast majority

can at least get up and running without an on-site customer visit. As a result,

a great SaaS company can be very successful at a “land and expand”

strategy.

Customer stickiness: most if not all SaaS offerings require that the

customer input or import data into the service. For example, a human

resources management offering would likely require a customer to import its

organizational data. Having the customer complete the initial work is critical,

and sometimes challenging. But once the customer does this, they are likely

to stick as long as they are getting some value from the product. Having gone

through the process once, they are not likely to switch to another system.

Moreover, extracting and exporting data from service based offerings is

harder than it was with installed software.

Measurable growth: with SaaS business model, a company can really

measure its performance. Once the revenue stream is established, a

company can focus on a few key metrics. Monthly Recurring Revenue (MRR)

indicates how much recurring (vs. new) revenue a company has each month

from its customer base. Companies can track their customer Payback Time

to see how long it takes to recoup the cost of acquiring a customer and

getting that customer up and running. Then companies can focus on

reducing this time.

Bookings more important than revenue: SaaS companies typically sign

multiyear agreements with only the first year collected upfront. Bookings

(revenue plus change in deferred revenue) will provide insight into the first

year. However, there is usually a second and third year (depending on the

length of the contract) of contractually guaranteed revenue that is essentially

an off-balance sheet item. Nevertheless, total bookings and its growth are

better indicators of current business momentum than revenue.

Lower gross margins than on-premise counterparts: on-premise vendors

provide only the software, a high margin sale, resulting in gross margins

11

GP Bullhound Ltd. November 2009

SaaS Sector Update

usually in the 90% plus range. On-demand vendors take on the full cost of

delivery and maintenance as well. Hence, spend on data centres and

networks to support the application have a negative impact on cost of goods

sold, lowering gross margin into the 60-80% typically.

Operating costs are front-end loaded: customer acquisition costs for SaaS

companies when compared to their first year of revenue from the customer

are high, since the company is counting on creating a high margin recurring

revenue stream from the customer. Thus, key metrics to watch include: (1)

changes in customer acquisition costs; (2) ASPs; (3) contract lengths; and,

(4) customer churn.

Higher capital expenditure requirements: the higher CapEx is driven by

the need to spend on data centres; ensuring security and reliability meet the

highest standards. Thus free cashflow is more important than operating

cashflow.

Ultimately cashflow is the most important factor in valuation: traditional

valuation metrics such as price-to-earnings (P/E) and even price-to-sales are

lagging indicators for SaaS stocks given the large portion of on- and off-

balance sheet deferred revenue from ratable subscription models. When

valuing SaaS vendors, we rely on cash flowdriven metrics as well as a deep

understanding of long-term value of the customer versus the upfront

customer acquisition costs as well as factors such as churn.

In the early growth stage of a SaaS company, a higher portion of revenue is likely

come from lower margin professional services, as customers need help with the

initial implementation. However, over time as the company builds a base of

renewing subscribers, professional services will become a smaller portion of

revenues increasing gross margins.

How to Value a SaaS Business

Historically, software companies have sold perpetual license agreements to

customers. These agreements give the user the right to operate a number of

copies of a specific version of the software for as long as the user would like. In

order to get updates, patches, help, etc., the user must also purchase a

maintenance contract, typically about 20% of the list price of the license.

Most SaaS companies sell their products not as perpetual licenses, but on a

subscription basis. Users typically sign up to pay a monthly subscription fee for a

period of time (usually somewhere between one and three years). This monthly

subscription fee covers both the license and the maintenance portion of the fee

the user would pay had they purchased a perpetual license. The subscription not

only gives the user the access to the software, it also by default gives them

access to all updates and patches as the provider has just one version of the

software and, thus, all users are on the latest version. It is this different sales

model that in part leads to higher multiples for growing on-demand vendors.

To illustrate this point, we will look at two sample companies that sell the same

software. The first company, “OnPremise Co.” sells the software as a perpetual

license, while the second, SaaS Co. sells its software on a subscription basis.

12

GP Bullhound Ltd. November 2009

SaaS Sector Update

We will assume that OnPremise Co. sells its license for a price of $5m with yearly

maintenance of $1m and that SaaS Co. sells its software as a service, for a

subscription price of $2m per year. Exhibit 11 illustrates customer payments to

both companies over the life of the application.

Exhibit 11 – Customer Payments for OnPremise Co. and SaaS Co.

$7 Customer Payments for OnPremise Co. $7 Customer Payments for SaaS Co.

$6 $6

$1

$5 $5

$4 $4

$3 $3

$5

$2 $2

$1 $1 $2 $2 $2 $2 $2

$1 $1 $1 $1

$0 $0

Year 1 Year 2 Year 3 Year 4 Year 5 Year 1 Year 2 Year 3 Year 4 Year 5

License Maintenance Subscription

Source: GP Bullhound

In Exhibit 11 we can see that a customer pays significantly more upfront for the

perpetual license, but over time the subscription fee catches up in total cost, as

the customer is paying for both the license and the maintenance in years two

through five. The sum of the payments over the life of the software is $10 million

for both applications and under our simplified analysis, the OnPremise Co.

customer would need to redeploy a new application beginning year six, starting

this process over again.

We now look at how revenue multiples for these two companies would differ over

a three-year growth period. Again, our analysis simplifies the situation, but allows

us to understand the disparity we see in multiples. For our analysis, we assume

that both companies make one sale in year one, two sales in year two, and four

sales in year three.

Exhibit 12 – Revenue for OnPremise Co. and SaaS Co.

$30 Revenues for OnPremise Co. $16 Revenues for SaaS Co.

$25 $14

$7

$12

$20

$10

$15 $8

$3 $14

$10 $20 $6

$4

$5 $1 $10 $6

$5 $2

$2

$0 $0

Year 1 Year 2 Year 3 Year 1 Year 2 Year 3

License Maintenance Subscription

Source: GP Bullhound

Exhibit 12 illustrates the revenues we would expect from OnPremise Co. and

SaaS Co. Despite the fact that the two companies are selling the same number of

applications per year, we can see that OnPremise Co. has three times the

revenue of SaaS Co. in year one and nearly twice the revenue of SaaS Co. in

year three. With OnPremise Co. growing revenue at more than 100% over year

one, it would not be unreasonable to see a multiple of 2x placed on its first year-

end license revenues at the beginning of year one. As the companies are selling

13

GP Bullhound Ltd. November 2009

SaaS Sector Update

the same number of the same licenses for the same total cost, it would be logical

to assume that the two companies should receive the same value in the

marketplace. This would equate to a 4x revenue multiple for SaaS Co. in year

one.

Our analysis overly simplifies the situation, as many companies who sell

perpetual licenses would only recognise a portion of the license revenue upfront

and would then recognise the remaining portion over the life of the application.

Thus, we would expect lower revenues and higher multiples for a company like

OnPremise Co. The subscription fee for SaaS Co. would also likely be higher

than the $2m we estimate in our example, in order to make the present value of

payments received over our five-year period equal to the value of the payments

that OnPremise Co. would receive over that same period, thus lowering SaaS

Co.’s revenue multiple. That said, these two corrections would bring the two

multiples closer together, but SaaS Co., the on-demand subscription model,

would still have a higher multiple in the growth phase due to the fact that these

two companies should have the same value.

Public Markets Valuations Diverge from Theory

Although the above example helps us understand the major valuation difference

between a SaaS and traditional software business, in reality the public markets

have tended to focus more on the high growth nature of SaaS businesses when

valuing them.

Exhibit 13 – 2008/09 Forecasted Revenue Growth for Traditional Software vs. SaaS

14.0%

12.0%

12.0%

Revenue Growth Forecast

10.0% 9.3%

7.5%

for 2008/09

8.0% 6.4%

6.0%

4.0%

2.0%

-0.2%

0.0%

-2.0% $1B+ Rev Avg. Software $100-1B Rev <$100B Rev SaaS

Source: CapIQ

Given the high-growth nature of SaaS businesses they have historically traded at

a higher sales multiple. However, this has recently changed as growth forecast

for SaaS businesses keep being revised downward.

Exhibit 14 – Average Growth Rates for SaaS Sector and Revised 08/09 Forecasts

60.0% 55.0%

50.0% 46.0%

40.0% 32.0%

30.0% 24.0%

20.0%

20.0% 12.0%

10.0%

0.0%

06/07 07/08 Oct-08 Dec-08 Feb-09 Oct-09

08/09 Growth Projection

Source: CapIQ

14

GP Bullhound Ltd. November 2009

SaaS Sector Update

The current forecasted 08/09 revenue growth rate for SaaS businesses is 12%,

one third of the actual 07/08 growth rate and down from 32% in forecasted in

October 2008. Given the early nature of most SaaS business and the current

economic cycle, changes in growth forecasts has impacted SaaS valuations more

than traditional software valuations.

Exhibit 15 – ‘09 EV / Sales Multiple for Enterprise Software and SaaS Sector

4.3x 4.2x

SaaS

4.0x Enterprise Software

3.7x 3.6x 3.6x 3.8x

'09 EV / Sales

3.4x

3.4x

3.1x

3.1x 2.9x 3.3x 3.3x

2.8x

3.0x

2.8x 3.0x

3.0x

2.9x

2.5x

Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09

Source: CapIQ

We can see the effect of lower growth forecasts on SaaS multiples in the exhibit

above. It shows that since April of this year the SaaS sector has been at a

discount to the Enterprise Software sector. We believe this to be a temporary

state and have already experience a reversal. We anticipate current multiples

trends to continue as market and economic conditions normalise and investors

continue to focus on the predictable nature of SaaS revenues.

15

GP Bullhound Ltd. November 2009

SaaS Sector Update

FAST-GROWING EUROPEAN SAAS COMPANIES

Elateral Limited develops solutions for the customisation and

integration of marketing communications. Over the last four

years Elateral has achieved sales CAGR of 44%, and grew revenues by 48% in 2008.

Elateral has recurring revenues north of 100% and services blue chip companies such

as Cisco, Coke and Symantec. The company provides its product in various modules,

such as commercial print, direct marketing, local print, branded email, adaptive

advertising, sales proposal, landing page, PoS, and file share module. It also offers

consulting, implementation, managed services, document engineering, asset

management, and technical services. Elateral was incorporated in 1995 and is based in

Farnham, the United Kingdom.

e-conomic international a/s is a web-based innovative

accounting system that exploits the opportunities of the

Internet for easy-to-use, flexible and secure accounting

solutions. The company grew revenues by 40% in 2008 and has 21,000 customers using

its platform. e-conomic was founded in 2001, has a staff of 60 and is headquartered in

Copenhagen with offices in the UK, Sweden, Norway, Spain and Germany.

16

GP Bullhound Ltd. November 2009

SaaS Sector Update

Epoq Group Limited provides a legal service delivery

platform bringing together document automation, workflow

and content. The platform is targeted directly at corporations with in-house legal teams,

small-to-medium size law firms and individuals. The company grew revenues by 30% in

2008 and subscriptions are around 90% of revenues. Epoq has recently launched its

Direct Law platform which enables your law firm to become a "virtual law firm" without

the need for IT resources as it automates legal documents, legal advice, and other online

legal services. Epoq was founded in 1994 and is headquartered in London, UK with

additional offices in the US.

eCommera Ltd. provides the first truly scalable enterprise

grade SaaS platform for e-commerce and multichannel

retail combined with trading and marketing advisory services to help improve customer

acquisition and conversion online. The Company’s solutions are used by an extensive

client portfolio of UK and international brands across multiple customer segments in the

B2C markets. eCommera was founded in 2007 and is headquartered in London, UK.

17

GP Bullhound Ltd. November 2009

SaaS Sector Update

Net Transmit & Receive, S.L. offers remote support, remote

access, remote systems management, and enterprise

mobility management solutions for individuals, small and mid-

sized businesses, and enterprises. It offers its products through SaaS, self-hosting

licensing, and on-site licensing to small and medium businesses, corporations,

government agencies, and multi-nationals. The company was founded in 2000 and is

headquartered in Barcelona, Spain.

Single Sign‐On

Web Services / Features

Remote File Session

FirstHelp ACD Alerts

Control Transfer Recording

RC Agents Voice

Backup Survey Bots Chat

DSA Video

Customization Layer

Integration Layer

Open XML Standard Ext. Int.

API/SDK Reporting Interfaces Tools

Welfore GmbH provide small and mid sized enterprises (< 100

Employees) as well as project based environments at larger

enterprises cost effective, standardized and highly automated

modular business processes across all sectors, but with a clear

focus on trade and services. This will be achieved by using intelligent and standardized

process models, which will be offered as time and location independent SaaS.

18

GP Bullhound Ltd. November 2009

SaaS Sector Update

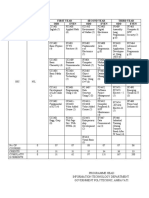

SECTOR VALUATIONS

Public Trading COMPS

Market Cap EV R e v e nue M ult iple E B IT D A M ult iple

Com pany Nam e ($m ) ($m ) 2009 2010 2009 2010

Ariba Inc. 1,104 975 2.9x 2.7x 13.7x 12.1x

Concur Technologies, Inc. 1,865 1,624 6.4x 5.2x 21.4x 17.6x

Omniture Inc. 1,662 1,545 4.4x 3.9x 20.8x 17.3x

Rightnow Technologies Inc. 515 425 2.8x 2.5x 26.4x 18.7x

Salesforce.com 7,827 7,433 5.8x 5.0x 30.6x 25.4x

Taleo Corp. 733 672 3.4x 3.0x 14.2x 12.0x

Ultimate Softw are Group Inc. 752 725 3.6x 3.1x 34.2x 22.7x

NetSuite, Inc. 1,005 889 5.4x 4.8x 87.7x 60.1x

DemandTec, Inc. 244 176 2.2x 2.1x 35.8x 31.2x

SuccessFactors, Inc. 1,149 1,042 7.0x 5.9x NM 203.1x

Intuit Inc. 9,616 9,269 2.9x 2.7x 8.3x 7.7x

Mean 4.2x 3.7x 29.3x 38.9x

Median 3.6x 3.1x 23.9x 18.7x

So urce : GP B ullho und, Capital IQ

26-Oct-09

19

GP Bullhound Ltd. November 2009

SaaS Sector Update

M&A Transactions

Consideration Sales

Date Acquirer Target Target Description

($m ) Multiple

Provides on-demand softw are to healthcare

Apr-08 Nuance Comm. eScription 368.1 8.2x

enterprises

Develops, licenses, and supports proprietary

Apr-08 Apax Trizetto Group Inc. 1,258.7 2.8x and third-party softw are products for the

healthcare industry

Provides on demand talent management

May-08 Taleo Corp. Vurv Technology 131.2 2.6x

softw are for businesses

May-08 Blackbaud Kintera 48.1 1.0x Provides SaaS to nonprofit organisations

Provides on-demand employment screening

Jun-08 US Investigation HireRight 249.8 2.8x

solutions

Provides integrated talent management

Sep-08 Bedford Authoria 63.1 3.8x

solutions

Provides solutions for managing human

Dec-08 Salary.com Genesys Softw are 10.5 1.2x

resources

Develops on-demand customer relationship

Dec-08 Intuit Entellium 7.7 4.5x

management softw are

Provides SaaS financial clearing solutions to

Dec-08 Experian Plc SearchAmerica 90.0 6.4x

the healthcare industry

Develops customs brokerage and manifest

Feb-09 Descartes Systems Oceanw ide 8.5 1.4x softw are for airlines, container freight

stations, and importers

Develops marketing, distribution, and support

of learning, performance, and talent

Apr-09 Vista Equity Partners SumTotal Systems 133.7 0.9x

development softw are solutions and on-

demand subscriptions w orldw ide

Provides enterprise configuration

May-09 EMC Corp. Configuresoft 86.8 3.2x

management solutions

Provides online payroll services to small

Jun-09 Intiut PayCycle 169.0 5.7x

businesses and non-profit employers

Builds on-demand softw are for small

Jul-09 United Business Media The Fuel Team 7.0 2.0x businesses, healthcare, new s distribution,

and nonprofit organizations

Provides online business optimization

Sep-09 Omniture Adobe 1,675.7 4.6x products and services through the Omniture

Online Marketing Suite

Provides a Web-based solution for online

Sep-09 Intiut Mint Softw are 170.0 N/A

financial management

Provides on demand Web application

experience management services to measure

Oct-09 Compuw are Corp. Gomez 299.6 5.5x

and manage Web site and Web application

performance

Provides softw are as a service Web

Oct-09 ScanSafe Cisco Systems 183.0 N/A Security, w hich is the provision of Web

security over the Internet

Average 3.5x

Median 3.0x

20

GP Bullhound Ltd. November 2009

SaaS Sector Update

Analyst Profiles

GP Bullhound is a research centric investment bank headquartered in London

with offices in San Francisco.

Claudio Alvarez – Claudio joined GP Bullhound in 2007. He previously worked

as an equity research analyst at Execution Limited in the telecoms group,

where he covered large cap telecom operators – both fixed and mobile – in

Southern and Eastern Europe. Claudio graduated from Wesleyan University

with a dual Bachelor’s Degree in Economics and Philosophy.

Per Roman – Per co-founded GP Bullhound in 1999. He previously worked as

an investment banker for Lehman Brothers focused on technology and Internet

transactions. Per also has experience from the software industry where he held

various roles both in Europe and US for Autodesk, Inc. Per holds an MSc

Finance from Stockholm School of Economics. Per is a regular speaker on

CNBC Europe, CNN Int. and BBC World.

Disclaimer: Information contained in the document does not constitute an offer to buy or sell or the solicitation of any offer to buy or sell

any securities. This document is made available for general information purposes only and is intended for institutional investors who have

a high degree of financial sophistication and knowledge. This document and any of the products and information contained herein are not

intended for the use of private investors in the UK. Although all reasonable care has been taken to ensure that the information contained

in this document is accurate and current, no representation or warranty, express or implied, is made by GP Bullhound Ltd. as to its

accuracy, completeness and currency. This report contains forward-looking statements, which involve risks and uncertainties. Actual

results may differ significantly from the results described in the forward-looking statements. In particular, but without limiting the preceding

sentences, you should be aware that statements of fact or opinion made, may not be up-to-date or may not represent the current opinion

(whether public or confidential) of GP Bullhound Ltd. In addition, opinions and estimates are subject to change without notice. This report

does not constitute a specific investment recommendation or advice upon which you should rely based upon, or irrespective of, your

personal circumstances. Use of this document is not a substitute for obtaining proper investment advice from an authorized investment

professional. Potential private investors are therefore urged to consult their own authorized investment professional before entering into

any investment agreement. Past performance of securities is not necessarily a guide to future performance and the value of securities

may fall as well as rise. In particular, investments in the technology sector can involve a high degree of risk and investors may not get

back the full amount invested.

GP Bullhound Ltd. is authorised and regulated by the Financial Services Authority in the United Kingdom.

GP Bullhound Ltd, 52 Jermyn Street, London, SW1X 6LX

http://www.gpbullhound.com, info@gpbullhound.com, +44 20 7101 7560

21

GP Bullhound Ltd. November 2009

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Data Analyst Interview Questions To Prepare For in 2018Document17 pagesData Analyst Interview Questions To Prepare For in 2018Rasheeq RayhanNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Predictive AnalyticsDocument41 pagesPredictive AnalyticsBashar M. A. Tahayna100% (1)

- 8 Steps For Migrating Existing Applications To MicroservicesDocument44 pages8 Steps For Migrating Existing Applications To MicroservicesRizwan AhmedNo ratings yet

- Software Engineering Online Tutor Finder SystemDocument12 pagesSoftware Engineering Online Tutor Finder SystemAnkit singh100% (1)

- Top 100 Linux Interview QuestionsDocument8 pagesTop 100 Linux Interview Questionsvinod.nalawadeNo ratings yet

- Cryptlib ManualDocument354 pagesCryptlib Manualsg1121993No ratings yet

- Sap VBSDocument25 pagesSap VBSRVNo ratings yet

- 7 ThreadsDocument19 pages7 ThreadsmbhangaleNo ratings yet

- Sample IT Course Pathway for Diploma StudentsDocument1 pageSample IT Course Pathway for Diploma StudentsSwapnil KaleNo ratings yet

- CS8494 Software Engineering Requirements Analysis and SpecificationDocument41 pagesCS8494 Software Engineering Requirements Analysis and Specificationsathyaaaaa1No ratings yet

- Interface Python With MySQLDocument2 pagesInterface Python With MySQLAdarshNo ratings yet

- Error LogDocument2 pagesError LogabdulateefnsrNo ratings yet

- Activity 3Document2 pagesActivity 3Steffane Mae SasutilNo ratings yet

- Scribd Cc1 2012 2013 CorrigeDocument9 pagesScribd Cc1 2012 2013 CorrigePolaar NameNo ratings yet

- Sr. Analyst (Provider) JD - GridlexDocument4 pagesSr. Analyst (Provider) JD - GridlexAsmita Wankhede MeshramNo ratings yet

- Weblogic PatchDocument16 pagesWeblogic PatchRajNo ratings yet

- eBay Data Breach Exposed 145 Million AccountsDocument21 pageseBay Data Breach Exposed 145 Million AccountsAnson SooNo ratings yet

- Instalacion Tomcat en Fedora 17Document6 pagesInstalacion Tomcat en Fedora 17realvaradog4831No ratings yet

- Unit 3Document42 pagesUnit 3Diksha SinghalNo ratings yet

- Web Application Penetration Testing Course URLsDocument7 pagesWeb Application Penetration Testing Course URLsTaasiel Julimamm100% (1)

- Java GUI Application for Comic Book Rental ManagementDocument11 pagesJava GUI Application for Comic Book Rental ManagementMochamad LutfyNo ratings yet

- GoldenGate POCDocument13 pagesGoldenGate POCRathinavel SubramaniamNo ratings yet

- Project TitleDocument40 pagesProject TitlesircinomNo ratings yet

- Bhavan'S Vivekananda CollegeDocument3 pagesBhavan'S Vivekananda Collegekoduru555No ratings yet

- Tib BW Release NotesDocument102 pagesTib BW Release NotesRuchi ChopraNo ratings yet

- Introduction To Node: Submitted By, Sonel Chandra S7 Roll No-34Document19 pagesIntroduction To Node: Submitted By, Sonel Chandra S7 Roll No-34Sonel ChandraNo ratings yet

- Mastering Blockchain: Chapter 2, DecentralizationDocument15 pagesMastering Blockchain: Chapter 2, DecentralizationQuốc Khánh NguyễnNo ratings yet

- Retail Store Automation PresentationDocument15 pagesRetail Store Automation PresentationSakshi Khurana0% (2)

- Process Chains: Presenter: Gaurav SharmaDocument42 pagesProcess Chains: Presenter: Gaurav SharmaHari KrishnaNo ratings yet

- DevOps - Harshil Patel (1)Document7 pagesDevOps - Harshil Patel (1)Harshvardhini MunwarNo ratings yet