Professional Documents

Culture Documents

Cost Sheet

Uploaded by

Deboraj Bhattacharjee0 ratings0% found this document useful (0 votes)

157 views27 pagesfinal account

Original Title

Cost Sheet,

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfinal account

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

157 views27 pagesCost Sheet

Uploaded by

Deboraj Bhattacharjeefinal account

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 27

MEANING OF COST ‘COST’ represents a sacrifice of values, a foregoing or a release of

something of value. It is the price of economic resources used as a result of p

roducing or doing the thing costed. It is the amount of expenditure incurred on

a given thing. Cost has been defined as the amount measured in money or cash exp

ended or other party transferred, capital stock issued, services performed or a

liability incurred in consideration of goods and serviced received or to be rece

ived. By cost, we mean the actual cost i.e. historical cost. ICWA (UK) defines c

ost as the amount of expenditure (actual or notional) incurred on, or attributab

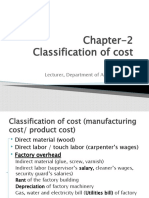

le to a specified thing or activity. CLASSIFICATION OF COST Cost classification

is the process of grouping costs according to their common features. Costs are t

o be classified in such a manner that they are identified with cost center or co

st unit. ON THE BASIS OF BEHAVIOUR OF COST Behavior means change in cost due to

change in output. On the basis of behavior cost is classified into the following

categories: FIXED COST It is that portion of the total cost which remains const

ant irrespective of the output upto capacity limit. It is called as a period cos

t as it is concerned with period. It depends upon the passage of time. It is als

o referred to as non-variable cost or stand by cost, capacity cost or “period” cost.

It tends to be unaffected by variations in output. These costs provide conditio

ns for production rather than costs of production. They are created by contractu

al obligations and managerial decisions. Rent of premises, taxes and insurance,

staff salaries constitute fixed cost.

VARIABLE COST This cost varies according to the output. In other words, it is a

cost which changes according to the changes in output. It tends to vary in direc

t proportion to output. If the output is decreased, variable cost also will decr

ease. It is concerned with output or product. Therefore, it is called as a “produc

t” cost. If the output is doubled, variable cost will also be doubled. For example

, direct material, direct labour, direct expenses and variable overheads. It is

shown in the diagram below.

SEMI-VARIABLE COST This is also referred to as semi-fixed or partly variable cos

t. It remains constant up to a certain level and registers change afterwards. Th

ese costs vary in some degree with volume but not in direct or same proportion.

Such costs are fixed only in relation to specified constant conditions. For exam

ple, repairs and maintenance

of machinery, telephone charges, supervision professional tax, etc.

ON THE BASIS OF ELEMENTS OF COST Elements means nature of items. A cost is compo

sed of three elements, material, labour and expenses. Each of these elements can

be direct and indirect. DIRECT COST It is the cost which is directly chargeable

to the product manufactured. It is easily identifiable. Direct cost consists of

three elements which are as follows: • DIRECT MATERIAL It is the cost of basic ra

w material used for manufacturing a product. It becomes a part of the product. N

o finished product can be manufactured without basic raw materials. It is easily

identifiable and chargeable to the product. For example, leather in leatherware

s, pulp in paper, steel in steel furniture, sugarcane for sugarcane etc. what is

raw material for one manufacturer might be finished product for another. Direct

material includes the following:

1. All materials specially purchased for production or the process. 2. All compo

nents purchased for production or the process. 3. Material transferred from one

cost center to another or one process to another. 4. Primary packing materials,

wrappings, cardboard boxes etc, necessary for preservation or protection of prod

uct. Some of the items like nails or thread in the store are a part of finished

product. They are not treated as direct materials in view of negligible cost. • DI

RECT LABOUR OR DIRECT WAGES It is the amount paid to those workers who are engag

ed in the manufacturing line for conversion of raw materials into finished goods

. The amount of wages can be easily identified and directly charged to the produ

ct. These workers directly handle raw materials, work in progress and finished g

oods on the production line. Wages paid to the workers operating lathes, drillin

g, cutting machines etc are direct wages. Direct wages are also as productive la

bour, process labour or prime cost labour. Direct wages include the payment made

to the following group of workers: 1. Labour engaged on the capital production

of the product. 2. Labour engaged in aiding the operations viz. Supervisor, Fore

man, Shop clerks and Worker on internal transport. 3. Inspectors, Analysts neede

d for such production.

• DIRECT EXPENSES OR CHARGEABLE EXPENSES It is the amount of expenses which is dir

ectly chargeable to the product manufactured or which may be allocated to produc

t directly. It can be easily identified with the product. For example, hire char

ges of a special machine used for manufacturing a product, cost of designing the

product, cost of patterns, architects fees/surveyors fees, or job cost of exper

imental work carried out especially for a job etc. Cost of special drawings, cos

t of special

layout designs, patents, patterns, cost of models, surveyors fees, Excise duty,

royalty on production, cost of rectifying defective work. Utility of such expens

es is exhausted on completion of job. • INDIRECT COST It is that portion of the to

tal cost which cannot be identified and charged directly to the product. It has

to be allocated and apportioned and absorbed over the units manufactured on a su

itable basis. It consists of the following three elements: • INDIRECT MATERIAL It

is the cost of the material other than direct material which cannot be charged t

o the product directly. It cannot be treated as a part of the product. It is als

o known as expenses materials. It is the material which cannot be allocated to t

he product but which can be apportioned to the cost units. Examples are as follo

ws: 1. Lubricants, cotton waste, oil, grease, stationery etc 2. Small tools for

general use 3. Some minor items such as thread in dress making, cost of nails in

shoemaking etc • INDIRECT LABOUR It is the amount of wages paid to those workers

who are not engaged on the manufacturing line, for example, wages of workers in

administration department, watch n ward department, sales department, general su

pervision. • INDIRECT EXPENSES It is the amount of expenses which is not chargeabl

e to the product directly. It is the cost of giving service to the production de

partment. It includes factory expenses, administrative expenses, selling and dis

tribution expenses etc.

• OVERHEADS OR ON COST OR BURDEN OR SUPPLEMNTARY COST Aggregate of indirect cost i

s referred to as overheads. It arises as a result of overall operation of a busi

ness. According to Weldon overheads mean, ”the cost of indirect material, indirect

labour and such other expenses, including services as cannot conveniently be ch

arged direct to specific cost units”. It includes all manufacturing and non-manufa

cturing supplies and services. These costs cannot be associated with a particula

r product. The principal feature of overheads is the lack of direct traceability

to individual product. It remains relatively constant from period to period. Th

e amount of overheads is not directly chargeable i.e. it has to be properly allo

cated, apportioned and absorbed on some equitable basis. CLASSIFICATION OF OVERH

EADS • ON THE BASIS OF FUNCTIONS • FACTORY OVERHEADS It is the aggregate of all the

factory expenses incurred in connection with manufacture of a product. These are

incurred in connection with running of factory. It includes the items of expens

es viz, factory salary, work managers salary, factory repairs, rent of factory p

remises, factory lighting, lubricants, factory power, drawing office salary, hau

lage (cost of internal transport) depreciation of plant and machinery unproducti

ve wages, estimation expenses, royalties, loose tools w/ off, material handling

charges, time office salaries, counting house salaries etc. • ADMINISTRATIVE OR OF

FICE OVERHEADS It is the aggregate of all the expenses as regards administration

. It is the cost of office service or decision-making. It consists of the follow

ing expenses: Staff salaries, printing and stationery, postage and telegram, tel

ephone charges, rent of office

premises, office conveyance, printing and stationery and repairs and depreciatio

n of office premises and furniture etc.

• SELLING & DISTRIBUTION OVERHEADS It is the aggregate of all the expenses incurre

d in connection with sales and distribution of finished product and services. It

is the cost of sales and distribution services. Selling expenses are such expen

ses which are incurred acquiring and retaining customers. It includes the follow

ing expenses: (a) Advertisement (b) Show room expenses (c) Traveling expenses (d

) Commission to agents (e) Salaries of Sales office (f) Cost of catalogues (g) D

iscount allowed (h) Bad debts written off (i) Commission on sales (j) Rent of Sa

les Room (k) Sample and Free gifts (L) After sales service expenses (m) Expenses

on demonstration and technical advice to prospective customers (n) Free repairs

and servicing expenses (o) Expenses on market research (p) Fancy packing and de

monstration. Distribution expenses include all those expense which are incurred

in connection with making the goods available to customers these expense include

s the following (a) Packing charges (b) Loading charges (c) Carriages on sales (

d) Rent on warehouse (e) Insurance and lighting of warehouse (f) Insurance of de

livery van (g) Expense on delivery van (h) Salaries of Godownkeeper, drivers and

packing staff.

COST SHEET For determination of total cost of production a statement showing the

various elements of cost is prepared. This statement is called as a statement o

f cost or cost sheet. Cost sheet is a statement which provides assembly of the d

etailed cost of a cost center or a cost unit. It is a statement showing the deta

ils of a) total cost of job b) Cost of an operation or order. It brings out the

composition of total cost in a logical order under proper classifications & sub-

divisions. The period is covered by the cost sheet may be by a week a month or s

o. Separate columns are provided to show total cost, cost per-unit etc. In case

of different products there are different cost sheets for different products. A

cost sheet is prepared under output or unit costing method.

PURPOSE OF COST SHEET

1. 2. 3. 4. 5. 6.

It gives the break up of total cost under different elements. It shows total cos

t as well as cost per unit. It helps in comparison with previous years. It facil

ities preparation of tenders or quotations. It enables the management to fix up

selling price. It controls cost.

DIVISIONS OF COST • PRIME COST It comprises of all direct materials, direct labour

and direct expenses. It is also known as flat cost Prime cost = Direct Material

s + Direct Labour + Direct Expenses • WORKS COST It is also known as a factory cos

t or cost of manufacture. It is the cost of manufacturing an article. It include

s prime cost and factory expenses. Works Cost = Prime Cost + Factory Overheads • C

OST OF PRODUCTION It represents factory cost plus administrative expenses. Cost

of Production = Factory Cost + Administrative Expenses

• TOTAL COST It represents cost of production plus selling and distribution expens

es. Total Cost= Cost of Production + Selling & Distribution Expenses • SELLING PRI

CE It is the price which includes total cost plus margin of profit or minus loss

, if any. Selling Price = Total Cost + Profit (-Loss)

NON COST ITEMS Non-cost items are those items which do not form part of cost of

a product. Such items should not be considered while ascertaining the cost of a

product. These are items included in the Profit & Loss A/c. These will not come

in the cost sheet a) Income tax b) Interest on capital c) Interest on loan d) Pr

ofit on Sale of fixed assets e) All the assets f) Donations g) Capital Expenditu

re h) Discount on shares & Debentures i) Commission to Partners, Managers etc j)

Brokerage k) Preliminary Expenses Written off. l) Wealth tax etc

m)Bonus to directors and employees if it is based on profit, expenses of raising

capital, penalties & fines.

UTILITY OF COST SHEET • DETERMINE THE TOTAL COST A total cost sheet (statement) he

lps in determining aggregate cost of manufacturing a product or providing a serv

ice. • DETERMINING PRODUCT PRICE A cost sheet helps in identifying the total cost

for a product or service which in turn helps in properly pricing of products & s

ervices. • COST REDUCTION OR COST CONTROL Cost sheets helps in identifying the tot

al cost stage wise & any unwanted cost can be curtailed. • PREPARE BUDGETS A cost

statement helps in preparing budget for each department

• PROFIT PLANNING It helps to minimize cost & increase profits. 1. STAGE WISE COST

IDENTIFICATION Costs such as prime cost, factory cost, cost of production, cost

of goods sold, total cost of sale etc.

2. DETERMINE THE COST PER UNIT This helps in determining cost per unit on which

u can predict further cost.

DETERMINATION OF TOTAL COST Cost of product is determined as per cost attach con

cept. Total cost of a product consists of various elements of cost which have th

e quality of coherence. All the elements of cost can be grouped and regrouped. G

rouping and regrouping of various elements of cost leads to significant division

s of cost. The logical process of determination of cost by grouping and regroupi

ng various elements is illustrated as follows:

COST SHEET PROFORMA OF COST SHEET PARTICULARS Opening Stock Raw Materials Add: P

urchase Add: Carriage Inward Add: Octroi and Customs Duty Less: Closing Stock of

Raw Materials Cost of Direct Material Consumed Direct Wages Direct or Chargeabl

e Wages PRIME COST XXX Add: Works of Factory Overheads: Indirect Materials Indir

ect Wages Leave Wages Bonus to Workers Overtime Wages Fuel and Power Rent and Ta

xes Insurance Factory Lightings Supervision Works Stationary Canteen and Welfare

Expenses Repairs Works Salaries Depreciation of Plant and Machinery Works Expen

ses Gas and Water Technical Director’s Fees Laboratory Expenses Works Transport Ex

penses Works Telephone Expenses XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX TOTAL CO

ST Rs.

XXX XXX XXX XXX

Add: Opening Stock of Work-in-Progress Less: Closing Stock of Work-in-Progress L

ess: Sale of Waste WORKS COST

XXX XXX XXX XXX

Add: Office and Administration Overheads: Office Salaries Directors Fees Office

Rents And Rates Office Stationary and Printing Sundry Office Expenses Depreciati

on on Office Furniture Subscription to Trade Journals Office Lightings Establish

ment Charges Directors Traveling Expenses Consultants Fees Contribution to Provi

dent Fund Postage Legal Charges Audit Fees Bank Charges Depreciation And Repairs

of Office Equipments Bonus to Staff COST OF PRODUCTION Add :Opening Stock of Fi

nished Goods Less: Closing Stock of Finished Goods COST OF GOODS SOLD

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

Add: Selling and Distribution Overheads Advertising Show Room Expenses Salesman’s

Salaries and Expenses

XXX

Packing Expenses Carriage Outward Commission of Sales Agents Cost of Catalogues

Expenses of Delivery Vans Collection Charges Traveling Expenses Cost Tenders War

ehouse Expenses Cost of Mailing Literature Sales Manager’s Salaries Insurance of S

howroom Sales Director’s Fees Sales Office Expenses Rent of Sales Office Depreciat

ion of Delivery Vans Expenses of Sales Branch Establishments Branch Office Expen

ses TOTAL COST/TOTAL OF SALES Profit or Loss SALES

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX

ESTIMATION OF COST Very often, the management desires to know, ‘what will be the c

ost?’ even before the production starts. The purpose to know the cost before it is

incurred, might be different. It may be to keep the cost within control or it m

ay be used for profit planning. May times it is required to submit tenders, to g

ive quotations, to prepare price lists etc. For this purpose the estimations of “p

robable cost” of production is essential. This requires the past cost data to be a

nalysed, present circumstances are taken into consideration and future is projec

ted. The technique is known as estimation of cost. This involves the study of ea

ch and every element of cost and their nature of behaviour . Keeping in view the

nature of behaviour of elements of cost, it can be classified into following th

ree categories: • FIXED COST Fixed cost is that cost which remains unaffected even

though there is change in the level of output. It remains constant at all level

s of output for a given period of time. Examples of such costs are rent, rated a

nd taxes of factory premises, salary of general manager, foreman, watchman, insu

rance, depreciation etc. These expenses incur according to the unit of time and

not according to level of production. Hence sometimes it is called as periodic c

ost. For example such fixed cost is ascertained of a particular concern Rs. 1200

0 pm. The capacity of this concern is to produce 1000 units pm. If they produce

100 units or 500 units or 700 units or 100 units the fixed cost will remain cons

tant at all these levels of output. This fixed cost remains fixed at all levels

of output, but the cost per unit changes if there is a change in the level of ou

tput. • VARIABLE COST It is the cost which tends to vary directly with the volume

of output. If there is increase in output this cost increases and vice versa. Th

e change in the variable cost takes place in the same direction in which the lev

el of output changes. This cost consists of direct materials, direct wages, dire

ct expenses and some part of indirect expenses which varied according to the lev

el of output. Say for example if standard unit of final product requires the raw

materials of Rs.20 per unit the expenses on direct materials will

change if level of output changes. However variable cost per unit will remain un

changed provided the price level does not change. • SEMI-VARIABLE COST This is the

third category of nature of behavior of the expenses. These expenses are neithe

r fixed nor variable. These expenses change in the same direction in which the l

evel of output changes. Thus these expenses are partly fixed partly variable in

nature. Examples of such expenses are depreciation of plant and machinery, maint

enance of factory building etc. These expenses will increase if factory is run f

rom single shift to double or triple shifts. Depreciation and maintenance will i

ncrease but not in the same ratio, the output increases. Thus these expenses are

neither fixed nor variable cent percent. Hence they are called as semi variable

expenses.

CERTIFICATE The following project has been satisfactorily performed by Nikhil Ab

hyankar 01 Mangala Borkar 11 Sunil Chadda 12 Bhagyesh Gandhi 21 Avinash Dhone 17

Snehal Dolas 19 Roshan Kambli 38 Ketki Khandagale 43 Priyank Mehta 53 Abhijeet

Motto 58 studying in Bhavans College, Class F.Y. BMS Div A during the academic y

ear 2008-2009

DECLARATION We hereby declare that this project namely COST SHEET is done solely

by our group, which consists of TEN people whose names are given below Nikhil A

bhyankar 01 Mangala Borkar 11 Sunil Chadda 12 Bhagyesh Gandhi 21 Avinash Dhone 1

7 Snehal Dolas 19 Roshan Kambli 38 Ketki Khandagale 43 Priyank Mehta 53 Abhijeet

Motto 58 under the expert guidance of our respected professor Mrs. Riddhi Sharm

a. We further declare that the content of this project is true and to the best o

f our knowledge.

Solved example of Cost Sheet The accounts of Z ltd for the yr ended 31st Dec 200

4, shows the following: Rs. Work office salaries 6500 Administrative office sala

ries 12600 Cash Discounts Allowed 2900 Carriage Outward 4300 Carriage Inward 715

0 Bad Debts Written Off 6500 Repairs to Plant & Machinery 4450 Rents, Rates, Tax

es, Insurance etc Factory 8500 Office 2000 Sales 461000 Stock of Raw Materials 1

st Jan, 04 48000 st 31 Jan, 04 62000 Materials Purchased 185000 Traveling Expens

es 2100 Travelers Salaries and Commission 7700 Productive Wages 126000 Depreciat

ion on Plant & Machinery 6500 Depreciation on Office Furniture 300 Directors Fee

s 6000 Gas & Water (Factory) 1200 Gas & Water (Office) 400 Managers salary (1/4

office & ¾ Factory) 10000 General Expenses 3400

You are required to prepare a cost statement for the year ended 31st Dec 04

Solution: Z Ltd Cost Statement for the yr ended 31st Dec 2004 Particulars Rs. Ra

w Materials Consumed: Stock of Raw materials as on 1st Jan 04 (+) Materials Purc

hased (+) Carriage Inward (-) Stock of Raw Materials as on 31st Dec 04 Raw Mater

ials Consumed Productive Wages Prime Cost Add: Works/Factory Overheads Work Offi

ce Salaries Repairs to P/M Rents, Rates, Taxes & Insurance etc- Factory Deprecia

tion on P/M Gas & Water (Factory) Manager’s Salary (3/4) Works or Factory Overhead

s Works Cost Add: Office & Administrative Overheads Administrative Office Salari

es Rents, Rates, Taxes, Insurance etc- Office Depreciation on Office furniture D

irector’s Fees Gas & Water (office) Manager’s salary (1/4) General Expenses Office &

Administrative Overheads Cost of Production/ Cost of Goods Sold Add: Selling &

Distribution Overheads Carriage Outward Traveling Expenses Travelers Salary & Co

mmission Selling & distribution Overheads Total Cost of Sales 48,000 1,85,000 7,

150 62,800 1,77,350 1,26,000 3,03,350 6,500 4,450 8,500 6,500 1,200 7,500 34,650

3,38,000 12,600 2,000 300 6,000 400 2,500 3,400 27,200 3,65,200 4,300 2,100 7,7

00 14,100 3,79,300 Rs.

Add: Profit (Balancing Figure) Sales

81,700 4,61,000

PROFORMA OF ESTIMATED COST SHEET Total Cost XXX XXX XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX Per Unit XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX Total Cost XXX

XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX XXX Per Unit XXX XXX XXX XXX XXX XXX XXX

XXX XXX XXX XXX XXX

Direct Material Direct Labour Direct Wages Prime Cost Factory Overheads Works Co

st Office & Administration Overheads Cost of Production Selling & distribution O

verheads Cost of Sales Profit Sales

SOLVED EXAMPLE OF ESTIMATED COST SHEET Swadeshi Electronics Ltd. furnishes you t

he following information for the year ended 31st March 06 Production & sales Sal

es Direct wages Direct materials Factory overheads Administrative overheads Sale

s overheads 15000 units Rs. 1275000 Rs. 270000 Rs. 330000 Rs. 225000 Rs.105000 R

s. 90000

On account of intense competition following changes are estimated in the subsequ

ent year: 1. Production and sales activity will be increased by one third 2. Mat

erial rate will be lowered by 25%. However there will be increase in consumption

by 20% 3. Direct wages cost would be reduced by 20% due to automation 4. Out of

the above factory overheads rs. 45000 are fixed in nature. The remaining factor

y expenses are variable in proportion to the number of units produced 5. Total a

dministrative expenses will be lowered by 40% 6. Sales overhead per unit would r

emain the same 7. Sales price per unit would be lowered by 20% Prepare a stateme

nt of cost for both the yrs ending 31st March 06 and 31st March 07 showing maxim

um possible details of cost

Solution: Swadeshi Electronics Ltd Cost Sheet for the yr ended 31st Mar 06 & 31s

t March 07 15000 20000 Total Per Unit Total Per Unit Cost Cost Direct Materials

330000 22 396000 19.8 Direct Wages 270000 18 288000 14.4 Prime Cost Factory Over

heads Works Cost Administrative Overheads Cost of Production Sales Overheads Cos

t of Sales Profit Sales 600000 225000 825000 105000 930000 90000 1020000 255000

1275000 40 15 55 07 62 06 68 17 85 684000 285000 969000 63000 1032000 120000 115

2000 208000 1360000 34.2 14.25 48.45 3.15 51.6 06 57.6 10.4 68

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Finance for Managers in 40 CharactersDocument311 pagesFinance for Managers in 40 CharacterssanjibkrjanaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chapter 5 Question Answer KeyDocument83 pagesChapter 5 Question Answer KeyBrian Schweinsteiger FokNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Financial AcountingDocument853 pagesFinancial AcountingKgaogelo Mawasha (Washa de deejay)No ratings yet

- Accounting Ratios For ProjectDocument13 pagesAccounting Ratios For ProjectRoyal ProjectsNo ratings yet

- Basic Accounting Course ModuleDocument5 pagesBasic Accounting Course ModuleBlairEmrallafNo ratings yet

- Entrep. Module 10... Grade 12 BezosDocument13 pagesEntrep. Module 10... Grade 12 Bezosadrian lozano0% (1)

- Partnerships: Formation, Operation and Ownership Changes: Advanced Accounting, Fifth EditionDocument58 pagesPartnerships: Formation, Operation and Ownership Changes: Advanced Accounting, Fifth EditionFadhlurrahmi JeonsNo ratings yet

- Bài Tập 2-27 - Nhóm8LớpKN007Document6 pagesBài Tập 2-27 - Nhóm8LớpKN007nguyenhongNo ratings yet

- Eclerx Services Private Limited: 7 Annual ReportDocument22 pagesEclerx Services Private Limited: 7 Annual ReportNikhil AroraNo ratings yet

- Entreprenerial Finance Master DocumentDocument65 pagesEntreprenerial Finance Master DocumentemilspureNo ratings yet

- PT Davomas Abadi Tbk. Dan Anak Perusahaan/And SubsidiaryDocument45 pagesPT Davomas Abadi Tbk. Dan Anak Perusahaan/And SubsidiaryMadaraNo ratings yet

- Mufidah & Yuliana / Jurnal Manajemen, Vol 10, No. 2 (2020) : 105 - 116Document12 pagesMufidah & Yuliana / Jurnal Manajemen, Vol 10, No. 2 (2020) : 105 - 116aman amanNo ratings yet

- Britannia Industries: PrintDocument2 pagesBritannia Industries: PrintTanmoy BhuniaNo ratings yet

- A Study On Financial Performance of Ultratech Cement LTDDocument67 pagesA Study On Financial Performance of Ultratech Cement LTDpankaj vermaNo ratings yet

- CHAPTER 10 - Changes in Accounting EstimateDocument8 pagesCHAPTER 10 - Changes in Accounting EstimateChristian GatchalianNo ratings yet

- MGT 201 All Solved Quiz 2 in One FileDocument77 pagesMGT 201 All Solved Quiz 2 in One FilenargisNo ratings yet

- Isa 810Document18 pagesIsa 810baabasaamNo ratings yet

- SV Chapter-IV CLCDocument63 pagesSV Chapter-IV CLCĐinh Phương DungNo ratings yet

- Advance Accounting Sample Ch3Document38 pagesAdvance Accounting Sample Ch3MarielyLopezBrigantty83% (6)

- Apostila - Accounting Chart of AccountsDocument3 pagesApostila - Accounting Chart of Accounts4gen_5No ratings yet

- Questions and AnswersDocument28 pagesQuestions and AnswersSamuel LeitaoNo ratings yet

- Acc117-Chapter 2Document26 pagesAcc117-Chapter 2Fadilah JefriNo ratings yet

- Chapter 2 (Cost Classification)Document13 pagesChapter 2 (Cost Classification)Najia MuktaNo ratings yet

- Error DiscussionDocument2 pagesError DiscussionGloria Beltran100% (1)

- Reviewer: Accounting For Partnership Part 2Document14 pagesReviewer: Accounting For Partnership Part 2gab mNo ratings yet

- Paper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Document16 pagesPaper 5 - Financial Accounting: Answer To MTP - Intermediate - Syllabus 2008 - June 2015 - Set 2Aleena Clare ThomasNo ratings yet

- Hershey Case StudyDocument16 pagesHershey Case StudyNino50% (2)

- Financial Reporting (International) : Wednesday 5 June 2013Document9 pagesFinancial Reporting (International) : Wednesday 5 June 2013Ruslan LamievNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and Errors - Ias 8Document27 pagesAccounting Policies, Changes in Accounting Estimates and Errors - Ias 8Manuel MagadatuNo ratings yet

- Chapter Thirteen The Value of Operations and The Evaluation of Enterprise Price-to-Book Ratios and Price-Earnings RatiosDocument36 pagesChapter Thirteen The Value of Operations and The Evaluation of Enterprise Price-to-Book Ratios and Price-Earnings RatiosceojiNo ratings yet