Professional Documents

Culture Documents

Strategic Review Feb2008

Uploaded by

justin_1230 ratings0% found this document useful (0 votes)

35 views4 pagesWorldwide technology products and related services sector spends are estimated to have grown at 7. Per cent to nearly reach USD 1. Trillion in 2007. India's IT-BPO revenue aggregate is expected to grow by over 33 per cent and reach USD 64 billion by the end of FY2008. Domestic IT market (including hardware) is estimated to reach 23. Billion in FY2008 as against USD 16. Billion in FY2007.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentWorldwide technology products and related services sector spends are estimated to have grown at 7. Per cent to nearly reach USD 1. Trillion in 2007. India's IT-BPO revenue aggregate is expected to grow by over 33 per cent and reach USD 64 billion by the end of FY2008. Domestic IT market (including hardware) is estimated to reach 23. Billion in FY2008 as against USD 16. Billion in FY2007.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views4 pagesStrategic Review Feb2008

Uploaded by

justin_123Worldwide technology products and related services sector spends are estimated to have grown at 7. Per cent to nearly reach USD 1. Trillion in 2007. India's IT-BPO revenue aggregate is expected to grow by over 33 per cent and reach USD 64 billion by the end of FY2008. Domestic IT market (including hardware) is estimated to reach 23. Billion in FY2008 as against USD 16. Billion in FY2007.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 4

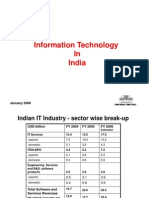

Indian IT Industry

Key Highlights of the IT-BPO sector performance in FY 2007-08

IT Industry-Sector-wise break-up

USD billion FY2004 FY2005 FY2006 FY2007 FY2008 E

IT Services 10.4 13.5 17.8 23.5 31.0

-Exports 7.3 10.0 13.3 18.0 23.1

-Domestic 3.1 3.5 4.5 5.5 7.9

BPO 3.4 5.2 7.2 9.5 12.5

-Exports 3.1 4.6 6.3 8.4 10.9

-Domestic 0.3 0.6 0.9 1.1 1.6

Engineering Services and 2.9 3.8 5.3 6.5 8.5

R&D, Software Products

-Exports 2.5 3.1 4.0 4.9 6.3

-Domestic 0.4 0.7 1.3 1.6 2.2

Total Software and Services 16.7 22.5 30.3 39.5 52.0

Revenues

Of which, exports are 12.9 17.7 23.6 31.3 40.3

Hardware 5.0 5.6 7.1 8.5 12.0

-Exports n.a. 0.5 0.6 0.5 0.5

-Domestic n.a. 5.1 6.5 8.0 11.5

Total IT Industry 21.6 28.2 37.4 48.0 64.0

(including Hardware)

N.A.: Not available

Note: Figures may not add up due to rounding off.

Source: NASSCOM

GLOBAL SOURCING TRENDS IN 2007

! Worldwide technology products and related services sector spends are estimated to

have grown at 7.3 per cent to nearly reach USD 1.7 trillion in 2007

! IT-BPO services, growing at an above-sector-average rate of nearly 8 per cent,

remain the largest category, accounting for an increasing share of the worldwide

technology sector revenue aggregate.

! Outsourcing continues to be the primary growth driver, sustained by gradual shifts

in regional spending patterns – with increasing traction in Europe and Asia Pacific

offsetting a marginal decline in share of the Americas.

! Underlying this steady growth in services spends is the increasing adoption and

continued evolution of the global sourcing supply-chain. Global sourcing of

technology related services is estimated to have grown by about 30 per cent to

reach USD 70-76 billion in 2007.

Indian IT Industry

! Increasing emphasis on innovation-led growth added to the secular trend in

technology related spending, with IT-enablement.

! Global delivery now being recognized as complementary means of effectively

increasing productivity, reducing time-to-market and thereby increasing the

returns on innovation investment.

INDIAN IT-BPO PERFORMANCE IN FY2008

! The Indian IT-BPO revenue aggregate is expected to grow by over 33 per cent and

reach USD 64 billion by the end of FY2008.

o IT exports (including hardware exports) are expected to cross USD 40.8

billion in FY2008 as against USD 31.9 billion in FY2007, a growth of 28 per

cent.

o Domestic IT market (including hardware) is estimated to reach 23.2 billion

in FY2008 as against USD 16.2 billion in FY2007, a growth of 43 per cent

! The direct employment in the sector is expected to reach nearly 2 million, an

increase of about 375,000 professionals over FY2007.

o IT services exports, BPO exports and Domestic IT industry provides direct

employment to 865,000, 704,000 and 427,000 professionals respectively.

! As a proportion of national GDP, the Indian technology sector revenue has grown

from 1.2 per cent in FY1998 to an estimated 5.5 per cent in FY2008.

SOFTWARE AND SERVICES EXPORTS FY 2008:

! Exports remain the mainstay of the sector

and are estimated to reach USD 40.3

billion in FY2008, contributing nearly 64

per cent to the overall revenue aggregate

! IT services (excluding BPO, product

development and engineering services),

contributing to 57 per cent of the total

software and services exports, remains

the dominant segment and is expected to

cross USD 23 billion, a growth of 28 per

cent in FY2008.

Split by service offerings in IT Services

! BPO services, accounting for over

27 per cent of the export

aggregate, is the fastest growing

segment across software and

services exports driven by scale as

well as scope. Export revenues for

this segment are expected to cross

Split by service offerings in BPO services

Indian IT Industry

USD 10.9 billion, a growth of 30 per cent in

FY2008.

! Export revenues from relatively high-value-

added services such as engineering and

R&D, offshore product development and

made-in-India software products is

estimated to be growing at over 27 per

cent, and are forecast to reach USD 6.3

billion in FY2008.

Split by service offerings in S/w

products & Eng. Services

! While US & UK remained the largest export markets

(accounting for about 61 per cent and 18 per cent

respectively, in FY2007), the industry is steadily

increasing its exposure to other geographies. Exports to

Continental Europe in particular have witnessed notable

gains, growing at a CAGR of more than 55 per cent over

FY2004-2007.

Geographic market

exposure of IT-BPO Exports

! Banking, Financial Services

and Insurance (BFSI) remains

the largest vertical market for

Indian IT-BPO exports,

followed by High-technology

and Telecom accounting for

nearly 60 per cent in FY2007.

Manufacturing and Retail

followed, contributing 23 per

cent to the aggregate. Other

key segments include Media,

Healthcare, Airlines and

Transportation, and Utilities.

Vertical Split for Indian IT-BPO Exports

DOMESTIC IT MARKET IN FY2008

! Technology adoption in the domestic market also reported steady gains in 2007.

This segment is expected to cross USD 23 billion in FY2008, reporting healthy

growth across all key segments.

o Hardware remains the largest segment of the domestic market, and is

expected to grow at 44 per cent in FY2008.

Indian IT Industry

o Domestic IT services spends are estimated to be growing at about 43 per

cent in FY2008.

! Software and services and BPO spending growth in the domestic market is being

supported by increasing adoption, and is expected to grow by over 42 per cent and

45 per cent, respectively.

! Growing levels of technology adoption are now accompanied by a steady

appreciation of the rupee, is also making India more attractive as a market – even

for players that had earlier maintained a stricter focus on exports.

You might also like

- Indian IT-BPO Industry 2009: NASSCOM AnalysisDocument5 pagesIndian IT-BPO Industry 2009: NASSCOM AnalysisMaruthi Krishna TuragaNo ratings yet

- Mumbai: Trade Body and 'Voice' of The IT - BPO Industry in India NASSCOM Has AnnouncedDocument6 pagesMumbai: Trade Body and 'Voice' of The IT - BPO Industry in India NASSCOM Has AnnouncedBinaya SabataNo ratings yet

- Project On Investment AnalysisDocument69 pagesProject On Investment Analysispavsbiet07No ratings yet

- Infrastructure System E - Infrastructure Indian ICT Sector Overview Sector Profile & DevelopmentsDocument25 pagesInfrastructure System E - Infrastructure Indian ICT Sector Overview Sector Profile & DevelopmentsSaurabh SumanNo ratings yet

- Information Technology': GPTAIE Presentation OnDocument54 pagesInformation Technology': GPTAIE Presentation OnKaran AhujaNo ratings yet

- Industry Overview - ITDocument5 pagesIndustry Overview - ITNidhi RathodNo ratings yet

- IT-BPM Industry UpdateDocument8 pagesIT-BPM Industry UpdateGovinda SomaniNo ratings yet

- Summer Project - HarshitaDocument19 pagesSummer Project - Harshitasailesh60No ratings yet

- It & Ites: Presented By: Harpreet Singh Meghna Peethambaran Vijay Subramanian Giridhar KrishnaDocument26 pagesIt & Ites: Presented By: Harpreet Singh Meghna Peethambaran Vijay Subramanian Giridhar KrishnaKavitha PeethambaranNo ratings yet

- Final Project WorkDocument100 pagesFinal Project WorkRaja SekharNo ratings yet

- Global Sourcing TrendsDocument5 pagesGlobal Sourcing Trendsraghavendra38No ratings yet

- Information TechnologyDocument6 pagesInformation TechnologyFayazuddin EtebarNo ratings yet

- IT/ITES Sector in India: An Analysis of Revenue, Employment & GrowthDocument30 pagesIT/ITES Sector in India: An Analysis of Revenue, Employment & GrowthSabitavo DasNo ratings yet

- Case Study: Igate: The Merger With Patni Computer Systems LTDDocument20 pagesCase Study: Igate: The Merger With Patni Computer Systems LTDShone ThattilNo ratings yet

- Industry & Services Information Technology and Information Technology Enabled Services (Ites)Document9 pagesIndustry & Services Information Technology and Information Technology Enabled Services (Ites)rohityadavalldNo ratings yet

- India's Growing IT Industry and Its Contribution to the EconomyDocument29 pagesIndia's Growing IT Industry and Its Contribution to the EconomyVaibhav GalaNo ratings yet

- Business Process OutsourcingDocument21 pagesBusiness Process OutsourcingAnsarAnsariNo ratings yet

- Financial Analysis On TcsDocument28 pagesFinancial Analysis On TcsBidushi Patro20% (5)

- Emerging Trends in Indian IT IndustryDocument1 pageEmerging Trends in Indian IT IndustryGarvitaNo ratings yet

- Marketing of Services - 1Document7 pagesMarketing of Services - 1kirtiraj sahooNo ratings yet

- IT SECTOR BY HARMEET SEHGALDocument9 pagesIT SECTOR BY HARMEET SEHGALMonisha MalhotraNo ratings yet

- Indian Information Technology Industry: Presented By: Govind Singh KushwahaDocument14 pagesIndian Information Technology Industry: Presented By: Govind Singh KushwahadrgovindsinghNo ratings yet

- It & Ites: November 2010Document42 pagesIt & Ites: November 2010pastrana2No ratings yet

- It Sector in India PDFDocument77 pagesIt Sector in India PDFAnish NairNo ratings yet

- Information Technology in India: January 2006Document18 pagesInformation Technology in India: January 2006richdev009_106456088100% (1)

- Analyzing Growth of India's IT IndustryDocument7 pagesAnalyzing Growth of India's IT IndustryMandar KulkarniNo ratings yet

- IBEF IT-and-BPM-January-2021Document34 pagesIBEF IT-and-BPM-January-2021akumar4u100% (1)

- IT-ITes - Beacon Sector Special 2021Document32 pagesIT-ITes - Beacon Sector Special 2021Mammen Vergis PunchamannilNo ratings yet

- Dynamics of Indian IT IndustryDocument42 pagesDynamics of Indian IT IndustryKhushii NaamdeoNo ratings yet

- Athena Consulting - Investment ReportDocument36 pagesAthena Consulting - Investment Reportrevantkalra2006No ratings yet

- AxisCap - India IT and Business Services - SR - 7 Aug 2023Document35 pagesAxisCap - India IT and Business Services - SR - 7 Aug 2023Deepul WadhwaNo ratings yet

- Snehal KambleDocument63 pagesSnehal KambleSheeba MaheshwariNo ratings yet

- It & Ites: April 2010Document40 pagesIt & Ites: April 2010anshulkulshNo ratings yet

- KSA IT Sector U CapitalDocument27 pagesKSA IT Sector U Capitalikhan809No ratings yet

- Electronics 270111Document29 pagesElectronics 270111Vikash KediaNo ratings yet

- IT Industry in India: Indian Education SystemDocument9 pagesIT Industry in India: Indian Education SystemPradeep BommitiNo ratings yet

- A Snap Shot of Indian IT IndustryDocument10 pagesA Snap Shot of Indian IT IndustryGanesh JanakiramanNo ratings yet

- SWOT Analysis of Infosys: Submitted by Sharwan Kumar Mahala JKBS - 090450Document20 pagesSWOT Analysis of Infosys: Submitted by Sharwan Kumar Mahala JKBS - 090450Ashutosh Kumar Dubey100% (1)

- Indian IT IndustryDocument4 pagesIndian IT IndustryPiyush GaurNo ratings yet

- Information_Technology_in_India_PresentDocument10 pagesInformation_Technology_in_India_Presentminaf47No ratings yet

- Studiu de Caz IndiaDocument17 pagesStudiu de Caz IndiaAngela IriciucNo ratings yet

- Make in India PresentationDocument24 pagesMake in India PresentationPsrawat RawatNo ratings yet

- IT & ITes IndustryDocument14 pagesIT & ITes IndustryAchalGuptaNo ratings yet

- It in IndiaDocument27 pagesIt in Indiashashank0803No ratings yet

- Annualreport2006-07 Indian It MinistryDocument65 pagesAnnualreport2006-07 Indian It MinistrysusheelsuryanNo ratings yet

- IT and BPM July 2021Document34 pagesIT and BPM July 2021PrakashNo ratings yet

- IT and BPM May 2021Document34 pagesIT and BPM May 2021wofedor973No ratings yet

- IT & ITeS - 2020Document27 pagesIT & ITeS - 2020Ashutosh PatidarNo ratings yet

- Chapter - V Summary, Conclusion & Suggestions Summary:: Page - 144Document11 pagesChapter - V Summary, Conclusion & Suggestions Summary:: Page - 144vSravanakumarNo ratings yet

- Growth and Development StrategDocument13 pagesGrowth and Development Strategaryaa_statNo ratings yet

- Technical Services & IT SolutionsDocument6 pagesTechnical Services & IT SolutionsVernon VellozoNo ratings yet

- IT Sector Contribution To GDPDocument18 pagesIT Sector Contribution To GDPShiran KhanNo ratings yet

- IT and ITeS Industry in India PDFDocument7 pagesIT and ITeS Industry in India PDFMujahid RezaNo ratings yet

- It Ites March 220313Document34 pagesIt Ites March 220313Doshi KevalNo ratings yet

- Market SurveyDocument3 pagesMarket SurveyJake PaulNo ratings yet

- Exporting Services: A Developing Country PerspectiveFrom EverandExporting Services: A Developing Country PerspectiveRating: 5 out of 5 stars5/5 (2)

- Cellular & Wireless Telecommunication Revenues World Summary: Market Values & Financials by CountryFrom EverandCellular & Wireless Telecommunication Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Wireless Telecommunications Carrier Revenues World Summary: Market Values & Financials by CountryFrom EverandWireless Telecommunications Carrier Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Graphic Design Service Revenues World Summary: Market Values & Financials by CountryFrom EverandGraphic Design Service Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Telecommunications Reseller Revenues World Summary: Market Values & Financials by CountryFrom EverandTelecommunications Reseller Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Women Worth LessDocument4 pagesWomen Worth Lessjustin_123No ratings yet

- UntitledDocument38 pagesUntitledjustin_123No ratings yet

- UntitledDocument38 pagesUntitledjustin_123No ratings yet

- The Quran As Hate SpeechDocument13 pagesThe Quran As Hate Speechjustin_123No ratings yet

- Women Covering Themselves: What Does The Religion of Peace Teach About..Document3 pagesWomen Covering Themselves: What Does The Religion of Peace Teach About..justin_123No ratings yet

- ViolenceDocument9 pagesViolencejustin_123No ratings yet

- Wife BeatingDocument3 pagesWife Beatingjustin_123No ratings yet

- TortureDocument4 pagesTorturejustin_123No ratings yet

- Stealing: What Does The Religion of Peace Teach About..Document3 pagesStealing: What Does The Religion of Peace Teach About..justin_123No ratings yet

- The Assassinations of Satirical Poets in Early IslamDocument23 pagesThe Assassinations of Satirical Poets in Early Islamjustin_123No ratings yet

- The Myths of MuhammadDocument3 pagesThe Myths of Muhammadjustin_123No ratings yet

- Stoning AdulterersDocument3 pagesStoning Adulterersjustin_123No ratings yet

- The Life of MuhammadDocument15 pagesThe Life of Muhammadjustin_123No ratings yet

- The Sex Life of The ProphetDocument5 pagesThe Sex Life of The Prophetjustin_1230% (1)

- SlaveryDocument4 pagesSlaveryjustin_123No ratings yet

- Sex and Sexuality in Islam PrinterDocument77 pagesSex and Sexuality in Islam Printerjustin_123No ratings yet

- Killing For Allah To Avoid HellDocument3 pagesKilling For Allah To Avoid Helljustin_123No ratings yet

- Homosexuality: What Does The Religion of Peace Teach About..Document3 pagesHomosexuality: What Does The Religion of Peace Teach About..justin_123No ratings yet

- Quran and ScienceDocument4 pagesQuran and Sciencejustin_123No ratings yet

- Prostitution Temporary MarriageDocument2 pagesProstitution Temporary Marriagejustin_123No ratings yet

- Forced ConversionDocument4 pagesForced Conversionjustin_123No ratings yet

- Martyrdom Suicide AttacksDocument3 pagesMartyrdom Suicide Attacksjustin_123No ratings yet

- Man in Charge of WomanDocument3 pagesMan in Charge of Womanjustin_123No ratings yet

- Sex and Sexuality in IslamDocument58 pagesSex and Sexuality in Islamjustin_1230% (1)

- Polygamy: What Does The Religion of Peace Teach About..Document3 pagesPolygamy: What Does The Religion of Peace Teach About..justin_123No ratings yet

- Loyalty To Non Muslim GovernmentDocument3 pagesLoyalty To Non Muslim Governmentjustin_123No ratings yet

- Friendship With Christians and JewsDocument4 pagesFriendship With Christians and Jewsjustin_123100% (1)

- Freedom To Criticize IslamDocument3 pagesFreedom To Criticize Islamjustin_123No ratings yet

- Lying Taqiyya and KitmanDocument4 pagesLying Taqiyya and Kitmanjustin_123No ratings yet

- JizyaDocument2 pagesJizyajustin_123No ratings yet

- Atik's Supplement 2023 May PDFDocument32 pagesAtik's Supplement 2023 May PDFMd. Jahidur RahmanNo ratings yet

- Question Papers of Anna University IBMDocument9 pagesQuestion Papers of Anna University IBMKrishnamurthy Prabhakar83% (6)

- Annual Report - 2012-2013 - English-French-Spanish-Russian PDFDocument72 pagesAnnual Report - 2012-2013 - English-French-Spanish-Russian PDFandres14830% (1)

- Independence Interdependence and DependenceDocument21 pagesIndependence Interdependence and DependenceShreepanjali ModNo ratings yet

- Report On China Lodging GroupDocument2 pagesReport On China Lodging GroupJudyNo ratings yet

- Federal Register / Vol. 73, No. 67 / Monday, April 7, 2008 / NoticesDocument11 pagesFederal Register / Vol. 73, No. 67 / Monday, April 7, 2008 / NoticesJustia.comNo ratings yet

- Cambridge Studies in International RelationsDocument327 pagesCambridge Studies in International RelationsGilberto GuerraNo ratings yet

- SAFTA's History, Objectives, Principles and BenefitsDocument13 pagesSAFTA's History, Objectives, Principles and Benefitscrabrajesh007No ratings yet

- Carlos Castaneda-The Second Ring of Power (1991)Document250 pagesCarlos Castaneda-The Second Ring of Power (1991)bala1307100% (4)

- Wto GattDocument21 pagesWto GattSukhman BrarNo ratings yet

- Q.No. Question Options AnswerDocument23 pagesQ.No. Question Options Answerakshaykohli7890No ratings yet

- 1.mining Industry Performance During 2011 & Role of Mining in The Namibian Economy - Robin Sherbourne PDFDocument18 pages1.mining Industry Performance During 2011 & Role of Mining in The Namibian Economy - Robin Sherbourne PDFAndré Le RouxNo ratings yet

- N-LC-01 Bank of America v. CADocument2 pagesN-LC-01 Bank of America v. CAKobe Lawrence VeneracionNo ratings yet

- SCM AgreementDocument6 pagesSCM AgreementankitaprakashsinghNo ratings yet

- 4 Salvatore Cap. 4 SCDocument32 pages4 Salvatore Cap. 4 SCtisyahaiderNo ratings yet

- Guide To Cargo InsDocument36 pagesGuide To Cargo Insmib_santoshNo ratings yet

- Profile of IMC Chamber of Commerce and IndustryDocument1 pageProfile of IMC Chamber of Commerce and IndustryGaneshan PillaiNo ratings yet

- OIV - Global Economic Survey (03/2012)Document19 pagesOIV - Global Economic Survey (03/2012)Yorgos TsonisNo ratings yet

- Extra-Territorial Jurisdiction Under Competition Law: Hidayatullah National Law University Raipur, C.GDocument28 pagesExtra-Territorial Jurisdiction Under Competition Law: Hidayatullah National Law University Raipur, C.GLucky RajpurohitNo ratings yet

- International Economics Chapter 8-12Document13 pagesInternational Economics Chapter 8-12Alfred Martin50% (2)

- APTFF Schedule of The Week 2017Document1 pageAPTFF Schedule of The Week 2017randaNo ratings yet

- Indian Toy Industry Hit Hard by ImportsDocument2 pagesIndian Toy Industry Hit Hard by ImportsNikunj PatelNo ratings yet

- IATA Introduction - International Air Transport Association OverviewDocument10 pagesIATA Introduction - International Air Transport Association Overviewgurwinder89No ratings yet

- Indian Cosmetic IndustryDocument4 pagesIndian Cosmetic IndustryabhiNo ratings yet

- Econ 101, Sections 4 and 5, S09 Schroeter Exam #3, BlueDocument7 pagesEcon 101, Sections 4 and 5, S09 Schroeter Exam #3, BlueexamkillerNo ratings yet

- Pitrela Essay - Fresto - TriszkaDocument8 pagesPitrela Essay - Fresto - TriszkaTriszkaNo ratings yet

- Globalization and EthiopiaDocument31 pagesGlobalization and EthiopiaMastewal Yebejal71% (14)

- Globalization and PovertyDocument20 pagesGlobalization and PovertyDiana RomanNo ratings yet

- Waiver Solution in Public Health and Pharmaceutical Domain Under TRIPS AgreementDocument7 pagesWaiver Solution in Public Health and Pharmaceutical Domain Under TRIPS AgreementRojina ThapaNo ratings yet

- CV of Tapas Paul - 2016Document6 pagesCV of Tapas Paul - 2016Tapas Kumar PaulNo ratings yet