Professional Documents

Culture Documents

Financial History and Ratios

Uploaded by

howieg430 ratings0% found this document useful (0 votes)

77 views1 pageCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

77 views1 pageFinancial History and Ratios

Uploaded by

howieg43Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

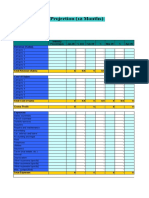

Financial history & ratios

Enter your Company Name here

Fiscal Year Ends Jun-30

RMA Current: from

Average mm/yyyy to

% mm/yyyy % 2000 % 1999 % 1998 %

Assets Notes on Preparation

Cash/ Equivalents $- - $- - $- - $- -

Trade Receivables - - - - You may

- want to print

- this information

- to use as reference

- later. To

delete these instructions, click the border of this text box and then

Inventory Value - - - - press- the DELETE key.

- - -

All other current - - - - - - - -

Total Current The value of a spreadsheet is that it puts a lot of information in one place

Assets - - - - to facilitate

- comparison - and analysis. -Enter information

- from your past

three years' financial statements and from current year-to-date

Fixed Assets (net) - - - - -

statements, - but simplify the

if available, - information in- two ways to fit into

Intangibles (net) - - - - -

this format: - - -

All other - - - - - - - -

Total Assets $- 0.00% $- 0.00% 1) Compress

$- your chart of accounts.$-Your financial

0.00% 0.00% statements, no doubt,

have many more lines than are provided on this spreadsheet. Combine

categories to fit your numbers into this format.

Liabilities/ Equity %

Notes payable (ST) $- - $- - 2) Condense

$- the numbers

- for ease of

$-comprehension.

- We recommend

that you express your values in thousands, rounding to the nearest $100;

Current L. T. Debt - - - - - - - -

i.e., $3,275 would be entered as $3.3.

Trade Payables - - - - - - - -

Income Tax 3) Fill in the "RMA Avg." column.

Payable - - - - a. "RMA"

- refers to the-book Statement- Studies, published

- annually by

Robert Morris Associates, who are now called the Risk Management

All other current - - - - - - - -

Association. The book contains financial average data sorted by type of

Total Current business and size of firm. It is a standard reference for bankers and

Liabilities - - - - - analysts. You- can find it at major

financial - libraries, or- ask your banker.

Long-term Debt - - - - b. Enter

- the percentages - and ratios from- RMA for your - size and type of

business in the "RMA Avg." column. You will note that the format of our

Deferred Taxes - - - - - - - -

spreadsheet is exactly the same as the format in the RMA book.

All other non- c. Note that for some of the ratios, the RMA book gives three numbers.

current - - - - These - are the median- (the value in the- middle of the -range; i.e.: the

Net Worth - - - - "average"),

- the upper -quartile (the value

- half way between

- the middle and

the extreme upper case), and the lower quartile (the value half way

Total Liabilities & between the middle and the extreme lower case).

Net Worth $- 0.00% $- 0.00% $- 0.00% $- 0.00%

4) Analyze your financial history:

Income Data % a. Look for significant changes in absolute values ($) or relative

Net Sales $- 100.00% $- 100.00% distribution

$- of100.00%

Assets, Liabilities, or Expenses

$- (%). What do these

100.00%

changes tell you about how your company is evolving?

Cost of Sales b. Also look for changes in your ratios. Why are ratio values shifting, and

(COGS) - - - - what -does this mean?- - -

Gross Profit - - - - c. If you

- are unfamiliar- with ratio analysis,

- study the "Explanation

- ... and

Definition of Ratios" sections near the front of the RMA book. They are

Operating

exceptionally clear and well written. Periodic ratio analysis will give you

Expenses - - - - - insights into -the financial dynamics

valuable - -

of your company.

Operating Profit - - - - - ratio values -differ from the industry

d. If your - average- for similar firms, try

All other expenses - - - - to understand

- why, and

- explain in the -business plan. -

Pre-tax Profit $- - $- - $- - $- -

Ratio Analysis

Current Ratio 0.0 - - - -

Inventory Turnover 0.0 - - - -

Debt/ Net Worth 0.0 - - - -

% Return on Tang.

N/W 0.00% - - - -

% Return on Assets 0.00% - - - -

You might also like

- Profit and Loss StatementDocument3 pagesProfit and Loss Statementchetnaa100% (1)

- 12-Month Cash Flow ForecastDocument7 pages12-Month Cash Flow Forecastm qaiserNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisVdvg SrinivasNo ratings yet

- BoookDocument4 pagesBoookpranav pandyaNo ratings yet

- Boook 4Document2 pagesBoook 4pranav pandyaNo ratings yet

- Company Name: Purchase Without Tax Invoice / Exp Incl BillDocument10 pagesCompany Name: Purchase Without Tax Invoice / Exp Incl BillrockyrrNo ratings yet

- Projected Financial Statements SummaryDocument43 pagesProjected Financial Statements SummaryKumar SinghNo ratings yet

- CNHS_Canteen_E-SalesDocument1 pageCNHS_Canteen_E-Salestiffany portezNo ratings yet

- BookkeepingDocument4 pagesBookkeepingAriel MercialesNo ratings yet

- Income Tax Calculator FY 2019-20 (AY 2020-21)Document1 pageIncome Tax Calculator FY 2019-20 (AY 2020-21)J DassNo ratings yet

- 2008 CashflowDocument1 page2008 CashflowJohn RichardsNo ratings yet

- Boook 1Document3 pagesBoook 1pranav pandyaNo ratings yet

- Income Tax Calculator FY 2022-23 (AY 2023-24)Document3 pagesIncome Tax Calculator FY 2022-23 (AY 2023-24)Ravindra BagateNo ratings yet

- Guided Projections TMPLDocument4 pagesGuided Projections TMPLvictorialozano013No ratings yet

- Delay Analysis 2019Document4 pagesDelay Analysis 2019Alsayed DiabNo ratings yet

- Class - XII Accountancy Chapter-5 Part - B Cash Flow StatementDocument10 pagesClass - XII Accountancy Chapter-5 Part - B Cash Flow StatementAnonymous NSNpGa3T93No ratings yet

- Analysis of Balance Sheet and Calculation of PBFDocument9 pagesAnalysis of Balance Sheet and Calculation of PBFverinderksharmaNo ratings yet

- Mfar FormatDocument21 pagesMfar FormatKhaerul MalikNo ratings yet

- Cash Flow Forecast ADocument7 pagesCash Flow Forecast AYudith RachmadiahNo ratings yet

- Balance Sheet TemplateDocument4 pagesBalance Sheet TemplateSolomon Ahimbisibwe100% (1)

- Minutes of Meeting 06132020Document6 pagesMinutes of Meeting 06132020Jerome MacasiebNo ratings yet

- Peloton Company Financial ReportDocument48 pagesPeloton Company Financial ReportAli MasoudNo ratings yet

- Project CostDocument3 pagesProject CostSagar WayakoleNo ratings yet

- Rental Property Business Income and ExpensesDocument147 pagesRental Property Business Income and ExpensesFaizal NugrohoNo ratings yet

- Fast - R & Pay.Document128 pagesFast - R & Pay.sufyanNo ratings yet

- Annual Organization Budget With Cash FlowDocument6 pagesAnnual Organization Budget With Cash FlowDiegoNo ratings yet

- Rental Property Income and Expenses V1.0Document149 pagesRental Property Income and Expenses V1.0Gomv Cons0% (1)

- DM 2022Document15 pagesDM 2022siwarabdenadher22No ratings yet

- Cma FormatDocument13 pagesCma FormatPrateek RastogiNo ratings yet

- Financial History and Ratios1Document1 pageFinancial History and Ratios1Mukhlish AkhatarNo ratings yet

- Profit Loss 12 MonthDocument6 pagesProfit Loss 12 MonthMstefNo ratings yet

- 12 Month Profit and Loss WorksheetDocument6 pages12 Month Profit and Loss Worksheetaregb18No ratings yet

- Roshan Tent HouseDocument12 pagesRoshan Tent Houseafroz khanNo ratings yet

- Shree Ganapati Mobile CentreDocument12 pagesShree Ganapati Mobile Centreafroz khanNo ratings yet

- Cash Flow SpreadsheetDocument4 pagesCash Flow SpreadsheetIzwan HafizNo ratings yet

- New Kuswaha Electric CentreDocument12 pagesNew Kuswaha Electric Centreafroz khanNo ratings yet

- Excel TestDocument29 pagesExcel TestHarish KannaNo ratings yet

- Personal Finance Worksheet - SinglesDocument23 pagesPersonal Finance Worksheet - SinglesChelsy SantosNo ratings yet

- MJF Group tea companies balance sheetDocument78 pagesMJF Group tea companies balance sheetDilan Maduranga Fransisku ArachchiNo ratings yet

- Format Pre - LOBDocument21 pagesFormat Pre - LOBJerryJoshuaDiazNo ratings yet

- Excise Reconciliation For The Year 2010-2011 Name of Entity: Excise Redn No. Address Range Division CommissionerateDocument3 pagesExcise Reconciliation For The Year 2010-2011 Name of Entity: Excise Redn No. Address Range Division CommissionerateVishal GiriNo ratings yet

- Salary Adjustment SpreadsheetDocument4 pagesSalary Adjustment SpreadsheetanasNo ratings yet

- Annual Report 4Document5 pagesAnnual Report 4Rakib ShikderNo ratings yet

- Bloo IndDocument10 pagesBloo IndsemledeztcvyjnmmnuNo ratings yet

- Sole Trader or Partnership VAT Business Plan Financials 2017Document25 pagesSole Trader or Partnership VAT Business Plan Financials 2017Phuc NguyenNo ratings yet

- Income Tax Calculation Sheet For Financialyear 2018-19 (A.Y.2019-20)Document8 pagesIncome Tax Calculation Sheet For Financialyear 2018-19 (A.Y.2019-20)Giri SukumarNo ratings yet

- Roman Merchandising Purchases Journal Date JV No. Bought From Explanation Credit INV. No. DR CR CR Terms Purch Cash APDocument14 pagesRoman Merchandising Purchases Journal Date JV No. Bought From Explanation Credit INV. No. DR CR CR Terms Purch Cash APJedidiah ManglicmotNo ratings yet

- Sharda AgrovetDocument12 pagesSharda Agrovetafroz khanNo ratings yet

- Booook 2Document2 pagesBooook 2pranav pandyaNo ratings yet

- Financial TemplateDocument6 pagesFinancial TemplateLiyin LeeNo ratings yet

- 5 - Profit and Loss WorksheetDocument8 pages5 - Profit and Loss WorksheetMarc Joshua VillordonNo ratings yet

- Personal Budget SpreadsheetDocument12 pagesPersonal Budget SpreadsheetViruxy ViruxNo ratings yet

- Company Financial History and RatiosDocument1 pageCompany Financial History and Ratiospradhan13No ratings yet

- Income Statement Analysis 2003-2011Document4 pagesIncome Statement Analysis 2003-2011Sameer NevileNo ratings yet

- XYZ Company: Cash Flow Schedule 2013Document4 pagesXYZ Company: Cash Flow Schedule 2013Roger LiuNo ratings yet

- RED plans and add-ons comparisonDocument1 pageRED plans and add-ons comparisonPratik MitraNo ratings yet

- Tds On SalaryDocument3 pagesTds On SalaryRakeshsingh145No ratings yet