Professional Documents

Culture Documents

Errata Sheet Financial Derivatives

Uploaded by

masniahmakmurOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Errata Sheet Financial Derivatives

Uploaded by

masniahmakmurCopyright:

Available Formats

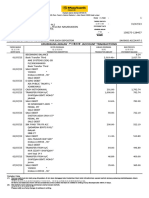

Errata Sheet for Financial Derivatives: Markets and Applications Second Edition

Page 33, Table 3.3, Column—Margin Account Balance , 0 day should be 1,200

Page 48, Question 12, Line 4, market losses should be market inflows

Page 52 Section II, Table, Column—Action, Line 3, [(1,013.63x25)x21]should be [(1,013.63x25)x2]

Page 62, Line 7 workings should be

1,000 pts x RM50 =RM50,000

Cost per ling position =RM 30

Transaction cost as % of value (RM30/RM50,000)X100=0.06%

Page 66, Scenario 2, Column—Action, Line 3 Borrow 120,000 should be Borrow 60,000

Page 67, First Table, Item ii) Short Spot Position Today should read 60,000, Item iii) Lend RM60, 000@ 4% for 90 days,

Item iv) Borrow RM 300 @4% to replace divs, Position Today should be blank.

Page 68, Section a) 12x1.2=12 contracts should be 12x1.2=24 contracts

Page 85, paragraph 2, line 8, Short 6 should be Long 6

Page 86, Table—Cash & Carry Arbitrage with SSF, Column—action I, short 1SIF should be short 10SSF

Page 90, Question 8, Line 6 RM 100 should be RM 50

Page 109, Paragraph Result of Hedge, Line 8, workings should be

Total earning =RM 50,000+RM 50,000

=RM 100,000

Page 112, Scenario 2, Line 9,-RM 1,250 should be RM 1,250

Page 127 In Simplified Bank Balance Sheet, under liabilities last line should read total liabilities

Page 128, Duration of Liabilities Line 2 should be

=(0) + (0.2) + (1.6)

Page 136, Table 6.1, Column—(P/L) payoff, Line 1,(0.50) should be (2.50)

Page 163, Illustration under 7.4 Intermediation and Margining the arrows should be

Option Buyer Exchange Option Seller

Page 164, Figure 7.1 (a) Line 2 Long KLCI 850 put should be Long KLCI 850 call

Page 178, Table 8.2, Column 2, Value of Long Stock Position should be Value of Short Stock Position, Column 3, Profit/Loss to

Long Put Position should be Profit/Loss to Long Call Position

Page 183, Figure 8.4, P/L axis, Short call 0.5 should be 0.05

Page 187 Last Table, Column—Break-Even Point for Bear Call, price-difference should be price+ difference

Page 197 Table 8.12, Column Proft/Loss to Short 7.50 @0.10 should be Short 7.50 call @ 0.10

Page 198 Line 7, 17.93 should be 17.38

Page 198 Line 11, 8.696 should be 8.686

Page 209, Table—Payoff to Call Ratio Spread (2:1) P/L axis, 90 should be 0.90

Page 220, Figure 9.5, Line 1 Call Value should be Put Value

Page 220, Second paragraph, Line 3 workings should be

P3= [ (0) +……[0], + [(0.125x3) (RM 1.09)+[(0.125)(RM2.710)]

Page 221, Figure 9.6, Line 1 Call Value should be Put value and Call Payoff should be Put Payoff

Page 227, Line 15, Step 3, workings should be

C=RM11(0.7291)-RM10.e (-0.10x0.25).(0.6406)

Page 228, Line 11, N(-d2) should be N(d2)

Page 228, Line 12, workings should be

N(-d2)=1-N(d2)1-0.6406=0.3594

Page 246 footnote toTable 9.7, Line 2

Note: N’(d) is determined as = e-d i2/2

2

Page 248, Line 11, 12,13 and 14 RM 4.68 should be RM 4.98.

Page 248, Line 15 and 16, 0.5657 should be 0.602

Page 264, Line 9, 20 sen should be 24 sen

Page 278 Illustration in paragraph 4 should be as follows

RM 10 mil

Prob.=0.05

RM 1 mil Prob.=0.95

0

Page 307 Last Paragraph Line 10, country should be currency

Page 319 Question 7, Line 8, The 3-month KLIBOR is now 4.5%, while the 3 month futures is at 95.0, En Aman wants to lock-in

the current cost of 7.5%

Page 320 Line 2, 7% should be 7.5%

Page 320, Line 5, lock-in-the 7% cost should be lock-in-a 7% cost of funds

Page 321, Question 14, Line 6

Time 6-Month Libor

0.5 5.25%

1.0 5.5%

1.5 6%

2.0 6.2%

2.5 5.44%

Page 339 Question 10, Line 4, Answers should be Profit from Long SIF=RM1,418, Loss on short spot 1,250, interest earned on

lending =RM369.50, replace borrowed dividends=(RM164.06): so arbitrage profit=RM371.82

Page 340,Chapter 7, Question 7 Put IV=.10 should be Put TV .10

Page 340 Chapter 8, Question 5a) straddle position should be strangle position , Question 7b)RM7.70 (Break-even), Max

Profit=RM0.70, Max Profit RM 0.30

Page 343, Question 21, Long 800 should be Long 400

You might also like

- Corrections in The BookDocument5 pagesCorrections in The BookAsif Iqbal 2016289090No ratings yet

- 3B Group2 Case StudyDocument8 pages3B Group2 Case Studynatasya hanimNo ratings yet

- Mathematics Ratio, Proportion & PercentageDocument3 pagesMathematics Ratio, Proportion & PercentageXaronAngelNo ratings yet

- Fin320 Simulation 2020 JulyDocument40 pagesFin320 Simulation 2020 JulyMohd Azmezanshah Bin Sezwan100% (1)

- FM09-CH 11Document5 pagesFM09-CH 11Mukul KadyanNo ratings yet

- EXAMPLE CHAPTER 4 - No1Document1 pageEXAMPLE CHAPTER 4 - No1Jia Xin TanNo ratings yet

- Epjj Latest Tutorial Q and A On Setting Minimum Bid Price and EAC As at 12 Nov 2021Document4 pagesEpjj Latest Tutorial Q and A On Setting Minimum Bid Price and EAC As at 12 Nov 20212022961653No ratings yet

- FINANCE Case Study NoDocument15 pagesFINANCE Case Study Nofalina100% (1)

- Chap 2 On-Line Assignment AnsDocument5 pagesChap 2 On-Line Assignment Ansjimmy_chou1314No ratings yet

- Induvidual Assignment 2 - Hirosha Vejian (264096)Document5 pagesInduvidual Assignment 2 - Hirosha Vejian (264096)Hirosha VejianNo ratings yet

- Add or DeleteDocument5 pagesAdd or DeleteMAZLIZA AZUANA ABDULLAHNo ratings yet

- Share & Business Valuation Case Study Question and SolutionDocument6 pagesShare & Business Valuation Case Study Question and SolutionSarannyaRajendraNo ratings yet

- Chapter 5 Economic Analysis of Equipment Purchase and Manufacturing CostsDocument7 pagesChapter 5 Economic Analysis of Equipment Purchase and Manufacturing CostsMohd AizatNo ratings yet

- Additional Practice Prob With Solutions - Session 1 - 3Document2 pagesAdditional Practice Prob With Solutions - Session 1 - 3Aniket AnilNo ratings yet

- Solution Maf653 - Dec 2019 - StudentDocument7 pagesSolution Maf653 - Dec 2019 - Studentdini ffNo ratings yet

- Assignment/ Tugasan: BDEK1103 Introductory Microeconomics Pengenalan Mikroekonomi January 2023 SemesterDocument11 pagesAssignment/ Tugasan: BDEK1103 Introductory Microeconomics Pengenalan Mikroekonomi January 2023 SemesterMalar StylesNo ratings yet

- Entrepreneurship & IP: Financial AnalysisDocument9 pagesEntrepreneurship & IP: Financial Analysiswihanga100% (2)

- Tutorial 8 PDFDocument12 pagesTutorial 8 PDFtan keng qi100% (2)

- Type Answers On This Side of The Page OnlyDocument40 pagesType Answers On This Side of The Page Only嘉慧No ratings yet

- Dec 2019Document7 pagesDec 2019ANo ratings yet

- Tutorial Question 2 NPV AnalysisDocument8 pagesTutorial Question 2 NPV AnalysisTheva LetchumananNo ratings yet

- Tutorial Question 2 201909 BBCA 2053Document8 pagesTutorial Question 2 201909 BBCA 2053Theva LetchumananNo ratings yet

- Lecturer: R.Rajaraman Subject: Applied Operation Research Code: BA1603 UNIT I: Introduction To Linear Programming Part-ADocument19 pagesLecturer: R.Rajaraman Subject: Applied Operation Research Code: BA1603 UNIT I: Introduction To Linear Programming Part-ASivabalan100% (1)

- The University of Nottingham: Suggested Solution (I)Document5 pagesThe University of Nottingham: Suggested Solution (I)Hoang BaoNo ratings yet

- Exercises Topic 2 With AnswersDocument2 pagesExercises Topic 2 With AnswersfatehahNo ratings yet

- Money Market SolutionDocument6 pagesMoney Market SolutionAnkit Poudel100% (2)

- W6 - Team DDocument4 pagesW6 - Team Dasdfghkl1323No ratings yet

- Cost Volume Profit (CVP) AnalysisDocument10 pagesCost Volume Profit (CVP) AnalysiszahidkhanNo ratings yet

- Maf653 Tutorial Questions - Shares (Student)Document3 pagesMaf653 Tutorial Questions - Shares (Student)JebatNo ratings yet

- 610 HWset 2dfgndfgnDocument43 pages610 HWset 2dfgndfgnmanoman12345No ratings yet

- Revision Question Topic 3,4-AnswerDocument5 pagesRevision Question Topic 3,4-AnswerNur WahidaNo ratings yet

- Task 1 Determine The Fair Price of A Future Contract That You Have Chosen and Explain That Affect Its PricingDocument10 pagesTask 1 Determine The Fair Price of A Future Contract That You Have Chosen and Explain That Affect Its Pricing洁儿No ratings yet

- Busi4489 E1Document7 pagesBusi4489 E1ArkamNo ratings yet

- Spot - Future) (Ending-Beginning)Document8 pagesSpot - Future) (Ending-Beginning)DR LuotanNo ratings yet

- Tutorial 5 Capital BudgetingDocument5 pagesTutorial 5 Capital BudgetingAhmad Azim HazimiNo ratings yet

- T2-Forward and Future MarketsDocument3 pagesT2-Forward and Future MarketsJennieNo ratings yet

- DMS 4032 - Solution CVP AnalysisDocument5 pagesDMS 4032 - Solution CVP AnalysisyelenmotorsportNo ratings yet

- Scan Aug 27, 2022Document5 pagesScan Aug 27, 2022Aniket ShrivastavaNo ratings yet

- Project Management Assignment (1) 7 SeptDocument15 pagesProject Management Assignment (1) 7 Septsan sanNo ratings yet

- Reg. No.: Q.P. Code: (07 DMB 03)Document3 pagesReg. No.: Q.P. Code: (07 DMB 03)umamaheswari palanisamyNo ratings yet

- Ltp-Structur 2 - Bom - 11-11-2020Document16 pagesLtp-Structur 2 - Bom - 11-11-2020vidyaNo ratings yet

- Problem Set 3Document23 pagesProblem Set 3Demir NurullahNo ratings yet

- Questions For ReviewDocument13 pagesQuestions For Reviewنور عفيفهNo ratings yet

- Correct gross profit after purchases book overcast errorDocument5 pagesCorrect gross profit after purchases book overcast errorBiswajit DasNo ratings yet

- 4A2F'S Emeriz Café No. Daftar Perniagaan Atau Syarikat: Ca0281965-KDocument2 pages4A2F'S Emeriz Café No. Daftar Perniagaan Atau Syarikat: Ca0281965-KAmirul HasanNo ratings yet

- Cpa Review School of The Philippines: Management Advisory Services AGE OFDocument9 pagesCpa Review School of The Philippines: Management Advisory Services AGE OFJohn Carlo CruzNo ratings yet

- Final Practrice (Unit 4 and 5)Document9 pagesFinal Practrice (Unit 4 and 5)mjlNo ratings yet

- Activity cost analysis and product costing problemsDocument7 pagesActivity cost analysis and product costing problemsKHAkadsbdhsgNo ratings yet

- Final Assessment Test - November 2016: Course: - Class NBR(S) : Slot: Time: Three Hours Max. Marks: 100Document3 pagesFinal Assessment Test - November 2016: Course: - Class NBR(S) : Slot: Time: Three Hours Max. Marks: 100ak164746No ratings yet

- ENME619.12 Fundamentals of Pipeline EconomicsDocument8 pagesENME619.12 Fundamentals of Pipeline Economicssalman hussainNo ratings yet

- Kami Export - STEVEN ST ANGEL - Monopoly Pricing WorksheetDocument3 pagesKami Export - STEVEN ST ANGEL - Monopoly Pricing WorksheetSTEVEN ST ANGEL0% (2)

- Answer Scheme Tutorial 9Document3 pagesAnswer Scheme Tutorial 9eiraNo ratings yet

- Question.5 Allegheny Steel Corporation Has Been Looking Into The Factors That Influence How ManyDocument5 pagesQuestion.5 Allegheny Steel Corporation Has Been Looking Into The Factors That Influence How ManyRajkumarNo ratings yet

- Management Science 2Document8 pagesManagement Science 2Joia De LeonNo ratings yet

- Management accounting - Pareto analysis reveals vital few customersDocument3 pagesManagement accounting - Pareto analysis reveals vital few customersKrishnan SampathNo ratings yet

- Mathematics for Electrical Engineering and ComputingFrom EverandMathematics for Electrical Engineering and ComputingRating: 5 out of 5 stars5/5 (6)

- Let's Practise: Maths Workbook Coursebook 6From EverandLet's Practise: Maths Workbook Coursebook 6No ratings yet

- 141672Document6 pages141672masniahmakmurNo ratings yet

- 1Document18 pages1masniahmakmurNo ratings yet

- Effects of Economic Environment On Automobile Companies in MalaysiaDocument1 pageEffects of Economic Environment On Automobile Companies in MalaysiamasniahmakmurNo ratings yet

- SWOT Analysis of GoogleDocument1 pageSWOT Analysis of GooglemasniahmakmurNo ratings yet

- Effects of Economic Environment On Automobile Companies in MalaysiaDocument1 pageEffects of Economic Environment On Automobile Companies in MalaysiamasniahmakmurNo ratings yet

- Carrefour in MexicoDocument6 pagesCarrefour in MexicomasniahmakmurNo ratings yet

- International Finance: Currency Options and Options MarketsDocument14 pagesInternational Finance: Currency Options and Options MarketsmasniahmakmurNo ratings yet

- PA 242.2 Problem Set 2Document2 pagesPA 242.2 Problem Set 2Laurence Niña X. OrtizNo ratings yet

- Chapter 14 Financial StatementsDocument82 pagesChapter 14 Financial StatementsKate CuencaNo ratings yet

- TallyDocument109 pagesTallyRamya RamamurthyNo ratings yet

- CALCULATING YTM FOR BONDSDocument4 pagesCALCULATING YTM FOR BONDSJapponjot SinghNo ratings yet

- DocxDocument352 pagesDocxsino akoNo ratings yet

- Micro-Finance Management & Critical Analysis in IndiaDocument47 pagesMicro-Finance Management & Critical Analysis in IndiaSABUJ GHOSH100% (1)

- IAS 36 - Impairment of Assets - 2020Document17 pagesIAS 36 - Impairment of Assets - 2020ayman el-saidNo ratings yet

- ComplaintDocument32 pagesComplaintmikelintonNo ratings yet

- CH 9-The Cost of Capital by IM PandeyDocument36 pagesCH 9-The Cost of Capital by IM PandeyJyoti Bansal89% (9)

- Pairs Trading Cointegration ApproachDocument82 pagesPairs Trading Cointegration Approachalexa_sherpyNo ratings yet

- Tangible and Intangible Assets: IAS 16, IAS 38Document39 pagesTangible and Intangible Assets: IAS 16, IAS 38petitfmNo ratings yet

- Orascom Construction PLC Corporate Presentation September 2022Document27 pagesOrascom Construction PLC Corporate Presentation September 2022Mira HoutNo ratings yet

- QUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestDocument3 pagesQUARTER 2 GENMATH WEEK3 Lesson 26 4 Solving Problems Involving Simple and Compound InterestLalaine Jhen Dela CruzNo ratings yet

- OM Chapter 1Document135 pagesOM Chapter 1መስቀል ኃይላችን ነውNo ratings yet

- Buenaventura V MetrobankDocument2 pagesBuenaventura V MetrobankRobert Rosales100% (1)

- PT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYADocument3 pagesPT INDOFOOD CBP SUKSES MAKMUR TBK DAN ENTITAS ANAKNYARama fauziNo ratings yet

- M2U SA 128457 Jul 2023Document5 pagesM2U SA 128457 Jul 2023syafiqah.mohdali38No ratings yet

- Rating Project FinanceDocument20 pagesRating Project Financesuperandroid21100% (2)

- Ap Workbook PDFDocument44 pagesAp Workbook PDFLovely Jay AbanganNo ratings yet

- Allied Banking Corp vs Lim Sio WanDocument12 pagesAllied Banking Corp vs Lim Sio WanKathleen MartinNo ratings yet

- Accounting ConceptsDocument32 pagesAccounting ConceptsSarika KeswaniNo ratings yet

- ScrisoriDocument2 pagesScrisoriSimona GheorgheNo ratings yet

- Fairway Mortgage DocumentsDocument6 pagesFairway Mortgage DocumentsFairway Independent MortgageNo ratings yet

- A-IDEA Business Incubation TemplateDocument6 pagesA-IDEA Business Incubation TemplatevasantsunerkarNo ratings yet

- CASH FLOW STATEMENT ANALYSISDocument32 pagesCASH FLOW STATEMENT ANALYSISPranav MishraNo ratings yet

- Financial Planning, Tools EtcDocument31 pagesFinancial Planning, Tools EtcEowyn DianaNo ratings yet

- Latest Jurisprudence and Landmark Doctrines On DepreciationDocument2 pagesLatest Jurisprudence and Landmark Doctrines On DepreciationCarlota Nicolas VillaromanNo ratings yet

- Create Settlement Rules for Asset CapitalizationDocument18 pagesCreate Settlement Rules for Asset CapitalizationnguyencaohuyNo ratings yet

- BDA Advises Quasar Medical On Sale of Majority Stake To LongreachDocument3 pagesBDA Advises Quasar Medical On Sale of Majority Stake To LongreachPR.comNo ratings yet

- Tutoring Business Plan ExampleDocument23 pagesTutoring Business Plan Example24 Alvarez, Daniela Joy G.No ratings yet