Professional Documents

Culture Documents

Jeevan Bharti A Women Plan - 9811896425

Uploaded by

Harish ChandOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jeevan Bharti A Women Plan - 9811896425

Uploaded by

Harish ChandCopyright:

Available Formats

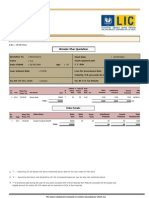

Harish Chand

Delhi LIC Agent

577, GH-9, PASCHIM VIHAR

NEW DELHI- 110087

INDIA, 9811896425, 9212201725

www.delhiLICagent.com

160 - Jeevan Bharati

Pg. 1

Term Age Sum

Minimum 15 18 50000

Maximum 20 50 2500000

Premium Ceasing Age : 70 Premium Ceasing Term : 0

Plan Highlights

Features

Jeevan Bharati is a money back plan covering illness peculiar to women. Female Critical Illness

(FCI) benefit and Congenital Disability Benefit (CDB) cover will be available to proposers under

the Jeevan Bharati plan.

Special Features

· This policy offers guaranteed additions at a rate of Rs.50/- per thousand basic sum assured

to accrue at the end of each completed year for which premium is paid, during the first 5

years of a policy and will be paid on death or maturity.

· 20% of the Sum Assured will be offered at the end of 5/10 years for a 15 year term

(balance payable on maturity plus Guaranteed Additions plus bonus, if any)

· Free Insurance cover: Provided at least two years' premiums have been paid under a

policy, full death cover (irrespective of survival benefit payments made) will be admissible

for a period of three years from the date of first unpaid premium.

· Encashment of survival benefits as and when needed: A policyholder can take the survival

benefits on or after the due dates, but before the date of maturity. In case of deferment,

the Corporation will pay increased survival benefit, and the increment will be at rates

decided by the Corporation from time to time.

· Accident and Disability Benefit (optional): Accident Benefit can be availed under this plan,

subject to the payment of an additional premium of Re.1/- per thousand Sum Assured. This

is inclusive of the maximum limit of Rs.25,00,000 placed under other life insurance plans

taken from Life Insurance Corporation of India.

· Flexibility to pay premiums in advance: A policyholder will have the flexibility to pay the

next yearly premium in advance (in maximum three instalments). She will be eligible for a

premium rebate of 4% p.a. for complete number of months on the portion of premium

paid.

· Option to receive maturity benefits in the form of an annuity: The policyholder will have the

option (to be exercised 6 months before the date of maturity) to receive the maturity

proceeds (including Guaranteed Additions and bonuses) in the form of an annuity. The

immediate annuity rates prevalent at the time of maturity will be applicable.

Benefits

Survival Benefits:

Survival benefits will be paid at the end of 5, 10 and 15 years. As a percentage of basic sum

assured for a 15 year plan the insured will receive 20 percent each at the end of 5 years and

10 years respectively. In case of a 20 year plan the insured will receive 20 percent at the end

of 5, 10 and 15 years respectively.

Death Benefit:

Full Sum Assured irrespective of all earlier survival benefits paid plus Guaranteed Additions

Insure And Be Secure

Plan Features Continue .......... Pg. 2

Insure And Be Secure

You might also like

- Bima Gold by Lic of India - 9811896425Document3 pagesBima Gold by Lic of India - 9811896425Harish ChandNo ratings yet

- Akansha Investment Services: Home Products Services SMS Service FAQ Contact DetailsDocument6 pagesAkansha Investment Services: Home Products Services SMS Service FAQ Contact Detailssarup007No ratings yet

- Life BrochureDocument8 pagesLife BrochureHar DonNo ratings yet

- Jeevan Nidhi - 9811896425Document3 pagesJeevan Nidhi - 9811896425Harish ChandNo ratings yet

- Kotak Money Back PlanDocument2 pagesKotak Money Back PlanDriptendu MaitiNo ratings yet

- Benefits:: Participation in ProfitsDocument10 pagesBenefits:: Participation in Profitslakshman777No ratings yet

- Aadhaar StambhDocument16 pagesAadhaar StambhAbhijeetNo ratings yet

- Jeevan Surabhi - 106 - 107 - 108Document3 pagesJeevan Surabhi - 106 - 107 - 108Vinay KumarNo ratings yet

- Brochure SUD Life Jeevan AshrayDocument6 pagesBrochure SUD Life Jeevan Ashrayayushman rajNo ratings yet

- LIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentDocument11 pagesLIC's JEEVAN RAKSHAK (UIN: 512N289V01) - : Policy DocumentSaravanan DuraiNo ratings yet

- Dhan Vriddhi English Sales BrochureDocument16 pagesDhan Vriddhi English Sales BrochureNimesh PrakashNo ratings yet

- Dhan Varsha Sales BrochureDocument12 pagesDhan Varsha Sales BrochureCyril PilligrinNo ratings yet

- LIC - New Tech Term - Sales BrochureDocument11 pagesLIC - New Tech Term - Sales BrochureRahul ChauhanNo ratings yet

- Presentation ON Ulips: By: Sahil Arora 04721201810 BBA (B&I) 5 SEM. 2 ShiftDocument23 pagesPresentation ON Ulips: By: Sahil Arora 04721201810 BBA (B&I) 5 SEM. 2 ShiftSahil AroraNo ratings yet

- A Nu RagDocument9 pagesA Nu RagHarish ChandNo ratings yet

- Pradhan Mantri Vaya Vandana Yojana 05052018Document12 pagesPradhan Mantri Vaya Vandana Yojana 05052018SINU0607IITEEENo ratings yet

- Rad 01291Document2 pagesRad 01291Harish ChandNo ratings yet

- Product DetailsDocument13 pagesProduct Detailskannakumar1983No ratings yet

- LIC's Jeevan Anurag PlanDocument10 pagesLIC's Jeevan Anurag PlanMandheer ChitnavisNo ratings yet

- Sales Brochure LIC S Navjeevan To CC DeptDocument14 pagesSales Brochure LIC S Navjeevan To CC DeptRajasekar KaruppusamyNo ratings yet

- Insurance Pension PlansDocument35 pagesInsurance Pension Plansedrich1932No ratings yet

- Sales Brochure - LIC S New Children S Money Back PlanDocument11 pagesSales Brochure - LIC S New Children S Money Back Planamit_saxena_10No ratings yet

- Kotak Money Back PlanDocument2 pagesKotak Money Back PlanRupran RaiNo ratings yet

- Lic Market Plus IDocument8 pagesLic Market Plus Ianpuselvi125No ratings yet

- Lic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020Document16 pagesLic Leaflet Jeevan Anand 4 5x8 Inches WXH DEC 2020bantwal_venkateshNo ratings yet

- Benefits:: (A Non-Linked, Participating, Limited Premium, Individual, Life Assurance Savings Plan)Document11 pagesBenefits:: (A Non-Linked, Participating, Limited Premium, Individual, Life Assurance Savings Plan)coolestkasinovaNo ratings yet

- Sales - Brochure - LIC S New Money Back 25 Yrs PlanDocument11 pagesSales - Brochure - LIC S New Money Back 25 Yrs PlanShubham PandeyNo ratings yet

- Endowment PolicyDocument38 pagesEndowment PolicyGourav DeNo ratings yet

- Max Life Monthly Income Advantage Plan ProspectusDocument11 pagesMax Life Monthly Income Advantage Plan Prospectushemantchawla89No ratings yet

- LIC's Jeevan Umang plan offers income, protection and savingsDocument14 pagesLIC's Jeevan Umang plan offers income, protection and savingsmanoj gokikarNo ratings yet

- Lic Leaflet Endoment Plan4 5x8 Inches WXH NewDocument16 pagesLic Leaflet Endoment Plan4 5x8 Inches WXH NewVishal 777No ratings yet

- Addar ShilaDocument16 pagesAddar ShilaK M Reddy ReddyNo ratings yet

- GSIP BrochureDocument2 pagesGSIP Brochureabdul.nm4064No ratings yet

- Exide Life InsuranceDocument26 pagesExide Life InsuranceMaheshNo ratings yet

- Endowment Policy: By: Prateek BindalDocument38 pagesEndowment Policy: By: Prateek BindalPrateek BindalNo ratings yet

- Jeev Anankur-807 - CircularDocument8 pagesJeev Anankur-807 - CircularKamlesh Kumar Mandal100% (1)

- PD 191 Modified LIC's AADHAAR SHILA Plan No.944Document14 pagesPD 191 Modified LIC's AADHAAR SHILA Plan No.944Ram Shanker DewanganNo ratings yet

- Reliance Life Insurance Super Endowment Plan benefitsDocument13 pagesReliance Life Insurance Super Endowment Plan benefitsmiteshtakeNo ratings yet

- Never Put All Eggs in One Basket: Insurance Portfolio Suggested For Mr. D. BansalDocument8 pagesNever Put All Eggs in One Basket: Insurance Portfolio Suggested For Mr. D. BansalmonamipanjaNo ratings yet

- LIC Jeevan Anand HomeDocument3 pagesLIC Jeevan Anand HomeAnkit AgarwalNo ratings yet

- Fulfil dreams with HDFC Life Super Income PlanDocument8 pagesFulfil dreams with HDFC Life Super Income PlanSajeed ShaikhNo ratings yet

- Sales Brochure LIC S Jeevan Lakshya PDFDocument11 pagesSales Brochure LIC S Jeevan Lakshya PDFamit_saxena_10No ratings yet

- Child Fortune Plus Write UpDocument7 pagesChild Fortune Plus Write Upap87No ratings yet

- 5 YearDocument1 page5 YearHarish ChandNo ratings yet

- LIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - EngDocument13 pagesLIC - Jeevan Labh - Brochure - 9 Inch X 8 Inch - Engnakka_rajeevNo ratings yet

- Aviva i-Life Secure Provides Regular Income for 15 YearsDocument1 pageAviva i-Life Secure Provides Regular Income for 15 YearsPinal JEngineerNo ratings yet

- Jeevan-Bharati_512N220V01Document4 pagesJeevan-Bharati_512N220V01darkhank420No ratings yet

- 934 Sales Brochure Jeevan TarunDocument16 pages934 Sales Brochure Jeevan TarunRV Ranveer SharmaNo ratings yet

- Bima Nivesh Triple Cover Table NoDocument3 pagesBima Nivesh Triple Cover Table Noravirawat15No ratings yet

- LIC's Endowment Plus: (Plan No. 802)Document16 pagesLIC's Endowment Plus: (Plan No. 802)Abhinav VermaNo ratings yet

- Smartkid RPDocument6 pagesSmartkid RPRajbir Singh YadavNo ratings yet

- Secure Income Plan BrochureDocument18 pagesSecure Income Plan Brochuremantoo kumarNo ratings yet

- LICJeevan AnuragDocument10 pagesLICJeevan Anuragnadhiya2007No ratings yet

- Lic Pension PlansDocument5 pagesLic Pension PlansMarsh JainNo ratings yet

- Jeevan SafarDocument7 pagesJeevan SafarNishant SinhaNo ratings yet

- Tata AIA Life Insurance Sampoorna Raksha+: FeaturesDocument6 pagesTata AIA Life Insurance Sampoorna Raksha+: Featuressenthilkumar.sNo ratings yet

- LIC Jeevan Anurag Plan ReviewDocument11 pagesLIC Jeevan Anurag Plan ReviewJayaram JaiNo ratings yet

- 836 JeevanLabh 304V01 SLDocument9 pages836 JeevanLabh 304V01 SLPriya PahujaNo ratings yet

- LIC's Jeevan Labh plan overviewDocument9 pagesLIC's Jeevan Labh plan overviewPriya PahujaNo ratings yet

- How to Enroll in Medicare Health Insurance: Choose a Medicare Part D Drug Plan and a Medicare Supplement PlanFrom EverandHow to Enroll in Medicare Health Insurance: Choose a Medicare Part D Drug Plan and a Medicare Supplement PlanNo ratings yet

- 16 Year at 41 AgeDocument4 pages16 Year at 41 AgeHarish ChandNo ratings yet

- Agency Presentation - ZTCDocument24 pagesAgency Presentation - ZTCHarish ChandNo ratings yet

- Corporate AgentsDocument1,023 pagesCorporate AgentsVivek Thota0% (1)

- Anmol Jeevan - 9811896425Document1 pageAnmol Jeevan - 9811896425Harish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Rad 28 E72Document1 pageRad 28 E72Harish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- Harish Chand: Jeevan Anand Plan PresentationDocument4 pagesHarish Chand: Jeevan Anand Plan PresentationHarish ChandNo ratings yet

- Rad 211 D0Document1 pageRad 211 D0Harish ChandNo ratings yet

- Mr. Gupta: Harish ChandDocument4 pagesMr. Gupta: Harish ChandHarish ChandNo ratings yet

- Mr. Gupta: Insurance Proposal ForDocument8 pagesMr. Gupta: Insurance Proposal ForHarish ChandNo ratings yet

- Mr. Harish Chand: Presentation Specially Prepared ForDocument4 pagesMr. Harish Chand: Presentation Specially Prepared ForHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Mrs. Nirali Mehta: Insurance Proposal ForDocument5 pagesMrs. Nirali Mehta: Insurance Proposal ForHarish ChandNo ratings yet

- Jeevan AkshayDocument1 pageJeevan AkshayHarish ChandNo ratings yet

- All Illustration of LICDocument6 pagesAll Illustration of LICHarish ChandNo ratings yet

- All Illustration of LICDocument6 pagesAll Illustration of LICHarish ChandNo ratings yet

- Rad 1 F405Document3 pagesRad 1 F405Harish ChandNo ratings yet

- Rad 1 FDF9Document2 pagesRad 1 FDF9Harish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Jeevan Saral IllustrationDocument3 pagesJeevan Saral IllustrationHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Rad 20356Document1 pageRad 20356Harish ChandNo ratings yet

- Rad 1 F405Document3 pagesRad 1 F405Harish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Harish Chand: Multi - Plan ChartDocument4 pagesHarish Chand: Multi - Plan ChartHarish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Premiums Due Statement: Harish ChandDocument1 pagePremiums Due Statement: Harish ChandHarish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- 945 - Jeevan UmangDocument6 pages945 - Jeevan UmangSaro SaravananNo ratings yet

- CFP Risk Analysis and Insurance Planning Practice Book SampleDocument34 pagesCFP Risk Analysis and Insurance Planning Practice Book SampleMeenakshi100% (7)

- Guide For Foreign Doctors Working in FinlandDocument10 pagesGuide For Foreign Doctors Working in FinlandNick BourNo ratings yet

- Demystifying IFRS 17 - Philip JacksonDocument26 pagesDemystifying IFRS 17 - Philip JacksonWubneh AlemuNo ratings yet

- INSURANCE Finals ReviewerDocument6 pagesINSURANCE Finals ReviewerRonyr RamosNo ratings yet

- Teamsters Local Union No. 72 - Redacted Bates HWDocument46 pagesTeamsters Local Union No. 72 - Redacted Bates HWAnonymous kprzCiZNo ratings yet

- Health insurance document analysisDocument12 pagesHealth insurance document analysisrishi284No ratings yet

- Land Sale DisputesDocument5 pagesLand Sale DisputesMartinNo ratings yet

- Aviation Insurance GuideDocument12 pagesAviation Insurance GuideMunni ChukkaNo ratings yet

- Insurance Dispute Over Fire Damage PaymentDocument37 pagesInsurance Dispute Over Fire Damage PaymentMonica MoranteNo ratings yet

- CM2A September23 EXAM Clean ProofDocument7 pagesCM2A September23 EXAM Clean ProofVishva ThombareNo ratings yet

- Kudankulam Nuclear Power ProjectDocument30 pagesKudankulam Nuclear Power ProjectRadhe MohanNo ratings yet

- Comparative Analysis of Insurance Product of HDFC BankDocument67 pagesComparative Analysis of Insurance Product of HDFC BankUmar ThukarNo ratings yet

- Business Studies TermDocument9 pagesBusiness Studies TermPiyush JhamNo ratings yet

- Beyond Walls:: Business Ethics ABM-12Document2 pagesBeyond Walls:: Business Ethics ABM-12Cassandra De SenaNo ratings yet

- HDFC FW Comprehensive MH70UVIVIGJ 1705417806189Document2 pagesHDFC FW Comprehensive MH70UVIVIGJ 1705417806189f2994667No ratings yet

- Property RelationsDocument25 pagesProperty RelationsNimpa PichayNo ratings yet

- JKR 203N Pin 2007 PDFDocument32 pagesJKR 203N Pin 2007 PDFZazliana IzattiNo ratings yet

- Professional Responsibility OutlineDocument21 pagesProfessional Responsibility OutlineMissy Meyer100% (2)

- Unlimited Riches Making Your Fortune in Real Estate-966413Document274 pagesUnlimited Riches Making Your Fortune in Real Estate-966413ahmed nawazNo ratings yet

- Company Website Persona First Namelast Namedesignatiocontact IdDocument39 pagesCompany Website Persona First Namelast Namedesignatiocontact IdSiddharthNo ratings yet

- Health Insurance Premium Receipt-RaviDocument2 pagesHealth Insurance Premium Receipt-RaviSanjay Balamurthy100% (1)

- Financial Accounting ACT 421 (Section:1) Assignment For Final AssessmentDocument2 pagesFinancial Accounting ACT 421 (Section:1) Assignment For Final AssessmentAinul Momen RafatNo ratings yet

- Transforming Data Collection From The UK Fnancial Sector: Discussion PaperDocument56 pagesTransforming Data Collection From The UK Fnancial Sector: Discussion PaperRaad AbwiniNo ratings yet

- Summer Internship Report at Insplore ConsultantsDocument17 pagesSummer Internship Report at Insplore ConsultantsHelary Shah0% (1)

- Offer & Appointment Letter DetailsDocument12 pagesOffer & Appointment Letter DetailsArjav Jain0% (1)

- Two Insurance Copy ITDocument1 pageTwo Insurance Copy ITbaranimba5No ratings yet

- Compensation Strategy of Bharti AirtelDocument17 pagesCompensation Strategy of Bharti AirtelParvathi M LNo ratings yet

- National Trust Purchase Order 85292950Document2 pagesNational Trust Purchase Order 85292950Jeremy MooreNo ratings yet