Professional Documents

Culture Documents

Dormant Commerce Clause 1-2-3

Uploaded by

Matthew LeaperCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dormant Commerce Clause 1-2-3

Uploaded by

Matthew LeaperCopyright:

Available Formats

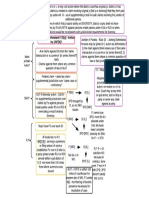

THE DORMANT COMMERCE CLAUSE 1-2-3

Matthew Leaper © 2011

A. DETERMINE IF LAW IS DISCRIMINATE OR NON-DISCRIMINATE

Rule: a facially discriminatory law against out-of-staters will be subject to a Rule: a facially neutral law will be found discriminatory if it is deemed to have either

virtually per se rule of invalidity. a a discriminatory purpose or effect, or a disproportionate adverse effect on

interstate commerce.

A1: Is the law facially discriminate?

A2: Is It facially neutral with a discriminate purpose or effect?

Ex: to advantage in-state businesses

Camps Newfound/Owatonna, Inc. v. Town of Harrison, Maine (invalidating a law that Ex: to effect a protectionist purpose

created tax exemptions for in-state non-profits) [B1] H.P. Hood & Sons v. DuMond (invalidating a law that prevented out-of-staters from

United Haulers Ass’n v. Oneida-Herkimer SWMA (upholding a law that discriminates in infringing upon the in-state milk supply) [B1]

favor of a state-owned entity) [B1]

Reynoldsville Casket Co. v. Hyde (invalidating a law that allowed for a longer toward Ex: to exclude [all or some] out-of-staters from an in-state market

period on the statute of limitations for claims involving out-of-staters) [B1] Baldwin v. G.A.F. Seelig, Inc. (invalidating a law regulating the minimum prices to be paid to

all out-of-state milk producers by in-state dealers) [all, B1]

Ex: to impose additional costs on out-of-staters

Oregon Waste Systems, Inc. v. DoEQ (invalidating a law imposing a unjustifiable Ex: to impose additional costs on out-of-staters

surcharge tax on out-of-state waste) [B1] Bacchus Imports, LTD. v. Dias (invalidating a law that exempted in-state producers from a

West Lynn Creamery, Inc. v. Healy (invalidating a law that taxed all in-state sales of milk 20% wholesale tariff) [B1]

at local retailers and rebated the proceeds to in-state farmers) [B1] Hunt v. Wash. State Apple Ad. Comm’n (invalidating a law that prohibited non-USDA

grading systems for in-state apples at the expense of out-of-state apple producers) [B1]

Ex: to limit access to local resources

Hughes v. Oklahoma (invalidating a law forbidding any person to transport or ship in- A3: Or, is it facially neutral with a disproportionate adverse effect?

state minnows for sale out-of-state) [B1]

Philadelphia v. New Jersey (invalidated a landfill usage law that created additional costs Ex: to require the use of local businesses (e.g. local processing)

for out-of-staters by limiting the supply of in-state landfill space) [B1] Pike v. Bruce Church, Inc. (invalidating a law requiring cantaloupe to be processed in-state

Lewis v. BT Investment Managers, Inc. (invalidating a law prohibiting out-of-state banks in order to classify as ‘Arizona-grown’) [B1 or B2]

from ownership of in-state investment advisory businesses) [B2]

Maine v. Taylor (upholding a law banning out-of-state baitfish because it was a Ex: to enforce a legitimate local interest

compelling, least discriminating means conservation) [B1] Exxon, Corp. v. Governor of Maryland (upholding a law preventing integrated petroleum

producers or refiners from operating service stations in-state) [B2]

Ex: to require use of local businesses with a geographical boundary Minnesota v. Clover Leaf Creamery (upholding a law requiring all milk sold in-state to be

Dean Milk v. Madison (invalidating a law requiring the processing of milk within a five sold in paper cartons because it benefited the local paper industry) [B2]

mile radius of Madison, WI) [B1] Kassel v. Consolidated Freightways Corp. (invalidating a law banning the use of 65’ foot

Cooley v. Board of Wardens (invalidating a law requiring ships entering or leaving the double trailers on in-state roads) [B2]

port of Philadelphia to engage a local pilot to guide them through the harbor) [B1] Southern Pacific v. Arizona (invalidating a law which prohibiting trains of more than 14

C & A Carbone, Inc. v. City of Clarkstown (invalidating a flow control ordinance requiring passenger or 70 freight cars to travel on in-state railways) [B1, b/c it was prior to B2]

all recyclers to pay transfer station fees to a local, private processer) [B1] Bibb v. Navajo Freight Lines, Inc. (invalidating a law requiring all trucks and trailers on in-

South-Central Timber Dev., Inc. v. Wunnicke (invalidating an Alaska law requiring timber state highways to use curved mudguards) [B2]

to processed locally) [B1] CTS Corp. v. Dynamics Corp. of America (upholding a law limiting corporate takeovers of

United Haulers Ass’n v. Oneida-Herkimer SWMA (invalidating a flow control ordinance in-state corporations, by requiring a majority approval of disinterested shareholders) [B2]

requiring all recyclers to pay transfer station fees to a local, public processer) [B1] Edgar v. MITE Corp (invalidating a business takeover act requiring offers to be registered

in-state 20 days before the offer became effective) [B2]

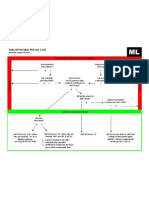

B. DETERMINE IF LAW IS CONSTITUTIONAL

B1. LAW IS DISCRIMINATORY, PRESUMPTION = UNCONSTITUTIONAL B2. LAW IS NON-DISCRIMINATORY , PRESUMPTION = CONSTITUTIONAL

APPLY EFFECTS TEST APPLY BALANCING TEST

Does the law achieve a compelling, non-protectionist purpose? Do local interests (soft) outweigh burdens on interstate commerce ($$$)?

Yes Maine v. Taylor (guard against invasive species) Yes CTS Corp. v. Dynamics Corp. of America (corporate law)

Exxon, Corp. v. Governor of Maryland (big oil)

No, the law acted to preserve natural or commercial resources. Minnesota v. Clover Leaf Creamery (paper milk cartons)

H.P. Hood & Sons v. DuMond (milk supply)

Hughes v. Oklahoma (minnow market) No Bibb v. Navajo Freight Lines, Inc. (mud flaps)

Lewis v. BT Investment Managers, Inc. (denied market access) Edgar v. MITE, Corp. (sales of stock)

Philadelphia v. New Jersey (landfill use) Kassel v. Consolidated Freightways Corp. (65 foot doubles)

Pike v. Bruce Church, Inc. (local processing)

No, the law created a local economic advantage. Southern Pacific v. Arizona (local train regulations)

Bacchus Imports, LTD. v. Dias (tax advantages)

Baldwin v. G.A.F. Seelig, Inc. (milk prices) Does the law effect the “least discriminative alternative”?

Camps Newfound/Owatonna, Inc. v. City of Harrison, Maine (tax advantages) Yes Minnesota v. Clover Leaf Creamery (best strategy)

Hunt v. Wash. State Apple Ad. Comm’n (additional fees) No Not a controlling analysis for non-discriminatory laws

Oregon Waste Systems, Inc. v. DoEQ (additional fees)

Pike v. Bruce Church, Inc. (local processing)

Reynoldsville Casket Co. v. Hyde (towing period) C. APPLY EXCEPTIONS

West Lynn Creamery, Inc. v. Healy (tax advantages)

C1. Does it discriminate in favor a public entity?

No, the law required the use of local private businesses. Yes Un’d Haulers Ass’n v. Oneida-Herkimer SWMA (state-owned entity)

C & A Carbone, Inc. v. City of Clarkstown (trash flow, private) Department of Kentucky v. Davis (the state)

Cooley v. Board of Wardens (local pilots) No C & A Carbone, Inc. v. City of Clarkstown (quasi-private entity)

Dean Milk v. Madison (local processing)

South-Central Timber Dev., Inc. v. Wunnicke (local processing) C2. Is it a quarantine law?

Yes Maine v. Taylor (invasive baitfish)

No Philadelphia v. New Jersey (trash)

Does the law effect the “least discriminative alternative”?

Yes Maine v. Taylor (only effective strategy) C3. Has the law been approved by congress?

No Dean Milk v. Madison (other alternatives available) Yes Prudential Insurance Co. v. Benjamin (taxes)

Hughes v. Oklahoma (most discriminating option)

Pike v. Bruce Church, Inc. (less expensive options available) C4. Does the market participant doctrine apply?

Yes United Building & Constr. Trades Council v. Camden (doctrine allows the

state to specific local labor requirements on in-state projects)

No South-Central Timber Dev., Inc. v. Wunnicke (doctrine does not allow for

downstream regulation)

You might also like

- Dormant Commerce Clause FCDocument1 pageDormant Commerce Clause FCslbernstein100% (1)

- Chart - Constitutional Law - Preemption, DCC, PICDocument1 pageChart - Constitutional Law - Preemption, DCC, PICSean Williams100% (3)

- Crim Pro Attack PlanDocument14 pagesCrim Pro Attack PlanElNo ratings yet

- Intro: Legal Knowledge Skill Thoroughness PreparationDocument2 pagesIntro: Legal Knowledge Skill Thoroughness PreparationHaifaNo ratings yet

- Constitutional Law II Zietlow Outline VillanuevaDocument49 pagesConstitutional Law II Zietlow Outline VillanuevaCatNo ratings yet

- Constitutional Law Free Speech OutlineDocument2 pagesConstitutional Law Free Speech OutlineEl0% (1)

- Outline (Con Law II - Peller)Document74 pagesOutline (Con Law II - Peller)Andrew ShawNo ratings yet

- DCCDocument1 pageDCCBrat WurstNo ratings yet

- Con Law Flow Chart EPC DPCDocument2 pagesCon Law Flow Chart EPC DPCBaber Rahim100% (1)

- State ActionsDocument1 pageState ActionsKatie Lee WrightNo ratings yet

- Con Law 2 Gulasekaram 1Document10 pagesCon Law 2 Gulasekaram 1Big BearNo ratings yet

- ENS CivPro Attack OutlineDocument4 pagesENS CivPro Attack OutlineseabreezeNo ratings yet

- Powers & Limitations of The Judiciary Step 1: Can/will The Supreme Court Hear The Case?Document1 pagePowers & Limitations of The Judiciary Step 1: Can/will The Supreme Court Hear The Case?Brat WurstNo ratings yet

- Congress regulating channels or instrumentalities of interstate commerceDocument1 pageCongress regulating channels or instrumentalities of interstate commercemimiandnini100% (2)

- Commerce Clause Chart: Points To RememberDocument3 pagesCommerce Clause Chart: Points To Rememberfshahk100% (1)

- Checklist PRDocument8 pagesChecklist PRDouglas GromackNo ratings yet

- Midterm OutlineDocument40 pagesMidterm OutlineAlejandra Aponte100% (2)

- FlowchartDocument2 pagesFlowchartBre HitchNo ratings yet

- Conflict of Laws OutlineDocument54 pagesConflict of Laws OutlinesjanvieNo ratings yet

- Con Law Flow ChartsDocument6 pagesCon Law Flow ChartsBrady WilliamsNo ratings yet

- Con Law II OutlineDocument59 pagesCon Law II OutlineHenry ManNo ratings yet

- Commerce Clause FlowchartDocument1 pageCommerce Clause FlowchartMark Adamson100% (1)

- Con Law OutlineDocument14 pagesCon Law Outlinetm05101No ratings yet

- Constitutional Law - Opening Paragraphs (1) Standing: TH TH THDocument2 pagesConstitutional Law - Opening Paragraphs (1) Standing: TH TH THLaura SkaarNo ratings yet

- Con Law IIDocument48 pagesCon Law IIKatie TylerNo ratings yet

- PR Outline For Midterm and FinalDocument33 pagesPR Outline For Midterm and FinalDanielleNo ratings yet

- Con Law II Vandevelede Outline (Ross)Document43 pagesCon Law II Vandevelede Outline (Ross)chrisngoxNo ratings yet

- Executive Powers - Page 1Document1 pageExecutive Powers - Page 1Brat WurstNo ratings yet

- Quick Attack SheetDocument2 pagesQuick Attack SheetBrianStefanovicNo ratings yet

- Allocation of Foreign Policy PowerDocument1 pageAllocation of Foreign Policy PowerBrat WurstNo ratings yet

- Clear and Present Danger TestDocument6 pagesClear and Present Danger TestnbluNo ratings yet

- Bill of Rights & Freedom of SpeechDocument64 pagesBill of Rights & Freedom of SpeechRicky Nelson100% (1)

- CONTRACTS SHORT OUTLINE - HendersonDocument20 pagesCONTRACTS SHORT OUTLINE - HendersonSio Mo0% (1)

- Commerce Clause Tests GuideDocument10 pagesCommerce Clause Tests Guidemdaly102483No ratings yet

- Fed Court Subject Matter Jurisdiction and Personal Jurisdiction SummarizedDocument24 pagesFed Court Subject Matter Jurisdiction and Personal Jurisdiction SummarizedNoel CheungNo ratings yet

- Commerce Clause Flowchart (Mate) PDFDocument2 pagesCommerce Clause Flowchart (Mate) PDFBrady WilliamsNo ratings yet

- Freer Lecture OutlineDocument10 pagesFreer Lecture Outlinesublime12089No ratings yet

- Speedy, and Inexpensive Determination of Every Action and ProceedingDocument43 pagesSpeedy, and Inexpensive Determination of Every Action and ProceedingDan SandsNo ratings yet

- Professional Responsibility OutlineDocument6 pagesProfessional Responsibility OutlineTiffany Brooks100% (1)

- FirstAmendmentOutline OlsonDocument33 pagesFirstAmendmentOutline OlsonAJ SharmaNo ratings yet

- Con Law SkeletalDocument20 pagesCon Law Skeletalnatashan1985No ratings yet

- Leg Reg Pre WriteDocument19 pagesLeg Reg Pre WriteashleyamandaNo ratings yet

- Civ Pro Personal Jurisdiction Essay A+ OutlineDocument5 pagesCiv Pro Personal Jurisdiction Essay A+ OutlineBianca Dacres100% (1)

- My Con Law I Outline (Charts & Bones)Document13 pagesMy Con Law I Outline (Charts & Bones)Priscilla QuansahNo ratings yet

- Evidence Checklist ChillDocument1 pageEvidence Checklist Chillafisher-poguelawNo ratings yet

- Takings FlowchartDocument1 pageTakings FlowchartAmandaNo ratings yet

- Joinder-Big Picture: R J I R Diver TyDocument1 pageJoinder-Big Picture: R J I R Diver Tysafkdjafgh leeeNo ratings yet

- To The States, Are Reserved To The States Respectively, or To The People."Document1 pageTo The States, Are Reserved To The States Respectively, or To The People."Brat WurstNo ratings yet

- P JoiningDocument1 pageP JoiningBrat WurstNo ratings yet

- Con Law Fed State FlowchartDocument5 pagesCon Law Fed State Flowchartrdt854100% (1)

- Conlaw Rights Outline - CODY HOCKDocument49 pagesConlaw Rights Outline - CODY HOCKNoah Jacoby LewisNo ratings yet

- Business Organizations OutlineDocument29 pagesBusiness Organizations OutlineMissy Meyer100% (1)

- Con Law Cheat Sheet (Judicial Tests)Document4 pagesCon Law Cheat Sheet (Judicial Tests)Rachel CraneNo ratings yet

- Constitutional Law I Outline 2013Document29 pagesConstitutional Law I Outline 2013The Lotus Eater100% (2)

- Con Law Outline For FinalDocument55 pagesCon Law Outline For FinalBrian PalmerNo ratings yet

- Flowchart - Negligence (Occupier's Liability) : Issue 1: Did The Defendant Owe The Plaintiff A Duty of Care?Document4 pagesFlowchart - Negligence (Occupier's Liability) : Issue 1: Did The Defendant Owe The Plaintiff A Duty of Care?NDNo ratings yet

- Business Organizations: Outlines and Case Summaries: Law School Survival Guides, #10From EverandBusiness Organizations: Outlines and Case Summaries: Law School Survival Guides, #10No ratings yet

- Dormant Commerce ClauseDocument2 pagesDormant Commerce ClauseEva CrawfordNo ratings yet

- C A Carbone, Inc. v. Town of CL RK Town, New York: R.U E 0 LADocument4 pagesC A Carbone, Inc. v. Town of CL RK Town, New York: R.U E 0 LAKsusha SukhoverkhovaNo ratings yet

- I. DCC: Discrimination-Facial or Effectively Discrim. Then Apply Strick Scrun. Presumed Void. BurdenDocument4 pagesI. DCC: Discrimination-Facial or Effectively Discrim. Then Apply Strick Scrun. Presumed Void. BurdenHolly Waltman RipleyNo ratings yet

- In Rem FourSquareDocument1 pageIn Rem FourSquareMatthew LeaperNo ratings yet

- PressedImages, ML01-03Document3 pagesPressedImages, ML01-03Matthew LeaperNo ratings yet

- Paragraphatize, or To Outline by Prethinking and Predrafting.Document4 pagesParagraphatize, or To Outline by Prethinking and Predrafting.Matthew LeaperNo ratings yet

- A Factored Negligence FormulaDocument1 pageA Factored Negligence FormulaMatthew LeaperNo ratings yet

- The Oberlin Herald - 043008Document1 pageThe Oberlin Herald - 043008Matthew LeaperNo ratings yet

- Design Principles - LC002Document10 pagesDesign Principles - LC002Matthew LeaperNo ratings yet

- The Definitive Snow Cone of Federal JurisdictionDocument1 pageThe Definitive Snow Cone of Federal JurisdictionMatthew LeaperNo ratings yet

- ML - ResumeDocument1 pageML - ResumeMatthew LeaperNo ratings yet

- Flowchart For UCC 2-207Document1 pageFlowchart For UCC 2-207Matthew LeaperNo ratings yet

- The Hill - Redevelopment Option #3Document16 pagesThe Hill - Redevelopment Option #3Matthew LeaperNo ratings yet

- 515 East GrantDocument25 pages515 East GrantMatthew LeaperNo ratings yet

- PAS - ContainersDocument28 pagesPAS - ContainersMatthew LeaperNo ratings yet

- Beaver Lake ProfileDocument9 pagesBeaver Lake ProfileMatthew LeaperNo ratings yet

- Cass County ProfileDocument5 pagesCass County ProfileMatthew LeaperNo ratings yet

- Study Plan For The Mechanical PE ExamDocument2 pagesStudy Plan For The Mechanical PE ExamMatthew Leaper100% (2)

- PAS - ContainersDocument28 pagesPAS - ContainersMatthew LeaperNo ratings yet

- 157-Sampaguita Auto Transport Corporation v. NLRC G.R. No. 197384 January 30, 2013Document7 pages157-Sampaguita Auto Transport Corporation v. NLRC G.R. No. 197384 January 30, 2013Jopan SJNo ratings yet

- PNB vs. GonzalesDocument2 pagesPNB vs. GonzalesRaymarc Elizer AsuncionNo ratings yet

- Lawsuit: Jennifer Neill v. Beasley Broadcast Group and John DeBellaDocument57 pagesLawsuit: Jennifer Neill v. Beasley Broadcast Group and John DeBellajalt610% (1)

- Court hears case of assault and self-defenseDocument13 pagesCourt hears case of assault and self-defenseMariam BautistaNo ratings yet

- Audit PPT (Reading Version)Document23 pagesAudit PPT (Reading Version)Saradindu Chakraborty0% (1)

- N33191 13 R 1240Document24 pagesN33191 13 R 1240CarlosCortesNo ratings yet

- Action in RemDocument2 pagesAction in RemIftikhar HussainNo ratings yet

- Code of Ethics Nov22Document55 pagesCode of Ethics Nov22Law_PortalNo ratings yet

- Florida Department of Health To Delray Beach Consent OrderDocument9 pagesFlorida Department of Health To Delray Beach Consent OrderPeterBurke100% (1)

- 61 - Wolf v. WELLS - Oral Deposition of Marie McDonnell October 2, 2012Document59 pages61 - Wolf v. WELLS - Oral Deposition of Marie McDonnell October 2, 2012mozart20No ratings yet

- Overture Services, Inc. v. Google Inc. - Document No. 95Document2 pagesOverture Services, Inc. v. Google Inc. - Document No. 95Justia.comNo ratings yet

- Metropolitan Water District Not Liable for Student's Drowning (1958Document1 pageMetropolitan Water District Not Liable for Student's Drowning (1958Frances Ann TevesNo ratings yet

- Midterm Examination in Evidence (Question and Answer)Document5 pagesMidterm Examination in Evidence (Question and Answer)Jade Marlu DelaTorreNo ratings yet

- CIVIL ENGINEERING MANUAL UPDATEDocument0 pagesCIVIL ENGINEERING MANUAL UPDATEAshokan KelothNo ratings yet

- Detroit V Adams Realty ServicesDocument15 pagesDetroit V Adams Realty ServicesMichigan Court WatchNo ratings yet

- Nachura Reviewer - Chapter 1 - 5Document31 pagesNachura Reviewer - Chapter 1 - 5jamilove20100% (1)

- Yantra for Victory in Court Cases"TITLE"Charm Ensures Success in Legal Disputes" TITLE"Indian Occult Remedy Wins Lawsuits"TITLE"Yantra Removes Fear of Government PenaltiesDocument4 pagesYantra for Victory in Court Cases"TITLE"Charm Ensures Success in Legal Disputes" TITLE"Indian Occult Remedy Wins Lawsuits"TITLE"Yantra Removes Fear of Government PenaltiessubhashNo ratings yet

- Commissioner of Customs Vs Hypermix FeedsDocument2 pagesCommissioner of Customs Vs Hypermix FeedsMichelle FajardoNo ratings yet

- Gibbs Vs Govt Digest and FulltextDocument5 pagesGibbs Vs Govt Digest and FulltextMJ DecolongonNo ratings yet

- Foreclosure Defenses ChecklistDocument5 pagesForeclosure Defenses ChecklistSachin DarjiNo ratings yet

- Skyline Software Systems, Inc. v. Keyhole, Inc Et Al - Document No. 14Document3 pagesSkyline Software Systems, Inc. v. Keyhole, Inc Et Al - Document No. 14Justia.comNo ratings yet

- Eugenio v. CADocument2 pagesEugenio v. CAKier UyNo ratings yet

- Assignment 3Document4 pagesAssignment 3SoumyaNo ratings yet

- Lagon vs. VelasoDocument2 pagesLagon vs. VelasoRobNo ratings yet

- Family LawsuitDocument8 pagesFamily LawsuitCBS Austin WebteamNo ratings yet

- Ap2001 08470284701874143143Document481 pagesAp2001 08470284701874143143rseresfer34533373563No ratings yet

- UntitledDocument218 pagesUntitledJivitesh GuptaNo ratings yet

- UMC v. VelascoDocument4 pagesUMC v. VelascobusinessmanNo ratings yet

- Palafox Vs Province of Ilocos NorteDocument3 pagesPalafox Vs Province of Ilocos NorteKrys Martinez0% (1)

- Julia Haart v. Silvio Scaglia, Exhibits 40-53 To Amended and Supplemental Verified PetitionDocument136 pagesJulia Haart v. Silvio Scaglia, Exhibits 40-53 To Amended and Supplemental Verified PetitionDebbie MolloyNo ratings yet