Professional Documents

Culture Documents

Income Statements: Brown & Company PLC

Uploaded by

prabathdeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Statements: Brown & Company PLC

Uploaded by

prabathdeeCopyright:

Available Formats

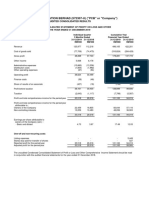

Brown & Company PLC

Income Statements

Consolidated

Unaudited Unaudited % Unaudited

3 months to 3 months to Change 12 months to

30.6.2008 30.6.2007 31.3.2008

Gross turnover 1,625,170 1,307,260 24 5,845,880

Turnover tax (27,416) (10,821) 153 (49,132)

Net turnover 1,597,754 1,296,439 23 5,796,748

Cost of sales (1,202,236) (1,008,860) 19 (4,552,328)

Gross Profit 395,518 287,579 38 1,244,420

Other operating income 3,510 4,466 (21) 144,203

Operating expenses (236,807) (186,010) 27 (795,993)

Financing Cost (167,409) (78,973) 112 (397,060)

Change in fair value of Investment Proerties - 20,226

Profit on disosal of Subsidiary - 51,587

Share of Associate Companies Profit (

Net of Tax ) 4,227 7,209 (41) 20,077

Profit/(Loss) before tax (961) 34,271 (103) 287,460

Income tax expense (8,357) (9,171) (9) 148,902

Profit / (Loss) for the Period (9,319) 25,100 (137) 436,362

Attributable to :

Equity Holders of the Company (9,347) 24,970 445,450

Minority interest 28 130 (9,088)

(9,319) 25,100 436,362

Basic earnings/(deficit) per share - Rs. (3.56) 9.56 (137) 169.70

Company

Unaudited Unaudited % Unaudited

3 months to 3 months to Change 12 months to

30.6.2008 30.6.2007 31.3.2008

Gross turnover 1,456,353 1,161,103 25 5,169,610

Turnover tax (11,323) (9,503) 19 (43,592)

Net turnover 1,445,030 1,151,600 25 5,126,018

Cost of sales (1,120,026) (918,587) 22 (4,074,094)

Gross Profit 325,004 233,013 39 1,051,924

Other operating income 2,008 3,411 (41) 78,038

Operating expenses (206,032) (146,741) 40 (658,233)

Financing Cost (107,056) (69,922) 53 (320,333)

Change in fair value of Investment Proerties - 20,226

- - - -

Profit before tax 13,924 19,761 (30) 171,622

Income tax expense (7,607) (5,006) 52 137,068

Profit for the Period 6,317 14,755 (57) 308,690

Attributable to :

Equity Holders of the Company 6,317 14,755 308,690

Minority interest

6,317 14,755 308,690

Basic earnings/(deficit) per share - Rs. 2.41 5.62 (57) 117.60

Note : All values are in Rupees '000s, unless otherwise stated

The above figures are subjected to audit.

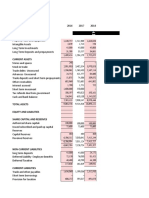

Brown & Company PLC

Balance Sheets

Consolidated Company

As at Unaudited as at As at Unaudited as at

30.06.2008 31.3.2008 Change 30.06.2008 31.3.2008 Change

ASSETS

Non-current assets

Property, Plant and Equipment 3,265,204 3,266,859 (0.1) 3,068,081 3,068,895 (0.03)

Investment Properties 151,967 151,967 - 151,967 151,967 -

Leasehold Right over Land 48,052 48,052 - 48,052 48,052 -

Investment in Subsidiaries - - - 76,737 76,736 -

Investment in Joint Ventures - - - 135,000 100,000 35

Investment in Associates 142,700 170,629 (16) 450 450 -

Other long term investments 3,842,847 3,788,793 1 2,110,542 2,110,541 -

Deffered Tax Assets 353,760 373,032 (5) 334,347 334,347 -

Intangible Assets 9,429 12,601 (25) 2,357 2,514 (6)

7,813,959 7,811,933 0.03 5,927,533 5,893,502 0.6

Current assets

Inventories 1,434,074 1,032,198 39 1,199,808 911,839 32

Trade and other receivables 2,194,255 1,855,207 18 1,538,289 1,255,963 22

Short Term Investments / Deposits 31,954 44,355 (28) - - -

Cash in hand & at bank 80,994 48,673 66 51,713 35,660 45

3,741,277 2,980,433 26 2,789,810 2,203,462 27

Total assets 11,555,236 10,792,366 7 8,717,343 8,096,964 8

EQUITY AND LIABILITIES

Capital and reserves

Stated capital 21,101 21,101 - 21,101 21,101 -

Reserves 7,105,127 7,115,871 (0.2) 5,276,382 5,270,065 0.1

Equity Attributable to Equity Holders of

the Parent 7,126,228 7,136,972 (0.2) 5,297,483 5,291,166 0.1

Minority interest 6,728 5,681 18 -

Total equity 7,132,956 7,142,653 (0.1) 5,297,483 5,291,166 0.1

Non-current liabilities

Interest-bearing loans and borrowings 930,275 892,493 4 518,968 552,449 (6)

Retirement benefit obligations 68,975 63,880 8 55,150 53,213 4

999,250 956,373 4 574,118 605,662 (5)

Current liabilities

Interest-bearing loans and borrowings 1,621,918 1,310,465 24 1,063,918 709,575 50

Trade & other payables 1,789,698 1,366,221 31 1,774,726 1,483,289 20

Income tax payable 11,414 16,654 (31) 7,098 7,273 (2)

3,423,030 2,693,340 27 2,845,742 2,200,137 29

Total equity, minority -interest

and liabilities 11,555,235 10,792,366 7 8,717,343 8,096,965 8

Net assets per share (Rs. 2,714.75 2,718.85 2,018.09 2,015.68

Note : All values are in Rupees '000s, unless otherwise stated

The above figures are subjected to audit

The Balance Sheet as at 30th June 2008 and related Statements of Income, Changes in Equity and Cash Flow for th

quarter ended 30th June 2008 are drawn up from the unaudited financial statements of the Company, it

Subsidiaries and Associates, and they provide the information required by the Colombo Stock Exchang

The Board of Directors is responsible for the preperation and presentation of these financial Statements. The Chief Financial Offic

certifies that the financial statements have been prepared in compliance with the requirements of the Companies Act No. 7 of 200

Signed on behalf of the Board

Mrs. R.L. Nanayakkara N. M. Prakash J. Dissanayake

Chairperson CEO/Group Managing Director Chief Financial Officer

12th August 2008

The market value of an ordinary share of Brown & Company PLC was as follows

30.06.2008 30.06.2007

Rs. Rs.

Last traded price recorded for 3 months ended 950 610

Highest price recorded for 3 months ended 1,120 700

Lowest price recorded for 3 months ended 930 525

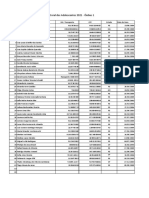

Brown & Company PLC

Cash Flow Statements

Consolidated Company

3 Months to 30th June 3 Months to 30th June

2008 2007 2008 2007

Cash flows from Operating Activities

Profit Before Taxation (961) 34,271 13,924 19,761

Adjustment for

Share of Associate Company Profi (4,227) (7,209) - -

(Gain)/ loss on disposal of

property, plant & equipmen - (2,268) - (2,264)

(Gain)/ loss on disposal of investments - - - 7,395

Depreciation on property, plant & equipmen 9,614 7,217 7,845 6,599

Provision for retiring gratuity 2,761 3,091 2,567 2,107

Interest paid 167,409 81,279 107,056 69,922

Interest Income (936) - - -

Dividend Received - (2,304) - -

Working Capital Changes

(Increase)/decrease in inventorie (401,876) (670) (287,969) (28,251)

(Increase)/decrease in receivable (339,048) 168,190 (282,326) (90,683)

Increase/(decrease) in payable 423,477 16,356 291,437 228,007

Cash generated from operations (143,788) 297,953 (147,466) 212,593

Interest paid (167,409) (81,279) (107,056) (69,922)

Income tax paid (13,771) (25,814) (7,782) (19,772)

Retiring gratuity paid (666) (2,031) (630) (1,037)

Net cash flows from operating activities (325,634) 188,829 (262,934) 121,862

Cash flows from Investing Activities

Purchase and construction of

property, plant & equipmen (20,984) (6,613) (17,904) (3,972)

Purchase of investments (40,000) - (35,000) -

Proceeds from sale of property, plant & equipmen - 2,264 - 2,264

Proceeds from sale of investments - 74,651 - 73,627

Dividend Received - 2,304 - -

Interest income 936 - -

Net cash used in investing activities (60,048) 72,606 (52,904) 71,919

Cash flows from Financing Activates

Lease rental paid (3,614) (1,922) (1,151) (1,223)

Repayment of term loans (42,970) (31,639) (34,477) (29,376)

Net cash flows from financing activities (46,584) (33,561) (35,628) (30,599)

Net Increase / (decrease) in cash &

cash equivalents (432,266) 227,874 (351,466) 163,182

Cash and cash equivalents at the

beginning of the year (266,248) (266,248) (481,604) (337,115)

Cash and cash equivalents at the

end of the period (Note A) (698,513) (38,374) (833,070) (173,933)

A. Analysis of Cash & Cash Equivalents

Bank and cash balances 80,994 221,985 51,713 211,779

Short term deposits 31,954 29,764 -

Bank Borrowings (811,461) (290,123) (884,783) (385,712)

(698,513) (38,374) (833,070) (173,933)

Notes to the Financial Statements

1. The quarterly Financial Statements have been prepared in accordance with the Accounting Policies set out in the Ann

Report for the year ended 31st March 2007 and also in compliance with the Sri Lanka Accounting Standard 35- Inte

Financial Reporting

2 Brown & Company PLC's stated capital represents Issued and fully paid 2,625,000 ( 2,625,000 - 31.03.2008 ) ordina

shares as at 30.06.2008

4. Interim figures are provisional and subject to audi

5 All values are in Rupees '000s, unless otherwise state

Brown & Company PLC

Statements of Changes in Equity

Consolidated

Attributable to Equity Holders of Parent

Stated Capital Revenue Total Minority Total

Capital Reserves Reserves Interest Equity

Balance as at 01.04.2007 21,101 4,755,485 491,682 5,268,268 16,265 5,284,533

Effect of changes in equity

holdings 23,003 23,003 23,003

Disposal of Subsidiary 119 (7,303) (7,184) (7,184)

Profit for the period 24,970 24,970 130 25,100

Balance as at 30.06.2007 21,101 4,755,604 532,352 5,309,057 16,395 5,325,452

For the balance period - 1,432,222 395,693 1,827,915 (10,714) 1,817,201

Balance as at 31.03.2008 21,101 6,187,826 928,045 7,136,972 5,681 7,142,653

Adjustment for debit balance

in Minority Interest (1,019) (1,019) 1019 -

Changes in equity holdings 1,512 (1,890) (378) (378)

Profit for the period (9,347) (9,347) 28 (9,319)

Balance as at 30.06.2008 21,101 6,189,338 915,789 7,126,228 6,728 7,132,956

Company

Stated Capital Revenue Total

Capital Reserves Reserves

Balance as at 01.04.2007 21,101 3,760,921 212,723 3,994,745

Disposal of Subsidiary (55,761) 48,367 (7,394)

Profit for the period 14,755 14,755

Balance as at 30.06.2007 21,101 3,705,160 275,845 4,002,106

For the balance period - 1,033,053 256,007 1,289,060

Balance as at 31.03.2008 21,101 4,738,213 531,852 5,291,166

Profit for the period 6,317 6,317

Balance as at 30.06.2008 21,101 4,738,213 538,169 5,297,483

Brown & Company PLC

Segment Information

Turnover

3 months to Unaudited 12

months to

30.06.2008 30.06.2007 31.03.2008

Trading 1,423,881 1,164,782 5,470,623

Manufacturing - 1,428 2,909

Travel & Tours 4,016 4,056 16,839

Finance 46,428 34,717 153,541

Power & Energy 94,387 59,119 252,980

Pharmaceuticals 68,003 43,158 16,256

1,636,715 1,307,260 5,913,148

Intra group eliminations (11,545) - (67,268)

1,625,170 1,307,260 5,845,880

Profit/(Loss) from Operations

3 months to Unaudited 12

months to

30.06.2008 30.06.2007 31.03.2008

Trading 114,391 85,774 429,927

Manufacturing (1,054) (729) (4,168)

Travel & Tours 178 363 2,005

Finance 35,806 12,642 82,999

Power & Energy 10,963 4,069 22,477

Pharmaceuticals 5,230 3,916 12,768

165,514 106,035 546,008

Intra group eliminations (3,294) - (18,218)

162,220 106,035 527,790

Note : All values are in Rupees '000s, unless otherwise stated

The above figures are subjected to audit.

You might also like

- 2b22799f-f7c1-4280-9274-8c59176f78b6Document190 pages2b22799f-f7c1-4280-9274-8c59176f78b6Andrew Martinez100% (1)

- Odysseus JourneyDocument8 pagesOdysseus JourneyDrey MartinezNo ratings yet

- Are You ... Already?: BIM ReadyDocument8 pagesAre You ... Already?: BIM ReadyShakti NagrareNo ratings yet

- L1 Support-Windows Server Interview Question & AnswersDocument6 pagesL1 Support-Windows Server Interview Question & AnswersSmile Ever100% (3)

- Pronunciation SyllabusDocument5 pagesPronunciation Syllabusapi-255350959No ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- NICOL Financial Statement For The Period Ended 30 Sept 2023Document4 pagesNICOL Financial Statement For The Period Ended 30 Sept 2023Uk UkNo ratings yet

- IGB REIT-Interim Report-Dec19-200122Document18 pagesIGB REIT-Interim Report-Dec19-200122Gan Zhi HanNo ratings yet

- GCB-Q3 2023 - Interim - ReportDocument16 pagesGCB-Q3 2023 - Interim - ReportGan ZhiHanNo ratings yet

- Quarterly Report 20200930Document18 pagesQuarterly Report 20200930Ang SHNo ratings yet

- Income Statement and Balance SheetDocument8 pagesIncome Statement and Balance SheetMyustafizzNo ratings yet

- Sedania Innovator Berhad - 2Q2022Document19 pagesSedania Innovator Berhad - 2Q2022zul hakifNo ratings yet

- Olam International LimitedDocument17 pagesOlam International Limitedashokdb2kNo ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- Financial Analysis DataSheet KECDocument22 pagesFinancial Analysis DataSheet KECSuraj DasNo ratings yet

- FIN 422-Midterm AssDocument43 pagesFIN 422-Midterm AssTakibul HasanNo ratings yet

- Bangladesh q2 Report 2020 Tcm244 553471 enDocument8 pagesBangladesh q2 Report 2020 Tcm244 553471 entdebnath_3No ratings yet

- 2011 MAS Annual 2Document9 pages2011 MAS Annual 2Thaw ZinNo ratings yet

- Sapnrg-Fs q4 31 Jan 2023Document33 pagesSapnrg-Fs q4 31 Jan 2023Mohd Faizal Mohd IbrahimNo ratings yet

- Interim Results 2023 Media ReleaseDocument16 pagesInterim Results 2023 Media ReleaseKNNo ratings yet

- Rent-Way Rentavision Pro Forma Adjustments Pro FormaDocument6 pagesRent-Way Rentavision Pro Forma Adjustments Pro FormaBassoonDude05No ratings yet

- Atlas Honda (2019 22)Document6 pagesAtlas Honda (2019 22)husnainbutt2025No ratings yet

- Financial Statement 2017 - 2019Document14 pagesFinancial Statement 2017 - 2019Audi Imam LazuardiNo ratings yet

- Financial Satements of 7elevenDocument15 pagesFinancial Satements of 7elevenKhairun HusnaNo ratings yet

- Financial Analysis Data Sheet - Raymonds (2023) - Revised (29 Jun, 2023)Document22 pagesFinancial Analysis Data Sheet - Raymonds (2023) - Revised (29 Jun, 2023)b23005No ratings yet

- Q4 2022 Bursa Announcement - 2Document13 pagesQ4 2022 Bursa Announcement - 2Quint WongNo ratings yet

- Tutorial 1 Presentation of FS (A)Document7 pagesTutorial 1 Presentation of FS (A)fooyy8No ratings yet

- Bangladesh q3 Report 2020 Tcm244 556009 enDocument8 pagesBangladesh q3 Report 2020 Tcm244 556009 entdebnath_3No ratings yet

- Quarterly Report 20191231Document21 pagesQuarterly Report 20191231Ang SHNo ratings yet

- Golden Harvest Agro Industries Limited: Statement of Financial Position As at June 30, 2012Document8 pagesGolden Harvest Agro Industries Limited: Statement of Financial Position As at June 30, 2012khurshid topuNo ratings yet

- Orascom - Interim Financial Report Q1 2020 FinalDocument28 pagesOrascom - Interim Financial Report Q1 2020 FinalTawfeeg AwadNo ratings yet

- Balance Sheet (December 31, 2008)Document6 pagesBalance Sheet (December 31, 2008)anon_14459No ratings yet

- Bursa Announcement DIYQ32022Document13 pagesBursa Announcement DIYQ32022Quint WongNo ratings yet

- Time Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210Document13 pagesTime Watch Investments Limited Unaudited 2nd QTR 1HF2009 Financial Statement 090210WeR1 Consultants Pte LtdNo ratings yet

- Wema-Bank-Financial Statement-2020Document24 pagesWema-Bank-Financial Statement-2020john stonesNo ratings yet

- Nigeria German Chemicals Final Results 2012Document4 pagesNigeria German Chemicals Final Results 2012vatimetro2012No ratings yet

- Peoples Bank FS June 2023 WEB FormatDocument13 pagesPeoples Bank FS June 2023 WEB FormatroomyfarizNo ratings yet

- Abans QuarterlyDocument14 pagesAbans QuarterlyGFMNo ratings yet

- UploadDocument83 pagesUploadAli BMSNo ratings yet

- Cargills (Ceylon) PLC: Provisional Financial StatementsDocument6 pagesCargills (Ceylon) PLC: Provisional Financial Statementskareem_nNo ratings yet

- RBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtDocument2 pagesRBGH Financials 30 June 2021 Colour 15.07.2021 2 Full Pages EdtFuaad DodooNo ratings yet

- ATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)Document15 pagesATA IMS - Q3 2023 Ended 31 Dec 2022 270223 (Final)eunjoNo ratings yet

- Unaudited Consolidated Financial Results For The Quarter Ended 31 March 2010Document4 pagesUnaudited Consolidated Financial Results For The Quarter Ended 31 March 2010poloNo ratings yet

- 31 March 2020Document8 pages31 March 2020lojanbabunNo ratings yet

- CR - MA-2023 - Suggested - AnswersDocument15 pagesCR - MA-2023 - Suggested - AnswersfahadsarkerNo ratings yet

- MR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Document15 pagesMR D.I.Y. Group (M) Berhad: Interim Financial Report For The Third Quarter Ended 30 September 2020Mzm Zahir MzmNo ratings yet

- Sterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Document1 pageSterling Bank PLC Abridged Financial Statement For The Year Ended September 30, 2008Sterling Bank PLCNo ratings yet

- Airasia Quarter ReportDocument34 pagesAirasia Quarter ReportChee Meng TeowNo ratings yet

- Cfin Sep2022Document14 pagesCfin Sep2022jdNo ratings yet

- Enterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Document8 pagesEnterprise Group PLC: Unaudited Financial Statements For The Year Ended 31 December 2021Fuaad DodooNo ratings yet

- Financial Statements: For The Year Ended 31 December 2019Document11 pagesFinancial Statements: For The Year Ended 31 December 2019RajithWNNo ratings yet

- Quarterly - Report - 2q2021-Segment ReportDocument2 pagesQuarterly - Report - 2q2021-Segment ReporthannacuteNo ratings yet

- Consolidated Profit or Loss and Other Comprehensive Income: RAK Ceramics (Bangladesh) LTDDocument1 pageConsolidated Profit or Loss and Other Comprehensive Income: RAK Ceramics (Bangladesh) LTDDream Air International Travels & ToursNo ratings yet

- UntitledDocument135 pagesUntitledRohol Amin RajuNo ratings yet

- Annual Report - PadiniDocument23 pagesAnnual Report - PadiniCheng Chung leeNo ratings yet

- Xiezhong International Holdings Limited 協 眾 國 際 控 股 有 限 公 司Document39 pagesXiezhong International Holdings Limited 協 眾 國 際 控 股 有 限 公 司in resNo ratings yet

- Quarterly Report 20180331Document15 pagesQuarterly Report 20180331Ang SHNo ratings yet

- Financials 9Document4 pagesFinancials 9Sagar ChaurasiaNo ratings yet

- National Central Cooling Company PJSCDocument24 pagesNational Central Cooling Company PJSCMohamed NaieemNo ratings yet

- Unaudited Financials BSX December 2023Document2 pagesUnaudited Financials BSX December 2023BernewsNo ratings yet

- Intermediate AccountingDocument5 pagesIntermediate AccountingWindelyn ButraNo ratings yet

- Subject To Central Bank of Oman ApprovalDocument1 pageSubject To Central Bank of Oman ApprovalAttaNo ratings yet

- Interim Financial Report 2016.Q2Document26 pagesInterim Financial Report 2016.Q2Shungchau WongNo ratings yet

- Awasr Oman and Partners SAOC - FS 2020 EnglishDocument42 pagesAwasr Oman and Partners SAOC - FS 2020 Englishabdullahsaleem91No ratings yet

- Coding Decoding 1 - 5311366Document20 pagesCoding Decoding 1 - 5311366Sudarshan bhadaneNo ratings yet

- Gwinnett Schools Calendar 2017-18Document1 pageGwinnett Schools Calendar 2017-18bernardepatchNo ratings yet

- Grile EnglezaDocument3 pagesGrile Englezakis10No ratings yet

- Albert EinsteinDocument3 pagesAlbert EinsteinAgus GLNo ratings yet

- AGM Minutes 2009Document3 pagesAGM Minutes 2009Prateek ChawlaNo ratings yet

- Leadership and Followership in An Organizational Change Context (Sajjad Nawaz Khan, (Editor) ) (Z-Library)Document381 pagesLeadership and Followership in An Organizational Change Context (Sajjad Nawaz Khan, (Editor) ) (Z-Library)benjaminwong8029No ratings yet

- John 5:31-47Document5 pagesJohn 5:31-47John ShearhartNo ratings yet

- S No Clause No. Existing Clause/ Description Issues Raised Reply of NHAI Pre-Bid Queries Related To Schedules & DCADocument10 pagesS No Clause No. Existing Clause/ Description Issues Raised Reply of NHAI Pre-Bid Queries Related To Schedules & DCAarorathevipulNo ratings yet

- 7 Principles or 7 CDocument5 pages7 Principles or 7 Cnimra mehboobNo ratings yet

- Updated 2 Campo Santo de La LomaDocument64 pagesUpdated 2 Campo Santo de La LomaRania Mae BalmesNo ratings yet

- Questionnaires in Two-Way Video and TeleconferencingDocument3 pagesQuestionnaires in Two-Way Video and TeleconferencingRichel Grace PeraltaNo ratings yet

- Read The Following Case Study Carefully and Answer The Questions Given at The End: Case # 3. ElectroluxDocument3 pagesRead The Following Case Study Carefully and Answer The Questions Given at The End: Case # 3. ElectroluxDarkest DarkNo ratings yet

- Q2 Emptech W1 4Document32 pagesQ2 Emptech W1 4Adeleine YapNo ratings yet

- Coral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascDocument1 pageCoral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascGabriel Kuhs da RosaNo ratings yet

- Total Gallium JB15939XXDocument18 pagesTotal Gallium JB15939XXAsim AliNo ratings yet

- Resume 2022-2023Document3 pagesResume 2022-2023Daniela ChavezNo ratings yet

- 10 Types of Innovation (Updated)Document4 pages10 Types of Innovation (Updated)Nur AprinaNo ratings yet

- Persuasive Writing Exam - Muhamad Saiful Azhar Bin SabriDocument3 pagesPersuasive Writing Exam - Muhamad Saiful Azhar Bin SabriSaiful AzharNo ratings yet

- Ciplaqcil Qcil ProfileDocument8 pagesCiplaqcil Qcil ProfileJohn R. MungeNo ratings yet

- Folio BiologiDocument5 pagesFolio BiologiPrincipessa FarhanaNo ratings yet

- Worldpay Social Gaming and Gambling Whitepaper Chapter OneDocument11 pagesWorldpay Social Gaming and Gambling Whitepaper Chapter OneAnnivasNo ratings yet

- Itinerary KigaliDocument2 pagesItinerary KigaliDaniel Kyeyune Muwanga100% (1)

- Postcolonial FeministReadingDocument10 pagesPostcolonial FeministReadinganushkamahraj1998No ratings yet

- Richard Neutra - Wikipedia, The Free EncyclopediaDocument10 pagesRichard Neutra - Wikipedia, The Free EncyclopediaNada PejicNo ratings yet

- Mt-Requirement-01 - Feu CalendarDocument18 pagesMt-Requirement-01 - Feu CalendarGreen ArcNo ratings yet