Professional Documents

Culture Documents

Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10

Uploaded by

Anita PanigrahiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Explain The Following Terms in Not More Than Two Sentences Each: 1x 10 10

Uploaded by

Anita PanigrahiCopyright:

Available Formats

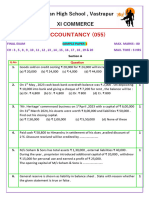

ACCOUNTANCY

Full Marks : 100 Time : 3 hours

1. Explain the following terms in not more than two sentences each : 1x 10 = 10

(a) Capital (b) Book-keeping (c) Drawings (d) Liabilities(e)Depreciation (f)

Current Assets (g) Prepaid expenses (h) Journal (i) Sundry creditor (j) Accounting

Equation.

2. Classify the following documents under personal, real and nominal headings: 1x5=5

(a) Wages outstanding (b) Kalyani publishers (c) charity account (d) Purchases

return account (e) Reserve for discount on debtors.

3. Correct the following journal entries: 1x10 = 10

S.L. No. Transactions Entries

1 Received interest from Mr.x Interest A/c Dr.

To Mr.x

2 Salary due in the month December. Cash A/c Dr.

To Outstanding salary A/c

3 Installation expenses incurred on Installation charges A/c Dr.

the machine To Machinery A/c

4 Computer purchased on cash Purchased A/c Dr.

To Cash A/c

5 Commission received in cash Commission A/c Dr.

To Cash A/c

6 Cash withdrawn by the Proprietor Capital A/c Dr.

for self To Cash A/c

7 Receipt on account from Amitabh Amitabh A/c Dr.

To Cash A/c

8 Rent paid to Landlord Rent A/c Dr.

To Landlord A/c

9 Salary paid to Gorika Salary A/c Dr.

To Gorika A/c

10 Received Cheques on account of Sales A/c Dr.

sales To Bank A/c

4. Fill in the Blanks with appropriate words: 1x5 = 5

(i) Nominal account having credit balance represents…………

(ii) Real account can’t have ………. Balance.

(iii) Journal is a book of …………

(iv) Goods distributed as “free samples” should be debited to ……. Account.

(v) When cash is deposited into and withdrawn from bank, the entry is the cash book

is called ……..

5. Answer the following questions within two to three sentences. 2x5 = 10

(i) Give an example of contra entry.

(ii) What is triple column cash Book?

(iii) What is mean by transaction?

(iv) Explain modern rules of double entry system.

(v) What is Accounting year?

GROUP B

Answer any Five Questions from the Followings: 5x12 = 60

6. Journalise the following transactions and post them into ledger.

2008

July 1 Business commenced with cash Rs.40, 000 and own equipments Rs. 8,000

July 4 Deposited into bank Rs. 9,000

July 9 Bought furniture for office use Rs.5,000

July 10 Drew from bank for office use Rs. 2,000

July 11 Bought goods of Rafique Rs. 410

July 17 Paid Rafique in full settlement Rs.400

July 25 Repaid the loan to sunny Rs. 1,000

July 30 Goods uninsured worth Rs. 5,000 were destroyed by fire.

July 31 Interest on capital Rs.500.

7. The following balances appear in various accounts on 31-12-2006. You are

asked to prepare a Trial Balance. Rs.

Rs.

Capital 20,000 Apprentice premium 300

Machinery 8,000 Insurance premium 200

Building 9,000 Interest on investment 600

Carriage inward 500 Bank charges 100

Debtors 6,000 Discount allowed 300

Return inwards 900 Creditors 3,000

Bills payable 1,950 Provision for doubtful debts 650

Loan from Raj & Co. 8,000 Rent outstanding 1,200

Opening stock 500 Sales 9,000

Bank 1500 Purchases 3,500

Cash 500 Furniture 2,000

Drawings 2,000

8. From the following trial balance and subjoined information, prepare trading

and profit and loss account for the year ending 31 st March, 2010 and balance

sheet as on that date.

Debit balance Rs. Credit balance Rs.

Drawings 1,420 Capital account 8,500

Machinery 1,900 Sales 23, 812

Stock 1st April. 2009 2,920 Return outward 582

Purchases 20,724 Apprentice premium 240

Sundry expenses 880 Bank overdraft 400

Return inward 420 Sundry creditors 2,000

Rent 240 Provision for doubtful debts 210

Rates and taxes 400 Bills payable 360

Bad debts 344 Discount 120

Sundry debtors 6,400

Cash at office 96

Bills receivable 480

Adjustments:

(a) Stock on 31st March, 2010 was Rs.3,400.

(b) Provide for doubtful debts at 5% on sundry debtors.

(c) Rent due was Rs. 80

(d) Taxes, Rs.160 were paid in advance.

(e) Depreciate machinery at 10% p.a.

(f) Apprentice premium , Rs.40 was received in advance.

(g) Charge interest on capital at 5% p.a.

9. Enter the following transactions in the three columnar cash book and balance

it.

2006

Nov. 1 Balance of cash in hand Rs. 14,000 and in bank Rs. 10,000.

Nov. 2 Received cash from Mohan Rs. 1,000 and allowed him discount Rs. 30.

Nov. 3 Paid into the bank Rs. 2,000.

Nov. 4 Paid to Divakar by cheque Rs.320 in full settlement of their

account for Rs.350.

Nov. 5 Received from cash sales, cash Rs. 275 and cheque Rs.225.

Nov. 6 Paid for purchases by cheque Rs.645.

Nov. 7 Paid by cheque to Ravi Rs. 725 in full settlement of Rs.800.

Nov. 8 Drew from bank for office use Rs.900 and Rs.100 for personal use.

10. From the following particulars prepare a bank reconciliation statement and

ascertain the balance as per Pass book as on 31st March, 2009.

(i) Balance as per cash Book on 31st March, 2009 was Rs.12,000.

(ii) Cheque issued Rs, 2000 were not presented at Bank by 31-03-09.

(iii) Cheques for Rs.8,000 were deposited in bank but were not cleared.

(vi) Bank received interest on Debenture on behalf of Madhab amounting to Rs.250.

(vii) Bank charges debited in pass book but not recorded in cash book Rs.50.

(viii) A cheque for Rs.200 received from Dhaban and deposited in bank was

dishonoured.

(ix) An amount of Rs. 1,500 was directly deposited by a debtor into bank.

(x) Cheques totaling Rs.800 have been deposited into bank on 20th March, but only

cheque amounting to Rs.300 have been collected and credited in pass book.

(xi) A bill receivable for Rs. 1248.20 was collected by bank but there was no entry

regarding this in the cash book.

11. What is Book-keeping? What are the objectives of Book-keeping ? What are

the advantages of Book-keeping? How does Book-keeping differ from

Accountancy?

You might also like

- SOP - Finance and Accounting DepartmentDocument52 pagesSOP - Finance and Accounting Departmentcoffee Dust100% (21)

- Quizzes - Chapter 9 - Acctg Cycle of A Service BusinessDocument12 pagesQuizzes - Chapter 9 - Acctg Cycle of A Service BusinessAmie Jane Miranda50% (4)

- Excercises On Branch and Home Office Chapter TwoDocument3 pagesExcercises On Branch and Home Office Chapter Twoሔርሞን ይድነቃቸው50% (4)

- Financial Accounting Punjab University: Question Paper 2010Document4 pagesFinancial Accounting Punjab University: Question Paper 2010ZeeShan IqbalNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- 202AF13A Financial AccountingDocument14 pages202AF13A Financial AccountingkalpanaNo ratings yet

- Sample Paper 5 (Final Exam XI Accountancy)Document9 pagesSample Paper 5 (Final Exam XI Accountancy)pritanshutripathi84No ratings yet

- Accounting MockDocument6 pagesAccounting MockGSNo ratings yet

- Book-Keeping Form Three PDFDocument4 pagesBook-Keeping Form Three PDFdesa ntosNo ratings yet

- Individual Assignment.123Document5 pagesIndividual Assignment.123Tsegaye BubamoNo ratings yet

- Mid Sem 1sem Exam Paper Oct2015Document26 pagesMid Sem 1sem Exam Paper Oct2015angel100% (1)

- Screenshot 2023-02-21 at 1.23.27 AMDocument12 pagesScreenshot 2023-02-21 at 1.23.27 AMGracy AroraNo ratings yet

- Accounts (A)Document3 pagesAccounts (A)Sameer Gupta100% (1)

- AccountancyDocument8 pagesAccountancyAnkit KumarNo ratings yet

- 5627Document8 pages5627MS 7No ratings yet

- Double Entry Book Keeping Rules Chapter - 03Document10 pagesDouble Entry Book Keeping Rules Chapter - 03Ramainne RonquilloNo ratings yet

- Costing and AccountancyDocument3 pagesCosting and AccountancyDeepakNo ratings yet

- Accountancy CLASS-XI-WPS OfficeDocument7 pagesAccountancy CLASS-XI-WPS Officemaruthesh.vNo ratings yet

- Acc Xi Class Test-I 2022Document4 pagesAcc Xi Class Test-I 2022shaurya kapoorNo ratings yet

- Sample Paper For See Acc Xi - 1Document6 pagesSample Paper For See Acc Xi - 1Piyush JNo ratings yet

- Fundamental of Accounting I Assigment IIDocument6 pagesFundamental of Accounting I Assigment IIadinannejash146No ratings yet

- Mock-Iv AccountsDocument6 pagesMock-Iv AccountsAnsh UdainiaNo ratings yet

- Yardstick International College: Masters of Business Administration (2013)Document7 pagesYardstick International College: Masters of Business Administration (2013)Dani Azmi AwokeNo ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- Class Xi Acc QPDocument7 pagesClass Xi Acc QP8201ayushNo ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- Accounting Analysis of TransactionsDocument14 pagesAccounting Analysis of TransactionscamilleNo ratings yet

- Accounting For Managers Assignment IDocument3 pagesAccounting For Managers Assignment ITsgereda Mekasha86% (7)

- Cbse Class 11 Accountancy Sample Paper Set 1 QuestionsDocument6 pagesCbse Class 11 Accountancy Sample Paper Set 1 QuestionsNishtha 3153No ratings yet

- TallyDocument27 pagesTallyRonak JainNo ratings yet

- FA Question Bank TT1-1Document14 pagesFA Question Bank TT1-1rock SINGHALNo ratings yet

- Chapter 6-Trial Balance and Rectification of Errors Previous QuestionsDocument12 pagesChapter 6-Trial Balance and Rectification of Errors Previous Questionscrescenthss vanimalNo ratings yet

- Co 2101Document3 pagesCo 2101PRIYA LAKSHMANNo ratings yet

- Accountancy Practice Paper - 1Document2 pagesAccountancy Practice Paper - 1Rinshi GuptaNo ratings yet

- 12 Com....Document5 pages12 Com....Advanced AcademyNo ratings yet

- Accounts Test Paper From JeegyasaDocument6 pagesAccounts Test Paper From JeegyasaAnushka KunduNo ratings yet

- Financial Accounting Punjab University: Question Paper 2009Document5 pagesFinancial Accounting Punjab University: Question Paper 2009Abrar AliNo ratings yet

- 11 Sample Papers Accountancy 2Document10 pages11 Sample Papers Accountancy 2AvcelNo ratings yet

- 12 C BK Mock Board PraveenaDocument4 pages12 C BK Mock Board PraveenaAdvanced AcademyNo ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Sample Question Paper IN AccountancyDocument7 pagesSample Question Paper IN AccountancyRahul TyagiNo ratings yet

- CBM 514-3 Question 3Document3 pagesCBM 514-3 Question 3hafsamohmd793No ratings yet

- Pilot TestDocument6 pagesPilot TestNguyễn Thị Ngọc AnhNo ratings yet

- 11 AccDocument6 pages11 AccPushpinder KumarNo ratings yet

- Section "A" Very Short Answer Questions) (Attempt All Questions)Document5 pagesSection "A" Very Short Answer Questions) (Attempt All Questions)Ayusha TimalsinaNo ratings yet

- Tally Repor1Document74 pagesTally Repor1Ronak JainNo ratings yet

- Finacial Accountig1Document7 pagesFinacial Accountig1Prashanth PendyalaNo ratings yet

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- LHU8Q Olopr DaisyAcountXIDocument35 pagesLHU8Q Olopr DaisyAcountXIDido MuczNo ratings yet

- 11th Accountancy Practice PaperDocument5 pages11th Accountancy Practice PaperPrachi RustagiNo ratings yet

- Chapter 2 Review Sheet AnswersDocument7 pagesChapter 2 Review Sheet AnswersKenneth DayohNo ratings yet

- Accountancy Sample PaperDocument6 pagesAccountancy Sample PaperDevansh BawejaNo ratings yet

- 11 Accounts Sample Paper 2Document15 pages11 Accounts Sample Paper 2Techy ParasNo ratings yet

- Acc101 - Chapter 2: Accounting For TransactionsDocument16 pagesAcc101 - Chapter 2: Accounting For TransactionsMauricio AceNo ratings yet

- Mid Term Exam POA 2023 - Đề 2Document5 pagesMid Term Exam POA 2023 - Đề 2Anh Nguyễn MaiNo ratings yet

- AfB1 Tutorial Questions For Week 3Document3 pagesAfB1 Tutorial Questions For Week 3zhaok0610No ratings yet

- Accounts Mega ModelDocument8 pagesAccounts Mega Modellekha ram100% (1)

- Book Keeping FivDocument6 pagesBook Keeping FivALE MEDIANo ratings yet

- 11 Sample Papers Accountancy 2020 English Medium Set 3Document10 pages11 Sample Papers Accountancy 2020 English Medium Set 3Joshi DrcpNo ratings yet

- The Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItFrom EverandThe Puppet Masters: How the Corrupt Use Legal Structures to Hide Stolen Assets and What to Do About ItRating: 5 out of 5 stars5/5 (1)

- EC1 - Module 2 3Document6 pagesEC1 - Module 2 3Vincent Anthony SandoyNo ratings yet

- BaysaJadzMeric IT 225 RequirementsDocument3 pagesBaysaJadzMeric IT 225 RequirementsGrace TVNo ratings yet

- CH 8Document7 pagesCH 8sunanda88No ratings yet

- Syllabus MAN213 2018 2019 SpringDocument4 pagesSyllabus MAN213 2018 2019 SpringOğuzhan KöksalNo ratings yet

- Assignment 7Document12 pagesAssignment 7Mayuri FulewaleNo ratings yet

- Advantages and Limitations of Career Planning Accounting EssayDocument7 pagesAdvantages and Limitations of Career Planning Accounting EssayHND Assignment HelpNo ratings yet

- Introduction To Accounting: Dr. Seema PanditDocument29 pagesIntroduction To Accounting: Dr. Seema Panditiiidddkkk 230No ratings yet

- CS Executive Account MergeDocument216 pagesCS Executive Account Mergegautam shahNo ratings yet

- Reviewer Chapter 1 - Book 1 - Comprehensive ExamDocument5 pagesReviewer Chapter 1 - Book 1 - Comprehensive ExamKrizel Dixie ParraNo ratings yet

- Bookkeeping: Bookkeeping Is The Recording of Financial Transactions. Transactions Include SalesDocument7 pagesBookkeeping: Bookkeeping Is The Recording of Financial Transactions. Transactions Include SalesCharlie True FriendNo ratings yet

- Module 3Document47 pagesModule 3Harrold HarryNo ratings yet

- 7 ElevenDocument80 pages7 ElevenakashNo ratings yet

- Monday 4 May 2020: AccountingDocument20 pagesMonday 4 May 2020: AccountingDURAIMURUGAN MIS 17-18 MYP ACCOUNTS STAFFNo ratings yet

- Lesson 1Document30 pagesLesson 1Winoah HubaldeNo ratings yet

- F & A - Basic Accounting TermsDocument3 pagesF & A - Basic Accounting TermsAbdul Azeez 312No ratings yet

- Mock Test No 2Document18 pagesMock Test No 2atingoyal1No ratings yet

- Cash Book ObjectivesDocument5 pagesCash Book ObjectivestarabhaiNo ratings yet

- Accounting Manager or Accounting Supervisor or Financial AnalystDocument3 pagesAccounting Manager or Accounting Supervisor or Financial Analystapi-78394041No ratings yet

- Cash Book & Petty Cash BookDocument3 pagesCash Book & Petty Cash BookArman ArmanNo ratings yet

- BTech Textile Tech Syllabus PDFDocument48 pagesBTech Textile Tech Syllabus PDFDurjoy RoyNo ratings yet

- Mark Scheme June 2003 GCE: AccountingDocument11 pagesMark Scheme June 2003 GCE: AccountingSaadArshadNo ratings yet

- Iroko Exam Third Term Jss1Document10 pagesIroko Exam Third Term Jss1ogunfunminiyiestherNo ratings yet

- A Text Book Corporate Financial Accounting Non BsaDocument192 pagesA Text Book Corporate Financial Accounting Non BsaJade JadeNo ratings yet

- Fundamentals of Accounting Fall 2022Document5 pagesFundamentals of Accounting Fall 2022umer iqbalNo ratings yet

- Rembulat-Bookkeeping (Session Plan)Document4 pagesRembulat-Bookkeeping (Session Plan)ksj rembulatNo ratings yet

- 2023-24 F.Y.B.C.a 101 FundamentaL of AccountancyDocument2 pages2023-24 F.Y.B.C.a 101 FundamentaL of AccountancyPoonam Sunil Lalwani LalwaniNo ratings yet

- Resume MisikirDocument2 pagesResume MisikirTaddelemisikirNo ratings yet

- CHAPTER 1 Introduction To AccountingDocument12 pagesCHAPTER 1 Introduction To Accountingrosendophil7No ratings yet