Professional Documents

Culture Documents

Wrongful Foreclosure Xyz ABC

Uploaded by

Janet and JamesCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wrongful Foreclosure Xyz ABC

Uploaded by

Janet and JamesCopyright:

Available Formats

1

Xyz Abc

2 Plaintiff, In Propria Persona

3

5

SUPERIOR COURT OF CALIFORNIA

6

COUNTY OF LOS ANGELES, –Central District Stanley Mosk

7

8

Xyz Abc, Case No.:_

9

Plaintiff

10 FIRST AMENDED VERIFIED

vs. COMPLAINT

11

1. DECLARATORY RELIEF

12

BANK OF AMERICA HOME LOANS 2. FRAUD & CONSPIRACY TO

13 SERVICING, LP (BOA) f/k/a COMMIT FRAUD;

14 COUNTRYWIDE HOME LOANS

3. TORTIOUS VIOLATION OF

SERVICING LP., INC.(CHL); STATUTE;

15

MORTGAGE ELECTRONIC 4. CONVERSION;

16

REGISTRATION SYSTEMS, INC.

5. REFORMATION (NOTE);

17 (MERS) as Beneficiary;

6. VIOLATION OF BUSINESS &

18 RECONTRUST (ReCon); PROFESSIONS CODE §17200

19 FIRST LOS ANGELES MORTGAGE 7. VIOLATION OF CA CIV. CODE

20 (1st LAM); §2923.6, 1788.17, 1572;

21 MICHAEL S. MAGNESS; 8. INJUNCTIVE RELIEF;

JANE/JOHN DOES 1-100, SPECIFIC PERFORMANCE

22

9. BREACH GOOD FAITH

23 Defendants &FAIRNESS

24 __________________________________

25 JURY TRIAL DEMANDED

26

27

COMES NOW, Plaintiff Xyz Abcs, proceeding in propia persona, and files

28

Plaintiff‟s First Amended Verified Complaint - 1

1

Plaintiff’s First Amended Verified Complaint.

2 Plaintiff requests that his Pro se status be recognized, and treated by the Court

3

as The United States Supreme Court, and US District Courts have held such status be

4

recognized and treated. “A pro se litigant's pleadings are to be construed liberally and

5

6 held to a less stringent standard than formal pleadings drafted by lawyers”. Haines v.

7

Kerner, 404 U.S. 519, 520-21, 92 S.Ct. 594, 30 L.Ed.2d 652 (1972); see also Estelle v.

8

Gamble, 429 U.S. 97, 106, 97 S.Ct. 285, 292, 50 L.Ed.2d 251 (1976); Gillihan v.

9

10 Shillinger, 872 F.2d 935, 938 (10th Cir.1989). “We hold pro se pleadings to a less

11

stringent standard than pleadings drafted by attorneys and construe them liberally”.

12

Tannenbaum v. United States, 148 F.3d 1262, 1263 (11th Cir. 1998) (per curiam)

13

14

15 THE PARTIES

16

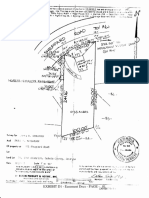

1. This action concerns certain real property, of which, Plaintiff, Xyz Abc,

17

18 an individual residing in the State of California, County of Los Angeles, and inter alia,

19 is the purchaser of the real property, located at 123 Four Five Six, and claims an

20

equitable and beneficial right of title to the real property described herein at all times

21

22

relevant from and after April 4, 2006., Xyz Abc owns, and where he currently resides.

23 The certain real property is located at 123 Four Five Six, identified as Assessor‟s

24

Parcel Nos. 01, 02, 03 in the County of Los Angeles, State of California (“the

25

property” or “property”) and is more particularly, legally described as:

26

27 Lot 111, 222, 333 of Tract No. 5555, in the City of Los Angeles,

County of Los Angeles, State of California, as per Map recorded in

28

Book00 pages 00 to 00 inclusive of Maps, in the Office of the County

Plaintiff‟s First Amended Verified Complaint - 2

1

Recorder of said County.

2 2. Defendant BANK OF AMERICA HOME LOAN SERVICING, INC.

3

(“BOA”) formerly known as Countrywide Home Loans Servicing (“CHL”), is a

4

member of a National Banking Association, and are lenders and servicers, which

5

6 regularly engage in business in the State of California, and who regularly provide

7

mortgage loans and related services to residents in the State of California. BOA

8

named Mortgage Electronic Registration Systems “MERS” as nominee and who is

9

10 either assigned or nominated as beneficiary of the certain Deeds of Trust recorded at

11

the County Recorder. CHL was a New York corporation duly licensed to do business

12

in the State of California, with its principal place of business in the state of California

13

14 located at 4500 Park Granada, Calabasas, California 91302, and was the issuer of two

15 separate mortgages taken out by defendant Magness on or about April 4, 2007, and

16

secured by certain Deeds of Trust recorded as Document Nos. 06-0763938 and 06-

17

18 0763939 in the Office of the County Recorder of the County of Los Angeles, State of

19 California. Plaintiff is informed and believes, therefore alleges that by virtue of said

20

mortgages, BOA claims some right, title, estate, lien, or interest in the property,

21

22

adverse to Plaintiff‟s title.

23 3. Defendant MORTGAGE ELECTRONIC REGISTRATION

24

SYSTEMS, INC. (“MERS”) is a corporation duly organized and existing under the

25

laws of the State of Delaware, with an address and telephone number of: Post Office

26

27 Box 2026, Flint, Michigan, 48501-2026. MERS is an electronic registration system,

28

that was created by the real estate industry to electronically register properties in order

Plaintiff‟s First Amended Verified Complaint - 3

1

for the properties to be sold into securitization; and keep the costs down by cheating

2 the States and Counties out of the taxes associated with Registering the properties after

3

each such sale. Plaintiff is informed and believes that Defendant MERS is the

4

nominee of Defendant BOA and the beneficiary of those certain Deeds of Trust

5

6 recorded as Document Nos. 06-0763938 and 06-076939 in the Office of the County

7

Recorder of the County of Los Angeles, State of California, and is sued herein on that

8

basis and only in said Defendant‟s capacity as the named Beneficiary for such Deeds

9

10 of Trust and for any part they had in the unlawful Sale Under Power performed by the

11

rest of the defendants.

12

4. Defendant RECONTRUST (“ReCon”) is “Headquartered in Thousand

13

14 Oaks, CA, ReconTrust is a member of the Bank of America family of companies.” 1

15 “Our offerings include: •Foreclosure services in non-judicial states: We currently offer

16

foreclosure trustee services in Alaska, Arizona, Arkansas, California, Hawaii, Idaho,

17

18 Mississippi, Montana, Nevada, Nebraska, Oregon, Tennessee, Texas, Utah, Virginia,

19 and Washington with plans for expansion into additional non-judicial jurisdictions.”2

20

5. Defendant MR. MICHAEL S. MAGNESS3 (“Mr. Magness”, or

21

22

“Magness”) is an individual residing in the State of California, County of Los

1

23 http://www.recontrustco.com/about_us.aspx

2

24 http://www.recontrustco.com/default_services.aspx ReCon states several places

throughout their website “non-judicial foreclosures”, which causes suspicion.

25

3

Plaintiff and Magness had been friends since late childhood, and over the course of

26 their friendship, Plaintiff was aware that Magness was employed as a mortgage broker

27 in the County of Los Angeles, State of California. Magness had informed Plaintiff that

there were problems with Plaintiff‟s credit that would complicate his efforts to obtain

28 financing.

Plaintiff‟s First Amended Verified Complaint - 4

1

Angeles. Plaintiff is informed and believes and on the basis of such information and

2 belief, holds that Defendant Magness claims an interest in the Property, due to having

3

illegally put the loan and deed of the property into his name rather than the name of

4

Plaintiff. Mr. Magness, at all times relevant, has been/was licensed as a salesperson

5

6 employed by 1stLAM with the Department of Real Estate, and also was working part-

7

time as a mortgage broker/salesman with Countrywide Home Loans, Inc. (“CHL”),

8

who became Bank of America.

9

10 6. Plaintiff is informed and believes that Jane/John Does 1 thru 100

11

(“Does”) are liable for some acts, omissions and wrongs committed against Plaintiff,

12

but Plaintiff at present, is uncertain as to the correct names and capacities of said

13

14 unnamed defendants.

15 7. Plaintiff hereby sues such DOES, and reserves the right under Cal. Civ.

16

Code 474, et al., to amend the names and capacities of such DOES when ascertained.

17

18 GENERAL ALLEGATIONS

19 8. Mr. Magness committed fraud by knowingly, willingly, wantonly,

20

maliciously, and in bad faith, took out loans for the property that Plaintiff was

21

22

purchasing in his own name.

23 9. Mr. Magness‟ fraudulent, and deceitful acts in bad faith, resulted in great

24

monetary enrichment for Mr. Magness.

25

10. Mr. Magness continued to prevent Plaintiff‟s loan and property from

26

27 being placed into Plaintiff‟s name, with the actual knowledge of Magness‟ employers

28

CHL and 1stLAM.

Plaintiff‟s First Amended Verified Complaint - 5

1

11. Defendant 1stLAM knowingly, willingly, wantonly, maliciously, and

2 intentionally, submitted the loan package, from which key documents, such as the

3

sales contract, were missing.

4

12. Defendant 1stLAM‟s Mr. John Pianalto knowingly, willingly, wantonly,

5

6 maliciously, and with the intent to defraud Plaintiff, had actual knowledge that

7

Plaintiff was the true purchaser of the property, and was aware of Mr. Magness‟s

8

illegal acts; as stated in Sworn testimony, Mr. Pianalto “knew” what was going on, he

9

10 “didn‟t care”, and he only wanted “to get paid”.

11

13. All defendants are business entities unless otherwise stated, they do

12

business and have residency and business contacts within the County of Los Angeles,

13

14 California

15 14. The Defendants,4 and each of them, were the agents, employees,

16

representatives, partners, officers, principals and/or joint venturers of each of the

17

18 remaining defendants, and in doing the things hereinafter alleged, were acting within

19 the scope, course and purpose of such agency, employment or position, or within the

20

apparent scope, course and purpose of such agency, employment or position and with

21

22

permission and consent of each of the remaining defendants

23 15. Defendants had actual knowledge that Plaintiff had previously sought,

24

and was being approved for a loan elsewhere and defendants led Plaintiff to believe

25

that he would get a much better deal with them.

26

4

27 Whenever appearing in this complaint, each and every reference to Defendants or to

any of them, is intended to be and shall be a reference to all Defendants hereto, and to

28 each of them, unless said reference is specifically qualified.

Plaintiff‟s First Amended Verified Complaint - 6

1

16. Plaintiff is informed, believes, and has a transcript of Mr. Magness

2 stating that he had taken money in the amount of $150,000.00 from Plaintiff that he

3

was to secure a loan for the Plaintiff‟s property, in Plaintiff‟s name.

4

17. Plaintiff is informed and believes that after the loan was originated and

5

6 funded, it was transferred to defendant Mr. Magness.

7

18. Mr. Magness, in fact obtained the loan in his own name, and later took a

8

second loan against the property without Plaintiff‟s knowledge or permission.

9

10 19. Mr. John Pianalto, employed with 1stLAM, in sworn, Oral testimony,

11

stated that they had actual knowledge of Mr.Magness‟ acts, and did nothing to rectify

12

the problem, thereby becoming as guilty as Mr. Magness for the act.

13

14 20. After Plaintiff learned that the loan and deed were not in his name,

15 Plaintiff was able to have the TITLE ordered5 into his name, and although Plaintiff

16

diligently attempted to have the loan transferred into his own name, Plaintiff could not

17

18 have the loan associated with the property transferred.

19 21. Mr. Magness, while under Oath, during Oral testimony, admitted that he

20

had taken out a second loan against the Plaintiff‟s property, and that Mr. Magness had

21

22

spent the money on “various expenses” not associated with the Plaintiff‟s property.

23 22. Plaintiff, while attempting to have the loan put into the proper name, was

24

told by CHL and later BOA, that they would no longer accept payment from him, due

25

to his name not being on the loan documents.

26

27 5

Superior Court of Los Angeles for the County of Los Angeles, Civil Action #:

28 BC3333333

Plaintiff‟s First Amended Verified Complaint - 7

1

23. Mr. Magness failed to make payments, and Plaintiff was forbidden to

2 make payments, causing the loan to go into default.

3

24. BOA, and ReCon unlawfully foreclosed on Plaintiff‟s property, with

4

actual knowledge that Plaintiff had been a victim of fraudulent acts of defendants Mr.

5

6 Magness and 1stLAM.

7

25. Plaintiff, further, is informed and believes, that the documents show

8

without doubt that defendants who performed the unlawful foreclosure of his property,

9

10 lacked standing to perform such foreclosure.

11

26. Plaintiff alleges that the foreclosure sale of the property was not

12

executed in accordance with the requirements of California Civil Code §§ 1624, 2924

13

14 et seq.

15 27. BOA and/or ReCon, who were allegedly acting as the agent of the

16

principal, failed to have written authorization to act for the principal and under Cal.

17

18 Civ. Code §1624 the agency relationship must also be in written form.

19 28. The notices and foreclosure failed to conform with the provisions of Cal.

20

Civ. Code §§1624, 2932.5 et seq., and Commercial Code § 3302 et seq.

21

22

29. Plaintiff further alleges that Cal. Civ. Code § 2924 and its subparts are

23 being/have been applied to Plaintiff in a manner that is unlawful, because at least in

24

part BOA and ReCon had proceeded with the foreclosure of Plaintiff‟s property

25

notwithstanding the following facts and circumstances:

26

27 a. Plaintiff tendered an amount of One Hundred Fifty-Two ,Four

28

Hundred Thirty-Three Dollars ($152,433.00), as more particularly alleged in

Plaintiff‟s First Amended Verified Complaint - 8

1

herein;

2 b. Plaintiff is informed and believes that neither BOA, nor ReCon

3

were in possession of the original Note, that the Note when it was assigned to

4

MERS did not convey the power of sale because it violated the terms of Cal.

5

6 Civ. Code §2932.5, and/or that the Note executed was no longer a negotiable

7

instrument because the assignment was not physically applied to the Note, and

8

as such the foreclosure of Plaintiff‟s subject property did not conform with the

9

10 strict mandates of Cal. Civ. Code § 2924.

11

30. Plaintiff is informed and believes that BOA and ReCon were acting as

12

the agent of the agent of the agent of the Beneficiary for Plaintiff‟s Note and the

13

14 notices therein.

15 31. By virtue of the method and manner of defendants‟ carrying out of Cal.

16

Civ. Code §2924, Defendants proceeded with the foreclosure of the property were

17

18 acting in violation of said statute.

19 32. April, 2007, Plaintiff filed a civil action to quiet title, which Quiet Title

20

was Granted in Plaintiff‟s favor.

21

22

33. April, 2010 Plaintiff had to file Bankruptcy due to the actions/inactions

23 of the defendants.

24

34. On or about July 2008, and October 2009, Plaintiff served by letter on

25

Defendants BOA, Notice of Dispute & Request for Accounting, Notice Pursuant to

26

27 Real Estate Settlement Procedures Act (RESPA) a Qualified Written Request.

28

35. In violation of RESPA, 12 U.S.C. §2607, said defendants have failed to

Plaintiff‟s First Amended Verified Complaint - 9

1

respond to said notice by plaintiffs and have substantially failed to respond to all other

2 communications and inquiries by plaintiffs. Attached and incorporated by this

3

reference as “Exhibit A”.

4

36. Plaintiff further contends:

5

(a) that Plaintiff tendered the full amount owing as of the date of tender

6

as more particularly alleged herein;

7

(b) that failing to comply with RESPA as more particularly alleged

8

herein, defendants were not entitled to proceed with the foreclosure until

9

such compliance occurred; and

10

(c) on information and belief, that defendants were not otherwise

11

entitled to continue with said foreclosure because of the lack of proper

12

statutory execution of the deed of trust as more fully alleged herein;

13

(d) Although Plaintiff, at the time, did not know the Defendants had

14

actual knowledge that the loan was never in Plaintiff‟s name, took

15

payments from Plaintiff, until he managed to get the Deed transferred

16

into his name, then defendants refused payment from him, claiming that

17

the loan is not in Plaintiff‟s name.

18

19

37. Plaintiff, having been tricked and deceived, through fraud, to think that

20

21

he had applied for, and was approved for a loan in his own name, and having paid a

22 down payment of One Hundred Ten Thousand Dollars ($110,000.00), believed that

23

said loan had been approved, and that the loan and Deed were in Plaintiff‟s name the

24

entire time.

25

26

27

28

Plaintiff‟s First Amended Verified Complaint - 10

1

I.

2 FIRST CAUSE OF ACTION

3 FOR DECLARATORY RELIEF AGAINST

4

(As Against All Defendants)

5 38. Plaintiff incorporates Paragraphs one (1) through Thirty-Seven (37) of

6

this Amended Complaint, all paragraphs of general allegations, and any unnumbered

7

8

paragraphs, as though they have been fully restated and set forth herein.

9 39. An actual controversy exists in which the parties must ascertain their

10

rights, duties and right to title in the Subject Property.

11

40. A judicial determination is necessary that the parties may ascertain their

12

13 rights, duties and right to title in the Subject Property.

14

41. The Plaintiff desires the court make a judicial determination as to the

15

party‟s rights, and duties concerning Plaintiff‟s Real Property.

16

17 42. An actual controversy has arisen and now exists between Plaintiff and

18

Defendants, and each of them, concerning their respective rights, obligations and

19

duties as it relates to the Subject Property. In particular, on one hand, Plaintiff

20

21 contends:

22 (a) that Plaintiff tendered the full amount owing as of the date of tender

23 as more particularly alleged herein;

24 (b) that failing to comply with R.E.S.P.A. as more particularly alleged

25 herein, defendants were not entitled to proceed with the foreclosure until

26 such compliance occurred; and

27 (c) on information and belief, that defendants were not otherwise

28 entitled to continue with said foreclosure because of the lack of proper

Plaintiff‟s First Amended Verified Complaint - 11

1

statutory execution of the deed of trust as more fully alleged herein;

(d) Although Plaintiff, at the time, did not know the Defendants had

2

actual knowledge that the loan was never in Plaintiff‟s name, took

3

payments from Plaintiff, until he managed to get the Deed transferred

4

into his name, then defendants refused payment from him, claiming that

5

the loan is not in Plaintiff‟s name.

6

7

43. Plaintiff, having been tricked and deceived, through fraud, to think that

8

9 he had applied for, and was approved for a loan in his own name, and having paid a

10

down payment of One Hundred Ten Thousand Dollars ($110,000.00), and an

11

additional Forty-One Thousand, Seven Hundred Dollars in payments; believed that

12

13 said loan had been approved, and that the loan and Deed were in Plaintiff‟s name the

14 entire time.

15

WHEREFORE Plaintiff Moves for the following Relief:

16

17 (a)Plaintiff desires a judicial determination of Plaintiff‟s Rights, and of

18 Defendants obligations and duties, and a declaration as to who is responsible

19

for payment of the loan;

20

21

(b). For an Order, requiring Defendant to have a loan reflecting only the

22 Plaintiff to coincide with the Deed in Plaintiff‟s name, and a restraining

23

order/injunction preventing Defendants and/or their/its agents, employees,

24

officers, attorneys, and representatives in the future from engaging in or

25

26 performing any of the following acts: (i) offering, or advertising this property

27

for sale and (ii) attempting to transfer title to this property and or (iii) holding

28

Plaintiff‟s First Amended Verified Complaint - 12

1

any auction thereof;

2 (c) For costs of suit incurred herein;

3

(d) For reasonable attorney‟s fees provided by contract or statute; and

4

(e) For such other and further relief as the court may deem just and proper.

5

6 II.

7

SECOND CAUSE OF ACTION

8 FRAUD AND CONSPIRACY TO COMMIT FRAUD

9 (As against Defendants)

10

44. Plaintiff incorporates Paragraphs one (1) through Forty-Three (43) of

11

this Amended Complaint, all paragraphs of general allegations, and any unnumbered

12

13 paragraphs, as though they have been fully restated and set forth herein.

14

45. Plaintiff alleges that the defendants, each of the separately and together

15

discussed Plaintiff‟s finances and his intent on purchasing the property where he now

16

17 resides; defendants conspired, reached an agreement to defraud Plaintiff out of his

18

property, and they put their scheme into play.

19

46. Plaintiff alleges that Defendants, and each of them, were also engaged in

20

21 an illegal scheme the purpose of which was to execute loans secured by real property

22 in order to make commissions, kick-backs, illegal undisclosed yield spread premiums,

23

and undisclosed profits by the sale of any instruments arising out of the transaction.

24

25 47. Plaintiff alleges that Defendants, each of them, had represented to

26 plaintiff, and to third parties, that they were the owner of the Trust Deed and Note as

27

either the Trustee, or the Beneficiary regarding Plaintiff‟s real property.

28

Plaintiff‟s First Amended Verified Complaint - 13

1

48. Based upon the foregoing representations, of the Defendants, Plaintiff

2 did in fact repose his trust in the representations of Defendants, and that such trust was

3

reasonable.

4

49. Defendants, presented a loan to Plaintiff whereby they represented that

5

6 he did qualify for underwriting, and that the loan was within Plaintiff‟s personal

7

financial needs and limitations given the amount of down-payment, and the

8

confidential financial information that Plaintiff shared with Defendants.

9

10 50. Plaintiff believed that his down-payment had been applied to the loan,

11

that his name was on the loan, and the Deed in his name.

12

51. Defendants had a duty to disclose their true acts, and true intentions

13

14 concerning the loan, the amount of down payment paid, and the true name the loan and

15 deed were in.

16

52. Plaintiff acquired the foregoing property by virtue of the said funding

17

18 based on the representations of Defendants, that the loan was the best they could

19 obtain, and that the loan was well within Plaintiff‟s financial needs and limitations.

20

53. Plaintiff is informed and believes that Defendants, represented to

21

22

Plaintiff that they were working for the benefit of Plaintiff and in his particular best

23 interest, to obtain for him the best loan, and at the best rates available.

24

54. At the time Defendants, with actual knowledge that the foregoing false

25

representations to Plaintiff, were untrue and the representations were material

26

27 representations, that Plaintiff would rely and depend upon.

28

55. The foregoing representations were made in order to induce Plaintiff to

Plaintiff‟s First Amended Verified Complaint - 14

1

act on and take the said loan(s) in order for defendants to make a substantial amount of

2 money thereby and there from.

3

56. Plaintiff was induced to believe, and did in fact believe that he had taken

4

out the loan, as his own, based on the said representations

5

6 57. Plaintiff was induced to rely and did rely on the mis-representations of

7

defendants through deception, and his reliance was justified as he believed that

8

Defendants were working for him, and in his best interest.

9

10 58. Defendants had made Plaintiff numerous verbal promises, one of which

11

was that the loan and deed would be, and in fact, were secured in Plaintiff‟s name,

12

while defendants had actual knowledge that they were misleading Plaintiff and that

13

14 Plaintiff was relying on that false representation..

15 59. After Plaintiff‟s payments were rejected, and based upon the defendants‟

16

prior misrepresentations, the defendants caused a Notice of Default to be issued and

17

18 recorded without disclosing their true role, and thereafter a notice of intent to foreclose

19 and finally foreclosure was completed, permanently affecting Plaintiffs right, title and

20

interest in the Subject Property.

21

22

60. Now, by virtue of Plaintiff‟s reliance and the lack of payments accepted

23 toward the property, Plaintiff has been damaged in the loss of his credit, loss through

24

foreclosures, and loss from being involved in litigation that Plaintiff had not bargained

25

for, causing him further harm, damage and injury.

26

27 61. Plaintiff relied on defendants‟ false representations, and because of this

28

reliance, had made various moves to avoid the foreclosure, all to no avail, while

Plaintiff‟s First Amended Verified Complaint - 15

1

defendants knew all the time that they were deceiving Plaintiff.

2 62. Plaintiff‟s reliance was justified based upon cremin falsi, and

3

representations of Defendants, Plaintiff had no reason to believe that a party

4

representing a bank would go to such lengths to deceive and to assist others in

5

6 converting Plaintiff‟s property.

7

63. Defendants knowingly, willingly, wantonly, and maliciously with the

8

intent to defraud, made the mis- representations to Plaintiff, and defendants knew at

9

10 the time that they were attempting to foreclose on Plaintiff‟s Trust Deed and note that

11

they had no right to do so, but continued anyway.

12

64. Defendants, by and through said conspiracy, and fraudulent scheme,

13

14 knowingly, willingly, wantonly, intentionally, fraudulently, and with malicious intent,

15 aimed to keep Plaintiff‟s right, title and interest to the property, and all equity therein.

16

65. Plaintiff‟s trust and reliance on Defendants‟ mis-representations has

17

18 caused Plaintiff harm, and injury; he has been damaged in an amount that currently

19 exceeds $300,000 and will suffer substantially from additional costs of moving from

20

the property, and the costs to relocate back to the subject Property.

21

22

66. Additionally, Plaintiff has been made to suffer deep and severe

23 emotional distress, mortification, anxiety, embarrassment, and humiliation, due to the

24

defendants‟ acts, in an amount the totality of which has not yet been fully ascertained.

25

67. In fact, Plaintiff alleges that the promissory note which Plaintiff thought

26

27 was executed by, and for himself, and which initially formed a basis of a security

28

interest in the subject property, was in fact put into the name of Mr. Magness.

Plaintiff‟s First Amended Verified Complaint - 16

1

68. Mr. Magness was allowed to borrow even more money against the

2 Plaintiff‟s property, when Mr. Magness decided that he wanted a Forty Thousand

3

Dollar ($40,000.00) swimming pool at Mr. Magness‟ own home.

4

69. Further, through Defendants‟ acts of conspiracy and fraud, therefrom

5

6 resulted in a promissory note which had been rendered as non-negotiable and no

7

power of sale was conveyed with the note at the time of the assignment, therefore,

8

Defendants, each of them, had no lawful security interest in the subject property.

9

10 70. Defendants Mr. Magness, and 1stLAM (partners/brokers) as a „partner

11

broker‟ of CHL, had a superior bargaining strength over Plaintiff, and Plaintiff was

12

relegated only the opportunity to adhere to what he was led to believe about the

13

14 contract or reject it; CHL/1stLAM drafted all of the documents related to the loan, and

15 no negotiations were possible between Plaintiff and 1stLAM/CHL and that the

16

contract was a contract of adhesion.

17

18 71. The issues Plaintiff later learned about the loan, were unconscionable in

19 that the loan was never in Plaintiff‟s name, the payments were rejected, making

20

repayment impossible; Plaintiff learned the truth that neither the loan, nor the title was

21

22

in his name.

23 72. Defendants, and each of them, could not enforce the terms and

24

conditions of the loan against Plaintiff, and any non-judicial foreclosure arising there

25

from is void.

26

27 73. Through no fault of the Plaintiff, the loan associated with Plaintiff‟s

28

property went into default; Plaintiff had faithfully, in good faith, paid and had intended

Plaintiff‟s First Amended Verified Complaint - 17

1

to continue paying the loan; the default was occasioned by the rejection of proper

2 tender.

3

74. Plaintiff actually was not in default because of the prior fraudulent acts

4

of defendants, and their breach of the terms of the notes, any claimed default, had to be

5

6 excused.

7

75. BOA and ReCon, acting as the agent of the Principal failed to have

8

written authorization to act for the principal and under California Civil Code §1624 the

9

10 agency relationship must also be in written form.

11

76. Notices, and foreclosure failed to conform with the provisions of

12

California Civil Code §§ 1624, 2923.5, 2932.5 et seq., and Commercial Code Section

13

14 3302

15 77. The loan contract, deed of trust, and accompanying documents were

16

offered to Plaintiff on a take it or leave it basis, and Plaintiff had already provided One

17

18 Hundred Fifty Thousand Dollars ($150,000.00) toward the loan.

19 78. BOA and Recon acted as agents of the Beneficiary and signed

20

documents as the agent, of the agent, of the agent of the Beneficiary for Plaintiff‟s

21

22

Note and the notices therein, notwithstanding the fact that the Note was not negotiable

23 prior to the sale of the Subject Property.

24

79. By virtue of the method and manner of Defendants‟ carrying out Cal.

25

Civil Code § 2924 et seq., the foreclosure of the Subject Property is void ab initio as a

26

27 matter of law.

28

80. Defendants, and each of them, are and have, engaged in, and will

Plaintiff‟s First Amended Verified Complaint - 18

1

continue to engage in, violations of California law, including but, not limited to: Cal.

2 Civil Code §§ 2924 et seq., 2932.5 et seq., and unless restrained, will continue to

3

engage in such misconduct; a public benefit necessitates that Defendants be restrained

4

from such conduct currently being practiced, and that conduct which will be conducted

5

6 in the future.

7

WHEREFORE Plaintiff Moves for the following Relief:

8

(a) For compensatory damages according to proof at time of trial;

9

10 (b) For special damages according to proof at time of trial;

11

(c) For costs of suit incurred herein;

12

(d) For punitive damages subject to proof at time of trial;

13

14 (e) For costs of suit incurred herein;

15 (f) For reasonable attorney‟s fees provided by contract or statute; and

16

(g) For such other and further relief as the court may deem just and proper.

17

18 III.

19 THIRD CAUSE OF ACTION

20 Tortious Violation of Statute

21

Real Estate Settlement Procedures Act

12 USC section 2607 (b)

22 (As Against Defendants All Defendants)

23

24 81. Plaintiff incorporates Paragraphs one (1) through Eighty (80) of this

25

Amended Complaint, all paragraphs of general allegations, and any unnumbered

26

paragraphs, as though they have been fully restated and set forth herein.

27

28 82. Plaintiff alleges that The Congress by implementing Title 12 U.S.C.

Plaintiff‟s First Amended Verified Complaint - 19

1

§2601 stated the following Congressional findings and purpose:

2 (a) The Congress finds that significant reforms in the real estate

3

settlement process are needed to insure that consumers throughout the

Nation are provided with greater and more timely information on the

4

nature and costs of the settlement process and are protected from

5 unnecessarily high settlement charges caused by certain abusive

6 practices that have developed in some areas of the country. The

Congress also finds that it has been over two years since the Secretary of

7

Housing and Urban Development and the Administrator of Veterans'

8 Affairs submitted their joint report to the Congress on ``Mortgage

9 Settlement Costs'' and that the time has come for the recommendations

for Federal legislative action made in that report to be implemented.

10

(b) It is the purpose of this chapter to effect certain changes in the

11

settlement process for residential real estate that will result--

12

(1) in more effective advance disclosure to home buyers and sellers

13 of settlement costs;

14 (2) in the elimination of kickbacks or referral fees that tend to

15 increase unnecessarily the costs of certain settlement services;

16 (3) in a reduction in the amounts home buyers are required to place in

escrow accounts established to insure the payment of real estate taxes

17

and insurance; and

18

(4) in significant reform and modernization of local recordkeeping of

19

land title information.

20

83. Plaintiff alleges that Defendants, and each of them, as set forth herein

21

22 violated both the terms and spirit of sections 12 U.S.C. §2601, etc. et seq.

23

84. Plaintiff alleges that he was in the group of persons for whom 12 U.S.C.

24

§2601, etc. et seq. was intended to protect and that Plaintiff suffered damages which

25

26 were actually and proximately caused by Defendants‟ violations thereof.

27

85. Plaintiff alleges that section 12 U.S.C. §2607(d)(5) provides for a private

28

Plaintiff‟s First Amended Verified Complaint - 20

1

right of action to recover damages and treble damages for violations therein. Said

2 section provides both civil and criminal penalties for violations thereof.

3

86. That the failure to respond to plaintiff‟s RESPA requests constitutes a

4

violation of 12 USC §2607(b) and that therefore as provided by statute, he is entitled

5

6 to and seek treble damages therefore in a sum subject to proof at time of trial.

7

87. Plaintiff alleges that his‟ claims regarding fees and penalties are not time

8

barred as the purpose of these fees were not explained to Plaintiff.

9

10 88. Plaintiff has suffered damages actually and proximately caused by

11

Defendants‟ violation of the within statute in an amount the totality of which has not

12

yet been fully ascertained but, in no event less than the jurisdictional requirements of

13

14 this court.

15 WHEREFORE Plaintiff Moves for the following Relief:

16

(a) For damages as provided by statute;

17

18 (b) For costs of suit incurred herein;

19 (c) For reasonable attorney‟s fees as provided by contract or statute; and

20

(d) For such other and further relief as the court may deem just and proper

21

22

IV.

23 FOURTH CAUSE OF ACTION

24 Conversion

25

89. Plaintiff incorporates Paragraphs one (1) through Eighty-eight (88) of

26

this Amended Complaint, all paragraphs of general allegations, and any unnumbered

27

28 paragraphs, as though they have been fully restated and set forth herein.

Plaintiff‟s First Amended Verified Complaint - 21

1

90. Conversion is an intentional tort that evolved to protect against

2 interference with possessory and ownership interests in personal property.

3

91. Plaintiff has shown that his claims meet the criteria, the three elements

4

required to establish a cause of action for conversion: (1) plaintiff's ownership or right

5

6 to possession of the property at the time of the alleged conversion; (2) defendant's

7

conversion by a wrongful act or disposition of plaintiff's property rights; and (3)

8

damages.

9

10 92. Defendants BOA, ReCon, Mr. Magness, and possibly the Does

11

committed acts that resulted in foreclosure and were of such nature to cause an actual

12

interference with Plaintiff‟s ownership or right to possess the subject property.

13

14 93. The fraudulent acts associated with the loan and deed, show an intention

15 or purpose to convert the property, so that the defendants could exercise ownership

16

over it, and/or to remove the property from Plaintiff‟s ownership.

17

18 94. Defendants knowingly, willingly, wantonly, and with malicious intent,

19 kept the loan from Plaintiff‟s name, refused payments from Plaintiff, and thereby

20

intended to convert the property by taking possession of it.

21

22

95. Further, because the property is of “peculiar interest” to the Plaintiff, and

23 the acts of defendants were willful, both Civ. Code 3355, as well as Civ. Code §3365

24

apply.

25

96. Because the conversion involved malice, fraud, and/or oppression,

26

27 exemplary or punitive damages can be properly awarded; the detriment caused by the

28

wrongful conversion of property is further, presumed to include fair compensation for

Plaintiff‟s First Amended Verified Complaint - 22

1

time and money properly expended in pursuit of the converted property.

2 WHEREFORE Plaintiff Moves for the following Relief:

3

(a) For an award of exemplary/punitive damages in the amount of Two

4

Million Dollars ($2,000,000.00), which will include all of the damages to

5

6 the Plaintiff and the property for the conversion count, only.

7

(b) Grant attorney‟s fees, which, although Plaintiff currently does not have

8

legal representation, he continues to seek competent legal representation.

9

10 (c) All court costs, and costs associated with pursuing a remedy of the illegal

11

acts of the defendants.

12

(d) Any other relief that Plaintiff fails to realize, and/or that this Court deems

13

14 fair and just under the circumstances.

15 V.

16

FIFTH CAUSE OF ACTION

17

Reformation (Note) as Against BOA, ReCon, 1stLAM, and Does

18

19

97. Plaintiff realleges and incorporates Paragraphs One (1) through Ninety-

20 Six (96) of this Amended Complaint, all paragraphs of general allegations, and any

21

unnumbered paragraphs, as though they have been fully restated and set forth herein.

22

23

98. Plaintiff alleges that BOA, 1stLAM, and Mr. Magness committed a fraud

24 against Plaintiff in that BOA, 1stLAM, employees and/or agents intentionally

25

misrepresented to Plaintiffs that BOA, 1stLAM would only make a loan that Plaintiff

26

could afford to pay, said Defendants did not disclose the terms and conditions for

27

28 repayment, interest, annual percentage rate, or that the loan and deed would not be in

Plaintiff‟s First Amended Verified Complaint - 23

1

Plaintiff‟s name.

2 99. Plaintiff alleges that pursuant to Civil Code §3399, that the loan

3

documents which were executed did not truly express the intention of Plaintiff, more

4

particularly that the loan would have a repayment schedule that Plaintiff could afford,

5

6 as well as that the loan and deed would not be in Plaintiff‟s name.

7

100. Plaintiff alleges that utilization of any reasonable underwriting

8

guidelines, Plaintiffs had no hope whatsoever of repaying the loan, especially after Mr.

9

10 Magness added another Forty Thousand ($40,000.00) to the balance of the loan.

11

101. Employees and/or agents of BOA and/or 1stLAM represented that said

12

employees and/or agents could work-around the fact that Plaintiff‟s credit was not in

13

14 good standing and could get Plaintiff approved for the loan. Defendants did not

15 disclose at any time to Plaintiff that the loan and deed would never be in Plaintiff‟s

16

name.

17

18 102. Plaintiff alleges that the loan contract, deed of trust and accompanying

19 documents were offered to Plaintiff on a take it or leave it basis, and Plaintiff had

20

already at that time, provided One Hundred Ten Thousand Dollars ($110,000.00),

21

22

which had been applied as down payment for the loan.

23 103. Plaintiff alleges that Defendants BOA and 1stLAM had a superior

24

bargaining strength over Plaintiff, and that Plaintiff was relegated only the

25

opportunity to adhere to the contract or reject it, that defendants BOA, and/or 1stLAM,

26

27 and/or Mr. Magness had drafted all of the documents related to the loan, that no

28

negotiations were possible between Plaintiff and lender, and that the contract was a

Plaintiff‟s First Amended Verified Complaint - 24

1

contract of adhesion.

2 104. Plaintiff alleges that the loan was unconscionable in that the repayment

3

terms were unfair and unduly oppressive, the loan was not, and it was never intended

4

to be in Plaintiff‟s name, and Defendants, each of them, could not legally enforce the

5

6 terms and conditions of the loan against Plaintiff, and any non-judicial foreclosure

7

arising there from is void.

8

105. Plaintiff is informed and believe that all Defendants, entered into a

9

10 fraudulent scheme, the purpose of which was to make a loan to Plaintiff, which each of

11

the defendants were keenly aware were never to be placed into Plaintiff‟s name;

12

thereby Plaintiff‟s payments would be denied.

13

14 106. Further, BOA, 1stLAM, and Mr. Magness falsely represented to Plaintiff

15 that he would not qualify for any other financing, that Plaintiffs could not qualify

16

under any reasonably underwriting guidelines, that such scheme was devised to extract

17

18 illegal and undisclosed compensation from Plaintiff by virtue of an undisclosed yield

19 spread premium and which Defendants, shared in some presently unknown percentage.

20

107. The court has by and through its inherent power and discretion, and

21

22

further under the purview of Civil Code §3399, the power to reform the terms of the

23 loan to meet the Plaintiff‟s expectations of the loan, its terms, the principal amount of

24

the loan, interest, and that the court place fair market value of the property of

25

approximately $150,000.00, for purposes of reforming the terms and conditions of the

26

27 loan.

28

108. Since Defendants proceeded with the invalid Foreclosure sale the sale be

Plaintiff‟s First Amended Verified Complaint - 25

1

set aside, and that equity should confer upon said defendants a right of equitable

2 indemnification as against defendants, for their fraud.

3

WHEREFORE Plaintiff Moves for the following Relief:

4

(a) For general damages subject to proof at time of trial;

5

6 (b) For costs of suit incurred herein;

7

(c) For reasonable attorney‟s fees subject to proof at time of trial; and

8

(d) For such other and further relief as the court may deem just and proper.

9

10 VI.

11

SIXTH CAUSE OF ACTION

12

VIOLATION of BUSINESS and PROFESSIONS CODE §17200

13

As Against BOA, and 1STLAM, Mr. Magness, and Does Inclusive

14

15 109. Plaintiff realleges and incorporates Paragraphs One (1) through One

16

hundred eight (108) of this Amended Complaint, all paragraphs of general allegations,

17

18 and any unnumbered paragraphs, as though they have been fully restated and set forth

19 herein

20

A. Plaintiff Suffered Damages As A Result of Defendants’ Conduct:

21

22

110. As a direct result of Defendants‟ acts, Plaintiff has incurred actual

23 damages consisting of mental and emotional distress, nervousness, grief,

24

embarrassment, loss of sleep, anxiety, worry, mortification, shock, humiliation,

25

indignity, pain and suffering, and other injuries.

26

27 111. Plaintiff has incurred out of pocket monetary damages.

28

112. Plaintiff continue to incur monetary damages.

Plaintiff‟s First Amended Verified Complaint - 26

1

113. Plaintiffs will incur the loss of his personal residence if the defendants

2 are allowed to prevail.

3

114. Each of Defendants harassing acts were so willful, vexatious,

4

outrageous, oppressive, and maliciously calculated enough, so as to warrant statutory

5

6 penalties and punitive damages.

7

WHEREFORE Plaintiff Moves for the following Relief:

8

(a) For an Order enjoining Defendants from continuing to violate the

9

10 statutes alleged herein;

11

(b) For costs of suit incurred herein;

12

(c) For reasonable attorneys fees subject to proof and as available by

13

14 contract or statute; and

15 (d) For such other and further relief as the court may deem just and proper.

16

VII.

17

18 SEVENTH CAUSE OF ACTION

19 Violation Of California Civil Code 2923.6

20 115. Plaintiff realleges and incorporates Paragraphs One (1) through One

21

hundred fourteen (114) of this Amended Complaint, all paragraphs of general

22

23

allegations, and any unnumbered paragraphs, as though they have been fully restated

24 and set forth herein

25

116. Defendants‟ Pooling and Servicing Agreement ( “PSA”) contains a duty

26

to maximize net present value to its investors and related parties.

27

28 117. California Civil Code §2923.6 broadens and extends this PSA duty by

Plaintiff‟s First Amended Verified Complaint - 27

1

requiring servicers to accept loan modifications with borrowers.

2 118. Pursuant to California Civil Code §2923.6(a), a servicer acts in the best

3

interest of all parties if it agrees to or implements a loan modification where the (1)

4

loan is in payment default, and (2) anticipated recovery under the loan modification or

5

6 workout plan exceeds the anticipated recovery through foreclosure on a net present

7

value basis.

8

119. California Civil Code §2923.6(b) now provides that the mortgagee,

9

10 beneficiary, or authorized agent offer the borrower a loan modification or workout

11

plan if such a modification or plan is consistent with its contractual or other authority.

12

120. Defendants refused to consider such modification with Plaintiff.

13

14 WHEREFORE Plaintiff Moves for the following Relief:

15 (a) For an Order requiring Defendants to modify the existing loan as set forth

16

herein;

17

18 (b) For costs of suite incurred herein;

19 (c) For reasonable attorneys fees subject to proof and as available by contract

20

or statute; and

21

22

(d) For such other and further relief as the court may deem just and proper.

23 VIII.

24

EIGHTH CAUSE OF ACTION:

25

Violation Of § 1788.17 Of The RFDCPA

26

121. Plaintiff realleges and incorporates Paragraphs One (1) through One

27

28 hundred twenty (120) of this Amended Complaint, all paragraphs of general

Plaintiff‟s First Amended Verified Complaint - 28

1

allegations, and any unnumbered paragraphs, as though they have been fully restated

2 and set forth herein

3

122. California Civil Code §1788.17 requires that Defendants comply with

4

the provisions of 15 U.S.C. § 1692, through their acts including but not limited to, the

5

6 following:

7

(a) The Defendants violated California Civil Code §1788.17 by

8 engaging in conduct, the natural consequence of which is to harass,

9

oppress, and abuse persons in connection with the collection of the

alleged debt, a violations of 15 U.S.C. § 1692(d);

10

(b) The Defendants violated California Civil Code §1788.17 by

11

misrepresenting the status of the debt, a violations of 15 U.S.C. §

12 1692(e)(s)(A);

13 (c) The Defendants violated California Civil Code §1788.17 by using

14 unfair or unconscionable means to collect or attempt to collect a debt, a

violation 15 U.S.C. § 1692(f); and

15

(d) The Defendants violated California Civil Code §1788.17 by using

16

deceptive means to collect or attempt to collect a debt from the Plaintiff,

17 a violation of 15 U.S.C. § 1692e(10).

18

123. The foregoing violations of 15 U.S.C. §1692 by Defendants result in

19

20 separate violations of California Civil Code §1788.17

21 124. The forgoing acts by Defendants were willful and knowing violations of

22

Title 1.6C of the California Civil Code (FRDCPA), are sole and separate violations

23

24 under California Civil Code §1788.30(b), and trigger multiple $1,000.00 penalties.

25 125. California Civil Code §1788.17 provides that Defendants are subject to

26

the remedies of 15 U.S.C. §1692(k), for failing to comply with the provisions of 15

27

28

U.S.C. §1692(b)(6) and §1692(c)c.

Plaintiff‟s First Amended Verified Complaint - 29

1

126. The foregoing acts by Defendants were intentional persistent, frequent,

2 and devious violations of 15 U.S.C. §1692, which trigger additional damages of

3

$1,000.00 under 15 U.S.C. §1692(k)(a)(2)(A).

4

WHEREFORE Plaintiff Moves for the following Relief:

5

6 (a) For an Order enjoining Defendants from continuing to violate the statutes

7

alleged herein;

8

(b) For costs of suite incurred herein;

9

10 (c) For reasonable attorneys fees subject to proof and as available by contract

11

or statute; and

12

(d) For such other and further relief as the court may deem just and proper.

13

14 IX.

15 NINTH CAUSE OF ACTION:

16 Violation Of Civil Code §1572

17

127. Plaintiff realleges and incorporates Paragraphs One (1) through One

18

19

hundred twenty-six (126) of this Amended Complaint, all paragraphs of general

20 allegations, and any unnumbered paragraphs, as though they have been fully restated

21

and set forth herein

22

23

128. The misrepresentations by Defendants‟ and/or Defendants‟ predecessors,

24 failures to disclose, and failure to investigate as described above were made with the

25

intent to induce Plaintiff to obligate himself on the Loan in reliance on the integrity of

26

Defendants and/or Defendants‟ predecessors.

27

28 129. Plaintiff is an unsophisticated customer, whose reliance upon Defendants

Plaintiff‟s First Amended Verified Complaint - 30

1

and/or Defendants‟ predecessors was reasonable and consistent with the Congressional

2 intent and purpose of California Civil Code §1572 enacted in 1872 and designed to

3

assist and protect consumers similarly situated as Plaintiff in this action.

4

130. As an unsophisticated customer, Plaintiff could not have discovered the

5

6 true nature of the material facts on his own.

7

131. The accuracy by Defendants and/or Defendants‟ predecessors of

8

representation is important in enabling a consumer, such as the Plaintiff to compare

9

10 market lenders in order to make informed decisions regarding lending transactions

11

such as a loan.

12

132. Plaintiff was ignorant of the facts which Defendants and/or Defendants‟

13

14 predecessors misrepresented and failed to disclose.

15 133. Plaintiff‟s reliance on Defendants and/or Defendants‟ predecessors was a

16

substantial factor in causing him harm.

17

18 134. Had the truth about the Loan been accurately represented and disclosed

19 by Defendants and/or Defendants‟ predecessors, Plaintiff would not have accepted the

20

Loan nor been harmed.

21

22

135. Had Defendants and/or Defendants‟ predecessors investigated Plaintiff‟s

23 financial capabilities, they would have been forced to deny Plaintiff on this particular

24

loan.

25

136. Defendants and/or Defendants‟ predecessors conspired and agreed to

26

27 commit the above mentioned fraud.

28

137. As a proximate result of Defendants and or Defendants‟ predecessors‟

Plaintiff‟s First Amended Verified Complaint - 31

1

fraud, Plaintiff has suffered damage in an amount to be determined at trial.

2 138. The conduct of Defendants and/or Defendants‟ predecessors as

3

mentioned above was fraudulent within the meaning of California Civil Code

4

§3294(c)(3), and by virtue thereof Plaintiff is entitled to an award of punitive damages

5

6 in an amount sufficient to punish and make an example of the Defendants.

7

WHEREFORE Plaintiff Moves for the following Relief:

8

(a) For punitive damages subject to proof at time of trial;

9

10 (b) For costs of suit incurred herein;

11

(c) For reasonable attorney‟s fees subject to proof and as available by

12

contract or statute; and

13

14 (d) For such other and further relief as the court may deem just and proper.

15 X.

16

TENTH CAUSE OF ACTION:

17

Injunctive Relief Against Defendants

18

19

139. Plaintiff realleges and incorporates Paragraphs One (1) through One

20 hundred tthirty-eight (138) of this Amended Complaint, all paragraphs of general

21

allegations, and any unnumbered paragraphs, as though they have been fully restated

22

23

and set forth herein

24 140. Defendants did not have standing or enforceable right to enforce the note

25

and any incidental right to collateral so as to foreclose on Plaintiff‟s Home, including

26

without limitation, conducting a Sale Under Power relative to that property.

27

28 141. Such action resulted in a cause of action for “wrongful foreclosure,” and

Plaintiff‟s First Amended Verified Complaint - 32

1

caused irreparable harm to Plaintiff, and caused pecuniary compensation which will

2 not afford adequate relief because Plaintiff‟s Home is unique.

3

142. Injunctive relief is necessary to enjoin Defendants from continuing to

4

harm Plaintiff and his Home since they lacked standing and any enforceable rights

5

6 under the Promissory Note.

7

WHEREFORE Plaintiff Moves for the following Relief:

8

(a) For an Order, requiring Defendant to reinstate Plaintiffs on title to

9

10 their Property, and or a restraining order preventing Defendants and

11

his, hers, or its agents, employees, officers, attorneys, and

12

representatives from engaging in or performing any of the following

13

14 acts: (i) offering, or advertising this property for sale and (ii)

15 attempting to transfer title to this property and or (iii) holding any

16

auction therefore;

17

18 (b) For costs of suit incurred herein;

19 (c) For reasonable attorney‟s fees provided by contract or statute; and

20

(d) For such other and further relief as the court may deem just and

21

22

proper.

23 CONCLUSION AND PRAYER

24

Whereas the Plaintiff has shown that Defendants, from the very beginning,

25

showed bad faith, and knowingly, willingly, wantonly, maliciously, and with

26

27 fraudulent intent, conspired and defrauded Plaintiff in acts that encompassed several

28

years of Plaintiff‟s life, thereby causing harm and injury to both himself and his

Plaintiff‟s First Amended Verified Complaint - 33

1

property.

2 The defendants, showing such callous attitudes for the acts, have surely done

3

the same to others, and will continue to do the same to others, unless they are shown

4

that their behavior will not be tolerated. Many of their acts have been not only civil in

5

6 nature, but criminal as well, for which acts, the Plaintiff Moves the court to levy

7

criminal charges against the defendants.

8

WHEREFORE, Plaintiff prays judgment as follows:

9

10 The Court will levy criminal charges for the crimes committed against the

11

Plaintiff, and surely countless other unsuspecting individuals.

12

FOR THE FIRST CAUSE OF ACTION:

13

14 (a) For an Order, requiring Defendant to have a loan reflecting only the Plaintiff

15 to coincide with the Deed in Plaintiff‟s name, and a restraining order/injunction

16

preventing Defendants and/or their/its agents, employees, officers, attorneys,

17

18 and representatives in the future from engaging in or performing any of the

19 following acts: (i) offering, or advertising this property for sale and (ii)

20

attempting to transfer title to this property and or (iii) holding any auction

21

22

thereof;

23 (b) For costs of suit incurred herein;

24

(c) For reasonable attorney‟s fees provided by contract or statute; and

25

(d) For such other and further relief as the court may deem just and proper.

26

27 FOR THE SECOND CAUSE OF ACTION:

28

(a) For compensatory damages according to proof at time of trial;

Plaintiff‟s First Amended Verified Complaint - 34

1

(b) For special damages according to proof at time of trial;

2 (c) For costs of suit incurred herein;

3

(d) For punitive damages subject to proof at time of trial;

4

(e) For costs of suit incurred herein;

5

6 (f) For reasonable attorney‟s fees provided by contract or statute; and

7

(g) For such other and further relief as the court may deem just and proper.

8

FOR THE THIRD CAUSE OF ACTION:

9

10 (a) For damages as provided by statute;

11

(b) For costs of suit incurred herein;

12

(c) For reasonable attorney‟s fees as provided by contract or statute; and

13

14 (d) For such other and further relief as the court may deem just and proper

15 FOR THE FOURTH CAUSE OF ACTION:

16

(a) For an award of exemplary/punitive damages in the amount of Two

17

18 Million Dollars ($2,000,000.00), which will include all of the damages to

19 the Plaintiff and the property for the conversion count, only.

20

(b) Grant attorney‟s fees, which, although Plaintiff currently does not have

21

22

legal representation, he continues to seek competent legal representation.

23 (c) All court costs, and costs associated with pursuing a remedy of the illegal

24

acts of the defendants.

25

(d) (d) Any other relief that Plaintiff fails to realize, and/or that this

26

27 Court deems fair and just under the circumstances.

28

FOR THE FIFTH CAUSE OF ACTION:

Plaintiff‟s First Amended Verified Complaint - 35

1

(a) For general damages subject to proof at time of trial;

2 (b) For special damages subject to proof at time of trial;

3

(c) For costs of suite incurred herein;

4

(d) For reasonable attorney‟s fees subject to proof at time of trial; and

5

6 (e) For such other and further relief as the court may deem just and proper.

7

FOR THE SIXTH CAUSE OF ACTION:

8

(a) For an Order enjoining Defendants from continuing to violate the

9

10 statutes alleged herein;

11

(b) For costs of suit incurred herein;

12

(c) For reasonable attorneys fees subject to proof and as available by

13

14 contract or statute; and

15 (d) For such other and further relief as the court may deem just and proper.

16

FOR THE SEVENTH CAUSE OF ACTION:

17

18 (a) For an Order requiring Defendants to modify the existing loan as set

19 forth herein;

20

(b) For costs of suite incurred herein;

21

22

(c) For reasonable attorneys fees subject to proof and as available by

23 contract or statute; and

24

(d) For such other and further relief as the court may deem just and proper.

25

FOR THE EIGHTH CAUSE OF ACTION:

26

27 (a) For an Order enjoining Defendants from continuing to violate the

28

statutes alleged herein;

Plaintiff‟s First Amended Verified Complaint - 36

1

(b) For costs of suite incurred herein;

2 (c) For reasonable attorneys fees subject to proof and as available by

3

contract or statute; and

4

(d) For such other and further relief as the court may deem just and proper.

5

6 FOR THE NINTH CAUSE OF ACTION:

7

(a) For punitive damages subject to proof at time of trial;

8

(b) For costs of suit incurred herein;

9

10 (c) For reasonable attorney‟s fees subject to proof and as available by

11

contract or statute; and

12

(d) For such other and further relief as the court may deem just and proper.

13

14 FOR THE TENTH CAUSE OF ACTION:

15 (a) For an Order, requiring Defendant to reinstate Plaintiffs on title to their

16

Property, and or a restraining order preventing Defendants and his, hers, or its

17

18 agents, employees, officers, attorneys, and representatives from engaging in or

19 performing any of the following acts: (i) offering, or advertising this property

20

for sale and (ii) attempting to transfer title to this property and or (iii) holding

21

22

any auction therefore;

23 (b) For costs of suit incurred herein;

24

(c) For reasonable attorney‟s fees provided by contract or statute; and

25

(d) For such other and further relief as the court may deem just and proper.

26

27 Respectfully submitted, this 27th day of November, 2010,

28

By: ____________________________

Plaintiff‟s First Amended Verified Complaint - 37

You might also like

- Post-Foreclosure Complaint Plaintiffs)Document46 pagesPost-Foreclosure Complaint Plaintiffs)tmccand93% (15)

- Post-Foreclosure Complaint Plaintiff)Document48 pagesPost-Foreclosure Complaint Plaintiff)tmccand100% (1)

- CARLOS AGUIRRE - Quiet Title ActionDocument33 pagesCARLOS AGUIRRE - Quiet Title Actionprosper4less822075% (4)

- Complaint For Wrongful Foreclosure, Fraud, Negligence, Quiet Title and Unfair Business PracticesDocument25 pagesComplaint For Wrongful Foreclosure, Fraud, Negligence, Quiet Title and Unfair Business PracticesDinSFLA83% (12)

- Pre-Foreclosure Complaint Plaintiffs)Document49 pagesPre-Foreclosure Complaint Plaintiffs)tmccand100% (2)

- Adversary Complaint FinalDocument16 pagesAdversary Complaint FinalJennifer Harwood100% (7)

- Defeat Foreclosure: Save Your House,Your Credit and Your Rights.From EverandDefeat Foreclosure: Save Your House,Your Credit and Your Rights.No ratings yet

- Petition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261From EverandPetition for Certiorari – Patent Case 99-396 - Federal Rule of Civil Procedure 12(h)(3) Patent Assignment Statute 35 USC 261No ratings yet

- Petition for Certiorari Denied Without Opinion: Patent Case 96-1178From EverandPetition for Certiorari Denied Without Opinion: Patent Case 96-1178No ratings yet

- An Inexplicable Deception: A State Corruption of JusticeFrom EverandAn Inexplicable Deception: A State Corruption of JusticeNo ratings yet

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1151From EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1151No ratings yet

- Sample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimFrom EverandSample Motion to Vacate, Motion to Dismiss, Affidavits, Notice of Objection, and Notice of Intent to File ClaimRating: 5 out of 5 stars5/5 (21)

- Circuit Court Complaint Challenges Wrongful ForeclosureDocument28 pagesCircuit Court Complaint Challenges Wrongful ForeclosureBarry Eskanos100% (2)

- Motion to Cancel Foreclosure Sale Due to Lack of Standing and FraudDocument16 pagesMotion to Cancel Foreclosure Sale Due to Lack of Standing and FraudNelson Velardo100% (9)

- FORECLOSURE Response To JP Morgan Chase ForeclosureDocument102 pagesFORECLOSURE Response To JP Morgan Chase ForeclosureLAUREN J TRATAR96% (23)

- Lynn Szymoniac 3rd Amended PDFDocument214 pagesLynn Szymoniac 3rd Amended PDFGreg Wilder100% (3)

- Foreclosure Case Killer! - An Allonge Is Not Admissable Evidence of Bank's OwnershipDocument12 pagesForeclosure Case Killer! - An Allonge Is Not Admissable Evidence of Bank's OwnershipForeclosure Fraud97% (31)

- Foreclosure DefenseDocument80 pagesForeclosure Defense83jjmack100% (8)

- Foreclosure Emergency Motion To Cancel Sale Vacate Final Judgment and Set Aside DefaultDocument16 pagesForeclosure Emergency Motion To Cancel Sale Vacate Final Judgment and Set Aside Defaultwinstons231183% (12)

- TRO Temporary Restraining Order Pleadings 39-2Document13 pagesTRO Temporary Restraining Order Pleadings 39-2DUTCH551400100% (3)

- Florida Quiet Title Complaint by Kathy Ann Garcia-Lawson (KAGL)Document85 pagesFlorida Quiet Title Complaint by Kathy Ann Garcia-Lawson (KAGL)Bob Hurt60% (5)

- JSC First Amended Complaint For Wrongful ForeclosureDocument22 pagesJSC First Amended Complaint For Wrongful Foreclosurejsconrad12100% (1)

- Mortgage Fraud Complaint 110304Document14 pagesMortgage Fraud Complaint 110304richardtzur100% (18)

- Foreclosure Injunction TroDocument15 pagesForeclosure Injunction TroAndrey Ybanez86% (7)

- Gregory Johnson V HSBC Bank - Big Win For Homeonwer - CA FEDERAL COURT-HOW TO USE SECURITIZATION IN YOUR COURT CASEDocument11 pagesGregory Johnson V HSBC Bank - Big Win For Homeonwer - CA FEDERAL COURT-HOW TO USE SECURITIZATION IN YOUR COURT CASE83jjmack100% (3)

- Wrongful Foreclosure Complaint - GA StateDocument22 pagesWrongful Foreclosure Complaint - GA Statewekesamadzimoyo1100% (5)

- Foreclosure Cross ClaimDocument14 pagesForeclosure Cross ClaimDwayne ZookNo ratings yet

- Motion To Set Aside JudgmentDocument8 pagesMotion To Set Aside JudgmentMike RobinsonNo ratings yet

- WRONGFUL Foreclosure Action NOTICE JeaDocument19 pagesWRONGFUL Foreclosure Action NOTICE JeaAlbertelli_Law100% (1)

- LYNN E. SZYMONIAK, ESQ. Open Letter To Honorable Judges in Foreclosure and Bankruptcy ProceedingsDocument5 pagesLYNN E. SZYMONIAK, ESQ. Open Letter To Honorable Judges in Foreclosure and Bankruptcy ProceedingsDinSFLA100% (3)

- Superior Court of The State of California County of SacramentoDocument19 pagesSuperior Court of The State of California County of Sacramentomlkral100% (1)

- Foreclosure Motion To Dismiss - Lack of StandingDocument10 pagesForeclosure Motion To Dismiss - Lack of StandingDwayne Zook100% (3)

- Objection To Foreclosure Sale (Florida)Document7 pagesObjection To Foreclosure Sale (Florida)jrgosz100% (7)

- Complaint For Violation of The One Action Rule, Violation of Rosenthal Act, Wrongful Foreclosure, Conversion, Fraud, Misrepresentation, Unfair Business PracticesDocument22 pagesComplaint For Violation of The One Action Rule, Violation of Rosenthal Act, Wrongful Foreclosure, Conversion, Fraud, Misrepresentation, Unfair Business PracticesCameron Totten100% (2)

- Foreclosure Injunction TroDocument16 pagesForeclosure Injunction TroRon Houchins100% (1)

- Quiet TitleDocument8 pagesQuiet TitleJOSHUA TASK100% (3)

- Neal, Complaint For Quiet TitleDocument36 pagesNeal, Complaint For Quiet Titleronaldhouchins100% (1)

- Motion To Dismiss - Capacity US Bank - PITA NoA Cost BondDocument16 pagesMotion To Dismiss - Capacity US Bank - PITA NoA Cost Bondwinstons2311100% (2)

- Wrongful Foreclosure Appeal 11th Cir.Document33 pagesWrongful Foreclosure Appeal 11th Cir.Janet and James100% (2)

- Huge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New CenturyDocument33 pagesHuge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New Century83jjmack0% (1)

- Orcilla v. Big Sur, Inc.: Headnotes/SummaryDocument68 pagesOrcilla v. Big Sur, Inc.: Headnotes/SummaryRich LardnerNo ratings yet

- Excellent Quiet Title LawsuitDocument22 pagesExcellent Quiet Title LawsuitKaryl Hawes-Jones96% (24)

- Vidal Quiet TitleDocument11 pagesVidal Quiet TitleRudy Centeno100% (1)

- Dismissed Foreclosure!!Document15 pagesDismissed Foreclosure!!Mortgage Compliance Investigators100% (14)

- April Charney Emergency Motion To Stop Foreclosure Sale 1Document10 pagesApril Charney Emergency Motion To Stop Foreclosure Sale 1winstons2311100% (2)

- Affidavit of Lynn e Szymoniak Esq Defendant's ExpertDocument7 pagesAffidavit of Lynn e Szymoniak Esq Defendant's ExpertSampall100% (3)

- Foreclosure DefenseDocument76 pagesForeclosure Defenseluke17100% (9)

- Quantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetFrom EverandQuantum of Justice - The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall Street: The Fraud of Foreclosure and the Illegal Securitization of Notes by Wall StreetNo ratings yet

- The Complete Guide to Preventing Foreclosure on Your Home: Legal Secrets to Beat Foreclosure and Protect Your Home NOWFrom EverandThe Complete Guide to Preventing Foreclosure on Your Home: Legal Secrets to Beat Foreclosure and Protect Your Home NOWRating: 4.5 out of 5 stars4.5/5 (4)

- The Foreclosure Workbook: The Complete Guide to Understanding Foreclosure and Saving Your HomeFrom EverandThe Foreclosure Workbook: The Complete Guide to Understanding Foreclosure and Saving Your HomeNo ratings yet

- Loan Modifications, Foreclosures and Saving Your Home: With an Affordable Loan Modification AgreementFrom EverandLoan Modifications, Foreclosures and Saving Your Home: With an Affordable Loan Modification AgreementNo ratings yet

- Free & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageFrom EverandFree & Clear, Standing & Quiet Title: 11 Possible Ways to Get Rid of Your MortgageRating: 2 out of 5 stars2/5 (3)

- Beating Banks At Their Own Game: Don't fear Big Brother; fear Big BanksFrom EverandBeating Banks At Their Own Game: Don't fear Big Brother; fear Big BanksNo ratings yet

- Petition for Extraordinary Writ Denied Without Opinion– Patent Case 94-1257From EverandPetition for Extraordinary Writ Denied Without Opinion– Patent Case 94-1257No ratings yet

- Petition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)From EverandPetition for Certiorari – Patent Case 01-438 - Federal Rule of Civil Procedure 52(a)No ratings yet

- Chain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure FraudFrom EverandChain of Title: How Three Ordinary Americans Uncovered Wall Street’s Great Foreclosure FraudRating: 3 out of 5 stars3/5 (1)

- American Foreclosure: Everything U Need to Know About Preventing and BuyingFrom EverandAmerican Foreclosure: Everything U Need to Know About Preventing and BuyingNo ratings yet

- Court of Appeals of Georgia Reinstated AppealDocument2 pagesCourt of Appeals of Georgia Reinstated AppealJanet and JamesNo ratings yet

- Liberty Mutual Complaint Filed To GA Atty GeneralDocument12 pagesLiberty Mutual Complaint Filed To GA Atty GeneralJanet and JamesNo ratings yet

- Opposition To Temporary Restraining Order Involving Easement Over LandDocument56 pagesOpposition To Temporary Restraining Order Involving Easement Over LandJanet and JamesNo ratings yet

- Ebola Back in The United StatesDocument8 pagesEbola Back in The United StatesJanet and JamesNo ratings yet

- 7 Things To Know About The DeKalb Government Investigation - WWW - MyajcDocument6 pages7 Things To Know About The DeKalb Government Investigation - WWW - MyajcJanet and JamesNo ratings yet

- Now Check This OutQ FACT SHEET: The Biden Administration's 21 Executive Actions To Reduce Gun ViolenceDocument4 pagesNow Check This OutQ FACT SHEET: The Biden Administration's 21 Executive Actions To Reduce Gun ViolenceJanet and JamesNo ratings yet

- DeKalb Pay Raise Summary July 6 2022Document8 pagesDeKalb Pay Raise Summary July 6 2022Janet and JamesNo ratings yet

- Adversary Complaint Filed Into Bankruptcy CourtDocument34 pagesAdversary Complaint Filed Into Bankruptcy CourtJanet and James100% (1)

- Complete Opposition To TRODocument56 pagesComplete Opposition To TROJanet and JamesNo ratings yet

- 21CV8640 - Complaint or Petition For Quiet TitleDocument7 pages21CV8640 - Complaint or Petition For Quiet TitlenootkabearNo ratings yet

- Preserving A Fair and Impartial JudiciaryDocument12 pagesPreserving A Fair and Impartial JudiciaryJanet and James100% (1)

- Proposal TemplateDocument7 pagesProposal Templateapi-296878826No ratings yet

- To DeKalb Planning & SustainabilityDocument6 pagesTo DeKalb Planning & SustainabilityJanet and JamesNo ratings yet