Professional Documents

Culture Documents

Preserve South Russell

Uploaded by

Stephen J. Latkovic, Esq., CPAOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Preserve South Russell

Uploaded by

Stephen J. Latkovic, Esq., CPACopyright:

Available Formats

Preserve South Russell’s Future

Keep Our Important LOCAL Community Services

VoteRunning

YES May 3rd

A 1/4 of one percent (0.25%) increase in the Village income tax

will be on the May 3rd ballot and YOUR support is needed

WHY does South Russell need WHAT HAPPENS if the increase is

an income tax increase now? not approved by the voters?

Projecting a $250,000 annual budget shortfall Police, EMS, and Fire service levels will be

starting in 2012 impacted

High quality Chagrin Falls Fire and Emergency Annual road paving/repair programs will be

Medical Services (EMS) are very important to severely cutback or eliminated

our residents and the costs for these services Winter snow plowing services will be reduced

have more than doubled since 2001 2011 Fall Festival may be cancelled & SR

Village employee health care costs and workers’ Village Park maintenance cut

compensation costs have also increased 2011 Trash Day has already been cancelled

dramatically and the 2012 event will also be cancelled

Road paving costs have increased much faster

than inflation due to large cost increases for

paving materials (oil and other commodities)

WHAT STEPS HAVE BEEN TAKEN TO LIMIT EXPENSES

before asking voters to approve a tax increase?

Wages have been frozen for all employees and

Village officials for 2010 and 2011

Annual $250,000 road paving and maintenance

program has been eliminated

Delayed/eliminated equipment purchases and

infrastructure projects

Expense budgets for every department have

been cut over the last several years

Operating cost increases held to just 1.1% per

year on average over the last 10 years (inflation

averaged 2.5% annually over this time period)

South Russell has the LOWEST effective income

tax rate* in the Chagrin Valley

Income tax rate has not increased since 1969

(over 42 years)

How will a tax increase AFFECT ME?

Relatively small increase for the typical South Russell resident (see

chart below)

EXCLUDED from the increase is income from:

o Pensions

o Dividends

o Interest

o Social Security benefits

o Other fixed income sources

NO increase in property taxes!

Impact of a 1/4 of One Percent (0.25%) Increase on the typical South Russell resident**

Wages & Earned Income Net Monthly Increase Net Annual Increase

$50,000 $2.60 $31.25

$75,000 $3.91 $46.88

$100,000 $5.21 $62.50

$200,000 $10.42 $125.00

*Effective Income Tax Rate - the tax rate a resident actually pays to South Russell after any credits for taxes

paid to other taxing communities in which he/she works. The vast majority of residents are in this category.

** These are estimates based on a typical resident’s tax situation and actual results will vary.

For more information or questions, email the Preserve South Russell’s Future Committee at

preservesouthrussell@gmail.com

Vote Yes to Preserve South

Russell’s Future

Paid for by Preserve South Russell’s Future Committee - preservesouthrussell@gmail.com

Jayne Hasler – Treasurer – 604 Doe Ct., South Russell, OH 44022

You might also like

- Independent Sales Representative AgreementDocument7 pagesIndependent Sales Representative AgreementCarlos GonzalezNo ratings yet

- A Tea Party PrimerDocument8 pagesA Tea Party PrimerGreg MildNo ratings yet

- 5co01 Assignment ExampleDocument13 pages5co01 Assignment ExampleSteve Wetherall0% (2)

- Project On Multiplex ThetaresDocument36 pagesProject On Multiplex ThetaresGeetanjali Dhandore100% (1)

- Panchshil Domestic Bill-JuneDocument60 pagesPanchshil Domestic Bill-JuneUJJWALNo ratings yet

- IGCSE Economics Self Assessment Chapter 35 AnswersDocument3 pagesIGCSE Economics Self Assessment Chapter 35 AnswersDesreNo ratings yet

- Bongbong Marcos challenged BIR's levy of late Pres. Marcos' properties to cover tax deficienciesDocument5 pagesBongbong Marcos challenged BIR's levy of late Pres. Marcos' properties to cover tax deficienciesJelena SebastianNo ratings yet

- LINN 2013 BudgetDocument18 pagesLINN 2013 Budgetsteve_gravelleNo ratings yet

- Central New York School Boards Association Annual Legislative BreakfastDocument19 pagesCentral New York School Boards Association Annual Legislative BreakfastTime Warner Cable NewsNo ratings yet

- Using Strategic Planning To Transform A Budgeting Process: Cary A. Israel, Brenda KihlDocument10 pagesUsing Strategic Planning To Transform A Budgeting Process: Cary A. Israel, Brenda KihlDwi RaraNo ratings yet

- Introduced Budget InformationDocument3 pagesIntroduced Budget InformationAndrew CasaisNo ratings yet

- TRC News and Notes 2-16-12Document1 pageTRC News and Notes 2-16-12James Van BruggenNo ratings yet

- Teamsters Local 320 Summer NewsletterDocument8 pagesTeamsters Local 320 Summer NewsletterForward GallopNo ratings yet

- Levy Brochure 2013-15 WebDocument2 pagesLevy Brochure 2013-15 WebldearmoreNo ratings yet

- Affordable Housing Making Development Match NeedDocument41 pagesAffordable Housing Making Development Match NeedCharles Elsesser100% (1)

- Livingston County Adopted Budget (2023)Document401 pagesLivingston County Adopted Budget (2023)Watertown Daily TimesNo ratings yet

- House PDFDocument1 pageHouse PDFBen RossNo ratings yet

- Rev Review Memo June 2014Document1 pageRev Review Memo June 2014tom_scheckNo ratings yet

- Dear Friends,: Reed Pleased Budget Completed Disappointed With Some DetailsDocument4 pagesDear Friends,: Reed Pleased Budget Completed Disappointed With Some DetailsPAHouseGOPNo ratings yet

- Economic Snapshot-0514Document1 pageEconomic Snapshot-0514The Dallas Morning NewsNo ratings yet

- Cutting RD Loan Assistance Devastating Blow To Affordable Housing in El PasoDocument16 pagesCutting RD Loan Assistance Devastating Blow To Affordable Housing in El PasoTedEscobedoNo ratings yet

- 2012 Budget Process To Neighborhood Groups - FINALDocument40 pages2012 Budget Process To Neighborhood Groups - FINALdmcintosh853No ratings yet

- Rates Fact SheetDocument2 pagesRates Fact SheetAlexander DarlingNo ratings yet

- By The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006Document45 pagesBy The Numbers: What Government Costs in North Carolina Cities and Counties FY 2006John Locke FoundationNo ratings yet

- 3 Eco Forecast LaymanDocument21 pages3 Eco Forecast LaymanVikas BhatterNo ratings yet

- State of The VillageDocument3 pagesState of The VillageMNCOOhioNo ratings yet

- Dutchess County UnemploymentDocument10 pagesDutchess County Unemploymentapi-107641637No ratings yet

- Pennsylvania State Budget PresentationDocument20 pagesPennsylvania State Budget PresentationNathan BenefieldNo ratings yet

- MnDOR LetterDocument3 pagesMnDOR LetterTim NelsonNo ratings yet

- California City and County Sales and Use Tax Rates: California State Board of EqualizationDocument23 pagesCalifornia City and County Sales and Use Tax Rates: California State Board of Equalizationapi-2494755100% (2)

- Taxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerDocument21 pagesTaxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerKatherine SauerNo ratings yet

- Pennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationDocument22 pagesPennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationNathan BenefieldNo ratings yet

- Douglas County Budget HearingDocument48 pagesDouglas County Budget HearingCeleste EdenloffNo ratings yet

- Press Release: Alameda County Supervisor Keith Carson, Fifth DistrictDocument2 pagesPress Release: Alameda County Supervisor Keith Carson, Fifth DistrictlocalonNo ratings yet

- North Dakota REV-E-NEWS: Message From The DirectorDocument4 pagesNorth Dakota REV-E-NEWS: Message From The DirectorRob PortNo ratings yet

- 2021 Budget in Brief Executive SummaryDocument2 pages2021 Budget in Brief Executive SummaryScott AtkinsonNo ratings yet

- June 2012 Revenue Collections MemoDocument1 pageJune 2012 Revenue Collections Memotom_scheckNo ratings yet

- Tax Increase For Gov 09-10 Budget - 7-23Document1 pageTax Increase For Gov 09-10 Budget - 7-23jmicek100% (2)

- Kansas, Tax Reform, and Economic Growth: Louis R. Woodhill March 1, 2012Document13 pagesKansas, Tax Reform, and Economic Growth: Louis R. Woodhill March 1, 2012api-34406941No ratings yet

- DDS Proposed FY 11 Funding Facts May 10Document2 pagesDDS Proposed FY 11 Funding Facts May 10tjsutcliffeNo ratings yet

- Property Tax and Income - Brief - FINALDocument9 pagesProperty Tax and Income - Brief - FINALThe GazetteNo ratings yet

- US Internal Revenue Service: p950Document12 pagesUS Internal Revenue Service: p950IRSNo ratings yet

- FY 2014 Budget Status Final CorrectedDocument74 pagesFY 2014 Budget Status Final Correctedted_nesiNo ratings yet

- Professor Craig S. Maher Clow Faculty 408 Office Ph. 920-424-7304Document62 pagesProfessor Craig S. Maher Clow Faculty 408 Office Ph. 920-424-7304Diana PobladorNo ratings yet

- Pennsylvania State Spending: by Nathan Benefield Commonwealth FoundationDocument25 pagesPennsylvania State Spending: by Nathan Benefield Commonwealth FoundationCommonwealth FoundationNo ratings yet

- 2011-2012 Preliminary Budget Overview: Board of Education MembersDocument18 pages2011-2012 Preliminary Budget Overview: Board of Education MembersvchineseNo ratings yet

- LPHTA Newsletter 2007-MayDocument3 pagesLPHTA Newsletter 2007-MayLPHTANo ratings yet

- Living Wage Report 2023 With Cover PageDocument28 pagesLiving Wage Report 2023 With Cover PageCTV Calgary DigitalNo ratings yet

- Swanger Spring 2010Document4 pagesSwanger Spring 2010PAHouseGOPNo ratings yet

- SDRS at A Glance: SDRS Board of TrusteesDocument1 pageSDRS at A Glance: SDRS Board of TrusteesTravis JohansenNo ratings yet

- Flat Tax Final VersionDocument2 pagesFlat Tax Final VersionStephen GrahamNo ratings yet

- Tax Rate PropDocument23 pagesTax Rate PropDC StrongNo ratings yet

- DART Financial Outlook Review: March 23, 2010Document31 pagesDART Financial Outlook Review: March 23, 2010rodgermjonesNo ratings yet

- Tax Reform and BudgetDocument13 pagesTax Reform and BudgetDaggett For GovernorNo ratings yet

- LMT 2011 1st Quarter Finance ReportDocument14 pagesLMT 2011 1st Quarter Finance ReportBucksLocalNews.comNo ratings yet

- Median Increase Percentage in Home Prices 2010-PresentDocument6 pagesMedian Increase Percentage in Home Prices 2010-PresentAnonymous iVoSPSV0sNo ratings yet

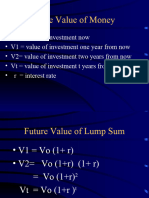

- Time Value of Money With Marg TaxDocument31 pagesTime Value of Money With Marg Taxmuriithipeter761No ratings yet

- Chapter 5Document21 pagesChapter 5Steve CouncilNo ratings yet

- Siirg-Cga With Case Study 1 4 Copy-1Document2 pagesSiirg-Cga With Case Study 1 4 Copy-1api-286600475No ratings yet

- Chapter 2Document28 pagesChapter 2Steve CouncilNo ratings yet

- Seattle Property Tax BreakdownDocument13 pagesSeattle Property Tax BreakdownWestSeattleBlog0% (1)

- Pennsylvania State Budget: by Nathan Benefield Commonwealth FoundationDocument26 pagesPennsylvania State Budget: by Nathan Benefield Commonwealth FoundationCommonwealth FoundationNo ratings yet

- Council Rates Frequently Asked QuestionsDocument4 pagesCouncil Rates Frequently Asked QuestionsJohnyNo ratings yet

- Dear Friends,: Coffee and ConversationDocument4 pagesDear Friends,: Coffee and ConversationPAHouseGOPNo ratings yet

- The Sherando Times: October 6, 2010Document16 pagesThe Sherando Times: October 6, 2010Dan McDermottNo ratings yet

- The Financial Death Spiral of the United States Postal Service ...Unless?From EverandThe Financial Death Spiral of the United States Postal Service ...Unless?No ratings yet

- Cleveland 2011 Development Map - Courtesy of The Plain DealerDocument1 pageCleveland 2011 Development Map - Courtesy of The Plain DealerStephen J. Latkovic, Esq., CPANo ratings yet

- AGC BlueprintDocument12 pagesAGC BlueprintStephen J. Latkovic, Esq., CPANo ratings yet

- PCG Northeast Ohio Newsletter - February/March 2010Document5 pagesPCG Northeast Ohio Newsletter - February/March 2010Stephen J. Latkovic, Esq., CPANo ratings yet

- Highlights From FHA/HUD MAP Lender ConferenceDocument3 pagesHighlights From FHA/HUD MAP Lender ConferenceStephen J. Latkovic, Esq., CPANo ratings yet

- Health Affairs - Assisted Living 10-01Document9 pagesHealth Affairs - Assisted Living 10-01Stephen J. Latkovic, Esq., CPANo ratings yet

- 2010 Real Estate Investment Outlook: A Special Research ReportDocument4 pages2010 Real Estate Investment Outlook: A Special Research ReportCRE ConsoleNo ratings yet

- Realpoint CMBS Delinquency ReportDocument15 pagesRealpoint CMBS Delinquency ReportStephen J. Latkovic, Esq., CPANo ratings yet

- Special Journals Cherry Lopez Wear Ever Store BSA13Document12 pagesSpecial Journals Cherry Lopez Wear Ever Store BSA13Erika RepedroNo ratings yet

- Prepayments (Prepaid Expenses)Document3 pagesPrepayments (Prepaid Expenses)Eat ChalkNo ratings yet

- InvoiceDocument1 pageInvoicekunalbariya58No ratings yet

- InvoiceDocument1 pageInvoiceimprakhar7No ratings yet

- Tax Increment Financing TIF Districts in Oklahoma 2011Document21 pagesTax Increment Financing TIF Districts in Oklahoma 2011Kaye BeachNo ratings yet

- Standards of Conduct TrainingDocument17 pagesStandards of Conduct TrainingCenter for Economic ProgressNo ratings yet

- Exemptions from withholding tax on compensation under ₱90K and ₱250KDocument2 pagesExemptions from withholding tax on compensation under ₱90K and ₱250KrjNo ratings yet

- Avenue E-Commerce Limited: You SavedDocument1 pageAvenue E-Commerce Limited: You SavedRahul KeniNo ratings yet

- 10000000879Document299 pages10000000879Chapter 11 DocketsNo ratings yet

- Fiscal IzationDocument4 pagesFiscal IzationMilan JankovicNo ratings yet

- 61 Yale LJ14Document32 pages61 Yale LJ14Bruno IankowskiNo ratings yet

- MATLA PAYROLLDocument2 pagesMATLA PAYROLLTshikani JoyNo ratings yet

- Sustainability 10 00602 v2Document24 pagesSustainability 10 00602 v2Layla MainNo ratings yet

- Burgum July QuarterlyDocument767 pagesBurgum July QuarterlyRob PortNo ratings yet

- Prakash Resume NewDocument3 pagesPrakash Resume Newprakash gholveNo ratings yet

- 01wbaar Apeal 2023 - 20230420Document7 pages01wbaar Apeal 2023 - 20230420ranadip mayraNo ratings yet

- KD Chem Pharma - Proforma InvoiceDocument1 pageKD Chem Pharma - Proforma InvoiceJOYSON NOEL DSOUZANo ratings yet

- PAGCOR Exemption from Taxes UpheldDocument2 pagesPAGCOR Exemption from Taxes UpheldKingNoeBadongNo ratings yet

- Zlib - Pub - The Economics of Property and Planning Future ValueDocument231 pagesZlib - Pub - The Economics of Property and Planning Future ValueAinun Devi AlfiaNo ratings yet

- Master of Management in EU Funds DMWDocument12 pagesMaster of Management in EU Funds DMWAzoska Saint SimeoneNo ratings yet

- The Following Information Is Available For The Employees of Webber PDFDocument1 pageThe Following Information Is Available For The Employees of Webber PDFDoreenNo ratings yet

- Ebooks v15-2Document76 pagesEbooks v15-2Marcos Rodriguez MercadoNo ratings yet

- Non-Resident Tax Rates GuideDocument2 pagesNon-Resident Tax Rates GuideEmy EspirituNo ratings yet