Professional Documents

Culture Documents

MSc Management Assignment Cover Sheet: Should Ford Go Ahead With The VEP

Uploaded by

Vistasp MajorOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MSc Management Assignment Cover Sheet: Should Ford Go Ahead With The VEP

Uploaded by

Vistasp MajorCopyright:

Available Formats

MSc Management

Assignment Cover Sheet

Submitted by: 0860091

Date Sent: 15th April 2009

Module Title: Corporate Finance

Date/Year of Module: January 2009

Submission Deadline: 15th April, 2009

Number of Pages: 2

Word Count: 855

Question: [Question umber and Title, or Description of Project]

'' Ford Motor Company’s Value Enhancement Plan''

“All the work contained within is my own unaided effort and conforms to the

University's guidelines on plagiarism.”

Student ID: 0860091 1

Should Ford Go Ahead With The VEP?

The VEP is detrimental to the interests of the common shareholder as it issues

additional common shares to the Ford family free of cost. While not an additional

economic claim, this represents additional representation given to the Ford family. In

addition, these extra common shares given to the family can be sold in the open

market without any significant effect in the family’s controlling interest in Ford

through Class B shares, from where the dilutive property of this plan originates. The

two mentioned pension funds have also been sceptical about the actual intentions of

the VEP, and correctly so.

A large chunk of value in Ford’s share comes from its cash balances. These balances

belong to the shareholders and should be returned to them for investment as they see

fit, if no economic value creating opportunities are present within the company’s core

business itself.

Although Modigliani and Miller opine that the form of distribution of cash to

shareholders, whether by dividend or repurchase is irrelevant, an assumption here is

that all investors are total return maximizing, precluding any preference for dividends

(annuities or pension funds) or for capital gains (growth oriented wealthy investors

with higher tax brackets). It also ignores the signalling effects of dividends or

repurchases. The primary objective of a company is survival; secondary is

maximizing value for its shareholders. The cost of capital for Ford in 1999 was 11.5%

[1], hence it can be assumed that it would not change drastically for 2000. It can be

proved that Ford is a business with a lower PVGO component to the P/E ratio and

individuals would have a preference for a stable and continuous stream of income,

and decide on investment themselves.

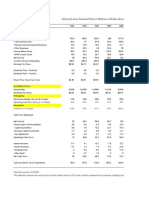

Proof 1:

K = 11.5%

P = 51.38

EPS=5.86

Therefore:

PVGO = P – EPS/k

PVGO = 0.423

The current price of the Ford share owes only a miniscule amount of it to its growth

potential; hence the best alternative is an extraordinary cash dividend as it would

create greatest value for the common shareholder.

If The VEP Is Implemented

If the VEP were to be implemented, let us describe what choice different stakeholders

Student ID: 0860091 2

would choose and why:

Ford Family Member

As a Ford family member, my choice would be to go for receiving a mixture of shares

and cash. The additional shares would give further ownership and control to the Ford

family without disturbing their Class B share portfolio. Since it has been mentioned

that liquidity for the family members was a major concern due to real estate disputes,

divorce settlements etc., the cash would also be welcome as they could be used to

settle current settlements due. The share price would be expected to rise, yielding a

higher return post the VEP being implemented; hence those could be liquidated when

required as well.

Institutional Investor

As an institutional investor, a lot would depend on the taxation rules being applied for

that company. Pension funds like TIAA- Cref and the Calpers would prefer cash for

two reasons. Firstly, pension funds always need to have a strong position of liquidity.

Since pensions of their clients need to be given out rapidly and regularly, a strong

cash balance is a pre-requisite for a pension fund to perform properly. Secondly, a

pensions fund’s income is not taxed. For other institutional investors, the choice could

depend heavily on the way they are taxed for non-operating income. The VEP

mentions that the cash dividend would be taxed like a capital gain, but only if the

stake in the company was less than 1% and it had no control over corporate affairs.

Larger institutions would presumably have large stakes and hence prefer additional

shares to save on tax.

Individual Investor

As in investor, the cash dividend v/s the issue of more shares is a highly debatable

matter. Some would argue that the announcement of a large cash dividend can be a

bad thing as it means that future growth of the company is low and there are no

further investable opportunities, hence preferring a cash dividend. However Ford’s

management have also announced the spin off of Visteon, a subsidiary of Ford. This

can give the market a positive sign of growth and confidence in the future. It might

then seem that a growth investor would benefit with a payout of shares and the short-

term investor would prefer the cash pay out as the cash dividend would be treated as a

capital gain as far as tax was concerned. However keeping in mind the company’s

record of dividend pay outs, a sudden surge of payout due to the VEP, would signal

that growth opportunities are indeed scarce and the company has no better alternative

than to distribute the excess cash to shareholders. A $20 payout for each share held as

stock or cash is a massive change from the $0.50 currently being paid every quarter

for each share held. As a result, it is more likely that the jump signifies that growth

opportunities are limited for the future, and hence an individual investor would prefer

a cash dividend.

References:

1. Depamphilis, D. M. (2007). Mergers, acquisitions, and other restructuring

activities. Academic Press advanced finance series. Amsterdam, Academic.

Student ID: 0860091 3

You might also like

- Porsche's FX Hedging and VW Acquisition StrategyDocument2 pagesPorsche's FX Hedging and VW Acquisition StrategyRavi Patel100% (1)

- Individual AssignmentDocument10 pagesIndividual Assignmentparitosh nayakNo ratings yet

- Running Head: FERRARI 2015 IPO CASE STUDY 1Document11 pagesRunning Head: FERRARI 2015 IPO CASE STUDY 1Umair JanNo ratings yet

- DuPont Corporation Sale of Performance CoatingsDocument1 pageDuPont Corporation Sale of Performance Coatingsj2203950% (2)

- Ford's VEP Returns $10B to ShareholdersDocument8 pagesFord's VEP Returns $10B to ShareholdersRatish Mayank100% (3)

- Structure of Case Study Invest Policy Hewlett Foundation.Document4 pagesStructure of Case Study Invest Policy Hewlett Foundation.SulaimanAl-SulaimaniNo ratings yet

- GR-II-Team 11-2018Document4 pagesGR-II-Team 11-2018Gautam PatilNo ratings yet

- Submission2 - General Mills Acquisition of PillsburyDocument10 pagesSubmission2 - General Mills Acquisition of PillsburyAryan AnandNo ratings yet

- Ferrari DocDocument1 pageFerrari DocFidelNo ratings yet

- GAP Sample Case Analysis Part 2Document13 pagesGAP Sample Case Analysis Part 2VirgileOrsotNo ratings yet

- Ford's Value Enhancement Plan: Individual Investor PreferencesDocument3 pagesFord's Value Enhancement Plan: Individual Investor PreferencesTuhin ChaturvediNo ratings yet

- ACF Assignment - Infineon - PDFDocument5 pagesACF Assignment - Infineon - PDFSuvinay SethNo ratings yet

- The Verizon versus Qwest Battle for MCI TakeoverDocument17 pagesThe Verizon versus Qwest Battle for MCI TakeoverLucas Tai100% (1)

- FNCE 6018 Group Project: Hedging at PorscheDocument2 pagesFNCE 6018 Group Project: Hedging at PorschejorealNo ratings yet

- FPL Group Dividend Policy AnalysisDocument3 pagesFPL Group Dividend Policy AnalysisGovert Wessels100% (1)

- Loewen Group CaseDocument2 pagesLoewen Group CaseSu_NeilNo ratings yet

- Facebook, Inc: The Initial Public OfferingDocument5 pagesFacebook, Inc: The Initial Public OfferingHanako Taniguchi PoncianoNo ratings yet

- Ferrari Case Study - Recommended IPO Price of $48Document9 pagesFerrari Case Study - Recommended IPO Price of $48Rkive SaccharineNo ratings yet

- Buffet Bid For Media GeneralDocument21 pagesBuffet Bid For Media Generalshivam chughNo ratings yet

- HF objectives and constraints as a long-term investorDocument3 pagesHF objectives and constraints as a long-term investorRobert Collier0% (1)

- Case 11 Group 1 PDFDocument56 pagesCase 11 Group 1 PDFRumana ShornaNo ratings yet

- Unique Aspects of The Hospitality IndustryDocument25 pagesUnique Aspects of The Hospitality Industry李曉泉100% (1)

- Ford CaseDocument5 pagesFord Casejessi graceaNo ratings yet

- Dividend Policy at PFL GroupDocument5 pagesDividend Policy at PFL GroupWthn2kNo ratings yet

- VW Porsche Case Study FinalDocument50 pagesVW Porsche Case Study Finalderek.fdez67% (3)

- Facebook IPO Valuation AnalysisDocument13 pagesFacebook IPO Valuation AnalysisMegha BepariNo ratings yet

- FPL Dividend Policy-1Document6 pagesFPL Dividend Policy-1DavidOuahba100% (1)

- NYT - Paywall - For StudentsDocument69 pagesNYT - Paywall - For StudentsSakshi Shah100% (1)

- Williams CEO evaluates $900M financing offer and long-term strategyDocument1 pageWilliams CEO evaluates $900M financing offer and long-term strategyYun Clare Yang0% (1)

- General Mills Pillsbury Case - MACRDocument7 pagesGeneral Mills Pillsbury Case - MACRNikita GulguleNo ratings yet

- Porsche's Attempted Acquisition of VolkswagenDocument12 pagesPorsche's Attempted Acquisition of VolkswagenNadia FernandesNo ratings yet

- Dividend Policy Analysis Florida Power LightDocument5 pagesDividend Policy Analysis Florida Power LightShilpi Kumari100% (1)

- Executive Performance Measures and CompensationDocument16 pagesExecutive Performance Measures and CompensationCarlo manejaNo ratings yet

- Ford's Value Enhancement Plan (A)Document8 pagesFord's Value Enhancement Plan (A)Ilya K100% (1)

- Ferrari Case StudyDocument2 pagesFerrari Case StudyjamesngNo ratings yet

- Annualized Net Income GrowthDocument25 pagesAnnualized Net Income GrowthAdarsh Chhajed0% (2)

- Dividend Policy at Linear Technology - Case Analysis - G05Document2 pagesDividend Policy at Linear Technology - Case Analysis - G05Srikanth Kumar Konduri60% (5)

- Linear Technology's dividend policy decision: pay dividends or repurchase sharesDocument6 pagesLinear Technology's dividend policy decision: pay dividends or repurchase sharesprashantkumarsinha007100% (1)

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDocument11 pagesUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- SpyderDocument3 pagesSpyderHello100% (1)

- Sealed Air Corporation-V5 - AmwDocument8 pagesSealed Air Corporation-V5 - AmwChristopher WardNo ratings yet

- FPLDocument20 pagesFPLJasmani CervantesNo ratings yet

- Ferrari IPO Case v3.0Document9 pagesFerrari IPO Case v3.0Kshitish100% (1)

- Questions - Linear Technologies CaseDocument1 pageQuestions - Linear Technologies CaseNathan Toledano100% (1)

- Case 16 Group 56 FinalDocument54 pagesCase 16 Group 56 FinalSayeedMdAzaharulIslamNo ratings yet

- Stanley Black & Decker IncDocument6 pagesStanley Black & Decker IncNitesh RajNo ratings yet

- Linear TechnologyDocument4 pagesLinear TechnologySatyajeet Sahoo100% (2)

- 2839 MEG CV 2 CaseDocument10 pages2839 MEG CV 2 CasegueigunNo ratings yet

- Linear Technology Dividend Policy and Shareholder ValueDocument4 pagesLinear Technology Dividend Policy and Shareholder ValueAmrinder SinghNo ratings yet

- Sealed Air Case DiscussionDocument6 pagesSealed Air Case DiscussionSukrut Parikh100% (1)

- Dividend Policy at Linear TechnologyDocument9 pagesDividend Policy at Linear TechnologySAHILNo ratings yet

- Linear Technology Case - Ashmita SrivastavaDocument4 pagesLinear Technology Case - Ashmita SrivastavaAshmita Srivastava0% (1)

- Reversing The AMD Fusion Launch (Case Study)Document6 pagesReversing The AMD Fusion Launch (Case Study)SanyamRajvanshiNo ratings yet

- LinearDocument6 pagesLinearjackedup211No ratings yet

- Apple Cash Case StudyDocument2 pagesApple Cash Case StudyJanice JingNo ratings yet

- Ferrari Report Group1Document8 pagesFerrari Report Group1DavidNo ratings yet

- Massey Ferguson CaseDocument6 pagesMassey Ferguson CaseMeraSultan100% (1)

- EADS FX Hedging Strategies ComparisonDocument8 pagesEADS FX Hedging Strategies ComparisonSarvagya JhaNo ratings yet

- Chapter 14-1Document73 pagesChapter 14-1Naeemullah baigNo ratings yet

- Lecture - Sources of FinanceDocument27 pagesLecture - Sources of FinanceNelson MapaloNo ratings yet

- Corporate Finance BasicsDocument27 pagesCorporate Finance BasicsAhimbisibwe BenyaNo ratings yet

- Corporate Finance IndividualDocument3 pagesCorporate Finance Individualarry widodoNo ratings yet

- Fin 9895 Pe Assignment 1Document14 pagesFin 9895 Pe Assignment 1Sheikh shawonNo ratings yet

- PPA for Procurement of Solar PowerDocument54 pagesPPA for Procurement of Solar Powersamik_sarkar7041No ratings yet

- Coal OmanDocument7 pagesCoal OmanVistasp MajorNo ratings yet

- Dynea Group Annual Report 2010Document47 pagesDynea Group Annual Report 2010Vistasp MajorNo ratings yet

- The Iphone's Rise To Glory and Challenges Ahead For The New Year: A Supply Chain PerspectiveDocument9 pagesThe Iphone's Rise To Glory and Challenges Ahead For The New Year: A Supply Chain PerspectiveVistasp MajorNo ratings yet

- MSC Management Assignment Cover SheetDocument11 pagesMSC Management Assignment Cover SheetVistasp MajorNo ratings yet

- New Hair Streamer Marketing PlanDocument24 pagesNew Hair Streamer Marketing PlanTANGI85No ratings yet

- Economic Value Added: Calculating EVADocument3 pagesEconomic Value Added: Calculating EVAsanjaycrNo ratings yet

- 04 Victorias Milling Co. Inc. vs. Municipality of VictoriasDocument2 pages04 Victorias Milling Co. Inc. vs. Municipality of VictoriasJamaica Cabildo ManaligodNo ratings yet

- (EXTERNAL) 2013 Pattern PDFDocument63 pages(EXTERNAL) 2013 Pattern PDFAshwin kaleNo ratings yet

- URC 2011 Annual Report HighlightsDocument146 pagesURC 2011 Annual Report HighlightsMelan YapNo ratings yet

- Session 6. The Statement of Cash FlowsDocument22 pagesSession 6. The Statement of Cash FlowsAmrutaNo ratings yet

- AIS ReviewerDocument20 pagesAIS ReviewerkimmibanezNo ratings yet

- Batas Pambansa BLGDocument2 pagesBatas Pambansa BLGKevin Joe CuraNo ratings yet

- RN170907113212734 RpuDocument13 pagesRN170907113212734 RpunadiaNo ratings yet

- A Guide To Investing in Closed-End Funds: Key PointsDocument4 pagesA Guide To Investing in Closed-End Funds: Key Pointsemirav2No ratings yet

- HAL Presentation Jan 2017Document31 pagesHAL Presentation Jan 2017Sujatha LokeshNo ratings yet

- A Project Management Bench Mark: Delhi MetroDocument26 pagesA Project Management Bench Mark: Delhi Metrodineshsoni29685No ratings yet

- BSNL TM SalaryDocument1 pageBSNL TM SalaryDharmveer SinghNo ratings yet

- Financial Policy For IvcsDocument11 pagesFinancial Policy For Ivcsherbert pariatNo ratings yet

- Manual of Cost Accounting in The Ordnance and Ordnance Equipment Factories Section - I General ObjectsDocument73 pagesManual of Cost Accounting in The Ordnance and Ordnance Equipment Factories Section - I General ObjectsSachin PatelNo ratings yet

- The Personal MBA (Summary)Document13 pagesThe Personal MBA (Summary)Boy BearishNo ratings yet

- Solved Ashley Company Uses A Perpetual Inventory System From The Following PDFDocument1 pageSolved Ashley Company Uses A Perpetual Inventory System From The Following PDFAnbu jaromiaNo ratings yet

- Amway Business Plan STP by Mandeep Kaur and Kulwinder SinghDocument22 pagesAmway Business Plan STP by Mandeep Kaur and Kulwinder SinghKulwinder SinghNo ratings yet

- Strategy and National DevelopmentDocument35 pagesStrategy and National DevelopmentelmarcomonalNo ratings yet

- Death of Big LawDocument55 pagesDeath of Big Lawmaxxwe11No ratings yet

- Resume Ch.11 Consolidation TheoriesDocument3 pagesResume Ch.11 Consolidation TheoriesDwiki TegarNo ratings yet

- F3 and FFA Full Specimen Exam Answers PDFDocument5 pagesF3 and FFA Full Specimen Exam Answers PDFFarhanHaiderNo ratings yet

- Corporate Finance: Topic: Company Analysis "Infosys"Document6 pagesCorporate Finance: Topic: Company Analysis "Infosys"Anuradha SinghNo ratings yet

- Arrangement of Section in Income Tax Act 1961Document8 pagesArrangement of Section in Income Tax Act 1961Jitendra VernekarNo ratings yet

- Global LCC Outlook v2Document310 pagesGlobal LCC Outlook v2JcastrosilvaNo ratings yet

- Essential Characteristics of TaxDocument1 pageEssential Characteristics of TaxMarinelle MejiaNo ratings yet