Professional Documents

Culture Documents

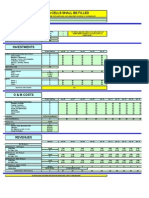

12 Month Cash Flow Statement

Uploaded by

iPakistan100%(2)100% found this document useful (2 votes)

2K views1 page12 Month Cash Flow Statement

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLS, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document12 Month Cash Flow Statement

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

100%(2)100% found this document useful (2 votes)

2K views1 page12 Month Cash Flow Statement

Uploaded by

iPakistan12 Month Cash Flow Statement

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLS, PDF, TXT or read online from Scribd

You are on page 1of 1

Twelve-month cash flow Enter Company Name Here Fiscal Year Begins: Jan-05

Pre-Startup Total Item

Jan-05 Feb-05 Mar-05 Apr-05 May-05 Jun-05 Jul-05 Aug-05 Sep-05 Oct-05 Nov-05 Dec-05

EST EST

Cash on Hand (beginning of

0 0 0 0 0 0 0 0 0 0 0 0 0

month) Notes on Preparation

CASH RECEIPTS Note: You may want to print this information to use as reference later. To delete

these instructions, click the border of this text box and then press the DELETE

Cash Sales key.

Collections fm CR accounts Refer back to your Profit & Loss Projection. Line-by-line ask yourself when you

should expect cash to come and go. You have already done a sales projection,

Loan/ other cash inj.

now you must predict when you will actually collect from customers. On the

TOTAL CASH RECEIPTS 0 0 0 0 expense

0 side,

0 you have 0 previously0 projected

0 expenses; 0 now predict0 when you 0 0 0

will actually have to write the check to pay those bills. Most items will be the

Total Cash Available (before cash

0 0 0 0 same

0 as on0the Profit 0& Loss Projection.

0 Rent

0 and utility

0 bills, for 0instance, are

0 0 0

out) usually paid in the month they are incurred. Other items will differ from the Profit

& Loss view. Insurance and some types of taxes, for example, may actually be

CASH PAID OUT payable quarterly or semiannually, even though you recognize them as monthly

expenses. Just try to make the Cash Flow as realistic as you can line by line. The

Purchases (merchandise) payoff for you will be an ability to manage and forecast working capital needs.

Change the category labels in the left column as needed to fit your accounting

Purchases (specify) system.

Purchases (specify)

Note that lines for 'Loan principal payment' through 'Owners' Withdrawal' are for

Gross wages (exact withdrawal) items that always are different on the Cash Flow than on the Profit & Loss. Loan

Principal Payment, Capital Purchases, and Owner's Draw simply do not, by the

Payroll expenses (taxes, etc.) rules of accounting, show up on the Profit & Loss Projection. They do, however,

definitely take cash out of the business, and so need to be included in your Cash

Outside services plan. On the other hand, you will not find Depreciation on the Cash Flow because

you never write a check for Depreciation. Cash from Loans Received and

Supplies (office & oper.) Owners' Injections go in the "Loan/ other cash inj." row. The "Pre-Startup" column

is for cash outlays prior to the time covered by the Cash Flow. It is intended

Repairs & maintenance

primarily for new business startups or major expansion projects where a great

Advertising deal of cash must go out before operations commence. The bottom section,

"ESSENTIAL OPERATING DATA", is not actually part of the Cash model, but it

Car, delivery & travel allows you to track items which have a heavy impact on cash. The Cash Flow

Projection is the best way to forecast working capital needs. Begin with the

Accounting & legal amount of Cash on Hand you expect to have. Project all the Receipts and Paid

Outs for the year. If CASH POSITION gets dangerously low or negative, you will

Rent need to pump in more cash to keep the operation afloat. Many profitable

Telephone businesses have gone under because they could not pay the bills while waiting

for money to flow in. Your creditors do not care about profit; they want to be paid

Utilities with cash. Cash is the financial lifeblood of your business.

Insurance

Taxes (real estate, etc.)

Interest

Other expenses (specify)

Other (specify)

Other (specify)

Miscellaneous

SUBTOTAL 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Loan principal payment

Capital purchase (specify)

Other startup costs

Reserve and/or Escrow

Owners' Withdrawal

TOTAL CASH PAID OUT 0 0 0 0 0 0 0 0 0 0 0 0 0 0

Cash Position (end of month) 0 0 0 0 0 0 0 0 0 0 0 0 0 0

ESSENTIAL OPERATING DATA (non cash flow information)

Sales Volume (dollars)

Accounts Receivable

Bad Debt (end of month)

Inventory on hand (eom)

Accounts Payable (eom)

Depreciation

You might also like

- Template Financial Forecast ModelDocument46 pagesTemplate Financial Forecast ModelMLastTry100% (2)

- Chartofaccounts ExampleDocument3 pagesChartofaccounts ExampleherawandonoNo ratings yet

- Format of Financial Statements Under The Revised Schedule VIDocument97 pagesFormat of Financial Statements Under The Revised Schedule VIDebadarshi RoyNo ratings yet

- Cash Position Cash In: Abbreviated Business Plan - Medchill - 1Document1 pageCash Position Cash In: Abbreviated Business Plan - Medchill - 1kaseymedchillNo ratings yet

- Hotel Financial Model 2013 Complete V6-Xls 2Document59 pagesHotel Financial Model 2013 Complete V6-Xls 2AjayRathorNo ratings yet

- Hindustan Unilever Development Centre: BasementDocument20 pagesHindustan Unilever Development Centre: BasementAssem ElhajjNo ratings yet

- FY 2019 ANNUAL INVESTMENT PROGRAM SUMMARYDocument31 pagesFY 2019 ANNUAL INVESTMENT PROGRAM SUMMARYercelito varquezNo ratings yet

- Procurement FormsDocument22 pagesProcurement FormsILECO UNONo ratings yet

- Reduce Telecom Costs 40Document21 pagesReduce Telecom Costs 40Lawrence BrownNo ratings yet

- Hospitality Industry Chart of Accounts PDFDocument12 pagesHospitality Industry Chart of Accounts PDFAmeliaPrisiliaNo ratings yet

- Project Cost Break Up2Document1 pageProject Cost Break Up2DrJennifer LoboNo ratings yet

- Project Budget & Costs TemplateDocument15 pagesProject Budget & Costs TemplateDenimfajita100% (3)

- Charts of AccountsDocument7 pagesCharts of Accountszindabhaag100% (1)

- Cashflow ProjectionsDocument1 pageCashflow ProjectionsJoe MageroNo ratings yet

- Financial ModelDocument8 pagesFinancial Modelapi-382249450% (4)

- Cash Flow TemplateDocument13 pagesCash Flow TemplateJohn ArikoNo ratings yet

- TOTAL PC FLOWTEC INDIA ORGANIZATION CHARTDocument51 pagesTOTAL PC FLOWTEC INDIA ORGANIZATION CHARTHarshanand KalgeNo ratings yet

- 03 Indzara Small Business Product Catalog v1 3Document18 pages03 Indzara Small Business Product Catalog v1 3vijay sainiNo ratings yet

- MEPDocument2 pagesMEPsardarmkhanNo ratings yet

- Cash Receipt Process Flowchart2Document8 pagesCash Receipt Process Flowchart2nongmckeyNo ratings yet

- Tender Access FormDocument337 pagesTender Access Formvishal.nithamNo ratings yet

- Expense Report: From: To: Purpose: Statement #: Name: Employee ID: Department: ManagerDocument4 pagesExpense Report: From: To: Purpose: Statement #: Name: Employee ID: Department: Managerprajapatiprashant40No ratings yet

- Salary Increase LetterDocument2 pagesSalary Increase LetterGokilavani Muthusamy100% (1)

- Personlig BudgetDocument6 pagesPersonlig BudgetAnn SundkvistNo ratings yet

- Assignment 01 2018 Financial Analysis HotelDocument6 pagesAssignment 01 2018 Financial Analysis HotelEllie NguyenNo ratings yet

- Inter Company Process v6 SYDocument65 pagesInter Company Process v6 SYrikizalkarnain88No ratings yet

- Budget Template All DepartmentsDocument45 pagesBudget Template All DepartmentsAli Azeem Rajwani100% (2)

- Ugandan Children's Education BudgetDocument5 pagesUgandan Children's Education BudgetMayamba Ivan100% (1)

- Restaurant Financial ProjectionsDocument37 pagesRestaurant Financial ProjectionsPaul NdegNo ratings yet

- The Uniform Chart of AccountsDocument137 pagesThe Uniform Chart of AccountsElzein Amir ElzeinNo ratings yet

- Generally Accepted Scheduling Principles Gasp CompiledDocument1,821 pagesGenerally Accepted Scheduling Principles Gasp CompiledIgnacio Manzanera0% (1)

- Micro Eportfolio Competition Spreadsheet Data-Fall 18Document4 pagesMicro Eportfolio Competition Spreadsheet Data-Fall 18api-334921583No ratings yet

- Employee Expense Report TemplateDocument4 pagesEmployee Expense Report TemplateTyler Beth VandeWaterNo ratings yet

- P&L AccountDocument13 pagesP&L AccountRajneesh SehgalNo ratings yet

- Time Sheet For Daily Work at MCS-TB1 2016Document5 pagesTime Sheet For Daily Work at MCS-TB1 2016Roland NicolasNo ratings yet

- Project Status Dashboard Xl2007Document22 pagesProject Status Dashboard Xl2007Jkjiwani AccaNo ratings yet

- Corporate Budget Memo No. 39Document95 pagesCorporate Budget Memo No. 39mcla28No ratings yet

- Construction Cash FlowDocument38 pagesConstruction Cash FlowTriet Truong100% (1)

- Chart of Accounts PDFDocument22 pagesChart of Accounts PDFEvans MulliNo ratings yet

- TEMPLATE Financial Projections WorkbookDocument22 pagesTEMPLATE Financial Projections WorkbookFrancois ChampenoisNo ratings yet

- Constrcution Project Cash Flow FormatDocument5 pagesConstrcution Project Cash Flow FormatAnoop NimkandeNo ratings yet

- Fixed Asset Acquisition FormDocument1 pageFixed Asset Acquisition Formkamran1983No ratings yet

- Clinic Financial Model Excel Template v10 DEMODocument77 pagesClinic Financial Model Excel Template v10 DEMOdeddyNo ratings yet

- Mfg Operations MIS Reports Capacity Demand ForecastDocument2 pagesMfg Operations MIS Reports Capacity Demand Forecastharish_inNo ratings yet

- Step 3: Purchase OrdersDocument56 pagesStep 3: Purchase OrdersBelajar MONo ratings yet

- Financial Model Flow ChartDocument1 pageFinancial Model Flow ChartTallal Mughal100% (1)

- TimeSheet-Calculator TrumpExcelRevised-2017 v1Document7 pagesTimeSheet-Calculator TrumpExcelRevised-2017 v1ianachieviciNo ratings yet

- Cost CodesDocument37 pagesCost CodesIrving Angeles100% (1)

- Personal Budget SpreadsheetDocument7 pagesPersonal Budget Spreadsheetamiller1987No ratings yet

- Project Cost Tracking ReportDocument1 pageProject Cost Tracking ReportMandalinaQitry100% (1)

- Financial MGT TermsDocument14 pagesFinancial MGT TermsAmit KaushikNo ratings yet

- Salary Survey Entry 45 BenjonesDocument365 pagesSalary Survey Entry 45 BenjonesFabio DantasNo ratings yet

- 12 Month Cash Flow Statement1Document1 page12 Month Cash Flow Statement1Vorn Ra VuthNo ratings yet

- 12 Month Cash FlowDocument3 pages12 Month Cash FlowDarkchild HeavensNo ratings yet

- Cash Flow (12 Months) : Enter Company Name Here Fiscal Year Begins: Jan-17Document3 pagesCash Flow (12 Months) : Enter Company Name Here Fiscal Year Begins: Jan-17Adam PerezNo ratings yet

- Free Business TemplatesDocument3 pagesFree Business Templateshowieg43100% (9)

- 12 Month Cash Flow StatementDocument1 page12 Month Cash Flow StatementSmita KumarNo ratings yet

- ABK - 12 Month Cash Flow Statement1Document1 pageABK - 12 Month Cash Flow Statement1erkingulerNo ratings yet

- 12 Month Cash Flow - 0Document4 pages12 Month Cash Flow - 0LulaNo ratings yet

- Cash Flow (12 Months) : Enter Company Name Here Fiscal Year Begins: Jan-19Document3 pagesCash Flow (12 Months) : Enter Company Name Here Fiscal Year Begins: Jan-19MUHAMMAD -No ratings yet

- 34 Ways Candidates Strike Out On InterviewsDocument4 pages34 Ways Candidates Strike Out On InterviewsiPakistanNo ratings yet

- Excel Template Design - ColorfulDocument2 pagesExcel Template Design - ColorfuliPakistanNo ratings yet

- Excel Template, Equipment Inventory ListDocument2 pagesExcel Template, Equipment Inventory ListiPakistan100% (1)

- Two Year Balance SheetDocument1 pageTwo Year Balance SheetiPakistan100% (2)

- Treasury Analysis WorksheetDocument5 pagesTreasury Analysis WorksheetiPakistan100% (3)

- Very Good PresentationDocument24 pagesVery Good PresentationiPakistanNo ratings yet

- 73 Designed Quality Excel Chart TemplatesDocument63 pages73 Designed Quality Excel Chart TemplatesiPakistan100% (9)

- Market Analysis Worksheet: (Company Name) (Date)Document6 pagesMarket Analysis Worksheet: (Company Name) (Date)iPakistanNo ratings yet

- Income StatementDocument19 pagesIncome StatementiPakistan67% (3)

- Fill in FormDocument4 pagesFill in FormiPakistan100% (2)

- Monthly Bills Due DatesDocument2 pagesMonthly Bills Due DatesiPakistan100% (5)

- Job Search LogDocument10 pagesJob Search LogiPakistan100% (4)

- To Do ListDocument1 pageTo Do ListiPakistan100% (3)

- Dual Currency Conversion InvestmentsDocument2 pagesDual Currency Conversion InvestmentsiPakistanNo ratings yet

- Household Monthly BudgetDocument1 pageHousehold Monthly BudgetiPakistan100% (4)

- Quarterly Lead TrackingDocument3 pagesQuarterly Lead TrackingiPakistanNo ratings yet

- Perpetual Event CalendarDocument1 pagePerpetual Event CalendarMusadya100% (1)

- Detail Account ClassificationDocument6 pagesDetail Account ClassificationiPakistanNo ratings yet

- 2008 Tax CalculatorDocument1 page2008 Tax CalculatoriPakistan100% (1)

- Letter of InterestDocument1 pageLetter of InterestiPakistan100% (3)

- Excel FunctionsDocument33 pagesExcel FunctionsiPakistan100% (1)

- Interview, Thank You Letter That Mentions Interview AfterthoughtsDocument1 pageInterview, Thank You Letter That Mentions Interview AfterthoughtsiPakistanNo ratings yet

- Interview, A Thank You Letter That Stresses FitDocument1 pageInterview, A Thank You Letter That Stresses FitiPakistanNo ratings yet

- Event Planning Budget Template (Excel)Document3 pagesEvent Planning Budget Template (Excel)MicrosoftTemplates100% (7)

- Interview, Sample Post-Interview Thank You LetterDocument1 pageInterview, Sample Post-Interview Thank You LetteriPakistan50% (2)

- Excel Monthly Payment CalendarDocument1 pageExcel Monthly Payment CalendariPakistan67% (6)

- P&L StatementDocument2 pagesP&L StatementiPakistan100% (8)

- Cash Breakeven Analysis: Awus $10,000 100%Document13 pagesCash Breakeven Analysis: Awus $10,000 100%iPakistanNo ratings yet

- A Free General Thank You Letter SampleDocument1 pageA Free General Thank You Letter SampleiPakistan100% (1)

- Simple Payroll CalculatorDocument4 pagesSimple Payroll CalculatormaginguaNo ratings yet

- Lecture 1 Family PlanningDocument84 pagesLecture 1 Family PlanningAlfie Adam Ramillano100% (4)

- Kahveci: OzkanDocument2 pagesKahveci: OzkanVictor SmithNo ratings yet

- Huawei WCDMA Primary Scrambling Code PlanningDocument22 pagesHuawei WCDMA Primary Scrambling Code PlanningZeljko Vrankovic90% (31)

- Application of ISO/IEC 17020:2012 For The Accreditation of Inspection BodiesDocument14 pagesApplication of ISO/IEC 17020:2012 For The Accreditation of Inspection BodiesWilson VargasNo ratings yet

- Spsi RDocument2 pagesSpsi RBrandy ANo ratings yet

- Ks3 Science 2008 Level 5 7 Paper 1Document28 pagesKs3 Science 2008 Level 5 7 Paper 1Saima Usman - 41700/TCHR/MGBNo ratings yet

- Obiafatimajane Chapter 3 Lesson 7Document17 pagesObiafatimajane Chapter 3 Lesson 7Ayela Kim PiliNo ratings yet

- Lesson 2 Mathematics Curriculum in The Intermediate GradesDocument15 pagesLesson 2 Mathematics Curriculum in The Intermediate GradesRose Angel Manaog100% (1)

- Biomotor Development For Speed-Power Athletes: Mike Young, PHD Whitecaps FC - Vancouver, BC Athletic Lab - Cary, NCDocument125 pagesBiomotor Development For Speed-Power Athletes: Mike Young, PHD Whitecaps FC - Vancouver, BC Athletic Lab - Cary, NCAlpesh Jadhav100% (1)

- FBCA Biomarkers and ConditionsDocument8 pagesFBCA Biomarkers and Conditionsmet50% (2)

- FALL PROTECTION ON SCISSOR LIFTS PDF 2 PDFDocument3 pagesFALL PROTECTION ON SCISSOR LIFTS PDF 2 PDFJISHNU TKNo ratings yet

- Lecture 1: Newton Forward and Backward Interpolation: M R Mishra May 9, 2022Document10 pagesLecture 1: Newton Forward and Backward Interpolation: M R Mishra May 9, 2022MANAS RANJAN MISHRANo ratings yet

- Ch07 Spread Footings - Geotech Ultimate Limit StatesDocument49 pagesCh07 Spread Footings - Geotech Ultimate Limit StatesVaibhav SharmaNo ratings yet

- Ca. Rajani Mathur: 09718286332, EmailDocument2 pagesCa. Rajani Mathur: 09718286332, EmailSanket KohliNo ratings yet

- Um 0ah0a 006 EngDocument1 pageUm 0ah0a 006 EngGaudencio LingamenNo ratings yet

- Username: Password:: 4193 Votes 9 Days OldDocument6 pagesUsername: Password:: 4193 Votes 9 Days OldΘώμηΜπουμπαρηNo ratings yet

- MSDS FluorouracilDocument3 pagesMSDS FluorouracilRita NascimentoNo ratings yet

- Control SystemsDocument269 pagesControl SystemsAntonis SiderisNo ratings yet

- Feasibility StudyDocument47 pagesFeasibility StudyCyril Fragata100% (1)

- Embryo If Embryonic Period PDFDocument12 pagesEmbryo If Embryonic Period PDFRyna Miguel MasaNo ratings yet

- The Singular Mind of Terry Tao - The New York TimesDocument13 pagesThe Singular Mind of Terry Tao - The New York TimesX FlaneurNo ratings yet

- Major Bank Performance IndicatorsDocument35 pagesMajor Bank Performance IndicatorsAshish MehraNo ratings yet

- Easa Ad Us-2017-09-04 1Document7 pagesEasa Ad Us-2017-09-04 1Jose Miguel Atehortua ArenasNo ratings yet

- Weir Stability Analysis Report PDFDocument47 pagesWeir Stability Analysis Report PDFSubodh PoudelNo ratings yet

- Ground Water Resources of Chennai DistrictDocument29 pagesGround Water Resources of Chennai Districtgireesh NivethanNo ratings yet

- Scharlau Chemie: Material Safety Data Sheet - MsdsDocument4 pagesScharlau Chemie: Material Safety Data Sheet - MsdsTapioriusNo ratings yet

- IP68 Rating ExplainedDocument12 pagesIP68 Rating ExplainedAdhi ErlanggaNo ratings yet

- Doe v. Myspace, Inc. Et Al - Document No. 37Document2 pagesDoe v. Myspace, Inc. Et Al - Document No. 37Justia.comNo ratings yet

- Key ssl101 Academic Skills For University Success ssl101cDocument196 pagesKey ssl101 Academic Skills For University Success ssl101cHùng NguyễnNo ratings yet

- Roadmap For Digitalization in The MMO Industry - For SHARINGDocument77 pagesRoadmap For Digitalization in The MMO Industry - For SHARINGBjarte Haugland100% (1)