Professional Documents

Culture Documents

Jeevan Saral Plan Presentation: Harish Chand

Uploaded by

Harish ChandOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jeevan Saral Plan Presentation: Harish Chand

Uploaded by

Harish ChandCopyright:

Available Formats

HARISH CHAND

Sample Report For Demonstration Purpose Only

205-206, C-Wing, Crystal Plaza,New Link Road,

Andheri(W), Mumbai - 400 053.

Tel: 4060 1000 Fax:4060 1226.

e-mail. support@datacompwebtech.com

Jeevan Saral Plan Presentation

Date : 21/06/2010

HIGHLIGHTS

LIC’s Jeevan Saral is a unique plan having good features of the conventional plans and

the flexibility of unit linked plans. To the policyholder it provides —

· higher cover

· a smooth return,

· liquidity and

· a lot of flexibility

BENEFITS:

On death:

· 250 times the monthly premium, plus

· return of premiums excluding extra/rider premium and first year premium,

plus

· the loyalty addition, if any.

On Maturity:

· Maturity sum assured, plus

· The Loyalty Additions, if any

Special Features:

· High risk cover at low premium

· Extended risk cover for one year after 3 years premium payment.

· Optional higher cover through Term Riders

· The policyholder can choose a maximum term but can surrender at any time

without any surrender penalty or loss after 5 years

· Any number of withdrawals through partial surrendering

ELIGIBILITY CONDITIONS AND OTHER RESTRICTIONS:

· Age at entry : Minimum 12 (completed) and maximum 60 years nearest

· Age at maturity: Maximum 70 years.

· Term : All terms from 10 to 35 years.

· Premium : Minimum premium of Rs.250/- per month for entry age

upto 49 years and Rs.400/- per month for entry age 50

years and above. There will be no limit on the maximum

premium per month.

· Mode : Yearly, Half-yearly, Quarterly and Monthly under Salary

Saving Scheme

In case of term rider, minimum and maximum age at entry will be 18 and 50 years

respectively. Further minimum sum assured will be Rs.1 lakh.

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

HARISH CHAND

Sample Report For Demonstration Purpose Only

205-206, C-Wing, Crystal Plaza,New Link Road,

Andheri(W), Mumbai - 400 053.

Tel: 4060 1000 Fax:4060 1226.

e-mail. support@datacompwebtech.com

Jeevan Saral Plan Presentation

Jeevan Saral Plan Continued ... Pg. 2

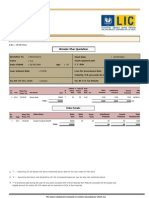

Name

Mr.:Mukesh Ram Age : 27 years

Term :

20 Years Mode : Yearly

Premium Budget p. m. : 2000 Installment Premium : 23520

Term Rider : 0 Term Rider Premium : 0

DAB : 500000 DAB Premium : 500

Total Installment Premium : 24020 Total Annual Premium : 24020

Section 80 CCE Invst. Limit : 100000 Section 80 CCE Tax Savings : 33.99 %

Risk Cover Benefits

DEATH BENEFIT

Variable Total

Annual Tax Nett Total

Year Age Premium Saved Premium Premium Paid Guaranteed Scenario1 Scenario2 Scenario1 Scenario2

2010 27 24020 8164 15856 15856 500000 0 0 500000 500000

2011 28 24020 8164 15856 31712 524000 0 0 524000 524000

2012 29 24020 8164 15856 47568 548000 0 0 548000 548000

2013 30 24020 8164 15856 63424 572000 0 0 572000 572000

2014 31 24020 8164 15856 79280 596000 0 0 596000 596000

2015 32 24020 8164 15856 95136 620000 0 0 620000 620000

2016 33 24020 8164 15856 110992 644000 0 0 644000 644000

2017 34 24020 8164 15856 126848 668000 0 0 668000 668000

2018 35 24020 8164 15856 142704 692000 0 0 692000 692000

2019 36 24020 8164 15856 158560 716000 35000 90000 751000 806000

2020 37 24020 8164 15856 174416 740000 40000 100000 780000 840000

2021 38 24020 8164 15856 190272 764000 45500 115000 809500 879000

2022 39 24020 8164 15856 206128 788000 51500 137500 839500 925500

2023 40 24020 8164 15856 221984 812000 58000 167500 870000 979500

2024 41 24020 8164 15856 237840 836000 65000 205000 901000 1041000

2025 42 24020 8164 15856 253696 860000 74000 247500 934000 1107500

2026 43 24020 8164 15856 269552 884000 86000 297500 970000 1181500

2027 44 24020 8164 15856 285408 908000 102000 355000 1010000 1263000

2028 45 24020 8164 15856 301264 932000 123000 422500 1055000 1354500

2029 46 24020 8164 15856 317120 956000 150000 500000 1106000 1456000

480400 163280 317120

Note : The figures in columns Scenario 1 and Scenario 2 above are non-guaranteed. They are estimated on the assumption of

LIC’s projected investment rate of return of 6% and 10% respectively on the investible portion of the premium.

The Investible portion of the premium is calculated as per LIC's benefit Illustration.

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

HARISH CHAND

Sample Report For Demonstration Purpose Only

205-206, C-Wing, Crystal Plaza,New Link Road,

Andheri(W), Mumbai - 400 053.

Tel: 4060 1000 Fax:4060 1226.

e-mail. support@datacompwebtech.com

Jeevan Saral Plan Presentation

Jeevan Saral Plan Continued ... Pg. 3

Name

Mr.:Mukesh Ram Age : 27 years

Term :

20 Years Mode : Yearly

Premium Budget p. m. : 2000 Installment Premium : 23520

Term Rider : 0 Term Rider Premium : 0

DAB : 500000 DAB Premium : 500

Total Installment Premium : 24020 Total Annual Premium : 24020

Section 80 CCE Invst. Limit : 100000 Section 80 CCE Tax Savings : 33.99 %

Maturity / Surrender Value Benefits

MATURITY / SURRENDER VALUE BENEFIT

Variable Total

Annual Tax Nett Total

Year Age Premium Saved Premium Premium Paid Guaranteed Scenario1 Scenario2 Scenario1 Scenario2

2010 27 24020 8164 15856 15856 0 0 0 0 0

2011 28 24020 8164 15856 31712 0 0 0 0 0

2012 29 24020 8164 15856 47568 41008 0 0 41008 41008

2013 30 24020 8164 15856 63424 65628 0 0 65628 65628

2014 31 24020 8164 15856 79280 94660 0 0 94660 94660

2015 32 24020 8164 15856 95136 117860 0 0 117860 117860

2016 33 24020 8164 15856 110992 142040 0 0 142040 142040

2017 34 24020 8164 15856 126848 167280 0 0 167280 167280

2018 35 24020 8164 15856 142704 193780 0 0 193780 193780

2019 36 24020 8164 15856 158560 222140 35000 90000 257140 312140

2020 37 24020 8164 15856 174416 252360 40000 100000 292360 352360

2021 38 24020 8164 15856 190272 282840 45500 115000 328340 397840

2022 39 24020 8164 15856 206128 315580 51500 137500 367080 453080

2023 40 24020 8164 15856 221984 350740 58000 167500 408740 518240

2024 41 24020 8164 15856 237840 389180 65000 205000 454180 594180

2025 42 24020 8164 15856 253696 421300 74000 247500 495300 668800

2026 43 24020 8164 15856 269552 453560 86000 297500 539560 751060

2027 44 24020 8164 15856 285408 486720 102000 355000 588720 841720

2028 45 24020 8164 15856 301264 519940 123000 422500 642940 942440

2029 46 24020 8164 15856 317120 553100 150000 500000 703100 1053100

480400 163280 317120

Note : The figures in columns Scenario 1 and Scenario 2 above are non-guaranteed. They are estimated on the assumption of

LIC’s projected investment rate of return of 6% and 10% respectively on the investible portion of the premium.

The Investible portion of the premium is calculated as per LIC's benefit Illustration.

The above statement is based on certain assumptions which are

liable to change according to Government/Corporation's policies.

You might also like

- LIC's Jeevan Saral Plan Presentation HighlightsDocument3 pagesLIC's Jeevan Saral Plan Presentation HighlightsRohit Kumar DasNo ratings yet

- Jeevan Saral Plan Presentation: R. SubramaniDocument3 pagesJeevan Saral Plan Presentation: R. SubramaniSiva GNo ratings yet

- Harish Chand: Magic Yield PresentationDocument6 pagesHarish Chand: Magic Yield PresentationHarish ChandNo ratings yet

- Report Master. V 874 Age 2 SA 1000000Document4 pagesReport Master. V 874 Age 2 SA 1000000basavarajbalagod8No ratings yet

- Sales-Brochure 108Document4 pagesSales-Brochure 108nirmal kumarNo ratings yet

- Report Mr. VV 920 20 15 Age 31 SA 305000Document5 pagesReport Mr. VV 920 20 15 Age 31 SA 305000arvindNo ratings yet

- Life Insurance Company The Whole Life Policy-Single PremiumDocument13 pagesLife Insurance Company The Whole Life Policy-Single PremiumNazneenNo ratings yet

- Financial Plan of Chemical Industry: Amardeep PigmentDocument17 pagesFinancial Plan of Chemical Industry: Amardeep Pigmentsant1306No ratings yet

- Mr. Kumar Gaurav: Insurance Proposal ForDocument6 pagesMr. Kumar Gaurav: Insurance Proposal ForHarish ChandNo ratings yet

- Mixing - 30-1-2021 0.47.0Document8 pagesMixing - 30-1-2021 0.47.0..No ratings yet

- Mr. Sanjay: Insurance Proposal ForDocument6 pagesMr. Sanjay: Insurance Proposal Forrajkamal eshwarNo ratings yet

- Report Mr. V 934 23 18 Age 2 SA 1000000Document5 pagesReport Mr. V 934 23 18 Age 2 SA 1000000basavarajbalagod8No ratings yet

- Mr. Rakesh Chaturvedi: Insurance Proposal ForDocument5 pagesMr. Rakesh Chaturvedi: Insurance Proposal ForHarish ChandNo ratings yet

- Report Mr. Amit 945 76 12 Age 24 SA 2020000Document6 pagesReport Mr. Amit 945 76 12 Age 24 SA 2020000Sudeep MandalNo ratings yet

- Sujatha: Exclusively Prepared For: Ven DOC: 1/3/2019 - Age: 48 Plan Criteria Input Data Premium & Rider DetailsDocument6 pagesSujatha: Exclusively Prepared For: Ven DOC: 1/3/2019 - Age: 48 Plan Criteria Input Data Premium & Rider DetailsKilli ValavanNo ratings yet

- Kum. Akshaya. L.: Insurance Proposal ForDocument7 pagesKum. Akshaya. L.: Insurance Proposal ForAkshaya LakshminarasimhanNo ratings yet

- Jeevan NidhiDocument2 pagesJeevan NidhiAkhil RajNo ratings yet

- Jeevan Saral Plan Presentation: Harish ChandDocument3 pagesJeevan Saral Plan Presentation: Harish ChandHarish ChandNo ratings yet

- Anikit Pradhan - 11Document4 pagesAnikit Pradhan - 11Anurag pradhanNo ratings yet

- Report Mr. Tharun 936 25 16 Age 18 SA 500000Document5 pagesReport Mr. Tharun 936 25 16 Age 18 SA 500000tharunshanmugam25No ratings yet

- Report Mr. A 945 70 20 Age 30 SA 2000000Document6 pagesReport Mr. A 945 70 20 Age 30 SA 2000000Sai VkcNo ratings yet

- Insurance savings quote for Vijay JonnalagaddaDocument1 pageInsurance savings quote for Vijay JonnalagaddaninthsevenNo ratings yet

- Report Mr. Chandana 871 82 Age 18 SA 500000Document7 pagesReport Mr. Chandana 871 82 Age 18 SA 500000ChandanaNo ratings yet

- Report - Mr. - Chandigarh - 871 - 39 - Age - 61 - SA - 1000000Document5 pagesReport - Mr. - Chandigarh - 871 - 39 - Age - 61 - SA - 1000000naveend9741No ratings yet

- Avdhoot InvestmentDocument2 pagesAvdhoot Investmentsaroj09No ratings yet

- As 936 16 10 Age 44 SA 200000Document5 pagesAs 936 16 10 Age 44 SA 200000SUMIT KUMARNo ratings yet

- New Jeevan Nidhi Plan Presentation: LIC DIRECT-Quick, Simple and EasyDocument2 pagesNew Jeevan Nidhi Plan Presentation: LIC DIRECT-Quick, Simple and EasyKSNo ratings yet

- LIC - Retire and EnjoyDocument4 pagesLIC - Retire and EnjoyThiagarajan VasuNo ratings yet

- Jlakshya - 10-12-2020 4.53.21 PDFDocument8 pagesJlakshya - 10-12-2020 4.53.21 PDFAnuNo ratings yet

- Income StatementDocument3 pagesIncome StatementBiswajit SarmaNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Report - Mr. - Abraham Kuruvila - 936 - 16 - 10 - Age - 44 - SA - 2300000Document4 pagesReport - Mr. - Abraham Kuruvila - 936 - 16 - 10 - Age - 44 - SA - 2300000anoopapNo ratings yet

- Financial Plan: Sales ForecastDocument8 pagesFinancial Plan: Sales ForecastAyush BishtNo ratings yet

- Single Plan For PensionDocument2 pagesSingle Plan For PensionHarish ChandNo ratings yet

- Jeevan Anand insurance plan sample reportDocument4 pagesJeevan Anand insurance plan sample reportSiva Krishna NeppaliNo ratings yet

- Project Report For Home AllplianceDocument6 pagesProject Report For Home Allpliancerajesh patelNo ratings yet

- Report Mr. XXXXX - 917 25 1 Age 1 SA 50000Document5 pagesReport Mr. XXXXX - 917 25 1 Age 1 SA 50000gyanugautam575No ratings yet

- 933-Jeevan Lakshya: Prepared byDocument8 pages933-Jeevan Lakshya: Prepared byVishal GuptaNo ratings yet

- 936-Jeevan Labh Policy SummaryDocument6 pages936-Jeevan Labh Policy Summary09789993119No ratings yet

- LIC S Jeevan Samridhi - 512N215V01Document6 pagesLIC S Jeevan Samridhi - 512N215V01azizsultanNo ratings yet

- Mixing - 11-2-2024 0.31.13Document7 pagesMixing - 11-2-2024 0.31.13DanishZaferNo ratings yet

- New Bima GoldDocument1 pageNew Bima GoldHarish ChandNo ratings yet

- Sales Forecast & Cost of Sales - NaometDocument3 pagesSales Forecast & Cost of Sales - NaometErnest Mohau SomolekaeNo ratings yet

- Mr. Dhilip: Insurance Proposal ForDocument6 pagesMr. Dhilip: Insurance Proposal ForthilipkumarNo ratings yet

- Insurance Proposal for Retirement IncomeDocument6 pagesInsurance Proposal for Retirement IncomeAkshaya LakshminarasimhanNo ratings yet

- Product Detail ForYelloDocument3 pagesProduct Detail ForYelloAnne PriceNo ratings yet

- Jeevan Tarun (934) : Sri. HaarikaDocument5 pagesJeevan Tarun (934) : Sri. Haarikaservas123No ratings yet

- Pooja & Pooja Team Profit-and-Loss-StatementDocument5 pagesPooja & Pooja Team Profit-and-Loss-StatementPOOJA SUNKINo ratings yet

- Ram Dinesh - JeevanAnand - 4-9-2023 5.49.34Document8 pagesRam Dinesh - JeevanAnand - 4-9-2023 5.49.34Narasegowda ANo ratings yet

- Capital BudgetingDocument18 pagesCapital Budgetingteen agerNo ratings yet

- Baby - SIIP - 13-6-2023 7.56.27Document5 pagesBaby - SIIP - 13-6-2023 7.56.27anju aggarwalNo ratings yet

- 21 Useful Chart - 2020Document40 pages21 Useful Chart - 2020Kiran KudtarkarNo ratings yet

- Mr. Bhatta: An Innovative Retirement Solution ForDocument8 pagesMr. Bhatta: An Innovative Retirement Solution ForTapan DuttaNo ratings yet

- New Jeevan Anand (915) : Mr. YesDocument5 pagesNew Jeevan Anand (915) : Mr. YesPankaj YadavNo ratings yet

- Report Mr. Kakani 936 16 10 Age 58 SA 200000Document4 pagesReport Mr. Kakani 936 16 10 Age 58 SA 200000Omi RamaniNo ratings yet

- LIC Term Plan Proposal SummaryDocument9 pagesLIC Term Plan Proposal Summary..No ratings yet

- Amro Ismail Kasht 200802124: Engineering EconomyDocument5 pagesAmro Ismail Kasht 200802124: Engineering EconomyAmroKashtNo ratings yet

- GM - DhanSanchay - 21-7-2022 3.51.32Document4 pagesGM - DhanSanchay - 21-7-2022 3.51.32GRV KakashiNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Agency Presentation - ZTCDocument24 pagesAgency Presentation - ZTCHarish ChandNo ratings yet

- Mrs. Nirali Mehta: Insurance Proposal ForDocument5 pagesMrs. Nirali Mehta: Insurance Proposal ForHarish ChandNo ratings yet

- Corporate AgentsDocument1,023 pagesCorporate AgentsVivek Thota0% (1)

- 16 Year at 41 AgeDocument4 pages16 Year at 41 AgeHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Harish Chand: Jeevan Anand Plan PresentationDocument4 pagesHarish Chand: Jeevan Anand Plan PresentationHarish ChandNo ratings yet

- Anmol Jeevan - 9811896425Document1 pageAnmol Jeevan - 9811896425Harish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- Mr. Harish Chand: Presentation Specially Prepared ForDocument4 pagesMr. Harish Chand: Presentation Specially Prepared ForHarish ChandNo ratings yet

- Rad 28 E72Document1 pageRad 28 E72Harish ChandNo ratings yet

- Mr. Gupta: Insurance Proposal ForDocument8 pagesMr. Gupta: Insurance Proposal ForHarish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Rad 211 D0Document1 pageRad 211 D0Harish ChandNo ratings yet

- Jeevan AkshayDocument1 pageJeevan AkshayHarish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Mr. Gupta: Harish ChandDocument4 pagesMr. Gupta: Harish ChandHarish ChandNo ratings yet

- Rad 1 FDF9Document2 pagesRad 1 FDF9Harish ChandNo ratings yet

- All Illustration of LICDocument6 pagesAll Illustration of LICHarish ChandNo ratings yet

- Rad 20356Document1 pageRad 20356Harish ChandNo ratings yet

- Rad 1 F405Document3 pagesRad 1 F405Harish ChandNo ratings yet

- Jeevan Anand: Harish ChandDocument4 pagesJeevan Anand: Harish ChandHarish ChandNo ratings yet

- Multi - Plan Chart: Harish ChandDocument3 pagesMulti - Plan Chart: Harish ChandHarish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Premiums Due Statement: Harish ChandDocument1 pagePremiums Due Statement: Harish ChandHarish ChandNo ratings yet

- Rad 1 F405Document3 pagesRad 1 F405Harish ChandNo ratings yet

- Harish Chand: Multi - Plan ChartDocument4 pagesHarish Chand: Multi - Plan ChartHarish ChandNo ratings yet

- All Illustration of LICDocument6 pagesAll Illustration of LICHarish ChandNo ratings yet

- Rad 09206Document3 pagesRad 09206Harish ChandNo ratings yet

- Jeevan Saral IllustrationDocument3 pagesJeevan Saral IllustrationHarish ChandNo ratings yet