Professional Documents

Culture Documents

Form ST-13A

Uploaded by

Ever GarciaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form ST-13A

Uploaded by

Ever GarciaCopyright:

Available Formats

Department of Taxation

Form ST-13A

COMMONWEALTH OF VIRGINIA

SALES AND USE TAX CERTIFICATE OF EXEMPTION

(For use by a church conducted not for profit that is exempt from income taxation under Section 501 (c) (3) of the

Internal Revenue Code or from property taxation under Section 58.1-3606 of the Code of Virginia.)

To: ___________________________________________________________________ Date: ________________

(Name of Dealer)

(Number and Street or Rural Address) (City, Town or Post Office) (State & ZIP Code)

The Virginia Retail Sales and Use Tax Act provides that the sales and use tax shall not apply to

(check proper box below):

1. Tangible personal property purchased by churches organized not for profit and which are exempt from

taxation under Section 501 (c) (3) of the Internal Revenue Code, or whose real property is exempt from

local taxation pursuant to the provisions of Section 58.1-3606 of the Code of Virginia, for use

(a) in religious worship services by a congregation or church membership while meeting together in a

single location,

(b) in the libraries, offices, meeting or counseling rooms or other rooms in the public church buildings used

in carrying out the work of the church and its related ministries, including kindergarten, elementary and

secondary schools. The exemption for such churches shall also include baptistries, bulletins, programs,

newspapers and newsletters which do not contain paid advertising and are used in carrying out the work

of the church and gifts, including food, for distribution outside the public church building, and

(c) in (i) caring for or maintaining property owned by the church including, but not limited to, mowing

equipment, and (ii) building materials installed by the church and for which the church does not contract

with a person or entity to have installed, in the public church buildings used in carrying out the work of the

church and its related ministries, including, but not limited to worship services; administrative rooms; and

kindergarten, elementary, and secondary schools.

2. Food, disposable serving items, cleaning supplies and teaching materials used in the operation of camps or

conference centers by a church as defined in Item 1 above or an organization composed of such churches

and which are used in carrying out the work of the church or churches.

The undersigned, for and on behalf of the nonprofit church, certifies that all tangible personal property purchased

under this exemption certificate is for the purposes indicated above, unless specified on each order, and that the

purchases will be paid for out of church funds.

Name of nonprofit church _______________________________________________________________

Address _____________________________________________________________________________

(Number and Street or Rural Route) (City, Town or Post Office) (S tate and ZIP Code)

I certify that I am authorized to sign this Certificate of Exemption and that, to the best of my knowledge and belief, it

is true and correct, made in good faith, pursuant to the Virginia Retail Sales and Use Tax Act.

By: _________________________________________________ Title: ________________________________

(Signature)

Information for supplier. - A supplier is required to have on file only one Certificate of Exemption properly executed

by each nonprofit church buying tangible personal property tax exempt under this Certificate.

NOTE: This exemption certificate does not provide exemption for any tangible personal property purchased by

a church other than that specified above.

VA DEPT OF TAXATION

6201137 Rev. 6/07

You might also like

- FBC Use of Church Facilities AppDocument2 pagesFBC Use of Church Facilities AppHoussan LindmanNo ratings yet

- Application For Accreditation For Donee Institution StatusDocument2 pagesApplication For Accreditation For Donee Institution Statusalfx216No ratings yet

- HB 5714Document5 pagesHB 5714Ashrifa GuroNo ratings yet

- C - Äätü Éy Güâà (' - Ç - Áàü - Xá: Church/Ministry Charter ApplicationDocument1 pageC - Äätü Éy Güâà (' - Ç - Áàü - Xá: Church/Ministry Charter Applicationreadme345No ratings yet

- Ap 209Document2 pagesAp 209Steven FirminNo ratings yet

- Trust AgreementDocument2 pagesTrust AgreementMich Angeles100% (3)

- Form CRI 200 Short Form Registration Verification Statement PDFDocument5 pagesForm CRI 200 Short Form Registration Verification Statement PDFWen' George BeyNo ratings yet

- Sworn Statement For Boa AccreditationDocument1 pageSworn Statement For Boa AccreditationJaime CenirNo ratings yet

- Sworn Statement For Boa AccreditationDocument1 pageSworn Statement For Boa AccreditationRheg TeodoroNo ratings yet

- American Bible Society Vs Manila 101 Phil 386Document4 pagesAmerican Bible Society Vs Manila 101 Phil 386HannesNo ratings yet

- Central Philippine Union Conference Seeks Property Tax ExemptionDocument2 pagesCentral Philippine Union Conference Seeks Property Tax ExemptionHeber BacolodNo ratings yet

- Membership Agreement PDF 654138640c97fDocument3 pagesMembership Agreement PDF 654138640c97frealfreestyleflowNo ratings yet

- RCIA Registration FormDocument1 pageRCIA Registration FormRon PanganNo ratings yet

- BOA Accreditation Sworn StatementDocument1 pageBOA Accreditation Sworn StatementJanetNo ratings yet

- SOC EAD - Charlotte Parish Draft AOI (4.18.2023)Document9 pagesSOC EAD - Charlotte Parish Draft AOI (4.18.2023)neutralnaNo ratings yet

- Appication Land TransferDocument2 pagesAppication Land TransferFelix EvangelistaNo ratings yet

- Anatolia Cultural FoundationDocument110 pagesAnatolia Cultural FoundationStewart Bell100% (3)

- Taxes and ChurchesDocument19 pagesTaxes and Churchesmharhielle gonzagaNo ratings yet

- Application For Accreditation For Donee Institution StatusDocument10 pagesApplication For Accreditation For Donee Institution StatusbobbysingersyahooNo ratings yet

- ACC Church Souvenir Program AdDocument3 pagesACC Church Souvenir Program AdNikkaNo ratings yet

- Taxation Case DigestDocument23 pagesTaxation Case DigestAnonymous vUC7HI2BNo ratings yet

- Lladoc VS CirDocument1 pageLladoc VS CirYosi IsoyNo ratings yet

- Icaai Mc28s2020 Annexes DDocument1 pageIcaai Mc28s2020 Annexes DJeffereson MasalloNo ratings yet

- Sponsorship LetterDocument3 pagesSponsorship LetterEmmanuel ServantsNo ratings yet

- Affidavit Against GamingDocument1 pageAffidavit Against Gamingfightingmaroon100% (1)

- Letter Request For Income Tax ExemptionDocument6 pagesLetter Request For Income Tax Exemptiondhin caragNo ratings yet

- IRS - Tax Guide For ChurchesDocument28 pagesIRS - Tax Guide For ChurchesTim McGheeNo ratings yet

- LTR TaxexemptionDocument3 pagesLTR TaxexemptionattyleyyaNo ratings yet

- Iocese: Atholic OF Uperior Matrimonial Tribunal DepartmentDocument16 pagesIocese: Atholic OF Uperior Matrimonial Tribunal DepartmentKingin HonchoNo ratings yet

- NHCT 2a ReportDocument11 pagesNHCT 2a Reportapi-364422685No ratings yet

- Sac Application and LiabiltiyDocument2 pagesSac Application and LiabiltiyPablo CruzNo ratings yet

- Application For Membership 2010Document2 pagesApplication For Membership 2010vknittersguildNo ratings yet

- Wedding Registration SheetDocument3 pagesWedding Registration Sheetmichaelrichardson1515No ratings yet

- TM Sozo App 2019Document2 pagesTM Sozo App 2019watchkeepNo ratings yet

- Wilton New Account Form 2022Document4 pagesWilton New Account Form 2022Saif Ur RehmanNo ratings yet

- Request For Income Tax ExemptionDocument5 pagesRequest For Income Tax ExemptionGlory Perez100% (5)

- Reply to FTB Notice Requesting Tax ReturnDocument6 pagesReply to FTB Notice Requesting Tax Returnsrive1No ratings yet

- Chiropractic Application Form: Section A: Contact InformationDocument6 pagesChiropractic Application Form: Section A: Contact InformationAmanakeNo ratings yet

- American Bible Society vs. City of ManilaDocument2 pagesAmerican Bible Society vs. City of ManilaJairus Adrian VilbarNo ratings yet

- NCC Disaffiliation Agreement 8-4-22Document16 pagesNCC Disaffiliation Agreement 8-4-22Steven DoyleNo ratings yet

- Sworn Application For Tax Clearance - Non-IndDocument1 pageSworn Application For Tax Clearance - Non-IndIdan AguirreNo ratings yet

- Certificate For Exempt Purchases: Form AS 2916.1Document2 pagesCertificate For Exempt Purchases: Form AS 2916.1nareshkumharNo ratings yet

- Short Intern and Volunteer Application-2Document3 pagesShort Intern and Volunteer Application-2Anonymous TCXV3yTgqbNo ratings yet

- Articles of Incorporation-Non Stock CorpDocument3 pagesArticles of Incorporation-Non Stock CorpAllan MolinaNo ratings yet

- Yarisantos, Aileen Mae U. (Case Analysis)Document4 pagesYarisantos, Aileen Mae U. (Case Analysis)Aileen Mae YarisantosNo ratings yet

- IRS Tax Exemption Application Process for ChurchesDocument5 pagesIRS Tax Exemption Application Process for Churchesbarg1113No ratings yet

- Undertaking 2021Document2 pagesUndertaking 2021Joey A. BocalaNo ratings yet

- New Application Form Pcec 2022Document3 pagesNew Application Form Pcec 2022cuteshammahNo ratings yet

- Case 90 Lladoc vs. Comm. of Int. Rev. 14 SCRA 292 1965 Facts: Sometime in 1957, The M.B. Estate, Inc., of Bacolod City, Donated P10,000.00 inDocument6 pagesCase 90 Lladoc vs. Comm. of Int. Rev. 14 SCRA 292 1965 Facts: Sometime in 1957, The M.B. Estate, Inc., of Bacolod City, Donated P10,000.00 inDawn Jessa GoNo ratings yet

- Petition To Withdraw As Counsel With ConformityDocument1 pagePetition To Withdraw As Counsel With ConformityShyrell CleminoNo ratings yet

- American Bible Society vs. City of Manila, 181 Phil. 386 (1957)Document17 pagesAmerican Bible Society vs. City of Manila, 181 Phil. 386 (1957)Bea Patricia CutorNo ratings yet

- ZOE - Amnesty ApplicationDocument2 pagesZOE - Amnesty Applicationzoelifefam1No ratings yet

- Reasons for Pag-IBIG loan delinquency and non-availment of penalty condonationDocument1 pageReasons for Pag-IBIG loan delinquency and non-availment of penalty condonationWerner SchlagerNo ratings yet

- AFFIDAVIT OF UNDERTAKING FOR AN EMISSION TESTING CENTER (For Scribd)Document1 pageAFFIDAVIT OF UNDERTAKING FOR AN EMISSION TESTING CENTER (For Scribd)Gaillard Guerrero67% (3)

- The Journey: Appalachia to Paradise to PurgatoryFrom EverandThe Journey: Appalachia to Paradise to PurgatoryNo ratings yet

- Pefa 2018 Mid Year ReportDocument176 pagesPefa 2018 Mid Year ReportPranjal PatilNo ratings yet

- Anand Medical t16Document1 pageAnand Medical t16Kamlesh PrajapatiNo ratings yet

- Republic v. Razon and Jai Alai CorporationDocument3 pagesRepublic v. Razon and Jai Alai CorporationYanz RamsNo ratings yet

- The University of Lahore: Regular Fee VoucherDocument1 pageThe University of Lahore: Regular Fee Voucherchadeelishtiaq1No ratings yet

- Approved Ein - FS Ventures IncDocument3 pagesApproved Ein - FS Ventures IncKarthi KeyanNo ratings yet

- Payslip 2023 2024 5 200000000029454 IGSLDocument2 pagesPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNo ratings yet

- Vishvanath Enterprise Bill dt08032022Document1 pageVishvanath Enterprise Bill dt08032022rahulNo ratings yet

- Pay Slip TemplateDocument3 pagesPay Slip TemplateRachiel Kintos100% (1)

- RCBC v. CIR GR No. 170257 Sep. 7, 2011Document14 pagesRCBC v. CIR GR No. 170257 Sep. 7, 2011AlexandraSoledadNo ratings yet

- Boston University Department of Economics: Cas Ec 367 Public Economics Summer 2021Document3 pagesBoston University Department of Economics: Cas Ec 367 Public Economics Summer 2021Rafael KrigerNo ratings yet

- Klenzofab Quotation 01-10-2022Document1 pageKlenzofab Quotation 01-10-2022ME-B AMAN SHAIKHNo ratings yet

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Document2 pages1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNo ratings yet

- Nur Hidayah AprilDocument1 pageNur Hidayah AprilglobalamshaNo ratings yet

- Semi FinalDocument17 pagesSemi FinalJane TuazonNo ratings yet

- SepDocument1 pageSepBachu RameshNo ratings yet

- Workshop 6 SOL Additional QuestionDocument5 pagesWorkshop 6 SOL Additional Questiontimlee38100% (1)

- Bibliography: BooksDocument17 pagesBibliography: BooksRaj SomaniNo ratings yet

- 1701qjuly2008 (ENCS)Document5 pages1701qjuly2008 (ENCS)Mary Rose AnilloNo ratings yet

- PaySlip 10 2023 MergedDocument3 pagesPaySlip 10 2023 MergedThe Cool Telly UpdateNo ratings yet

- Calculating MAGIDocument1 pageCalculating MAGIf0123250No ratings yet

- B-4 Account Computation PFC SuerteDocument3 pagesB-4 Account Computation PFC SuerteElmer AlasNo ratings yet

- When Does Importation Begin?: Chloe Jane B. Macabalos CA-201 Assignment 3 - Border Control & SecurityDocument2 pagesWhen Does Importation Begin?: Chloe Jane B. Macabalos CA-201 Assignment 3 - Border Control & SecurityChloe Jane MacabalosNo ratings yet

- General Principles of TaxationDocument3 pagesGeneral Principles of TaxationRussel Saez ReyNo ratings yet

- Local-Taxes-And-Fees-As-A-Source-Of-Income-To-The-Local-Budget - Content File PDFDocument6 pagesLocal-Taxes-And-Fees-As-A-Source-Of-Income-To-The-Local-Budget - Content File PDFHaini AncutaNo ratings yet

- Deductible Losses and NOLCO RulesDocument5 pagesDeductible Losses and NOLCO RulesDiane HeartphiliaNo ratings yet

- Comparative Analysis of VAT and GSTDocument39 pagesComparative Analysis of VAT and GSTsaahilp_10% (5)

- Comparative & Common Size StatementDocument2 pagesComparative & Common Size StatementTaaran ReddyNo ratings yet

- Fiscal Policy of BangladeshDocument16 pagesFiscal Policy of BangladeshMdSumonMiaNo ratings yet

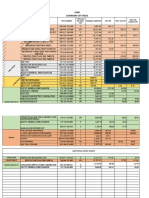

- June Summary of Taxes and Supplier PaymentsDocument8 pagesJune Summary of Taxes and Supplier PaymentsDanah RebicoyNo ratings yet

- Income Tax Numericals For PracticeDocument3 pagesIncome Tax Numericals For PracticeAdil MalikNo ratings yet