Professional Documents

Culture Documents

Health Protection From LIC of India - 9811896425

Uploaded by

Harish ChandCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Health Protection From LIC of India - 9811896425

Uploaded by

Harish ChandCopyright:

Available Formats

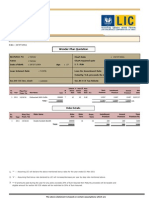

Harish Chand

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

902 - Health Protection Plus

Pg. 1

Term Age Sum

Minimum 20 18 0

Maximum 57 55 0

Premium Ceasing Age : 75 Premium Ceasing Term : 0

Plan Highlights

Unit linked Health Protection Insurance plan, which provides for insurance cover against following health

risks:

1. Hospital Cash Benefit (HCB)

2. Major Surgical Benefit (MSB)

3. Reimbursement of domiciliary treatment expenses

HCB is on per day basis. MSB shall be a percentage of sum assured.

The Principle Insured (PI) can take the policy covering himself / herself. The spouse and/or dependent

children can be covered under the policy. To be covered under the policy at inception of the policy only and if

not done, will not be covered under the policy in future.

DEATH BENEFIT:

1. If policy is issued on a single life: N.A.V. Payable to nominee.

2. If one or more Insured lives (other than PI) are covered

The payment of premiums will cease. However, the cover shall continue for the surviving Insured lives

till the maximum benefitceasing age or till the fund is sufficient to recover the charges for hospital cash cover

and surgical benefit cover, whichever is earlier

1. Hospital Cash Benefit (HCB)

· HCB is payable on per day basis.

· This Benefit will increase at each policy anniversary by 5% till it reaches a maximum of 1.5 times the

Initial Daily Benefit.

· ICU Daily Benefit: Twice Applicable Daily Benefit of that policy year.

· For every hospitalization, no benefit paid for the first 48 hours (two days)

· Maximum. 18 days hospitalization & including not more than 9 days in intensive care unit in the 1st

policy year for each insured.

· Maximum. 60 days hospitalization. and including not more than 30 days in I.C.U. in the 2nd &

subsequent policy years for each insured.

· Limited to a maximum of 365 days during entire policy term for each insured.

· Insured Child up to age 5 yrs: Maximum period of 90 (ninety) days.

· Applicable only within India.

· Waiting period: 180 days for new policy & 90 days after revival.

· Termination: After his/her reaching 75 years OR Maximum lifetime claim limit of 365 days.

2. Major Surgical Benefit (MSB)

· MSB shall be a percentage of sum assured.

· The Corporation will pay the chosen Major Surgical Benefit Amount, as calculated as a % of Sum

Assured, regardless of actual costs incurred.

· The Major Surgical Benefit shall be paid as a lump sum

· Maximum Benefit payable in any Policy year for an insured person not exceeds 100% of the S.A. in

respect of each member.

· Maximum limit of three times the Sum Assured.

· A child included will be automatically covered after age 18 years.

· Applicable for surgery conducted only within India.

· Waiting period: 180 days for new policy & 90 days after revival.

· Termination: After his/her reaching 75 years and/or Maximum lifetime claim limit of three (03) times S.A.

Insure And Be Secure

Plan Features Continue .......... Pg. 2

Insure And Be Secure

You might also like

- Brochure (PRU@Work)Document36 pagesBrochure (PRU@Work)aviro259156No ratings yet

- Term Protector Product Summary: Important NoteDocument8 pagesTerm Protector Product Summary: Important NotesoxoNo ratings yet

- Econ Problem PracticeDocument5 pagesEcon Problem PracticeAnonymous LusWvy100% (2)

- RAJA DAKUA LIC DEVELOPMENT OFFICER CONTACTDocument2 pagesRAJA DAKUA LIC DEVELOPMENT OFFICER CONTACTDhiman NaskarNo ratings yet

- Whodoirelyon When I Encounter Medical Emergencies?: Bharti Axa Life Hospi Cash Benefit RiderDocument18 pagesWhodoirelyon When I Encounter Medical Emergencies?: Bharti Axa Life Hospi Cash Benefit RiderpradiphdasNo ratings yet

- Prospectus - Young Star Insurance PolicyDocument26 pagesProspectus - Young Star Insurance PolicyNaveenraj SNo ratings yet

- Term Paper of InsuranceDocument10 pagesTerm Paper of InsuranceLove MittalNo ratings yet

- Great Critical Care Relief GCCRDocument7 pagesGreat Critical Care Relief GCCRraathi_cdiNo ratings yet

- My+Health+Medisure+Classic Web+Brochure 02Document16 pagesMy+Health+Medisure+Classic Web+Brochure 02Preeti KatiyarNo ratings yet

- Mediclassic NewDocument2 pagesMediclassic NewPiyush KantNo ratings yet

- IPru Sarv Jana Suraksha BrochureDocument6 pagesIPru Sarv Jana Suraksha BrochureyesindiacanngoNo ratings yet

- 5 ProspectusDocument17 pages5 ProspectusDonkupar KharwarNo ratings yet

- Complete Health Insurance BrochureDocument5 pagesComplete Health Insurance BrochureDeepak SureshNo ratings yet

- Women Care - 29-Dec-2022-20-46-39testDocument7 pagesWomen Care - 29-Dec-2022-20-46-39testSrinivas SNo ratings yet

- I-Great Medi Care: Your Hassle-Free Personal Medical CareDocument24 pagesI-Great Medi Care: Your Hassle-Free Personal Medical Carenrlyn_mduNo ratings yet

- Joy (Maternity Insurance Product) Prospectus Cum Sales LiteratureDocument23 pagesJoy (Maternity Insurance Product) Prospectus Cum Sales Literaturesanjay4u4allNo ratings yet

- Prospectus New India Floater Mediclaim 21012020 - 1Document20 pagesProspectus New India Floater Mediclaim 21012020 - 1mail2sranjanNo ratings yet

- Dengue BrochureDocument3 pagesDengue BrochureDr Ankit PardhiNo ratings yet

- Prospectus New India Mediclaim Policy Wef 01 04 2021Document22 pagesProspectus New India Mediclaim Policy Wef 01 04 2021Venkatesan RNo ratings yet

- Complete Health Insurance BrochureDocument5 pagesComplete Health Insurance BrochureRaghib ShakeelNo ratings yet

- Axis GroupMedicare E-Brochure (Top-Up)Document4 pagesAxis GroupMedicare E-Brochure (Top-Up)RKNo ratings yet

- "A Plan That Gives Me & My Family... ": No Matter What The Actual Bill IsDocument12 pages"A Plan That Gives Me & My Family... ": No Matter What The Actual Bill IsShashank BisenNo ratings yet

- SBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness TooDocument2 pagesSBI General's Health Insurance Policy - Retail: Take Control of Your Family's Health. and Happiness ToobpshuNo ratings yet

- Group Assurance Health Plan introduces Double Sum InsuredDocument2 pagesGroup Assurance Health Plan introduces Double Sum InsuredChandu SwarnkarNo ratings yet

- New India Sixty Plus Mediclaim Policy Highlights in 35 CharactersDocument17 pagesNew India Sixty Plus Mediclaim Policy Highlights in 35 Charactersvishal shahNo ratings yet

- Product BrochureDocument10 pagesProduct BrochuresmshekarsapNo ratings yet

- Mediclaim Insurance Policy (Individual) - ProspectusDocument23 pagesMediclaim Insurance Policy (Individual) - ProspectusSatyaki DuttaNo ratings yet

- CCP&CCM PDFDocument4 pagesCCP&CCM PDFjOHN rEMEDYNo ratings yet

- Grameen Care (Micro Insurance Product) Prospectus Cum Sales LiteratureDocument25 pagesGrameen Care (Micro Insurance Product) Prospectus Cum Sales Literaturesanjay4u4allNo ratings yet

- Myhealth SurakshaDocument12 pagesMyhealth SurakshaAshokNo ratings yet

- Family Health Optima Insurance PlanDocument6 pagesFamily Health Optima Insurance PlanMuhammad AhsunNo ratings yet

- Jeevan ArogyaDocument24 pagesJeevan Arogyassvelu5654No ratings yet

- Group Mediclaim Policy Coverages For Employees of Century PlyDocument2 pagesGroup Mediclaim Policy Coverages For Employees of Century PlyUDAYNo ratings yet

- Sbi General'S Retail Health Insurance Policy: Ensure Your Family's HappinessDocument12 pagesSbi General'S Retail Health Insurance Policy: Ensure Your Family's HappinessYOGESHNo ratings yet

- New India Assurance Arogya Sanjeevani Policy GuideDocument16 pagesNew India Assurance Arogya Sanjeevani Policy GuidestauheedNo ratings yet

- Wealth + Health PlanDocument25 pagesWealth + Health PlanGireesh Bhat UNo ratings yet

- Prospectus New India Floater Medi Claim 21042023Document22 pagesProspectus New India Floater Medi Claim 21042023riyashaluriyaNo ratings yet

- Features At-A-Glance : 205-206, C-Wing, Crystal Plaza, New Link Road, Sample Report For Demonstration Purpose OnlyDocument3 pagesFeatures At-A-Glance : 205-206, C-Wing, Crystal Plaza, New Link Road, Sample Report For Demonstration Purpose OnlySubhodeep NandiNo ratings yet

- New Products Launch by New IndiaDocument52 pagesNew Products Launch by New IndiaNewindia assuranceNo ratings yet

- Maxima Health Insurance Prospectus SummaryDocument3 pagesMaxima Health Insurance Prospectus SummarySaurabh SoodNo ratings yet

- agentAUX - 2 Dec 2022 21 34 13testDocument5 pagesagentAUX - 2 Dec 2022 21 34 13testNirav ChauhanNo ratings yet

- Health InsuranceDocument18 pagesHealth Insurancesneha sarodeNo ratings yet

- TATA Medicare PremierDocument10 pagesTATA Medicare PremierRenu SahetaNo ratings yet

- National Insurance Arogya Sanjeevani PolicyDocument18 pagesNational Insurance Arogya Sanjeevani PolicySAYAN SARKARNo ratings yet

- Arogya Sanjeevani Policy, Icici Lombard Prospectus: What Is Covered?Document11 pagesArogya Sanjeevani Policy, Icici Lombard Prospectus: What Is Covered?pradiphdasNo ratings yet

- Cigna TTK Health Insurance Prohealth Cash ProspectusDocument12 pagesCigna TTK Health Insurance Prohealth Cash ProspectusChrissy CattonNo ratings yet

- Endowment Policy: By: Prateek BindalDocument38 pagesEndowment Policy: By: Prateek BindalPrateek BindalNo ratings yet

- ICICI Pru Saral Jeevan BimaDocument9 pagesICICI Pru Saral Jeevan BimaThampy ATNo ratings yet

- Anmol Jeevan - 9811896425Document1 pageAnmol Jeevan - 9811896425Harish ChandNo ratings yet

- Heart and Health BrochureDocument30 pagesHeart and Health BrochureApoorva kNo ratings yet

- Endowment PolicyDocument38 pagesEndowment PolicyGourav DeNo ratings yet

- Company Profile: Bajaj Allianz General Insurance Company LinitedDocument27 pagesCompany Profile: Bajaj Allianz General Insurance Company Linitedsidhantha100% (1)

- Prospectus New India Floater Mediclaim Wef 01 04 2021Document26 pagesProspectus New India Floater Mediclaim Wef 01 04 2021SnehaAnilSurveNo ratings yet

- A. Life and Disability Insurance Plan B PDFDocument11 pagesA. Life and Disability Insurance Plan B PDFRickz CabaloNo ratings yet

- Financial PlanningDocument29 pagesFinancial PlanningAbhas AgarwalNo ratings yet

- Advantage: A Health Cover For at The Cost of Your Monthly Internet BillDocument4 pagesAdvantage: A Health Cover For at The Cost of Your Monthly Internet BillAmitabh WaghmareNo ratings yet

- Health-Booster BrochureDocument10 pagesHealth-Booster BrochureParasaram SrinivasNo ratings yet

- Textbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterFrom EverandTextbook of Urgent Care Management: Chapter 9, Insurance Requirements for the Urgent Care CenterNo ratings yet

- 16 Year at 41 AgeDocument4 pages16 Year at 41 AgeHarish ChandNo ratings yet

- Jeevan AkshayDocument1 pageJeevan AkshayHarish ChandNo ratings yet

- Corporate AgentsDocument1,023 pagesCorporate AgentsVivek Thota0% (1)

- Agency Presentation - ZTCDocument24 pagesAgency Presentation - ZTCHarish ChandNo ratings yet

- All Illustration of LICDocument6 pagesAll Illustration of LICHarish ChandNo ratings yet

- Mr. Gupta: Insurance Proposal ForDocument8 pagesMr. Gupta: Insurance Proposal ForHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- Rad 28 E72Document1 pageRad 28 E72Harish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Mrs. Nirali Mehta: Insurance Proposal ForDocument5 pagesMrs. Nirali Mehta: Insurance Proposal ForHarish ChandNo ratings yet

- Rad 20356Document1 pageRad 20356Harish ChandNo ratings yet

- Harish Chand: Jeevan Anand Plan PresentationDocument4 pagesHarish Chand: Jeevan Anand Plan PresentationHarish ChandNo ratings yet

- Anmol Jeevan - 9811896425Document1 pageAnmol Jeevan - 9811896425Harish ChandNo ratings yet

- Mr. Gupta: Harish ChandDocument4 pagesMr. Gupta: Harish ChandHarish ChandNo ratings yet

- Mr. Harish Chand: Presentation Specially Prepared ForDocument4 pagesMr. Harish Chand: Presentation Specially Prepared ForHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Rad 211 D0Document1 pageRad 211 D0Harish ChandNo ratings yet

- Premiums Due Statement: Harish ChandDocument1 pagePremiums Due Statement: Harish ChandHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Rad 1 FDF9Document2 pagesRad 1 FDF9Harish ChandNo ratings yet

- Rad 1 F405Document3 pagesRad 1 F405Harish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- All Illustration of LICDocument6 pagesAll Illustration of LICHarish ChandNo ratings yet

- Rad 1 F405Document3 pagesRad 1 F405Harish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Harish Chand: Multi - Plan ChartDocument4 pagesHarish Chand: Multi - Plan ChartHarish ChandNo ratings yet

- Jeevan Saral IllustrationDocument3 pagesJeevan Saral IllustrationHarish ChandNo ratings yet

- PrakashDocument51 pagesPrakashRavi GahlotNo ratings yet

- UNCTAD Report Analyzes 2008-2010 Iron Ore MarketDocument99 pagesUNCTAD Report Analyzes 2008-2010 Iron Ore MarketppmusNo ratings yet

- An Endowment Policy Is A Life Insurance Contract Designed To Pay A Lump Sum After A Specific TermDocument3 pagesAn Endowment Policy Is A Life Insurance Contract Designed To Pay A Lump Sum After A Specific TermParmeshwar SutharNo ratings yet

- ) Presenting The Contribution As A Group of Assets 2: Does Not Equal Pay Receive Is Not DeterminedDocument20 pages) Presenting The Contribution As A Group of Assets 2: Does Not Equal Pay Receive Is Not Determinedايهاب غزالةNo ratings yet

- Steven Belkin Case AnalysisDocument7 pagesSteven Belkin Case AnalysisDiva PatriciaNo ratings yet

- Economy Current Affairs by Teju, Nextgen Ias - November 2020Document50 pagesEconomy Current Affairs by Teju, Nextgen Ias - November 2020akshaygmailNo ratings yet

- MNP Transfer PricingDocument2 pagesMNP Transfer PricingNational PostNo ratings yet

- 100-F2014 Assignment 6 Perfect Competition, Monopoly and Consumer Choice TheoryDocument6 pages100-F2014 Assignment 6 Perfect Competition, Monopoly and Consumer Choice TheoryKristina Phillpotts-BrownNo ratings yet

- Investing in Perak's Manufacturing SectorDocument12 pagesInvesting in Perak's Manufacturing SectorPrasath RajuNo ratings yet

- Landmark HondaDocument39 pagesLandmark HondaAnuj KadelNo ratings yet

- TCS Acquiring CMC: Project Report On MACR Submitted To: Prof. J. S. MatharuDocument22 pagesTCS Acquiring CMC: Project Report On MACR Submitted To: Prof. J. S. MatharuAdithi VaishNo ratings yet

- Maths Chapter 1Document18 pagesMaths Chapter 1Abrha636100% (3)

- FAR23 Employee Benefits - With AnsDocument13 pagesFAR23 Employee Benefits - With AnsAJ Cresmundo100% (1)

- CRT Mock Test Level 1 Question Paper (Confidential)Document3 pagesCRT Mock Test Level 1 Question Paper (Confidential)yr48No ratings yet

- Netflix: Submitted By:-Avinash Kumar 19022 Core 1Document11 pagesNetflix: Submitted By:-Avinash Kumar 19022 Core 1Aastha GiriNo ratings yet

- Ey - Report - Ipo Q1 2019Document37 pagesEy - Report - Ipo Q1 2019JimmyNo ratings yet

- Exchange Rates & Foreign Markets DocumentDocument5 pagesExchange Rates & Foreign Markets DocumentclareNo ratings yet

- Colgate Palmolive Company: A Quick SWOT AnalysisDocument14 pagesColgate Palmolive Company: A Quick SWOT AnalysisPalak SinghalNo ratings yet

- Types of Dividend PolicyDocument7 pagesTypes of Dividend PolicyRakibul Islam JonyNo ratings yet

- Tech Analysis - Martin PringDocument149 pagesTech Analysis - Martin Pringapi-374452792% (13)

- Wal-Mart's Global Expansion Risks and StrategiesDocument8 pagesWal-Mart's Global Expansion Risks and StrategiesChunxiao QiuNo ratings yet

- History of Money: 1. Early Money 3. Paper Money - Carrying Around Large Quantities ofDocument6 pagesHistory of Money: 1. Early Money 3. Paper Money - Carrying Around Large Quantities ofDivine Grace JasaNo ratings yet

- Price Theory 2018-2021Document20 pagesPrice Theory 2018-2021Gabriel RoblesNo ratings yet

- Marketing Strategies of Asian PaintsDocument39 pagesMarketing Strategies of Asian PaintsSandiep SinghNo ratings yet

- Introduction To Money: The Medium of ExchangeDocument10 pagesIntroduction To Money: The Medium of ExchangeDHWANI DEDHIANo ratings yet

- Commodity Manager Supplier Procurement in Los Angeles CA Resume Diane MorrisDocument2 pagesCommodity Manager Supplier Procurement in Los Angeles CA Resume Diane MorrisDianeMorris2No ratings yet

- Platts Pe 24 June 2015Document12 pagesPlatts Pe 24 June 2015mcontrerjNo ratings yet

- CHAPTER 6 - Capital Asset Pricing ModelDocument23 pagesCHAPTER 6 - Capital Asset Pricing Modelemmiliana kasamaNo ratings yet

- Calculate WACC to Evaluate New ProjectsDocument52 pagesCalculate WACC to Evaluate New ProjectsksachchuNo ratings yet